HI Market View Commentary 10-12-2020

| Market Recap |

| WEEK OF OCT. 5 THROUGH OCT. 9, 2020 |

| The S&P 500 index rose 3.8% last week, marking its second consecutive week higher, as the materials, energy, technology and utilities sectors led broad gains amid renewed hopes for a pandemic stimulus plan. The market benchmark ended the week at 3,477.13, up from last Friday’s close of 3,348.44, putting the index into the black for October with a month-to-date increase of 3.4%. All of the S&P 500’s sectors ended above their week-earlier levels with both the materials sector and energy sector finishing the week up 5.1%. That was followed by gains of 4.6% each in technology and utilities. The strong weekly advance came as investors grew more hopeful for a second round of stimulus measures to be agreed upon by Congress, especially as President Donald Trump — who returned to the White House this week following hospitalization and treatment for COVID-19 — appeared eager to distribute stimulus checks. Trump said Thursday that negotiators on Capitol Hill were “starting to have some very productive talks” on stimulus. Still, Democrats and Republicans continue to disagree over key details. The materials sector’s gainers included Martin Marietta Materials (MLM). Shares rose 14% as the company’s stock was boosted by an improved analyst view. Deutsche Bank upgraded its investment rating on the stock to buy from hold. The jump in energy stocks coincided with a strong weekly gain in crude oil futures thanks to the hopes for renewed stimulus talks while Hurricane Delta forced the evacuation of Gulf of Mexico platforms. Gainers in the sector included ONEOK (OKE), whose shares rallied 9.5% this week amid positive analyst actions. Among them, Wells Fargo upgraded its investment rating on the shares to overweight from equal-weight. The technology sector was boosted by a 6.0% jump in the shares of International Business Machines (IBM) as the company unveiled plans to split off its Managed Infrastructure Services unit into a separate, publicly trading company. IBM said the new company, which has yet to be named, will be a tax-free spin-off to investors, expected to be completed by the end of 2021. The remaining IBM will have 50% of its portfolio in recurring revenue, the company said. In the utilities sector, DTE Energy (DTE) also benefited from positive analyst actions, with JPMorgan upgrading its investment rating on the stock to overweight from neutral while raising its price target on the shares to $134 from $126. This came amid a report the company is considering selling or spinning off its natural gas pipelines and other non-utility operations. Shares of DTE climbed 5.4%. Next week, the Q3 earnings reporting season kicks off in earnest, with those releasing quarterly results next week including Johnson & Johnson (JNJ), JPMorgan Chase (JPM) and Delta Air Lines (DAL). Investors will also be watching next week for Tuesday’s release of the consumer price index for September, Wednesday’s producer price index for September, and retail sales and consumer sentiment due Friday, among other data points. Provided by MT Newswires. |

At the beginning of the year Technology run had ended by all market experts

Lonely and loving it !!! Being a contrarian at time can be very difficult

HI – Doesn’t invest in funds, we do our own research, we protect so we can be wrong without blowing up someone’s portfolio, we let the numbers do the talking

That doesn’t mean we don’t get stuck waiting for a period of time

We are actively doing something while you wait SO the equity doesn’t have to come back as much

What are we doing? Protecting for earnings and the uncertainty of the election

YOU should expect more from your advisor/broker and find out what they really do for you !!!!

Where will our markets end this week?

Higher

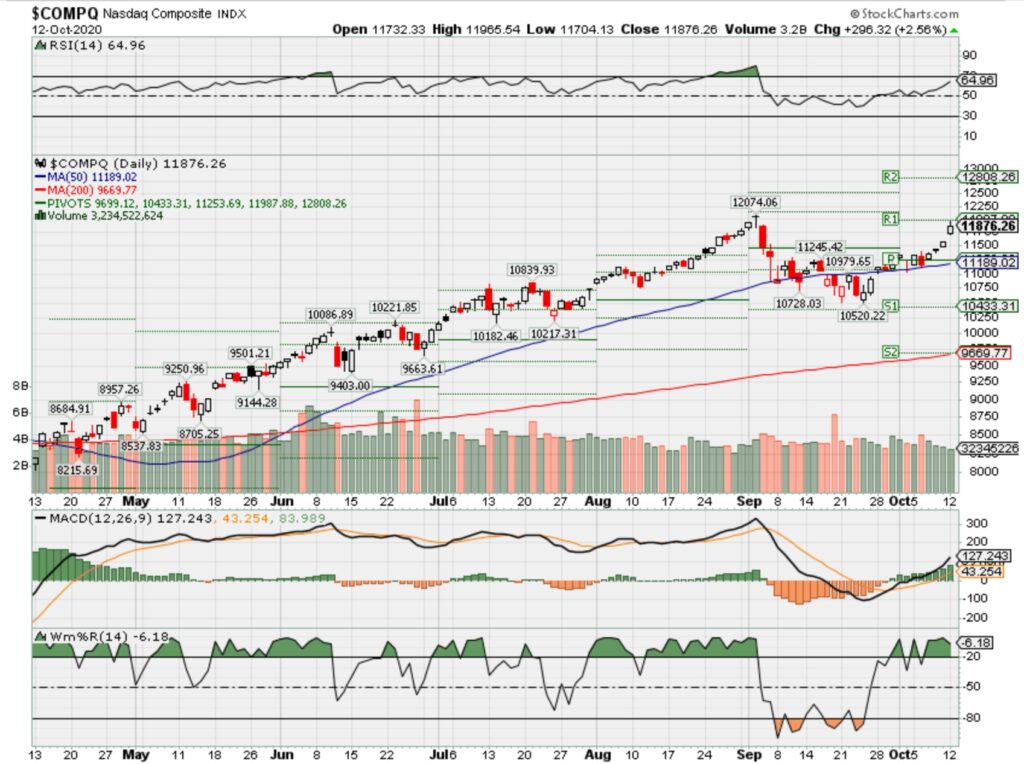

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end October 2020?

10-12-2020 0.0%

10-05-2020 -5.0%

09-28-2020 -5.0%

Earnings:

Mon:

Tues: C, BLK, FAST, JNJ, JPM

Wed: GS, USB, UNH, WFC, AA, UAL, BAC

Thur: SCHW, MS, WBA, ISRG

Fri: BK, SLB, VFC

Econ Reports:

Mon:

Tues: CPI , Core CPI, NFIB Small Business Outlook

Wed: MBA, PPI, Core PPI, Beige Book

Thur: Initial Claims, Continuing Claims, Phil Fed, Empire Manufacturing, Import, Export

Fri: Retail Sales, Retail ex-auto, Capacity Utilization, Industrial Production, Business Inventories, Michigan Sentiment, NAHB Housing Market Index, OPTIONS EXPIRATION MONTHLY

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

All positions are mostly protected and now looking for OTM covered calls to add for full collar positions. Just trying to get to the elections and earnings.

EARNINGS

AA 10/14 AMC

AAPL 10/29 AMC

BA 10/28 BMO

BAC 10/14 BMO

BIDU 11/05 est

LLY 10/27 BMO

DIS 11/12 AMC

F 10/28 AMC

FB 10/29AMC

JPM 10/13 BMO

KEY 10/21 BMO

UAA 11/02 BMO

V 10/28 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

When is the best time to have protection on?

When you have tech crossover, one – two weeks before earnings (ATM !!!), Prior to a management or new product announcement

https://www.cnbc.com/2020/10/12/disney-reorganizes-to-focus-on-streaming-direct-to-consumer.html

Disney says its ‘primary focus’ for entertainment is streaming — announces a major reorg

KEY POINTS

- Disney is restructuring its media and entertainment divisions.

- In order to further accelerate it’s direct-to-consumer strategy, the company will be centralizing its media businesses into a single organization that will be responsible for content distribution, ad sales and Disney+.

- The change comes as the global coronavirus pandemic has crippled its theatrical business and ushered more customers towards its streaming options.

Disney is restructuring its media and entertainment divisions, as streaming becomes the most important facet of the company’s business.

On Monday, the company revealed that in order to further accelerate it’s direct-to-consumer strategy, it would be centralizing its media businesses into a single organization that will be responsible for content distribution, ad sales and Disney+.

The move by Disney comes as the global coronavirus pandemic has crippled its theatrical business and ushered more customers towards its streaming options. As of August, Disney has 100 million paid subscribers across its streaming offerings, more than half of which are subscribers to Disney+.

Only last week, activist investor Dan Loeb called on Chief Executive Officer Bob Chapek to end the company’s annual $3 billion dividend to divert more capital to new Disney+ content.

Loeb’s Third Point Capital is one of Disney’s largest shareholders and bought more shares earlier this year in support of Disney’s repositioning around Disney+, its flagship subscription streaming service.

As part of this reorganization, Disney has promoted Kareem Daniel, the former president of games and publishing within Disney’s consumer products division. He will now oversee the new media and entertainment distribution group.

He’ll be in charge of making sure streaming becomes profitable, as the company continues to invest heavily in its various streaming products. Daniels will hold the reins to all of the company’s streaming services and domestic television networks, including all content distribution, sales and advertising.

Disney is becoming more reliant on Disney+ as movie theaters have been unable to recover after being shuttered in March due to the outbreak. Ticket sales have been particularly lackluster at domestic cinemas since the industry attempted a large-scale reopening in late August.

In recent months, the company pushed back a number of its theatrical releases including Marvel blockbuster “Black Widow.” The much anticipated Pixar film “Soul” has also been postponed. It will now arrive on Disney+ in December.

Analysts are still awaiting word from Disney about how “Mulan” fared after Disney removed it from theatrical release and sold it through Disney+ for $30. It is expected the company will share more details about its performance during its next earnings report in November.

Daniel will be responsible, in part, for making big decisions about Disney’s theatrical and streaming release schedules going forward.

Reorganizing Disney’s media business

Alan Horn and Alan Bergman will remain in charge of the company’s studios, Peter Rice will continue to head the company’s general entertainment group and James Pitaro will stay as head of the company’s sports content.

All will report directly to CEO Bob Chapek. The company’s parks, experiences and products segment will remain under the leadership of Josh D’Amaro and Rebecca Campbell will remain on as the chairman of direct-to-consumer and international operations. Campbell will report directly to Chapek for all things related to international operations but will report to Daniel when it comes to Disney+, Hulu and ESPN+.

“Given the incredible success of Disney+ and our plans to accelerate our direct-to-consumer business, we are strategically positioning our Company to more effectively support our growth strategy and increase shareholder value,” Chapek said in a statement announcing the reorganization. “Managing content creation distinct from distribution will allow us to be more effective and nimble in making the content consumers want most, delivered in the way they prefer to consume it.”

Under Horn and Bergman, the studios segment will focus on creating content for theatrical release, Disney+ and Hulu. Walt Disney Studios, Marvel Studios, Pixar Animation Studios, Walt Disney Animation Studios, Lucasfilm, 20th Century Studios and Searchlight Pictures all fall under their perview.

Rice’s general entertainment segment includes 20th Television, ABC Signature and Touchstone Television, ABC News, Disney Channels, Freeform, FX and National Geographic.

As for Pitaro’s sports segment, that will focus on live sports programming, sports news and original and non-scripted sports-related content across ESPN, ESPN+ and ABC.

Daniel’s media and entertainment distribution group will manage all distribution, operations, sales and advertising across the three content groups. Daniel has spent 14 years at with company in a variety of positions. He helped transform Disney’s Star Wars property into the two Star Wars: Galaxy’s Edge lands in Disney World and Disneyland as well as aided in bringing Toy Story Land, Pixar Pier and Avengers Campus to the parks.

“Kareem is an exceptionally talented, innovative and forward-looking leader, with a strong track record for developing and implementing successful global content distribution and commercialization strategies,” said Chapek.

This new structure is effective immediately. The company currently expects to transition its financial reporting to reflect these changes beginning in the first quarter of fiscal 2021.

Additionally, Disney announced that it will hold a virtual investor day on Dec. 10.

— CNBC’s Julia Boorstin contributed to this report.

Amazon Prime Day is coming up and here are the deals to watch for

KEY POINTS

- Amazon will hold its annual Prime Day Oct. 13 to 14.

- Here’s how to take advantage of the 48-hour sales event.

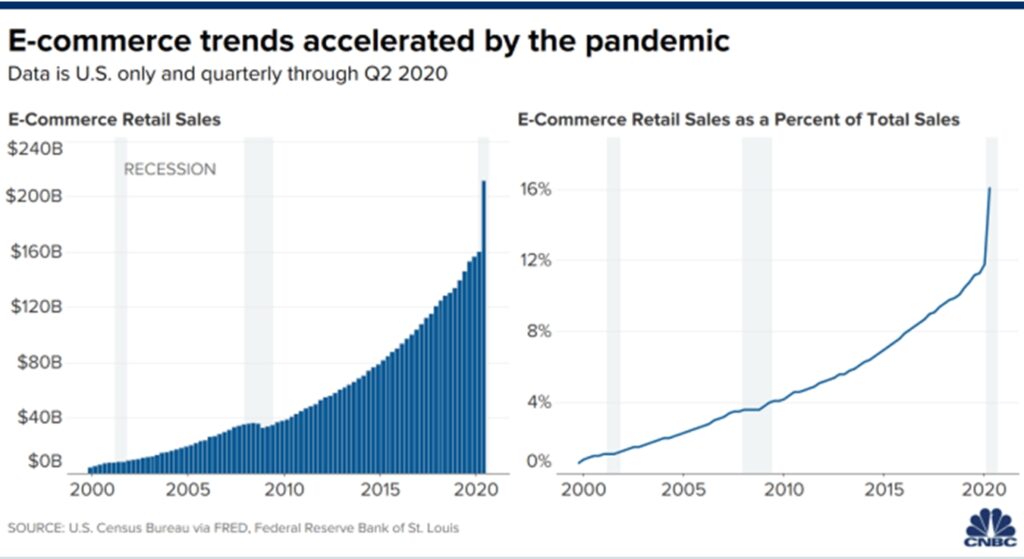

Amazon is betting that, after months of conserving cash, Americans may be ready to shop again — if the price is right.

The online retail giant is kicking off its annual two-day shopping event at midnight PT (3 a.m. ET) on Tuesday, Oct. 13.

Prime Day, which was originally slated for July but postponed due to the pandemic, will run through Wednesday, Oct. 14, with discounts on more than 1 million items, including intermittent “Lightning Deals,” for Prime members.

However, even as the holidays approach, how much consumers are willing to spend remains very much up in the air, according to the National Retail Federation.

“The outlook is clouded, with uncertainty pivoting on Covid-19 infection rates,” the NRF’s Chief Economist Jack Kleinhenz said in a statement.

This year, the deal could make all the difference, said Bethany Hollars, a shopping strategist.

“People are cutting back on non-essential shopping and looking for deals,” she said. “If they can’t get a good deal, for a lot of people, they can’t buy it.”

“There is always one thing everybody goes for,” said Julie Ramhold, a consumer analyst at DealNews.com, of the two-day shopping event.

Last year, it was the Amazon coat. This year, it will likely be geared toward people staying in, she said. “I wouldn’t be surprised if it was a fire pit.”

Typically, about 40% of the deals on Prime Day are home- and garden-related, according to Ramhold.

That may prove even more desirable now that Americans are spending much more time at home amid the coronavirus crisis.

Already, the Toshiba 32-inch Smart HD Fire TV is marked down more than 30% to $119.99 and some furniture, appliances and tools are 20% off.

Not surprisingly, Amazon devices, such as the Echo or Kindle, will also be deeply discounted.

Other retailers are also starting holiday deals as early as October and extending them throughout the holiday season.

Target announced its own sales event — Target Deal Days — during the same two-day period. It said it will have more than double the digital deals it offered last year on electronics, beauty items, toys and more.

Walmart said it will feature Black Friday-like savings during its “Big Save Event,” which starts the evening of Oct. 11 and runs through Oct. 15. The deals will include $50 off of a Pioneer Woman 6-quart Instant Pot and a 55-inch JVC 4K HDR Roku Smart TV for $248.

To best navigate Prime Day, Ramhold advises shoppers to download the Amazon app and scroll through upcoming deals, then mark the items you are interested in as “watching” — you’ll receive a notification when the price drops.

When a deal is live, add the item to your cart immediately. Some Lightning Deals can sell out quickly, she said. Once it is in your cart, you’ll have 15 minutes to decide whether to complete the purchase.

If there is a specific product that you are set on and you don’t see it in upcoming sales, you can create a wish list and Amazon will alert you if it does become part of a Prime Day deal.

Over 40 airlines have failed so far this year — and more are set to come

KEY POINTS

- Huge aid packages saved airlines at a time when air travel came to a near standstill because of the coronavirus, but the worst is not over, analysts said.

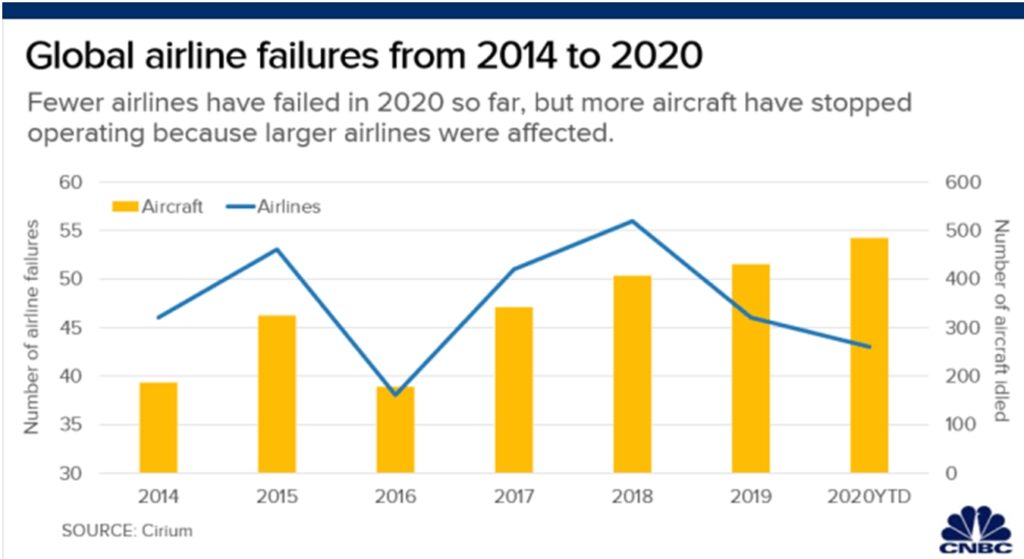

- Travel data company Cirium found that 43 commercial airlines have failed — completely ceased or suspended operations — in 2020 so far, compared to 46 in all of 2019 and 56 throughout 2018.

- The effect of the pandemic is so great that larger airlines have also been badly hit in this environment, said Rob Morris of Cirium.

SINGAPORE — Strong government support has stopped some airlines from going bankrupt — but more carriers could fail in the coming months, aviation experts say.

Travel data company, Cirium, found that 43 commercial airlines have failed since January this year, compared to 46 in the whole of 2019 and 56 in all of 2018. A failed airline is one that has completely ceased or suspended operations, according to Cirium’s definition.

“Without government intervention and support we would have had mass bankruptcies in the first six months of this crisis. Instead, we have had a manageable number of bankruptcies and very few collapses,” said Brendan Sobie, an independent analyst at Sobie Aviation.

Sobie said many airlines were already struggling before the pandemic hit, but they now have a “better chance at survival” because of government help.

“If there is any silver lining in all of this, it is that things were so bad that governments had no option but to support,” said Rob Morris, global head of consultancy at Cirium.

More failures on the way?

Despite the financial aid, however, the outlook for the rest of 2020 is “not encouraging,” Morris said.

“Many airline failures typically occur in the final few months of the year,” he told CNBC in an email. The first and fourth quarters are “the hardest” because most of the revenue is generated in the second and third quarters.

But I still don’t expect mass bankruptcies. The number of bankruptcies and collapses should be manageable and also spread out over a relatively long period of time.

Brendan Sobie

SOBIE AVIATION

“I would typically characterize that airlines spend summers building ‘war chests’ so that they can survive winters,” he added. The goal for airlines now is to “survive at any cost” and see if the summer of 2021 brings solutions or higher demand.

“With demand recovery in most regions stalled and airlines still struggling with revenue generation and cash outflow, we expect to see more failures in the final quarter of 2020 and first quarter of 2021 at least,” he said.

Brendan Sobie of Sobie Aviation agreed with the prediction, and said some governments may be reluctant to bail airlines out a second time.

“But I still don’t expect mass bankruptcies. The number of bankruptcies and collapses should be manageable and also spread out over a relatively long period of time,” he said.

Larger airlines affected

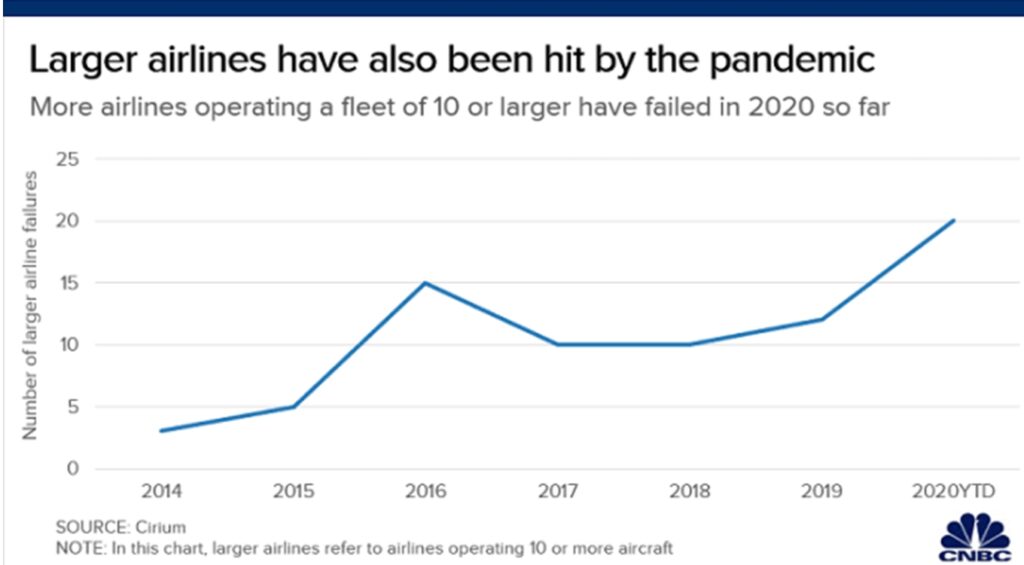

Bigger airlines are being impacted this time, Morris pointed out.

Of the 43 airlines that failed in 2020 so far, 20 of them operated at least 10 aircraft, compared to 12 in all of 2019 and 10 throughout 2018, Cirium’s data showed.

“Although we have seen fewer airline failures this year, the number of those airlines failing that operated ten or more aircraft is already greater than we have seen in any of the past six complete years. Thus it is clear that the pandemic is impacting larger airlines and causing them to fail,” Morris said.

A higher number of aircraft has also stopped operating as a result. Some 485 planes have been idled because of airline failures so far, versus 431 in 2019 and 406 in 2018.

Airlines may go bankrupt because of poor business models or other local issues, he highlighted. But the larger failures of 2020 and those to come are “inevitably a consequence of the pandemic-induced loss of demand.”

“Coming off the back of ten years of continued demand expansion which resulted in the global traffic base almost doubling in that time, this sudden shock has left airlines with no revenue and structurally high costs,” Morris added.

The International Air Transport Association this week warned that the industry will burn $77 billion in cash in the second half of 2020, and continue to bleed around $5 billion or $6 billion per month in 2021 because of slow recovery.

How Garmin survived the iPhone and started growing again

Robert Ferris@IN/ROBERT-FERRIS-A482061/@ROBERTOFERRIS

Garmin was once a rising star in consumer electronics, with its personal navigation devices a common sight on car dashboards and in hikers’ backpacks.

The company’s heyday — roughly the late 1990s to around 2008 — ended with the birth of GPS-enabled smartphones from Apple and Google, which offered convenience and features like real-time traffic data Garmin didn’t have.

But the Kansas-based tech company has orchestrated a successful second act by building niche businesses in smartwatches, navigation for boats and airplanes and other segments. The company has even begun to rebuild its automotive business, but this time as direct supplier to automakers such as BMW.

Garmin’s revenue hit a peak of about $3.5 billion in 2008, but in one-year’s time it fell to $2.9 billion, as the country plunged into a years-long recession. Garmin continued to struggle until about 2013.

The American economy recovered, but Garmin’s dashboard navigation device business did not. Instead, since about 2015, the company has been growing by focusing on niche uses for its technology. Two big areas of growth have been fitness and outdoor, where it has a couple of lines of smartwatches aimed at serious athletes like marathon runners.

Longbow Research analyst Nikolay Todorov looked at more than 50,000 data uploads from runners in major marathons, such as New York, Boston and Chicago, as well as events in Europe, and found more than 70% of participants using a watch were using one made by Garmin. They have actually grown share since 2016.

Over the past 12 months, Garmin shares have climbed 13% to about $96, as its investments have begun to pay off.

Its fitness and outdoor businesses have grown more than five times in size since 2009, aviation and marine have grown three times, Todorov told CNBC. But it has taken a while for the whole company to see growth, because the declining car dashboard device business had once been such a large percentage of the company’s total sales.

To sustain its newfound momentum, it will need to fend off competitors with innovation and continue to differentiate itself. For example, its smartwatches are known for their long battery life, which far exceeds that of the typical Apple Watch. They also have specialized apps that can collect a wide range of data for specific activities, such as surfing or mountain biking.

“So they have really found themselves in niche sub-segments in each of those broader markets. They have focused on product quality and execution,” Todorov said. “And they have they’re starting to reap up really good success.”

Growing RIAs Aren’t Bluffing. Clients Feel Let Down and Want New Advisors.

Advisors who are embracing new technologies amid the pandemic have happier clients, suggests a new AssetMark survey. · Greg Bartalos

October 08, 2020Until this year, advisors have had it relatively easy — or at least easier. A decade-long bull market allowed them to loosen their ties and not spring from the chair each time the phone rang. Clients were generally happy and not overly demanding given that stocks pushed higher year after year. As long as their goals were being met, investors generally forgave advisors for underperforming a benchmark because the “numbers on the screen” were still green. Then the pandemic struck, changing everything.

Suddenly, advisors had to scramble to more tangibly demonstrate value and justify their costs while calming jittery clients to ensure they are happy, or at least not plotting their exit while staring around the clock at their portfolios with bulging, blood-shot eyes.

While this narrative may sound familiar, a new survey is putting hard numbers next to the words.AssetMark’s first American Financial Experience Survey states that since the pandemic began 62% of investors with advisors changed how they view their advisor’s performance. While 28% feel more positive about their advisor, 26% are “now questioning who they’re with” and 8% “are now unhappy with their advisor.”

[Like this article? Subscribe to RIA Intel’s’ twice-weekly newsletter.]

What’s the difference between happy clients and those unhappy or questioning their relationships?

“It speaks to which advisors could pivot and connect with clients,” Michael Kim, Chief Client Officer of AssetMark, told RIA Intel. Those that have embraced new technologies and virtual technology “are making a positive impression.”Kim mentions, as an example, an advisor who sends birthday videos to clients. It’s “fun, personal” and effective. “He should be in Hollywood.” He also mentioned a Houston-based advisor who requires both spouses or involved parties to attend Zoom client meetings. “Travel is a non-issue.”

“The key takeaway is that there is incredible demand for education and awareness about how to invest,” said Kim, who notes that current uncertainty is driving this desire. “Advisors that can translate a complex topic into what it means for a client,” are particularly well positioned, he said.

AssetMark’s inaugural survey, which is aimed at “understanding the pulse of the investing public,” indicates that 46% of investors are seeking to learn more about investing. “We believe this demonstrates a tremendous opportunity for advisors to educate clients and prospects about the opportunities in investing, how to start, and the value advisors provide.”

Victor Ricciardi, Visiting Assistant Professor of Finance, Washington and Lee University, underscores the importance of frequent and frank client communication. That involves listening, he told RIA Intel.“Advisors that are concerned about how clients perceive their overall performance should have honest and open conversations with their clients. Financial professionals that have proactive communications and demonstrate a genuine caring relationship with their clients are more likely to have happier clients. Remember to let your clients speak and express themselves, sometimes all they might need is an advisor that is a good listener in order to reduce the stress level of the client.”

One in four clients would leave their financial advisor due to lack of “personal connection,” according to an August study by AIG Life & Retirement and MIT AgeLab that surveyed more than 2,000 financial clients.

Younger clients and the wealthiest communicate most with their advisors. It reports that “30-45-year-olds and people with $250k+ in investible assets were in significantly more contact” with their financial planner.

The study noted that more than one-third of clients 30-to-45 years old say they view their ideal advisor as a life coach (40%) or friend (35%). Younger clients describe their financial advisor’s network (53%) and personality (48%) as key drivers of satisfaction. And quirk can go far with younger clients. “Nearly 20% prefer the tone of the meeting to be humorous.”

Greg Bartalos (@gregorianchance) is editor of New York City-based RIA Intel.

Subscribe to RIA Intel’s twice-weekly newsletter and follow the publication on Twitter and LinkedIn.

HI Financial Services Mid-Week 06-24-2014