HI Market View Commentary 06-28-2021

What is the most important “thing” in relation to successful investing or trading

My most important “thing” for successful investing = TIME

My Quote of the Day: The blockchain concept was pioneered within the context of crypto-currency Bitcoin, but engineers have imagined many other ways for distributed ledger technology to streamline the world. Stock exchanges and big banks, for example, are looking at blockchain-type systems as trading settlement platforms. Anthony Scaramucci

BlockChain is the easiest way for someone to blackmail someone else?!??!!!!!!!

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF JUN. 21 THROUGH JUN. 25, 2021 |

| The S&P 500 index rose 2.7% last week to a new closing high as the energy and financial sectors led a broad advance that more than wiped out last week’s 1.9% tumble. The market benchmark ended Friday’s session at 4,280.70, up from last Friday’s closing level of 4,166.45 and marking a record closing high. The index also reached a fresh intraday high Friday at 4,286.12. The S&P 500 had been down 0.9% for the month of June as of last week’s close, but last week’s climb sent the index back into the black for the month; it is now up 1.8% for June to date, with just three sessions remaining in the month. It is also up 14% for the year to date. The rally came as investors grew more comfortable with the Federal Reserve’s warnings last week that it may raise rates by late 2023, which is sooner than previously anticipated. The market was encouraged to see President Joe Biden and a group of senators agreed on a $1 trillion infrastructure plan. The agreement calls for new investments in the electrical grid, transit, roads and bridges and other forms of infrastructure. Every sector got swept up in the weekly advance. The energy sector had the largest percentage gain of the week, up 6.7%, followed by financials, up 5.3%, and industrials, up 3%. The weakest sector was utilities, which still edged up 0.7%. The energy sector’s jump came as crude oil futures rose amid a report showing US oil inventories fell by 7.6 million barrels last week to their lowest level since March 2020, while gasoline inventories also dropped. The larger-than-expected drop also marks the fifth consecutive decline and was seen as an indication that demand is continuing to improve from pandemic lows, including a near-doubling of aviation fuel demand from a year earlier. Among the sector’s gainers, shares of Occidental Petroleum (OXY) jumped 18% last week. The stock has been the recipient of a number of positive analyst actions recently, including a price target boost from BMO Capital last week and an investment rating upgrade from Morgan Stanley last Friday. Morgan Stanley, which now has an overweight rating on the stock, up from equal-weight, said it now sees the oil producer as having a “more compelling risk-reward against a backdrop of sustained higher oil prices.” The financial sector was boosted by a report from the Federal Reserve Board saying all 23 large banks remained “well above” risk-based minimum capital requirements in its annual stress test results. As a result, additional restrictions put in place during the COVID-19 pandemic will come to an end, the Fed said late Thursday. Gainers included Wells Fargo (WFC), whose shares rose 11% on the week, and Citigroup (C), up 5.8%. Among the stocks keeping a lid on the utilities sector’s gains, shares of Evergy (EVRG) fell 1.4% last week as Wells Fargo downgraded its investment rating on the power supplier’s stock to equal-weight from overweight. Next week, the biggest focus of the week among economic data will be the June nonfarm payrolls and unemployment rate due Friday from the Labor Department. Investors will also be parsing the ADP employment report on the private sector on Wednesday and the Labor Department’s weekly jobless claims on Thursday for indications of what to expect Friday. Other data set to be released next week include June consumer confidence on Tuesday, May pending home sales on Wednesday and May construction spending on Thursday. Provided by MT Newswires |

Earnings Dates

AAPL – 07/29 est

BA – 07/28 est

BABA – 08/19 est

BAC – 07/14 BMO

BIDU – 08/12 est

COST – 09/23 AMC

DIS – 08/03 est

F – 07/28 AMC

FB – 07/28 est

FSLR – 07/29 est

GE – 07/27 est

GM – 08/04 AMC

JPM – 07/13 BMO

MU – 06/30 AMC

TGT – 08/19 BMO

UAA – 07/29 est

V- 07/27 est

Where will our markets end this week?

Flat

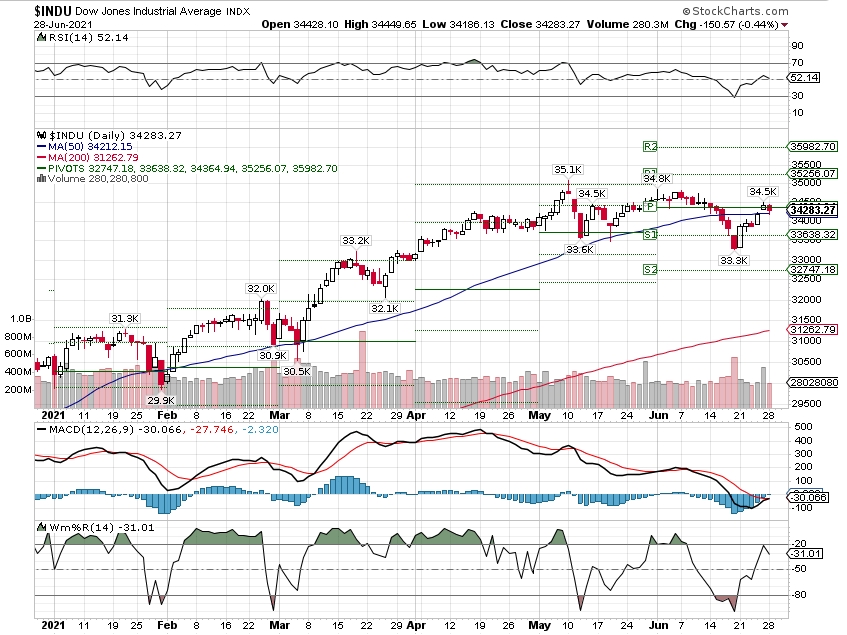

DJIA – Bullish

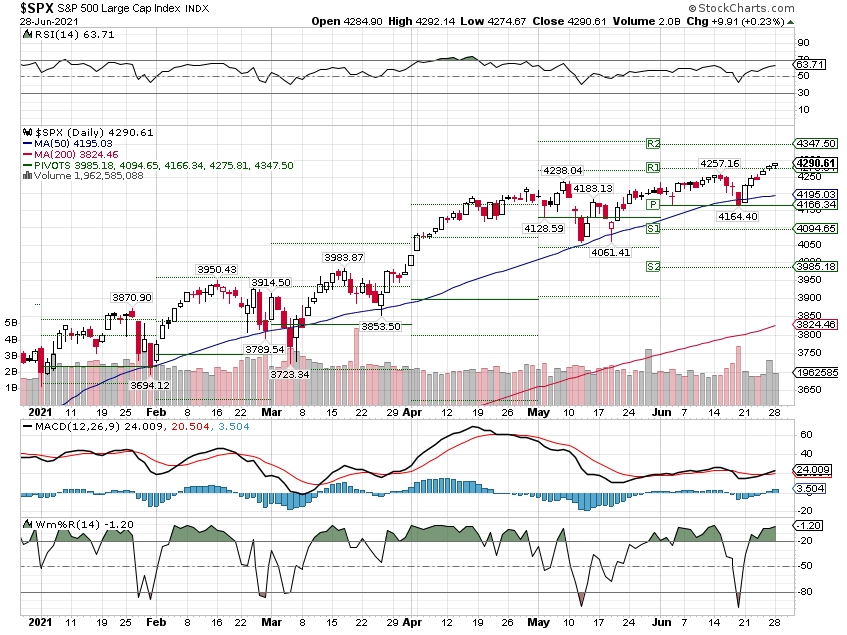

SPX – Bullish

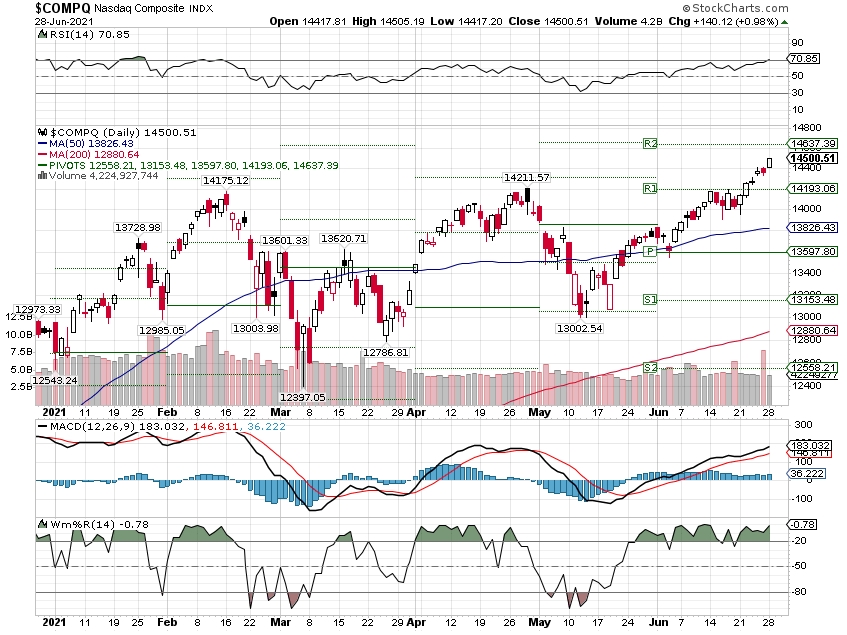

COMP – Bullish

Where Will the SPX end July 2021?

06-21-2021 3.0%

Earnings:

Mon: MLHR

Tues:

Wed: BBBY, STZ, GIS, MU

Thur: MKC, WBA

Fri:

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, S&P Case Shiller, Consume Confidence

Wed: MBA, ADP Employment, Chicago PMI, Pending Home Sales,

Thur: Initial Claims, Continuing Claims, Construction Spending, ISM Index

Fri: Average Workweek, Non-Farm Payroll, Private Payroll., Hourly Earnings, Unemployment Rate, Factory Orders, Trade Balance

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

June 25, 2021

Robinhood’s IPO Plans Slowed By SEC Review

by Bloomberg News

Bloomberg – Robinhood Markets Inc., which had sought to go public this month, has seen its listing plans slowed in recent weeks by a back-and-forth with regulators over its prospectus, according to people familiar with the matter.

Robinhood’s growing cryptocurrency business, which was rolled out in 2018 and now allows customers to trade Bitcoin, Ethereum and even Dogecoin, has drawn questions from the U.S. Securities and Exchange Commission, one of the people said, asking not to be identified because the matter is private.

While a listing might come this summer, the popular trading app’s plans could also slip into the fall, one of the people said. The company aims to reveal its financials as soon as possible and to go public once the SEC finishes its review, they said.

Robinhood said it filed confidentially for an initial public offering in March. It had been targeting June for its IPO but that plan slipped to July, Bloomberg News has reported.

A representative for Robinhood declined to comment. An SEC spokesperson declined to comment, citing the agency’s policy of not commenting on specific filing reviews.

WILD RIDE

Robinhood soared in popularity — and controversy — during the coronavirus pandemic. With about half of Robinhood users being first time investors, the app can often serve as a path for novices into potentially volatile assets.

Earlier this year, Chief Executive Officer Vlad Tenev was called to testify in front of U.S. lawmakers about Robinhood’s role in the frenzied trading of GameStop Corp. stock. He told the House Financial Services Committee in February that the brokerage fell short but will improve from the experience.

Crypto markets, too, have had a particularly wild ride this year. The price of Bitcoin briefly jumped above $64,000 in mid-April, egged on by high-profile advocates like Elon Musk. The rally didn’t last, and Bitcoin dipped below $40,000 in June. The SEC, under new Chairman Gary Gensler, is poised to make a number of critical rulings on the virtual tokens in coming months.

Robinhood’s application comes amid a busy year at the SEC for IPOs including those for special purpose acquisition companies, creating a backlog of equity capital markets work. Agency staff warned lawyers this year that it may take 30 days to review paperwork for SPACs and to expect an additional two weeks to hear back on changes or amendments, Bloomberg News reported.

It’s not uncommon for companies to see their listings slip when their paperwork is under review. Coinbase Global Inc. moved its direct listing from March to April while it was awaiting approval, Bloomberg News previously reported.

Robinhood appointed new board members this month. It also announced it would enable customers to buy into IPOs, including its own listing.

How companies can drum up enthusiasm for a return to the office and vaccines

PUBLISHED SAT, JUN 26 202110:30 AM EDT

KEY POINTS

- Companies should pick a concise strategy surrounding vaccines, allow employees to voice opinions on returning to the office, and be transparent about how decisions are made.

As companies design plans to bring workers back into the office, chief human resources officers are contending with a plethora of issues. Do they mandate vaccines or simply urge employees to get them? How should hybrid schedules be decided and does innovation suffer when people continue to work from home?

These questions and more were addressed by Katy Milkman, a professor at The Wharton School of the University of Pennsylvania, and author of the new book, How to Change: The Science of Getting From Where to Where You Want to Be. She joined CNBC’s Workforce Executive Council’s Town Hall on Thursday to help CHROs figure out the best ways to make long-lasting change and get employees on board with new ways of operating as we all move forward.

Pick a concise strategy around vaccines

While the United States inches closer to herd immunity against Covid-19, virus variants and a total death toll surpassing 600,000 are heightening hesitancy about returning to the office. Milkman said companies should pick a clear strategy surrounding vaccines to alleviate concerns.

There is a spectrum of strategies that companies can take when it comes to vaccines, said Milkman. On one hand, she said, it is legal for companies to mandate vaccinations before returning to work.

Morgan Stanley recently announced it will require employees to show proof of vaccination while JPMorgan will urge vaccinations but also require employees to log their vaccination status on a company portal before coming back to the office.

With mandates as an option, a swath of companies such as American Airlines, Kroger and Target are continuing to incentivize employees to get vaccinated through cash prizes, paid time off and transportation to vaccine sites.

If companies do not feel comfortable mandating or incentivizing, Milkman said they can take a “softer approach” by using communication strategies to encourage vaccination. One approach is emphasizing vaccines belong to employees. When people feel like something belongs to them, they are less likely to give it up, she said.

“Just communicating that a vaccine is reserved for you can increase vaccination rates substantially at very little cost,” Milkman said.

Be transparent with the return-to-work decision

While companies like Dropbox are allowing employees to continue working from home, others such as Apple and Bank of America are expecting employees back in the office by September.

No matter what plan a company chooses, Milkman said they should be transparent with their employees on how decisions are made and why the ultimate decision was chosen.

“The best practice is figuring out what is best for your business and, in terms of communicating it, doing so with empathy, clarity and the ability to have conversations with people,” Milkman said.

Allow employees to vocalize their opinions

In a response to Apple’s decision, employees started protesting the return-to-work plan in early June and urged the company to allow teams to decide individual plans.

There are two key factors in how employees respond to decisions that are made, Milkman said. One factor is whether or not they like the decision, and the other is whether they think the process in reaching the decision is fair or not.

“The elements that influence whether we think the process is fair include feeling like my voice was heard,” Milkman said. “Was I surveyed? Was I asked for my opinion? Maybe you made a different decision, but at least you heard me, and other voices in the organization were a part of this decision.”

Google initially planned to bring all employees back into the office by September, but later changed their plan to allow more employees to work from home, or outside of the office in some capacity. Other tech giants like Twitter and Facebook are giving their employees the choice to continue working from home.

“The emotional response people have to a decision like this is driven more by the procedure feeling fair than by the outcome itself,” Milkman said.

I built a 6-figure investment portfolio while paying off my 6-figure debt: Here’s my best advice

Published Sat, Jun 26 202110:30 AM EDT

Today I have a six-figure investing portfolio and have paid off $169,000 in consumer debt and counting. But for a long time, the notion of tackling even one of these money goals was daunting, let alone the idea of accomplishing both at the same time.

In my 20s, I was accruing debt, I wasn’t saving — not even a small emergency fund — and I knew nothing about investing. This combination led me to make one of my first big financial mistakes.

I recovered, though, and now, as a confident and consistent investor, I have learned that it is possible to achieve multiple money goals at the same time. Here is my best advice.

Don’t let early mistakes hold you back

At my first job out of school, I started putting money into my employer 401(k). A couple years later, after being laid off, I decided to take some money out of my retirement account to help cover bills and keep me in my home while I looked for another position.

What I didn’t know was that I would be hit with a tax penalty for taking that money out early. It was something of a shock the next winter when I got a statement from the IRS the following year saying that I owed them $5,000. I promised myself then that I would never do that again.

While I did open a new 401(k) and a Roth IRA at my new gig, I still felt like I didn’t have enough financial savvy to make the right calls when it came to my investments. For over a decade, I took this hands-off approach.

Finally, in 2014, when my husband and I got married and we started combining our finances, I decided that I wanted to learn more about investing, especially if we wanted to ensure that we were working together to build generational wealth for our family.

Ask for help when you need it

In December 2014, I met with a financial advisor for the first time. They walked me through financial concepts like compound interest and helped me understand how mutual funds work.

Even the meeting with the advisor was new territory for me. I had never gotten help from one before because I always thought they only worked with high net-worth individuals or big financial institutions.

I started reviewing my investing statements consistently and began figuring out how I could accelerate the growth of my retirement savings.

My husband and I also started having regular discussions about how we wanted to grow our retirement savings over the next 10 to 15 years. That helped lay the groundwork for tackling my other financial goals.

1

Start small (it can make a big difference)

When I started investing, the only thing I knew was that my first company offered to match my contributions, so that seemed like a good place to start. At my second job, when I opened the 401(k) and the Roth IRA, I had minimal guidance or training about how to choose the best performing mutual funds, and there were a limited amount of investing options.

I chose a selection of target funds based on my estimated retirement date, but I rarely tracked their performance or made any changes, like regularly upping my contributions or choosing a better-performing mutual fund.

When I looked at my quarterly statements, I could see that my investments were growing, if not up to their full potential. But not knowing much about how to navigate the stock market made it feel intimidating, and I didn’t want to make any more mistakes.

After that initial meeting with the advisor, I decided to take control by starting small. In my 20s, I started investing $50 per pay period in my employer’s 401(k) plan, and that strategy remained largely unchanged for many years. But in 2014, after assessing what I was able to comfortably contribute to the 401(k), that amount went up to $300 per pay period and increased over time.

Make room in your budget to pay yourself first

When I started budgeting in April 2018 as part of my debt-elimination plan, I created budget items to allocate some of my savings to my emergency fund and my retirement accounts.

Every month, my goal is to save at least $800 towards my retirement accounts. In order for me to stay disciplined to consistently “pay myself first,” I set up an automated deposit into my retirement accounts every month.

This system has helped me develop my savings habit because I know my money has been invested before it touches my hands. Now when I receive a tax refund or any additional income, after that base $800 has been allocated, any additional money will go to my retirement accounts.

I aim to put at least $1,000 a month towards my debt. In the past, any month that I felt I couldn’t cover both debt repayment and save for retirement, I still contributed a reduced amount to my retirement account and prioritized the debt payment.

Over time I’ve learned how to set up my budget each month and make adjustments to reduce my expenses in order to make it feasible to build wealth and eliminate debt at the same time.

Invest consistently and for the long term

When the pandemic began in March 2020, I made a concerted effort not to panic about my investments. I decided to keep consistently investing $50 each month into my Roth IRA. At one point, all my investments collectively went down $30,000 in a given month.

I knew based on my previous experience with the economic downturn in 2008 that even though we were going through a volatile period, this was the best time to keep my money in the stock market, because eventually it would rebound.

At that point, I had been investing in my retirement accounts for several years and I didn’t feel compelled to stop my routine. My investment portfolio lost a significant amount of value in April 2020.

Because I stayed the course, I was able to recover the lost value, though, and make a return on my investment. I’ve learned that if you have the mentality that you are investing for the long term, you will be able to sustain the ebbs and flows of the stock market.

Stay current and open to learning new things

After that first meeting with my financial advisor, I wanted to learn as much as I could. I met with them several more times to learn about how to invest with mutual funds and annuities.

I started following financial news sources like CNBC and Morningstar to see if there were any major daily changes in the stock market. I also started following other personal finance experts like Suze Orman and Tiffany Aliche, The Budgetnista. I admired their stories and their advice for women investors inspired me.

Since the end of 2014, each quarter I make sure to thoroughly read over my retirement account statements to review the performance of my investments. Doing this keeps me current and helps me make informed choices about whether to keep my allocations the way they are or find other mutual funds that have a history of performing well.

Overall I feel like this investment in my understanding of the stock market has made me more confident about my financial decisions.

Today, in my financial coaching business, Dollars Makes Cents, I use my experience building a six-figure investing portfolio to help my clients get more confident about their investments. I tell my clients that it doesn’t matter where you are today, it’s all about your belief that you can build substantial wealth.

By taking small steps and investing a consistent minimum every month, you can develop your savings habit muscles to grow your wealth and create a financial legacy for your family.

Shaquana Watson-Harkness is a wealth literacy expert and personal finance contributor who has been featured within Grow and Black Enterprise. She is the founder of Dollars Makes Cents and her goal is to help professional millennial women achieve financial independence by shifting their mindset towards wealth building. You can follow her on Instagram or Facebook for more personal finance tips and resources.

‘If you earn $200,000 or less,’ use the 1% spending rule to save money, says finance expert—here’s how it works

Published Thu, Jun 24 202111:55 AM EDTUpdated An Hour Ago

Chris Browning, Contributor@POPCORNFINANCE

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

When you spend too much, a sense of shame or regret can overwhelm you — and even hold you back from your financial goals. On the other hand, not spending on the things or experiences that bring you joy can cause a sense of deprivation.

So how do you find the right balance?

As a financial analyst and host of the podcast Popcorn Finance, I get to hear about the creative strategies people use to curb their spending. One of favorites comes from Glen James, who hosts one of Australia’s top finance podcasts, My Millennial Money.

The 1% spending rule: To buy or not to buy?

During a conversation about how to spend money on things we enjoy without going broke, James told me about his 1% spending rule, which he came up with after he went to a department store with some friends — and ended up buying an Apple Watch for $1,300.

“It was a problem because when I woke up that morning, I wasn’t planning to buy watch that cost over a thousand dollars,” said James, who describes himself as a “compulsive spender.”

So immediately, he decided that he “needed a way to govern” his spending.

James’ 1% spending rule (not to be confused with the 1% rule in real estate) is straightforward: If you want to spend on something — a non-necessity — that costs or exceeds 1% of your annual gross income, you must wait one day before buying. During that time, ask yourself: Do I really need this? Can I afford it? Will I actually use it? Will I regret it?

If, after a good night’s rest, it still seems like a good idea, then go ahead and make the purchase.

Let’s say your annual gross salary is $60,000, and you want to buy a rug that costs $600 (1% of $60,000). You would need to wait a day before making a decision. Even if the rug you have now is worn down, you might decide, for example, that $600 is too much, and that you could easily do with something cheaper.

It’s a good rule ‘for anyone earning $200,000 or less’

“Now, the 1% rule just a guide — it’s simple and really works for me,” said James.

However, he mostly recommends it “for anyone earning $200,000 or less” a year. “If you’re making $2 million a year, it probably won’t work for you,” he said. “For super high earners, 1% of their annual pay may set a limit amount that’s too high.”

Then again, 1% may also be too much for low earners. In that case, James suggests setting a smaller cap: “You could change it to the 0.5% rule. Whatever the percentage, it should make sense based on your financial situation, needs, goals and priorities.”

Of course, there are other variations of spending rules, but many place a strict cap (a.k.a. you are not allowed to spend more than $X on something). James’ version is unique because it acts “more like a mental checkpoint” — a reminder to think before acting, establish boundaries and identify trigger points.

“Maybe you want to save to buy a home or for early retirement. Winning at personal finance often starts at the shop counter or the online checkout page,” said James. “So if you can limit that spending, you can save money and reach your goals faster.”

The 1% rule isn’t for everyone. Just remember that the best strategies for managing your money are the ones that are simple enough to stick with for years to come.

Chris Browning is financial analysis and creator and host of the award-winning podcast Popcorn Finance. He holds a bachelor’s degree in finance and also works as a financial analyst specializing in revenue analysis. Follow him on Instagram @PopcornFinancePodcast.

Warren Buffett is ‘halfway’ through giving away his massive fortune. Here’s why his kids will get almost none of his $100 billion

Published Wed, Jun 23 20215:02 PM EDTUpdated Wed, Jun 23 20217:33 PM EDT

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Warren Buffett is now halfway toward his goal of giving away his massive fortune, but even though he still has $100 billion left to give, he’s not planning on sharing it with his children.

The investing legend on Wednesday reiterated his long-held belief that his “incomprehensible” net worth would be better spent going toward philanthropic causes than into his kids’ investment portfolios.

“After much observation of super-wealthy families, here’s my recommendation: Leave the children enough so that they can do anything, but not enough that they can do nothing,” he said in a note to shareholders, adding that his own adult children “pursue philanthropic efforts that involve both money and time.”

The 90-year-old says that he has observed that dynastic behavior — or the passing along of massive wealth from one generation of a family to another — is less common in the U.S. than in other countries, and that he believes its appeal will likely diminish.

That’s not to say that Buffett’s kids, now in their 60s, haven’t received anything from their dad. Each child has a $2 billion foundation funded by Buffett, The Washington Post reported in 2014.

Buffett’s note announced that he had donated $4.1 billion worth of his Berkshire Hathaway shares to five charitable foundations as part of his effort to give away 99% of his wealth by the end of his life, bringing his total donation tally to $41 billion.

The Berkshire Hathaway CEO, who at one point was the world’s richest man and currently sits on a fortune worth more than $100 billion according to Forbes, plans to distribute his remaining 238,624 shares to philanthropic causes.

Buffett calls his philanthropy “the easiest deed in the world” because “the giving is painless and may well lead to a better life for both you and your children.”

Society has a use for my money; I don’t.

Warren Buffett

CEO, BERKSHIRE HATHAWAY

“Over many decades I have accumulated an almost incomprehensible sum simply by doing what I love to do,” he said. “I’ve made no sacrifice nor has my family. Compound interest, a long runway, wonderful associates and our incredible country have simply worked their magic. Society has a use for my money; I don’t.”

Buffett first announced his plan to give away the vast majority of his fortune in 2006, when he was 75 years old and owned 474,998 shares of Berkshire Hathaway. With Wednesday’s announcement, the Oracle of Omaha said that he is “halfway there.”

‘Nike Is a Brand That Is of China and for China,’ Company’s CEO Says

Company has recently been under fire over concerns of forced labor in communist China

June 26, 2021 Updated: June 27, 2021

Nike’s chief executive said that the corporation is a “brand that is of China,” amid recent allegations of the company being connected to human rights violations conducted by the Chinese Communist Party (CCP).

“Nike is a brand that is of China and for China,” CEO John Donahoe told Wall Street analysts last week in response to a question about competition from Chinese companies during a call about fourth-quarter earnings, the BBC reported.

“We’ve always taken a long-term view. We’ve been in China for over 40 years,” Donahoe said, expressing his optimism that the brand will continue to grow quickly in the world’s most populous country.

Donahoe also referred to the apparel brand’s co-founder and former CEO, Phil Knight.

“Phil invested significant time and energy in China in the early days, and today we’re the largest sports brand there,” he said.

Nike was recently criticized by a U.S. senator for turning a blind eye to allegations of forced labor in China, arguing that they’re making American consumers complicit in Beijing’s repressive policies.

Speaking at a Senate Foreign Relations Committee hearing on China’s repression of Uyghurs and other Muslim minorities in its western Xinjiang region, Sen. Marco Rubio (R-Fla.) said many U.S. companies hadn’t woken up to the fact that they were “profiting” from the Chinese government’s abuses.

“For far too long, companies like Nike and Apple and Amazon and Coca-Cola were using forced labor. They were benefiting from forced labor or sourcing from suppliers that were suspected of using forced labor,” Rubio said on June 10. “These companies, sadly, were making all of us complicit in these crimes.”

Rights groups, researchers, former residents, and some Western lawmakers say that Xinjiang authorities have facilitated forced labor by arbitrarily detaining around one million Uyghurs and other primarily Muslim minorities in a network of camps since 2016.

Sophie Richardson, China director for Human Rights Watch, told the Senate panel that Beijing’s “extreme repression and surveillance” made human rights due diligence impossible for companies.

Nike officials didn’t respond to a request for comment by press time.

Reuters contributed to this report.

How Biden, Democrats and GOP senators like Mitt Romney struck a bipartisan infrastructure deal

By Katie McKellar, Deseret News | Posted – June 24, 2021 at 4:29 p.m.

SALT LAKE CITY — After President Joe Biden announced Thursday “we have a deal” and gave a bipartisan group of senators the thumbs up on a massive, $579 billion infrastructure spending plan, Sen. Mitt Romney, R-Utah, applauded the president for showing “Republicans and Democrats can work together.”

“I believe that he recognizes that it’s important that we work in a bipartisan basis, and he recognizes the significance of communicating in our country and, frankly, around the world that America works,” Romney said on a call with reporters Thursday afternoon.

Romney pointed to Biden’s inaugural pledge to work in a more bipartisan fashion, “and this shows, in fact, the president was able to work on a bipartisan basis.”

Romney was part of an eight-member group of Republican and Democratic senators that pitched the infrastructure spending plan, which would add $579 billion in new spending to total $973 billion over five years, or $1.2 trillion over eight years. Biden originally sought about $2 trillion.

Biden announced the deal during a surprise appearance in front of the cameras after an agreement was reached at the White House. The plan, with rare bipartisan backing, could open the door to the president’s more sweeping $4 trillion proposals later on, the Associated Press reported.

Not everyone got what they wanted, Biden said. Other White House priorities — what Biden has called “human infrastructure,” including family plans and child care tax credits — would be addressed separately in a congressional budget process known as reconciliation, in which Democrats wouldn’t need Republican support.

“This reminds me of the days we used to get an awful lot done in the U.S. Congress,” Biden said. “We actually worked (together). We’ve got a bipartisan deal. Bipartisan deals mean compromise.”

The deal was reached amid months of partisan rancor, yet Biden, who began his administration with a pledge for bipartisanship, has insisted a compromise could be reached despite skepticism from many within his own party.

The group of senators was led by Republican Sen. Rob Portman of Ohio and Democrat Sen. Kyrsten Sinema of Arizona.

To strike the deal, Romney told reporters, Republicans did have to concede to some items on Biden’s wish list, including $66 billion for rail, which Romney said was a “high priority” for Biden, who has a long history of supporting the railroad that has earned him the nickname “Amtrak Joe.”

“The Republican group did not want to expand Amtrak at all and wanted to reduce the number even more,” Romney said. He noted Biden had originally sought $82 billion for rail, but Republicans were able to negotiate that down to $66 billion. “But we didn’t get it down as much as we would have liked.”

Romney also said Biden originally wanted more to fund transit infrastructure, but Republicans settled on $42 billion — still more than the GOP group members wanted. That’s the nature of negotiation, Romney said.

The interesting thing is, if you work on a bipartisan basis, there’s the prospect of actually getting something to become law … If you want to get something to actually happen, you have to work on a bipartisan basis, and that’s what our group does.

–Sen. Mitt Romney

“I think that there are a lot more of things that we got than things that we had to give up,” Romney said. “But there’s no question that Democrats got a number of things that they wanted that were not high on our priority list.”

By and large, Romney said, everyone agreed “this is good policy.”

“This is a good investment,” he said. “Our infrastructure needs help. You know, again, we’ve had president after president that wanted infrastructure. President Trump proposed $2 trillion in infrastructure spending. And that never was able to get done. And this goes a long way. It’s not as much as he wanted, but it goes a long way to upgrading our infrastructure.”

Romney said infrastructure is “a topic ideal for bipartisan work because we both recognize the need to improve our infrastructure.”

Romney hinted the bipartisan group of senators, while they consider the infrastructure plan “a great accomplishment,” expects to turn its sights on a new challenge. He said he and Sen. Kyrsten Sinema, D-Arizona, may look next to a proposal to raise the minimum wage.

“We’re going to keep working,” he said. “The interesting thing is, if you work on a bipartisan basis, there’s the prospect of actually getting something to become law … If you want to get something to actually happen, you have to work on a bipartisan basis, and that’s what our group does.”

The group of senators previously struggled over how to pay for the plan, but Romney said they’ve proposed a number of funding sources they’re confident will work.

“We found ways to pay for it,” Romney told reporters. “We’re not raising any taxes, and we’re not adding to the deficit. So we have not only a spending program but a funding program that balance and do not raise taxes.”

The bipartisan group has proposed a list of new funding sources, including repurposing unused money that’s already been allocated for COVID-19 relief, Romney said.

“So whether it’s the plan in January or the plans back in 2020, it was $120 billion of funds that were planning on going out with those programs that we instead move to this area,” Romney said.

Romney also said the group is proposing funds collected by ramped up enforcement of unemployment insurance fraud — an issue he said has cost the federal government an estimated $80 billion.

“We’re seeing numbers that suggest that there was massive fraud with regard to unemployment insurance, and we’re looking for recouping a good deal of that money through investment in additional agents in the Justice Department to go after people,” Romney said.

The senators have also proposed other financing sources, including reducing the IRS tax cap, redirecting unused employment insurance relief funds, allowing states to sell or purchase unused toll credits for infrastructure, extending expiring customs user fees, reinstating Superfund fees for chemicals, using 5G spectrum auction proceeds, extending the mandatory sequester and using funds from strategic petroleum reserve sales.

The senators also proposed state and local investment in broadband infrastructure, and using funds from public-private partnerships, private activity bonds, direct pay bonds and asset recycling for infrastructure investment.

The five-year infrastructure spending plan includes $312 billion for transportation and $266 billion for other infrastructure. Here’s a breakdown of how the new money would be spent, according to Romney’s office:

Transportation

- $109 billion for roads, bridges, major projects

- $11 billion for safety

- $49 billion for public transit

- $66 billion for passenger and freight rail

- $7.5 billion for electric vehicle infrastructure

- $7.5 billion for electric buses and transit

- $1 billion for “reconnecting communities”

- $25 billion for airports

- $16 billion for ports and waterways

- $20 billion for infrastructure financing

Other infrastructure

- $55 billion for water infrastructure

- $65 billion for broadband

- $21 billion for environmental remediation

- $73 billion for power infrastructure, including grid authority

- $5 billion for western water storage

- $47 billion for “resilience,” or prevention and response to emergencies including wildfires

Contributing: Associated Press

Federal Reserve gives U.S. banks a thumbs-up as all 23 lenders easily pass 2021 stress test

KEY POINTS

- The Federal Reserve, in releasing the results of its annual stress test, said that all 23 institutions in the 2021 exam remained “well above” minimum required capital levels during a hypothetical economic downturn.

- That scenario included a “severe global recession” that hits commercial real estate and corporate debt holders and peaks at 10.8% unemployment and a 55% drop in the stock market, the central bank said.

- While the industry would post $474 billion in losses, loss-cushioning capital would still be more than double the minimum required levels, the Fed said.

The Federal Reserve announced Thursday that the biggest U.S. banks could easily withstand a severe recession, a milestone for the once-beleaguered industry.

The Fed, in releasing the results of its annual stress test, said all 23 institutions in the 2021 exam remained “well above” minimum required capital levels during a hypothetical economic downturn. Bank shares popped after the release; the KBW Bank Index rose 1.5% at 5 p.m.

That scenario included a “severe global recession” that hits commercial real estate and corporate debt holders and peaks at 10.8% unemployment and a 55% drop in the stock market, the central bank said. While the industry would post $474 billion in losses, loss-cushioning capital would still be more than double the minimum required levels, the Fed said.

If there was an anticlimactic note to this year’s stress test, it’s because the industry underwent a real-life version in the past year when the coronavirus pandemic struck, leading to widespread economic disruption. Thanks to help from lawmakers and the Fed itself, banks fared extremely well during the crisis, stockpiling capital for expected loan losses that mostly didn’t materialize.

Nevertheless, during the pandemic, banks had to undergo extra rounds of stress tests and had restrictions imposed on their ability to return capital to shareholders in the form of dividends and buybacks. Those will now be lifted, as the Fed has previously stated.

“Over the past year, the Federal Reserve has run three stress tests with several different hypothetical recessions and all have confirmed that the banking system is strongly positioned to support the ongoing recovery,” Vice Chair for Supervision Randal K. Quarles said in a statement.

Dividend increases and buybacks coming

Following the passage of this latest exam, the industry will regain a measure of autonomy it lost since the last crisis. After playing a key role in the 2008 financial crisis, banks were forced to undergo the industry exam, and had to ask regulators for permission to boost dividends and repurchase shares.

Now, under something called the stress capital buffer framework, banks will gain flexibility in how they want to dole out dividends and buybacks. The stress capital buffer is a measure of capital each firm needs to carry based on the riskiness of their operations. The new regime was supposed to start last year, but the pandemic intervened.

“So long as they stay above that stress capital buffer requirement and all their other requirements every quarter, a bank can technically do whatever it chooses to do with regards to buybacks and dividends,” Jefferies bank analyst Ken Usdin told CNBC this week.

During a background call with reporters, senior Fed officials pushed back against the idea that the new regime resulted in a free-for-all. Banks are still subject to restrictions, and the Fed is confident that the stress capital buffer framework will protect their ability to support the economy during a downturn, they said.

While analysts have said they expect the industry can hike buybacks and dividends by tens of billions of dollars starting in July, the Fed has instructed lenders to wait until Monday afternoon to disclose their plans, according to people with knowledge of the situation. That’s when a flurry of press releases is expected.

HI Financial Services Mid-Week 06-24-2014