HI Market View Commentary 11-01-2021

Leadership = IS the stocks that are up, willing to put in the hours, hard workers, good leaders poop or get off the pot, someone who affects you positively, a leader can admit when they are wrong, leaders convince others to follow them, walk the walk and talk the talk, not afraid to get out front

Leadership is standing behind what you say and do, whether its right or not

Everyone want’s to be a leader until they have to do leader work.

My industry there are a lot of people using big words, ACTING like they’ve done the work

This year the expected leadership was supposed to be tech, energy and healthcare possibility of Banks

HI thought leadership would come from Financials, Technology and Automotive

ALL of our research tells us we should continue in the current positions we are in BECAUSE they just haven’t moved yet

We can make the year with AAPL, BIDU, DIS or UAA taking off and all of them are Christmas Rally stocks

Stimulus bill is coming this week supposedly = Because the FED has to start tapering the mortgage back bonds they’ve been buying

Because I have over 25 years in the market I am not planning on changing the methodology over this year

https://www.briefing.com/the-big-picture

Last Updated: 29-Oct-21 14:35 ET

A pathetic situation is unfolding in the Treasury market

The Treasury market is a bit of a riddle, wrapped in a mystery, inside an enigma these days. We say that knowing that there has been a rampant repetition from corporate America about supply chain pressures, rising input costs, labor shortages, and price increases to help offset the higher costs of doing business.

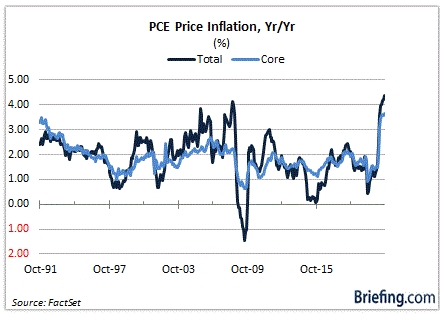

We learned this morning, too, that the PCE Price Index and core PCE Price Index, which excludes food and energy, sit at a 30-year high, and that, according to the University of Michigan Index of Consumer Sentiment, there hasn’t been as much uncertainty about the year-ahead inflation rate as there is now among consumers in nearly 40 years.

In brief, there is a lot of inflation, a lot of attention on inflation pressures, and elevated inflation expectations yet yields on longer duration Treasury securities are… falling?

The Takeaway

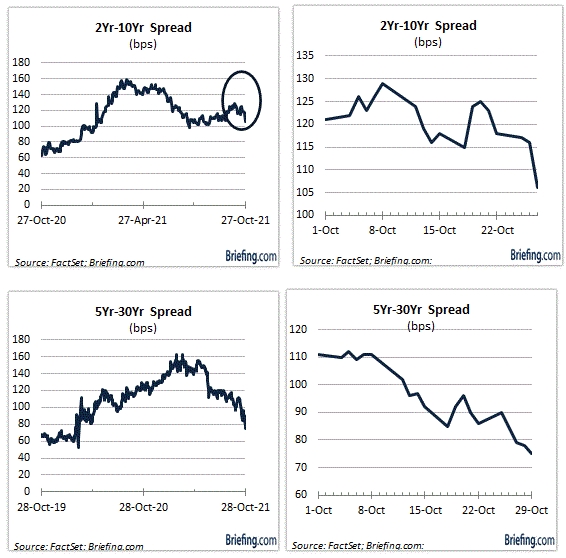

The yield on the 10-yr note has dropped nine basis points this week to 1.56% while the yield on the 30-yr bond has dropped 14 basis points to 1.95%.

At the same time, the yield on the 2-yr note has increased four basis points to 0.50%, but it had been up as many as 10 basis points to 0.56%.

The takeaway for market participants is that the yield curve is flattening, with the 2-yr note yield up 21 basis points this month and the 10-yr note yield up just four basis points. Similarly, the yield on the 5-yr note has risen 21 basis points this month to 1.20% while the yield on the 30-yr bond has dropped 14 basis points, leading to the narrowest spread for that pair since March 2020.

This flattening action is typically associated with an expectation for slower growth, if not an actual growth shock.

It is running counter to the narrative that Q4 GDP growth should accelerate from the tepid 2.0% growth in Q3, as the headwinds of the Delta variant dissipate and transportation bottlenecks, which have snarled supply chains and crimped sales prospects, become less bottlenecked.

However, with yields on shorter-dated securities rising faster than yields on longer-dated securities as inflation pressures persist, there is conjecture that the Treasury market is sniffing out a policy mistake by the Fed.

What would that policy mistake be? Tightening policy too aggressively to rein in inflation and choking off growth prospects in the process.

What It All Means

Currently, the CME FedWatch Tool shows a heightened probability (i.e., greater than 50%) of at least two hikes in the fed funds rate in the latter half of 2022. Assuming any rate hike would come in 25 basis point increments, that would leave the target range for the fed funds rate at 0.50-0.75% by the end of 2022.

It seems utterly ridiculous that there is such a nervous stir about growth prospects getting squished with a policy rate below 1.00%.

If anything, it goes to show how hooked the market has gotten on a policy rate at the zero bound if it thinks 50 basis points of tightening is going to sink the economy in a way that also takes care of the inflation pressures.

It’s a pathetic situation, but it is the reality of a market that has been awash in liquidity and has looked a gift horse in the mouth too long.

If 50 basis points of tightening off the zero bound ultimately turns into a policy mistake, as some think it might, then the neutral rate will be starkly lower for longer, and savers — especially those unable or unwilling to commit to the stock market — will continue to be penalized with pathetically paltry interest rates for a long time.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

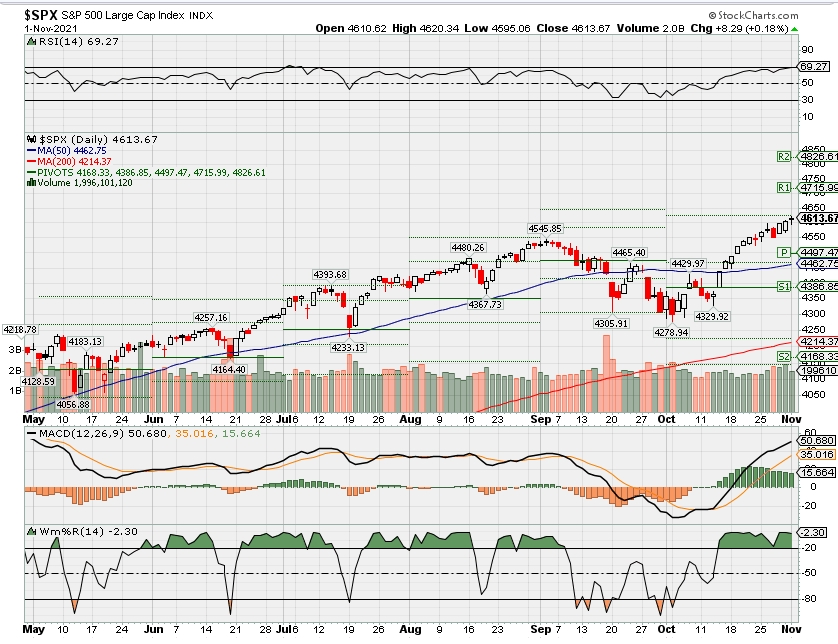

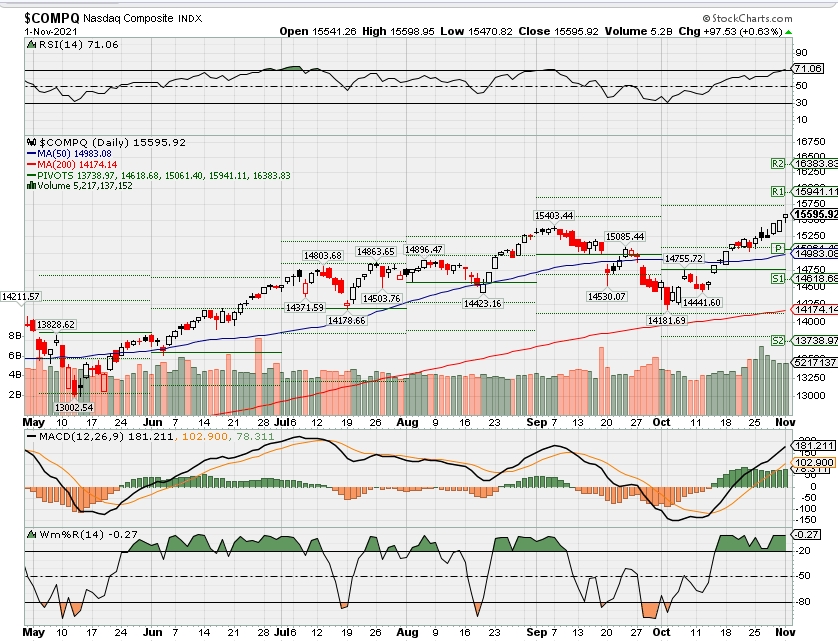

| Market Recap WEEK OF OCT. 25 THROUGH OCT. 29, 2021 The S&P 500 index rose 1.3% last week, lifting October’s monthly advance to 6.9%, as US corporations’ Q3 financial results continued to come in mostly above estimates. The market benchmark ended Friday’s session at 4,605.38, up from last Friday’s closing level of 4,544.90 and marking its highest closing level ever. The index also reached an intraday record high Friday at 4,608.08. Friday was the final trading day of October, which started Q4 on a strong note and wiped out the S&P 500’s 4.8% September slide. With just two months remaining in 2021, the index is now up nearly 23% for the year to date. The gains came as quarterly earnings reports have largely surpassed expectations at a time when supply-chain challenges, the continuation of the COVID-19 pandemic and inflation concerns have persisted. In many cases, these issues haven’t dented profits by as much as analysts and investors had feared. The consumer discretionary sector had the largest percentage increase of the week, up 4%, followed by gains of 2% each in communication services and technology. Four sectors were in the red last week: Financials fell 0.9%, energy shed 0.8%, utilities declined 0.5% and industrials edged down 0.3%. The consumer discretionary sector’s gainers included shares of Tesla (TSLA), which rallied 22% last week to record levels and sent the electric car maker’s market value above $1 trillion following an order for 100,000 vehicles from car-rental company Hertz Global. In communication services, shares of Alphabet (GOOGL) rose 7.6% as the parent of Google reported Q3 earnings and revenue above year-earlier results and analysts’ mean estimates. In the technology sector, Enphase Energy (ENPH) shares soared 31% as the supplier of solar power equipment reported fiscal Q3 earnings and revenue that roughly doubled from year-earlier results and topped analysts’ mean estimates. On the downside, the financial sector’s decliners included Huntington Bancshares (HBAN), which reported Q3 earnings that fell from the year-earlier period and missed analysts’ mean estimate despite revenue being up from the year-earlier period and slightly above the Street view. Shares slipped 5.6% on the week. Next week, the companies releasing quarterly financial results are expected to include Mosaic (MOS), Simon Property Group (SPG), Pfizer (PFE), DuPont (DD), CVS Health (CVS), Kellogg (K) and American International Group (AIG). On the economic front, the market will be focused on a two-day meeting of the Federal Open Market Committee as well as October employment data being released next week. The FOMC meeting will conclude Wednesday. ADP will release October private-sector employment numbers on Wednesday, followed by the Labor Department’s weekly jobless claims on Thursday and monthly nonfarm payrolls on Friday. Provided by MT Newswires |

Earnings Dates

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end November 2021?

11-01-2021 +2.5%

Earnings:

Mon: CLX, MOS, RMBS, RIG, AMC

Tues: BP, COP, CMI, DD, EL, PFE, ATVI, AKAM, AMGN, DENN, WU, ZG, UAA, TMUS

Wed: MAR, CF, EA, HUBS, MGM, NUS, QCOM, ROKU, CVS,

Thur: GOLD, CI, DUK, K, MUR, PZZA, ABNB, DBX, GPRO, UBER, YELP, BABA, FSLR, SQ,

Fri: CNK, D, DKNG

Econ Reports:

Mon: ISM Manufacturing, Consumer Spending

Tues:

Wed: MBA, ADP Employment, Factory Orders, ISM Services, FOMC Rate Decision,

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs, Trade Balance

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Consumer Credit

How am I looking to trade?

Long put protection has been added and getting ready for earnings

BIDU – 11/16

DIS – 11/10 AMC

COST – 12/09

SQ – 11/04 AMC

TGT – 11/17 BMO

UAA – 11/02 BMO

MU- 12/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Apple chip shortage will end, but U.S.-China supply chain ‘train wreck’ is coming

KEY POINTS

- Apple said on Thursday it lost the equivalent of $6 billion in sales due to chip shortages.

- The semiconductor shortage has led to calls for more chip production within the U.S. as part of shoring up supply chains for key technology across sectors including autos.

- A larger geopolitical rivalry between the U.S. and China over technology sovereignty and tech as a national security concern poses a threat to supply chain stability that will last longer than the current global manufacturing and logistics bottlenecks.

The semiconductor chip shortage is old news, but when the second-largest public company in the history of the U.S. stock market says it just left $6 billion in potential sales on the table as a result of limited chip supply — as Apple just did — it reinforces why the U.S. economy needs to rethink how it sources its semiconducting technology so that doesn’t happen again. This short-term supply chain phenomenon will pass, but tech executives and policy advisors say the future may be one of even larger, longer-term supply chain shocks. A shift from decades during which the largest companies benefitted from a manufacturing model in which “designed in California” and “assembled in Asia” was king needs to occur to shore up the supply of key components.

From $2 trillion Apple to $1 billion lidar sensing technology marker Ouster, the supply chain policy of industry and government needs to change.

Mark Frichtl, co-founder and chief technology officer at Ouster, said as the maker of products that have dozens or hundreds of integrated parts, it needs to manage and make sure it can get all of those. “Anyone making electronic devices has to do that,” he said, and it is now a global problem affecting all industries, whether phones or cars or Lidar sensors.

Results from the just-completed fourth quarter survey of CNBC Technology Executive Council members show the current labor shortage is the top concern cited across sectors (57%), more than twice those citing the supply chain (26%), but the two are connected.

“If a part becomes truly unavailable, companies need to find substitutes that could require additional engineering,” Frichtl said. “Any company making electronic devices, they will look a little tired because of all the extra work they’ve been doing. It’s not something we want to continue.”

Executives responding to the survey said an inability to upgrade their own technology was the second-biggest consequence of the supply chain bottlenecks.

“We need tech that is intuitive and easy to use to get people in here,” said Mark Wheeler, director of supply chain solutions at Zebra Technologies. “To compete for them, better tools help us to do that. … New people coming into enterprise have high expectations,” he said.

Forty-one members of the CNBC Technology Executive Council responded to the Q4 survey, which was conducted Oct. 1-Oct. 15.

Biggest supply chain risks still in future

Policy advisors and executives across industries are worried that the business sector is not planning for the long-term supply shocks that may be far worse than what has been a short-term crisis.

The current commercial issues causing the supply chain shortages will end, but ” what frightens me the most is the geopolitical … the politics of this is just getting starting in Washington and Beijing,” Dewardric McNeal, managing director and senior policy analyst at Longview Global, who worked for the Secretary of Defense on East Asia and China security relations during the Obama administration, said at a recent CNBC Technology Executive Council Town Hall.

Policy discussions about a semiconductor “rebalance” and “sovereignty of the supply chain” or “minimal viable manufacturing capacity” have McNeal concerned that industry is unprepared for what is coming. If not handled properly, the resulting situation could lead to mandates on companies to buy a certain percentage of domestic chips.

On Friday in an op-ed for The New York Times, Republican Senator Josh Hawley of Missouri outlined his proposal for a “made in America” rethinking of the supply chain including domestic content requirements.

https://art19.com/shows/bcd08fc3-8958-4c47-bf8e-524432adcd77/episodes/061eb7cf-1f94-418d-9173-fb6d46212128/embed “Telling me how to allocate is bad for a chip CEO. Telling me where I need to locate is bad. So I’m concerned we have a real train wreck coming even when we got beyond some of the short-term stuff,” McNeal said. “The man-made stuff, the political stuff, I don’t know if industry is quite prepared to really understand how bad it is going to get between Washington and Beijing.”

The auto industry is a good example, where the chip shortage continues to wreak havoc for carmakers. The car industry is all about efficiency and gaining scale, and in a future scenario in which companies have to start divvying up semiconductor buying based on a government mandate, “you start chipping away at these economies of scale,” said Mark Fields, former Ford CEO and current interim CEO at Hertz, on the recent CNBC TEC Town Hall. “It’s not a good economic choice.”

Fields said over the past half-decade, many of the economic decisions made by automakers on where to source supply did not take into account the recent geopolitics and trade decisions and that may yet come back to haunt the automakers. “I think some manufacturers will be pretty surprised to see the economic decision or rationale that was so compelling back then really didn’t turn out to be the case. So I think there is going to be a lot of soul-searching over what’s the best thing to do to balance both the economics and the geopolitics of this.”

The cost of disruption in recent years from Covid and trade has been significant and that has to result in companies rethinking supply chains and accepting that increased costs may be worth it if they de-risk the business “from some of those unknowns that can hit your business very significantly as they have in the past few years,” Fields said.

The long tail of Huawei

Matt Murphy, CEO of Marvell Technology, which designs chips but outsources the manufacturing, said the situation should be on everyone’s radar, and it has been on his at least since the events of 2018 related to the Trump administration and Chinese cell phone maker Huawei.

Murphy, who was head of the semiconductor industry trade association during that period, said the Huawei situation was “the undeniable signal if there ever was a signal sent about what the U.S. was prepared to do.”

He said the politicians are dealing with substantial issues of importance to the industry, from IP theft originating in China to China’s broader flouting of World Trade Organization rules, but the extent to which the U.S. government went after Huawei — from targeting handsets all the way to its ability to procure components for enterprise gear — was a surprise. And he added the situation has not changed in ways executives expected it would. The Biden administration has “doubled down” on the policies of the prior administration, he said.

“If there is only one thing Congress and government officials can agree on … it’s China,” Murphy said. “If Huawei is the preamble for what’s to come, it’s additional risks.”

Chips and economic competitiveness

Ouster buys and sells a significant amount of material in China and a worsening of the trade relationship between the U.S. and China is bad for almost everyone, Frichtl said. But for the business community, he said the argument needs to be made in terms of economic competitiveness rather than saber-rattling.

“What people want is the existence of a U.S.-based supply where right now it doesn’t really exist,” Frichtl said. “The investment to form those fabs can be thought about in a national security context, but it is also purely economic development.”

One of the largest chip contract manufacturers in the world, Taiwan Semiconductor Manufacturing Company, is building a plant in Arizona.

The federal government also has been considering a $50 billion-plus spending effort to build a domestic chip industry — in the most recent version of the Biden spending plan there is an advanced manufacturing credit for chip production.

https://art19.com/shows/bcd08fc3-8958-4c47-bf8e-524432adcd77/episodes/30369294-05fb-435d-b521-0de042712416/embed “We need a company like TSMC [Taiwan Semiconductor Manufacturing Company] in Arizona times 10, and many more in the U.S. if we want security from interruption,” Frichtl said.

The way to avoid mandates on domestic component sourcing is for government and industry to work on the creation of a U.S.-based supply of semiconductors that is economically competitive. “TSMC is a global company, and they want those Arizona fabs competitive, so we just need to make sure policies we create here encourage economically competitive supply, not just have a mandate you have to buy 25% from a U.S. supplier,” Frichtl said.

In addition to the national security risks, he said there is simply too much geographic concentration of the world’s most advanced fabs in Asia, and a single calamity could take them out. A year from now, the acute shortages could be over, every part needs available and on reasonable lead times and global semi capacity at a high level of utilization.

“In the event of a flood or earthquake and we could fall back into this issue. … I would argue this has demonstrated to the world that there’s this thing [semiconductor manufacturing] that’s really important to the functioning of the most valuable businesses, like Apple, which has to get semis to make phones, and if we don’t create policy around ensuring day to day supply that can absorb minor shocks we will be in this situation again. We are having a shortage now, but it could be no new chips and that would be catastrophic,” Frichtl said.

Autos got a taste of that after the Fukushima nuclear disaster, according to Fields, which led the companies to realize the importance of at least having deeper layers of knowledge and visibility into multiple tiers of their supply chains.

“What we have seen, the disruption of the last 18 months and even before that, has shaken a lot of companies to their core in terms of how they view the supply chain,” Wheeler said.

Supply chain models have been built to deliver service to the market at the optimal cost, and they were built with assumptions about supply availability and transport availability and cost, and many of those assumptions have been made invalid by the market reality. “Without the assumptions being true, there is a premium on visibility. If you don’t know what you have and where it is, you can’t plan and reoptimize,” Wheeler said.

“The shortages we are experiencing now are causing companies to understand how their supply chain policies may be in a very dynamic environment. What that comes down to from our perspective is a premium on supply chain visibility and customers want to improve that. Where is our stuff, not only in the enterprise but at the dock, plant and warehouse,” he said. “Securing the supply chain is critical right now and it will be with us for a while.”

In the past, buyers might play one vendor against another until the last possible moment to obtain the best possible price, but now buyers will be willing to pay for capacity in advance or sign up for take-or-pay agreements, which would include a potential penalty.

“We’re viewing this as a shift to capacity being strategic, not just an afterthought,” Murphy said.

McNeal said the concepts being weighed including technology sovereignty and near-shoring outlined in legislation like the $50 billion CHIPS Act are part of the process of industry and government understanding expectations and level-setting, but he isn’t convinced that everyone is on the same page domestically, or globally with allies in Europe and southeastern Asia when it comes to coalescing around a rebalancing of supply chains. “I am not so sure our European and ASEAN friends are really fully on board, not sure how to really navigate the geopolitics of the supply chain,” he said.

History does include an example of how economic development of a domestic tech manufacturing hub can lead to a larger economy.

“Silicon Valley came to be what it is now because there were Silicon fabs in the Valley,” Frichtl said.

Treasury Secretary Yellen says spending bills will be anti-inflationary, lowering important costs

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Treasury Secretary Janet Yellen told CNBC on Friday that the administration’s infrastructure spending proposal will lower inflation at a time when it is increasing rapidly.

- Speaking from Rome, she insisted that “what this package will do is lower some of the most important costs, what they pay for health care, for child care. It’s anti-inflationary in that sense as well.”

- Her remarks come with growth slowing and inflation rising, both due in large part to major supply chain issues that she expects to be resolved.

Treasury Secretary Janet Yellen asserted Friday that the administration’s infrastructure spending proposal will lower inflation by reducing costs vital to households.

Speaking to CNBC from Rome where she is attending the G-20 conference of global leaders, Yellen renewed her push for White House spending plans that are unpopular with several factions of Congress and have yet to be approved.

“I don’t think that these investments will drive up inflation at all,” she told CNBC’s Sara Eisen during a live “Worldwide Exchange” interview.

The $1 trillion infrastructure and companion $1.8 trillion climate and social spending spending plans have been pared back considerably during negotiations with Congress. At their core is an effort to improve the nation’s infrastructure, over which the Biden administration has cast a wide umbrella of not only the traditional investments in roads and bridges, but also across a wide swath of social programs like early child care.

Additional spending has drawn fears of inflation at a time when prices are rising close to their fastest pace in 30 years, but Yellen said the package will not exacerbate the pressures.

“It will boost the economy’s potential to grow, the economy’s supply potential, which tends to push inflation down, not up,” she said. “For many American families experiencing inflation, seeing the prices of gas and other things that they buy rise, what this package will do is lower some of the most important costs, what they pay for health care, for child care. It’s anti-inflationary in that sense as well.”

Yellen’s remarks come at a tenuous time for the U.S. economy.

Not only has inflation risen, but growth also has decelerated. Due in large part to supply chain issues that have left dozens of ships stranded at U.S. ports, the pace of gross domestic product growth slowed to 2% in the third quarter, the slowest rate since the pandemic-induced recession ended in April 2020.

Part of the administration’s G-20 agenda will be addressing its pet economic concerns, including the implementation of a global minimum for corporate taxes, as well as climate change and the supply chain issues that have hampered growth and threaten to cut into holiday spending patterns. Yellen said she expects the supply chain situation “will be addressed over the medium term.”

She called the White House’s Build Back Better program “transformational” in addressing the economy’s needs as the nation seeks to emerge from the Covid-19 pandemic. She insisted the spending plans are “fully paid for” through tax proposals primarily aimed at higher earners and corporations.

“I think it really helps us invest in physical capital. That’s public infrastructure that’s important to productivity growth,” she said. “There’s investment in human capital, there’s investment in research and development, the support that families will receive that will help them participate in the labor market.”

Yellen added that she’s hopeful economic growth will accelerate and inflation will recede.

Economic officials, including Federal Reserve Chairman Jerome Powell, have become less willing to use the word “transitory” to describe inflation as price pressures already have lasted longer than anticipated.

Yellen said she still expects inflation to ebb over time and return to its longer-run average around 2%, which is the Fed’s goal.

“I think it’s still fair to use [‘transitory’] in the sense that even if it doesn’t mean a month or two, it means a little bit longer than that. I think it conveys that the pressures that we’re seeing are related to a unique shock to the economy,” she said. “As the United States recovers and as vaccinations proceed globally, and the global economic activity revives, that pricing pressure will ease.”

Debt cancellation and free tuition proposals target student loan crisis in first big push to expand college access since World War II

KEY POINTS

- As the cost of higher education soars, fewer families can afford college without relying on student loans.

- If passed, tuition-free college and debt cancellation proposals would address the affordability crisis.

Most Americans see college as excessively expensive, but it wasn’t always that way.

Over the last decade, the cost of attending a four-year public college or university has grown significantly faster than income.

Deep cuts in state funding for higher education contributed to substantial tuition increases and pushed more of the costs of college onto students, according to an analysis by the Center on Budget and Policy Priorities, a nonpartisan research group based in Washington, D.C.

At private four-year schools, average tuition and fees rose 26% in a 10-year period. Tuition plus fees at four-year public schools, which were harder hit, jumped 35%.

Because so few families can shoulder the higher cost, they have increasingly turned to federal and private aid to cover at least some of the tab.

Roughly half of families now borrow, or take out loans, according to Sallie Mae’s most recent “How America Pays for College” report, pushing outstanding student debt to a stunning $1.7 trillion.

The typical senior now graduates with nearly $30,000 in debt.

Although getting a college degree is, in general, increasingly important for those aiming to get ahead in today’s economy, price has become a deterrent, particularly among low-income families.

“There is a recognition that college prices are out of control and not just at the top end but even at community college where tuition is relatively affordable,” said Mark Huelsman, director of policy and advocacy at the Hope Center for College, Community, and Justice.

Now, for the first time since 1944, when Congress passed what’s now known as the GI Bill — which helps veterans cover the cost of tuition, books and housing — there are two pieces of legislation to make higher education more accessible.

Student debt forgiveness

For those already struggling under the weight of hefty student loan bills, there’s a chance that borrowers could see their balances reduced or eliminated entirely.

“It’s more likely we will see some sort of broad loan forgiveness versus anytime in the past,” according to higher education expert Mark Kantrowitz.

President Joe Biden said he supports erasing at least $10,000 for all borrowers — a move he could potentially make through executive action.

If we don’t do something that prevents this problem from happening in the future, we are going to be here again in five years.

Mark Huelsman

DIRECTOR OF POLICY AND ADVOCACY AT THE HOPE CENTER FOR COLLEGE, COMMUNITY, AND JUSTICE

Alternatively, if the White House leaves student loan forgiveness to Congress, Democrats could use the budget reconciliation process to get it done.

Either way, if all federal student loan borrowers get $10,000 of their debt forgiven, “it erases the debt of about a third of all student loan borrowers,” according to Kantrowitz. And, the outstanding education debt in the country would fall to around $1.3 trillion, from $1.7 trillion.

However, “it’s after the fact,” Kantrowitz added. “It doesn’t make college more affordable and it doesn’t increase the number of students going to college or graduating from college.”

Further, “if we don’t do something that prevents this problem from happening in the future, we are going to be here again in five years,” the Hope Center’s Huelsman said.

Tuition-free college

That’s where free college comes in.

To be sure, free community college is not new. As of the latest tally, 26 states already have some type of program in place.

Most are “last-dollar” scholarships, meaning the program pays for whatever tuition and fees are left after financial aid and other grants are applied. In other words, students receive a scholarship for the amount of tuition that is not covered by existing state or federal aid.

The Democrats’ $3.5 trillion spending plan, if left largely intact, would make community college tuition-free for two years across the board — a move President Biden has also been advocating since the campaign trail.

Under this plan, states would no longer have to fill the gap between scholarships and tuition. If they opt into the program, student tuition is paid for entirely by the federal government.

Enrollment at four-year private colleges would fall by about 12%, while enrollment at four-year public universities and community colleges would rise by roughly 18%, according to a study on the economic impact of making some college tuition-free by the Campaign for Free College Tuition and the student-led advocacy group Rise.

“You’ve got a net effect of almost 2 million more students enrolled in college,” said Robert Shapiro, lead author of the study and a former economic advisor to President Bill Clinton.

“Every state that’s done it right has seen an enormous increase in enrollment, particularly among women and minority groups,” said Morley Winograd, president and CEO of the Campaign for Free College Tuition.

Graduation rates would also rise, Shapiro found, resulting in an increase in social mobility and higher incomes overall.

In the aftermath of the pandemic, “it’s very timely,” Huelsman added. “College enrollment is down.

“Something like free community college could spark college-going again,” he added.

“When you think about the fact that those students would also be earning more money, that’s an enormous boost to the economy,” Winograd said.

This could be the worst market for a first-time homebuyer, experts say

KEY POINTS

- Buying a first home is always a big decision, and a hot housing market untamed by the pandemic has made it harder than ever.

- Interest rates are a historic lows, and there is high demand and not enough supply.

- Financial advisors say this could be the worst market for home buyers we’ve ever seen, and caution clients to perhaps wait.

Buying a first home is always a huge decision. It’s even bigger when the market has been as hot as it has in the last two years.

Financial advisors say this could be the worst market for home buyers we’ve ever seen, and caution clients to perhaps wait.

Certified financial planner Rick Kahler, founder of Kahler Financial Group in Rapid City, South Dakota, expected the coronavirus pandemic might cool down a real estate market that had been rising for the last decade.

“I told a client 18 months ago not to buy a home, but he did,” said Kahler, who lives in Rapid City. “I was dead wrong, of course.”

Not only has the pandemic failed to cool the hot housing market, it has kicked it into higher gear. At the end of September, the average home price in the U.S. was $377,000, according to real estate broker Redfin. That’s up 14% from the same month last year and a staggering 30% from September 2019, when the average selling price for a home was $291,000.

The reasons for the rise are clear enough.

“Interest rates are at historic lows, there is a lot of demand for houses in the pandemic and there aren’t enough houses for people to buy,” said Daryl Fairweather, chief economist at Redfin, noting that the last decade saw the fewest homes built in the U.S. since the 1960s.

“The forces at play in the market are still present,” Fairweather added.

Fairweather expects that interest rates will rise by 60 basis points next year, but with the national average annual percentage rate on FHA-approved mortgages at 3.63% on Oct. 13, according to Bankrate.com, that would still be a low rate. She also doesn’t believe that the construction industry has the capacity to right the housing supply/demand situation anytime soon because of shortages of both materials and labor.

“I don’t think housing prices will come down next year,” said Fairweather. “We are in a seller’s market, and we are very far from a buyer’s market.”

Current homeowners are in the catbird seat. If they “overpay” for a new home, they can make up for it by selling their old one. For first-time homebuyers, however, it’s a different story.

“This could be the worst market for a first-time homebuyer that I’ve ever seen,” said CFP Sheryl Garrett. “Don’t be in such a hurry to buy a house.”

Garrett, founder of the Garrett Planning Network, suggests that some people are driven to own a home for the wrong reasons.

“Our society has a mentality that if you don’t own your own house, you’re a nobody,” Garrett said. “There is nothing to be ashamed about with renting a home.”

(Editor’s note: Garrett owns a home in Eureka Springs, Arkansas.)

Unfortunately, rental costs are also rising, though not to the same degree as housing prices. Average national rent across all sizes of apartments and homes rose 13.1% in the last two years, according to data from Redfin and RentPath, a digital marketing site.

If you’re thinking of buying a home now, I would put it off for a year.

Rick Kahler

FOUNDER OF KAHLER FINANCIAL GROUP

Despite underestimating the housing market 18 months ago, Kahler also advises patience for first-time homebuyers.

“If you’re thinking of buying a home now, I would put it off for a year,” he said. “Prices have gone up 20% to 30% in the last 18 months.

“Renting may be a better option now,” he added.

Like Garrett, Kahler sees people buying homes impulsively without enough consideration of the commitment involved.

“Buying a home seems to be in our DNA,” he said. “People make decisions emotionally — and they can often be poor decisions.”

If you are determined to buy a house in this environment, Kahler and Garrett suggest keeping the following things in mind:

- Do not take on more house than you can afford. Set boundaries for yourself and stick to them. “I see people overspending by $400 to $500 per month to get what they want,” Kahler said.

- Keep your monthly housing costs (which includes taxes, insurance and expected maintenance) at a manageable percentage of your income. “I like 25% of income as a limit,” he said.

- Hire a fiduciary as your agent, not one that serves both sides of the transaction. “Real estate transactions can happen quickly,” said Kahler. “You need someone to reach out to for a reality check when counteroffers come up.”

- Make very sure you want to live in the home and the neighborhood for an extended period, suggested Garrett. “A renter can just pack up and move,” she added. “If you own the house, you could be stuck in it for months or years.”

Congress has a new plan to fix Social Security. How it would change benefits

KEY POINTS

- A House Democratic proposal to reform Social Security is being reintroduced in Congress.

- The new version of the bill, called Social Security 2100: A Sacred Trust, has changes aimed at drawing support from President Joe Biden and from Republicans.

- The reintroduction follows the Social Security Administration’s latest estimates that the trust funds that support the program will be depleted in just 13 years.

House Democrats are reintroducing a Social Security reform bill popular with their party. This time, it features some changes aimed at attracting more support from Republicans.

The bill, known as the Social Security 2100 Act, is being brought forward by Rep. John Larson, D-Conn., chairman of the House Ways and Means subcommittee on Social Security.

Rep. Alexandria Ocasio-Cortez, D-N.Y., and House Ways and Means Committee Chairman Richard Neal, D-Mass., appeared with Larson on Tuesday to announce the reintroduction of the bill.

Neal urged lawmakers to offset the concentration of wealth, which has become more prevalent in the U.S., by embracing this Social Security proposal and extending the expanded child tax credit.

“We have this rare moment to accomplish seismic achievements, and this is the time to do it,” he said.

The new version of the bill, called Social Security 2100: A Sacred Trust, follows the Social Security Administration’s latest estimates that the trust funds that support the program will be depleted in just 13 years. At that time, in 2034, only 78% of promised benefits will be payable.

The bill proposes extending that date to 2038 to give Congress more time to come up with a long-term solution to the program’s solvency issues.

The measure would also incorporate proposals made by President Joe Biden during his presidential campaign.

“We have a person on Pennsylvania Avenue who knows and understands that Social Security is a sacred trust,” Larson said of Biden.

This new bill combines Biden’s proposals with House Ways and Means initiatives to expand and enhance Social Security benefits, he said.

“It’s got a lot that’s attractive, and nothing that I think should cause Democrats problems in an election year,” said Nancy Altman, president of Social Security Works, an advocacy group that promotes expanding benefits.

Like Biden’s plan, the Social Security 2100 Act would set a higher minimum benefit for low-income workers. Benefits would be set at 125% above the poverty line and tied to current wage levels.

There’s also a benefit boost for both new and existing beneficiaries amounting to about 2% of the average benefit.

Annual cost-of-living adjustments would be tied to the Consumer Price Index for the Elderly, or CPI-E. The argument is that this experimental index may better reflect the costs seniors face. Biden also included this change in his Social Security proposals.

Notably, the Social Security 2100 Act proposed in 2019 had more than 200 co-sponsors, though all were Democrats. On Tuesday, lawmakers indicated that the new version of the bill has already drawn a similar level of support.

To have that social safety net isn’t just good for us individually for peace of mind, it helps us feel like we are part of a society that respects our elders and values our vulnerable.

Rep. Alexandria Ocasio-Cortez

DEMOCRATIC CONGRESSWOMAN FROM NEW YORK

Ocasio-Cortez spoke about how Social Security benefits helped her family when her father died unexpectedly of cancer.

“Social Security checks helped my family through,” she said. “It’s why my brother and I were able to go to college.”

“It’s why I felt confident while I was at college that my mom would be able to have something to eat,” she added. “To have that social safety net isn’t just good for us individually for peace of mind, it helps us feel like we are part of a society that respects our elders and values our vulnerable.”

Seeking bipartisan support

The plan also integrates a couple of elements that might help draw support from across the aisle.

The new version would repeal rules that reduce Social Security benefits for public workers and their spouses, widows or widowers who also have pension income. These are known as the Windfall Elimination Provision and Government Pension Offset.

This issue came up at a recent House hearing on Social Security and has bipartisan support.

The elimination of one proposal — a higher payroll tax rate — may also help draw more support. The Social Security 2100 Act had previously called for gradually increasing contributions to the program from workers and employers to 7.4%, up from the current rate of 6.2%, over roughly 20 years.

However, the legislation does call for increasing Social Security taxes paid by higher-wage earners. In 2021, those taxes are capped at $142,800 in wages, and in 2022 that will rise to $147,000. This proposal reapplies taxes on wages at $400,000 and up, which is also in line with what Biden has proposed.

At the same time, the bill would also raise the thresholds above which income including Social Security is taxed. The plan calls for changing that to $35,000 for individuals and $50,000 for couples, up from $25,000 and $32,000, respectively.

The bill would also prevent the reduction of benefits for certain beneficiaries if the National Average Wage Index declines due to unforeseen circumstances, such as events impacting the economy.

It would also require the SSA to mail paper statements to all workers ages 25 and up, unless they request electronic delivery.

Other changes in the bill include extending benefits for students up through age 25, increasing certain widows’ and widowers’ benefits, boosting beneficiaries’ benefits after 15 years, eliminating a five-month waiting period to receive disability benefits, and creating caregiver credits so that the retirement benefits of those who take time out of the workforce are not reduced.

It remains to be seen how much attention this bill will get amid Congress’ busy legislative agenda and whether it will be embraced by Republican lawmakers.

However, advocates such as Social Security Works are optimistic.

“We’re all hoping that after they finish, however they finish the reconciliation and the debt limit and all these other things, that they will bring up Social Security,” Altman said.

The National Committee to Preserve Social Security and Medicare was also among the groups to support the proposal.

“There is good news for everyone in this bill, which is only fitting, since Social Security touches almost every American’s life,” said Max Richtman, the organization’s president and CEO.

“It is time for the full House to pass Rep. Larson’s bill and send it on to the Senate,” he said.

HI Financial Services Mid-Week 06-24-2014