HI Market View Commentary 10-25-2021

FB= Facebook

SNAP reported very bad earnings and blamed AAPL new IOS that give consumers (IPhone) the ability to turn off advertising tracking

IF you turn off tracking you DON’T get targeted ads = splattering of ads to see what sticks

Those that sell ads will also be hit with lower numbers

Last Week Facebook dropped $22 and then they rebounded after bad earnings due to 50 B in buybacks

COST

Earnings for Costco coming up and today we took a profit on the leap long calls

Currently COST closed at $490.10

It’s previous all time high was 486 and my Costco doesn’t have toilet paper

BTO 41 contracts @ $40.65

Closed most @ 106.65

$66.00 profit or a 162% return from June 29 to Oct 25th

We took the earnings risk off the table

So occasionally there is a problem = Maybe you get out to early, Maybe the stock doesn’t move like you would expect, Maybe your best educated guess is wrong.

It’s OK being wrong as long as you have a way to make up some of the downward movement

Stock ownership = Long put insurance like protection

For Leaps it = Dollar cost averaging and giving yourself the time to be right

The Key for what I do is Passion for the market and I want to make money FOR MYSELF so why not do it for others at the same time

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 22-Oct-21 12:17 ET

Bull market okay until interest rate push comes to shove

When the stock market’s worst-performing sector is up 6.2% for the year in mid-October, it almost goes without saying that the stock market has had a good year. “Good,” however, isn’t the word this year. The right word is “great.”

Nine out of 11 sectors have registered double-digit percentage gains ranging from 15.3% to 51.6%. The S&P 500, as of this writing, is up 20.5% before dividends.

An investor simply hasn’t gone wrong at the index level. Sure, there have been ample losses beneath the index level, but at the index level everyone is a winner.

That’s not going to change. Barring some cataclysmic event before year-end, 2021 will be a winning year for the stock market.

The only question now is, will the stock market get pushed, or shoved, into year-end?

The answer, like a lot of things this year, will have a lot to do with interest rates, COVID, and Congress.

Inflation Expectations Rising

The persistence of low interest rates has been the great driver of this bull market. It has strongly influenced a buy-the-dip mentality, it has been a rationale for multiple expansion, and it has been the basis for embracing the idea that there is no better alternative than the stock market for generating inflation-beating returns.

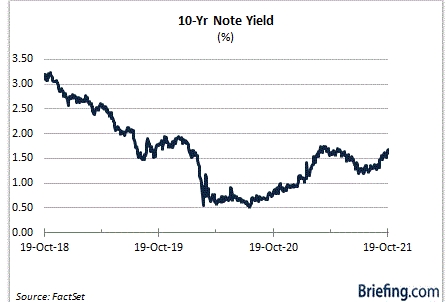

The focal point in this respect has been the target range for the fed funds rate and the 10-yr note yield. The former has been pinned at the effective lower bound since March 2020. The latter has traded this year between 0.91% and 1.71%.

You can’t get lower than the zero bound, unless you take rates negative, but the Federal Reserve isn’t going there. We’ve seen the 10-yr yield lower than 0.91%, but one has ample reason to think in the current environment that the 10-yr yield isn’t going back below 1.00% anytime soon (if ever).

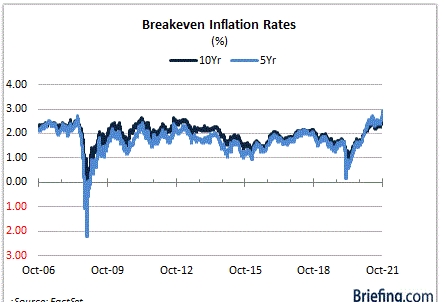

It would take a deflationary episode to get there, and while some pundits have suggested that deflation is a bigger concern for them than inflation, the market is not pre-occupied with deflation worries. At this point, the market is concerned about inflation — a concern that is manifesting itself in breakeven inflation rates and a yield curve that is flattening due to spiking yields in shorter-dated securities.

There is reason to be concerned about it, too. Supply chain pressures are universal, easy monetary policy has been universal, labor shortages are turning into a universal problem, commodity inflation is universal, and here at home wage inflation is picking up.

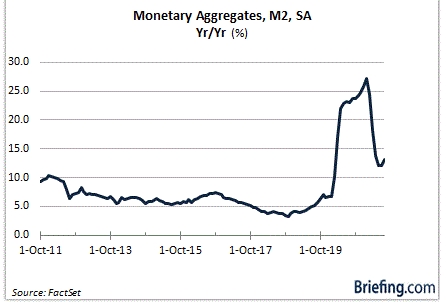

Prices have increased for essential items, ranging from food to electricity to gasoline. The Consumer Price Index is up 5.4% year-over-year and the Core Consumer Price Index, which excludes food and energy, is up 4.0%. Money supply continues to increase at a heightened pace.

Rate of Change Matters

Frankly, it’s a wonder that the 10-yr note yield is only at 1.68%, but financial engineering by the world’s central banks has helped suppress long-term rates. Interest rates are even lower, or negative, in other developed countries, and of course the Federal Reserve has been buying Treasury securities to the tune of at least $80 billion per month.

The Fed may soon taper those asset purchases, but it has been very clear that it doesn’t expect to raise its policy rate anytime soon. That’s a remarkable revelation given the pace of economic growth, the pace of inflation, and the pace of home price and stock price appreciation, but it is the stuff a bull market is more than happy to use to its advantage.

That’s why, if there is a change in expectations about the Fed’s interest rate policy position, the bull market’s ride can be expected to get rougher. Specifically, if inflation and inflation expectations force the Fed to raise its policy rate sooner than expected, and/or more than expected, the stock market would be contending with a downward adjustment in equity valuations.

That concern promises to be a pressing 2022 issue. The remainder of 2021, though, will still be influenced by interest rate expectations.

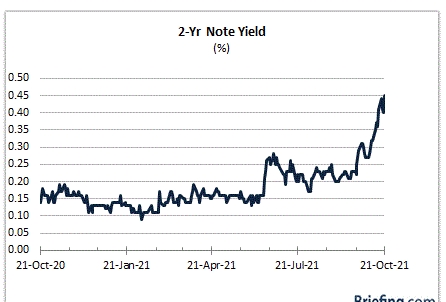

The 10-yr note yield has been moving up along with inflation rates and burgeoning assumptions that the Fed will raise its policy rate at least once next year. That view is best evidenced in the 2-yr note yield, which has risen from 0.20% in late September to 0.45% today.

The stock market has shown that it can tolerate rising interest rates at these nominally low levels. What it has some difficulty with is a rapid rate of change in interest rates.

When rates rise gradually, it is billed as an expression of confidence in the economic outlook. When rates rise quickly, it is viewed as a nervous expression of inflation pressures and the specter of the Fed being forced to raise rates to keep inflation in check.

Hence, the push into year-end could turn into a shove if the 10-yr note yield happens to make a beeline for 2.00% and keeps buzzing.

COVID Tracker

The push into year-end could also turn into a shove if the world is wrestling with a new COVID variant that is worse than the Delta variant, meaning it’s more transmissible, leads to more severe disease symptoms, and reduces the efficacy of vaccines.

Such a variant would presumably spur renewed prevention measures that would weigh on output, exacerbate supply chain pressures and transportation bottlenecks, reduce discretionary spending, slow travel activity, and feed continued labor shortages. In other words, it would cut into earnings prospects.

It’s possible given recent reports discussing the Delta Plus variant (AY.4.2) that is showing up more in sequencing tests in the U.K. That variant has not been labeled a variant of concern, but it is one scientists are monitoring carefully.

The stock market, which is at a record high, isn’t overly concerned about it, which is perhaps why it can turn into a spoiler if it becomes a variant of concern. Simply put, the stock market is not expecting such an outcome.

The stock market, though, seems grounded in vaccine efficacy, so the biggest risk for the stock market with any future variant is if it renders the vaccines ineffective in mitigating the risk of severe disease, hospitalization, and death.

More Questions than Answers from Congress

Congress, meanwhile, will be pushing into year-end to get something done on the infrastructure bills. The $1 trillion bipartisan plan is there for the taking. The House just needs to vote on it, yet passage of that bill is being delayed by a group of recalcitrant Democrats who are insisting that an agreement on a larger social infrastructure spending package must happen first before the vote on the bipartisan bill happens.

Briefly, reports suggest any agreement on the social infrastructure package is likely to be in the $1.7-1.9 trillion range, down substantially from the originally proposed $3.5 trillion plan. Democrats are fighting among themselves, however, to reach an agreement on the size of that package and how to pay for it.

The upside for the stock market at this juncture is the idea that corporate tax rates won’t be increased to pay for any social spending package.

There should be more fiscal stimulus coming. Doing nothing would presumably be politically damaging to a Democratic party that has the legislative ability to do something of its own volition. On the flip side, there is a school of thought that passing a social spending package on top of the bipartisan infrastructure bill could be politically damaging, too, if it stokes added inflation pressures.

The midterm elections in 2022 will provide the answers. In the meantime, the questions of when and how much with respect to additional fiscal stimulus remain unanswered, but it sounds like push is coming to shove for the Democrats.

On a related Congressional note, December 3 is a push date. That is when the current budget resolution expires and when the $480 billion debt ceiling extension also expires, so Congress will have to push an agreement through on both fronts to avoid a government shutdown during the holidays and/or a potential default situation.

Failure to get an agreement on the debt ceiling would be a shove that destabilizes global markets in the push to year end.

What It All Means

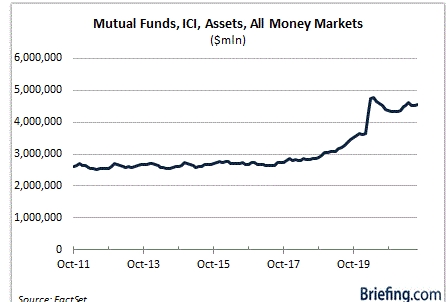

The stock market is entering a seasonally strong time of year, there is a ton of cash still sitting in money market mutual funds, and animal spirits are again rising from the dead.

The potential is there to end what has been a great year with a nice push, but there are potential spoilers in the mix. Of course, that has been the case all year, and the spoilers have not gotten the best of the stock market.

Instead, the stock market has shown rotational resolve no matter what has been thrown at it, primarily because earnings growth has been so strong, interest rates have remained low, and the Fed has provided a well-received verbal cue that it doesn’t expect to change its zero-bound policy rate anytime soon.

The wealth has literally been spread evenly across the market. The Russell 1000 Value Index and Russell 1000 Growth Index are both up 20.8% for the year as of this writing.

The gravy days for this bull market might be running on borrowed time, but the times are still good as far as the stock market is concerned. Accordingly, it remains driven by what it knows and not what it fears — and what it knows is that the interest rate environment remains conducive for more pushing, than shoving, into year-end.

When the stock market’s interest rate perspective changes for the worse is when this bull market will see push come to shove.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| WEEK OF OCT. 18 THROUGH OCT. 22, 2021 |

| The S&P 500 index rose 1.6% last week and reached fresh record highs amid better-than-expected Q3 corporate earnings and positive economic data. The market benchmark ended the week at 4,544.90, up from last Friday’s closing level of 4,471.37. The index reached its highest level ever Friday at an intraday high of 4,559.67 although it ended the day slightly below Thursday’s record closing high of 4,549.78. With just one trading week left in the month, the S&P 500 is now up 5.5% for October to date. It is up 21% for the year to date. The weekly climb came as many US companies’ Q3 earnings reports surpassed analysts’ expectations. In addition, weekly jobless claims fell to fresh pandemic lows while US existing home sales rose 7% in September to a seasonally adjusted annual rate of 6.29 million units from 5.88 million in August, exceeding expectations for a rise to 6.1 million in a Bloomberg poll of forecasters. All but one of the S&P 500’s sectors rose last week. Real estate had the largest percentage increase of the week, up 3.2%, followed by a 2.9% gain in health care and a 2.8% rise in financials. The one sector in the red was communication services, down 0.6%. The real estate sector’s gainers included Prologis (PLD), which reported annual growth in Q3 results a week ago as the logistics real estate company benefited from a record gain in market rents, which prompted it to raise the full-year outlook. Shares climbed 5.1% last week. In health care, shares of Anthem (ANTM) jumped 10% as the health insurance provider increased its full-year guidance after reporting better-than-expected Q3 results. Among the gainers in financials, State Street (STT) shares rose 7.2% as the bank holding company reported Q3 adjusted earnings per share and revenue above year-earlier results and analysts’ expectations. On the downside, the decliners in communication services included Omnicom Group (OMC), which reported Q3 earnings per share above analysts’ expectations but had lower-than-expected revenue. Shares fell 7.3% for the week. Next week, the companies expected to release quarterly results include Kimberly-Clark (KMB), Facebook (FB), 3M (MMM), General Electric (GE), Boeing (BA) and Merck (MRK). The economic data expected next week are expected to feature September new home sales and pending home sales in addition to the August S&P Case-Shiller home price index. October consumer confidence, September consumer spending, and September core inflation will also be released. Provided by MT Newswires |

Earnings Dates

Where will our markets end this week?

Higher

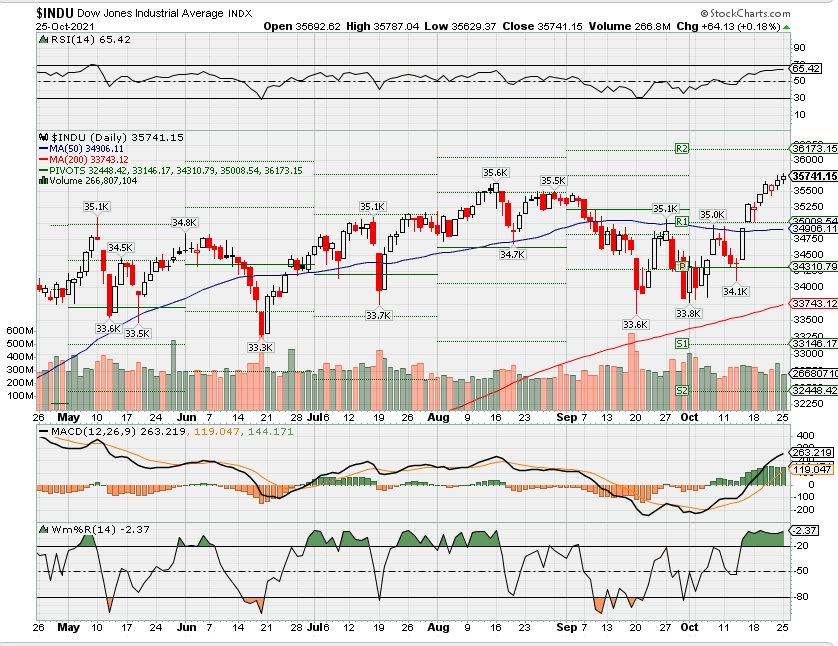

DJIA – Bullish

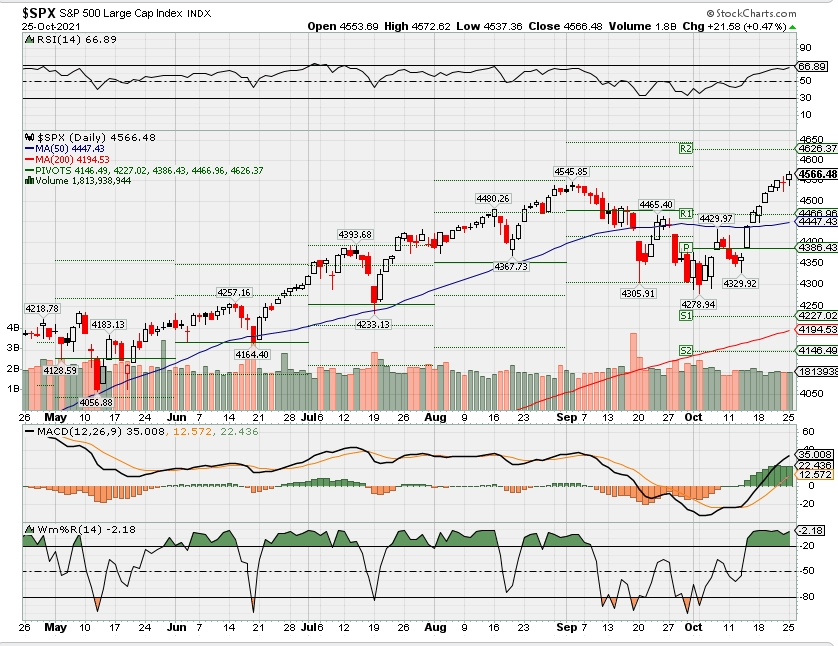

SPX – Bullish

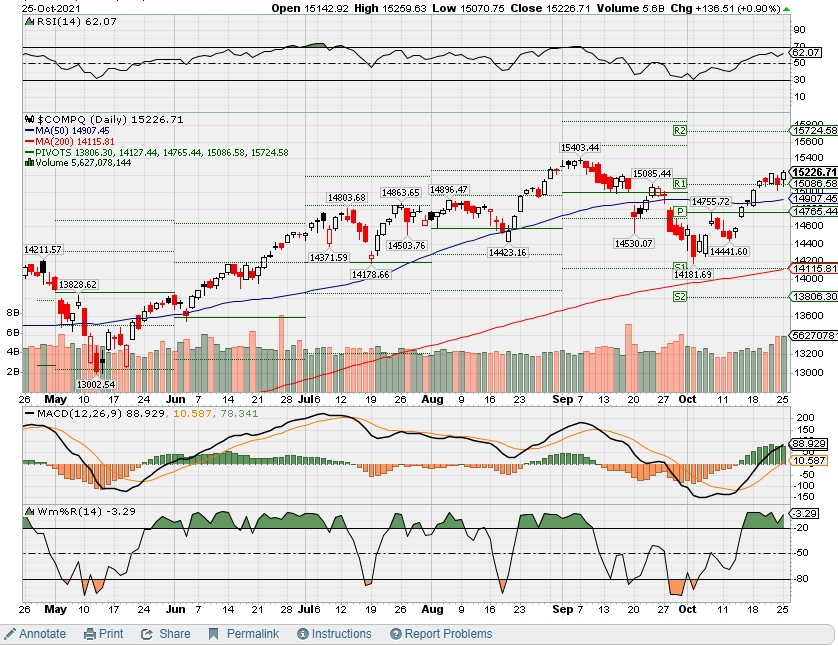

COMP – Bullish

Where Will the SPX end October 2021?

10-25-2021 -2.5%

10-18-2021 -2.5%

10-11-2021 -2.5%

10-04-2021 -2.5%

Earnings:

Mon: FB

Tues: MMM, ARCH, GLW, LLY, GE, HAS, JBLU, LMT, RTX, UBS, UPS, WM, GOOG, COF, FFIV, JNPR, MSFT, TWTR, V

Wed: BSX, CME, GRMN, HLT, MCD, SPOT, EBAY, BA, KO, GM, F,

Thur: MO, CAT, IMAX, KBR, MA, SIRI, YUM, AMZN, GILD, SKYW, X, AUY, AAPL, SBUX

Fri: CVX, CL, XOM, PSX, RCL

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, Case-Shiller, Consumer Confidence, New Home Sales

Wed: MBA, Durable Goods, Durable goods ex-trans

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator, Pending Home Sales

Fri: END OF MONTH Employment Cost Index, PCE Prices, Core PCE, Personal Income, Personal Spending, Chicago PMI, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Long put protection has been added and getting ready for earnings

AAPL – 10/28 AMC

BA – 10/27 BMO

BIDU – 11/16

DIS – 11/10 AMC

F – 10/27 AMC

FB – 10/25 AMC

COST – 12/09

SBUX – 10/28 AMC

SQ – 11/04 AMC

TGT – 11/17 BMO

UAA – 11/02 BMO

V – 10/26 AMC

MU- 12/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

US bill would stop Big Tech from favoring its own products | KSL.com

US bill would stop Big Tech from favoring its own products

By Diane Bartz, Reuters | Posted – Oct. 18, 2021 at 9:44 p.m.

About a dozen U.S. senators from both parties on Monday formally introduced a bill that would bar Big Tech platforms, like Amazon and Alphabet’s Google, from favoring their products and services. (Reuters)

WASHINGTON — About a dozen U.S. senators from both parties on Monday formally introduced a bill that would bar Big Tech platforms, like Amazon and Alphabet’s Google, from favoring their own products and services.

The bill follows others introduced with the goal of reining in the outsized market power of tech firms, including industry leaders Facebook and Apple. Thus far none became law, although one, which would increase resources for antitrust enforcers, passed the Senate.

Sens. Amy Klobuchar and Chuck Grassley’s bill would prohibit platforms from requiring companies operating on their sites to purchase the platform’s goods or services and ban them from biasing search results to favor the platform.

A companion has passed the House Judiciary Committee. It must pass both houses of Congress to become law.

Reuters reported on Wednesday, after reviewing thousands of internal Amazon documents, that Amazon’s India operations ran a systematic campaign of creating knock-offs and manipulating search results to boost its own private brands in the country, one of the company’s largest growth markets.

When news of the bill broke last week, both Amazon and Google warned of potential unintended consequences.

Amazon said in a statement that the bill, if it became law, “would harm consumers and the more than 500,000 U.S. small and medium-sized businesses that sell in the Amazon store, and it would put at risk the more than 1 million jobs created by those businesses.”

Google said that the measure would make it more difficult for companies to offer free services — Google’s search and maps are both free — and would make “those services less safe, less private and less secure.”

Facebook, which said that it competes with a range of social media, including TikTok and Twitter, said antitrust laws should “not attempt to dismantle the products and services people depend on.”

Klobuchar chairs the Senate Judiciary Committee’s antitrust subcommittee while Grassley is the top Republican on the full committee. Co-sponsors include five Democrats and five Republicans.

Companies expressing support for the bill included Spotify, Roku, Match Group and DuckDuckGo, Klobuchar’s office said in a statement.

The bill would not break up the companies or force them to drop services but bars some bad behaviors that affect businesses that rely on their platforms, said Stacy Mitchell with the Institute for Local Self-Reliance, who said that she would prefer a more aggressive bill.

Carmakers shift up a gear in race to go electric | KSL.com

Carmakers shift up a gear in race to go electric

By Nick Carey, Reuters | Posted – Oct. 18, 2021 at 10:23 p.m.

A Foxtron Model C electric vehicle is seen unveiled at a Foxconn event in Taipei, Taiwan on Monday. With electric car sales soaring and regulations increasingly favoring zero-emission vehicles, a flurry of announcements on Monday showed how the global auto industry has kicked into a higher gear as it races to speed past the fossil-fuel car era. (Fabian Hamacher, Reuters)

LONDON — With electric car sales soaring and regulations increasingly favoring zero-emission vehicles, a flurry of announcements on Monday showed how the global auto industry has kicked into a higher gear as it races to speed past the fossil-fuel car era.

As part of its own $34.7 billion electrification plan Stellantis — born out of a merger of PSA and Fiat Chrysler earlier this year — said it had entered a preliminary agreement with battery maker LG Energy Solution to produce battery cells and modules for North America, where the world’s No. 4 automaker expects more than 40% of its U.S. sales will be electric vehicles by 2030.

That follows a recent announcement that Daimler AG will take a 33% stake in battery cell manufacturer Automotive Cells Company, founded in 2020 by Stellantis and TotalEnergies in 2020.

Carmakers are racing to secure battery supplies as they switch to electric, with dozens of new battery plants planned across Europe and America.

Ford’s plans to go electric in Europe received a boost on Monday as the company said it would invest up to $316 million to retool an engine factory in northern England to produce electric car power units instead of combustion-engine transmissions.

The No. 2 U.S. carmaker has said its car lineup in Europe will be all-electric by 2030.

Companies like Mercedes-Benz Daimler maker have warned that shifting to electric will cost jobs at combustion-engine plants, so Ford’s announcement is a boost for workers making fossil-fuel engines at its Halewood plant near Liverpool.

The shift to electric has also been accompanied by changes in the automotive landscape, with a large number of startups hoping to become the next Tesla.

That has attracted the attention of Taiwan’s Foxconn, which has ambitious plans to diversify away from its role of building consumer electronics for Apple and other tech firms.

Indeed, Foxconn unveiled its first three EV prototypes on Monday — an SUV, a sedan and a bus — made by Foxtron, a venture between Foxconn and Taiwanese car maker Yulon Motor.

It first mentioned its EV ambitions less than two years ago and has moved relatively quickly, this year announcing deals to build cars with U.S. startup Fisker and Thailand’s energy group PTT.

The need for speed was also a reason Volkswagen AG had Tesla CEO Elon Musk address top executives at the German carmaker over the weekend.

Volkswagen’s CEO Herbert Diess has made no secret of his ambitions to chase and overtake Tesla, the world’s leading electric carmaker.

But in a Linkedin post, Diess said he had invited Musk as a “surprise guest” to drive home the point that VW needs faster decisions and less bureaucracy for what he called the biggest transformation in the company’s history.

How Evergrande found itself on the wrong side of China’s regulators (cnbc.com)

How Evergrande found itself on the wrong side of China’s regulators

KEY POINTS

- Worries about Evergrande’s ability to repay its debt and a total of $300 billion in liabilities has put global investors on edge about potential spillover into the rest of China’s real estate industry and economy.

- A closer look at Evergrande revealed a company with many of the same problems as others in the Chinese property sector, but didn’t act as quickly to respond to government rules aimed at resolving those issues.

- The company not only failed to address tighter regulation on debt levels, but was the biggest Chinese real estate issuer of overseas high-yield bonds.

BEIJING — Chinese developer Evergrande made little progress toward complying with Beijing’s crackdown on real estate debt — until it was too late for investors who poured money into its offshore bonds, now worth at least $19 billion.

Worries about the giant developer’s ability to repay its debt and a total of $300 billion in liabilities have put global investors on edge. Beyond the company itself, there are worries about a potential spillover into the rest of China’s real estate industry or economy.

A closer look at Evergrande revealed a company with many of the same problems as others in the Chinese property sector, but didn’t act as quickly to respond to government rules aimed at resolving those issues.

Evergrande has failed to meet several payment deadlines since September, and the latest was on Oct. 11 for interest owed on one of its U.S. dollar-denominated bonds. That brought its total missed payment to $279 million since last month, according to Reuters.

While the developer had taken on debt for years, its latest problems really came after tighter regulation in the last two years, analysts said.

China’s central bank on Friday said most real estate developers had stable operations, and called Evergrande a unique case in which the company “blindly” diversified and expanded. There was little indication a full-on rescue plan was on its way.

Here’s how the world’s most indebted property developer ended up in such dire straits:

Evergrande crosses all three red lines

Chinese authorities met with 12 real estate developers in August 2020, and asked them to reduce their reliance on debt. Evergrande was among those at the meeting, state media said.

The report described a “three red lines” policy, which hasn’t been officially announced. State media describe the “red lines” as three specific balance sheet conditions developers must meet if they want to take on more debt. The rules require developers to limit their debt in relation to the company’s cash flows, assets and capital levels.

Last summer, all 12 of the developers at the meeting had crossed at least one of the red lines, said Julian Evans-Pritchard, senior China economist at Capital Economics.

The problem this entire industry faces is the entire model relies too much on finance.

Zhang Yingji

SENIOR FELLOW, ICR

One year later, Evergrande and Greenland were the only companies of the original dozen that had still crossed at least one of the red lines, Evans-Pritchard said in a Sept. 22 report. As of the end of June, he said Greenland had crossed one, while Evergrande had breached all three red lines.

In contrast, “among the top 30 [developers], less than a third exceed any of the limits, compared with over two thirds a year ago,” he said. “Even firms that are not officially subject to the rules have generally complied.”

Evergrande warned investors of default in late August. Just days earlier, China’s central bank and other authorities told the company’s executives in a rare meeting to resolve their debt problems.

“The problem this entire industry faces is the entire model relies too much on finance,” said Zhang Yingji, senior fellow at Chinese real estate research institute ICR.

He said the restrictions on how quickly developers can expand come as ensuring affordable housing is a major part of China’s economic development plan for the next five years.

The average price for a residential home in China — typically an apartment — more than quadrupled between 2001 and 2019, while that of a new house in the U.S. rose 80% during the same time, according to official data from China and the U.S.

The price surge came even as Beijing began in 2016 to promote a slogan that “houses are for living in, not speculation.” It was an effort to control a property market that many likened to a bubble.

Evergrande’s U.S. dollar overseas debt

However, in the next few years, Chinese developers continued to take on debt, particularly in overseas markets.

Between 2016 and 2020, the industry’s value of offshore U.S. dollar bonds grew by 900 billion yuan ($139.75 billion) — that’s nearly two times the growth of 500 billion yuan in onshore yuan bonds, according to Nomura.

Evergrande was by far the leader in overseas debt issuance, accounting for six of the 10 largest offshore U.S. dollar-denominated bond deals by Chinese real estate companies between 2016 and 2021, according to Dealogic.

As of the first half of this year, Evergrande held 19% of U.S. dollar-denominated high yield bonds among Chinese real estate companies — the largest share, worth $19.24 billion, according to Natixis.

Next in line by overseas bond share were Kaisa, Yuzhou, China Fortune Land Development and Guangzhou R&F Properties, the data showed. All four of these companies crossed at least one red line, with China Fortune and R&F crossing all three, according to Natixis data analyzed by CNBC.

Hopson Development Holdings, which is reportedly set to acquire part of Evergrande, did not cross any of the red lines and ranks 28th by asset size, Natixis data showed.

Hopson declined to comment. Evergrande did not respond to a CNBC request for comment.

Heavy reliance on pre-sales

Like many developers in China, Evergrande sold apartments to individual consumers before the properties were completed. This allowed the company to generate cash, while taking out loans to develop the properties.

Over the last decade, the value of Evergrande’s properties under construction rose so quickly that it far exceeded the value of the company’s completed projects as well as what the company was able to sell.

By 2020, Evergrande had 1.26 trillion yuan ($195.89 billion) worth of projects under construction. But that was about 70% more than the properties the company was able to sell that year, at 723.2 billion yuan. Only about 148.47 billion yuan of projects were actually completed.

The value of properties under development accounted for just over half of Evergrande’s total assets, ticking up to 54.7% in the first half of this year, up from 54.3% at the end of last year.

https://datawrapper.dwcdn.net/EXIeL/1/ Keeping up with such a high ratio of construction projects became unsustainable once the new regulation kicked in and affected Evergrande’s ability to obtain financing.

“Financial institutions have already curtailed their direct exposures to Evergrande over the past two years,” Moody’s analysts said in an Oct. 11 note.

They said there was a drop in the company’s borrowings from banks, trust companies and other financial firms to 393.9 billion yuan at the end of June, down sharply from 604.7 billion yuan at the end of 2019.

Many of Evergrande’s projects lie in smaller Chinese cities, where economists say there is an oversupply of housing, compared to China’s largest cities, where there is a housing shortage.

The company is also in a tougher situation than other developers because of its heavy use of supplier commercial bills – tradeable contracts for paying suppliers and construction contractors, S&P Global Ratings analysts said in a Sept. 20 note.

“Evergrande’s contracted sales have fallen more than other issuers in the sector that have experienced distress,” the report said.

Without sufficient financing, it is harder to keep up construction and other assets that can be sold, S&P said. “This is shutting down Evergrande’s most important source of cash flow: contracted sales of its property projects.”

— Correction: The Evergrande chart in this story has been updated to reflect that the units are in billions of yuan.

Twitter and Square CEO Jack Dorsey says ‘hyperinflation’ will happen soon in the U.S. and the world

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Twitter co-founder and crypto advocate Jack Dorsey weighed in Friday on escalating inflation in the U.S., saying things are going to get considerably worse.

- “It will happen in the US soon, and so the world,” he tweeted.

In this article

Twitter co-founder Jack Dorsey weighed in on escalating inflation in the U.S., saying things are going to get considerably worse.

“Hyperinflation is going to change everything,” Dorsey tweeted Friday night. “It’s happening.”

https://platform.twitter.com/embed/Tweet.html?creatorScreenName=JeffCoxCNBCcom&dnt=false&embedId=twitter-widget-0&features=eyJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X2hvcml6b25fdHdlZXRfZW1iZWRfOTU1NSI6eyJidWNrZXQiOiJodGUiLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3NwYWNlX2NhcmQiOnsiYnVja2V0Ijoib2ZmIiwidmVyc2lvbiI6bnVsbH19&frame=false&hideCard=false&hideThread=false&id=1451733913961783299&lang=en&origin=https%3A%2F%2Fwww.cnbc.com%2F2021%2F10%2F23%2Ftwitter-and-square-ceo-jack-dorsey-says-hyperinflation-will-happen-soon-in-the-us-and-the-world.html&sessionId=eb6c807bf47bbd3fa83a7f8e899cc0347450527f&siteScreenName=CNBC&theme=light&widgetsVersion=f001879%3A1634581029404&width=550px The tweet comes with consumer price inflation running near a 30-year high in the U.S. and growing concern that the problem could be worse that policymakers have anticipated.

On Friday, Federal Reserve Chairman Jerome Powell acknowledged that inflation pressures “are likely to last longer than previously expected,” noting that they could run “well into next year.” The central bank leader added that he expects the Fed soon to begin pulling back on the extraordinary measures it has provided to help the economy that critics say have stoked the inflation run.

In addition to overseeing a social media platform that has 206 million active daily users, Dorsey is a strong bitcoin advocate. He has said that Square, the debit and credit card processing platform that Dorsey co-founded, is looking at getting into mining the cryptocurrency. Square also owns some bitcoin and facilitates trading in it.

Responding to user comments, Dorsey added Friday that he sees the inflation problem escalating around the globe. “It will happen in the US soon, and so the world,” he tweeted. Dorsey is currently both the CEO of Twitter and Square.

https://platform.twitter.com/embed/Tweet.html?creatorScreenName=JeffCoxCNBCcom&dnt=false&embedId=twitter-widget-1&features=eyJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X2hvcml6b25fdHdlZXRfZW1iZWRfOTU1NSI6eyJidWNrZXQiOiJodGUiLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3NwYWNlX2NhcmQiOnsiYnVja2V0Ijoib2ZmIiwidmVyc2lvbiI6bnVsbH19&frame=false&hideCard=false&hideThread=false&id=1451735753117999104&lang=en&origin=https%3A%2F%2Fwww.cnbc.com%2F2021%2F10%2F23%2Ftwitter-and-square-ceo-jack-dorsey-says-hyperinflation-will-happen-soon-in-the-us-and-the-world.html&sessionId=eb6c807bf47bbd3fa83a7f8e899cc0347450527f&siteScreenName=CNBC&theme=light&widgetsVersion=f001879%3A1634581029404&width=550px It’s one thing to call for faster inflation, but it may be surprising to some that Dorsey used the word hyperinflation, a condition of rapidly rising prices that can ruin currencies and bring down whole economies.

Billionaire investor Paul Tudor Jones and others have called for a period of rising inflation. Jones told CNBC earlier in the week that he owns some bitcoin and sees it as a good inflation hedge.

“Clearly, there’s a place for crypto. Clearly, it’s winning the race against gold at the moment,” Jones said Wednesday.

But most of the major investors have not gone so far as to call for hyperinflation like Dorsey.

Jones, Icahn, Einhorn, Gundlach — Some of the biggest names in investing are betting on inflation

Inflation has been a top-of-mind concern for Wall Street for quite some time, and warnings about persistent price pressures from some of the biggest investors reached a crescendo this week.

A number of legendary traders and investors, including Paul Tudor Jones, Carl Icahn and David Einhorn, are sounding the alarms on surging prices that some Federal Reserve officials insist are “transitory.”

These big names believe that the trillions of dollars in Covid-19 stimulus in the system is the impetus for inflation to run hotter for longer.

These widely followed investors revealed where they are hiding out and which areas of the markets they think will benefit from rising prices.

Paul Tudor Jones

Paul Tudor Jones didn’t mince words when it comes to his option about inflation. The founder and chief investment officer of Tudor Investment Corp. called inflation the “No. 1 issue facing Main Street investors” on CNBC’s “Squawk Box” this week and said it’s the single biggest threat to financial markets and society in general.

“Inflation can be much worse than what we fear. We have the demand side of the equation … and that is $3.5 trillion greater than what it normally would have … just sitting in liquid deposits,” Jones said. “They can go into stocks, or crypto, or real state, or be consumed, so that’s a huge amount of dry powder just sitting waiting to be utilized at some point, which is why inflation is not going away.”

The longtime trader said it’s time to double down on inflation hedges including commodities and Treasury inflation-protected securities, and that investors should avoid fixed income in this inflationary and low-rate environment.

“Double down on long commodities, long TIPS breakevens, long Aussie/yen in FX world,” Jones advised investors, referencing Treasury inflation-protected securities and the Australian dollar/Japanese yen currency pair.

“You don’t want to own fixed income,” Jones said. “You do not want to hold that whatsoever, because what they’re saying, what they’re telling you by their actions, is that they’re going to be slow and late to fight inflation and somewhere down the road, somebody will have to come in … and put the hammer down.”

The trader and hedge-fund manager also reiterated his bullish outlook on bitcoin and cryptocurrencies, calling the digital assets his preferred inflation hedge.

Carl Icahn

Longtime activist investor Carl Icahn said the U.S. markets could see major challenges over the long term in the face of excessive money supply and rising inflation.

“In the long run we are certainly going to hit the wall,” Icahn said on CNBC’s “Halftime Report.” “I really think there will be a crisis the way we are going, the way we are printing money, the way we are going into inflation. If you look around you, you see inflation all around you and I don’t know how you deal with that in the long term.”

Icahn was adamant about not making a market timing call, but he believes one day over the long term the markets will pay the price for those unprecedented stimulus programs.

David Einhorn

Greenlight Capital’s David Einhorn is betting big on homebuilder Green Brick Partners in the current inflationary environment. Einhorn told CNBC’s “Halftime Report” that Green Brick is his hedge fund’s largest holding, and that it makes a good bet on rising housing prices as the economy recovers from the pandemic.

“The reason we’re positioned for inflation is we believe that whether the Fed acts or doesn’t act, there’s going to be quite a lot of inflation,” Einhorn said.

The star manager has been playing the trend of higher prices in industries from real estate to financials and to commodities. His hedge fund holdings at the end of the second quarter revealed a number of inflation plays in resources.

Canadian mining company Teck Resources is a bet on the rise in base metal price. His CNX Resources stake is meant to take advantage of an expected bump in natural gas prices, and Einhorn also invested in Chemours Company to bet on a titanium dioxide price increase.

Jeffery Gundlach

Bond king Jeffrey Gundlach sees inflation in consumer prices likely staying elevated through 2021 and stay above 4% through at least 2022.

Citing pressures from shelter costs and rising wages, the head of DoubleLine Capital told CNBC’s “Halftime Report” that he sees the current inflation run as non-transitory and instead likely to persist well into the future.

“We believe that it’s almost certain that 2021 will end with a 5-handle on the [consumer price index], and it’s going higher in the next couple of readings, thanks primarily to the price of energy,” Gundlach said. “And we don’t think inflation is going below 4% anytime in 2022.”

— CNBC’s Jeff Cox contributed reporting.

China pushes to design its own chips, but still relies on foreign tech (cnbc.com)

China is pushing to develop its own chips — but the country can’t do without foreign tech

KEY POINTS

- Chinese technology giants from Alibaba to Baidu have been designing their own chips, a move seen as progress towards China’s goal to boost its domestic capabilities in a critical technology.

- In reality, China is still a long way off even if it’s one step closer to self-sufficiency, says one expert, adding that the country is still heavily dependent on foreign technology and lagging in the so-called leading edge part of the chip market.

- China’s reliance on foreign companies in the semiconductor supply chain could make domestic firms vulnerable to any geopolitical tensions as has been the case with both Huawei and SMIC.

GUANGZHOU, China — China’s technology giants have been pushing to develop their own semiconductors or chips, a move seen as progress toward China’s goal to become self-reliant in the critical technology.

In reality, China is still a long way off even if it’s one step closer to self-sufficiency, according to one expert, adding that the country is still heavily dependent on foreign technology and lagging in the so-called leading edge part of the chip market.

Semiconductors are key components in everything from smartphones to modern refrigerators to cars. They’ve also become a key focus of the broader technology battle between the U.S. and China.

The world’s second-largest economy has for years invested heavily into boosting its domestic chip industry, but it has struggled to catch up with rivals in the U.S. and other parts of Asia. Increasingly, semiconductors are seen as key to national security for many countries and a sign of technological prowess.

There’s been a slew of announcements from major Chinese technology companies this year regarding chips made in China.

In August, Baidu launched Kunlun 2, its second-generation artificial intelligence chip. This week, Alibaba released a chip designed for servers and cloud computing. Smartphone maker Oppo is also developing its own high-end processors for its handsets, the Nikkei reported on Wednesday.

This is a step in becoming more self-sufficient in semiconductors but a small one.

Peter Hanbury

PARTNER, BAIN & COMPANY

While these companies are designing their own chips, they might still have to rely on foreign tools to do so. But when it comes to manufacturing and the broader supply chain, China’s internet giants are still heavily dependent on foreign companies.

“This is a step in becoming more self-sufficient in semiconductors but a small one,” Peter Hanbury, a partner at Bain & Company, told CNBC by email. “Specifically, these are examples of locally designed chips but a lot of the IP [intellectual property], manufacturing, equipment and materials are still sourced internationally.”

The reason these companies are designing their own chips is because they can create semiconductors for specific applications so as to differentiate from their competitors.

Foreign-dominated supply chain

A closer look at the specifics of the silicon being designed shows China’s reliance on foreign companies.

Take Alibaba’s new Yitian 710 chip. That is based on architecture from British semiconductor firm Arm. It will also be built upon the so-called 5-nanometer process, the most advanced chip technology at the moment.

Baidu’s Kunlun 2 chip is based on the 7-nanometer process. Oppo meanwhile is reportedly working on a 3-nanometer chip.

The country does not have a company capable of manufacturing these leading edge semiconductors at these sizes. They will have to rely on just three companies — Intel from the U.S., TSMC from Taiwan and Samsung in South Korea.

China’s largest chip manufacturer SMIC is still years behind its companies in terms of manufacturing technology.

But it’s not just manufacturing. Even companies like TSMC and Intel rely on equipment and tools for the manufacturing process from other companies.

In that area, power is concentrated in the hands of a few: ASML, a company from the Netherlands, is the only company in the world capable of making a machine that chip manufacturers need to make the most advanced chips.

“The semiconductor ecosystem is large and complex, so building self-sufficiency is very difficult across such a broad range of technologies and capabilities,” Hanbury said.

“In general, the most challenging area to build self-sufficiency will be the leading edge. Here, the challenge is you need both investment dollars, but you also need to overcome the massive requirements around technical expertise and accumulated experience.”

Geopolitical vulnerabilities

The reliance on foreign companies leaves Chinese firms vulnerable to any geopolitical tensions — as was the case with both Huawei and SMIC.

Huawei designed its own smartphone processors called Kirin. The chips were usually based on the latest technology and helped the Chinese smartphone giant become one of the biggest smartphone players in the world.

However, the U.S. put Huawei on a trade blacklist called the Entity List in 2019 which cut off the Chinese company from certain U.S. technology. Last year, Washington introduced a rule which requires foreign manufacturers using American chipmaking equipment to get a license before they’re able to sell semiconductors to Huawei.

Huawei’s chips were manufactured by TSMC. But when the U.S. rule was introduced, TSMC could no longer make semiconductors for Huawei. That crippled its smartphone business globally.

SMIC is also on the U.S. blacklist which restricts its access to American technology.

These sanctions could be a concern for Chinese companies now developing their own chips.

“For example, if there was an effort to block the shipment of smart phone processors then Oppo, for example, would have a domestically designed source of chips,” Hanbury said. “However, most of these chips are still manufactured using international technology so they could still lose access to their chips if the manufacturing partner for these chips were blocked from manufacturing.”

Supply chain concerns

Governments around the world now see semiconductors as extremely strategic and important technology.

U.S. President Joe Biden has called for a $50 billion investment in semiconductor manufacturing and research and has looked for chipmakers to invest in the country. In March, Intel announced plans to spend $20 billion to build two new chip factories, called fabs, in the U.S.

“This is about out-competing China,” Commerce Secretary Gina Raimondo told CNBC in March.

https://buy.tinypass.com/checkout/offer/show?displayMode=inline&containerSelector=.nonpremium-pro-video&templateId=OT22LE29SGTR&offerId=OFM2EQ9FEKFR&formNameByTermId=%7B%7D&showCloseButton=false&experienceId=EXMVVFAI6X8Y&widget=offer&iframeId=offer-0-kluh3&url=https%3A%2F%2Fwww.cnbc.com%2F2021%2F10%2F25%2Fchina-pushes-to-design-its-own-chips-but-still-relies-on-foreign-tech.html%3F__source%3Diosappshare%257Ccom.apple.UIKit.activity.Mail&parentDualScreenLeft=0&parentDualScreenTop=0&parentWidth=1278&parentHeight=729&parentOuterHeight=800&aid=o19WonOrHQ&userProvider=publisher_user_ref&userToken=&customCookies=%7B%7D&hasLoginRequiredCallback=true&initMode=context&width=630&_qh=d6420864b9 Washington has looked to bring semiconductor manufacturing back to the U.S., seeing it as key for national security, given the supply chain is very concentrated in Asia.

But like-minded nations are also trying to work together to ensure their semiconductor supply chains are secure.

Leaders of the the United States, India, Japan and Australia, a group known as the Quad, announced plans in September to establish a semiconductor supply chain initiative aimed at identifying vulnerabilities and securing access to semiconductors and their vital components.

A lot of the recent discussion on semiconductor supply chains was sparked by a global chip shortage that has hit industries from autos to consumer electronics, and worried leaders about their countries’ ability to secure semiconductors when required.

So where is China now?

China may be ahead of its peers in some areas of chip development, but it will find difficulty catching up with cutting-edge technology, at least in the short term.

For example, SMIC can manufacture 28-nanometer chips on a large scale. These could be used in TVs or even autos — an area China could do well in, particularly with the current shortage of semiconductors.

https://art19.com/shows/bcd08fc3-8958-4c47-bf8e-524432adcd77/episodes/30369294-05fb-435d-b521-0de042712416/embed However, to put things in perspective, TSMC is already working on 3 nanometer technology. SMIC would have to master the manufacturing processes that TSMC has been doing for years before being able to catch up.

“So even moving quickly forward across these existing technologies would not be enough to catch up and reduce reliance at the leading edge because the leading edge is constantly moving forward,” Hanbury said.

“It’s like running a race to catch a really fast runner while that runner is quickly running away from you.”

Goldman Sachs says investing in China is more challenging now, but the country isn’t ‘uninvestable’

KEY POINTS

- Certain segments of the Chinese stock market have “done very well this year,” says Timothy Moe of Goldman Sachs.

- Moe said policy changes have in some cases served as a tailwind rather than headwinds in certain pockets of China’s markets.

- Concerns over an ongoing regulatory crackdown by Beijing have weighed heavily on China’s major markets this year.

There are pockets of opportunities in China’s stock markets despite an increasingly challenging investment backdrop, says Goldman Sachs’ Timothy Moe.

“There are certainly a host of challenges that China is facing right now — but we would push back quite vigorously on the sweeping statement that China is ‘uninvestable,’” Moe, chief Asia-Pacific equity strategist and co-head of Asia macro research at the investment banking giant, told CNBC’s “Squawk Box Asia” on Friday.

“It’s just way too overarching and really misses a lot of the specificity that is needed to invest in China,” he said.

That narrative does not necessarily extend across the entire Chinese stock market, Moe said, adding that policy has in some cases served as a tailwind for some sectors.

He cited the example of “hard technology areas” such as semiconductors, where Beijing has clearly signaled it wants to become self-sufficient in.

In March, China’s largest and most important chipmaker Semiconductor Manufacturing International Corporation announced it was building a $2.35 billion factory in Shenzhen — a major technology hub in the country.

Other sectors that have benefited from policy include the new energy space that was “espoused” in Beijing’s 14th five-year plan, Moe said. Last year, Chinese President Xi Jinping announced plans for the country’s carbon emissions to begin declining by 2030, with the aim of reaching carbon neutrality by 2060.

“If you look at those parts of the market, they’ve done very well this year,” Moe said, though he acknowledged that the investment environment in China has “become more challenging.”

Concerns over an ongoing regulatory crackdown by Beijing have weighed heavily on Chinese stocks this year.

The CSI 300 index, which tracks the largest mainland-listed stocks, was down nearly 5% as of Friday’s close. In comparison, other major regional indexes such as Japan’s Nikkei 225 surged roughly 5% in the same period.

On Wall Street, the Dow Jones Industrial Average and S&P 500 have also sailed to record highs in recent days on the back of strong corporate earnings.

— CNBC’s Yen Nee Lee contributed to this report.

HI Financial Services Mid-Week 06-24-2014