HI Market View Commentary 08-02-2021

SO I created Hurley Investments all these years ago for four reasons IF I remember correctly

- I knew there had to be a better way to invest than “funds” = WAY to expensive and the funds make more than you do over time, plus they rarely if ever beat the S&P 500

- I hated paying for someone to tell me to wait through down market ?

- I wanted more understanding and interaction = education on what my money was doing

- I wanted the control = I hate losing

I learned this:

It was a lot harder than I thought

Fear and greed with other peoples’ money is even harder than dealing with emotion on your own money

To do what I wanted to do it cost me 65K and takes a lot more time than the other losers who act like they are working

My expectations can be backed by real numbers !!!!

What is your expectation for the next three months?

It seems like the market will go sideways to down = September 3rd worst month and October is Always the worst month in the markets

Inflation, Fed raising rates, stimulus already baked in, Infrastructure bill not exactly what it is supposed to be, higher taxes (fed, states, income and capital gains), people not getting back to work until the end of September, a weakened Christmas Rally this year, lower earning yr over yr,, covid worldwide

Today a fed chair let the new know that it rates will stay lower for longer = banking will continue to be difficult for comparable quarterly returns

S&P moves on financials and transportation

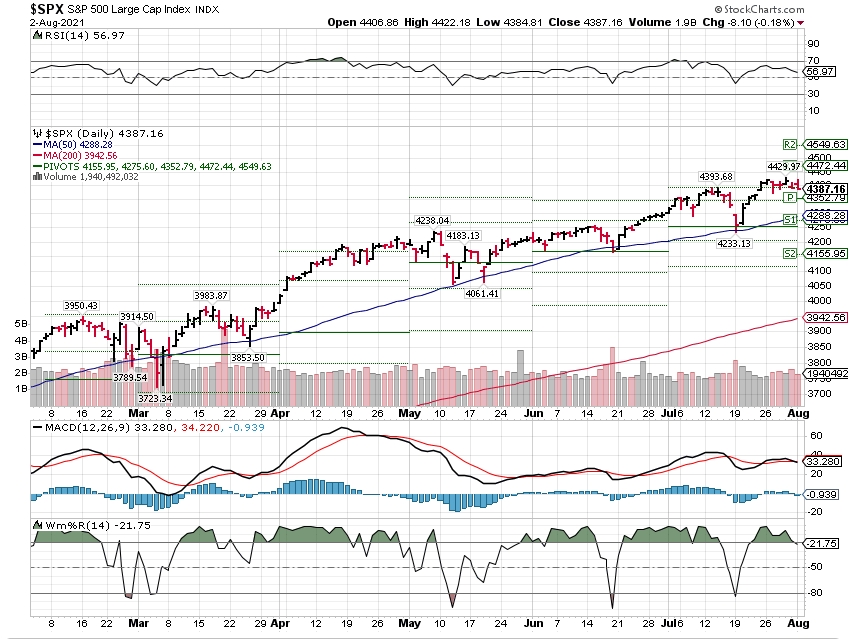

I really hope to see a 15.86% decline in our stock market = Nothing more than backing our stimulus from GDP and using a 5 year average S&P 500 returns vs going against last year

With all of this research and work it still doesn’t guarantee that any of it will come to pass

| https://go.ycharts.com/weekly-pulse Market Recap WEEK OF JUL. 26 THROUGH JUL. 30, 2021 The S&P 500 index fell 0.4% last week, weighed down by the consumer discretionary and communication services sectors, but the market benchmark still locked in a 2.3% gain for the month of July. The index ended Friday’s session at 4,395.26, down from last Friday’s closing level of 4,411.79, which was a record closing high at the time. It set another new closing high Monday at 4,422.30 and reached an intraday record high of 4,429.97 Thursday, but failed to revisit those levels by the end of the week. The weekly move was slight as investors struggled to reconcile quarterly earnings reports that have been coming in largely better than expected against concerns that the economic recovery may be slowing, especially amid impacts from the Delta variant of COVID-19. With COVID-19 cases on the rise again in much of the US, the Centers for Disease Control & Prevention recommended a resumption of indoor masking last week, even for people fully vaccinated against COVID-19, in areas with high or substantial transmission. Adding to the mixed market sentiment, data released Thursday showed Q2 gross domestic product rose 6.5%, an improvement from a 6.3% rate in Q1, but below expectations. The consensus estimate according to Econoday was for 8% growth. Still, the data showed consumer spending hasn’t slowed as personal consumption expenditures grew 11.8% in Q2, up slightly from an 11.4% expansion in Q1. The GDP data came a day after the Federal Reserve sounded a cautious note on the US economy as it maintained its highly accommodative interest-rate policy and kept quantitative easing measures in place. The consumer discretionary sector had the largest percentage drop of the week, down 2.6%, followed by a 1% drop in communication services and a 0.7% slip in technology. The materials sector led to the upside with a 2.8% climb, followed by a 1.6% increase in energy and a 0.7% rise in financials. The consumer discretionary sector was weighed down by a 9% tumble in Amazon.com (AMZN) shares as the online retailer’s Q2 sales missed analysts’ mean estimate, as did its guidance for Q3 sales. The report sparked concerns that COVID-19 engendered gains were cooling off sharply. Amazon also said Friday it was fined 746 million euros ($884.8 million) by the Luxembourg National Commission for Data Protection over claims it violated the European Union’s General Data Protection Regulation rules by processing personal data. In the communication services sector, shares of Activision Blizzard (ATVI) fell 8.6% as the videogame company grappled with the fallout of a recent sexual discrimination lawsuit. Activision initially called the allegations inaccurate and distorted, which led to employees planning a walkout. Chief Executive Bobby Kotick responded last week with a letter to employees that called the company’s initial responses “tone deaf.” The technology sector’s decliners included Citrix Systems (CTXS), whose shares shed 12% on the week. The digital workspace technology company reported Q2 adjusted earnings per share slightly above the Street consensus estimate, but revenue missed expectations and the company cut its earnings and revenue guidance for the full year. In the materials sector, shares of Freeport-McMoRan (FCX) rose 8.3% last week as the mining company reported Q2 adjusted earnings up from the year-earlier period. The energy sector’s advance came as crude oil futures rose on the week amid Energy Information Administration data showing crude oil inventories fell by 4.1 million barrels last week to their lowest level since January 2020. The report was taken as sign that demand is continuing to improve. Gainers in the energy sector included Valero Energy (VLO), whose shares climbed 5.1% on the week as the oil refiner reported it swung to a bigger-than-expected adjusted profit per share for Q2. The company’s Q2 revenue nearly tripled from the year-earlier period and topped the Street view. Next week, the Q2 financial reporting season is set to continue with reports coming from companies including Mosaic (MOS), Simon Property Group (SPG), ConocoPhillips (COP), DuPont (DD), General Motors (GM), Kraft Heinz (KHC) and Goodyear Tire & Rubber (GT). On the economic front, all eyes will be on the July employment data due next week, with ADP set to release private sector data on Wednesday ahead of weekly jobless claims on Thursday and the Labor Department’s Friday reports on monthly nonfarm payrolls and the unemployment rate. Ahead of the employment data, July manufacturing readings are due Monday from Markit as well as the Institute for Supply Management, which will both be releasing readings on the services sector on Wednesday. Investors will also be watching for July motor vehicle sales on Tuesday. Provided by MT Newswires |

Earnings Dates

BABA – 08/19 est

BIDU – 08/12 est

COST – 09/23 AMC

DIS – 08/12 AMC

GM – 08/04 AMC

TGT – 08/19 BMO

UAA – 08/03 BMO

Where will our markets end this week?

Lower

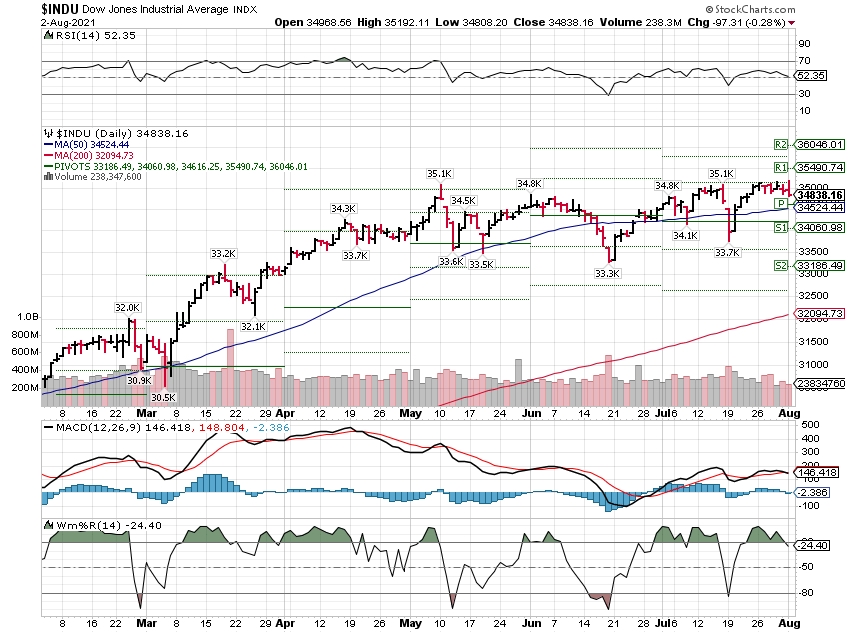

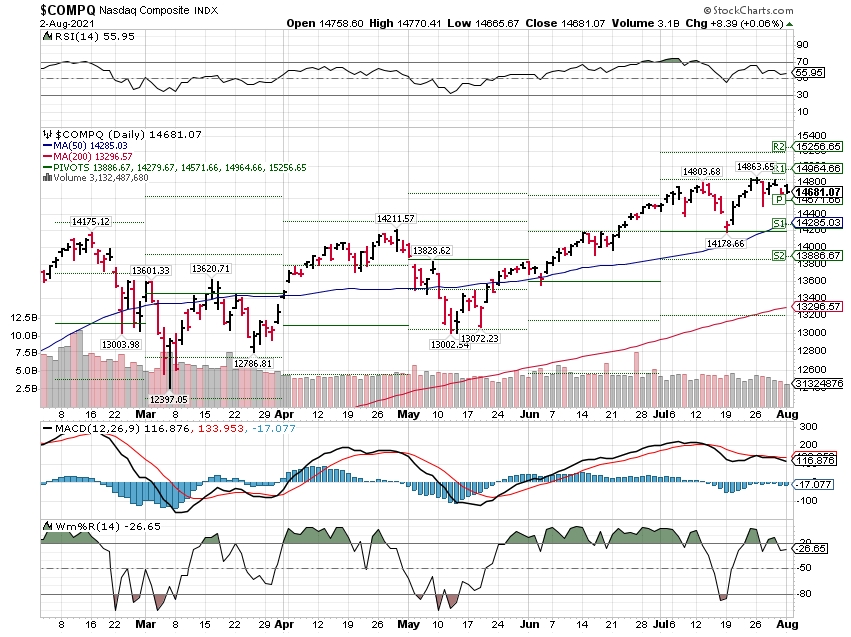

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2021?

08-02-2021 0.0%

07-26-2021 0.0%

Earnings:

Mon: MOS, RMBS, RIG

Tues: BABA, BP, CLX, COP, CMI, LLY, ATVI, AMGN, DENN, DVN, UAA,

Wed: CVS, KHC, RCL, ADT, ALL, MRO, MGM, NUS, ROKU, UBER, WDC, WYNN

Thur: CAH, CI, K, MUR, MRNA, VG, LOCO, FEYE, GPRO, GRMN, MNST, SQ, ZG

Fri: FLR, GT, D

Econ Reports:

Mon: Construction Spending, ISM Manufacturing Index

Tues: Factory Orders

Wed: MBA, ADP Employment, ISM Services Index,

Thur: Initial Claims, Continuing Claims, Trade Balance

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Wholesale Inventories, Consumer Credit

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Added protection for earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Here’s what’s in the $550 billion bipartisan infrastructure deal

Kevin Breuninger@KEVINWILLIAMB

KEY POINTS

- A bipartisan group of senators on Wednesday finally reached an agreement on the key details of a sweeping infrastructure bill that includes $550 billion in new spending.

- The legislation would pour federal money into physical infrastructure projects such as roads, bridges, passenger rails, drinking water and waste water systems.

- Significant details are unknown about the bill, which has yet to be released in full — especially regarding its offsets.

After weeks of haggling behind closed doors, a bipartisan group of senators on Wednesday finally reached an agreement on the key details of a sweeping infrastructure bill that will include $550 billion in new spending.

The legislation would pour federal money into physical infrastructure projects such as roads, bridges, passenger rails, drinking water and waste water systems, as well as expanding high-speed internet and climate-related infrastructure. The White House says the investments will add an average 2 million jobs per year as part of President Joe Biden’s agenda.

Significant details are unknown about the bill, which has yet to be released in full — especially regarding its offsets. Here’s what we know so far, according to a fact sheet from the White House:

- Roads and bridges: $110 billion in new funding will be allocated toward roads, bridges and other major projects. That includes $40 billion for bridge repair and replacement, which the White House touts as the largest such investment since the interstate highway system was proposed in the New Deal era, and $17.5 billion for unspecified “major projects.” The deal will also reauthorize a bipartisan surface transportation program for the next five years.

- Road safety: The deal puts $11 billion toward reducing car crashes and fatalities, including through a “Safe Streets for All” program. It will also double the funding that is sent to other programs that improve road safety.

- Public transit: The plan allocates $39 billion to modernize public transit and improv access for people with disabilities. The investment — the largest of its kind in U.S. history, the White House says — will replace thousands of buses and other transit vehicles with zero-emission upgrades.

- Passenger and freight rail: The deal would invest $66 billion to eliminate Amtrak’s backlog, modernize trains and expand service.

- Electric vehicles and buses: The plan includes $15 billion in spending for electric vehicle charging infrastructure, electric buses and transit.

- One billion dollars would also be put toward a program to reconnect communities divided by transportation infrastructure. The White House notes, for instance, that parts of the highway system were built through Black neighborhoods.

- Airports, ports and waterways: The bill dedicates $17 billion toward port infrastructure and $25 billion toward airports.

- Water infrastructure: The plan includes $50 billion for investment in weatherization and protection against climate-change fueled disasters like droughts and floods.

- Clean water: The plan has $55 billion in funding for clean drinking water, which includes replacing all the country’s lead pipes and service lines.

- High-Speed Internet: The deal includes $65 billion in spending for broadband internet infrastructure.

- Environmental clean-up: The plan includes $21 billion in funding for environmental remediation, including cleaning up superfund sites, reclaiming abandoned mine land and capping abandoned oil and gas wells.

- Power infrastructure: The plan includes $73 billion to shift the country from fossil fuels to clean energy. It invests in updated power infrastructure and research in technology like nuclear, carbon capture and clean hydrogen.

Clarification: This article was clarified to reflect that the interstate highway system was proposed in the era of the New Deal.

“Not A Drill”: Infrastructure Bill Could Sink American Crypto Industry

BY TYLER DURDEN

SATURDAY, JUL 31, 2021 – 05:00 PM

Authored by Jeff John Roberts via Decrypt.co,

The government aims to partially cover the cost of a massive infrastructure bill by taxing crypto companies… and the entire industry will feel it.

Things just got ugly for crypto in Washington, D.C.

For years, the threat of major regulation has been raised like a hammer, ready to smash the crypto industry. Now, the hammer is ready to drop in the unlikely form of a major infrastructure bill in the U.S. Senate.

“This is not a drill,” writes Jake Chervinsky, an influential crypto lawyer and a sober voices in a hype-prone industry. In a must-read Twitter thread, Chervinsky explains how the $550 billion bill – which is primarily about roads and bridges – could shiv American crypto companies.

The pain comes in the part of the bill that explains how the U.S. will help pay for those roads and bridge. Namely, the bill states that Uncle Sam plans to cover $28 billion of the costs by squeezing crypto brokers.

The trouble is that the bill defines “broker”—a term normally used to describe the likes of Coinbase and Robinhood—as basically any business that touches crypto.

As Chervinsky writes,

“This definition is so broad, it could apply to nearly every economic actor in the US crypto industry, if read literally.”

The catch-all “broker” term could apply to miners, DeFi startups, and others who will have to file customer forms with the IRS, a task that is in some cases impossible.

The upshot is that the U.S. crypto industry is in the same position as the online gambling industry a decade ago when Congress regulated it out of existence. In the eyes of lawmakers, crypto companies—like online casinos—appear to be both sinful and rich, which makes them the perfect target for a revenue raid.

The difference, of course, is that crypto is not a new form of vice to be taxed but rather a world-changing technology like the Internet. Sure, it has enabled bad stuff (including gambling-like behavior) but the Internet did too, and U.S. lawmakers came around to realize it made strategic sense to build the web on American shores rather than driving it out of the country.

There is also the matter of that $28 billion of taxes the crypto industry is supposed to provide. How did the Senate arrive at that figure? No one really knows, but that’s not the point. The point is for Congress to conjure up numbers that will “pay” for roads and bridges, and taxing crypto “brokers” offers a way to do that.

If you think that this is just another regulatory bogeyman that will never happen, think again. The crypto broker provision is part of a larger $550 billion package that is poised to pass, and that President Biden is aiming to make the landmark accomplishment of his first year. If the U.S. crypto industry has to become road kill to make that happen, few in Washington will bat an eye.

All of this reflects poorly on U.S. elected officials, but the crypto industry bears responsibility too. For years now, the industry’s leaders have carried on like they’re too rich or too cool to be bothered with Washington DC. Now, that’s coming back to bite them. Meanwhile, the handful of companies who are making a serious effort to help crypto build political capital get branded with the c-word (“centralized”) and dumped on by others in the industry. That’s what happened to Uniswap, which is probably the most promising DeFi project, when it it recently dared to devote some of its budget to defend crypto in the Capitol.

For now, everything is not lost. One Washington insider—who describes the situation as a “live fire exercise”—tells Decrypt the industry has mobilized like never before and various factions are putting aside differences to fight a common threat. But she added that “we’re running out of cards to play” as Democrats pull out the stops to pass the infrastructure bill by August. Ironically, the crypto industry’s best hope could be other Democrats—namely, the progressive caucus threatening to blow up the entire bill unless their leaders pass a related bill full of left-wing spending goodies.

In the absence of a Democratic party crack-up, the crypto industry’s best hope is a long-shot bid to rewrite the broker language before the bill takes another step forward. Barring that, Chervinsky notes that the next step will be fighting a rear-guard action in the courts, and urging allies in Congress to prevent the worst parts of the law decapitating the industry when it goes into effect in 2023.

The bottom line is that this regulatory storm has been brewing years. The crypto industry should have done more to head it off. Now, it may be too late.

https://www.investors.com/research/ford-stock-buy-now/?src=A00220

Is Ford Stock A Buy Now After Earnings? Automaker Hits Resistance At This Key Level

- ALEXIS GARCIA

- 02:05 PM ET 07/30/2021

Ford Motor (F) began the new decade with optimism as it emerged from a fundamental corporate redesign to compete in the era of smart vehicles and clean energy. The automaker is investing heavily in new technologies to keep pace with competitors in the markets for autonomous vehicles, ride sharing and electric cars. But is Ford stock a buy now?

The unveiling of the Mustang Mach-E in November 2019 was a key milestone in the company’s pivot toward what it called “the digital future.” The Ford Mustang Mach-E, an all-electric crossover, made its commercial debut in the U.S. late last year. Ford is beginning production of the Mach-E, a competitor to the Tesla (TSLA) Model Y, in China as well. And Ford didn’t stop at electrification with a crossover — it now has an electric version of the F-150 as well.

This new future also includes a pivotal tech partnership with Alphabet (GOOGL)-owned Google and a slew of other new vehicle launches. Among them: a resurrected Ford Bronco brand. Additional strategic partnerships include Volkswagen (VWAGY), Rivian and Mahindra to strengthen Ford’s global presence.

After a prolonged downtrend, Ford stock has been on a big run from 202o lows, along with peer General Motors (GM). If you’re thinking about buying shares of Ford, it’s key to analyze the fundamental and technical picture first.

Ford Stock Earnings

The automaker’s earnings continue to grow despite hurdles posed by a global chip shortage. Ford stock beat expectations for Q2 earnings on July 28. Ford earnings came in at 13 cents per share on revenue of $26.8 billion. Wall Street expected the automaker to deliver a loss of 3 cents per share on revenue of $23.01 billion.

Ford stock jumped above its 50-day line on the news, but that’s proving to be a resistance level for the stock at this time.

The Q2 beat came as the company navigated headwinds from the chip shortage rocking the automotive industry. In April, the automaker had projected a 50% decrease in production in response to the shortage, implying a loss for Q2. Instead, Ford grew its business in the most recent period. Ford executives credited pent-up demand and better flow of chips for the boost in profits on the company’s July 28 earnings call.

Strong demand for Ford’s EV products also played a pivotal role in lifting Ford stock earnings. The Mustang Mach-E is currently the No. 2 selling electric SUV in the U.S. market. Ford’s F-150 Lightening has racked up 120,000 reservations since May. Three-quarters of those future sales come from customers who are new to Ford.

“We’re on a new path, with the Ford+ plan, financial flexibility and a resolve to make us an even stronger company,” CFO John Lawler said in a July 28 earnings release. “We’re developing connected, high-quality vehicles and services that are great for customers and profitable for Ford.”

The carmaker also raised full-year adjusted EBIT guidance to $9 billion-$10 billion, citing improvements in chip availability.

Ford Stock Gains After Self-Driving Deal

Ford is partnering with ride-sharing giant Lyft to bring self-driving cars to the road. On July 21, the Detroit automaker, along with Argo AI, announced a plan to add autonomous vehicles to Lyft’s service operations by the end of 2021.

The companies said they plan to debut the AV fleet in Miami this year, with service to follow in Austin in 2022. Lyft passengers will be able to select self-driving cars in defined areas through the app as services come online. The cars will still have two safety drivers to ensure the vehicle is performing correctly as the nascent program rolls out.

“This is the beginning of an important relationship between three dynamic companies ultimately aiming to deliver a trusted, high-quality experience for riders in a multicity large-scale operation over time,” Ford Autonomous Vehicle and Mobility head Scott Griffith said in a July 21 release.

Ford stock rose. Lyft stock also bounced on news of the deal. The companies aim to have 1,000 self-driving vehicles in service by 2026.

Mustang Mach-E Named EV Of The Year

Ford snagged Car and Driver‘s 2021 EV of the Year award. The magazine, which publishes an annual list of best autos, singled out the Mustang Mach-E as its top pick in the electric car category.

“For new EV converts, piloting a Mach-E isn’t so different from driving a gas-burning SUV,” said the July 7 review from Car and Driver. “It’s the right car to bring drivers along during this watershed moment as EVs transition from niche alternative to new normal.”

Though the Ford Mach-E took top honors over rival Tesla, Ford stock fell despite the news. Shares are now pulling back toward their 50-day moving average.

Ford Puts More Money Into EVs

Ford outlined plans to increase investments in electric vehicles at its annual investor day on May 26. The automaker also expects costs of EV batteries to drop sharply. Ford stock rose.

Spending related to EV initiatives is expected to grow to more than $30 billion by 2025. The car company previously planned an investment of $22 billion on EV development. Ford expects nearly 40% of its global vehicle volume to be electric by 2030.

“This is our biggest opportunity for growth and value creation since Henry Ford started to scale the Model T, and we’re grabbing it with both hands,” CEO Jim Farley told investors on May 26.

Acquires Battery Charging Startup

Ford on June 17 announced the acquisition of Electriphi. The California-based startup provides battery-management and charging solutions. The deal is expected to boost Ford’s capabilities to develop battery charging and management services as it ramps up electrification efforts. Ford stock fell slightly.

“With Electriphi’s existing advanced technology IP in the Ford Pro electric vehicles and services portfolio, we will enhance the experience for commercial customers and be a single-source solution for fleet-depot charging,” Ford Pro CEO Ted Cannis said in a June 17 statement.

Ford Pro projects the charging depot segment could grow to 600,000 vehicles by 2030 and bring an additional $1 billion in revenue in that same time frame.

Ford did not disclose how much it’s paying for the San Francisco-based company. But executives say the acquisition is part of Ford’s $30 billion investment in electrification efforts. The deal is expected to close by the end of June.

Ford Launches Lightning F-150 EV

Ford on May 19 officially debuted its electric pickup truck, the F-150 Lightning. Just a day earlier, President Joe Biden visited a Ford plant in Michigan to tout his $174 billion electric-vehicle plan and take Ford’s electric truck for a test drive.

Ford stock surged 13% for the week, signaling investors are bullish about the sales potential for the newest version of the popular pickup model.

“Every so often, a new vehicle comes along that disrupts the status quo and changes the game … Model T, Mustang, Prius, Model 3. Now comes the F-150 Lightning,” CEO Farley said in a May 10 news release.

Production of the new F-150 won’t begin until 2022. The new model will compete amid a growing marketplace lineup of electric pickups. In addition to Tesla‘s (TSLA) heavily publicized Cybertruck, GMC and Chevy also have announced plans to release electric versions of the Hummer and Silverado truck models, respectively.

A Rivian EV pickup launches in June with GM’s Hummer EV out later this year. The Tesla Cybertruck is expected to launch sometime in 2022, but it’s unclear when.

Will Chip Shortage Force Redesign?

During Ford’s annual shareholder meeting on May 13, CEO Farley said the company is weighing future strategies to deal with chip woes. Some of these strategies include redesigning car components to work with more accessible chips and cutting supply deals directly with chip foundries.

Ford EV Sales Set New Record

Ford’s focus on EVs is translating to increased sales. Electric-car sales surged 117% to a first-half record in June. The Mustang Mach-E outsold the gas-powered Mustang for the first time, notching 12,975 total sales. F-150 PowerBoost hybrid sales totaled 17,039 vehicles.

Reservations for the new fully electric F-150 hit the 100,000 mark, according to July 2 totals released by the automaker.

Record EV sales continue a positive trend for Ford, topping an all-time monthly record in May. That month, the automaker saw electric-vehicle sales increase 186% to hit a monthly total of 11,172 vehicles. Those numbers were boosted by the popularity of new product offerings like the Mustang Mach-E and F-150 hybrid.

Google Partnership Lifts Ford Stock

Key tech partnerships are part of Ford’s strategy as well. Ford stock gained 2.9% on Feb. 1 after CEO Farley announced the 117-year old automaker is partnering with tech giant Google. The Michigan-based carmaker and Alphabet-owned company will form a new collaborative group called Team Upshift.

“We’re going to leverage the talent and assets of both companies to push the boundaries of Ford’s transformation,” Ford Motor wrote in a company blog post. “This may include projects ranging from modernizing our plants through vision AI, developing new retail experiences when buying a vehicle, creating new ownership offers based on connected vehicle data, and more.”

In addition to the joint venture, the deal will make Google the preferred cloud service for the Detroit automaker.

New Ford CEO Takes The Helm

On Oct. 1, COO James Farley took the helm as Ford’s CEO. His tenure began with a shake-up of key leadership roles. Ford announced Tim Stone is vacating his role as CFO. He replaced John Lawler, who recently oversaw Ford’s autonomous vehicle unit.

Along with Farley’s new position came a ramp-up in Ford’s intent to invest more in emerging technologies, including autonomous vehicles, electric cars and software-as-a-service capabilities. Ford stock investors have welcomed the changes, with shares almost doubling from last October through early February.

Farley stepped in after disappointing results in Hackett’s three-year bid to reshape the automaker. The centerpiece of Hackett’s tenure was an $11 billion restructuring plan. That plan ran into major roadblocks when Ford botched the redesign and launch of its popular Explorer SUV in 2019.

All in all, Ford stock declined roughly 60% during Hackett’s time as CEO.

In addition to C-suite changes, Ford announced last July it was resurrecting its iconic line of Ford Bronco SUVs. Production of the new Bronco lineup will include two-door and four-door models, as well as a smaller Bronco Sport edition. Consumers can now see some of the new Bronco models, set to hit showrooms in May 2021, online.

Bronco Relaunch Part Of New Strategy

The relaunch of the Bronco SUV — which was discontinued in 1996 — is part of Ford’s overall strategic initiative to capitalize on its iconic brand lineup to boost U.S. revenue and earnings.

Ford President of the Americas & International Markets Group Kumar Galhotra told CNBC last July he expects annual unit sales of the new Ford Bronco series to be “in the hundreds of thousands.” The Bronco SUV family is set to directly compete against the popular Jeep brand owned by Fiat Chrysler (FCAU).

The revival of the popular Bronco vehicle models came just weeks after the Detroit-based car company unveiled details of the latest version of its top-selling Ford F-150 pickup truck in late June. The truck is the first Ford vehicle to support over-the-air software updates, first pioneered by Tesla (TSLA) in 2012.

Ford Stock Fundamental Analysis

To determine whether Ford stock is a buy now, fundamental and technical analysis is key.

The IBD Stock Checkup tool shows Ford stock has an IBD Composite Rating of 82 out of a best-possible 99. The rating means Ford stock ranks relatively well vs. all stocks, but not outstanding, in terms of the most important fundamental and technical stock-picking criteria.

Ford stock has an EPS Rating of 67 out of 99, which compares quarterly and annual earnings-per-share growth with all other stocks. While that score could be better, it has improved since the last quarterly report. Ford has a spotty earnings track record, with many quarters of earnings declines over the past decade. But forward-looking estimates are pointing to growth.

The rankings place the carmaker in the No. 2 spot vs. its automotive industry peers. IBD’s automaker group is ranked a weak No. 170 out of the 197 industry groups tracked by IBD. In general, it’s ideal to focus on top stocks in the top quartile of IBD’s groups, but the market underperformance from Tesla this year in particular is weighing on the ranking.

Ford Stock Technical Analysis

A broad market pullback in mid-July sent Ford stock south of a key support level. Shares tumbled 6% the week of July 16, triggering a strong sell signal with a definitive break of the 10-week line.

Before that, Ford stock had been testing support at the 10-week line. Pullbacks to that level can be a critical test — they can either mark a buying opportunity if a stock finds support, or cue selling if the stock loses support.

Another sell signal? Shares round-tripped a double-digit gain from a breakout above a flat-base entry of 13.72 in late May. Ford stock is building a new base with a 16.55 buy point.

For investors hoping to enter a position on a post-earnings gap, Ford stock jumped 4% after Q2 results. While shares cleared the 50-day line intraday, Ford hit resistance at that level and closed at the low end of its trading range for the day. That is not a sign of a strong price move. Ford stock fell the next trading day.

Ford stock went on a big run earlier this summer. Shares broke out of a flat base in late May and hit the 20% profit zone within two weeks. Then, Ford started pulling back.

A rebound off the 21-day exponential moving average on June 21 was a potential buying opportunity for existing shareholders to add to their positions. While that was a tough hold, another entry opportunity came as Ford stock tested support at the 50-day line and its prior 13.72 buy point on July 7.

While these alternate entries ultimately didn’t work, investors who used closes below the 21-day and 50-day support levels as their exits were able to properly manage their risk.

Consider Ford’s Relative Strength

It’s also important to consider Ford’s relative price performance. Ford’s relative strength line — which measures a stock’s price performance vs. the S&P 500 — is back below its short-term peak in mid-March.

IBD’s research shows the importance of focusing on stocks outperforming the market. While Ford’s RS line is off recent highs, it’s normal action for a stock in the process of forming a new base. Investors should keep an eye on Ford’s performance vs. the S&P 500 as it seeks to find a bottom.

https://research.investors.com/ibdchartswp.aspx?cht=pvc&type=daily&symbol=F Ford Stock: A Buy Now?

On a monthly chart, Ford stock is breaking above its long-term downtrend going back to 1999. Looking at the weekly chart, shares have made a big move off 2020 lows. Ford broke out of a flat base in late May and is testing a key level.

As for the fundamentals, Ford sales and profits are rebounding. The company is moving more into electric vehicles, too. However, chip shortages are weighing on Ford and the entire auto industry.

Bottom line: Ford stock is not a buy now. While shares cleared a declining-tops trend line on July 29 on the heels of its estimate-beating earnings report, they quickly fell to the lower end of their trading range. Ford stock is now moving lower.

For investors interested in Ford stock, shares need to retake the 50-day line and hold above that level. The stock is currently forming a base with a 16.55 entry point.

Facebook beats earnings expectations, but warns of significant growth slowdown

KEY POINTS

- Facebook surpassed analysts’ estimates for earnings and revenue in its second-quarter earnings report.

- CEO Mark Zuckerberg spent much of the company’s earnings call discussing his vision for the metaverse: a digital world Facebook is investing billions of dollars to create.

Facebook shares fell as much as 5% in extended trading on Wednesday after the social media company called for revenue growth to slow in the quarters ahead, even as second-quarter results came in ahead of estimates.

Here’s how the company did:

- Earnings: $3.61 per share, adjusted, vs. $3.03 per share as expected by analysts, according to Refinitiv.

- Revenue: $29.08 billion, vs. $27.89 billion as expected by analysts, according to Refinitiv.

- Daily active users (DAUs): 1.91 billion, vs. 1.91 billion as expected by analysts, according to StreetAccount.

- Monthly active users (MAUs): 2.90 billion, vs. 2.91 billion as expected by analysts, according to StreetAccount.

- Average revenue per user (ARPU): $10.12, vs. $9.66 as expected by analysts, according to StreetAccount.

Facebook’s revenue grew by 56% year over year in the second quarter, according to a statement. It’s the fastest growth since 2016, accelerating from a 48% increase in the prior quarter. The company pointed to a 47% rise in average price per ad, along with a 6% increase in the number of ads it delivered.

Revenue from Facebook’s Other segment, including consumer hardware such as Oculus virtual reality headsets, totaled $497 million, up 36% and less than the $685.5 million StreetAccount consensus estimate.

The company’s free cash flow of $8.51 billion fell short of the $9.08 billion StreetAccount consensus.

https://datawrapper.dwcdn.net/YgITX/3/ With respect to guidance for the second half of the year, Facebook said it expects “year-over-year total revenue growth rates to decelerate significantly on a sequential basis as we lap periods of increasingly strong growth.” That’s effectively unchanged from Facebook’s guidance three months earlier. Analysts polled by Refinitiv had expected $28.22 billion in revenue for the third quarter, which implies 31% growth.

Facebook said in the second quarter it had 3.51 billion monthly users across its family of apps, up from 3.45 billion in the first quarter. This metric is used to measure Facebook’s total user base across its main app, Instagram, Messenger and WhatsApp.

In the U.S. and Canada, where Facebook generates more average revenue per user than in other regions, the company reported 195 million daily active users, the same as in the first quarter. In Europe the count declined sequentially to 307 million from 309 million in the first quarter.

During a conference call with analysts, CEO Mark Zuckerberg talked about the company’s goal to help develop the metaverse, which he described as “a virtual environment where you can be present with people in digital spaces.”

The comments came two days after Facebook announced the formation of a team that would work on the metaverse.

“In the coming years, I expect people will transition from seeing us primarily as a social-media company to seeing us as a metaverse company,” Zuckerberg said. Advertising will probably be a meaningful part of the metaverse, and Facebook’s goal won’t be to sell devices at a high premium, he said. Zuckerberg’s vision for the metaverse requires a sense of presence in a virtual world, which is why the company is investing heavily in its Oculus division to build the necessary hardware. Zuckerberg said he thinks Facebook will also be able to make money from the metaverse through the sale of digital goods and experiences.

https://datawrapper.dwcdn.net/CS1qS/2/ Facebook said in Wednesday’s statement that it still expects “increased ad targeting headwinds in 2021 from regulatory and platform changes, notably the recent iOS updates.” Snap and Twitter have navigated the challenges of Apple’s iOS 14.5 update, which gives people more control over apps that want to track them, without much trouble. Both companies did warn that the long-term impacts of iOS 14.5 remain to be seen, but so far, the early returns have been promising.

David Wehner, Facebook’s finance chief, said the company expects a larger impact from iOS 14.5 in the third quarter than in the second quarter. The degree of opting in is in line with Facebook’s expectations, Wehner said.

“We’re not fully rolled out with those changes, but Q3 will have the impact more or less of those meaningfully rolled out,” he said.

Facebook also had some run-ins with Washington during the quarter. A federal court dismissed an antitrust complaint from the Federal Trade Commission against the company, along with a separate case brought by 48 state attorneys general. The FTC has until Aug. 19 to change its complaint, and the group of states said Wednesday it will fight the court’s decision.

However, Facebook came under the scrutiny of the Biden administration earlier this month when the White House scolded the social media company for not doing enough to combat misinformation on its services that discourage people from taking Covid-19 vaccines. At one point, President Joe Biden said “they’re killing people” in regard to misinformation on Facebook.

Separately, Facebook’s vice president of people, Lori Goler, said the company will require employees to be vaccinated before entering its U.S. offices.

As of Wednesday’s close, Facebook shares were up 37% since the start of the year. The S&P 500 index has risen 17% over the same period.

https://seekingalpha.com/article/4438011-visa-stock-v-buy-buy-buy-and-never-sell

Visa: Buy, Buy, Buy And Never Sell

Jul. 06, 2021 10:37 AM ETVisa Inc. (V)72 Comments55 Likes

Summary

- Visa has rallied strongly in the last month, leaving many wondering if the company is overpriced.

- However, quality companies one can hold for the long term, like Visa, are hard to find.

- Visa possesses all the moat-like qualities you would expect from a company of its reach and value.

Thesis Summary

Visa Inc. (V) has rallied strongly in the last few weeks following earnings beats. The company trades at ATH, which might leave some investors wondering; is this a good time to sell? Clearly, that depends on your investing strategy. If your approach is to buy quality companies and hold for the long term, I would not think of selling Visa. The company is in a unique position and has one of the most compelling moats of any business.

In this article, I analyze Visa’s moats as categorized by Hamilton Helmer in 7 Powers, a book that was brought to my attention in this recent Palantir Technologies (PLTR) article. Both the article and book do a great job at describing the different types of moat that a business can have.

Visa, in my opinion, passes the “moat test” with flying colours.

Scale Economies

Something that I’m sure you have already heard about. Economies of scale occur when a company’s marginal costs become smaller as its volume of operations increases. Visa indeed enjoys economies of scale, because it has a whole network in place to process data and transactions. The cost of adding new clients to this network is negligible compared to the profits the company makes.

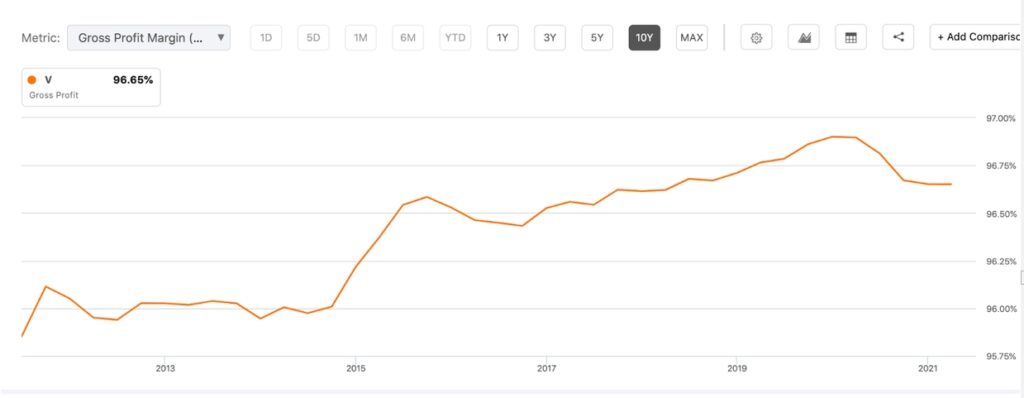

Clear evidence of this can be found in Visa’s gross margin:

Source: Seeking Alpha

In the last 10 years, Visa has achieved close to 97% gross profit margin. This is because, like most SaaS companies, it doesn’t have many costs directly associated with its revenues. Visa is perhaps the clearest example of economies of scale. This is both a benefit for Visa since it can achieve overall higher margins and a detriment to competitors, who won’t benefit from this superior profitability unless they reach a certain size.

Network Effect

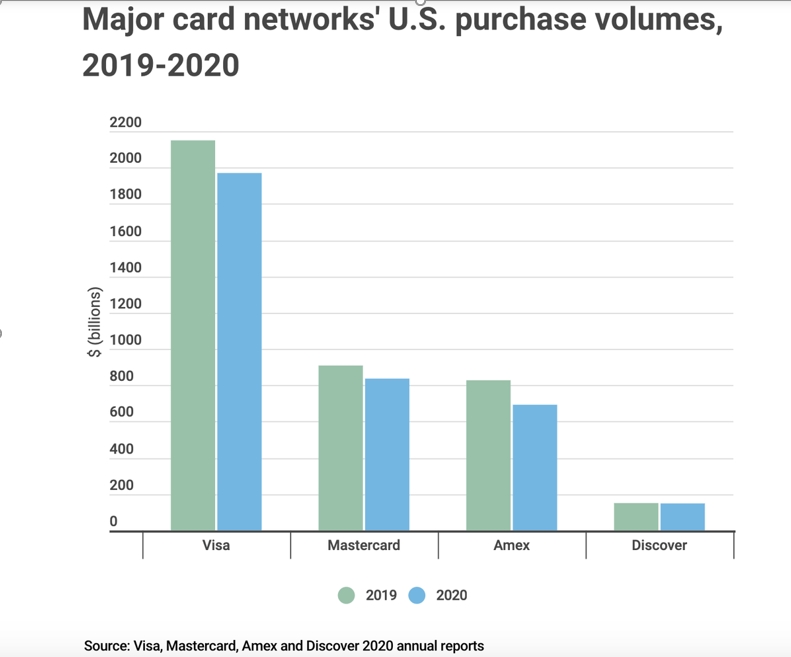

Once again, it’s hard to think of a better example of network effects in play than with Visa. The point of this is that the value of Visa’s service increases with every new user. This is exactly one of the main reasons consumers and merchants use Visa. Consumers, because it is accepted practically everywhere, and Merchants, because most consumers use Visa. It is a self-fulfilling prophecy. This point is even better illustrated with a graph:

In terms of purchase volume in the US, Visa has over half of the market, basically making it a requirement for any merchant to accept it. While this credit card market is often described as a duopoly between Visa and Mastercard Corporation (MA), the former is significantly ahead in terms of volume.

Switching costs

From a consumer standpoint, it’s pretty simple to get either a Visa or a Mastercard debit/credit card sent to you. There are also generally few costs associated with disposing of a card, and if there are any, it is more often down to the financial institutions which issue the cards.

The switching costs moat would apply more to the side of the banks. In other words, how much would a bank be penalized for switching from Visa to Mastercard? In reality, both of these are easily interchangeable, in fact, many banks offer both options. However, if you already have millions of Visa cards dispensed around the world, I can’t imagine it would be cheap to suddenly change this.

Also, it would take banks an incredibly large investment to implement their own payment structures, which we could also view as a high switching cost.

Branding

Visa, once again, is in a very unique situation when it comes to branding because it is a completely global and intersectional brand. Who does Visa market to? Everyone in the world is the answer.

Visa has successfully become a household name, and its name is associated with convenience and reliance. Entrusting your money to a company is a difficult thing to do, and this is in fact why companies like Visa and Mastercard have been able to keep such a tight grip on the market. Visa is an attractive payment option because it is used by almost everyone, and that means it must be trustworthy.

Visa is amongst the most well-regarded brands in the world. In fact, Visa was ranked 6th in BrandZ’s Top 100 Most Valuable Global Brands, and also ranked 45th in Interbrand’s 2020 Best Global Brands.

Counter-positioning

Now here’s a tricky one. Counter-positioning is a concept that can be understood as a “game theory” scenario between the newcomers and the established companies. In this case, we are looking at Visa, which is the established company.

The question we must ask ourselves is therefore the following; is there a disruptive business model in the payment industry that Visa can’t copy or absorb? And if so, why not?

There are a few scenarios where new businesses can develop models that incumbents can’t compete with or don’t want to copy/absorb. One example of this would be if the new business model is going to “cannibalize” the old business model. Another case where this happens is a lack of insight by management or even distorted incentives.

So far, I have not seen this happen with Visa. Over the last few years, Visa’s management has shown plenty of initiative to absorb and acquire new businesses in the innovative fintech space. This is actually what has allowed the company to continue to grow at double-digit rates. The company has now even made a move into blockchain technology, investing in Tink. Blockchain is about as counter-positioning as it gets in the space, but as long as Visa is willing and able to invest in this technology, its long-term potential is still unquestioned.

Cornered-resource

Out of all the 7 moats that 7 Powers delves into, this is, in my opinion, the least inspired. Cornered-resource, as far as I understand it, acts as a catch-all term for “exclusive access to something valuable”. Now, of course, this could be anything. In a more literal sense, we could be talking about a patent or exclusive rights to an oil drilling site. However, the book also mentions labour force as an example. While I do agree that this can qualify as a moat, it opens the door to add several things to this list. What constitutes a resource? In the case of Visa, I could talk about the previously mentioned value of their brand. This is after all a “resource” that only Visa has access to. I could also talk about Visa’s global transaction and data processing network, but this would fit in better in the next section.

Ultimately, if I had to talk about a cornered resource for Visa, I would mention its branding and privileged position in an oligopolistic market. In other words, it is one of the two main players in the payment processing industry, something which gives the company value and others doesn’t have access to.

Process Power

Last, and certainly not least, we have to acknowledge Visa’s Process Power. This can be defined as “embedded company organisation and activity sets which enable lower costs and/or superior product.”

Well, Visa has a very clear activity set that enables lower costs and a superior product. I am of course talking about VisaNet, which is the name given to Visa’s all-in-one payment network.

Source: usa.visa.com

The above infographic gives us a good idea of Visa’s size, which by many metrics we could call the largest payment network in the world.

Visa defines three key areas which the network tackles: Transactions, risk management, and data processing. Transaction processing is obviously a key part of the network, but I believe that risk management and data processing are the true differentiators and value adders in Visa’s network.

Fraud is rife in the world of payments, but Visa has managed to reduce instances of fraud to historical lows, claiming that less than $0.06 is lost out of every $100 in transactions.

On top of that, Visa actually helps process data and transforms it into actionable business insights. This is a huge growth area for the future and something which the Visa network does incredibly efficiently.

It’s easy to take these things for granted, but even the most innovative blockchain solutions struggle to compete with Visa’s network in these key areas. By some estimates, Bitcoin (BTC-USD) can carry out around 4,6 transactions per second, where Visa can carry out 1,736. Furthermore, the crypto space is still plagued by instances of fraud.

Don’t get me wrong, I am not trying to disparage Bitcoin and cryptocurrencies, which I own and believe in. I am simply saying that you can’t build a new network from one day or another, or even from one year to another. This gives Visa true Process Power.

What’s the risk?

The above is a compelling argument in support of the bull thesis for Visa, but even a company with so many moats has potential risks.

Although the company is well protected from competition, I do think that we could see Visa’s profit margins suffer in the long run. For now, Visa and Mastercard have quite a bit of pricing power, but this might change as new companies enter the market. In fact, the operating margin has been slowly decreasing in the last five years.

On top of that, Visa has to deal with the fact that there is technology out there that can one day replace its network. Blockchain technology, smart contracts, and decentralized apps are not quite there yet, but we can already see that they have the potential to bring about significant changes in the way money moves. Visa will have to keep up with this innovation, either through R&D and/or acquisitions, and this will put a strain on its finances.

Another issue with Visa is that it is highly dependent on a strong economy and benefits from consumer credit. The economy is recovering well from the pandemic, but this is being fueled by increased government spending and indebtedness, and we may see this credit cycle reverse at some point.

Lastly, it is worth mentioning that Visa trades at 42x future earnings, a multiple which is significantly higher than its 5-year average. Is there a particular reason for this? Visa continues to be a great company, with good earnings and solid growth but I don’t see why it should be trading at a higher valuation, other than the fact that the overall market seems to be more “inflated”.

Takeaway

In conclusion, I give Visa at least a 6.5/7 in the moat challenge. Scale and Network moats can be perfectly observed with Visa. Switching costs are also high for the players involved in Visa’s network, except for consumers. The company is one of the most well-established brands in the world, and I also think Visa is doing well to maintain its lead in the fintech space by investing in new companies. So far, I don’t see a company that can truly disrupt Visa in a way that leaves Visa completely helpless. Cornered resource, I’ll give them half a point for, as I can’t really point out a particular “asset” that isn’t already covered in the other section. Lastly, processing power is the key to the whole equation. Visa can’t be replaced; it may morph and have to adapt to new technologies and competitors, but the Visa network will be here for decades to come.

This article was written by

Here at the Value Trend, we use trendline analysis to forecast changes in market dynamics and reach fair va… more

Value, Growth At A Reasonable Price, Long-Term Horizon

Contributor Since 2019

Here at the Value Trend, we use trendline analysis to forecast changes in market dynamics and reach fair valuations for companies. We focus on long-term investments with an emphasis on big caps, tech, healthcare, and dividend stocks

Disclosure: I/we have a beneficial long position in the shares of V either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://seekingalpha.com/article/4442118-ford-just-will-not-stand-aside

Ford Just Will Not Stand Aside

Jul. 28, 2021 3:15 PM ETFord Motor Company (F)TSLAVWAGY105 Comments29 Likes

Summary

- Doesn’t Ford understand that it’s yesterday’s news?

- Along with GM, it’s the epitome of big metal, gas-guzzling, internal combustion engine production.

- So, yesterday, right? They need to step aside for all the brighter stars in the future automotive heavens.

- Not so fast. Jim, be nimble; Jim, be quick. New CEO Jim Farley has a company with strong cash flow, engineering genius, and a workforce with a desire to conquer.

Don’t count Ford (NYSE:F) out as being yesterday’s news. How many other auto companies, in just the past few months, unveiled two BEV (all-electric) models of existing iconic American automobiles?

The first of these is the Ford F-150 Lightning pickup. The ICE (internal combustion engine) model F-150 has been the best-selling pickup truck in the U.S. for decades. You do not gain a following that buys the same vehicle year after year without building it, as their ads say, “Ford tough.” And you don’t keep that following without picking up great credibility for your other models, as well.

2021 has been no exception. Ford already has sold more than 365,000 F-Series trucks. This new F-150 won’t be in full production until early 2022 but, according to the company, another 100,000 buyers have placed refundable deposits for the Lightning BEV F-150 already. Because Ford can make these in massive quantities, they are able to keep the price down to around $40,000.

One of the apps I really like about this BEV model is that, in the event of a power outage, this truck can act as a backup generator, supplying enough electricity for up to three days of typical household use.

This is a feature I discussed in one of my articles last month for Seeking Alpha. In My EV Company (Volkswagen) Is Better Than Your EV Company (Tesla) (here), wherein I discussed the investment merits of VW stock vs. Tesla stock for an investor buying today, I wrote:

“Two-way charging will, I believe, become the norm. For traveling, this is not an issue. But most drivers most of the time are not going 500 miles from home. They’re commuting or going to the grocery store or visiting friends and family nearby.

“My view of this issue may be colored by the fact that I live in the High Country in the Sierra Nevada. Come winter, the occasional 70-mile-an-hour wind and ice and snow have a way of ignoring man’s puny electrical stations and man’s need for comfort. Most folks up here buy a backup generator to deal with these occasional electrical outages.

“…this is one area where I’m a believer in millions of charging stations – home charging stations. Why use a bulky generator for a short outage when you already have one in the garage? It’s called an EV. Indeed, I can see a time when millions of EVs feed electricity into the grid during the highest use times – usually in the evenings local time – and then draw it back out in the dead of night when usage is lower. To stay relevant, I think smart auto manufacturers will brand these and sell them as part of the EV package.”

Ford just made it the norm. Unless they can be easily converted to two-way charging, all the other home wall converters just became obsolete.

Ford’s other BEV launch is already on the road. Also building on one of its iconic brands, the Mustang, Ford cleverly kept the styling reminiscent and the performance exceptional. The Ford Mach-E has since been crowned the Car and Driver 2021 EV of the Year. Comparing it to all other EVs (yes, all others) the Mach-E came out as its top pick just this month.

In their review, the editors at Car and Driver said, “For new EV converts, piloting a Mach-E isn’t so different from driving a gas-burning SUV. It’s the right car to bring drivers along during this watershed moment as EVs transition from niche alternative to new normal.” In the first half of 2021, for the first time ever, the Mustang Mach-E outsold the gas-powered Mustang, recording 12,975 total sales.

Car and Driver hit the nail on the head. There always are early adopters. There always are those who want something exotic. But there are far more car buyers who want something redolent of what they already know and love. That’s Ford’s brilliance in building upon the great reputation of its F-150. And that is Ford’s brilliance in selecting the Mustang as their very first entry into the BEV mainstream.

(NB – I should quickly note that since SA is a site for investors, I’m lauding the investment merits of Ford, not comparing how pretty its models are or how fast x Tesla will go 0-60 vs. how fast x Ford will do so. It’s all about making money. If some analysts are correct and TSLA will hit $3,000 a share from today’s $650, you will have made 4 ½ times your investment. To earn the same 4 ½ times your investment in Ford, it need only go to $63.)

What Else Is Ford Doing Right?

Ford is leaping into EVs with both feet and a hefty checkbook. The company now plans to spend $30 billion on EV technologies and product during the next four years. Deep pockets and steady cash flow mean a lot in the automotive business. So does manufacturing scale. Ford is looking to ensure that 40% of its sales (about 2 million vehicles!) are from BEV cars and trucks by 2030.

The company realizes that the next generation of car and truck buyer want all the electronic apps that distract them from driving. (“But full-attention driving on twisty mountain roads and serpentine race courses is the whole idea” some of us unrepentant throwbacks will lament.) Lamentations aside, that’s not what tomorrow’s “drivers” want.

As a result, Ford is forging strategic partnerships with other automakers for scale and with leading edge artificial intelligence companies to pioneer autonomous vehicles (AVs.) The company already has partnered with ride-sharing titan Lyft to bring self-driving cars to the road. Ford, Argo AI, and Lyft will debut their AV fleet in Miami this year, with a follow-on in Austin in 2022. Lyft passengers will be allowed to select self-driving cars as part of a “where the rubber meets the road” test of AV capabilities. The cars will have not one but two safety drivers to ensure the vehicle is performing as designed as this inaugural program rolls out.

Ford also understands that controlling battery production will keep costs from spiraling out of control. (A hat tip to Tesla for making Panasonic their partner early on at the Nevada gigafactory just down the road from me.) The company recently announced a partnership with SK Innovation in Korea to build facilities that could satisfy 100% of Ford’s battery needs by 2030.

The company also announced last month that they have acquired Electriphi, a company that provides battery-management and charging solutions. On the other end of the size scale, they also entered into a tech partnership with Google and a strategic partnership with Volkswagen (OTCPK:VWAGY), one of my favorite auto companies seen as a lumbering and out-of-touch behemoth by some. I see it as another great opportunity for savvy investors. It’s up 1005 since I bought it for our Investor’s Edge® Marketplace portfolio in October.

Ford reports its second quarter earnings today, July 28

I sincerely hope they are dreadful! That will give me a chance to buy their shares yet again. (I have bought and sold once already and look to get back in cheaper.) The reason earnings are likely to be down in the second quarter is the global chip shortage. Ford shuttered or slowed production of new vehicles by about half during this just-passed quarter. Today’s cars are all about electronic gee-gaws to operate anything and everything.

At Ford’s annual shareholder meeting in May, CEO Jim Farley said the company is looking at redesigning car components to work with more accessible chips as well as cutting supply deals directly with chip foundries.

Finally, not all Ford models are “all about electric.” Selecting yet another quintessential brand, discontinued years ago but immensely popular still today, the company has dedicated itself to bringing back the Ford Bronco, hewing closely to the original design but upgraded in so many ways. Watch out, Jeep – there’s a Bronco on the prowl. If it’s even half as popular as the original, it will be a big hit for Ford.

Today is pivotal. If investors overreact to the chip shortage induced earnings hit, I will look to own shares of Ford once again. For our Investors Edge® portfolio, I’m looking to buy 700 shares at a limit of 12.50 and another 500 if we are lucky enough to see a decline below 12.

Why ‘food miles’ matter and how to reduce your carbon footprint while shopping

By Amy Joi O’Donoghue, Deseret News | Posted – Aug. 1, 2021 at 4:10 p.m

Chad’s Produce sells fruit at the Wheeler Historic Farm farmers market in Murray on Sunday, July 25. (Jeffrey D. Allred, Deseret News)

SALT LAKE CITY — The COVID-19 pandemic that severely interrupted supply chains across the United States and in Utah continues to impact supplies of some items, amplifying the importance of “food security” and locally sourced products.

That distance it takes for your food to get to your pantry is called a “food mile,” and as the global community aims to tamp emissions and reduce its carbon footprint, there are ways consumers can make an impact, if they do a little research.

Sustainable America notes that just as people leave a carbon footprint when they travel, food milage racks up given its entanglement with the transportation industry — sushi flown in from Japan, California apples consumed in New York and Costa Rica pineapples sitting on a countertop in Hawaii.

The organization emphasizes the way to shave those miles is to concentrate on purchasing locally sourced food and non-processed, whole foods.

Produce for sale at the Wheeler Historic Farm farmers market in Murray on Sunday, July 25, 2021. (Photo: Jeffrey D. Allred, Deseret News)

But it is a challenge.

In 2019, Utah food manufacturing sales totaled $8.3 billion, but more than $5.3 billion of those products went out of state, and then Utah consumers bought some of it back, according to data being used by the Utah Department of Agriculture and Food as it looks to develop a comprehensive, strategic plan.

“A lot of our beef and lamb goes out of state and then we buy it back at a higher price,” said Linda Gillmor, director of marketing and economic development for the agency.

“Someone else is making that additional $5 billion we are talking about.”

Fry sauce and barley

As an example, Gillmor pointed to fry sauce. Utah loves its fry sauce, but none of it is produced in state because there are not any processing facilities for tomatoes.

In sauces alone, Gillmor said, the state is potentially losing out on nearly $46 million because those products are generally made elsewhere — 65% of sauces in Utah were imported in 2019.

While some Utah breweries purchase locally grown barley, the state is losing $289 million in that sector and another $124 million due to baked goods being produced out of state and then shipped back. In the sector of dry pasta, dough and flour mixes, the losses are estimated at $56 million a year.

“The potential loss just blows you away,” she said. “This should get the attention of anyone who cares about Utah’s economy and especially the rural economy where the food is produced.”

All those goods leaving the state — only to possibly end up on a shelf in a Utah grocery store — contribute to food miles.

When the products are from Utah, being shipped in Utah, it is much different than being flown in from somewhere else. Every one of those stops have a carbon footprint.

–Joshua Palmer

Gillmor blames, in part, the “basket of goods” economic philosophy.

“Our economists for decades have been talking about the basket of goods. The cheaper the basket of goods, the better it is for the consumer,” she said. “But they are not looking at the importance of preserving open space, they are not looking at the carbon footprint and they are not looking at food security.”

But Gillmor said she believes Utah residents want to purchase home-grown food products, they just need to know how.

“Being self-sufficient is part of our cultural heritage.”

She pointed to the growing popularity of farmers markets, which have taken on renewed importance in light of the pandemic.

There are at least 36 farmers markets across Utah that offer locally grown produce, meat and other products.

“The pandemic has been a gift as far as education and opening our eyes to our food supply and how important it is to all of us and and how important our local food system is,” Gillmor said.

“There has been a renaissance since the pandemic regarding the Utah’s Own program. The number of producers coming to us has increased, the website visitations have increased and people are just waking up the importance of local food.”

Buying local

The Utah’s Own program connects Utah producers to Utah consumers, keeping more locally produced goods in the state and reducing the miles those products have to travel.

Utah is also one of only five states in the country that lacks a “food hub,” but that is about to change with applications for grants that are available through the state.

Food hubs not only shorten the food supply chain and but can help tackle the amount of food that ends up in landfills that contribute to even more emissions.

Under the food hub model, a group of five to six farms can pool their resources to “aggregate” the production and harvesting of food. Gillmor said one example is to take fruit and vegetables that are not “pretty” enough to be sold in stores, clean them up, cook them or flash freeze for delivery to schools or hospitals.

“It can reduce food waste significantly and you are using local food for the local market.”

In another example of connecting Utah food with Utah consumers, Farmers Feeding Utah debuted last year after the pandemic struck. Launched by the Utah Farm Bureau, the program connects “food insecure” consumers with local producers who were faced with dumping milk, letting produce go to waste or selling off livestock due to the supply chain disruptions.

Through the Miracle of Agriculture Foundation created by local ranchers and farmers, more than 1.5 million pounds of food were distributed to more than 35,000 hungry Utah individuals and their families.

Keeping Utah food in Utah

In July, Farmers Feeding Utah launched a subscription service featuring only Utah products that can be delivered to consumers’ doorsteps.

The program will deliver new products each month, with the July offering including ribeye steaks, ground beef, tart cherries, cheese curds and more.

“We knew if Utahns would just taste local, they’d fall in love with it, so we decided to create an online farmers market to deliver Utah-grown food right to their doors,” said Ron GIbson, president of the Utah Farm Bureau.

The program supports Utah ranchers and farmers by paying them above the wholesale rate.

“One of our missions is for farmers to thrive, not just survive,” said Joshua Palmer, CEO of Cogburn Wire Co. and GovFriend Inc., which developed the software for the program and coordinates the orders and deliveries.

“I think it is a good thing to know you are supporting your neighbor.”

For every subscription, Palmer’s company and Farmers Feeding Utah will pledge a donation to the program to help underserved residents who are food insecure.

“I think there are so many benefits to this. When a semitruck is going across country to deliver food some place, there are emissions going along with it,” he said. “When the products are from Utah, being shipped in Utah, it is much different than being flown in from somewhere else. Every one of those stops have a carbon footprint.”

So far, more than a 1,000 households have signed up for the “Touch of Utah,” subscription service, from Logan to St. George.

Each monthly box contains unique products, and subscribers also have access to an online market to have their favorite products delivered in a separate shipment.

Palmer said subscriber rates doubled in just a few days.

“What it shows is that one, Utahns don’t want to see farms go away, and two, Utahns support their neighbors and it is really inspiring to see that,” he said. “We are humbled by the support we have seen.”

Each box costs $99.99.

“We know that $99.99 a month is a heavy lift for some people, but we did everything we could to make this be something reasonable.”

Palmer said he believes the quality of the food will win over people’s taste buds and wallets.

“There is nothing that goes out in these boxes that I have not tasted. There is a quality standard. It has to be a Utah producer and that producer has to deliver quality. And it is on us to deliver that kind of quality so people don’t want to cancel.”

Palmer, who helped establish Farmers Feeding Utah, said subscriber support will help keep Utah ranchers and farmers in business, help the “food insecure,” and help to preserve open space.

“I think being able to tell our kids and grandkids that we are going to go visit a farm is a really important thing and we think this can help.”

July jobs report could be what gives the market its next big jolt in the week ahead

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- More than a quarter of S&P 500 companies report in the week ahead, but the July jobs report on Friday will be what matters most to markets.

- One strategist said the jobs number could be a “game changer” since a strong number could encourage the Federal Reserve to tighten policy, while a weak number could delay it from paring back bond purchases.

Friday’s jobs report could be a catalyst that helps determine whether markets are volatile or will trade like it’s the quiet dog days of August.

More than a quarter of the S&P 500 report earnings in the coming week. The calendar includes companies in sectors such as consumer staples, insurance, pharma, travel and media. From Booking Holdings to ViacomCBS, Wayfair and Kellogg, investors will be watching to see what companies say about reopening activity, supply chain disruptions and rising costs.

“I think as much as 85% of the companies which are reporting earnings mentioned inflation on their earnings calls,” Franklin Templeton Fixed Income chief investment officer Sonal Desai said. “Inflation may not be a problem to policymakers and financial markets, which seem not to be concerned at all. It does seem to bother the people who have to buy stuff or people who produce stuff.”

The jobs factor

The Federal Reserve has said the sharp jump in inflation is just temporary, and many investors appear to be taking it in stride for now. The market is intensely focused on the central bank’s other mandate: the labor market. Fed Chairman Jerome Powell said Wednesday he would like to see strong jobs reports before winding down the central bank’s $120 billion a month bond-buying program.

The U.S. Bureau of Labor Statistics will release the July employment report on the morning of Friday, Aug. 6. It’s expected to show 788,000 nonfarm payrolls, down from 850,000 in June, according to Dow Jones. The unemployment rate is expected to dip to 5.7% from 5.9%. Average hourly wages are expected to rise 3.9% year over year.

Ironsides Macroeconomics director of research Barry Knapp said he expects the next two monthly jobs reports will be strong, and the Fed should then be ready to announce in September that it is ready to start the slow unwind of its bond purchasing program.

That is an important step since it would be the first real move away from the central bank’s easy policies that were put in place in the pandemic. It would also mean the Fed would be open to raising interest rates once the tapering is completed.

https://datawrapper.dwcdn.net/60pDw/1/ Game changer for markets

“Friday could be a game changer,” Knapp said of the employment report. Before that, he expects stocks to trade in a narrow range.

If the number of jobs added in July is much higher than expected, at more than 1 million, Knapp said the market could immediately sell off on the idea the Fed would be ready to pare back its bond purchases.

If the number is weaker than expected, the market could rally. “We are in a dead period after earnings, with concerns about the pace of the reopening. It’s still a bit of a question mark. The bias would be higher after a weak number. … Bad is good. Good is bad,” said Knapp.

Like some other strategists, he expects to see a stock market correction, possibly later this summer.

“I’m in the camp where I think we’re going to have our first major correction.” Knapp said. “What we’re likely to get is at least 10% or more. … It could really happen when they [Fed officials] make the announcement in September.”

Wilmington Trust chief economist Luke Tilley said he expects just 350,000 jobs, based on the high frequency data he watches.

“We think the run rate is about 500,000 jobs. Last month seems a little bit overcooked,” he said.

Reflation trade

The S&P 500 was down 0.4% in the past week, finishing at 4,395, while the Nasdaq lost even more , down 1.1% at 14,672.

Cyclical stocks were among the best performers. Materials jumped 2.8% in the week, and energy shares were up 1.6%. Financials gained 0.7%. But tech fell 0.7%.

Knapp said it now makes sense to hold stocks that are in the reflation trade, such as energy, industrials or materials.

https://datawrapper.dwcdn.net/EUcUT/1/ The surge in the delta variant of the coronavirus has become a worry among investors and has been a factor holding down interest rates. The 10-year yield, which moves opposite price, has held at low levels and was at 1.23% on Friday, amid concern that the delta variant of the coronavirus could slow growth.

Investors will be watching other important data in the coming week, including the Institute for Supply Management’s manufacturing data Monday, and jobless claims and trade data Thursday.

The China trade

China was also a dominant market story in the past week and could continue to be. Hong Kong’s Hang Seng Index fell 5% for the week. Chinese regulators continued their crackdown on internet companies, publicly traded education companies and other industries.

Strategists say Beijing is trying to reclaim its biggest companies as its own and turn them away from listings in foreign markets. Officials were particularly upset with Didi Global which reportedly went public even after being warned not to by Beijing.

Chinese regulators reportedly spoke with international banks after their actions sparked a wave of selling in internet stocks and the broader Chinese stock market. The regulators said companies could continue to go public in the U.S. if they met listing requirements.

“We will continue to see regulators try to calm the waters. I would say this was a communications misstep,” said Franklin Templeton’s Desai. “You don’t have massive swings without having negative impact.” She added it sent ripples through emerging markets.

“This is China trying to gain control, and they tried to do it in a very heavy way, and they were surprised at the backlash,” Desai said.

https://datawrapper.dwcdn.net/OLYXE/1/ The KraneShares CSI China Internet ETF has lost about half its value from its peak in February, and was down another 2.6% Friday.

Internet retailer Alibaba is one of the ETF’s top holdings. The company is expected to announce earnings on Tuesday.

Week ahead calendar

Monday

Earnings: Take-Two Interactive, Mosaic, Vornado Realty, Eastman Chemical, Simon Property, Transocean, Pioneer Natural Resources, Reynolds Consumer Products, ON Semiconductor, NXP Semiconductor, AXA, Loews

9:45 a.m. Manufacturing PMI

10:00 a.m. ISM manufacturing

10:00 a.m. Construction spending

2:00 p.m. Senior loan officer survey

Tuesday

Earnings: Alibaba, Amgen, Eli Lilly, Clorox, KKR, Under Armour, Eaton, Discovery, Pitney Bowes, Marriott, ConocoPhillips, Activision Blizzard, Avis Budget, Public Storage, Devon Energy, Jacobs Engineering, Bausch Health, Incyte, Philips 66, Ralph Lauren, Expeditors International, Nikola, Warner Music

10:00 a.m. Factory orders

11:00 a.m. New York Fed release on household debt and credit

Wednesday

Earnings: Booking Holdings, CVS Health, GM, Etsy, MGM Resorts, Allstate, Uber, Fox Corp., Electronic Arts, Roku, Kraft Heinz, Toyota, Sony, AmerisourceBergen, Marathon Petroleum, BorgWarner, Entergy, Apollo Global Management, New York Times, Scotts Miracle-Gro, Tupperware, MetLife, IAC/Interactive

8:15 a.m. ADP employment

9:45 a.m. Services PMI

10:00 a.m. ISM services

Thursday

Vehicle sales

Earnings: Regeneron, ViacomCBS, Beyond Meat, DropBox, Expedia, Sprouts Farmers Market, TrueCar, Shake Shack, Square, TripAdvisor, Cushman and Wakefield, Kellogg, Cigna, Zillow, Lions Gate, Ambac, Virgin Galactic, Motorola Solutions, Zynga, Illumina, AIG, SeaWorld, Cardinal Health, Duke Energy, Thomson Reuters, Datadog, Eventbrite, NRG Energy, Choice Hotels, Parker-Hannifin, Wayfair, Zoetis

8:30 a.m. Initial jobless claims

8:30 a.m. International trade

Friday

Earnings: Liberty Broadband, Liberty Media, AMC Networks, Draftkings, Fluor, Gannett, Canopy Growth, Nuance Communiciations, Goodyear Tire

8:30 a.m. Employment report

10:00 a.m. Wholesale trade

3:00 p.m. Consumer credit

Update: This story has been updated to show there is no event with Boston Fed President Eric Rosengren Monday

HI Financial Services Mid-Week 06-24-2014