HI Market View Commentary 09-12-2022

What’s happening in our market the last couple of days?= Bounce off the oversold, dead cat bounce

Wednesday we took off bank protection, Thursday took off financials V, SQ, SPY , Friday Took off Tech protection, Today took off F, UUA protection

We know on the 21st we have another rate hike so yes we are prepared on the next down day to add it all back on !!

Just about everything we made a good profit on the protection, AAPL, META, BAC, BIDU, JPM, DIS

YES the market is ever moving so we need to position portfolios accordingly

OK Let’s talk about education: I am for education

Pros = It teaches you how your money can be invested, it forces you to have some skin in the game, it protects you from all the garbage that is out there in the investing world

Cons = people think they know it all, they follow fictitious newsletters, trade recommendations, algorithms, they DO NOT LEARN and Blame the educator for their lack of effort, it can cost a fortune

Because of this I spend my Monday Evenings and Thursday morning with you

Earnings dates:

COST 9/22 AMC – ????

MU 9/28 – NO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 09-Sep-22 15:14 ET | Archive

An exciting week for stocks that proved only one thing

The Labor Day week was a short week but it was long on gains. As of this writing, the Dow, Nasdaq, and S&P 500 were up 2.8%, 4.1%, and 3.7%, respectively, for the week.

Those are some impressive gains, which include the losses that were registered on Tuesday. In effect, then, the Dow, Nasdaq, and S&P 500 have risen 3.7%, 5.5%, and 4.7%, respectively, in just three trading sessions.

What’s more is that they scored those gains while the Fed and other central banks were trying to score points as inflation fighters by either talking tough on the need to keep raising rates or by actually raising rates.

One can view the stock market’s winning performance either as a sign that it had already discounted the probability of aggressive rate hikes in the near term or as a sign that it does not believe the Fed and other central banks will ultimately be as tough with their policy tightening as they are indicating.

A third interpretation of this week’s gains is that they were predetermined by the negative sentiment that had been building over the course of three straight losing weeks for the stock market.

A fourth choice is all of the above.

Expectations Rising

A week ago, the fed funds futures market was pricing in only a 57.0% probability of a 75-basis point rate increase at the September 20-21 FOMC meeting. At the moment, that probability sits at 86.0%, according to the CME’s FedWatch Tool.

The strong pickup in expectations for a more aggressive rate hike was driven by several factors:

- China locked down Chengdu (a city with 21.2 million residents), exacerbating concerns about ongoing supply chain disruptions.

- Russia indicated that the shutdown of the Nord Stream 1 pipeline will be long lasting, compounding Europe’s energy crisis.

- Cleveland Fed President Mester (FOMC voter) repeated that she thinks the fed funds rate should be somewhat above 4.00% by early next year and that she is not anticipating a rate cut in 2023.

- A Wall Street Journal article on Wednesday suggested the Fed is likely on a path to raise the target range for the fed funds rate by 75 basis points at its September meeting (Nick Timiraos, who is thought by the market to be the Fed’s go-to correspondent when it wants to tease a policy idea, was the author of that article).

- Fed Governor Brainard (FOMC voter) said the same day as the Wall Street Journal article that monetary policy will need to be restrictive for some time and that the Fed is in this for as long as it takes to get inflation down. To be fair, she also acknowledged the risks of overtightening.

- Fed Chair Powell (FOMC voter) did not do anything to push back against the view floated in The Wall Street Journal when he spoke at the Cato Institute’s Monetary Conference. Instead, Mr. Powell reiterated that the Fed is strongly committed to its price stability mandate and will keep at it until the job is done.

- St. Louis Fed President Bullard (FOMC voter) told Bloomberg that he is favoring a 75-basis point rate hike at the September meeting.

- Fed Governor Waller (FOMC voter) said he supports another “significant increase in the policy rate” at the next meeting.

- The Reserve Bank of Australia raised its key lending rate by 50 basis points and the Bank of Canada and ECB both raised their key lending rates by 75 basis points this week.

There was some better inflation news in the ISM Non-Manufacturing Index for August, as the Prices Index dropped to 71.5% from 72.3%. That is still too high, but it at least pointed to a moderation in price pressures.

On balance, however, this week was littered with hawkish-minded Fed speak and hawkish-minded moves from other central banks. The comments and the rate-hike actions caused some headline stir, but clearly they did not faze the stock market.

When the market responds positively to a negative factor, it is fair to argue that the negative factor has been priced in already.

Not Convinced

Most central banks are talking tough about needing to get inflation down with higher interest rates. The Fed’s unofficial mantra is “higher for longer.”

The stock market knows policy rates are headed higher. It’s the longer part that it seems to be calling into question.

Participants are not convinced — not yet anyway — that the Fed will stick to its hard-headed ways. The Fed has itself to blame for that, largely because it has tacitly endorsed the Fed put since the financial crisis and in the process has groomed market participants to think the Fed won’t have the gumption to leave the stock market in a world of hurt.

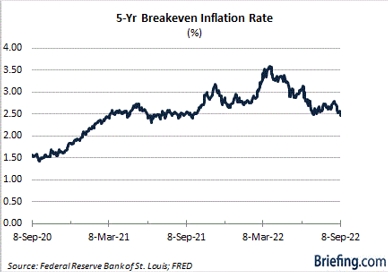

Beyond that, however, market participants are looking at falling commodity prices, sliding inflation expectations, a weakening housing market, a eurozone economy seemingly headed for a recession, and a growing number of earnings warnings (and earnings estimate cuts) as budding proof that the Fed will be compelled to take a kinder, gentler approach to raising rates before ultimately cutting them in 2023.

That’s a reason why the market trades better than one might think when bad news comes its way.

Bearish Sentiment Is Bullish Catalyst

The three-week stretch leading up to the Labor Day weekend was not a good stretch. The S&P 500 declined 8.3% over that stretch while the Nasdaq Composite fell 10.9%. Measured from the August 16 intraday high, the S&P 500 was down 9.3% and the Nasdaq was down 11.8% going into the Labor Day weekend.

The rally off the mid-June lows had been stopped in its tracks with a pointed failure right at the S&P 500’s 200-day moving average. A terse speech on August 26 from Fed Chair Powell on the need to restore price stability further fueled the selling efforts and undermined investor sentiment along with rising interest rates.

The Labor Day holiday was something to look forward to, yet investors approached it carrying a forlorn attitude about the stock market’s behavior.

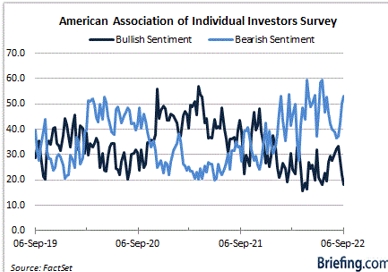

A gauge of just how forlorn investors had gotten was provided this week by the American Association of Individual Investors (AAII). It conducts a weekly survey and the latest survey revealed that bearish sentiment among individual investors had reached 53.3%, versus the historical average of 30.5%, while bullish sentiment had dropped to an unusually low 18.1%, versus the historical average of 38.0%.

The bull-bear spread is -35.2%, which the AAII also deems unusually low. On the bright side, the AAII observed that, “Historically, the S&P 500 has gone on to realize above-average and above-median returns during the six- and 12-month periods following unusually low readings for bullish sentiment and the bull-bear spread.”

The extreme level of bearish sentiment (and lack of bullish sentiment) was considered to be a contrarian indicator that sparked a willingness to buy into a short-term oversold market and to buy/swing trade beaten-down stocks.

It did not hurt matters either that market participants knew the summer rally was catalyzed by reports of extreme bearish sentiment and the notion that the Fed could engineer a soft landing and shift to a rate-cut cycle sooner rather than later.

What It All Means

We have been down this road before, where the stock market strings together a rally effort that defies the fundamental backdrop.

That backdrop did not improve this week so much as the stock market did. Stocks went up even though interest rates went up. Stocks went up even though China hurt global growth prospects by adhering to a zero-Covid policy. Stocks went up even though the geopolitical environment worsened.

Stocks went up because technical drivers outweighed fundamental factors. They went up because extreme bearish sentiment readings were a contrarian rally call.

Stocks went up because the mega-cap stocks got back in gear.

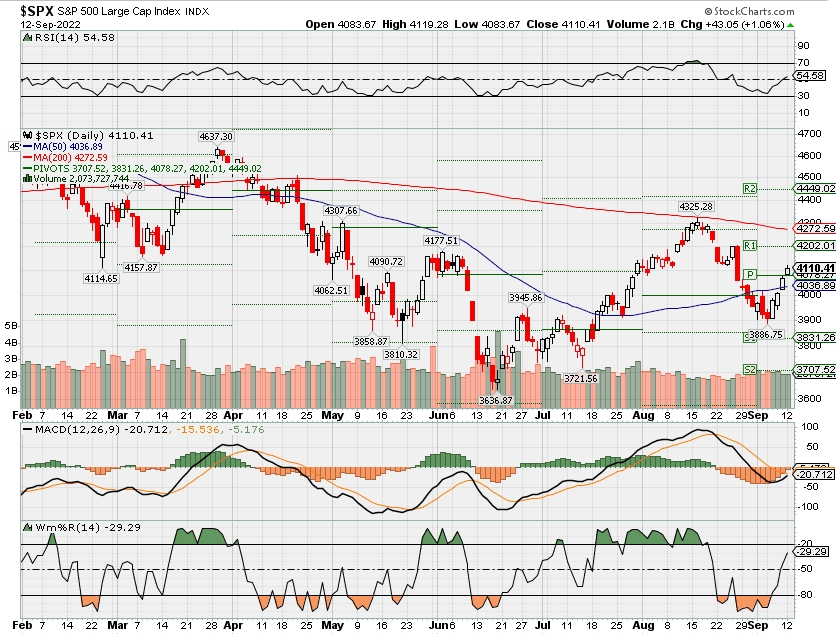

After three straight losing weeks, stocks went up because that is what they are prone to do from time to time in a range-bound market. It was a big week even though it was a short week of trading. The S&P 500 moved back above its 50-day moving average (4,029) but it did not break out of its summer trading range, the top end of which is 4,325.

The stock market got back to work with a bullish bias following the Labor Day weekend, but it has a lot of work left to do to stamp out the bear market challenges. That will not be easy with the Fed and other central banks still raising rates, earnings estimates still being cut, and global growth slowing.

It was an exciting week but it did not prove anything other than that the stock market was primed to bounce from a short-term oversold condition — a condition that came to be on the recognition that the fundamental backdrop is lacking the hues of a bull market.

—Patrick J. O’Hare, Briefing.com

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF SEP. 5 THROUGH SEP. 9, 2022 |

| The S&P 500 index rose 3.6% last week, changing direction after having tumbled a combined 8.3% in the previous three weeks. The S&P 500 ended Friday’s session at 4,067.36, up from last Friday’s closing level of 3,924.26. This marks the index’s first week in the black since the week ended Aug. 12. However, the index is still solidly in the red for the year to date with a decline of 15% for 2022. The weekly climb in US stocks came as investors grew more comfortable with the idea of another 75 basis-point rate increase by the Federal Open Market Committee as the policy-setting committee seeks to tamp down on inflation. Fed officials have made a number of comments in recent weeks indicating a rate increase of that size is likely to come this month following increases of 0.75 point each in June and July. All of the S&P 500’s sectors rose last week. Consumer discretionary had the largest increase, up 5.6%, followed by a 4.9% climb in materials and gains of 4.4% each in financials and health care. Energy had the smallest increase, eking out a 0.6% rise. Travel-related stocks were the best performers in the consumer discretionary sector as investors bet cruise operators and resort operators would benefit from consumers increasingly resuming travel following shutdowns earlier in the pandemic. Shares of Royal Caribbean Cruises (RCL) jumped 15% on the week, followed by a 13% rise in shares of Caesars Entertainment (CZR) and a 12% climb in shares of Norwegian Cruise Line (NCLH). The materials sector’s gainers included shares of Albemarle (ALB), which climbed 16% amid price target increases from analysts at firms including RBC Capital Markets and Citigroup. RBC’s analysts cited “attractive supply/demand fundamentals” for the boost. The energy sector’s modest gain came as futures in natural gas declined. Decliners included Williams (WMB), which said it has acquired NorTex Midstream, a fully contracted natural gas pipeline and storage asset in north Texas, from an affiliate of Tailwater Capital in a $423 million deal. Shares of Williams shed 2.8%. Next week, all eyes will be on updated inflation data as the New York Fed’s three-year inflation expectations for August will be released Monday, followed by the August consumer price index on Tuesday and the August producer price index on Wednesday. Other data due next week include August retail sales on Thursday and the University of Michigan’s September reading of consumer sentiment on Friday. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –technically bearish

COMP – Bearish

Where Will the SPX end September 2022?

09-12-2022 -2.0%

09-06-2022 -2.0%

08-29-2022 -2.0%

Earnings:

Mon: ORCL

Tues:

Wed:

Thur: ADBE

Fri:

Econ Reports:

Mon:

Tues: CPI, Core CPI, Treasury Budget

Wed: MBA, PPI, Core PPI

Thur: Initial Claims, Continuing Claims, Phil Fed, Chicago PMI, Retail Sales, Retail ex-auto, Capacity utilization, Industrial Production, Business Inventories,

Fri: Michigan Sentiment

How am I looking to trade?

Currently letting some most stocks run. Started taking puts off Wednesday.

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

These big bank stocks could rise 30% if economy avoids recession, Credit Suisse says

PUBLISHED WED, SEP 7 202212:19 PM EDTUPDATED 4 HOURS AGO

Big U.S. banks are on track to meet analysts’ third-quarter earnings expectations, thanks to good loan growth and rising interest rates, according to Credit Suisse.

With a few weeks remaining in the quarter, analysts led by Susan Roth Katzke examined key data points for the group.

Loan balances for the industry are heading for a 2.6% quarter-over-quarter increase, which combined with higher rates “should support more net interest revenue growth,” a crucial driver for banks, the analysts wrote Wednesday in a note.

At the same time, loan losses from credit cards and other products are still low, and volatility in markets supports good trading results, although investment banking remains moribund, they added.

“Every incremental data point improves the clarity of the fundamental picture,” Roth Katzke wrote.

Bank stocks have been hammered this year on fears that the U.S. is nearing a recession: The KBW Bank Index has fallen about 20%. But borrowers have held up relatively well, providing a boost to Main Street lending operations as the Federal Reserve raised rates four times this year. The dynamic provides opportunity to investors so long as a recession doesn’t create a punishing wave of defaults.

The companies, which begin reporting third-quarter results next month, are expected to post about 3% revenue growth from the second quarter, and per share earnings that jump 7%. The biggest risk to these estimates is tied to the “health of the markets,” including markdowns on assets amid market upheaval across asset classes.

The analysts see about 20% total returns on average across the large cap U.S. banking group if the Federal Reserve can successfully combat inflation without inducing a recession, but the group faces ”~25% downside to discount a mild recession,” according to Credit Suisse.

The analysts’ “highest conviction recommendations,” however, could return around 30%, and include Bank of America, Goldman Sachs and JPMorgan Chase, according to Roth Katzke.

— CNBC’s Michael Bloom contributed to this story.

Ukraine hails snowballing offensive, blames Russia for blackouts

PUBLISHED SUN, SEP 11 20223:05 AM EDTUPDATED SUN, SEP 11 20228:40 PM EDT

KEY POINTS

- Ukrainian forces kept pushing north in the Kharkiv region and advancing to its south and east, Ukraine’s army chief said on Sunday.

- Ukrainian officials accused retreating Russian forces of launching retaliatory attacks on civilian infrastructure, including a thermal power station in Kharkiv, that the authorities in Kyiv said caused widespread blackouts.

- In the worst defeat for Moscow’s forces since they were repelled from the outskirts of the capital Kyiv in March, thousands of Russian soldiers left behind ammunition and equipment as they fled the city of Izium, which they had used as a logistics hub.

Ukrainian forces kept pushing north in the Kharkiv region and advancing to its south and east, Ukraine’s army chief said on Sunday, a day after their rapid surge forward drove Russia to abandon its main bastion in the area.

Ukrainian officials accused retreating Russian forces of launching retaliatory attacks on civilian infrastructure, including a thermal power station in Kharkiv, that the authorities in Kyiv said caused widespread blackouts.

“No military facilities, the goal is to deprive people of light & heat,” Ukrainian President Volodymyr Zelenskyy wrote on Twitter of the attacks.

Moscow denies its forces deliberately target civilians.

Zelenskyy has described Ukraine’s offensive as a potential breakthrough in the six-month-old war, and said the winter could see further territorial gains if Kyiv received more powerful weapons.

In the worst defeat for Moscow’s forces since they were repelled from the outskirts of the capital Kyiv in March, thousands of Russian soldiers left behind ammunition and equipment as they fled the city of Izium, which they had used as a logistics hub.

Ukraine’s chief commander, General Valeriy Zaluzhnyi, said the armed forces had regained control of more than 3,000 square km (1,158 square miles) since the start of this month.

Moscow’s almost total silence on the defeat — or any explanation for what had taken place in northeastern Ukraine — provoked significant anger among some pro-war commentators and Russian nationalists on social media. Some called on Sunday for President Vladimir Putin to make immediate changes to ensure ultimate victory in the war.

‘Cynical defeat’

Zelenskyy said late on Sunday that Russian attacks caused a total blackout in the Kharkiv and Donetsk regions, and partial blackouts in the Zaporizhzhia, Dnipropetrovsk and Sumy regions.

“They are unable to reconcile themselves to defeats on the battlefield,” Dnipropetrovsk Governor Valentyn Reznichenko wrote on Telegram.

Kyrylo Tymoshenko, the deputy head of the president’s office, posted an image on Telegram of a power station on fire but added power had been restored in some regions.

Kharkiv Mayor Ihor Terekhov described attacks on infrastructure as “cynical revenge” for the success of Ukrainian troops at the front, particularly in Kharkiv.

Ukraine’s gains are important politically for Zelenskyy as he seeks to keep Europe united behind Ukraine — supplying weapons and money — even as an energy crisis looms this winter following cuts in Russian gas supplies to European customers.

Zelenskyy said Ukrainian forces would continue to advance.

“We will not be standing still,” he said in a CNN interview recorded on Friday in Kyiv. “We will be slowly, gradually moving forward.”

‘Snowball rolling down a hill’

Defence Minister Oleksii Reznikov said Ukraine needed to secure retaken territory against a possible Russian counterattack on stretched Ukrainian supply lines. He told the Financial Times that Ukrainian forces could be encircled by fresh Russian troops if they advanced too far.

But he said the offensive had gone far better than expected, describing it as a “snowball rolling down a hill.”

“It’s a sign that Russia can be defeated,” he said.

Kyiv-based military analyst Oleh Zhdanov said the gains could bring a further push into Luhansk region, whose capture Russia claimed at the beginning of July.

“If you look at the map, it is logical to assume that the offensive will develop in the direction of Svatove – Starobelsk, and Sievierodonetsk – Lysychansk,” he said.

The head of Russia’s administration in Kharkiv told residents to evacuate the province and flee to Russia, TASS reported on Saturday. Witnesses described traffic jams with people leaving Russian-held territory.

Washington appeared to take a cautious public posture, with the Pentagon referring Reuters to Defense Secretary Lloyd Austin’s remarks on Thursday about Kyiv’s “encouraging” battlefield successes.

Britain’s defense ministry said on Sunday that fighting continued around Izium and the city of Kupiansk, the sole rail hub supplying Russia’s front line across northeastern Ukraine, which has been retaken by Ukraine’s forces.

Nuclear reactor shuts down

As the war entered its 200th day, Ukraine on Sunday shut down the last operating reactor at Europe’s biggest nuclear power plant to guard against a catastrophe as fighting rages nearby.

Russia and Ukraine accuse each other of shelling around the Russian-held Zaporizhzhia plant, risking a release of radiation.

The International Atomic Energy Agency said a backup power line to the plant had been restored, providing the external electricity it needed to carry out the shutdown while defending against the risk of a meltdown.

French President Emmanuel Macron told Putin in a phone call on Sunday that the plant’s occupation by Russian troops is the reason why its security is compromised, the French presidency said. Putin blamed Ukrainian forces, according to a Kremlin statement.

Winner of $1.34 billion Mega Millions jackpot has just a few weeks left before a key claiming deadline

PUBLISHED FRI, SEP 9 20228:00 AM EDT

KEY POINTS

- As of Thursday, a Mega Millions jackpot won in July remained unclaimed, according to an Illinois Lottery spokesperson.

- If the winner doesn’t claim the jackpot by Sept. 27 — 60 days after the July 29 drawing — the prize will default to the annuity option.

- The one-time reduced lump-sum option — which is what most jackpot winners choose — for this $1.34 billion windfall is $780.5 million.

The clock is ticking for whoever landed the $1.34 billion Mega Millions jackpot in late July — if they want to claim their prize as a lump sum.

In Illinois, where the winning ticket was sold, Mega Millions winners get a year to claim their windfall if they want to receive it as an annuity spread over three decades. But they only get 60 days if they would rather take the prize as an upfront, reduced lump sum, according to the Illinois Lottery.

This means if the winner doesn’t claim the jackpot by Sept. 27 — 60 days after the July 29 drawing — the prize will default to the annuity option.

“They have a choice that will be made for them if they don’t make it,” said Susan Bradley, a certified financial planner and founder of the Sudden Money Institute in Palm Beach Gardens, Florida.

The $1.34 billion jackpot, which marked the second-largest prize in the game’s history, was won by a ticket purchased in Des Plaines, Illinois.

As of Thursday, the jackpot remained unclaimed, according to Illinois Lottery spokesperson Meghan Powers.

“For a prize of this magnitude, it’s not unusual for a winner to take a little bit longer to claim the prize as they may want to seek professional legal and financial advice prior to claiming,” Powers said.

Whether the prize is taken as a lump sum or an annuity, there are pros and cons to each option that are best sorted through with the help of a team of professionals, Bradley said.

That team could include experts in financial areas such as taxes, wealth advice, investments, trusts and philanthropy.

“Right now, this winner, in a perfect world, has already set up a brain trust,” Bradley said.

The lump-sum option is $780.5 million before taxes

The lump-sum, cash option — which most winners of big lottery jackpots choose — for this $1.34 billion prize is $780.5 million.

The amount would be reduced by a 24% federal tax withholding, or about $187.3 million. Another 4.95% would be withheld for state income taxes, which works out to $38.6 million. That would leave the winner with $554.6 million, although additional taxes would likely be due.

“Some people say take the lump sum because you manage it instead of the state,” she said. “But that’s loaded with all sorts of responsibilities that people can’t see coming.”

In other words, the cash amount would catapult the winner into possessing an amount of money that most people don’t see in a lifetime. To preserve the wealth, decisions would need to be made about investment and tax strategies, philanthropic goals, spending and gifting, insurance and more.

You may need to plan for a ‘replacement fund’

On the other hand, an annuity can appeal to winners who would rather have annual income for three decades, Bradley said. For this $1.34 billion jackpot, the yearly amount before taxes works out to average payments of $44.6 million, according to usamega.com.

In that scenario, however, the winner should give thought to what happens in 30 years when the payments stop.

“They should have a replacement fund,” Bradley said, referring to winners who opt for an annuity. This generally means setting aside a portion of their annuity income every year when the payment arrives.

“Assume 50% of the annual payment is yours after taxes,” she said. “Then split it in half again and put half in your replacement fund.”

It’s worth noting that the Illinois Lottery allows winners of prizes worth $250,000 or more to remain anonymous — which means you can keep your name out of the public eye.

Everything we learned about the Marvel Cinematic Universe at the D23 Expo

PUBLISHED SAT, SEP 10 20222:16 PM EDTUPDATED 4 HOURS AGO

KEY POINTS

- Disney unveiled footage for “Black Panther: Wakanda Forever,” “Ironheart,” “Secret Invasion,” “Werewolf by Night” and more during the D23 Expo.

- Matt Shakman, the director of “WandaVision,” will officially direct the MCU’s “Fantastic Four” feature film.

Hot on the heels of San Diego Comic Con in July, Disney unveiled more information about its burgeoning Marvel Cinematic Universe during the D23 Expo on Saturday.

Marvel Studios head Kevin Feige teased that his team has a plan for the next ten years of Marvel’s cinematic universe, and plans to incorporate the Fantastic Four, X-Men and Deadpool into the mix of already established Marvel heroes.

Here’s a breakdown of what audiences can expect from Disney’s Marvel Studios in the coming years:

Kevin Feige, head of Marvel Studios, started his portion of the D23 Expo panel with a rendition of “I Can Do This All Day” from “Rogers: The Musical,” which appeared in the Disney+ series “Hawkeye.”

‘Black Panther: Wakanda Forever’

Ryan Coogler, the director of “Black Panther: Wakanda Forever,” brought footage from the film, which is due out in theaters Nov. 11. The clips showed Queen Ramonda chastising the United Nations for trying to steal vibranium from Wakanda following the death of T’Challa.

The footage showcased the power of the Dora Milaje and set the stage for an epic fight against Namor and the Atlanteans.

“Excited for you to walk out of the cinema and feel proud of what we brought to you,” said Letitia Wright, who portrays Shuri in the film.

‘Ironheart’

Audiences got a quick glimpse at Riri Williams in the “Wakanda Forever” footage, but Marvel also shared a peek at the “Ironheart” Disney+ series, which is still in production. The clips showed Riri building bits of the Ironheart armor and Feige teased that the show will focus on the cross section of magic and technology.

‘Ant-Man and the Wasp: Quantumania’

Paul Rudd, Evangeline Lilly and Johnathan Majors appeared on stage to discuss the upcoming “Ant-Man and the Wasp: Quantumania,” the first film in phase 5 of the MCU.

“This thing is bananas,” Rudd said.

“This is going to be unlike anything you’ve seen from us and not to mention that guy,” he said, pointing to Majors, who portrays Kang. “Throws this whole thing into such new territory.”

Footage shows the Lang, Van Dyne and Pym families being pulled into the quantum realm and faced with a terrible new foe: Kang the Conqueror.

‘Werewolf by Night’

Gael Garcia Bernal and Laura Donnelly star in “Werewolf by Night,” special Marvel Studios presentation coming to Disney+ in October.

The film, which is shot entirely black and white, harkens back to “The Twilight Zone” and old monster movies of the ’30s and ’40s. Early footage shown at D23 Expo suggests the film follows a group of monster hunters seeking out a monster among them.

‘Secret Invasion’

“Secret Invasion” follows a faction of shapeshifting aliens known as Skrulls who have infiltrated all aspects of life on Earth. The Skrulls first appeared in 2018′s “Captain Marvel,” which was set in the ’90s.

Don Cheadle arrived to share footage from the upcoming Disney+ series filled with political intrigue and action. He also teased “Armor Wars,” a show that will begin shooting next year.

‘Loki’ and ‘Fantastic Four’

Feige brought on the cast of “Loki’ to showcase a teaser trailer from the second season, which promises even more mischief.

He announced Matt Shakman, the director of “WandaVision,” will officially direct the MCU’s “Fantastic Four” feature film.

‘Echo’

“Echo,” a new Disney+ show that centers on a deaf female heroine, takes place after “Hawkeye” and features heavy use of American Sign Language.

Footage from the series shows the return of Vincent D’Onofrio as King Pin. Alaqua Cox reprises her role as the title character.

‘Daredevil: Born Again’

D’Onofrio, who had been on stage to promote “Echo,” was joined by Charlie Cox to share footage of Matthew Murdock aka Daredevil in “She-Hulk.′ No footage was shown from the show, as it has not begun filming. D’Onofrio will appear in the series.

‘Captain America: New World Order’

Anthony Mackie returns as Captain America in “Captain America: New World Order.” He was joined on stage by Danny Ramiez, who plays Joaquin Torres, Carl Lumbly as Isaiah Bradley and Tim Blake Nelson as Samuel Sterns, aka the Leader.

‘Thunderbolts’

Feige announced the team that will be part of “Thunderbolts.” This includes Julia Louis-Dreyfus as Valentina Allegra de Fontaine, David Harbour as Red Guardian, Hannah John-Kamen as Ghost, Olga Kurylenko as Task Master, Wyatt Russel as John Walker aka U.S. Agent, Florence Pugh as Yelena Belova and Sebastian Stan as the Winter Soldier.

“It tells you all you need to know about the Thunderbolts when the beloved Winter Soldier is the most stable among them,” Feige teased.

‘The Marvels’

Brie Larson, Iman Vellani and Teyonah Parris closed out the panel with footage from the upcoming film. Miss Marvel, Captain Monica Rambeau and Captain Marvel find their powers have become intertwined and the three heroes must become untangled. In the mean time, the three continue to accidentally swap places, leading to quite a few laughs.

The footage shown at the D23 Expo was action-packed and filled with comedic beats. Also, everyone’s favorite Flerkin, Goose, will be back for more antics.

Correction: This story has been updated to correct the spelling of actor Tim Blake Nelson.

Wall Street’s favorite value stocks include a media giant that could surge 55%

PUBLISHED SUN, SEP 11 20229:00 AM EDTUPDATED MON, SEP 12 20228:58 AM EDT

This year’s tumble in stocks has led many on Wall Street to look at a previously underappreciated part of the market: value.

Value stocks are those names that typically trade at a low multiple relative to the broader market and have stable fundamentals.

In recent years, investors had been shunning value names in favor of their growth counterparts — those with high growth expectations relative to the broader market. Over the past five years, the SPDR Portfolio S&P 500 Growth ETF (SPYG) is up 87%, while the value-oriented SPYV fund has risen just 37% in that time.

However, some on Wall Street have recently voiced their preference toward value investing given current market conditions.

In June, AQR Capital Management co-founder Cliff Asness said value stocks were more attractive than growth names — even after this year’s correction that sent the S&P 500 into a bear market. “We’re sticking with it [value] because we always like some value in the portfolio. And we do like more when it looks very, very cheap,” Asness said on CNBC’s “Closing Bell.”

More recently, Goldman Sachs said it’s time for value to finally win out over growth, with analyst Cormac Conners noting: “Current relative valuations within the equity market imply the Value factor will generate strong returns over the medium term.”

With this in mind, CNBC Pro screened the SPDR Portfolio S&P 500 Value ETF (SPYV) for stocks that met the following criteria:

- Buy ratings from more than 50% of analysts covering them

- Upside to average price target of at least 20%

- Price-to-earnings ratio below the S&P 500′s

Here are the 10 names with the highest potential upside that made the cut.

WALL STREET’S FAVORITE VALUE STOCKS

| SYMBOL | NAME | SECTOR/SPACE | (%) BUY RATING | UPSIDE TO AVG PT (%) | PRICE / EARNS RATIO |

| DISH | DISH Network Corporation Class A | Telecommunications | 52.9 | 77.7 | 5.5 |

| NWSA | News Corporation Class A | Consumer Services | 66.7 | 55.3 | 16.0 |

| HAL | Halliburton Company | Energy | 65.4 | 44.9 | 17.8 |

| FDX | FedEx Corporation | Industrials | 58.1 | 39.2 | 14.1 |

| MU | Micron Technology, Inc. | Technology | 66.7 | 31.4 | 6.3 |

| DD | DuPont de Nemours, Inc. | Non-Energy Materials | 72.7 | 30.5 | 15.8 |

| TPR | Tapestry, Inc. | Consumer Cyclicals | 52.2 | 28.7 | 10.9 |

| PSX | Phillips 66 | Energy | 61.1 | 28.6 | 7.4 |

| URI | United Rentals, Inc. | Industrials | 52.4 | 27.9 | 12.6 |

| BBWI | Bath & Body Works, Inc. | Consumer Non-Cyclicals | 71.4 | 27.7 | 10.4 |

Source: FactSet

Topping the list in terms of potential upside is Dish Network, with analysts on average expecting the stock to rally nearly 78% from current levels, FactSet data show. Roughly 53% of analysts covering the stock rate it a buy. To be sure, the stock has struggled this year, dropping 40%.

Another stock that made our list is News Corp. Two-thirds of analysts covering the media company rate it a buy, with the average price target implying upside of 55% from current levels. News Corp shares are down more than 20% in 2022, but have rallied 12% in the third quarter, outperforming the broader market in that time.

Semiconductor giant Micron also made the cut, with 66% of analysts rating it a buy and seeing average upside of 31%. To be sure, Micron’s stock is down more than 8% over the past three months, after the company said in late June that weakening consumer demand will hurt smartphone memory chip sales.

Analysts also favor FedEx within the value cohort, with 58% of them rating the delivery and logistics company a buy. On top of that, the average price target among analysts implies upside of 39% from current levels.

The stock has been under pressure in 2022, falling 19% in that time. However, KeyBanc’s Todd Fowler thinks the stock can be a winner going forward.

“We believe concerns around a recently lowered macro outlook and related execution are increasingly discounted. We understand guidance credibility is important; however, we see upside potential with only slight improvement and additional support from more disciplined capital deployment,” Fowler, who has an overweight rating on FedEx, said in a note Thursday.

Fowler’s price target of $325 per share is roughly 55% above where the stock traded Friday.

Other names that made the list are: Halliburton, DuPont, Tapestry, Phillips 66, United Rentals and Bath & Body Works.

Correction: This story has been updated to correct the SPDR Portfolio S&P 500 Growth ETF’s ticker.

HI Financial Services Mid-Week 06-24-2014