HI Market View Commentary 09-07-2021

SO just some thoughts looking over the last week:

I’m grateful to have a methodology that allows me to wait for fundamentally underpriced stocks to rebound

I’m grateful for a methodology that allows me to actively do something other than wait while bearish markets or bearish trends are occurring

Three times the market was down by 0.20% or more and we were up 0.8% or higher

WHY do you like to see that? = Duh more money, better returns, It’s because it validates all the work done previously before we entered those positions

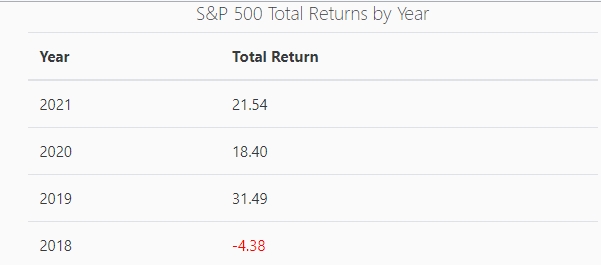

The last three weeks has given me hope that we will beat this year’s S&P 500

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 03-Sep-21 14:41 ET

August jobs report likely spoils September tapering announcement

We were hoping that the August employment report would provide some closure on the matter of when the Federal Reserve would announce some guidelines for a tapering of its asset purchases.

Our hope was that such guidelines would be shared at the conclusion of the September 21-22 FOMC meeting. Unfortunately, we think those hopes have been dashed by the August employment report.

Clear Progress

The Federal Reserve has a dual mandate that includes price stability and maximum employment. In his speech last week to the Jackson Hole economic symposium, Fed Chair Powell acknowledged his belief that the “substantial further progress” test has been met for inflation.

He did not say the same for maximum employment. On that front, he simply said that clear progress has been made. He went on to add that “We have much ground to cover to reach maximum employment.”

Our belief was that the Fed chair was eager to see more employment data — and specifically the August employment report — before subscribing to the idea, as many of his colleagues already have, that the Fed could issue guidelines at this month’s FOMC meeting for a tapering action.

With the data now available, Fed Chair Powell is apt to use his influence to keep the Fed on hold with a tapering announcement.

Powell Will Be Driving

Nonfarm payroll growth slowed sharply from July. Specifically, 235,000 positions were added to nonfarm payrolls in August versus 1.053 million in July. That was an undershoot of recovery expectations to say the least and well below consensus estimates that were pegged closer to 750,000.

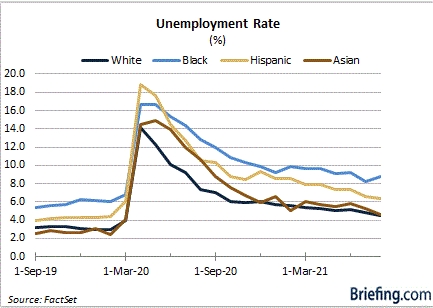

The total unemployment rate fell to 5.2% from 5.4% in July, yet that improvement wasn’t inclusive.

The Black or African American unemployment rate increased to 8.8% from 8.2%, nearly double the 4.5% unemployment rate for whites. The Hispanic or Latino ethnicity unemployment rate dropped to 6.4% from 6.6%. The Asian unemployment rate fell to 4.6% from 5.3%.

It was clear to see in the employment report that the Delta variant played a role in the disappointing payrolls growth. The clearest sight line there was the leisure and hospitality industry, which showed no change in payrolls after a 415,000 increase in July. Additionally, employment in the retail trade industry declined by 28,500.

With reports that the case surge related to the Delta variant could be peaking, the market is going to be looking for a sizable rebound in leisure and hospitality payrolls in coming months. Officials at the Federal Reserve likely will be, too.

Some will likely make the argument at the September 21-22 FOMC meeting that this expectation is a basis for why the Fed shouldn’t forestall a decision any longer to announce a tapering plan. We suspect they will lose that argument, especially since the loudest voices in this regard don’t have votes in 2021.

Fed Chair Powell will be steering the conversation, and if his prior views are any indication, he will be steering things to the slow lane.

The presumption, after the disappointing payrolls growth in August, is that the Powell-led Fed will maintain a conservative bearing and announce that it is going to watch incoming data closely for signs of substantial further progress in meeting the maximum employment test.

That view will be couched with language that makes it sound as if the Fed is still entertaining the idea of making a tapering announcement sometime before the end of the year. Such language will be a nod to the more aggressive-minded, back seat drivers in the meeting room. After the September meeting, the FOMC meets again on November 2-3 and December 14-15.

What It All Means

The market was hoping for some closure on when the Fed would announce its guidelines for a tapering decision. The August employment report was the answer for a September announcement, but, unfortunately, it only created more questions.

The consequence is that the Treasury market should see continued volatility, particularly longer-dated securities that are more sensitive to inflation pressures and inflation expectations.

On a related note, the August employment report also featured a 0.6% month-over-month increase in average hourly earnings, which are now up 4.3% year-over-year. It is possible that the lack of payroll growth in lower-paying leisure and hospitality and retail trade jobs pushed up the average hourly earnings number in August.

Still, over the last six months, which have cumulatively featured strong growth in those areas, average hourly earnings are running at an annualized rate of 5.0%. It is this understanding that creates angst about inflation and the risk of a policy error by continuing full throttle with the asset purchases at a time when the economy is still growing well above potential and the fed funds rate remains pinned at the effective lower bound.

Be that as it may, we suspect it will still be pedal to the metal in the slow lane for Fed Chair Powell.

—Patrick J. O’Hare, Briefing.com

Earnings Dates

COST – 09/23 AMC

Where will our markets end this week?

Higher

DJIA – Bearish

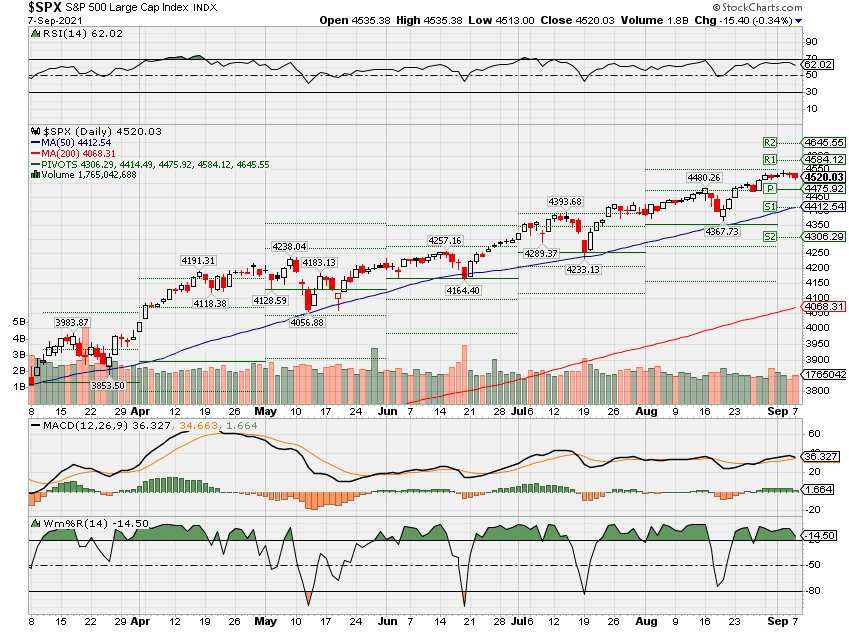

SPX – Bullish

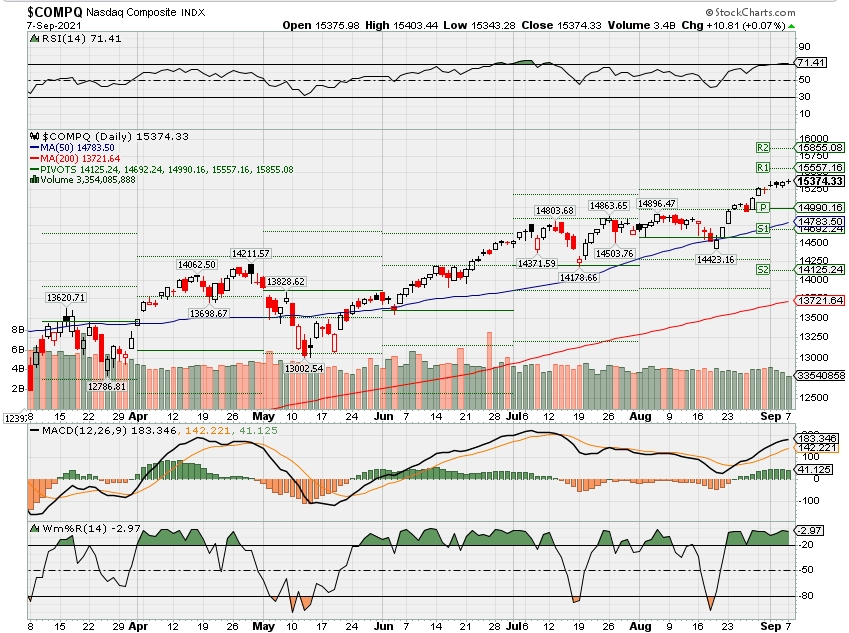

COMP – Bullish

Where Will the SPX end September 2021?

09-07-2021 -1.0%

08-30-2021 -1.0%

08-23-2021 -1.0%

Earnings:

Mon:

Tues:

Wed: GME, LULU

Thur: AOUT

Fri: KR

Econ Reports:

Mon:

Tues:

Wed: MBA, Fed Beige Book, Consumer Confidence

Thur: Initial Claims, Continuing Claims,

Fri: PPI, Core PPI, Wholesale Inventories

Int’l:

Mon –

Tues –

Wed –

Thursday – ECB Rate Decision

Friday-

Sunday –

How am I looking to trade?

Running stock higher until the seasonal pull back AND taking long put protection off some stocks that seem to be at a bottom

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

The SPAC market is turning bleaker by the day as investors head for the exits amid rising scrutiny, pushing the majority of deals below their IPO price.

A total of 125 blank-check deals have closed their mergers in 2021, and 58% of them are currently trading below $10 and more than a third of them had over 50% public shares redeemed, according to a CNBC analysis of SPAC Research data.

SPACs are typically priced at a nominal $10 per unit, and unlike a traditional IPO, they are not priced based on a valuation of an existing business.

https://datawrapper.dwcdn.net/gQImq/2/ “The SPAC boom has ended,” Paul Hickey, co-founder of Bespoke Investment Group, said in a note. “With so many deal teams chasing targets, the sorts of acquisitions now being made are far less attractive, and price declines for post-transaction SPAC companies have made the hype train harder to keep rolling.”

SPACs stand for special purpose acquisition companies, which raise capital in an IPO and use the cash to merge with a private company and take it public, usually within two years.

The worst-performing SPAC this year was Ensysce Biosciences, a biopharmaceutical company fighting drug overdoses, whose stock is trading just about $3 a share. CNBC previously reported this company merged with Leisure Acquisition Corp., a SPAC that was initially targeting a leisure company but pivoted its focus as deal-making environment became competitive.

Many on Wall Street saw the sharp reversal coming as the industry had grown too far, too fast in a market full of speculative activity. During the record first quarter, the SPAC market saw 89 new deals with $28.6 billion capital raised per month, and now the number tumbled to just 9 deals a month with $1.6 billion funds since April, according to data from Bespoke Investment Group.

“The boom in SPAC issuance was never sustainable, and it appears that financial reality is setting in,” Hickey said.

The cooldown coincided with heightened oversight from the Securities and Exchange Commission. Regulators have repeatedly warned investors of underlying risks in these deals, while demanding better disclosures and tighter accounting rules from blank-check deals.

In July, the SEC settled with Momentus, a space company that was taken public by SPAC Stable Road Acquisition, after charging the parties involved for misleading disclosures ahead of the merger. CNBC previously reportedStable Road was originally seeking to merge with a cannabis company.

Bill Ackman’s troubled SPAC got sued last month as plaintiffs alleged the blank-check company promised “staggering compensation” to directorsand asking that the entity’s special status be revoked.

Meanwhile, SPACs are getting hit by a rising number of class-actions as shareholders seek to hold deal leaders accountable amid sharp declines in the stock price.

— With assistance from Nate Rattner.

Tech giants are rushing to develop their own chips – here’s why

KEY POINTS

- Apple, Amazon, Facebook, Tesla and Baidu are all shunning established chip firms and bringing certain aspects of chip development in-house, according to company announcements and media reports.

- At this stage, none of the tech giants are looking to do all the chip development themselves.

- Setting up an advanced chip factory, or foundry, like TSMC’s in Taiwan, costs around $10 billion and takes several years.

Not content with relying on standard chips that are in high demand, some of the world’s biggest tech firms are developing their own semiconductors.

Apple, Amazon, Facebook, Tesla and Baidu are all shunning established chip firms and bringing certain aspects of chip development in-house, according to company announcements and media reports.

“Increasingly, these companies want custom-made chips fitting their applications’ specific requirements rather than use the same generic chips as their competitors,” Syed Alam, global semiconductor lead at Accenture, told CNBC.

“This gives them more control over the integration of software and hardware while differentiating them from their competition,” Alam added.

Russ Shaw, a former non-executive director at U.K.-based Dialog Semiconductor, told CNBC that custom-designed chips can perform better and work out cheaper.

“These specifically designed chips can help to reduce energy consumption for devices and products from the specific tech company, whether it relates to smartphones or cloud services,” Shaw said.

The ongoing global chip shortage is another reason why big tech firms are thinking twice about where they get their chips from, Glenn O’Donnell, research director at analyst firm Forrester, told CNBC. “The pandemic threw a big wrench in these supply chains, which accelerated efforts to do their own chips.”

“Many already felt limited in their innovation pace being locked into chipmaker timelines,” O’Donnell said.

A.I. chips and more

At present, barely a month goes by without a Big Tech company announcing a new chip project.

Perhaps the most notable example came in November 2020 when Apple announced it was moving away from Intel’s x86 architecture to make its own M1 processor, which now sits in its new iMacs and iPads.

More recently, Tesla announced that it is building a “Dojo” chip to train artificial intelligence networks in data centers. The automaker in 2019 started producing cars with its custom AI chips that help on-board software make decisions in response to what’s happening on the road.

Baidu last month launched an AI chip that’s designed to help devices process huge amounts of data and boost computing power. Baidu said the “Kunlun 2” chip can be used in areas such as autonomous driving and that it has entered mass production.

Some of the tech giants have chosen to keep certain semiconductor projects under wraps.

Google is reportedly edging closer to rolling out its own central processing units, or CPUs, for its Chromebook laptops. The search giant plans to use its CPUs in Chromebooks and tablets that run on the company’s Chrome operating system from around 2023, according to a report from Nikkei Asia on Sep. 1. Google did not immediately respond to a CNBC request for comment.

Amazon, which operates the world’s largest cloud service, is developing its own networking chip to power hardware switches that move data around networks. If it works, it would reduce Amazon’s reliance on Broadcom. Amazon, which already designs a number of other chips, did not immediately respond to a CNBC request for comment.

Facebook’s chief AI scientist told Bloomberg in 2019 that the company is working on a new class of semiconductor that would work “very differently” than most of the existing designs. Facebook did not immediately respond to a CNBC request for comment.

Designing but not manufacturing

At this stage, none of the tech giants are looking to do all the chip development themselves.

“It is all about the design and performance of the chip,” Shaw said. “At this stage, it is not about the manufacturing and foundries, which is very costly.”

Setting up an advanced chip factory, or foundry, like TSMC’s in Taiwan, costs around $10 billion and takes several years.

“Even Google and Apple are reticent to build these,” O’Donnell said. “They’ll go to TSMC or even Intel to build their chips.”

O’Donnell said there’s a shortage of people in Silicon Valley with the skills required to design high end-processors. “Silicon Valley put so much emphasis on software over the past few decades that hardware engineering was seen as a bit of an anachronism,” he said.

“It became ‘uncool’ to do hardware,” O’Donnell said. “Despite its name, Silicon Valley now employs relatively few real silicon engineers.”

These charts show which states will get the most money from Biden’s infrastructure bill

KEY POINTS

- California, Texas and New York will likely cash in big on the trillion-dollar infrastructure package if the bill makes its way to President Joe Biden’s desk.

- But far less populous states — such as Montana and Alaska — will get the most money per capita.

- The Senate overwhelmingly approved the $1 trillion infrastructure bill earlier this month. The House aims to pass the bill by October.

https://datawrapper.dwcdn.net/W8N55/6/ California, Texas and New York will likely cash in big on the trillion-dollar infrastructure package if the bill makes its way to President Joe Biden’s desk.

But far less populous states — such as Montana and Alaska — will get the most money per capita.

The administration said Californians should plan for at least $44.56 billion in infrastructure funds, the biggest sum for any state, with highways and public transit alone comprising about $34.8 billion of that total.

Texas came in at No. 2 with an estimated allocation of $35.44 billion, between $26.9 billion in estimated highway funds and $3.3 billion in estimated public transit funds. New York, in third, is projected to receive $26.92 billion.

See the full list of estimated allocations for each state at the bottom of this article.

CNBC’s analysis shows that Vermont, Montana, Wyoming and Alaska lead when it comes to estimated per capita infrastructure spending, with at least $3,500 per resident. California’s estimated per capita allocation is less than $1,250 per resident.

The White House, hoping to make good on Biden’s campaign promises ahead of the 2022 midterm elections, has billed the plan as a generational investment. The Senate overwhelmingly approved the $1 trillion infrastructure bill earlier this month in an effort to rebuild the nation’s crumbling roads and bridges and fund new climate resilience and broadband initiatives. The House aims to pass the bill by October.

https://datawrapper.dwcdn.net/2OVKI/1/ The administration touts that the infrastructure plan “will grow the economy, enhance our competitiveness, create good jobs” and improve a variety of other metrics.

It’s important to note that the White House estimates are summaries based on the allocation of funds in prior legislation. The current piece of legislation could change the formulas that determine which factors decide how much money a state or city receives.

Current White House estimates also leave out competitive grant programs for specific, economically significant one-time projects. Localities can often use those grants to help finance an isolated project if the federal government determines that a particular bridge or tunnel has outsized economic impact on a region.

Any improvements are likely to happen at the local level, since states and municipalities are the stewards of some 90% of non-defense public infrastructure assets and usually bear 75% of their cost of upkeep, according to the Center on Budget and Policy Priorities, a progressive think tank.

Washington typically funds major surface infrastructure initiatives through the Transportation Department, which issues grants to states. Those grants can come from several funds, including the Highway Trust Fund, which generates a significant amount of its revenues from gasoline taxes.

The calculations that determine how much money one state receives relative to another is set by statute and can vary slightly over time as lawmakers update spending models. Some factors, though, remain consistent, said Vikram Rai, head of Citi’s municipal bonds strategy.

“The Department of Transportation is given an allocation and they decide how to allocate to various states and localities,” Rai said. The number of factors that decide the size of a grant are many, but some factors are straightforward.

Rai explained that a state’s population usually weighs heavily on how much it receives as a proportion of total funding. The thinking there is clear: The more people in a state, the more wear and tear on that state’s roads, bridges and other transportation surfaces.

That’s why, in part, it’s not necessarily surprising to see New York, Texas and California, as three of the country’s most populated states, atop the funding list.

Other factors that go into determining grant size can be a bit more complicated.

Grants may be larger or smaller based on how many big cities a given state has. Or, if the grant is marked for urban areas, the size is determined by how many people live in a particular city.

In the 2015 FAST Act, an Obama-era transportation bill, urban-area grants were in part determined based on whether the city had more or less than 200,000 residents.

Those grants were then further magnified or shrunk based on other factors: The presence of a commuter rail, for example, or how many miles the city’s buses traveled in a particular day.

Those factors are clear in the current White House calculations.

New York, New Jersey and Connecticut are expected to receive $15.2 billion for public transportation based on formula funding. That’s 24% of the total allocated to public transportation, though those states make up about 10% of the U.S. population, suggesting that the administration thinks the vast public transit infrastructure in those three states merits additional attention.

On the other hand, Louisiana, which is contending with potentially billions of dollars in damage from Hurricane Ida, is expected to nab $1.01 billion for bridge replacement and repairs, seventh among all states and about 3.8% of the total dedicated to bridges.

The American Society of Civil Engineers said in a recent report that Louisiana, which relies heavily on bridges to transverse much of its low-lying countryside, is ranked fourth in the nation for total bridge area but second in the number of structurally deficient bridges based on square footage.

The Federal Transit Administration, a division of the Transportation Department that oversees financial assistance to local public transit systems, has published flow charts that show how the FAST Act’s formulas determined grant size.

Full state list

https://datawrapper.dwcdn.net/g3Kvg/3/ Correction: This story was updated to reflect correct figures for Louisiana’s rank and estimated bridge allocation.

Ford poaches top tech executive Doug Field who helped lead Apple’s top-secret car project

KEY POINTS

- Ford has hired former Tesla and Apple executive Doug Field to lead its emerging technology efforts, a key focus for the automaker under its new Ford+ turnaround plan.

- The hire is a major new addition for Ford, while a big hit to Apple and its secret car project, which the company has yet to confirm exists.

- Apple, in an emailed statement, said: “We’re grateful for the contributions Doug has made to Apple and we wish him all the best in this next chapter.”

DETROIT – Ford Motor said Tuesday it hired former Tesla and Apple executive Doug Field to lead its emerging technology efforts, a key focus for the automaker under its new Ford+ turnaround plan.

Field — who led development of Tesla’s Model 3 —most recently served as vice president of special projects at Apple, which reportedly included the tech giant’s Titan car project.

The hire is a major addition for Ford and a big hit to Apple and its secret car project, which the company has yet to confirm exists.

“I think any time you lose a well-respected, experienced executive who, as best we can tell, was really directing the automotive efforts at Apple, it’s a blow to any company,” Bernstein analyst Toni Sacconaghi, who covers the iPhone maker, told CNBC’s “Closing Bell.”

Apple, in an emailed statement, said: “We’re grateful for the contributions Doug has made to Apple and we wish him all the best in this next chapter.”

Ford said Field will serve in the new position of chief advanced technology and embedded systems officer. He will lead Ford’s vehicle controls, enterprise connectivity, features, integration and validation, architecture and platform, driver assistance technology and digital engineering tools.

“His talent and commitment to innovation that improves customers’ lives will be invaluable as we build out our Ford+ plan to deliver awesome products, always-on customer relationships and ever-improving user experiences,” Ford CEO Jim Farley said in a statement. “We are thrilled Doug chose to join Ford and help write the next amazing chapter of this great company.”

Field, who will report to Farley, actually began his professional career at Ford in 1987, according to his LinkedIn profile. He then held positions at Johnson & Johnson, Deka Research & Development and Segway before starting at Apple in 2008. After more than five years with the tech giant, he moved to Tesla before returning to Apple in 2018.

In 2016, Apple reportedly abandoned plans to build its own car, focusing more on developing the software for autonomous driving. Field’s most recent stint at Apple was seen by industry insiders as an indication that the company was again looking at building its own vehicles.

His most recent stint at Apple was seen by some industry insiders as a re-emphasis on vehicle design after the company refocused its efforts on autonomous driving software.

Field declined to discuss his work at Apple, but he said there’s “nothing that prevents me from being fully engaged at Ford” when asked if his former employer made him sign a non-disclosure agreement.

“Apple doesn’t talk about new products, and I’m not going to talk about my work at Apple either,” he said Tuesday during a call with reporters. “But there’s nothing that prevents me from being fully engaged at Ford, and I’m looking forward to using everything I’ve learned from all of the teams I’ve worked with and all the companies I’ve been privileged to be a part of.”

Field said he decided to join Ford after speaking with company executives and realizing there’s a “deep desire” to remake the automotive industry, specifically with connected vehicles.

Connected vehicles are a key part to Ford’s new turnaround plan that’s designed to reposition the automaker to generate more recurring revenue through software services.

Farley described the Field’s hire as a “watershed moment” for the automaker. It follows Ford Chair Bill Ford telling CNBC that the automaker would be announcing new executives to Farley’s management team.

– CNBC’s Kevin Stankiewicz and Kif Leswing contributed to this report

HI Financial Services Mid-Week 06-24-2014