HI Market View Commentary 05-03-2021

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF APR. 26 THROUGH APR. 30, 2021 |

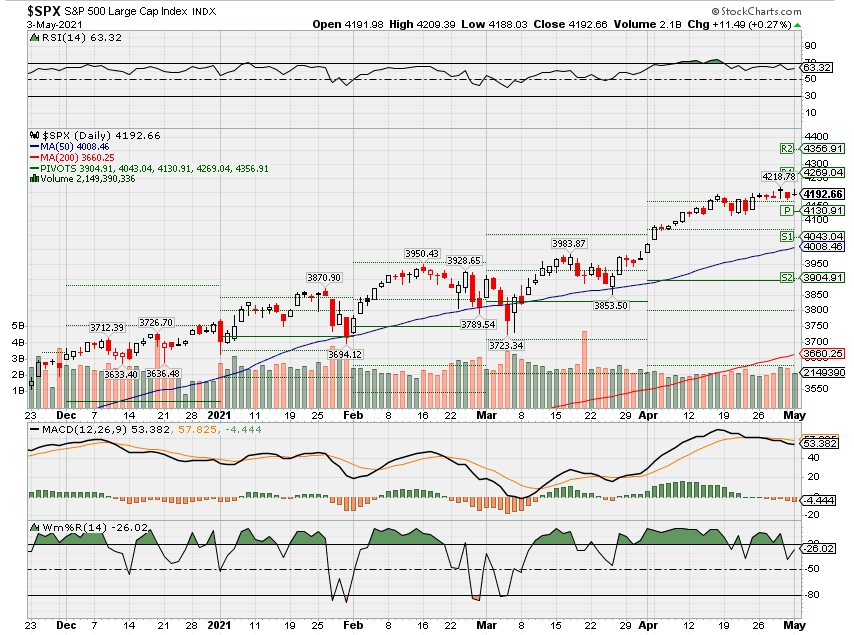

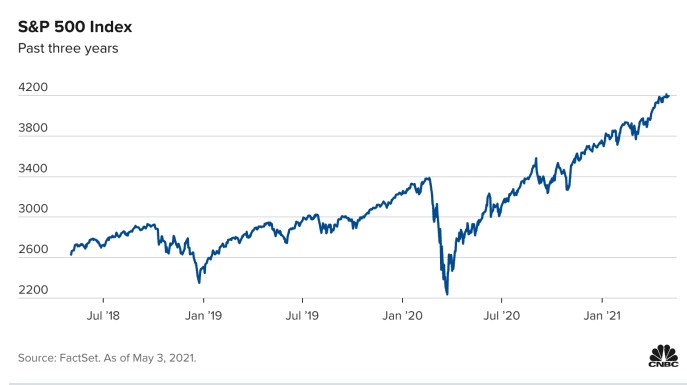

| The S&P 500 index reached a record high of 4,218.78 and ended up for the fifth week in six, fueled by the Federal Reserve’s commitment to keep its foot on the gas, upbeat earnings from mega-caps along with bullish economic data. Though month-end profit-taking faded most of last week’s gains, the benchmark index ended the week at 4,181.17, a gain of 0.02% from the prior week’s close of 4,180.17. The index ended April with a gain of 5.2%. The Federal Open Market Committee meeting on Wednesday gave stocks a boost as Fed Chair Jerome Powell’s uber-dovish stance in the face of simmering inflationary pressures and outsized economic growth nudged the index above 4,200. “Amid progress on vaccinations and strong policy support, indicators of economic activity and employment have strengthened … [and] the sectors most adversely affected by the pandemic remain weak but have shown improvement,” the FOMC said. In Washington, US President Joe Biden outlined his $2.3 trillion American Jobs and $1.8 trillion American Families Plan, pledging to pay for the unprecedented fiscal stimulus with higher taxes on Americans making more than $400,000. Of the 11 S&P 550 sectors, consumer staples, health care, and technology ended the week lower. The energy sector was the biggest percentage gainer with a move of +3.6% corresponding to a 2% gain in West Texas Intermediate futures. Within the energy sector, shares of NOV Inc (NOV) were driven 12.5% higher from last week as the expectation for a rebound in equipment bookings overshadowed a second consecutive miss in quarterly earnings. Exxon Mobil (XOM) which reported better-than-expected results on Friday, gained 3% last week with a tailwind from rising commodity prices. Despite impressive results from component stocks Apple (AAPL), Amazon (AMZN), Alphabet (GOOG, GOOGL) and Microsoft (MSFT), the technology sector was the biggest percentage decliner for the week. Seagate Technology (STX) took the top spot with a gain of 4.1% as the company beat both Q1 earnings and revenue expectations. Seagate’s strong performance wasn’t enough to keep the sector in the green, leaving it 2.1% lower for the week. Industrials squeezed out a 0.3% gain thanks to a rally in shares of United Parcel Service (UPS). The logistics company saw its profit and revenue increase above Wall Street’s expectations and ended the week with a 14% increase in its share price. The financial sector was underpinned by solid gains in Willis Towers Watson (WLTW) and Discover Financial Services (DFS), both of which beat expectations for the first quarter. The sector closed the week with a solid 2.3% gain. In economic data, dwindling inventory coupled with diminished affordability (the Case Shiller HPI posted its biggest gain in more than seven years) was reflected in housing market data. Pending home sales increased by just 1.9% in March, well below expectations for a gain of 4.4%. The preliminary glimpse of the first quarter showed that the economy grew at an annualized rate of 6.4%, well above the 4.3% pace in the fourth quarter, but shy of Wall Street expectations. Growth should continue to accelerate, evidenced by the stimulus-fueled 21% gain in personal income which was accompanied by a 4.2% increase in March personal spending. Additionally, consumer confidence shot higher, bolstered by massive government stimulus and low interest rates. The Conference Board’s consumer confidence index and sentiment index measured by the University of Michigan both reached their highest levels in a year. Next week’s earnings calendar includes Avis (CAR), Mosaic (MOS), CVS (CVS) DuPont (DD), Pfizer (PFE), Sysco (SYY), Under Armour (UAA), Hyatt (H), Lyft (LYFT), Prudential (PRU), T-Mobile (TMUS), Carnival (CCL), General Motors (GM), Hilton (HLT), PayPal (PYPL), Uber (UBER), Kellogg (K), Norwegian Cruise Lines (NCLH), ViacomCBS (VIAC), American International (AIG), Expedia (EXPE), Peloton (PTON), Shake Shack (SHAK), and Square (SQ). The economic calendar includes manufacturing and services sector data from US purchasing managers, factory orders, durable goods orders, non-farm productivity and unit labor costs, culminating Friday with the pivotal labor market report for May. Early estimates are for a 970,000 increase in non-farm payrolls for April, pushing the jobless rate down to 5.7% in April. Provided by MT Newswires |

Core Holdings,

BIDU – 5/17 est

COST – 5/27 AMC

DIS – 5/13 AMC

GM – 5/5 BMO

UAA – 5/04 AMC

Where will our markets end this week?

Higher

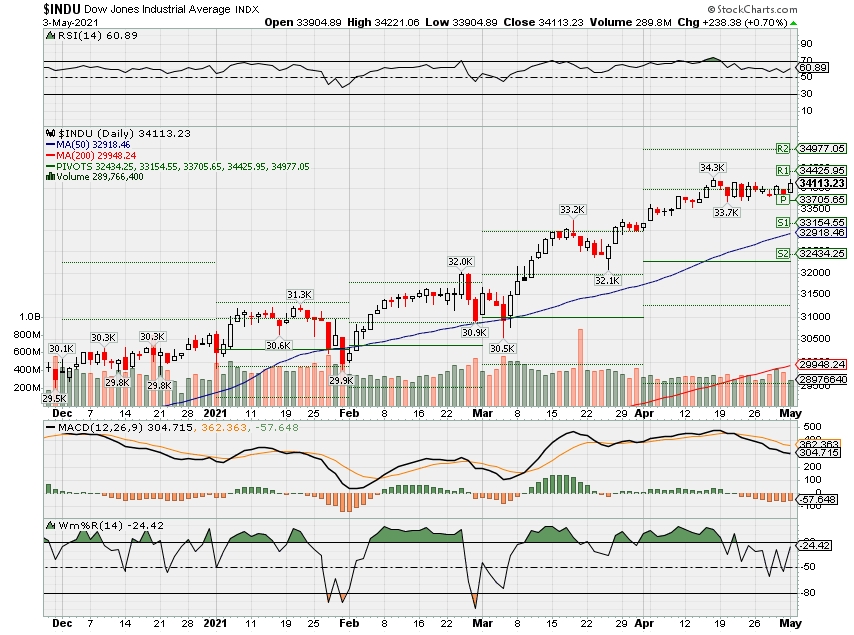

DJIA – Bullish

SPX – Bullish

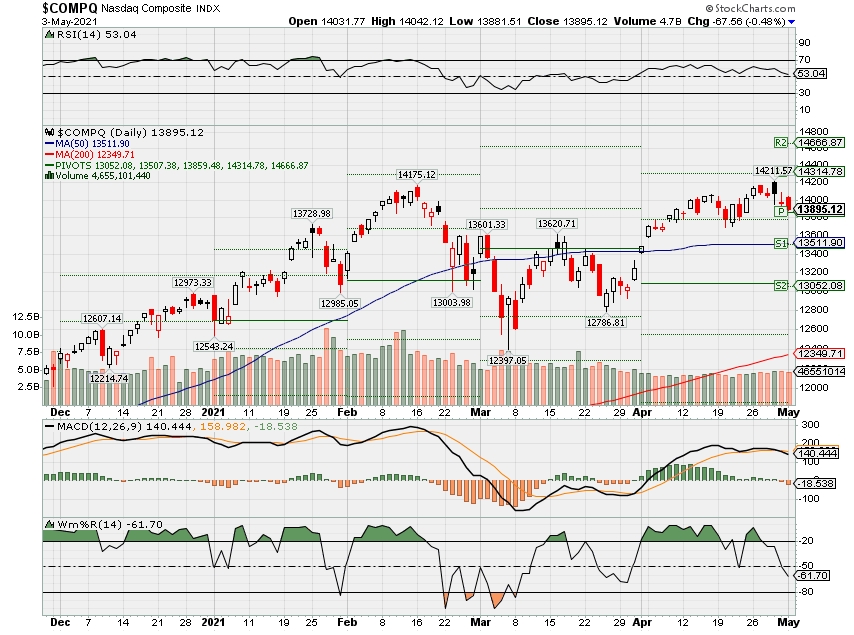

COMP – Bullish

Where Will the SPX end May 2021?

05-03-2021 4.0%

04-26-2021 4.5%

04-19-2021 2.0%

Earnings:

Mon: EL, CHGG, MOS, RMBS

Tues: LNG, COP, CMI, D, PFE, ATVI, AKAM, DENN, DVN, HLF, H, TMUS, WU, CVS, UAA,

Wed: GOLD, HLT, LL, ADT, CF, GDDY, MRO, VAC, NUS, PYPL, TWLO, UBER, GM

Thur: BUD, CAH, HAIN, K, MUR, PZZA, PPL, TPR, VG, BYND, DBX, LOCO, GPRO, ROKU, SHAK, SQ, YELP, AMC

Fri: DNKG, FLR

Econ Reports:

Mon: ISM Manufacturing, Construction Spending

Tues: Trade Balance, Factory Orders,

Wed: MBA, ADP Employment, ISM Services

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs

Fri: Ave. Work Week, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Wholesale Inventories, Consumer Credit

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Earnings and adding protection where needed

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

UAA earnings this week and I did not see a long put in place over the weekend?

IF UAA falls to $16 we can sell at $24.50 and buy back in at $16

1,519,000 / $16 = 94,937 shares of stock

So every 2000 shares would become 3000 shares

@ 16 buy in price for $1.43

New break even 2000 * 1.43 = $2,860 / 3000= $0.95

SO if UAA then moves to $16.95 we break even

IF UAA moves back t0 $20 we are profitable by 30 %

Warren Buffett says Robinhood is catering to the gambling instincts of investors

PUBLISHED SAT, MAY 1 20215:40 PM EDTUPDATED SUN, MAY 2 20218:20 AM EDT

Maggie Fitzgerald@MKMFITZGERALD

KEY POINTS

- Warren Buffett said Robinhood is promoting casino-like behavior in the stock market.

- Robinhood has “become a very significant part of the casino aspect, the casino group, that has joined into the stock market in the last year or year and a half,” Buffett said.

- Buffett said he was unhappy to learn how much short-term option activity there was in Apple, for example. He said he expected a lot of that activity is coming through Robinhood.

Legendary investor Warren Buffett believes millennial-favored stock trading app Robinhood is contributing to the speculative, casino-like trading activity in the stock market and benefitting from it.

Robinhood has “become a very significant part of the casino aspect, the casino group, that has joined into the stock market in the last year or year and a half,” Buffett said at Berkshire Hathaway’s annual meeting on Saturday.

The “Oracle of Omaha” also said he is looking forward to reading Robinhood’s pre-initial public offering SEC S-1 filing as the company nears it public debut, expected in the first half of 2021. The company, which pioneered zero-commission trading, is seen as the main gateway for young investors to access the markets.

“American corporations have turned out to be a wonderful place for people to put their money and save but they also make terrific gambling chips,” said Buffett. “If you cater to those gambling chips when people have money in their pocket for the first time and you tell them they can make 30 or 40 or 50 trades a day and you’re not charging them any commission but your selling their order flow or whatever…I hope we don’t have more of it.”

Robinhood — whose mission is to “democratize investing” — is often criticized for its gamification of investing. The Silicon Valley start-up found itself in the middle of a firestorm in January amid the short squeeze in GameStop, which was partially fueled by Reddit-driven retail investors. The app has take steps to disband this reputation, be eliminating the confetti animation when investors make their first trade.

Buffett said he was unhappy to learn short-term stock options activity in Apple’s stock was surging. He said he expected a lot of that activity is coming through Robinhood.

Robinhood’s user growth has been explosive in 2020 and 2021. Millions of new investors jumped into the market during the pandemic, and millions more have joined in 2021. The stock trading app Robinhood added nearly 6 million clients in the first two months of the year, according to estimates from JMP Securities.

“There’s nothing illegal about it, there’s nothing immoral but I don’t think you’d build a society around people doing it,” said Buffett.

“The degree to which a very rich society can reward people who now know how to take advantage essentially of the gambling instincts of not only the American public but the worldwide public, it’s not the most admirable part of the accomplishment,” said Buffett.

Berkshire Hathaway’s Vice Chairman Charlie Munger was less gentle with his description of Robinhood.

“I think it’s just God awful that something like that brought investments from civilized men and decent citizens,” Munger said. “It’s deeply wrong. We don’t want to make our money selling things that are bad for people,” Buffett’s right-hand-man added.

Robinhood defended its mission and the future of retail investing following Buffett’s comments.

“There is an old guard that doesn’t want average Americans to have a seat at the Wall Street table so they will resort to insults,” a Robinhood spokesperson told CNBC. “The future is diverse, more educated and propelled by engaging technologies that have the power to equalize. Adversaries of this future and of change are usually those who’ve enjoyed plentiful privileges in the past and who don’t want these privileges disrupted. Their criticisms are unfortunate but they prove why Robinhood’s mission is in fact critical.”

“The new generation of investors aren’t a ‘casino group.’ They are tearing down old barriers to investing and taking control of their financial futures. Robinhood is on the right side of history,” the spokesperson added.

Charlie Munger calls bitcoin ‘disgusting and contrary to the interests of civilization’

PUBLISHED SAT, MAY 1 20214:37 PM EDTUPDATED SUN, MAY 2 20212:19 PM EDT

KEY POINTS

- Berkshire Hathaway Vice Chairman Charlie Munger called bitcoin “disgusting and contrary to the interests of civilization.”

- “I don’t welcome a currency that’s so useful to kidnappers and extortionists and so forth, nor do I like just shuffling out of your extra billions of billions of dollars to somebody who just invented a new financial product out of thin air,” he said.

- The 97-year-old Munger has long criticized bitcoin for its extreme volatility and a lack of regulation.

Berkshire Hathaway Vice Chairman Charlie Munger’s disdain toward bitcoin has only intensified amid the digital asset’s record run this year.

“Of course I hate the bitcoin success,” the 97-year-old Munger said during a Q&A session at Berkshire’s annual shareholder meeting Saturday. “I don’t welcome a currency that’s so useful to kidnappers and extortionists and so forth, nor do I like just shuffling out of your extra billions of billions of dollars to somebody who just invented a new financial product out of thin air.”

“I think I should say modestly that the whole damn development is disgusting and contrary to the interests of civilization,” said Munger, a legendary investor in his own right.

Warren Buffett, who avoided the initial question on bitcoin earlier, responded to Munger’s answer: “I’m alright on that one.”

The “Oracle of Omaha” said he didn’t want to comment directly on the digital token because he didn’t want to get grief from everyone who is long.

The world’s largest cryptocurrency enjoyed a head-turning rally this year, topping $60,000 apiece in April as involvement from Tesla to major Wall Street banks made bitcoin mainstream. Tesla recently made a $1.5 billion bet on bitcoin and now accepts the digital currency as a method of payment for its cars. Meanwhile, Goldman Sachs and Morgan Stanley are looking to offer their wealthy clients some exposure to bitcoin.

Bitcoin last traded above $57,000, up from about $30,000 at the start of 2021, according to Coin Metrics.

Munger has long criticized bitcoin for its extreme volatility and a lack of regulation. At the annual shareholders meeting for Daily Journal in February, Munger said bitcoin is too volatile to serve well as a medium of exchange.

“It’s really kind of an artificial substitute for gold. And since I never buy any gold, I never buy any bitcoin,” Munger said then. “Bitcoin reminds me of what Oscar Wilde said about fox hunting. He said it was the pursuit of the uneatable by the unspeakable,” he added.

Biden to unveil $1.8 trillion plan for children and families — here’s what’s in it

PUBLISHED WED, APR 28 20215:00 AM EDTUPDATED WED, APR 28 202111:08 PM EDT

Kevin Breuninger@KEVINWILLIAMB

KEY POINTS

- President Biden will call on Congress to pass $1.8 trillion in investments and tax credits aimed toward children and families.

- Biden will pitch the new spending plan before a joint session of Congress less than a month after he issued a sweeping $2 trillion infrastructure proposal.

- The new proposal, which includes about $1 trillion in investments and $800 billion in tax credits over a decade, will be fully offset in 15 years in part by raising the amount of taxes paid by the richest Americans, the White House said.

President Joe Biden on Wednesday will pitch Congress on $1.8 trillion in new spending and tax credits aimed toward children, students and families, senior administration officials said.

Biden will unveil the massive new package less than a month after the White House issued a sweeping proposal to spend more than $2 trillion over eight years on infrastructure and other projects. Together, the plans comprise the Biden administration’s vision to overhaul the U.S. economy as the nation seeks to recover from, and look beyond, the coronavirus pandemic.

The new proposal, which includes about $1 trillion in investments and $800 billion in tax credits over a decade, will be fully offset in 15 years in part by raising the amount of taxes paid by the richest Americans, the White House said.

Here’s some of what the new plan calls for:

- $225 billion toward high-quality child care and ensuring families pay only a portion of their income toward child-care services, based on a sliding scale

- $225 billion to create a national comprehensive paid family and medical leave program

- $200 billion for free universal preschool for all 3- and 4-year-olds, offered through a national partnership with states

- $109 billion toward ensuring two years of free community college for all students

- About $85 billion toward Pell Grants, and increasing the maximum award by about $1,400 for low-income students

- A $62 billion grant program to increase college retention and completion rates

- A $39 billion program that gives two years of subsidized tuition for students from families earning less than $125,000 enrolled in a four-year historically Black college or university, tribal college or university, or minority-serving institution

- $45 billion toward meeting child nutritional needs, including by expanding access to the summer EBT program, which helps some low-income families with children buy food outside the school year

- $200 billion to make permanent the $1.9 trillion Covid stimulus plan’s provision lowering health insurance premiums for those who buy coverage on their own

- Extending through 2025, and making permanently fully refundable, the child tax credit expansion that was included in the Covid relief bill

- Making permanent the recent expansion of the child and dependent care tax credit

- Making permanent the earned income tax credit for childless workers

“These are investments that we can’t afford not to make as a country,” a senior administration official said Tuesday night in a conference call with reporters.

To fund the programs and tax perks, the proposal would, in part, reverse key pieces of the 2017 tax-cut law, the key legislative achievement of former President Donald Trump’s first year in office.

The Biden administration’s new spending plan would hike the top income tax rate to 39.6% for the wealthiest Americans. That rate had been cut to 37% for married couples with over $600,000 in taxable income as part of the 2017 law.

The plan would also seek to close a series of tax loopholes, and raise taxes on capital gains to 39.6% for households making more than $1 million.

The Biden administration maintains that under the new plan, no one making $400,000 a year or less will see their taxes go up.

Biden is set to detail the plan Wednesday night, during an in-person address before a joint session of Congress that also lays out his administration’s broader legislative priorities. The event comes on the eve of Biden’s 100th day in office.

Live from GE’s conference call; CEO Culp ‘playing for the long term’

Apr. 27, 2021 9:28 AM ETGeneral Electric Company (GE)By: Yoel Minkoff, SA News Editor18 Comments

- “We are playing for the long term,” GE (NYSE:GE) CEO Larry Culp says on a conference call, referencing renewables and the modernization of the energy grid, as well as rebounding air travel and the precision healthcare revolution. Q&A has begun…

- UBS: You talk more about playing offense… Pension problems are almost gone, as well as other headwinds, so can you comment on free cash flow margins? We feel confident about our potential to deliver a high-single digit percentage in 2023 or shortly thereafter.

- BofA: You expect $1.7B in improvements in industrial FCF in Q2. Can you walk us through that with some color? Improvements will be roughly in line with the improvements seen in Q1. That’s based on profit and working capital improvements.

- RBC Capital: There’s a lot of angst across the industrials about inflation and supply chain disruptions? Where are the pinch points or would it represent headwinds for GE? From a price-cost perspective, we’re clearly seeing some price pressure, but we’ve been able to mitigate that in Q1. Supply issues are occurring more where we see more growth, like Healthcare. Calling it a nuisance would be an understatement, but we’re handling it.

- Wolfe Research: Question about insurance. What’s the future for the unit? We’re not quite ready to say today that we’re going to something strategic with insurance. We’re going to continue to explore options, but we’re more focused on out four industrial segments.

- Citigroup: Could you give us more color on execution in Healthcare? Despite a choppy top-line due to the pandemic, the unit has done a heck of a job on margins and cash. That’s where we’ve pushed decentralization the furthest, as well as our lean culture. We can see putting more money back into the business to drive growth in digital and new products.

- Melius Research: How important is net price in turning around things in Renewables? When we talk about selectivity of contracts and projects… that is about price and margins, as well as risk and conditions. A good bit of what you’re seeing in onshore wind and increasingly in grid… we’re going back after the business where we are well-positioned and where we have a better risk profile.

Tesla’s bitcoin speculation helped boost profits by more than $100 million in Q1

PUBLISHED MON, APR 26 20216:18 PM EDTUPDATED MON, APR 26 20218:55 PM EDT

KEY POINTS

- Tesla bought $1.5 billion worth of “digital assets,” then sold $272 million worth, during Q1, according to an earnings release Monday.

- It also recorded a $101 million “positive impact” toward profitability from sales of bitcoin during the quarter; it accounted for this as a reduction in operating expenses.

- It’s not immediately obvious how trading in bitcoin, which requires significant amounts of energy to mine, fits in with Tesla’s vision of accelerating the transition to sustainable energy.

Tesla reported first-quarter results on Monday, including a record quarterly net profit of $438 million on a GAAP basis.

As usual, those profits were buoyed by sales of environmental regulatory credits. But in a new wrinkle this quarter, the company’s sales of bitcoin during the quarter also contributed $101 million toward the bottom line.

In February, Tesla made waves when it announced a $1.5 billion purchase of bitcoin and said it may continue investing in cryptocurrency more broadly.

On Monday, Tesla’s shareholder update revealed that sales of bitcoin made a $101 million “positive impact” to the company’s profitability during the period ending March 31, 2021.

On the company’s cash flows statement for Q1 (page 26), it recorded $1.5 billion in purchases of “digital assets,” as well as $272 million in proceeds from sales of digital assets during the quarter.

Elsewhere (page 5), the company says its profitability was helped from a sale of bitcoin which contributed a $101 million “positive impact, net of impairments, in ‘Restructuring and Other.’” This shows up as a $101 million reduction in operating expenses on the company’s Statement of Operations (page 24).

This suggests that the company quickly flipped some of its big bitcoin purchase for a gain of $101 million, as bitcoin prices rose during the quarter.

As CFO Zachary Kirkhorn said during the earnings call, “Elon and I were looking for a place to store cash” that wasn’t immediately being used to get returns. But they had a need to be able to access their cash quickly too.

“Bitcoin has proved to be a good decision, a good place to put some of our cash that’s not being used for daily operations…and be able to get some return on that.” Kirkhorn added that while they were pleased with the liquidity of the bitcoin market, “It is our intent to hold long-term.”

Tesla does accept bitcoin payments from customers now.

But apart from that, it’s not clear how investments in and use of cryptocurrency serve the mission of Elon Musk’s electric vehicle and energy storage business. The stated mission of Tesla has long been to “accelerate the world’s transition to sustainable energy.”

Vicki Bryan, founder of the bond investment research firm Bond Angle, wrote in an e-mail to CNBC:

“Bitcoin is not fungible or logically advantageous as currency, arguably not safer for the owner vs cash in transactions, and inexcusably damaging to the environment.”

Tesla had historically racked up around $1.6 billion in regulatory energy credits, primarily zero emission vehicle credits, Bryan notes. Credit sales helped Tesla to report more than four consecutive quarters of profitability, qualifying Tesla for addition to the S&P 500 index.

With Tesla’s bitcoin purchases, Bryan says, Tesla is adding a volatile asset with limited reported visibility to financial statements which “already conceal vital clarity of key operations and financial conditions.”

Buffett’s Berkshire Gets More Cautious on Stocks and Buybacks

May 1, 2021, 6:08 AM MDT Updated on May 1, 2021, 10:13 AM MDT

- Conglomerate was a net seller of stocks in the first quarter

- Buffett, Munger will hold Berkshire’s annual meeting Saturday

Warren Buffett’s capital-deployment machine pulled back on several fronts at the start of the year as the billionaire took a more cautious stance on stocks.

Berkshire Hathaway Inc.’s net stock sales in the first quarter were the second-highest in almost five years and the conglomerate, where the billionaire is chief executive officer, slowed its buyback pace, according to a regulatory filing Saturday. That helped push Berkshire’s cash pile up 5.2% from three months earlier to a near-record $145.4 billion at the end of March.

Buffett has struggled in recent years to keep up with Berkshire’s ever-gushing cash flow. That’s led him to repurchase significant amounts of Berkshire stock, pulling a lever for capital deployment that he had previously avoided in favor of big acquisitions or stock purchases. He set a record in the third quarter of last year, snapping up $9 billion of stocks, but slowed that pace during the first quarter with repurchases of $6.6 billion.

“If Buffett does not perceive there to be acquisitions available at fair prices and it’s evident, as a net seller of stocks, that he doesn’t see a lot of opportunities in the open market to buy publicly traded stocks, are we looking at cash growing to $175 billion over the course of the next year or so? Because that appears to be where we’re heading,” Jim Shanahan, an analyst at Edward D. Jones & Co., said in an interview. “If buybacks are going to decelerate, then what levers are left to pull?”

Buffett Sells Stocks

Berkshire’s 1Q net sales were second-largest in almost five years

Berkshire repurchased more stock in January and February than the company did in March, when the stock climbed nearly 5.8%, according to the filing. Buffett’s long been disciplined on the price of buybacks, noting in 2018 when the company loosened its repurchase policy that he and his longtime business partner and Berkshire Vice Chairman Charlie Munger can repurchase shares when they’re below Berkshire’s intrinsic value.

Berkshire has come up short on well-priced and sizable acquisitions in recent years, one of Buffett’s more preferred ways to put cash to work. He struck a deal last year for some natural gas assets from Dominion Energy Inc. and invested in some Japanese trading companies. But he’s long been sensitive to prices, not wanting to overpay for an asset, according to Shanahan, and the competitive landscape for deals has intensified with the boom in private equity and special purpose acquisition companies.

Still, Berkshire’s businesses pulled off a strong quarter, with earnings reaching the second-highest level in data going back to 2010. Operating profit of about $7.02 billion was only surpassed by the third quarter of 2019. The gains were partly fueled by the firm’s insurers and its group of manufacturers, servicing businesses and retailers.

Net earnings, which reflect Berkshire’s $282 billion equity portfolio, swung to a profit of $11.7 billion in the quarter, compared to a loss of $49.7 billion a year earlier, when the pandemic started to race across the U.S. and stocks slumped.

Business

Buffett’s Berkshire Gets More Cautious on Stocks and Buybacks

May 1, 2021, 6:08 AM MDT Updated on May 1, 2021, 10:13 AM MDT

- Conglomerate was a net seller of stocks in the first quarter

- Buffett, Munger will hold Berkshire’s annual meeting Saturday

Warren Buffett’s capital-deployment machine pulled back on several fronts at the start of the year as the billionaire took a more cautious stance on stocks.

Berkshire Hathaway Inc.’s net stock sales in the first quarter were the second-highest in almost five years and the conglomerate, where the billionaire is chief executive officer, slowed its buyback pace, according to a regulatory filing Saturday. That helped push Berkshire’s cash pile up 5.2% from three months earlier to a near-record $145.4 billion at the end of March.

Buffett has struggled in recent years to keep up with Berkshire’s ever-gushing cash flow. That’s led him to repurchase significant amounts of Berkshire stock, pulling a lever for capital deployment that he had previously avoided in favor of big acquisitions or stock purchases. He set a record in the third quarter of last year, snapping up $9 billion of stocks, but slowed that pace during the first quarter with repurchases of $6.6 billion.

“If Buffett does not perceive there to be acquisitions available at fair prices and it’s evident, as a net seller of stocks, that he doesn’t see a lot of opportunities in the open market to buy publicly traded stocks, are we looking at cash growing to $175 billion over the course of the next year or so? Because that appears to be where we’re heading,” Jim Shanahan, an analyst at Edward D. Jones & Co., said in an interview. “If buybacks are going to decelerate, then what levers are left to pull?”

Buffett Sells Stocks

Berkshire’s 1Q net sales were second-largest in almost five years

Source: Company filings

Berkshire repurchased more stock in January and February than the company did in March, when the stock climbed nearly 5.8%, according to the filing. Buffett’s long been disciplined on the price of buybacks, noting in 2018 when the company loosened its repurchase policy that he and his longtime business partner and Berkshire Vice Chairman Charlie Munger can repurchase shares when they’re below Berkshire’s intrinsic value.

Berkshire has come up short on well-priced and sizable acquisitions in recent years, one of Buffett’s more preferred ways to put cash to work. He struck a deal last year for some natural gas assets from Dominion Energy Inc. and invested in some Japanese trading companies. But he’s long been sensitive to prices, not wanting to overpay for an asset, according to Shanahan, and the competitive landscape for deals has intensified with the boom in private equity and special purpose acquisition companies.

Still, Berkshire’s businesses pulled off a strong quarter, with earnings reaching the second-highest level in data going back to 2010. Operating profit of about $7.02 billion was only surpassed by the third quarter of 2019. The gains were partly fueled by the firm’s insurers and its group of manufacturers, servicing businesses and retailers.

Net earnings, which reflect Berkshire’s $282 billion equity portfolio, swung to a profit of $11.7 billion in the quarter, compared to a loss of $49.7 billion a year earlier, when the pandemic started to race across the U.S. and stocks slumped.

The day’s biggest stories

Why investors should ignore the old Wall Street adage ‘Sell in May’

PUBLISHED MON, MAY 3 20213:15 PM EDTUPDATED 4 HOURS AGO

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- The Wall Street adage “sell in May and go away” refers to a period between May and October when the market on average underperforms the prior six months.

- But strategists say that does not mean investors should get out of the market in May and come back at the end of the year. Every year is different, and money left in the market has a better return.

- “Any investment strategy that you can summarize in a rhyme is probably a bad strategy,” said one strategist.

- But one technician thinks the market has found a top, and that means May and the next several months could be difficult.

The “sell in May, and go away” strategy isn’t getting much love on Wall Street this year.

Market pros acknowledge that history clearly shows the market’s strongest six-month period is November to April, but they also say that’s not necessarily a factor that should shape investors’ plans in any year.

“Any investment strategy that you can summarize in a rhyme is probably a bad strategy,” said Jonathan Golub, chief U.S. equity strategist at Credit Suisse. Golub raised his S&P 500 target on Friday to 4,600 for year end from 4,300, based on strong earnings.

He said on average the market’s performance does follow the pattern of weakness between May and October, but it’s not a reason to get out of stocks.

“This would be perfectly reasonable if every single May looked the same as the May the year before,” Golub said. Just comparing this year to last year shows a huge contrast.

“Last May of last year the market was jumping off the bottom.” He said now the backdrop has totally changed, from a country and economy gripped by the pandemic last year, to a period in which a booming economy and earnings should drive further gains.

“Look at what we’re having this earnings season. U.S. companies are beating estimates by 22% — 22% is unheard of. The economic data is phenomenal,” said Golub.

The second quarter is expected to be even stronger, and those earnings reports will be released in July.

“I’m not selling in May, and I wouldn’t advise somebody else to,” said Golub. “I think the biggest mistake you can make in a market like this is to get too cute and get out too early. You’re better off trying to stay a little longer than get out too early.”

Market topping?

Carter Worth, chief market technician at Cornerstone Macro, agrees that generally investors would not be well served to get out of the market in May and stay out through October.

But this year he expects the market to enter a weak period. Worth said aside from the seasonal factors, he expects the market has been topping.

“It’s a time to reduce exposure. Intermediate tops can last for three to five months,” he said.

Worth studied the seasonal trend and found that the 27.8% performance of the Dow from Nov. 1 through April 30 was the fourth strongest for that six-month period going back to 1896.

“After especially good November to April six-month runs, the ensuing six months is lackluster,” Worth said. He added that this could be the case for any six-month period following a strong gain for stocks.

The average gain for the Dow in the top 10 years for the November-to-April period was 27.5%, compared with an average 2.9% in the ensuing May-to-October periods, Worth found. The average overall gain for the full year in the 10 best years for November to April was 23.7%.

For all years going back to 1896, the Dow’s average return was 5.2% in November to April, and 2.1% in May through October, according to Worth’s analysis. The average performance for all years was 7.3%.

Even though Worth expects the market has found a near-term top, he said the seasonal investment strategy is the wrong approach.

“The six-month period of November to April has offered higher returns than the six-month period of May to October, 1896 to 2020,” he said. “But the best strategy by far, as all will know, is to keep capital exposed to the market year in and year out.”

Worth calculated that $1 million invested in the market in November-through-April periods going back to 1896 by investors who then went to cash from May to October would have returned $164.4 million.

Investors who stayed in all year would have a return of $672.6 million on that original $1 million.

A tendency for a summer rally

The pattern of seasonal weakness from May to October is also clear in the S&P 500, but the average return has been positive 66% of the time going back to 1928, according to Stephen Suttmeier, technical research strategist at Bank of America.

He said because the index had an average positive return of 2.2% for that six-month period, the “sell in May” strategy “leaves much to be desired.”

Suttmeier said his study confirms a tendency for a summer rally, and the decline in the May to October period is “back-end loaded.”

“Instead of ‘sell in May and go away’ it should be ‘buy in May and sell July/August,’” he wrote in a note. “Monthly seasonality suggests selling in the strong month of April, buying weakness in the risk-off month of May and selling in July to August, ahead of September, which is the weakest month of the year.”

The summer rally can be even stronger in the first year of a new president’s term, with the market strong in April and July, but also with a solid return in May, Suttmeier noted.

“This spring to summer rally and fall correction is magnified in Presidential Cycle Year 1 with April-June up 5.5% on average and August-October down 2.4% on average,” he wrote.

Any investment strategy that you can summarize in a rhyme is probably a bad strategy.

Jonathan Golub

CHIEF U.S. EQUITY STRATEGIST AT CREDIT SUISSE

Sam Stovall, chief investment strategist at CRFA also looked at the ’“sell in May” phenomena, through the performance of the S&P Equal Weight 500. This index gives each stock equal weighting rather than the market cap weighting of the S&P 500 index.

Through April 30, the S&P Equal Weight 500 was up 16.2% for the year, its third strongest four-month start to any year since the index was created in 1990.

“Investors now ask if this benchmark of unweighted large-cap U.S. stocks has gone too far, too fast,” wrote Stovall in an note.

He said history shows that such early strength is typically followed by a period where the market digests the gains in May. The market can be volatile through September before an above average gain in the final three months of the year.

With all the focus on “sell in May and go away,” investors should know that the history of the adage might have more to do with going on vacation than bailing from the stock market.

“The phrase ‘Sell in May and go away’ originates from an English saying, ‘Sell in May and go away, and come on back on St. Leger’s Day,’” said Cornerstone Macro’s Worth.

St. Leger’s Day refers to the St. Leger’s Stakes, a thoroughbred horse race held in mid-September.

“It refers to the custom of leaving the city of London for the countryside to escape the hot summer months,” Worth said.

HI Financial Services Mid-Week 06-24-2014