HI Market View Commentary 08-03-2020

| Market Recap |

| WEEK OF JUL. 27 THROUGH JUL. 31, 2020 |

| The S&P 500 index rose 1.7% last week, ending the month of July on a positive note as better-than-expected earnings in technology, real estate, consumer discretionary and communication services helped outweigh data showing Q2 had the largest-recorded contraction in gross domestic product.

The S&P 500 ended the week at 3,271.12, up from last week’s closing level of 3,215.63. This put the index’s gain for the month of July at 5.5%. It is now up 1.25% for the year to date. The recent gains have come as many companies have been reporting Q2 earnings results above analysts’ expectations despite a persistent increase in COVID-19 cases. While economic data released Thursday showed the US economy contracted at a record 32.9% rate last quarter and weekly jobless claims are on the rise thanks to the pandemic, earnings reports from companies including heavyweights Apple (AAPL), Facebook (FB) and Amazon.com (AMZN) have shown some companies are benefiting from increased demand for their products and services in the pandemic. By sector, technology recorded the largest percentage gain this week, up 5.0%, followed by a 4.2% increase in real estate, a 2.3% rise in communication services and a 1.1% boost in consumer discretionary. Four sectors were in the red for the week, led by energy, down 4.0%, and materials, down 1.8%. In the technology sector, Apple shares climbed 15% for the week as the company reported fiscal Q3 earnings and revenue above its year-earlier results and analysts’ expectations. Apple’s board also approved a four-for-one stock split to make the stock more accessible to a broader base of investors. Apple’s shares reached a fresh record intraday high Friday at $425.66 each. Advanced Micro Devices (AMD) shares were also strong, up 11.6% on the week, amid the chip maker’s report of Q2 adjusted net profit and revenue that were above year-earlier results and analysts’ mean estimates. For Q3, the company forecast revenue above the Street view. AMD also boosted its revenue guidance for 2020. The stock hit a fresh intraday record Friday at $78.96. The gainers in real estate included Digital Realty Trust (DLR), which also set a fresh record Friday after the company reported Q2 adjusted funds from operations that were even with the year-earlier period but ahead of the consensus view while revenue also topped the Street view. The real estate investment trust also boosted its guidance range for 2020 core FFO and revenue. Shares of Digital Realty Trust rose 9.2% on the week. Boosting consumer discretionary, shares of Amazon.com jumped 5.2% this week as the online retailer nearly doubled its Q2 profit per share from the year-earlier period while its revenue climbed 40%. The results were well above Street views. The company also forecast Q3 revenue above analysts’ view. In communication services, Facebook shares rose 10% this week and recorded a record high Friday at $255.85 each. The social media company reported year-over-year gains in Q2 earnings per share and revenue that surpassed Street expectations, which prompted many analysts to raise their price targets on the stock. On the downside, the drop in energy came as crude-oil futures fell this week amid continued worries about the pandemic’s negative impact on demand. The sector’s decliners included National Oilwell Varco (NOV), whose shares fell 9.7% on the week amid the company’s report of a wider-than-expected Q2 loss and lower-than-expected revenue. Next week, all eyes will be on the Labor Department’s Friday release of July employment data. Leading up to that report, investors will get July readings on manufacturing in addition to data on June construction spending Monday. Other economic reports to come next week include June factory orders due Tuesday and July readings on the services sector due Wednesday. |

AAPL = Beat top and bottom line

EPS $2.58 vs est $2.06

Revenue 59.685B vs est 52.238

August 24, 2020 date of record

August 31, 2020 date of receival

Those that have leap long calls and let’s say the stock is trading at $480 on 08/31

We will see AAPL leaps @ 500 will go for every 1 leap will turn into 4 contracts at $120 strike

What IF AAPL is a 477.77 / 4 = 119.4425 typically this will turn into a contract @ 199.50 strike price

What typically happens immediately after the split and shares are received?

Sell off and Price usually goes down

When you have a stock split like AAPL you usually have a pretty good run up

Which means you now have a position in your portfolio that over-weights the entire portfolio

Why collar trading?

Collar Trading has no time table but protects you from losing a third of your portfolio

It dollar costs averages without having to ask for more money placed in the account

It adds shares that all a stock to come back and make a killing in your portfolio

It SUCKS to have to be patient

Going back over your week, month, quaterly and year are the single most important key to success

Earnings soon:

BIDU 08/17 est

COST 09/24 AMC

DIS 08/04 AMC

MU 09/24 AMC

TGT 08/19 BMO

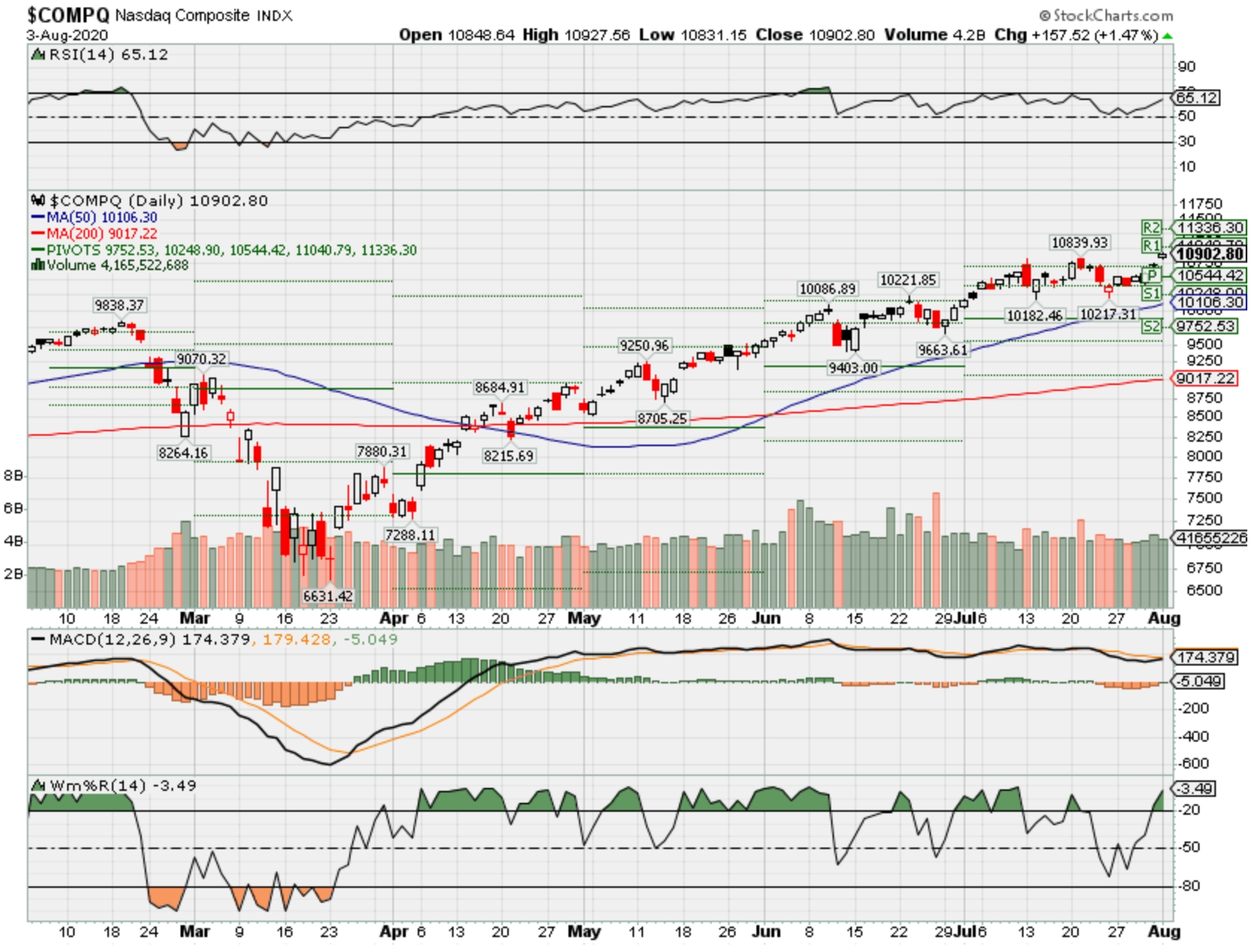

Where will our markets end this week?

Lower

DJIA – Bullisish

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2020?

08-03-2020 -2.0%

Earnings:

Mon: CLX, MCK, AIG, H, MOS, RMBS

Tues: BP, CNK, EMR, JELD, TREE, RL, ATVI, ALL, BYND, DVN, MNST, WU, WYNN, DIS

Wed: HUM, LL, ODP, WEN, DDD, ADT, HUBS, JACK, KBR, NUS, ROKU, SQ, VSLR, CVS

Thur: CAH, LNG, FLR, HLT, MUR, PZZA, VG, AMC, DBX, FSLR, GPRO, HLF, HTZ, TIVO, TMUS, TRIP, UBER, YELP, ZG

Fri:

Econ Reports:

Mon: Auto, Truck, Construction Spending

Tues: Factory Orders

Wed: MBA, ADP Employment Report, Trade Balance

Thur: Initial Claims, ISM NON-Manufacturing

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Consumer Credit, Wholesale Inventories

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Preparing protection for earnings

Adjusting options after verified trends after earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Senate GOP unveils coronavirus relief plan with 70% wage replacement in unemployment insurance

PUBLISHED MON, JUL 27 20204:40 PM EDTUPDATED TUE, JUL 28 202011:07 AM EDT

KEY POINTS

- Republicans unveiled major parts of their coronavirus relief plan Monday.

- The measure includes wage replacement of 70% in extended unemployment benefits, replacing the $600 weekly enhancement.

- The plan also includes another round of $1,200 stimulus checks and $500 payments for dependents of any age.

Senate Majority Leader Mitch McConnell unveiled the Republican coronavirus relief plan on Monday.

Here is what we know about the bill, as Republican leaders release the details:

- It would set enhanced federal unemployment insurance at 70% of a worker’s previous wages, replacing the $600 per week which states stopped paying out this week.

- The GOP would set the benefit at a sum of $200 per week on top of what recipients would normally receive from states through September, slashing what they got from April through July. In October, the 70% replacement would take effect up to a maximum of $500 per week.

- The proposal would send direct payments of $1,200 and $2,400 to individuals and couples, respectively. It would set the same qualifications as the checks approved in March: the payments started to phase out at an average of $75,000 in income per person, and individuals or couples making an average of $99,000 or more did not receive one. It would offer an additional $500 per dependent of any age.

- The legislation would shield entities such as businesses, doctors and schools from lawsuits, except for cases of “gross negligence” or “willful misconduct.”

- It would set aside $190 billion for Paycheck Protection Program loans. The bill would allow small businesses with fewer than 300 employees that have seen revenue fall by more than 50% to apply for a second round of aid. It would also authorize $100 billion for loans to seasonal businesses and companies in low-income Census tracts that can show revenue reduction of more than 50%.

- The bill provides $105 billion to help schools reopen in the fall. Roughly $30 billion of that amount would go to colleges, according to Senate Health, Education, Labor, and Pensions Chairman Lamar Alexander, R-Tenn. Most of the money would go to schools physically reopening to help them with the costs associated with safely restarting.

- It includes $16 billion to help states boost Covid-19 testing capacity, according to Senate Appropriations Committee Chairman Richard Shelby, R-Ala.

- Shelby said it would put $26 billion toward the development of Covid-19 vaccines and therapeutics.

- The plan includes 100% deductability of business meals, according to Sen. Tim Scott, R-S.C.

- It includes several tax credits, including an enhanced employee retention credit and a credit for expenses such as upgrades to workplaces and testing that help businesses operate safely.

- The bill also authorizes an unrelated $1.75 billion for construction of a new FBI headquarters building in downtown Washington D.C., a short walk from President Donald Trump’s hotel. His company worried plans to demolish the FBI’s current home, the J. Edgar Hoover Building, and move headquarters to the suburbs could allow a competitor hotel to move downtown, according to The Washington Post.

McConnell, of Kentucky, and his fellow Republicans unveiled the measure as Congress scrambles to respond to a pandemic still wreaking havoc across the country. GOP committee chairs outlined major parts of the legislation they hope will serve as a starting point in talks with Democrats on a bill that could pass both chambers of Congress.

House Speaker Nancy Pelosi, D-Calif., and Senate Minority Leader Chuck Schumer, D-N.Y., met with Treasury Secretary Steven Mnuchin and White House chief of staff Mark Meadows for nearly two hours at the Capitol on Monday. Leaving the discussion, Meadows told reporters the sides had a “very good meeting,” and said the administration officials would return for talks Tuesday.

Speaking to reporters after the discussions, Pelosi called the Republican proposal “pathetic.”

“It isn’t serious,” she said, according to reporters at the Capitol.

McConnell, in outlining the plan Monday, urged Democrats to come to an agreement quickly.

“The pandemic is not finished. The economic pain is not finished. So Congress cannot be finished either,” he said.

The GOP hoped to release a pandemic aid plan last week, but senators and the White House struggled to reach a consensus as Covid-19 cases and deaths rise around the country. Democrats, who passed a $3 trillion relief plan in May, will look to change many provisions in the Republican opening offer.

For now, the roughly 30 million people still receiving some form of unemployment insurance wait to see how quickly Congress will extend assistance — and whether it slashes benefits when it does. Speaking after McConnell unveiled the plan, Schumer said the reported Republican jobless benefit proposal would hurt unemployed Americans, draw money out of the economy and prove daunting for states to implement.

“The Republican proposal on unemployment benefits, simply put, is unworkable,” he said.

Senate Finance Committee ranking member Sen. Ron Wyden, D-Ore., called the proposal a “punch in the gut and a slap in the face for the 30 million Americans relying on lifeline unemployment benefits.”

Republicans and Democrats are at odds over how best to lift an American economy and health-care system damaged by an outbreak the U.S. has failed to contain. As of Monday afternoon, the U.S. had reported more than 4.2 million Covid-19 cases and roughly 147,000 deaths from the disease, according to data compiled by Johns Hopkins University.

The U.S. had an unemployment rate above 11% in June even after two strong months of job gains driven by states reopening their economies. But many states have had to pause or roll back their restart plans in response to coronavirus case spikes.

Congress has already approved more than $2.5 trillion in spending this year to combat the health and economic crises.

— CNBC’s Tucker Higgins contributed to this report

https://seekingalpha.com/article/4361134-exxon-mobil-this-price-makes-no-sense

Exxon Mobil: This Price Makes No Sense

Jul. 27, 2020 4:44 PM ET

About: Exxon Mobil Corporation (XOM)

Summary

After years of stellar shareholder value creation, Exxon continues to suffer from plummeting commodity prices coupled with a collapsed demand induced by the current crisis.

While debt-financed share buybacks left their mark on the company’s capital allocation history, the strong balance sheet could support a reliably growing dividend through turbulent times.

Despite the current weakness in fundamentals, all metrics point to significant undervaluation based on the long-term earnings power of Exxon, making it an attractive contrarian play for enterprising investors.

Written by the FALCON Team

Introduction

Just recently, we published our newly established monthly heat map of Dividend Champions exclusive for Seeking Alpha readers, providing interesting candidates for further analysis. After our recent coverage of narrow-moat AT&T (T), we now take a look at another dividend stalwart, Exxon Mobil (XOM), to see whether the sky-high entry yield justifies initiating a position at current levels.

In light of Buffett’s teachings distilled from his 50+ years of shareholder letters, our analysis is based on the three dimensions that truly matter: operations, capital allocation, and valuation. But before we do that, let’s jump into what makes Exxon an interesting candidate today.

So what’s the story with Exxon?

Exxon is undoubtedly one of the highest-quality integrated oil companies, with its downstream and chemicals segments forming key differentiators besides its most significant upstream business. The company’s biggest segment engages in exploration of crude oil and natural gas, while its downstream division manufactures and sells refined petroleum products, with petrochemicals accounting for the rest of the revenue. In 2020, the company saw commodity prices and margins drop to historic lows, due to market turmoil causing near-term oversupply across the industry, further worsened by the global setback in demand caused by the worldwide coronavirus pandemic. Despite the short-term pain, the company is betting heavily on the long-term positive underlying trend in energy demand, citing growing middle-class population worldwide, along with natural gas gradually outpacing coal for power generation. Overall, Exxon expects more than half of the world’s energy demand still to be relying on oil and natural gas by 2040. In line with that, the company targets to ramp-up its capital spending with the aim of doubling earnings and cash flow by 2025, with upstream leading the way through portfolio highgrading, acquisitions and new discoveries (e.g. Guyana). Exxon also expects to double both downstream and chemical segment earnings by 2025 as the company focuses on leveraging its integrated model. Unlike other “Big Oil” rivals, Exxon’s move into renewables is deemed unlikely by management, citing lack of unique competitive advantages, with offshore wind being a possible exception in the future.

Operations

As a general rule of thumb, a company has authentic earnings power when it has both defensive and enterprising profits. Thus, when assessing a firm’s operations, we care about two fundamental aspects: it has to pass the cash flow-based stability test, and it must be a consistent shareholder value creator measured in the EVA framework.

Stability: Assessing Cash Flow Consistency

As Hewitt Heiserman writes in his book, “It’s Earnings That Count”: The most ruinous mistake you can make as a buyer of common stocks is to own a company that goes bankrupt. For this reason, the defensive investor judges the quality of a firm’s accrual profit on the basis of its ability to self-fund. That is, whether it produces from ongoing operations more cash than it consumes, and not go deeper into debt or dilute current stockholders. When we look at the conventional financial statements, our primary concern therefore is the stability of the company’s cash generation.

Source: Morningstar

Due to the regular nature of divestiture activities, Exxon reports a consolidated figure of cash flow from operations that includes proceeds associated with asset sales, typically accounting for ~10% of OCF annually. The capital intensity of the underlying business is readily apparent by the CapEx numbers, also incorporating exploration expenditures of Exxon’s upstream segment. While the company’s operating cash flow is heavily dependent on the cyclical nature of commodity prices, there is only limited freedom to scale back on CapEx as the firm needs to pursue opportunities to find and produce new supplies of oil and natural gas.

Fueled by its integrated business model and scale, Exxon managed to remain free cash flow positive throughout the past decade, thus passing our stability test with a warning flag due to massive cash flow volatility. In the next step, we move on to the EVA (Economic Value Added) framework, examining if the company is able to consistently create shareholder value, as EVA cuts through accounting distortions and charges for the use of capital.

Value Creation: What type of moat rating is warranted?

We tend to lean towards companies whose businesses are protected by large and enduring economic moats, as buying those companies at the right price generally leads to overperformance, as outlined in our research article. In the EVA framework, the EVA Margin (EVA/Sales) can serve as our ratio to define a company’s moat. A 5% EVA Margin can be used as an indicator for a “good” company, whereas persistence of a 5%+ EVA Margin for 10 years makes a company great and thus “moaty”. While in case of our Dividend Champion Series, a company’s payout consistency is the primer selection criteria, we still want to see that the firm is able to maintain a meaningfully positive EVA Margin over an extended period of time.

In case of Exxon, the historical EVA Margin chart leaves a lot to be desired in terms of consistency. A correlation to crude oil and natural gas price development is readily apparent, as the pressure on the top line translates to depressed bottom-line EVA figures, given the relatively constant employed capital base. That is exactly what happened to Exxon, as the once stellar margins started to plummet after the oil price plunge in 2014, while commodity markets failed to recover ever since. The pressure on the company’s EVA fundamentals led to a lack of meaningful shareholder value creation in the subsequent years, marking a significant distance to the quantitative wide-moat EVA Margin threshold of 5%. On a more positive note: averaging out multiple cycles over the past 15 years, Exxon’s long-term EVA Margin comes in at 3.8%, which paints a better overall picture, yet the declining trend is nothing short of alarming. (The million dollar question is whether this is a part of a normal cycle or the beginning of a permanent deterioration. Only time will tell.)

Source: evaexpress.com

Assessing incremental EVA returns

EVA Momentum measures the growth rate in EVA, scaled to the size of the business (measured by its sales). It is the EVA framework’s equivalent for Return On Incremental Invested Capital, or ROIIC. Any positive EVA Momentum is good because it means EVA has increased, and it is an indication that it is worthwhile to reinvest capital in the underlying business. Instead of pinpointing any single-year performance, we prefer to look at the long-term trailing averages in EVA Momentum.

Source: Author’s calculation based on data from evaexpress.com

Over the past decade, Exxon has generated an average of -1.0% EVA Momentum, underpinning the declining trend in EVA creation as both the company’s sales and EVA Margin were dragged down by plummeting commodity prices. This performance stands in stark contrast to the broader market, as the long-run average for the 50th percentile of the US stock market (represented by the Russell 3000) has been 0.4% percent. Overall, the cyclicality of the underlying business is clearly reflected in Exxon’s EVA trajectory.

Our take on the moat

The EVA framework enabled us so far to prove from a rearview-mirror perspective, whether the company has an economic moat based on its historical consistency of shareholder value creation. In our opinion, despite the overall dependency on commodity markets, Exxon along with its “Big Oil” peers deserves a quantitative narrow-moat rating, since the very nature of the business requires an immense capital deployment that only a handful of companies can afford. Besides scale, Exxon distinguishes itself with its integrated refining and chemical manufacturing segments, which coupled with an access to cheap capital give the company a sufficient cushion to weather the commodity cycles and deliver excess returns over its WACC in the long run.

Taking a brief snapshot at the company’s debt profile, S&P recently downgraded Exxon’s rating to AA with a negative outlook, citing its cash flow deficit resulting from weakness in oil and natural gas prices, leading to an increase in debt levels. Although the company’s long-term debt-to-capital ratio stood at a moderate 24% at the end of Q1 2020, we believe additional steps will be needed to improve credit measures, such as boosting capital efficiency in the short term and executing on planned asset sales, in order to avoid a possible cut in shareholder distributions. We have to mention though, that prior to the initial downgrade back in 2016, Exxon was part of a truly elite group, being one of only three U.S. companies to have a pristine AAA credit rating, alongside Microsoft (MSFT) and Johnson & Johnson (JNJ).

Summary of operations – the Quality Score

The EVA framework’s Quality Score is a comprehensive way to assess a company’s overall quality, by combining its EVA-based Performance (EVA Margin and Trend) and Risk (e.g. Volatility and Vulnerability) metrics into a single score, measured against the broader market. In case of extraordinary companies, we would like to see a Quality Score consistently above 80 over a long period of time. As outlined in our research article, the upper quintile tends to outperform the market historically.

Exxon’s Quality Score followed a declining trend in the past decade, in line with the company’s deteriorating EVA fundamentals, falling sharply after the 2014 oil price plunge. With Exxon’s EVA Margin essentially turning negative (coupled with an increased stock price volatility), the Quality Score fell to the lower half of the scale during the subsequent years.

Source: evaexpress.com

As a final assessment: Exxon belongs to a subset of companies suitable for investors who are willing to compromise on quality in order to possibly profit from a compelling risk/reward scenario of a currently beaten-down sector. The dependency on commodity prices is clearly reflected in Exxon’s EVA performance, and as a result, the company would currently fail our operational criteria. Yet, its ability to navigate through multiple cycles with a positive long-term average shareholder value creation capability underscores Exxon’s narrow-moat rating from both a quantitative and a qualitative standpoint.

Capital Allocation

After looking at the operations dimension, we continue investigating the company through the capital allocation lens. Remember, incremental return on invested capital (measured by EVA Momentum) is a crucial element when it comes to the assessment of successful capital allocation by management. If the company can earn a positive EVA by reinvesting all the cash generated by the underlying business, shareholders are better off if the firm retains most of its earnings. In the table below, we have dissected all the possible uses of cash for Exxon over the past decade.

Source: Morningstar

As outlined earlier, Exxon’s operations require a considerably high level of reinvestment into its core business, with CapEx averaging ~70% of OCF in the past decade, incorporating also exploration expenditures of the company’s upstream segment. Exxon does have some freedom though to scale back on capital expenditures when deemed necessary, as it prudently did just recently, reducing its 2020 capital spending by 30% in response to low commodity prices, resulting from oversupply and demand weakness from the COVID-19 pandemic, citing:

Capital investments for 2020 are now expected to be about $23 billion, down from the previously announced $33 billion. […] The long-term fundamentals that underpin the company’s business plans have not changed, as population and energy demand will grow, and the economy will rebound.”

Source: Company News Release, April 7, 2020

Although scaling back on capital spending is a policy in place at Exxon since the 2014 oil price plunge, the company boosted its expenditures gradually during the recent years (with the goal of doubling earnings and cash flow by 2025), yet those failed to translate to any meaningful shareholder value creation thus far. Based on both the substantially negative EVA Momentum and our qualitative considerations, Exxon is a mature business at its core, meaning that most of the available free cash (after debt reduction) should be distributed to shareholders.

Source: Author’s illustration based on Morningstar data

As illustrated on the graph above, both dividends and share repurchases had been a regular practice before 2015 (with the company spending way above its means), while buybacks essentially dried up following the downturn in commodity markets. Between 2010 and 2019, the company generated an aggregate of $137 billion in free cash flow, while buybacks totaled $90 billion and dividends amounted to $116 billion (150% of FCF combined), with the majority of the difference financed by long-term debt.

Share Buybacks

As mentioned before, Exxon used to spend heavily on share buybacks (amounting to over $200 billion in a decade’s time from 2006 to 2015, marking the largest buyback amount in the entire S&P 500) before halting share repurchases in 2016, except to offset dilution in the subsequent years. The massive, partially debt-financed repurchase spree from the past leaves a lot to be desired in terms of value creation, while this activity also significantly reduced balance sheet flexibility.

Although at a first glance, the timing of repurchases seems to be opportunistic based on the FGR% metric (indicated for the period after 2010 in the graph below), the picture is more complex in case of cyclical names like Exxon, as market sentiment and thus the applied future EVA growth premium correlates with the perception of commodity price movements. Although it would have been prudent to return excess free cash flow to shareholders in the form of buybacks during the golden years, Exxon’s excessive, debt-financed buybacks were ill-advised as they left the company vulnerable to the subsequent downturn.

Source: evaexpress.com

Dividend

Exxon’s dividend payments to shareholders have grown at an average annual rate of 6.2% over the last 37 years, making the company a dividend aristocrat. As opposed to the terminated buyback program, dividend payments are of paramount importance for the company, as recently underpinned by Exxon’s management when asked about capital allocation priorities in light of the COVID-19 crisis:

The global economy will rebound. Populations and energy demand will grow and so will the demand for our products. Our objective is to strengthen the structure and earnings power of our business through industry advantage projects. This provides a solid foundation for generating cash, reliably growing the dividend and maintaining a strong balance sheet.”

Source: Darren Woods (Chairman and CEO), Annual Meeting, May 27, 2020

While the aforementioned excessive share buybacks left their mark in the form of rising debt levels, the company still maintains a relatively strong balance sheet, enabling it to continue dividend payments for around two years, even if its payout ratio (temporarily) exceeds 100% of FCF. However, if oil prices remain depressed for a longer period, then Exxon must reassess its capital allocation priorities. Investors should keep a close eye on dividend coverage and management’s communication going ahead.

Acquisitions

One of Exxon’s most expensive missteps to date was its $41 billion deal announced in 2009 to acquire U.S. shale gas pioneer XTO. With that, the company was placing a huge bet that natural gas would emerge as the fastest-growing domestic fuel, which quickly turned into an oversupply induced price collapse, leaving analysts questioning the timing and cost of the acquisition. Moreover (besides assuming $10 billion of XTO’s debt), the deal was financed with $30 billion of Exxon stock, leading to shareholder dilution that took years of buybacks to offset.

Following this serious capital allocation blunder, Exxon engaged only in smaller scale, bolt-on acquisitions, while the company continued to recycle its asset base. In light of the pandemic, signs of consolidation already started to emerge in the depressed upstream market (e.g. Chevron’s (NYSE:CVX) recently announced $13 billion Noble Energy deal), however, Exxon is expected to remain focused on organic development and asset divestitures going ahead. Prior to the current downturn, the company laid out its plan to sell billions of dollars worth of assets back in 2019, generating up to $15 billion in cash through 2025, while also citing a possible reinstatement of the halted buyback program. We believe a more prudent use of the proceeds would be to pay down debt gathered through the company’s reckless repurchase activity from the past, thus providing flexibility to pursue accretive acquisitions going forward.

Valuation

Future Growth Reliance

Our prime historical valuation indicator in the EVA world is the Future Growth Reliance (FGR), which is the percent proportion of the firm’s market value that is derived from, and depends on, growth in EVA. As outlined in our research article, it is the best-of-breed sentiment indicator that addresses accounting distortions, thus gives us a true picture of which wide-moat companies seem attractively valued in historical terms.

Source: evaexpress.com

As the saying goes: the cure for low oil prices is low oil prices, that also holds true the other way around. In case of Exxon, the FGR-based market sentiment reflects this principle of cyclicality in a crystal-clear way, implying that expectations always tend to skew towards the opposite direction. Numerically, the FGR ratio stands at 39% as of today, indicating that the market is pricing a future growth in EVA, fueled by the perceived reversion to the mean in commodity prices. In the present scenario, where Exxon operates with a negative EVA Margin, a 0% FGR metric would indicate that the current magnitude of value destruction would continue until perpetuity, which is obviously an overly pessimistic assumption. Simulating a still conservative scenario that assumes a reversion to zero EVA (as opposed to negative EVA currently) and no expectations for growth in EVA going forward, we arrive at a share price of $69.55. Your guess is as good as ours about when market sentiment will change in a favorable direction, yet it is hard to make a case that there is no value in Exxon today.

Morningstar DCF

As a second step, we use Morningstar’s valuation system, where analysts create industry and company-specific assumptions, and then all the inputs are used in a discounted cash flow model. In order to reflect all moving parts within the business, Morningstar also evaluates the level of uncertainty with all the stocks they cover. Morningstar assigns Exxon a medium uncertainty rating with a $74.0 fair value. The thresholds between the different star ratings are illustrated below:

Source: Author’s illustration based on Morningstar data

With the stock currently trading at $43.43 as of July 24, a 5-star rating is warranted, implying that Exxon’s shares fall in the significantly undervalued territory based on Morningstar’s estimate, with a ~40% discount to fair value. It is worth noting, that Morningstar’s valuation model operates with a long-term oil-price assumption of $60 per barrel, implying a reversion to more sustainable commodity prices over the long-run. The DCF-based fair value of $74 falls in line with our long-term EVA-neutral (thus still conservative) valuation model arriving at a share price of $69.55. No matter from which angle we look at it, the value proposition of Exxon’s shares seems compelling at current levels. (We bought shares on March 19 at a price of $33.28 and an entry yield of 10.46%, as we saw a very skewed risk-reward ratio at that price, while heavy insider purchases in the million dollar range also reinforced our confidence at those levels.)

Summary of the investment thesis

PRVit score – heat map vs. market

After all our due diligence, we turn to the PRVit model for a final judgment of the overall attractiveness of a stock. The PRVit is a multifactor quantitative stock selection model based on EVA-centric measures of Performance, Risk, and Valuation. Combining a company’s Quality Score with its actual Valuation Score can be visualized on a heat map like the one below, where the gradient diagonal line signals fair value. We want to see a stock in the upper-right hand corner of this heat map, but we are more concerned with the Quality Score, as we believe that over the long run, we are better off with a truly exceptional business bought at a fair price, rather than a fair company bought at an exceptionally attractive price.

Source: evaexpress.com

As visible on the heat map, Exxon’s Quality Ranking leaves a lot to be desired at the moment compared to the broader market, thus an investment thesis can be overwhelmingly based on a bargain-basement Valuation Ranking. As noted in our recent Dividend Champions update, the “Attractive Value” category is not for the faint-hearted, since these stocks tend to be cheap because their fundamental performance is far from exceptional. Therefore, the story with Exxon is clearly about betting on a recovery in commodity prices, while long-term positive demand trends could be a further catalyst.

With an overly pessimistic, EVA-destructive scenario baked in at today’s levels, Exxon’s shares represent a compelling entry opportunity at sub-$50 levels for enterprising contrarian investors, translating to an entry yield of more than 7%.

One more thing

If you liked this analysis and don’t want to miss any of the upcoming articles by our evidence-based stock selection process exclusive for SA readers, please scroll up and click “Follow” to be notified of future releases.

Disclosure: I am/we are long XOM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Boeing slashes aircraft production plans, warns on new job cuts as coronavirus devastates travel

PUBLISHED WED, JUL 29 20207:07 AM EDTUPDATED WED, JUL 29 20204:34 PM EDT

KEY POINTS

- CEO Dave Calhoun announced the production cuts after the company released a $2.4 billion quarterly loss.

- Boeing’s net loss narrowed to $2.40 billion, or $4.20 per share, from $2.94 billion, or $5.21 per share, a year earlier, when it posted a nearly $5 billion charge on its beleaguered 737 Max program.

- Boeing’s commercial aircraft unit suffered the most, with a 65% drop in revenue from a year earlier as deliveries of new planes tumbled.

Boeing said Wednesday it plans to cut aircraft production and warned about the possibility of further job cuts as the impact of the coronavirus pandemic ravages demand for air travel.

Boeing shares fell 2.8% to $166.01, muting gains for the Dow Jones Industrial Average. Boeing’s stock price is down more than 50% over the past year.

The pandemic is driving up financial losses for Boeing’s customers and sapped demand for new orders. Boeing was in crisis before the coronavirus spread around the world because of the fallout from two fatal crashes of its 737 Max that claimed 346 lives.

Weaker demand prompted Boeing earlier this year to announce a planned workforce cut of 10% of its 160,000-person staff, through buyout packages and involuntary reductions. The company said Wednesday that severance costs for 19,000 employees leaving the company helped drive more than $2 billion in charges in the quarter. Some of the reductions in headcount were offset by hiring in other areas, like Boeing’s defense unit.

“Regretfully, the prolonged impact of COVID-19 causing further reductions in our production rates and lower demand for commercial services means we’ll have to further assess the size of our workforce,” CEO Dave Calhoun said in a staff note after the company released a $2.4 billion quarterly loss. “This is difficult news, and I know it adds uncertainty during an already challenging time. We will try to limit the impact on our people as much as possible going forward.”

Here’s how Boeing did compared with what Wall Street expected, based on average analysts estimates compiled by Refinitiv:

- Losses per share: $4.79 a share, adjusted, vs $2.54 expected

- Revenue: $11.8 billion vs $13.16 billion expected

The company’s second-quarter results came in worse than analysts expected. Revenue fell 25% to $11.81 billion from $15.75 billion a year earlier and below analysts’ forecasts for sales of $13.16 billion. The commercial aircraft unit suffered the most with a 65% drop in revenue from a year earlier to $1.6 billion as deliveries of new planes tumbled.

Boeing’s defense unit proved more resilient than its commercial business, bringing in $6.6 billion, roughly flat on the year.

For the quarter ended June 30, Boeing’s net loss narrowed to $2.40 billion, or $4.20 per share, from $2.94 billion, or $5.21 per share, a year earlier, when it posted a nearly $5 billion charge on its beleaguered 737 Max program.

On an adjusted basis, Boeing lost $4.79 per share, compared with a $2.54 per-share loss Wall Street estimated.

Boeing’s shares were down about 1% in morning trading. But the stock is trading at roughly half its value from a year ago. Regulators aren’t expected to clear the 737 Max to fly again before the fall.

The lengthy grounding of the 737 Max along with financial pain at carriers has driven up cancellations and scarce new orders new Boeing jetliners this year, meaning less cash for manufacturers and suppliers.

“There is a customer calling us every day with a desire to want to defer and to deal with the difficult environments that they are dealing with,” Calhoun said in an interview with CNBC’s “Squawk on the Street.”

Calhoun said he expects an uneven recovery and that demand for new aircraft won’t likely return until the second half of next year, depending on timing of a coronavirus vaccine.

The impact has already trickled down to General Electric and Spirit Aerosystems. Spirit, which makes the fuselages for the Max, asked lenders to loosen the terms on some of its debt, sharing a forecast for far fewer deliveries of the 737s than originally expected, according to a forecast seen by CNBC.

Boeing confirmed plans to lower its planned ramp-up of production. It said it would gradually increase manufacturing of its 737 Max to 31 a month by the beginning of 2022, later than it had expected. It will again cut production of its 787 planes to six a month next year.

Boeing also said it would end production of the 747, a plane it has produced for more than five decades and is credited with spurring a boom in travel worldwide, in 2022.

Boeing has more than 470 planes sitting on the ground that haven’t been delivered to customers, most of them 737 Max jets, according to consulting firm Ascend by Cirium.

Airbus, Boeing’s main rival, is also hurt by the crisis and is set to report results on Thursday.

Calhoun said in April that air travel demand will likely take two or three years to recover. International demand has been particularly soft, hurting the outlook for Boeing’s widebody commercial planes, like the 787 Dreamliner. The International Air Transport Association, a trade group that represents most of the world’s airlines, said Tuesday it expects passenger air travel demand globally to recover to 2019 levels in 2024, a year later than it previously forecast.

Boeing has shored up liquidity with a monster $25 billion debt sale in April, Boeing’s largest ever, to help weather the crisis.

Read the full earnings release.

Correction: A table in an earlier version of this story said earnings per share. Boeing posted a loss.

Intel’s Manufacturing Delay Is a Red Flag for All Chip Stocks. Here’s Why.

Updated July 24, 2020 6:15 pm ET / Original July 24, 2020 5:40 pm ET

Intel’s embarrassing disclosure that its next-generation manufacturing is delayed at least six months triggered a seismic shift in the thesis surrounding semiconductor stocks in Friday trading.

Investors and analysts have long speculated that Intel (ticker: INTC) has been struggling to perfect its so-called seven-nanometer manufacturing process, but the startling admission that it will take at least another half year to get it right spurred investors to re-evaluate chip stocks across the sector. Suppliers that make equipment that Intel and others use to fabricate microprocessors were largely in the red Friday, while Intel competitor Advanced Micro Devices (AMD) notched its largest single-session gain since March 3, 1975, advancing 16.5% to $69.40.

Wall Street reacted briskly to Intel’s news, with at least seven sell-side analysts downgrading the stock Friday, according to a Barron’s count. Investors took billions of market value away from Intel, as the stock plunged 16% to close at $50.59 Friday, its own largest single-session loss since Oct. 16, 2002.

“As you’re scaling down to lower geometries, there’s a big change in how the manufacturing is supposed to happen,” Brian Bandsma, a portfolio manager at Vontobel Asset Management told Barron’s. “Intel used to be the leader and they lost that.”

The reason is clear: Intel admitting it’s unable to effectively make what is widely believed to be the next standard in microchip manufacturing has shaken the core thesis of the Silicon Valley company’s value. Unlike the majority of its rivals, Intel’s competitive advantage has long been that it both designs and manufactures the semiconductors it sells. Over the past 15 years, Intel has spent roughly $130 billion on capital expenditures, which includes investments in its fabrication facilities. Executives at the chip maker estimate it will spend $15 billion this year.

Intel’s failure to deliver on the long-promised technology will only further cement Taiwan Semiconductor Manufacturing’s (TSM) position as a leader in microprocessor manufacturing, having already achieved what Intel hasn’t.

Taiwan Semiconductor appears to be one company that has been able to manufacture the so-called seven-nanometer chips efficiently enough to turn a profit. American depositary receipts of Taiwan Semiconductor rose 9.7% to close at $73.90 Friday, in part because Intel CEO Bob Swan said on Thursday’s earnings call that the company was willing to hold talks with contractors about hiring a manufacturer for some of its fabrication. Several sell-side analysts have speculated that such talks are already under way with Taiwan Semiconductor, which already makes chips designed by Nvidia (NVDA) and AMD.

About 10 years ago, AMD spun out its fabrication capabilities into a company that would eventually become the closely held Globalfoundries, deciding then to focus on designing chips and leaving the manufacturing to others. Investors told Barron’s that the continuing delay has given AMD an advantage in the short-run—though one that, at this point, is far from guaranteed to vault it ahead of its much larger rival. Intel’s breadth of chip products is vast and the advantage means AMD likely can attack only a few of its rival’s lines of business. Personal computers and data centers are particularly vulnerable, but for the former, AMD will have to demonstrate a significant advantage for computer makers to abandon Intel—with many questions about demand for such equipment in the second half of the year due to the Covid-19 pandemic. And AMD will have to fight with Nvidia and others for share in the data center market.

Though Intel’s failure to advance its manufacturing is certainly an embarrassment for the company, it isn’t clear how much of a performance advantage scaling down the size of transistors it prints will accomplish. Intel has previously said that its 10-nanometer chips contain a density level close to what competitors have achieved with the seven-nanometer process.

Despite the Friday selloff, Intel beat analysts’ earnings expectations for the latest quarter, continues to pay a healthy dividend, and makes billions selling chips that don’t need the next-generation technique to remain viable.

The next-generation process Intel is grappling with—so-called extreme ultraviolet lithography—has proven challenging for chip makers. Resembling the technique used to print works of art such as photographs and paintings, EUV technology has proven elusive for some of the most sophisticated chip makers around the world. One of the companies that made the attempt, Globalfoundries, abandoned perfecting the EUV manufacturing process in 2018. It isn’t precisely clear how successful Samsung Electronics ’ process has been, according to Bandsma.

Write to Max A. Cherney at max.cherney@barrons.com

5 things to know before the stock market opens on Monday

PUBLISHED MON, AUG 3 20208:07 AM EDTUPDATED 36 MIN AGO

1. Stock futures rise to start the week

U.S. stock futures rose on Monday as traders looked for signs of progress on coronavirus stimulus negotiations and potential coronavirus treatments. Dow Jones Industrial Average futures climbed 91 points, or 0.4%. S&P 500 futures gained 0.5% and Nasdaq 100 futures traded 0.9% higher. Eli Lilly said its coronavirus prevention treatment was entering phase 3 trials, sending the stock up more than 1%. Clorox rose on better-than-expected earnings.

2. White House and Democrats deadlocked on unemployment benefits

The White House and Democrats are at an impasse over an expanded unemployment benefit launched in March that lapsed on Friday. House Speaker Nancy Pelosi told ABC’s “This Week” that Democrats are in favor of maintaining a $600-per-week benefit above regular unemployment insurance. Republicans have proposed extending the benefit at a lower rate of $200 per week. White House chief of staff Mark Meadows told CBS’ “Face the Nation” he is not “optimistic that there will be a solution in the very near term.”

3. Microsoft confirms talks to buy TikTok

Microsoft on Sunday confirmed reports that it was in talks to buy TikTok in the U.S. even as President Donald Trump threatens to ban the social app because of security concerns over its parent company’s ties to China. “This new structure would build on the experience TikTok users currently love, while adding world-class security, privacy, and digital safety protections,” Microsoft said. Terms of a potential deal were not disclosed by Microsoft or TikTok’s Chinese owner ByteDance. However, Microsoft noted it is aiming to end talks by Sept. 15.

4. Dr. Birx says U.S. in new phase of pandemic with ‘extraordinarily widespread’ cases

Dr. Deborah Birx, the White House coronavirus task force coordinator, urged Americans to wear masks and follow social-distancing guidelines because the country has entered a new phase of the pandemic. “What we are seeing today is different from March and April. It is extraordinarily widespread … it’s more widespread and it’s both rural and urban,” Birx told CNN on Sunday. More than 4.6 million coronavirus cases have been confirmed in the U.S., including more than 154,000 deaths, according to Johns Hopkins University.

5. Lord & Taylor, Tailored Brands file for Chapter 11

Lord & Taylor and Men’s Wearhouse owner Tailored Brands filed for bankruptcy on Sunday as the coronavirus pandemic causes more damage in the retail sector. Lord & Taylor, now owned by Le Tote of France, filed for bankruptcy protection in Virginia and Tailored Brands filed for Chapter 11 in Texas. J. Crew, Neiman Marcus and J.C. Penney are among other retailers that have filed for bankruptcy protection during the pandemic.

Eli Lilly starts late-stage study of coronavirus drug in nursing homes

PUBLISHED MON, AUG 3 20206:52 AM EDTUPDATED 21 MIN AGO

U.S. drugmaker Eli Lilly said on Monday it is beginning a late-stage trial to study whether one of its experimental Covid-19 antibody treatments can prevent the virus’ spread in residents and staff in U.S. nursing homes.

The phase 3 trial will test LY-CoV555, a treatment developed in partnership with Canadian biotech AbCellera, is expected to enroll up to 2,400 participants who live or work at a facility that have had a recently diagnosed case of Covid-19.

“Covid-19 has had a devastating impact on nursing home residents,” Lilly’s chief scientific officer Daniel Skovronsky said in a statement. “We’re working as fast as we can to create medicines that might stop the spread of the virus to these vulnerable individuals.”

Lilly is already testing the drug in hospitals to study whether it can work as a treatment in patients who have the disease. This trial will test whether it works prophylactically.

It is launching the phase 3 trial in partnership with several long-term care facility networks across the country as well as the U.S. National Institute of Allergy and Infectious Diseases (NIAID).

Lilly said in order to speed the study it has created mobile research units including retrofitted recreational vehicles that can be deployed in response to outbreaks of the virus at nursing homes across the U.S.

LY-CoV555 belongs to a class of treatments known as monoclonal antibodies that are among the most widely used biotechnology medicines. Regeneron Pharmaceuticals and other drugmakers are testing similar treatments against Covid-19.

Last week Lilly told investors that LY-CoV555 had moved into mid-stage trials as a treatment and would start late stage-trials in the coming weeks. It expects efficacy data from the mid-stage trial in the fourth quarter.

HI Financial Services Mid-Week 06-24-2014