HI Market View Commentary 10-04-2021

A 30,0000 ft. view of our portfolio this year

- Our loser stocks have gone sideways much of the year

- BA, UAA have gone up after earnings and then fell and went sideways.

- In other words we’ve paid too much for protection on these stocks.

SO.. why stick with them? Why not rotate out?

- Because the story is still alive

- The reopening trade is still coming along.

- DIS: Movies with better margin, still have parks that can open, The streaming app is brilliant because people need their kids to entertained, and DIS owns “happiness” with regard to kids.

- BA: more people taking trips, need to see more business trips.

SO what are we looking forward into the end of the year?

- Still have an infrastructure bill

- Christmas rally to look forward

- Still have the reopening play

or

What do you do when things get tough?

We are going to stick to our process/methodology because it has proven to be the best way to invest in the stock market since the inception of options!!!! It’s what we do and we do it very well!!!

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 01-Oct-21 15:20 ET

Third quarter 2021 earnings preview

There is talk of playoff baseball; pumpkins are out on doorsteps; and there is chatter about the great stock market crashes of 1929 and 1987. This can mean only one thing: the month of October has arrived.

No one can be certain if it will be a good month, or a bad month, for stocks. We can be certain, however, that it will be a month filled with lots of earnings news.

The third quarter earnings reporting period goes into full swing in the latter half of the month and that period will help determine if October is going to be a good month, or a bad month, for stocks.

Strong Growth Expected

Analysts are projecting strong earnings growth and strong revenue growth for the third quarter. According to FactSet, S&P 500 companies are expected to report earnings growth of 27.6% and revenue growth of 14.9%.

Those projections are in vaunted territory. There have been only two other instances since the third quarter of 2010 (i.e., the previous two quarters) when earnings growth has been stronger and only one other instance since 2008 (i.e., last quarter) when revenue growth has been stronger.

These estimates have been increasing, too. On June 30 they stood at 24.2% and 12.6%, respectively; moreover, they are well above the five-year average growth rates of 7.1% and 3.9% per FactSet.

The strong growth outlook is a byproduct of easier comparisons, but to be fair, it is also a byproduct of strong demand.

Ten of the 11 economic sectors are expected to report year-over-year earnings growth. The one exception is the utilities sector.

The energy, materials, and industrials sectors are anticipated to report the strongest growth of all sectors, though, which speaks to the strength of the cyclical recovery.

Concern about Earnings Prospects

It’s a good picture of things to come — or it seems to be anyway. So, then, why is the stock market in a funk right now?

At its record high on September 2, the S&P 500 was up 5.8% since June 30. At its low this Friday, the S&P 500 was down 0.2% since June 30. In other words, the stock market’s mood has shifted.

Various factors have accounted for the shift:

- An expectation that monetary policy is destined to become increasingly less dovish

- A rapid uptick in longer-dated Treasury yields, which has been driven by tapering expectations and inflation angst

- Misgivings about the infrastructure bills getting passed

- Relative weakness in the mega-cap stocks

- China’s regulatory crackdown and economic problems there altering the global growth outlook

One item conspicuously absent in the list above is concern about earnings prospects. It seems hard to believe knowing we are on the cusp of perhaps seeing some of the strongest earnings growth since 2010. That, however, is the issue.

There is concern that the third quarter is as good as it is going to get for some time and that there will be a progressive deceleration in earnings growth in coming quarters, not just because of tougher comparisons but also because of profit margin pressures driven by supply chain constraints, higher prices for raw materials, higher labor costs, and higher transportation expenses.

Ask Sherwin-Williams

Companies have been increasingly pointing a finger at these factors as a basis for sounding more cautious about their sales and earnings outlook. The market is understandably concerned that more such warnings will be heard during the third quarter reporting period.

The market has been put on notice by the likes of Nike (NKE), FedEx (FDX), 3M (MMM), Sherwin-Williams (SHW), DR Horton (DHI), Costco (COST), and Micron (MU), which have called attention to these earnings headwinds.

Importantly, though, they haven’t necessarily sounded an alarm about weakening demand; and many have talked about implementing price increases to help offset the impact of higher costs.

The fact that demand remains strong, generally speaking, has kept the stock market from freaking out — so to speak — about corporate earnings prospects as they currently stand.

There is an allowance for the idea that earnings growth will slow because of tough comparisons in coming quarters, but so long as companies are able to convey a continuation of strong demand for their products and/or services, the fallout from warnings about higher costs should be less pronounced.

Sherwin-Williams and Bed Bath & Beyond are good illustrations of this point.

Sherwin-Williams cut its third quarter and full-year outlook after the close on September 28. It did so citing worsening raw material availability and pricing inflation, but Sherwin-Williams also said that demand across its pro architectural and industrial end markets remains robust. Shares of SHW are up 3.2% since that warning.

Bed Bath & Beyond reported weaker than expected fiscal Q2 earnings before the open on September 30 and issued warnings for its fiscal Q3 and full year. Supply chain challenges were a factor, but the real knock came when the company also said it experienced slower than expected traffic trends in August across stores and digital. Shares of BBBY are down 24% since that warning.

What It All Means

Demand is key right now. If companies can point to a continuation of strong demand and an ability to offset higher costs with accepted price increases, then the market should be more forgiving of warnings tied to cost pressures. That’s not to say it is going to forgive and forget altogether, but it should have more patience for companies that continue to experience robust demand for their products and services.

In terms of the market’s conviction in earnings prospects, the tipping point — and true valuation constraint — is when price increases aren’t tolerated by customers. That’s when the impact to profit margins — without any corresponding cost relief — will hit home and multiple compression will (or should) follow.

We expect to hear plenty of good earnings news for the third quarter, but we also expect to hear plenty of talk about supply constraints and cost pressures. Hopefully, that will be mitigated with continued talk of robust demand.

Without it, peak earnings concerns just might lead the stock market to a lower place by the end of October.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| Market Recap WEEK OF SEP. 27 THROUGH OCT. 1, 2021 The S&P 500 index fell 2.2% last week as losses logged in the final days of Q3 amid worries about inflation and supply chain issues outweighed a positive start to Q4 on Friday as data showed August consumer spending rose more than expected. The index ended the week at 4,357.04, down from last Friday’s closing level of 4,455.48. The weekly decline would have been sharper if not for a 1.2% Friday jump as the market kicked off the new month and quarter on a positive note. The S&P 500 posted a 4.8% drop for the month of September, marking its first monthly drop since this January and its largest monthly decline since March 2020, when the pandemic began prompting shutdowns. Still, the index edged up 0.2% in Q3 as gains in the first two months of the quarter helped narrowly outweigh the September slump. It is now up 16% for the year to date. The week’s decline came as investors exerted caution into the end of the quarter amid concerns about inflation, supply chain disruptions and continued pandemic impacts on economic growth. Adding to the worries, the Federal Reserve’s Federal Open Market Committee indicated last week that it may begin reducing bond buying as soon as November and could start raising rates next year. Concerns about China’s economy have also weighed on sentiment and added to uncertainty. However, despite rising prices, data released Friday showed consumer spending rose by 0.8% in August, better than expectations for a 0.6% rise and marking a strong improvement from July’s 0.1% slip. Investors were encouraged by the better-than-expected consumer spending data, especially heading into the holiday shopping season. Nevertheless, the weekly slide was broad, with all but one sector declining. The health care sector had the largest tumble, down 3.5%, followed by a 3.3% drop in technology. Among other hard-hit sectors, consumer staples, consumer discretionary and real estate logged declines of more than 2% each. Energy was the lone sector in the black, up 5.8% for the week. The technology sector’s decliners included NXP Semiconductors (NXPI), whose shares fell 11% on the week as Bernstein downgraded its investment rating on the connectivity technology company’s stock to market perform from outperform. The firm also reduced its price target on NXP’s stock to $230 from $245. In health care, shares of Moderna (MRNA), the maker of one of the approved COVID-19 vaccines, shed 21% last week. The drop came even as the biotechnology company unveiled plans to create a new science center in Cambridge, Massachusetts to support the company’s growth and drug discovery efforts. A phased move-in is expected in 2023. On the upside, the energy sector’s gainers included Cabot Oil & Gas (COG), whose shares jumped 9.4% as its shareholders and shareholders of Cimarex Energy (XEC) voted in favor of Cabot’s acquisition of Cimarex, which was expected to close Friday. Wolfe Research upgraded its investment rating on Cabot’s shares to outperform from peer perform while raising its price target on the stock to $28 per share from $25. In economic data next week, the first full week of October and Q4, all eyes will be on employment data for the just-ended month. Private-sector September jobs data will be released Wednesday by ADP, followed by the Labor Department’s weekly jobless claims on Thursday and US nonfarm payrolls and the US unemployment rate for September on Friday. Provided by MT Newswires |

Earnings Dates

Where will our markets end this week?

Lower

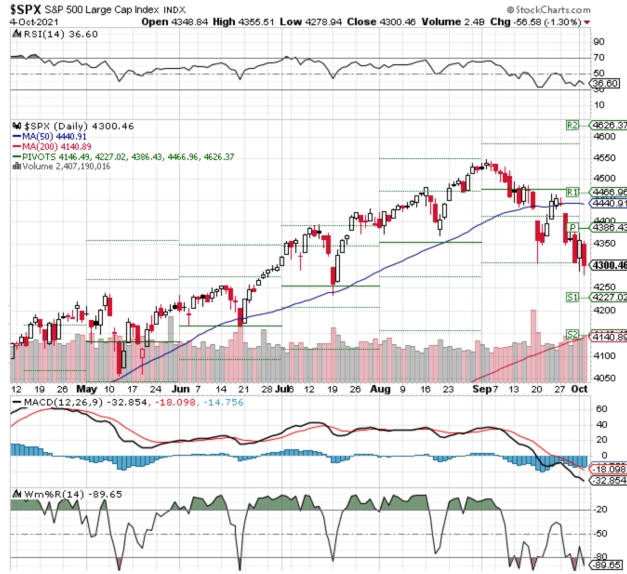

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end October 2021?

10-04-2021 -2.5%

Earnings:

Mon:

Tues: PEP

Wed: STZ, LEVI

Thur: CAG

Fri:

Econ Reports:

Mon: Factory Orders,

Tues: Trade Balance, ISM Manufacturing

Wed: MBA, ADP Employment

Thur: Initial Claims, Continuing Claims, Consumer Credit

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Wholesale Inventories

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Long put protection has been added and getting ready for earnings

AAPL – 10/28 AMC

BA – 10/27

BAC – 10/14 BMO

BIDU – 11/16

DIS – 11/11

F – 10/27 AMC

FB – 10/27

JPM – 10/13 BMO

COST – 12/09

SBUX – 10/28 AMC

SQ – 11/04 AMC

TGT – 11/17 BMO

UAA – 11/02 BMO

V – 10/27

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Market is unprepared for the inflation fallout, Wharton’s Jeremy Siegel warns

PUBLISHED SUN, OCT 3 20215:00 PM EDTUPDATED SUN, OCT 3 20217:52 PM EDT

Stephanie Landsman@STEPHLANDSMAN

Wall Street may be on the verge of an uncharacteristically painful quarter.

Wharton finance professor Jeremy Siegel, who’s known for his positive market forecasts, is sounding the alarm on the market’s ability to cope with inflation.

“We’re headed for some trouble ahead,” he told CNBC’s “Trading Nation” on Friday. “Inflation, in general, is going to be a much bigger problem than the Fed believes.”

Siegel warns there are serious risks tied to rising prices.

“There’s going to be pressure on the Fed to accelerate its taper process,’” he said. “I do not believe that the market is prepared for an accelerated taper.”

His cautious shift is a clear departure from his bullishness in early January. On Jan. 4 on “Trading Nation,” he correctly predicted the Dow would hit 35,000 in 2021, a 14% jump from the year’s first market open. The index hit an all-time high of 35,631.19 on August 16. On Friday, it closed at 34,326.46.

According to Siegel, the biggest threat facing Wall Street is Federal Reserve chair Jerome Powell stepping away from easy money policies much sooner than expected due to surging inflation.

“We all know that a lot of the levity of the equity market is related to the liquidity that the Fed has provided. If that’s going to be taken away faster, that also means that interest rate hikes are going to occur sooner,” he noted. “Both those things are not positives for the equity market.”

Siegel is particularly concerned about the impact on growth stocks, particularly technology. He suggests the tech-heavy Nasdaq, which is 5% away from its record high, is set up for sharp losses.

“There will be a challenge for the long duration stocks,” said Siegel. “The tilt will be towards the value stocks.”

He sees the backdrop boding well for companies benefitting from rising rates, have pricing power and deliver dividends.

“Yield is scarce and you don’t want to lock yourself into to long-term government bonds which I think are going to suffer quite a dramatically over the next six months,” he said.

The inflationary backdrop, according to Siegel, may set-up underperformers utilities and consumer staples, known for their dividends, for a strong run.

“They may have their day in the sun finally,” said Siegel. “If you have a dividend, firms can raise their prices and historically dividends are inflation-protected. They’re not as stable, of course, as a government bond. But they have that inflation protection and a positive yield.”

Siegel is bullish on gold, too. He believes it has become relatively cheap as an inflation hedge and cites bitcoin’s popularity as a reason.

‘They’re turning to bitcoin, and I think ignoring gold’

“I remember inflation in the 70s. Everyone turned to gold. They turned to collectables. They turned to precious metals,” he said. “Today in our digital world, they’re turning to bitcoin, and I think ignoring gold.”

He’s also not put off by the jump in real estate prices.

“I don’t think it’s a bubble,” Siegel said. “Investors have foreseen some of this inflation…. Mortgage rates are going to have to rise an awful lot more to really, I think, dent real estate. So, I think real estate [and] REITs still are good assets to own.”

Facebook whistleblower reveals identity, accuses the platform of a ‘betrayal of democracy’

PUBLISHED SUN, OCT 3 20218:32 PM EDTUPDATED AN HOUR AGO

KEY POINTS

- A Facebook whistleblower unmasked herself as former product manager for civic misinformation Frances Haugen during a “60 Minutes” interview that aired Sunday.

- The whistleblower leaked documents detailing private research to The Wall Street Journal and the U.S. Congress.

- The documents revealed that Facebook executives had been aware of negative impacts of its platforms on some young users.

A Facebook whistleblower who brought internal documents detailing the company’s research to The Wall Street Journal and the U.S. Congress unmasked herself ahead of an interview she gave to “60 Minutes,” which aired Sunday night.

Frances Haugen, a former product manager on Facebook’s civic misinformation team, according to her website, revealed herself as the source behind a trove of leaked documents. On her personal website, she shared that during her time at the company, she “became increasingly alarmed by the choices the company makes prioritizing their own profits over public safety — putting people’s lives at risk. As a last resort and at great personal risk, Frances made the courageous act to blow the whistle on Facebook.”

Haugen previously worked as a product manager at Pinterest, Yelp and Google, according to her LinkedIn profile. She also lists herself as the technical co-founder behind the dating app Hinge, saying she took its precursor, Secret Agent Cupid, to market.

“I’ve seen a bunch of social networks and it was substantially worse at Facebook than anything I’d seen before,” Haugen told “60 Minutes.”

Haugen told “60 Minutes” she left Facebook in May.

Jeff Horwitz, the Journal reporter who wrote the series of articles based on the leaked documents, also shared Haugen’s identity on Twitter on Sunday night, revealing her as the key source behind the stories.

The documents, first reported by the Journal, revealed that Facebook executives had been aware of negative impacts of its platforms on some young users, among other findings. For example, the Journal reported that one internal document found that of teens reporting suicidal thoughts, 6% of American users traced the urge to kill themselves to Instagram.

Facebook has since said that the Journal’s reporting cherry-picked data and that even headlines on its own internal presentations ignored potentially positive interpretations of the data, like that many users found positive impacts from engagement with their products.

“Every day our teams have to balance protecting the ability of billions of people to express themselves openly with the need to keep our platform a safe and positive place,” Facebook spokesperson Lena Pietsch said in a statement following Haugen’s identity reveal. “We continue to make significant improvements to tackle the spread of misinformation and harmful content. To suggest we encourage bad content and do nothing is just not true.”

Facebook VP of Content Policy Monika Bickert addressed the research in an interview on CNBC’s “Squawk Box” Monday.

“If we were a company who didn’t care about safety, if we were about trying to prioritize profit over safety, we wouldn’t do this kind of research,” Bickert said. “The whole point is understanding how we can be better and make a better experience.”

Haugen said she decided this year to make Facebook’s internal communications public, saying she realized she would need to do so “in a systemic way” and “get out enough that no one can question that this is real.”

Haugen in turn copied and released tens of thousands of pages of documents, “60 Minutes” reported.

Haugen pointed to the 2020 election as a turning point at Facebook. She said Facebook had announced it was dissolving the “Civic Integrity” team, to which she was assigned, after the election. Just a few months later, social media communications would be a key focus in the wake of the January 6 insurrection at the U.S. Capitol.

“When they got rid of Civic Integrity, it was the moment where I was like, ‘I don’t trust that they’re willing to actually invest what needs to be invested to keep Facebook from being dangerous,’” Haugen told “60 Minutes.”

Facebook told the news program that it had distributed the work of the Civic Integrity team to other units.

Haugen pointed to Facebook’s algorithm as the element that pushes misinformation onto users. She said Facebook recognized the risk of misinformation to the 2020 election and therefore added safety systems to reduce that risk. But, she said, Facebook loosened those safety measures once again after the election.

“As soon as the election was over, they turned them back off or they changed the settings back to what they were before, to prioritize growth over safety,” Haugen said. “And that really feels like a betrayal of democracy to me.”

In an interview with the Journal published shortly after the “60 Minutes” piece began to air, Haugen said she had found much of the research she took with her in Facebook’s internal employee forum, which she said was accessible to virtually all Facebook employees. She looked for research from colleagues she admired, according to the Journal, which she often found in goodbye posts calling out Facebook’s alleged failures.

Haugen also told the Journal that she openly questioned why Facebook didn’t hire more workers to tackle its issues with human exploitation on its platforms, among other things.

“Facebook acted like it was powerless to staff these teams,” she told the Journal.

Facebook spokesperson Andy Stone told the Journal that it has “invested heavily in people and technology to keep our platform safe, and have made fighting misinformation and providing authoritative information a priority.”

Lawmakers have appeared unmoved by Facebook’s responses to the Journal’s reporting based on Haugen’s disclosures. During a hearing before the Senate Commerce subcommittee on consumer protection Thursday, senators on both sides of the aisle lambasted the company, urging it to make its temporary pause on building an Instagram platform for kids permanent. The lawmakers said they did not have faith Facebook could be a good steward of such a platform based on the reports and past behavior.

The whistleblower is scheduled to testify before the Senate Commerce subcommittee on consumer protection on Tuesday. Facebook’s Global Head of Safety Antigone Davis told lawmakers on Thursday that Facebook would not retaliate against the whistleblower for her disclosures to the Senate.

Still, Bickert would not commit that Facebook would refrain from suing Haugen during her “Squawk Box” interview.

“Facebook’s actions make clear that we cannot trust it to police itself,” Sen. Richard Blumenthal, D-Conn., who chairs the subcommittee, said in a statement Sunday night. “We must consider stronger oversight, effective protections for children, and tools for parents, among the needed reforms.”

Haugen said she has “empathy” for Facebook CEO Mark Zuckerberg, saying he “has never set out to make a hateful platform. But he has allowed choices to be made where the side effects of those choices are that hateful, polarizing content gets more distribution and more reach.”

She called for more regulations over the company to keep it in check.

“Facebook has demonstrated they cannot act independently Facebook, over and over again, has shown it chooses profit over safety,” Haugen told “60 Minutes.” “It is subsidizing, it is paying for its profits with our safety. I’m hoping that this will have had a big enough impact on the world that they get the fortitude and the motivation to actually go put those regulations into place. That’s my hope.”

U.S. trade representative Tai vows to enforce ‘phase one’ trade deal with China

PUBLISHED MON, OCT 4 20215:00 AM EDTUPDATED 4 HOURS AGO

KEY POINTS

- U.S. Trade Representative Katherine Tai is set to deliver a speech Monday, outlining the Biden administration’s China trade strategy. She will be speaking at the Center for Strategic and International Studies, a Washington think tank.

- Washington must enforce the phase one trade deal with China, and will raise broader policy concerns with Beijing, Tai is expected to say.

- “China made commitments intended to benefit certain American industries, including agriculture that we must enforce,” according to prepared remarks.

- Tai is also expected to announce a targeted tariff exclusion process for firms to avoid punitive levies, and have “frank conversations” with Chinese counterparts in the coming days.

Washington must enforce the U.S.-China phase one trade agreement and will raise broader policy concerns with Beijing, U.S. Trade Representative Katherine Tai will say Monday, according to her press office.

“Today, I will lay out the starting point of our Administration’s strategic vision for realigning our trade policies towards China to defend the interests of America’s workers, businesses, farmers and producers, and strengthen our middle class,” according to remarks prepared for delivery at the Center for Strategic and International Studies.

“China made commitments intended to benefit certain American industries, including agriculture that we must enforce,” Tai is expected to say.

CNBC reported last week that the top trade advisor would announce that Beijing has not complied with the phase one deal that was reached under former President Donald Trump’s administration.

Tai is set to deliver a speech on Monday, outlining the Biden administration’s China trade strategy. She is scheduled to speak at the Washington think tank, the Center for Strategic and International Studies, at 10 a.m. ET.

According to the prepared remarks, Tai will say the U.S. has “serious concerns” about China’s “state-centered and non-market trade practices” that were not addressed in the phase one deal.

“As we work to enforce the terms of Phase One, we will raise these broader policy concerns with Beijing,” she will say.

Phase one agreement

In the trade deal, signed in January 2020, Beijing pledged to buy at least $200 billion more U.S. goods and services over 2020 and 2021, compared with 2017. The agreement paused a trade fight between the U.S. and China, which dragged on for about two years.

As of August, however, China had only reached 62% of that target, based on U.S. export data compiled by the think tank Peterson Institute for International Economics.

A senior administration official told reporters that U.S. President Joe Biden believes the phase one deal “did not meaningfully address our fundamental concerns with China’s trade practices.”

“Unlike his predecessor, President Biden is going to hold China to account where China is falling short of its commitments,” the official said during a background call.

The U.S. trade representative will say on Monday, “We will use the full range of tools we have and develop new tools as needed to defend American economic interests from harmful policies and practices.”

She is also expected to announce a targeted tariff exclusion process for firms to avoid punitive levies, and have “frank conversations” with Chinese counterparts in the coming days.

U.S. officials said during the background call that the phase one agreement will be revisited, and that Washington will not seek negotiations on a phase two deal.

“We recognize that China simply may not change, and that we have to have a strategy that deals with China as it is, rather than as we might wish it to be,” an official said.

Cathie Wood just had a rough quarter. Here’s the outlook for some of her stocks

PUBLISHED FRI, OCT 1 20212:07 PM EDT

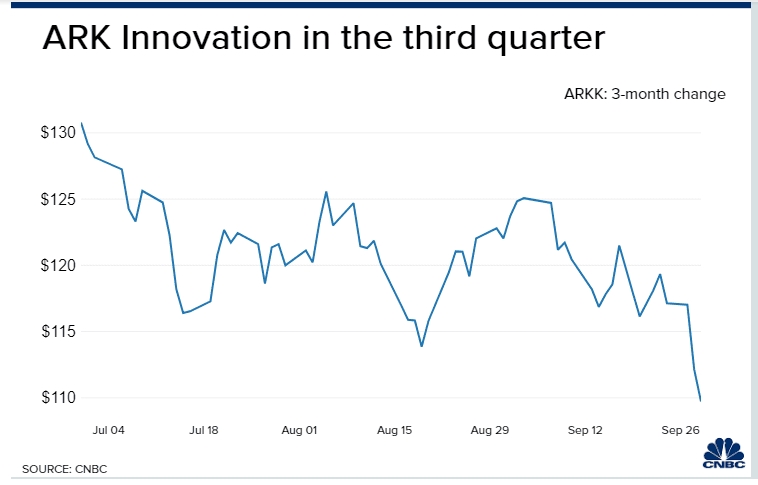

It was dismal quarter for Cathie Wood and her innovation funds, but the provocative investor — and even Wall Street — see some of her holdings moving higher from here.

Rising interest rates and worries of inflation have dented Wood’s disruptive technology names over the last three months. Wood’s flagship fund, ARK Innovation, tanked over 15% in the third quarter of 2021, bringing the ETF’s year-to-date losses to roughly 11%. ARK Innovation is approximately 31% off its 52-week high.

Wood’s strategies are going to take a hit when rates are shooting higher and rising prices are a major overhang for investors. Technology stocks trade on the promise of big earnings growth further out in the future. When rates rise, it makes those future potential cash flows less valuable.

ARK Innovation holdings Berkeley Lights and Skillz lost more than 50% in the third quarter.

Take a look at the biggest losers in ARK Innovation in the third quarter.

Despite some smaller stocks racking up major losses in the third quarter, two of the largest stocks, Tesla and Sea, gained.

Tesla is the largest market cap weighed company in Wood’s flagship fund and ended the quarter up 14%. This could be why Wood has been trimming her massive stake in the electric carmaker.

‘Looking for cash’

On Tuesday, Wood sold some $209 million worth of Tesla shares in her flagship fund. Tesla is still the largest holding in Ark Innovation, accounting for about 10.1% of the ETF. Wood’s base case for the stock is $3,000 in five years, with the best case being around $4,000.

Wood often says it is OK to trim your largest winning holdings to raise cash to buy what you feel will be your next big winner, especially when the market is giving you an opportunity to do so.

“I am always looking for cash, especially in the flagship fund, which is very concentrated and involves all of our technologies,” Wood said in September.

Here are ARK Innovation’s largest companies by market capitalization and how the performed in the third quarter.

Shopify, Square, Zoom Video and Twilio are some of the largest ARK holdings that dragged down the fund’s performance in the past three months. These names are coming off of massive pandemic-induced run-ups in their stocks in 2020.

However, Wood said the tides are changing for her highest-conviction names.

“We think we’re moving into the other side of the cycle,” Wood said during an Ark Invest webinar on earlier this month. “We don’t think we’re looking at a recession yet, but we do believe the market will start rotating back toward growth and innovation.”

The hot-handed investor is also calling for a period of deflation from innovation. Costs are coming down drastically as new technology changes the world order, said Wood.

If Wood turns out to be right about deflation and a rotation into growth, it will be big. Wood made a name for herself in 2020 when ARK Innovation rallied nearly 150% in the middle of a pandemic. Wood’s highest conviction stocks are those that the pandemic helped adopt like Zoom Video, Teladoc and Roku.

Where Wall Street sees ARK going from here

Wood also touts her firm’s five-year time horizon for her stocks, explaining that she isn’t concerned with near-term performance. However, Wall Street has high hopes for some of her fund’s holdings in the next year.

CNBC Pro screened for the ARK Innovation stocks that Wall Street sees roaring back the most. The following list contains the Ark-owned names with the most upside based on their average 12-month price target. They all have at least five analysts covering the names and more than 50% buy ratings.

After falling more than 50% in the third quarter, Berkeley Lights has more than 260% upside to its 12-month price target.

Compugen, Skillz, Zillow Group and Fate Therapeutics are also slated for big rallies in the next year.

Wood’s other four ETFs are also underperforming this year. ARK Next Generation Internet lost nearly 10% in the third quarter and is down more than 11% in 2021. ARK Genomic Revolutioncratered close to 20% in the three months ended on Thursday and has declined about that much this year. ARK Fintech Innovation ETF dropped close to 9% in the third quarter, although it is down less than 1% for the year.

Wood’s ARK Autonomous Technology and Robotics ETF is the only fund that is in the green for the year. It is up about 2% in 2021, drastically underperforming the tech-focused benchmark Nasdaq Composite.

Fed Chair Powell calls inflation ‘frustrating’ and sees it running into next year

PUBLISHED WED, SEP 29 20211:45 PM EDTUPDATED WED, SEP 29 20219:09 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Fed Chairman Jerome Powell still expects inflation to ease eventually, but said he sees the current pressures running into 2022.

- The central bank leader said the current inflation pressures are “frustrating.”

Federal Reserve Chairman Jerome Powell still expects inflation to ease eventually, but said Wednesday that he sees the current pressures running into 2022.

Assessing the current economic situation, the Fed chief said during a panel discussion hosted by the European Central Bank that he was “frustrated” that getting people vaccinated and arresting the spread of the Covid delta variant “remains the most important economic policy that we have.”

“It’s also frustrating to see the bottlenecks and supply chain problems not getting better — in fact at the margins apparently getting a little bit worse,” he added. “We see that continuing into next year probably, and holding up inflation longer than we had thought.”

Inflation by the Fed’s preferred measure is running at its hottest pace in about 30 years. Powell and most of his colleagues say they expect the current pressures to decline back to trend as supply chain bottlenecks ease and demand goes back to pre-pandemic levels. He said Wednesday that 2022 should be “quite a strong year” for economic growth.

However, officials as of late have acknowledged that the current inflation conditions have not eased the way the Fed thought they would. The Federal Open Market Committee last week collectively raised its projection for 2021 core inflation to 3.7% from the 3% forecast in June.

“The current inflation spike is really a consequence of supply constraints meeting very strong demand, and that is all associated with the reopening of the economy, which is a process that will have a beginning, a middle and an end,” Powell said.

“We see those things resolving,” he said. “It’s very difficult to say how big those effects will be in the meantime or how long they will last.”

Powell’s continued expectations that inflation is temporary were echoed by European Central Bank President Christine Lagarde, who sat on the panel with Powell, Bank of England Governor Andrew Bailey and Bank of Japan Governor Haruhiko Kuroda.

“We monitor very carefully, but we certainly have no reason to believe that these price increases we are seeing now will not be largely transitory going forward,” Lagarde said.

Should that not be the case, Powell said the Fed is prepared to act. Central bank officials already have indicated they are inclined to begin tapering their monthly asset purchases by the end of the year, though interest rate increases are not expected until at least the end of 2022.

“Of course, if we were to see sustained higher inflation and that were to become a serious concern, I would tell you the FOMC would certainly respond and we would use our tools to ensure that inflation runs at levels that are consistent with our goal,” Powell said.

HI Financial Services Mid-Week 06-24-2014