HI Market View Commentary 09-14-2020

We have some uncertainty in the next 6 weeks

So Today I want to start with the basic start to investing:

Sell high, Buy Low = 0.33% chance of being right

Diversification = 0.38% chance of being right

Annuities = Never make money but never lose money

Funds = 0.44% because they take out the losers and put in winner at the end of the year

Hedge Funds = 0.50% because they use option, non-correlated indexes

Single Options = 0.20% because of time decay, having to guess right

Forrex = 0.10% to hard, no pattern, all luck

Day Trading = 0.10% to hard, all luck, no patterns

Spread Trading = 0.52% because one option can make money either direction

You do YOU!!!

First you have to know who you are when it comes to the market!

Know your strengths, biases, weaknesses, market experiences, realistic market expectations

Make the most you can with as little risk as possible

The best market traders/investors always start out with the risk first !!!

| Market Recap |

| WEEK OF SEP. 7 THROUGH SEP. 11, 2020 |

| The S&P 500 index fell 2.5% last week, marking the benchmark’s second weekly drop in a row, as investors continued pulling back from the riskier holdings that had led many of the market’s summer gains. The S&P 500 ended the week at 3,340.97, down from last week’s closing level of 3,426.96. The index is now down 6.9% from its record intraday high of 3,588.11 reached Sept. 2. However, it is still up 9.9% over the past three months and up 3.4% for the year to date. This week’s drop came as investors have been losing confidence in the strength and sustainability of the market gains posted in recent months, especially as the COVID-19 pandemic continues to impact the economy and Congress remains at a standstill over a stimulus plan. Investors were also concerned by comments from President Donald Trump that he is considering a “decoupling” of the US and Chinese economies. The energy and technology sectors, which had been among the strongest sectors when the market was rallying in recent months, are now suffering the largest hits. The energy sector had the biggest percentage drop of the week, down 6.5%, followed by technology, which slipped 4.4%. Among the other decliners, communication services fell 3.2%, financials fell 2.3% and consumer discretionary shed 0.7%. Just one of the S&P 500’s sectors managed to post a gain this week: materials, which edged up 1%. The energy sector’s decline came as crude-oil futures tumbled amid data showing the first weekly increase in crude oil inventories in seven weeks. Demand for crude was hurt not only by the pandemic but also by hurricane activity. Among the decliners, shares of Occidental Petroleum (OXY) shed 17% while Apache (APA) fell 19%. In the technology sector, decliners this week included Apple (AAPL), which lost 7.4%, as well as salesforce.com (CRM), down 4.6%. The stocks are still up 32% and 39%, respectively, over the past three months. Shares of Adobe (ADBE) slipped 4.2% even as analysts at firms including UBS and RBC Capital Markets were raising their price targets on the stock ahead of the company’s fiscal Q3 report to be released Tuesday. On the upside, the materials sector’s gainers included Sherwin-Williams (SHW), whose shares rose 4.3% since last Friday as BMO Capital Markets upgraded its investment rating on the stock to outperform from market perform. The firm also raised its price target on the shares to $790 each from $674. KeyBanc also initiated coverage of Sherwin-Williams (SHW) shares this week with an overweight investment rating and a price target of $805. Also coming Tuesday, industrial production and capacity utilization for August will be released, followed by August retail sales and July business inventories Wednesday. Thursday’s economic calendar features housing data, with August housing starts and building permits due, while Friday will include the preliminary August reading on consumer sentiment from the University of Michigan. Provided by MT Newswires. |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end September 2020?

09-14-2020 -5.0%

09-08-2020 -5.0%

08-31-2020 -5.0%

Earnings:

Mon: LEN,

Tues: SINA, ADBE, FDX, HTZ

Wed:

Thur:

Fri:

Econ Reports:

Mon:

Tues: Empire Manufacturing, Improt, Export, Capacity Utilization, Industrial Production,

Wed: MBA, Retail Sales, Retail ex-auto, Business Inventories, NAHB Housing Market Index, FOMC Rate decision

Thur: Initial Claims, Continuing Claims, Phil Fed, Housing Starts, Building Permits,

Fri: Michigan Sentiment, Current Account Balances, Leading Indicators

Int’l:

Mon –

Tues – CN: Industrial Production, Retail Sales

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

ALL DONE with taking profits AND MOSTLY PROTECTED

I would look to add positions the last week of October especially if we are down around the 200-SMA

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

95-year-old billionaire Charlie Munger: The secret to a long and happy life is ‘so simple’

Published Thu, Feb 21 20193:46 PM ESTUpdated Fri, Feb 22 20199:29 AM EST

Catherine Clifford@CATCLIFFORD

At 95, Charlie Munger is best known for his steady role as the right-hand man of investing legend Warren Buffett.

As the vice chairman of Berkshire Hathaway, Munger is worth $1.7 billion, according to Forbes.

In addition to the his role alongside Buffett, Munger is chairman of the publisher the Daily Journal Corp. and is on the board of the big-box retailer Costco.

Munger has had, by almost any standard, a wildly successful life — and a long one, at that. He’s nearly a centenarian.

Last week, at The Daily Journal annual meeting in Los Angeles, California, Munger was asked to reflect on that journey.

“There were a lot of questions today — people trying to figure out what the secret to life is, to a long and happy life,” CNBC’s Becky Quick said to Munger when they talked in the middle of February.

The secret is “easy, because it’s so simple,” Munger told Quick.

Munger went on to rattle off a list of his best advice, each lesson succinctly delivered in bite-size form.

“You don’t have a lot of envy.

“You don’t have a lot of resentment.

“You don’t overspend your income.

“You stay cheerful in spite of your troubles.

“You deal with reliable people.

“And you do what you’re supposed to do.

“And all these simple rules work so well to make your life better. And they’re so trite.”

His prescription is logical, he says.

“Staying cheerful” is “a wise thing to do,” Munger told Quick, adding that in order to do so, you have to let go of negative feelings.

“And can you be cheerful when you’re absolutely mired in deep hatred and resentment? Of course you can’t. So why would you take it on?” Munger said. Munger on investing, the buyback debate and much more

Munger grew up in Omaha, Nebraska, as did his investing partner (Buffett’s birthplace explains his nickname, the “Oracle of Omaha”), and worked in Buffett’s grandfather’s grocery store, as did Buffett himself.

“Nevertheless, it was 1959 before I met Charlie, long after he had left Omaha to make Los Angeles his home. I was then 28 and he was 35. The Omaha doctor who introduced us predicted that we would hit it off — and we did,” Buffett wrote of his long-time partner in his 2014 annual letter to shareholders.

Prior to joining Berkshire Hathaway, Munger first worked as a lawyer — “with his time billed at $15 per hour,” Buffett notes in the shareholder letter — and also as an architect.

Buffett gives Munger credit for much of the success of Berkshire Hathaway. “Consequently, Berkshire has been built to Charlie’s blueprint. My role has been that of general contractor, with the CEOs of Berkshire’s subsidiaries doing the real work as sub-contractors,” Buffett says.

6 things successful people like Bill Gates and Jeff Bezos do on weekends to make their Mondays more productive

Published Sun, Mar 31 20199:00 AM EDTUpdated Mon, Apr 1 201910:42 AM EDT

Benjamin Spall, Contributor@BENJAMINSPALL

There are hundreds of thousands of daily habits you can adopt to stay inspired and boost your productivity, but how do you decide on which ones to focus on?

Over the past five years, I’ve interviewed and studied more than 300 highly accomplished people, from business leaders and university presidents to Olympians and artists, about their daily routines.

Here’s what some of the most successful people do on weekends to make their weekdays easier and more productive:

1. They catch up on sleep

Your body (and brain) won’t perform at its best if you don’t give it proper rest. Of the several hundred people I interviewed, their sleep times average out at seven hours and 29 minutes per night. Tim Cook, Bill Gates, Jack Dorsey and Jeff Bezos all say they get at least seven hours of sleep per night, as well.

But it can be hard to get in seven and a half hours, especially if you have a demanding job that often requires you to stay at the office late. If you find yourself falling behind during the week, use the weekend to catch up.

Don’t take this as an excuse to sleep five hours per night during the week, followed by 12 per night over the weekend, though. Just know that catching up on a few more hours over the weekend is better than nothing.

2. They spend time with their loved ones

If you feel guilty about how little time you’re able to spend with your family and friends Monday through Friday, you’re not alone. Whether you choose to work out with your spouse or take your kids to the park, doing it during the weekend will save you from feeling any guilt during the weekdays.

“On the weekends we have [a nanny] in the morning, so [my wife] Tiff and I go work out Saturday mornings. Then the rest of the weekend it’s just us,” Mark Cuban said at South by Southwest in 2014. “It’s us putting them to bed. It’s us at dinner. We try to be as normal as possible.”

Keep in mind, however, that if you need to get some work done over the weekend, aim to do it Saturday morning so you’re not thinking about it during the rest of the weekend.

3. They strategize on the week ahead

Successful people always strategize on their week ahead so they can get a head start on Monday. This can mean anything from blocking off a whole half-day on the weekend to spending 10 minutes on Sunday evening looking at next week’s calendar and taking notes on what you have coming up. Once Monday morning hits, you’ll be 110 percent ready.

“Saturday I take off. I hike. And then Sunday is reflections, feedback, strategy and getting ready for the rest of the week,” Jack Dorsey tells Brooke Potter, author of “Becoming More Productive: The Secrets of Successful People Revealed.”

1:03

Billionaires Bill and Melinda Gates play this ‘crazy’ game to unwind

4. They make time for what energizes them

While successful people make plans to ensure they don’t waste their days, they also make a point to relax — and there are plenty of hours in the weekend to do that. Many will eat breakfast at a more leisurely pace than weekdays allow, curl up on the couch with some books, meditate or work out.

Richard Branson’s Saturday evenings consist of more partying (to each their own, right?). On Sundays, he engages in more physical activities like rock jumping, paddle boarding and boat races, Branson tells the Telegraph.

In a Reddit AMA session in 2014, Gates said he prefers to keep his time off as mellow as possible. “Playing Bridge is a pretty old-fashioned thing in a way that I really like,” he said. “I was watching my daughter ride horses this weekend and that is also a bit old fashioned but fun. I do the dishes every night — other people volunteer but I like the way I do it.”

5. They take care of chores

Chores are important and if you don’t get to them, they’ll pile up and turn into a cloud of anxiety that lingers over your head. Successful people make time to take care of their chores, whether it’s shopping for groceries, doing laundry or taking care of bills, but they don’t let it take over their weekends completely. (If they did, there’d be no time to do any relaxing or reflecting.)

To properly space out your chores, you’ll have to prioritize getting some of them done during the weekdays. It can be as simple as setting aside 15 minutes before bedtime each night to do a little bit of this and a little bit of that. Then, when the weekend hits, schedule at least an hour or two to complete the chores that require more time and attention. You’ll feel much better and in control once you’ve finished them.

6. They set aside alone time and reflect

Reflection and alone time is healthy for your mind and body. It will also help you to better reach your goals. Successful people use the weekend to reflect or meditate on things that are important to them (how can they make more time for those things?), things that have been bothering them (what are some good solutions?) and their career (how can they improve their skills and performance?).

A Harvard study found that people who spent 15 minutes at the end of the day reflecting about lessons they learned performed 23 percent better compared to those who didn’t. Other studies have found that self-reflection can help you become a happier, more productive and less burned out person. Even if you struggle with the idea of self-reflection, at least try doing it on the weekends. It won’t be long before you start to see some of the benefits.

Benjamin Spall is the co-author of “My Morning Routine,” which was named as one of Amazon’s best business books of 2018 and a Financial Times book of the month. He has written for the New York Times, New York Observer, Quartz, Entrepreneur, Business Insider and more.

Shaq on his biggest investing mistake: ‘I lost a lot of money in the get-rich-quick schemes’

Published Thu, Aug 29 20199:00 AM EDTUpdated Thu, Aug 29 20199:00 AM EDT

Former NBA star Shaquille O’Neal has established himself as a successful investor: He was an early investor in Google and has since accumulated an impressive portfolio, including stakes in Apple, 24 Hour Fitness and nightclubs in Las Vegas.

He also owns 17 Auntie Anne’s, a Krispy Kreme franchise and a Big Chicken restaurant in Las Vegas.

O’Neal didn’t always put his money in the right places, though. When he first started investing, “I lost a lot of money in the get-rich-quick schemes,” he said on CNBC’s “Power Lunch” on Wednesday, while discussing his latest partnership with gig economy app Steady.

Specifically, his worst investment was in a paper company, he said: “It turned out to be a scam.”

When O’Neal was younger, he fell for deals that promised big money in a short amount of time: If someone said, “give me a million and in three years, it’ll be $10 million — deals like that, I would take every time. … No research, no due diligence.”

Today, O’Neal has a different philosophy, inspired by Amazon’s Jeff Bezos. “I heard the great Jeff Bezos say, ‘If you invest in stuff that’s going to change people’s lives, most of the time, you’ll win,’” he told CNBC.

It helps him decide which opportunities to jump on and which ones to pass up. O’Neal would rather focus on the impact a company could have, and invest in something he believes in, than pay close attention to the numbers. “I learned early that when I stopped thinking about the payouts, I’ll always be successful,” he said.

The U.S. needs $3 trillion in fiscal stimulus to support coronavirus-hit economy, says economist

PUBLISHED WED, SEP 9 202011:20 PM EDT

KEY POINTS

- The U.S. needs around $3 trillion in fiscal stimulus to support its pandemic-hit economy, said William Lee, chief economist at Milken Institute.

- Congress and the White House remain in a stalemate over what to include in the next relief package.

- “Every penny helps and the danger is that these guys will fiddle around to try to redesign the program to really meet some perfectionist criteria that shouldn’t be,” said Lee.

SINGAPORE — The U.S. needs around $3 trillion in fiscal stimulus to support its pandemic-hit economy, an economist said Thursday as Congress and the White House remain in a stalemate over what to include in the next relief package.

William Lee, chief economist at Milken Institute, said the $3 trillion should be spent on programs such as incentivizing businesses to increase remote working capabilities and helping the unemployed find jobs in companies with viable business models.

“I think the one thing that everyone … agrees with is we have to get in there and get in big. The issue is how do you get big without a permanent increase in fiscal deficit,” he told CNBC’s “Squawk Box Asia.”

“That’s why the programs that are put in place have to be targeted and designed in a way so that they disappear once the economy comes back online again,” he added.

But disagreements between Democrats and Republicans on what programs to fund have contributed to the impasse over passing another stimulus bill in the U.S.

In another attempt at resurrecting a coronavirus relief bill, the Republican-led Senate will vote on a new package as early as this week — but is unlikely to get the 60 votes needed to get through the chamber or receive support in the Democratic-led House.

The U.S. has reported the world’s highest number of Covid-19 cases and death toll, according to data compiled by Johns Hopkins University. As of Thursday morning, more than 6.3 million infections have been reported in the U.S. with over 190,000 deaths, the data showed.

Lockdown measures to contain the virus led the U.S. economy — the largest globally — to tank 31.7% on an annualized basis in the second quarter. That’s the country’s worst-ever quarterly plunge in economic activity.

That’s why further fiscal stimulus is important but American politicians “seem not to be able to hear that message,” said Lee.

“Every penny helps and the danger is that these guys will fiddle around to try to redesign the program to really meet some perfectionist criteria that shouldn’t be,” he said.

“We have to get the money out there

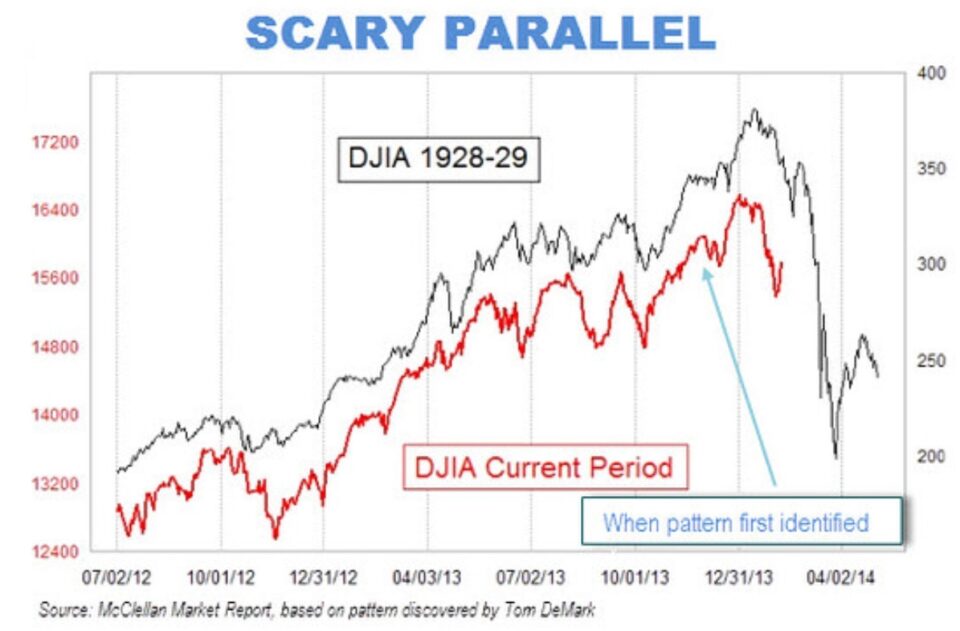

HI Financial Services Mid-Week 06-24-2014