HI Market View Commentary 08-10-2020

| Market Recap |

| WEEK OF AUG. 3 THROUGH AUG. 7, 2020 |

| The S&P 500 index rose 2.5% this week, marking a strong start to August amid earnings-driven gains and better-than-expected July jobs data.

The market benchmark ended the week at 3,351.28, up from last week’s closing level of 3,271.12. It is now up 3.7% for the year to date. The strong weekly advance came amid continued enthusiasm for technology and communication-services stocks thanks to better-than-expected earnings for many companies. Investors also were encouraged by the lowest number of weekly jobless claims since March while monthly nonfarm payrolls came in better than expected. The monthly jobs data reported Friday by the Labor Department showed employers added 1.8 million jobs in July while the unemployment rate declined to 10.2% from 11.1% in June. These figures were better than Econoday’s consensus estimates for an increase of 1.7 million jobs and an unemployment rate of 10.5%. This week’s gain in the S&P 500 also came on optimism for another pandemic relief package. However, as of Friday afternoon, talks between White House officials and Democratic leaders for additional pandemic relief appeared at a standstill. Every sector of the S&P 500 was in the black for the week. Industrials had the strongest percentage increase, up 4.7%, followed by a 3.4% rise in financials and a 3.2% increase in energy. Other strong sectors included communication services, up 3.1%, and technology, up 3.0%. The industrial sector was boosted by strong gains in the shares of US airlines as a group of Republican senators supported a new six-month extension of the $25 billion payroll assistance program that would help keep airline jobs through March 2021 as surging COVID-19 cases negatively impact travel demand. Among the gainers, shares of American Airlines (AAL) jumped 17.2% this week. Among financial stocks, shares of Assurant (AIZ) rose 13.7% this week as the company posted Q2 net operating income that was up from the year-earlier period and analysts’ mean estimate. The energy sector’s gains came as crude oil futures rose on the week. Shares of Devon Energy (DVN) rose 15.4% on the week as the oil-and-gas producer reported a narrower-than-expected Q2 core loss and cut its guidance for 2020 capital spending while raising its full-year forecast for oil production. The company’s board also declared a $100 million special dividend. In communication services, shares of Walt Disney (DIS) jumped 11.1% amid its report of a surprise adjusted profit when an adjusted loss had been expected. While the company’s Parks, Experiences and Products segment took a $3.5 billion hit to operating income from closures related to the pandemic, Disney benefited from a surge in subscriptions to its streaming service. Apple (AAPL) shares gave a strong boost to the technology sector as investors and analysts continued to cheer the consumer technology company’s fiscal Q3 earnings beat reported last week. The consumer technology company is benefiting from increased demand for its products at a time when many have been working or schooling at home. The stock jumped 4.6% this week. Next week’s economic calendar features the release of the July producer price index on Tuesday and the July consumer price index on Wednesday. Friday, the market will get July readings on retail sales, industrial production and capacity utilization. August consumer sentiment is also set to be posted Friday. Provided by MT Newswires. |

What about Gold or Silver? You probably missed the run

Thoughts on the summer doldrums and the upcoming election:

Glen Beck Marxist Revolution June 16, 2020 RELATED to Investing

- Amit to yourself that this is actually happening

- Follow the 6P Rule: Prior Proper Planning Prevents Piss-Poor Performance

- Rules of 3: For collar trading to add share must have minimum 300, three is two, two is one and one is none ????????? You need a backup for EVERYTHING

- You can and should be prepared for volatility in market movements

- Observe Situational Awareness

Where will our markets end this week?

Lower

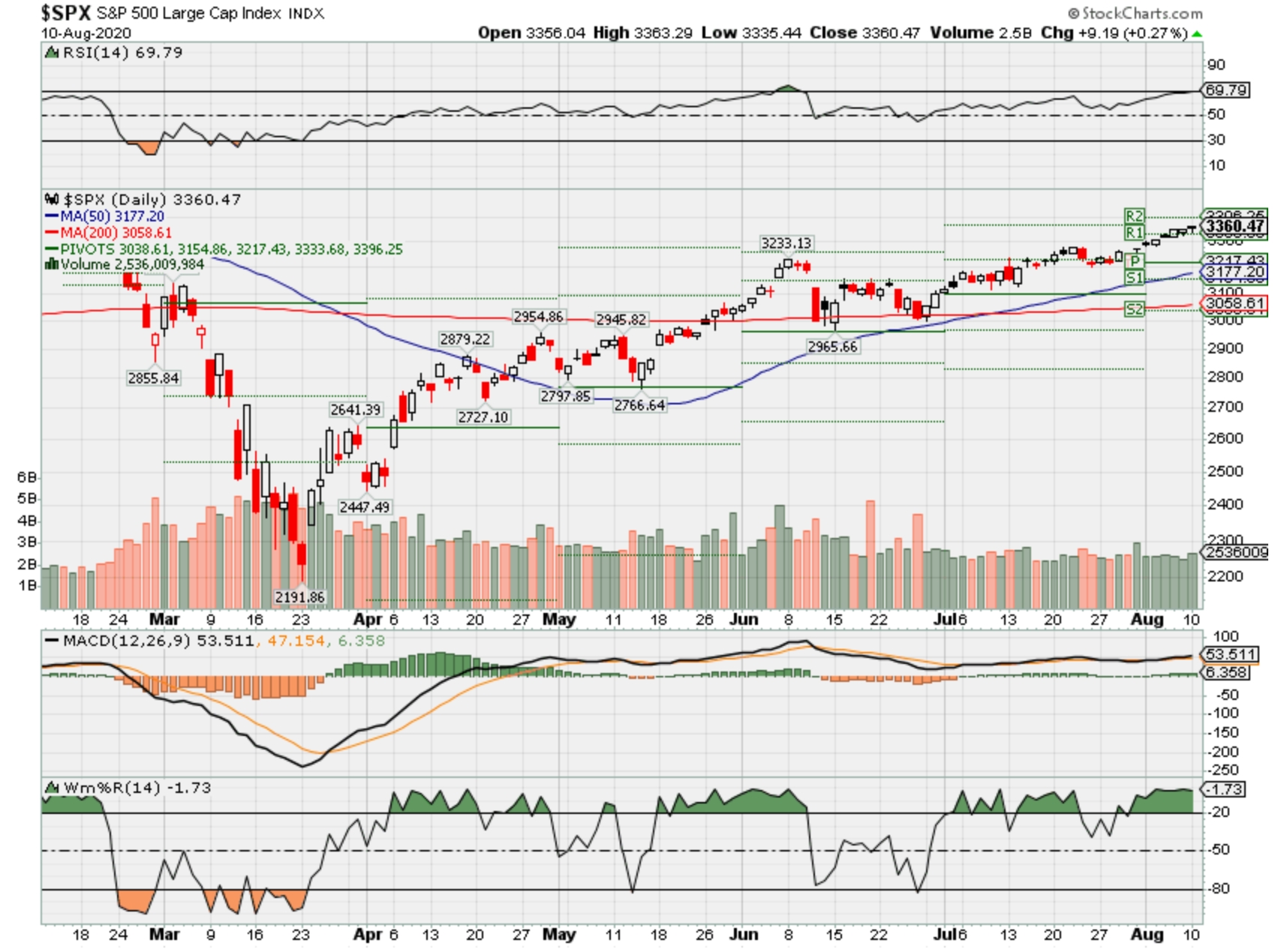

DJIA – Bullish

SPX – Bullish

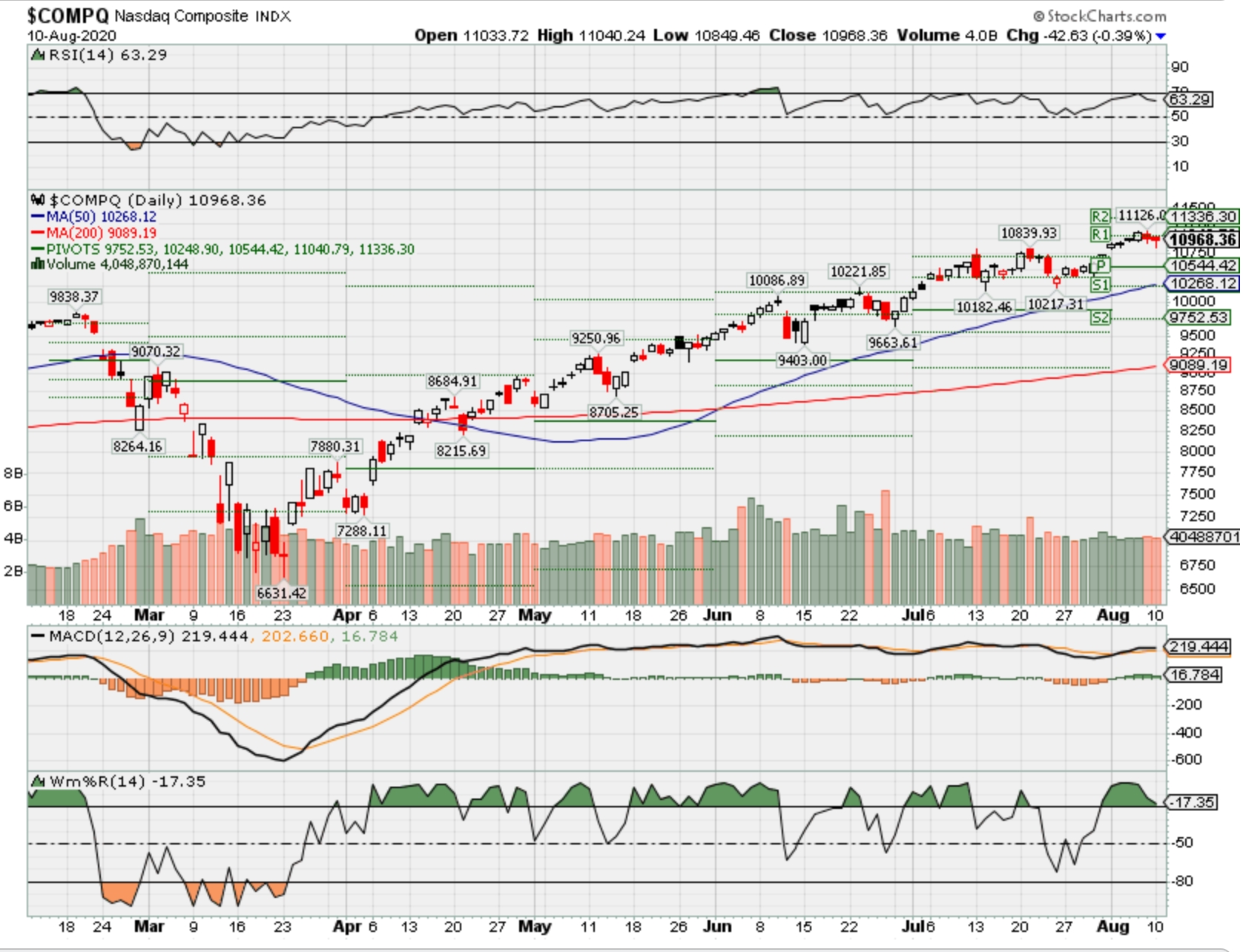

COMP – Bullish

Where Will the SPX end August 2020?

08-10-2020 -2.0%

08-03-2020 -2.0%

Earnings:

Mon: GOLD, DUK, MAR, HTZ

Tues:

Wed: CSCO, LYFT

Thur: NTES, TPR, IQ, BIDU

Fri:

Econ Reports:

Mon: JOLTS

Tues: PPI, Core PPI, NFIB Small Business Optimism Index

Wed: MBA, CPI, Core CPI, Treasury Budget

Thur: Initial Claims, Continuing Claims, Import, Export

Fri: Retail, Retail Ex-auto, Productivity, Capacity Utilization, Industrial Production, Business Inventories, Unit Labor Costs, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday- CN: Industrial Production and Retail Sales

Sunday –

How am I looking to trade?

Still letting most thing run but preparing for protection to get us through Oct and then new protection for the election

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Buffett’s firm has bought $2.1B of Bank of America stock

Posted on Wednesday, August 5th, 2020 By The Associated Press

OMAHA, Neb. (AP) — Warren Buffett’s company has bought $2.1 billion of Bank of America stock over the past three weeks after the latest purchases of $340 million of shares.

Berkshire Hathaway Inc. said Tuesday it bought 13.6 million Bank of America shares between Friday and Tuesday. The Omaha, Nebraska-based conglomerate has been steadily adding to its stake in the bank since July 20, and Berkshire now holds more than 1 billion shares of Bank of America stock, which represents 11.9% of the bank’s stock.

Before these latest purchases, Berkshire reported buying 71.5 million shares of Bank of America stock worth nearly $1.8 billion.

Investors follow what Berkshire buys and sells closely because of Buffett’s successful track record. Even before these recent purchases, Bank of America Corp. was the second largest investment in Berkshire’s portfolio behind only its Apple stake. Berkshire also holds sizeable investments in several other financial stocks, including U.S. Bancorp and Wells Fargo.

Besides investments, Berkshire owns a variety of more than 90 companies including insurers such as Geico, BNSF railroad and several large utilities.

Trump, Biden, and What the Candidates Mean for Portfolios

Clients need to be talked “off the ledge” and reminded how easy it is to miscalculate an election’s impact on markets.

August 04, 2020

For five months, financial advisors have been getting an earful from clients concerned about the impact of Covid-19 on their portfolios. But another worry has crept into conversations – the upcoming election in November that could pressure U.S. stocks like few in recent memory.

Based on the latest election polling, a big concern for many investors is that Washington could be taken over by Joe Biden and a Democratic-controlled Congress intent on reversing corporate tax cuts and other pro-business initiatives that helped fuel stock prices following Donald Trump’s surprise victory in 2016. Biden has also proposed raising both individual income and capital gains tax rates for those with high incomes.

Goldman Sachs estimates that the Biden tax plan, which among other provisions would raise the corporate tax rate from 21% to 28%, would effectively reduce S&P 500 earnings by more than 10% if enacted.

Polls and betting markets currently suggest that there’s a modest likelihood of a “Blue Wave” election outcome, with both the White House and Senate joining the House of Representatives under Democratic control.

For many investors, the prospect of a Democratic-controlled Washington seeking both tax hikes and greater regulation of carbon-rich industries is unnerving. “A lot of clients are freaking out that Trump is going to lose and that will taint the market,” says Jamie Cox, managing partner with Harris Financial Group, a Richmond, Va.-based financial advisor. “They want to rearrange portfolios and become defensive.”

If Trump can prevent this scenario and pull off another victory, it may bring a modest relief rally, particularly for certain sectors such as oil and gas and defense manufacturers. But there’s the worry that a Trump second-term, which almost certainly won’t occur this time with a big tax cut for corporations, could bring more negatives than positives for markets. This holds especially true if the president continues to pursue a Cold War with China over tensions related to trade, allegations of technology theft, and even the causes of what he has derisively called “the Chinese virus.”

Adding to these concerns is the possibility of an Election Day that takes place under the specter of the Covid-19 pandemic, leading to delayed vote counts and perhaps challenged results. President Trump has already declared that sizable levels of “fraudulent” mail-in voting is going to “rig the election.”

It’s small wonder that investors are expressing anxiety about the election outcome. A recent Goldman Sachs analysis of options activity concludes that implied volatility for the period around the November 3rd election is extremely high compared with prior cycles, primarily because of the coronavirus, “but the particularly high level of implied volatility in the periods before and after the election imply an extended period of election-related uncertainty.’’

According to global bank UBS, which polled more than 4,000 wealthy investors and business owners across 14 markets globally in late June and early July, a rising proportion of respondents, 46%, ranked the U.S. election among their biggest worries, up from 39% three months earlier.

But Cox and other advisors contacted by RIA Intel are advising clients not to alter portfolios based on how they anticipate an election playing out for their investments. History, they point out, has shown that reality often doesn’t match an election’s expectations. And many factors can easily intervene to alter markets including a sharp change for better or worse on the outlook for the Covid pandemic or additional waves of fiscal and monetary stimulus that the federal government stands ready to employ.

“In the next three months, improving Covid conditions and better economic improvements etc. can all push momentum a different way,” says Victoria Greene, a founder partner with G Squared Private Wealth, an investment advisory firm based in College Station, Texas. “Our approach is not to panic and make dramatic swings in your portfolio.”

Adds Brian Rose, senior economist, Americas with UBS Global Wealth Management: “It’s hard to forecast who is going to win and how much of their policy will make it into reality.” Even the prospect for a Democratic sweep, Rose adds, is “no reason to sell equities – a sweep will have a roughly neutral impact on markets with enough benefits because of government spending to offset a potential tax hike.”

Cox, for his part, says he has been talking many of his clients “off the ledge” by reminding them how easy it is miscalculate an election’s impact on markets.

For proof, one needn’t look further back than Trump’s surprise 2016 victory. On the eve of that election, many on Wall Street opined that a Trump victory would be disruptive to markets because of his protectionist views. And to be sure, once it become clear on election night that Trump had pulled off an upset, Dow and S&P 500 futures plummeted on shock and fear. But at 3 a.m. the following morning, when Trump gave a victory address that was surprisingly conciliatory, futures reversed their decline and shot higher. In the following weeks, as Trump began issuing business-friendly executive orders, stocks had far more up days than down ones in what has been called the Trump Rally: the country after all, had elected a president and Congress favorable to lower corporate taxes and less regulation on business.

The pundits even got sector calls wrong. “Many said that big tech would lag because the Trump administration would go after big tech and that steel and coal could do very well because he supported traditional American industries,” says Ryan Detrick, chief market strategist with LPL Financial. “Both of these predictions couldn’t have been more wrong.” Four years on, actions to break up major tech companies such as Apple and Amazon haven’t materialized. And Trump’s stated desires to protect the Old Economy haven’t offset the intrinsic weakness in these sectors.

It’s also hardly a given that a Blue Wave election would be a net negative for the stock market.

“While we’ve seen investors express concern over higher taxes under a Democratic sweep, we believe that recovery spending on stimulus – for health care, infrastructure, climate change and other initiatives – will more than offset these tax headwinds,” says Solita Marcelli, chief investment officer, Americas for UBS Global Wealth Management. Marcelli says that Biden’s spending proposals total nearly $7.5 trillion over 10 years while his tax increases total only 4 trillion.

There’s also the risk of fighting the Federal Reserve, an institution that stands ready to provide additional monetary stimulus in the form of quantitative easing. While John Allen, chief investment officer of Aspiriant, a Los Angeles-based wealth manager, believes that U.S. equities are sharply overvalued, he conceded that the combined forces of fiscal and monetary stimulus could be a “wild card” that keep stocks propped up in the coming year.

Granted, some investors can’t resist tinkering with their portfolios ahead of an election. For those betting on a Blue Wave outcome, UBS recommends overweighting a portfolio to stocks tied to energy efficiency, smart mobility, and renewables both in the U.S. and abroad. According to Greene, municipal bonds may do well in the Democratic sweep scenario as the desire for tax-free income rises in tandem with higher tax rates.

A less probable Red Wave, according to UBS, would benefit energy and financial companies as the threat of tighter regulation recedes, “while space and defense companies could also do well in a Trump second term.”

But the best advice may be to relegate the election handicapping to a tertiary investment concern.

“Trim your risk because that’s the right decision for your allocation and financial plan, not because of pre-panicking over an election,” concludes Greene of G Squared. “Much can change quickly and it is not prudent to knee jerk your financial plan due to potential future what-ifs. Often, making the choice to stick to your plan is in your best interest.”

Sen. Sanders proposes one-time tax that would cost Bezos $42.8 billion, Musk $27.5 billion

PUBLISHED THU, AUG 6 20205:00 PM EDTUPDATED FRI, AUG 7 20207:02 AM EDT

KEY POINTS

- Bernie Sanders, I-Vt., Ed Markey, D-Mass., and Kirsten Gillibrand, D-N.Y., on Thursday introduced the “Make Billionaires Pay Act,” which would tax tech’s top leaders tens of billions of dollars in wealth made during the pandemic.

- The “Make Billionaires Pay Act” would impose a one-time 60% tax on wealth gains made by billionaires between March 18, 2020, and Jan. 1, 2021.

- The funds would be used to pay for out-of-pocket health-care expenses for all Americans for a year.

Top tech leaders and other billionaires would be forced to hand over billions of dollars in wealth they’ve gained during the coronavirus pandemic under a new bill introduced by Sens. Bernie Sanders, I-Vt., Ed Markey, D-Mass., and Kirsten Gillibrand, D-N.Y.

The “Make Billionaires Pay Act” would impose a one-time 60% tax on wealth gains made by billionaires between March 18, 2020, and Jan. 1, 2021. The funds would be used to pay for out-of-pocket health-care expenses for all Americans for a year. As of Aug. 5, the bill would tax $731 billion in wealth accumulated by 467 billionaires since March 18, according to a press release. If passed, the bill would tax billionaires on wealth accumulated through the end of the year, however.

Under the bill, tech and other business titans who have seen their wealth shoot up during the pandemic would take huge charges. Amazon and Walmart, for example, have both seen their stocks grow as Americans increasingly relied on their services during stay-at-home orders during the pandemic.

That added billions of dollars in wealth for their top shareholders, Amazon CEO Jeff Bezos and Walmart founding family the Waltons, respectively.

Here’s how much some would pay under the bill due to wealth gains between March 18 and Aug. 5, according to a release accompanying the bill:

- AmazonCEO Jeff Bezos would pay a one-time wealth tax of $42.8 billion.

- Teslaand SpaceX CEO Elon Musk would pay a one-time wealth tax of $27.5 billion.

- FacebookCEO Mark Zuckerberg would pay a one-time wealth tax of $22.8 billion.

- The Walton family would pay a one-time wealth tax of $12.9 billion.

Those figures could rise (or lower) as the effect of the pandemic on the billionaires’ wealth changes over the rest of the year.

Buffett buys back record $5.1 billion in Berkshire stock as coronavirus hits operating earnings

PUBLISHED SAT, AUG 8 20208:29 AM EDTUPDATED SAT, AUG 8 202010:32 AM EDT

KEY POINTS

- Berkshire said it repurchased $5.1 billion worth in stock in May and June.

- The share repurchase is the most ever in a single period for Buffett, nearly double the $2.2 billion the conglomerate bought back in the final quarter of 2019

- Those buybacks come during a tough period for some of Berkshire’s wholly owned businesses as the pandemic thwarted economic activity in the U.S. and across the globe.

Berkshire Hathaway announced on Saturday it bought back a record amount of its own stock during the second quarter as the coronavirus pandemic dented operations for Warren Buffett’s conglomerate.

The company said it repurchased $5.1 billion worth in stock in May and June. Berkshire repurchased more than $4.6 billion of its Class B stock and about $486.6 million in Class A shares.

The share repurchase is the most ever in a single period for Buffett, nearly double the $2.2 billion the conglomerate bought back in the final quarter of 2019. In fact, the amount is slightly more than what Buffett spent buying back Berkshire stock in all of 2019. Despite the company’s record buybacks last quarter, the Berkshire’s cash hoard grew to more than $140 billion.

Berkshire Class A and Class B shares plunged more than 19% in the first quarter and lagged the S&P 500 during the second quarter with declines of more than 1%.

Those buybacks come during a tough period for some of Berkshire’s wholly owned businesses as the pandemic thwarted economic activity in the U.S. and across the globe.

Operating profits for Berkshire fell 10% during the second quarter, dropping to $5.51 billion from $6.14 billion in the year-earlier period. The company also took a charge of approximately $10 billion from Precision Castparts, Berkshire’s largest business within its manufacturing segment.

Berkshire’s investments in public markets gained $34.5 billion in the quarter. That gain caused overall second-quarter net earnings to surge to $26.3 billion, up from $14.1 billion a year ago. However, unrealized gains from investments quarter to quarter are volatile and Buffett himself warns investors not to focus on that overall net earnings figure.

The company is heavily invested in several companies that have rallied since the broader stock market bottomed in late March. Apple — Berkshire’s biggest common stock holding — has nearly doubled since March 23. JPMorgan Chase is up more than 27% over that time period and Amazon has popped more than 66%.

To be sure, Berkshire warned of the uncertainty presented to its businesses by the ongoing coronavirus pandemic, noting: “The risks and uncertainties resulting from the pandemic that may affect our future earnings, cash flows and financial condition include the nature and duration of the curtailment or closure of our various facilities and the long-term effect on the demand for our products and services.”

The company also said insurance giant Geico — which is owned by Berkshire — will likely see its underwriting results “negatively affected” by the pandemic for the rest of 2020 and into the first quarter of next year.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Correction: This story has been updated to reflect Berkshire’s operating profits fell to $5.51 billion. A previous version of this story misstated the figure.

Second $1,200 stimulus checks could be coming. For many, that won’t cover the rent

PUBLISHED SUN, AUG 9 20209:00 AM EDTUPDATED SUN, AUG 9 202010:46 AM EDT

KEY POINTS

- Washington lawmakers ended this week at a political stalemate with regard to the next stimulus legislation.

- One area they reportedly agree on is a second set of one-time $1,200 stimulus checks.

- But struggling Americans may find that money won’t cover one month’s rent in many parts of the country.

Negotiations over the next coronavirus stimulus package on Capitol Hill ended the week in a stalemate.

But there’s one form of help lawmakers reportedly agree on: a second set of stimulus checks.

This week’s political impasse prompted President Donald Trump to sign executive orders on Saturday aimed at providing immediate relief in certain areas including extra unemployment benefits, extending the federal moratorium on evictions, deferring some student loan payments and initiating a payroll tax holiday.

That’s as the unemployment rate fell to 10.2% in July. While that is an improvement, about 1 in 10 Americans can’t find work.

More from Personal Finance:

How negotiations over second $1,200 stimulus checks could shape up

The $600 unemployment boost is gone, leaving some with just $5 a week

What to do if you’re at risk of eviction now that the moratorium has ended

Washington lawmakers are at odds on how much extra federal unemployment to provide to jobless workers. Democrats want to continue the extra $600 per week through January. Republicans have proposed reducing that to $200 per week through September, followed by a 70% wage replacement through December.

Trump’s executive order would extend the enhanced unemployment pay at $400 per week, after the benefit expired last month, though this is likely to face legal action over his authority to do that absent Congressional assent.

Trump also moved to extend an eviction moratorium on that also lapsed in July.

Democrats have called for extending eviction protections, both in the House stimulus legislation and another plan put forward by Rep. Maxine Waters, D-Calif. The House has voted yes to both bills.

The crux of the political impasse is that the parties are at odds over how much they want to spend on the new coronavirus stimulus package. While Democrats have come up with a $3 trillion plan, Republicans have said they want to keep the cost at around $1 trillion.

Some politicians who want to limit the total cost have argued that the $1,200 stimulus checks could help make up for curtailed aid in other areas.

But a look around the country shows that one-time payments of up to $1,200 per individual won’t cover one months’ rent in many areas. Even with a moratorium on evictions, people will eventually have to pay back rent unless additional relief is provided.

A call for more targeted aid

Experts including Chuck Marr, senior director of federal tax policy at the Center on Budget and Policy Priorities, have argued that the stimulus checks are not targeted aid.

“They go to people who are hurting, but then other people who are not hurting,” Marr said.

It would be better for the government to focus its spending on other aid first, Marr said, for unemployed workers, renters at risk of eviction and families without access to food.

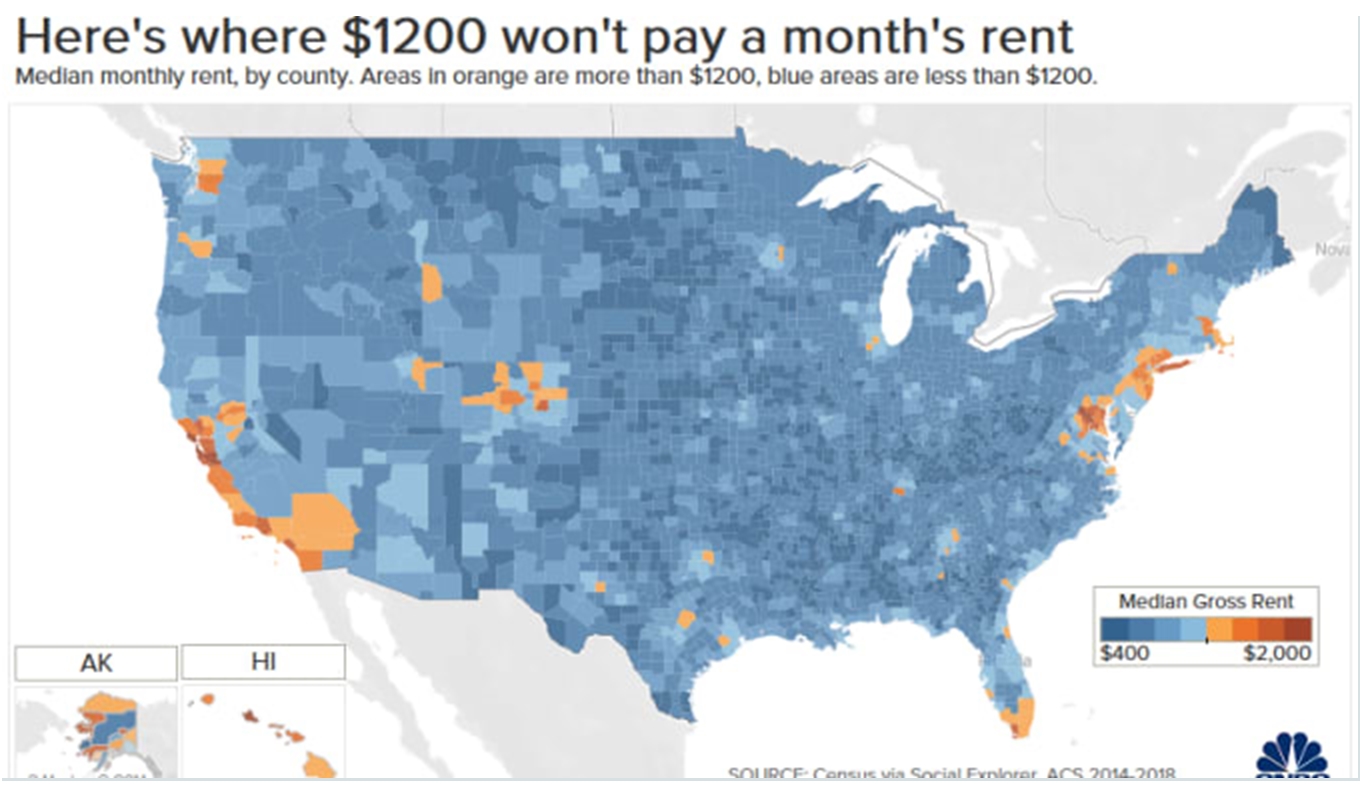

According to a CNBC analysis of Census data, in many parts of the country, $1,200 isn’t even enough to cover the median monthly rent payment. (The median is the middle in a list of numbers).

The map above shows where individuals will have the hardest time making their rent if they plan to cover it with their $1,200 stimulus checks.

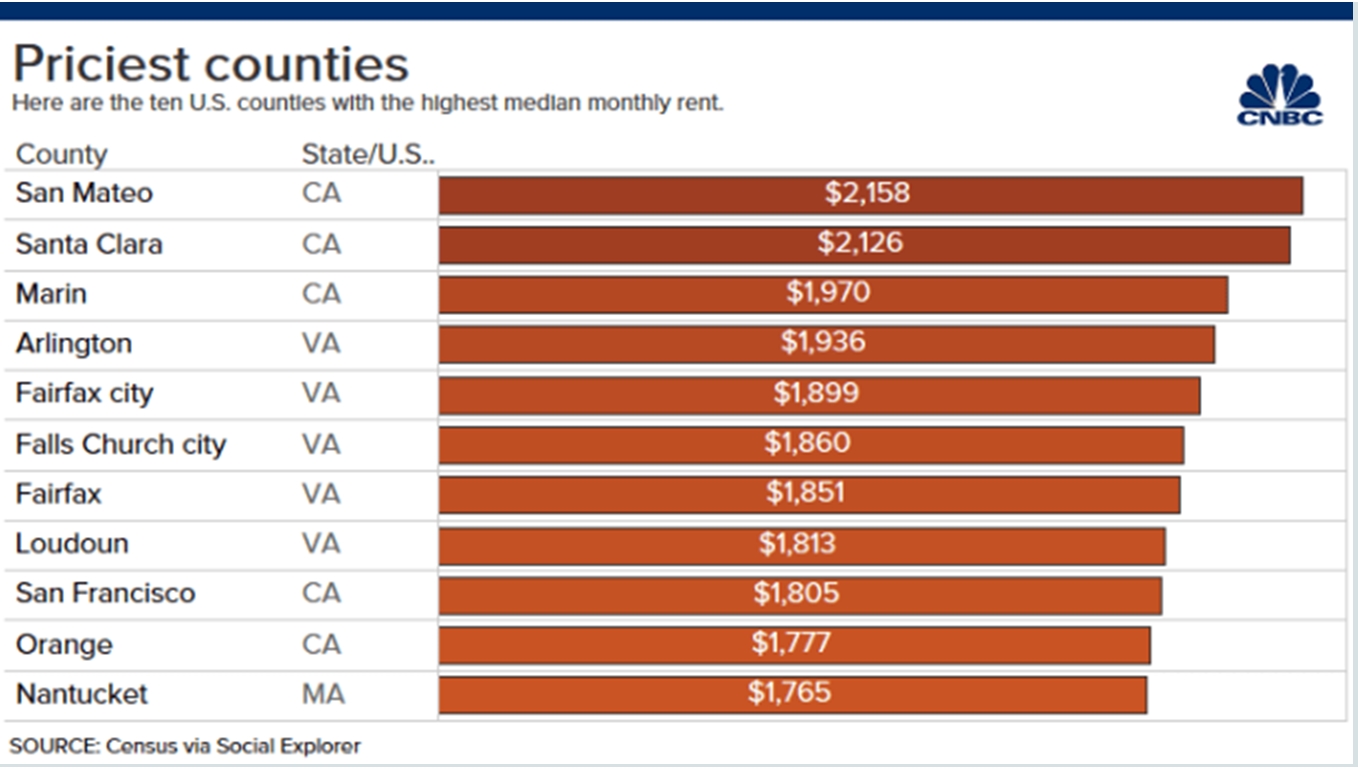

The 11 counties where it would be most difficult to stretch those payments were mostly in California or Virginia.

In California, that included San Mateo, Santa Clara, Marin, San Francisco and Orange counties. In Virginia, the list includes Arlington, Fairfax City, Falls Church City, Fairfax and Loudoun counties.

One exception to was Nantucket County in Massachusetts, which came in at No. 10.

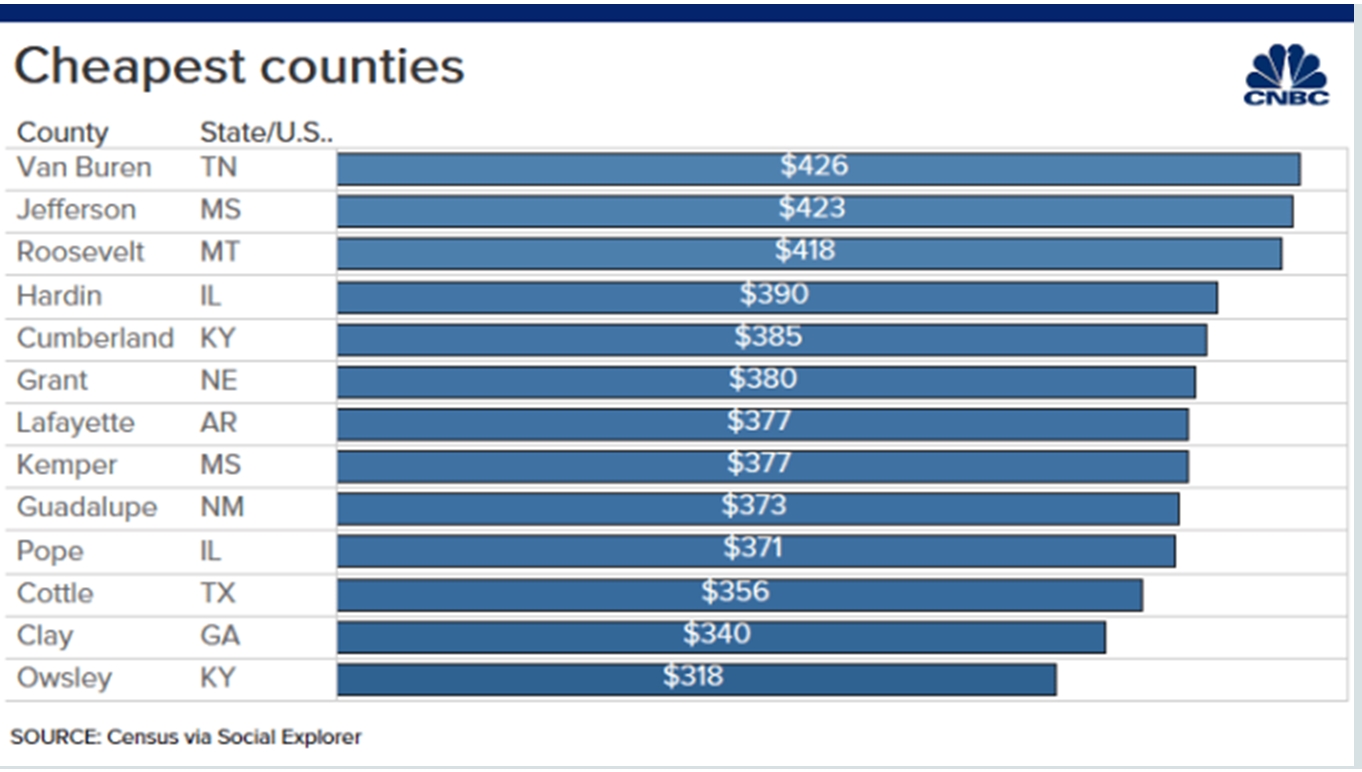

Meanwhile, the 13 counties where median rents are well below that $1,200 were spread across the country.

They include, in order of cheapest to most expensive: Owsley, Kentucky; Clay, Georgia; Cottle, Texas; Pope, Illinois; Guadalupe, New Mexico; Kemper, Mississippi; Lafayette, Arkansas; Grant, Nebraska; Cumberland, Kentucky; Hardin, Illinois; Roosevelt, Montana; Jefferson, Mississippi; and Van Buren, Tennessee.

U.S. tops 5 million coronavirus cases as outbreak threatens America’s Midwest

PUBLISHED SUN, AUG 9 202010:48 AM EDTUPDATED SUN, AUG 9 20202:43 PM EDT

KEY POINTS

- The United States has the worst Covid-19 outbreak in the world with more than 5 million cases, according to Johns Hopkins University data.

- S. health officials fear the virus may be widely circulating in parts of the Midwest now.

- California and Florida have both reported more than 500,000 total cases since the outbreak hit the U.S. in late January and Texas is closely approaching that number.

The United States has surpassed 5 million Covid-19 cases, a grisly milestone that represents roughly a quarter of all infections across the world confirmed since the coronavirus first emerged from Wuhan, China a little over seven months ago.

It took just six weeks for the number of Covid-19 infections to double in the U.S., which logged the last 1 million infections over the last two weeks, according to data compiled by Johns Hopkins University.

The latest grim record comes as growth in new cases in the U.S. appears to be leveling off at an average of 54,235 new infections a day over the last week, according to a CNBC analysis of Hopkins’ data. New cases peaked at 67,902 new cases on July 19, based on a seven-day average, after a resurgence of coronavirus cases ripped through the Sun Belt states in June and July.

California and Florida have both reported more than 500,000 total cases since the outbreak hit the U.S. in late January and Texas is closely approaching that number. Total cases for each state now exceed New York, which was once considered the epicenter of the nation’s outbreak earlier this year. However, those states have reported far fewer deaths than the Empire State, which has lost more than 32,000 people to the coronavirus so far, according to Hopkins.

Doctors say they’ve been able to save more lives compared with the peak in New York in March and April because they know more about the virus and have discovered better treatments, such as remdesivir. The recent surge in cases has also affected far more younger people, who also have higher survival rates.

U.S. health officials fear the virus may be widely circulating in parts of the Midwest now. White House coronavirus advisor Dr. Anthony Fauci and coronavirus task force coordinator Dr. Deborah Birx have voiced concern that states like Ohio, Tennessee, Kentucky and Indiana are beginning to see a tick up in their so-called positivity rates, or the percent of tests that are positive.

“Every country has suffered. We, the United States, has suffered … as much or worse than anyone,” Fauci said during an interview with CNN and the Harvard School of Public Health on Wednesday.

“I mean when you look at the number of infections and the number of deaths, it really is quite concerning,” he said.

Fauci has criticized the divisiveness created between public health measures to prevent the spread of the coronavirus and reopening the economy, saying it has become a debate between choosing one or the other.

He has suggested some states take a “serious” reexamination of where they are in the process of reopening and determine whether they need to pause or roll back some reopenings.

“I don’t think we need to go into the fall and the winter thinking we’re going to have a catastrophe,” Fauci said during a Q&A with the Brown University School of Public Health on Friday. “We could go into the fall and the winter coming out of it looking good if we do certain things.”

Meanwhile, President Donald Trump has continued to press states to reopen and reiterated his belief that lockdowns would cause more harm than good. He said the nation should now focus on keeping older Americans safe while sending people back to work and school.

“Lockdowns do not prevent infection in the future. They just don’t. It comes back many times, it comes back,” Trump said at a press briefing Monday.

However, Trump said on Wednesday that there’s “no question” the virus will eventually “go away like things go away.” The president’s comments contradict his medical advisors and the World Health Organization, which have all warned that the virus may never be completely eradicated from the planet. The president also continued to push for schools to reopen this fall, saying that he believes most of them will. When it comes to the coronavirus, he said children are able to “throw it off very easily.”

HI Financial Services Mid-Week 06-24-2014