HI Market View Commentary 05-02-2022

What you can tell me now that we are done with April:

You said there would be some tax selling and there was some and more ……

Possible double bottom with the market being down 15-16%

Horrible month for Technology (Nasdaq)

It seems like the market was down while some individual stocks were doing ok

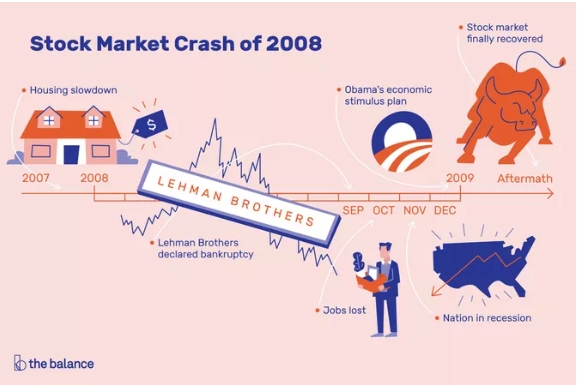

On one of the three major indexes we had a 2008 like scenario and on the S&P 500 We had the worst month since the bear market correction (-20%) in 2020

Stocks rebound after S&P 500 hits lowest level of 2022, Nasdaq rises 1.6%

PUBLISHED SUN, MAY 1 20226:03 PM EDTUPDATED 2 HOURS AGO

U.S. stocks staged a late comeback on Monday, with the S&P 500 and Nasdaq Composite hitting new lows for the year before closing up for the day.

The Nasdaq Composite rose 1.63% to 12,536.02, while the S&P 500 rose 0.57% to 4,155.38. The Dow Jones Industrial Average gained 84.29 points, or 0.26%, to close at 33,061.50. The Dow was down more than 500 points at its session lows.

The wild trading session came on the heels of a rough April for stocks. The Dow and S&P 500 are coming off their worst month since March 2020, when the pandemic took hold. The Nasdaq had its worst month since 2008.

David Katz, chief investment officer at Matrix Asset Advisors, said on CNBC’s “The Exchange” that the market has been overly worried about an economic slowdown and investors should step in to buy the dip in stocks.

“You’re able to buy a lot of great businesses at very attractive prices. Historically, that’s been a very good time to put money to work,” Katz said.

Other market strategists, however, warned of a possible short-lived relief rally and pointed to the fresh lows as a sign that stocks still had further to fall.

“Sentiment is negative, but we still didn’t see a flush. We almost needed to see at least a break of these lows to see some more fear in the market, more stop levels triggered,” said Keith Lerner, co-CIO at Truist Advisory Services.

“In some ways, as much as most technicians want to see support held, in my view you almost need to see that [break] to get a more durable bottom.”

Tech was a particular weak point in April, but the group led the rebound on Monday. Netflix and Facebook-parent Meta Platforms jumped about 4.8% and 5.3%, respectively. Microsoft and Google-parent Alphabet advanced more than 2% each.

Apple and Amazon closed up less than 1% after spending much of the session in negative territory. Art Cashin of UBS said on CNBC’s “Squawk on the Street” that the trading of Apple and Amazon in particular could be a barometer of the next steps for the broader market.

Semiconductors and energy stocks were two areas of strength on Monday. Intel and Chevron rose 3.1% and 2%, respectively, to support the Dow.

Volatility in the bond market likely contributed to the swings in stocks on Monday. The 10-year Treasury yield rose above 3% for the first time since 2018.

“3% is certainly important. … It’s a psychological barrier that’s got people worried about what the Fed is going to do,” said Matt Maley of Miller Tabak.

Investors are looking ahead to Wednesday, when the Federal Open Market Committee will issue a statement on monetary policy. The decision will be released at 2 p.m. ET, with Federal Reserve Chairman Jerome Powell holding a press conference at 2:30 p.m.

“With inflation so high and earnings growth slowing rapidly, stocks no longer provide the inflation hedge many investors are counting on. Real earnings yield tends to lead real stock returns on a y/y basis by about 6 months. It suggests we have meaningful downside at the index level as investors figure this out,” Morgan Stanley equity strategist Michael Wilson said in a note to clients.

Another key economic indicator will come Friday when April’s jobs report is released.

— CNBC’s Michael Bloom and Patti Domm contributed to this report.

SO this is why we collar trade

Can you stay solvent longer than the market can stay irrational ?

I can be honest with you, I HAVE BEEN WORRIED when our stocks don’t bounce back in a timely manner

We make up SOME of the downward movement

Make money with the puts than HI then uses to buy more shares for a quicker bounce back higher

Protection when other things are going against the market

We WILL have everything protected tomorrow for the Rate hike announcement on Wednesday

My thoughts for the month of April and this year:

I’m Pissed off some things should have come back

I hate inflation and I hate the current administration’s policies

I have experience knowing that IF is keep making up money to the downside when the market turns I will kill it as the market runs bullish

The Story of a dollar

IF your dollar loses 50% and gains 50% you have a ZERO percent return

BUT you also only have $0.75 on every dollar you invested

Collar or Protective put trading makes up something to the downside and when stocks lose half their bvalue I have twice as many shares making money as the stock bounces back

This is a couple of weeks old before last weeks negative GDP print so add another 4% to the losses and let’s go through the article to better understand how a 60/40 portfolio is “supposed” to work but never really does.

| And finally, here’s what Katie’s interested in this morning |

I’ve poked fun at obituaries for the 60/40 portfolio in the past, but given how remarkably bad performance has been, it’s time to check in again. A Bloomberg model tracking a portfolio of 60% stocks and 40% fixed-income securities has dropped about 10% in 2022, so far enduring the worst year since 2008.

That’s just a preview for how bad things could get for the popular asset-allocation strategy should the U.S. actually enter a recession. That’s the view of rates veteran Harley Bassman, creator of Wall Street’s famous MOVE Index to track Treasury volatility.

A toxic combination of fiscal largesse, a shrinking U.S. labor pool, broken supply chains and still-elevated asset prices all mean that inflation likely has yet to stabilize. If that’s the case, bond yields would likely continue to climb higher even should economic growth contract — meaning that Treasuries would provide little shelter from falling equity prices.

“For the past 20 years, stock and bond prices moved in the opposite direction,” Bassman told me via email. “But there have been times when they ride up and down in unison, and this would be a disaster for a 60/40 portfolio.”

Bassman sees long-term rates “in the ballpark” of 4% as the threshold for where the stock-bond correlation might flip — meaning bonds will fail to cushion equity losses. Yields on 10-year Treasuries are currently trading near 2.82%, while 30-year rates are hovering around 2.89%.

That’s a lot of gloom and doom, and of course, there’s still little reason to expect the U.S. economy to imminently descend into a recession. Despite last month’s scary yield curve inversion, the labor market and the American consumer are hanging tough.

Still, the warnings are getting louder. Deutsche Bank economists warned of a deep U.S. downturn next year this week, while Goldman Sachs Group has estimated chances of a contraction at about 35% over the next two years. Meanwhile, Ed Yardeni of Yardeni Research places the odds of a U.S. recession at 30% next year, up from an earlier forecast of 15%.

Follow Bloomberg’s Katie Greifeld on Twitter @kgreifeld

| Like getting this newsletter? Subscribe to Bloomberg.com for unlimited access to trusted, data-driven journalism and subscriber-only insights. Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. |

Earnings coming up:

BIDU 5/18 est

DIS 5/11 AMC

MU 6/30 est

SQ 5/05 AMC

TGT 5/18 BMO

UAA 5/06 BMO

SBUX 5/03 AMC

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 29-Apr-22 15:21 ET | Archive

The Federal Reserve is about to cross the Rubicon

Heads up! The Federal Open Market Committee (FOMC) meets May 3-4. It should be some meeting, too.

Since the last FOMC meeting in March, the war in Ukraine has worsened, China’s COVID problem has worsened, and inflation has worsened.

Stock prices are lower, bond prices are lower, energy prices are higher, the U.S Dollar Index has strengthened, and volatility has risen.

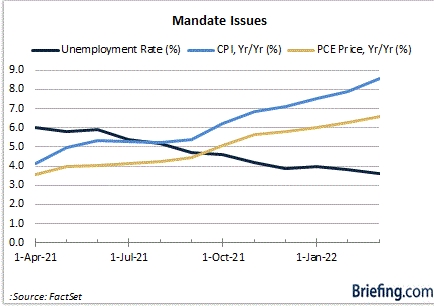

The unemployment rate has dropped to 3.6%, average hourly earnings growth has risen to 5.6%, and GDP growth has gone negative.

It is a messy situation in which to be setting monetary policy, but some of the mess — not all of it — has a lot to do with monetary policy. Don’t expect things to get cleaned up soon.

Being Blunt

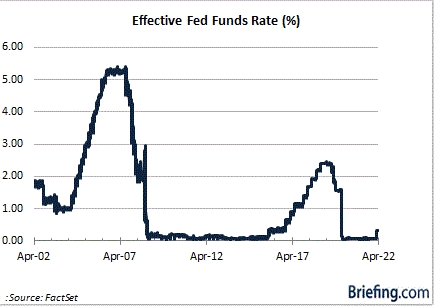

The FOMC was persuaded in March to hold off on a more aggressive rate hike by the uncertainty created by Russia’s invasion of Ukraine. The FOMC went with a 25-basis point rate hike, which moved the target range for the fed funds rate to 0.25-0.50%. For the record, St. Louis Fed President Bullard wanted the FOMC to raise the target range by 50 basis points.

We are confident in saying the FOMC isn’t going to take the conservative route in the coming week. It will raise the target range for the fed funds rate by 50 basis points. It will do so, not because the situation in Ukraine has improved, but because the inflation situation has worsened and because the fed funds futures market has fully priced in a 50-basis point rate hike.

It won’t be a surprise, but that doesn’t mean the market is necessarily going to like it. The reason being is that it is just the start of more rate hikes to come, not to mention what should also be the start of an official plan to reduce the size of the Fed’s balance sheet.

This meeting will effectively be the meeting in which the Fed crosses the Rubicon in its newly embraced campaign to get inflation under control.

To put it bluntly, a target range for the fed funds rate of 0.75-1.00% ain’t going to get it done when the consumer inflation rate is 8.5%, as measured by the Consumer Price Index, or 6.6%, as measured by the PCE Price Index.

There are many steps to be taken yet and that reality should continue to trip up the stock and bond markets.

A $64,000 Question

The fed funds futures market looks hip to the stark reality that the Fed is in chase mode when it comes to inflation. According to the CME’s FedWatch Tool, a 75-basis point rate hike at the June 14-15 meeting is also fully priced in now, as is another 50-basis point rate hike at the July 26-27 meeting.

That would leave the target range for the fed funds rate at 2.00-2.25% before Labor Day. It is a toss-up between a 25-basis point rate hike or a 50-basis point rate hike at the September 20-21 FOMC meeting, and the same rings just about true for the November 1-2 and December 13-14 FOMC meetings.

Obviously, a lot can, and will, happen between now and the December FOMC meeting, yet the consensus view at the moment is that the target range for the fed funds rate should be in the neighborhood of 3.00% by year end.

The $64,000 question is: Where will the inflation rate be by year end?

The latest projection from the Fed sees a median PCE inflation rate of 4.3% for 2022. That is better than where it stands today, but it is still higher than where the Fed and most consumers would prefer to see it. To wit, the Fed’s longer-run target for PCE inflation is 2.0%.

An Inflation Mandate in Ruins

Increasingly, we hear pundits on TV suggest falling stock prices will get the Fed to “chill” with its rate hikes. These pundits are not always under the age of 40, yet their perspective is completely understandable considering they have come of age in a period when the Fed has not only “chilled,” but has gone downright cryogenic with its interest rate moves whenever the stock market has had an — ahem — falling out.

That approach has been the basis for the so-called Fed put and the great perpetuator of moral hazard, partly for the rate cuts themselves but most certainly for the length of time that super-low, if not rock-bottom, policy rates have been allowed to persist.

It is an approach that is proving costly to many market participants now who played with speculative fire last year, especially younger ones, because the Fed put has gone kaput.

The point that more market participants should be appreciating now is that the Fed is not going to chill with its rate hikes because of problems in the stock market, unless there is a real dislocation in the functioning of the financial system. What we think this cohort underappreciates is that the Fed has to regain credibility as an inflation fighter.

You do not do that by kowtowing to a stock market that goes down 20% following a period in which it went up more than 100% and the unemployment rate remains under 5.0% (or below 4.0% as it is currently).

You do not do that when inflation pressures are the main source for growth problems, and you have a dual mandate that requires you to provide maximum employment and price stability. The employment side of the Fed’s mandate is more than satisfied at this juncture. The inflation side of the mandate is in ruins and desperately needs to be repaired.

What It All Means

Quite simply, the Fed cannot afford to chill early in this rate-hike cycle, even if it super sizes some its rate hikes in the next few meetings.

The Fed is in a tough position, but it put itself there keeping rates at the zero bound for too long and buying Treasury and agency mortgage-backed securities for too long. Now, it must extinguish the inflation fires that are burning in part because of its accommodative policy.

That will not be accomplished by chilling out in deference to stock market declines. It will be accomplished by keeping things hot with a rate-hike approach rooted in winning back the credibility the Fed has lost in satisfying the inflation side of its dual mandate.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| Market Recap |

| WEEK OF APR. 25 THROUGH APR. 29, 2022 |

| The S&P 500 limped into the close and ended a fourth consecutive week in the red after Amazon’s (AMZN) disappointing outlook weighed on sentiment. The benchmark index was down 3.3% in the latest week at 4,131.93 from last week’s close of 4,271.78 with all eleven sectors in the red. For the month of April, the S&P 500 suffered its heaviest losses since March 2020, down more than 9% over the last four weeks. Amazon fell to a 22-month low after saying Thursday it swung to a Q1 loss and issued a Q2 sales forecast that missed expectations, killing a rally into the end of the month that was led by bargain hunters. The sell-off caused tech stocks to lose ground for a second week, down another 1.2% from last Friday’s close. Stocks were defensive at the start of the week ahead of the flood of corporate results with earnings expected to disappoint following supply chain warnings from General Electric (GE) and downbeat results from Raytheon (RTX). The material sector escaped most of Friday’s selling frenzy with a loss of just 0.8% largely on a 12% rally in Sherwin-Williams (SHW) and an 8% jump in shares of Avery Dennison (AVY) both of which reported better-than-expected quarterly results last week. The energy sector was down 1.3% as the solid gains in shares of Valero (VLO) resulting from upbeat earnings insulated the sector from heavy losses from Halliburton (HAL) and Schulumber (SLB). The remaining sectors struggled into the close with consumer discretionary at the bottom of the pack with a 7.9% loss. Amazon and Tesla (TSLA) were the worst-performing stocks in the sector with Amazon losing 14% in value for the week, and shares of Tesla undermined by CEO Elon Musk’s $8.5 billion sale of his personal stock to help finance his $44 billion Twitter (TWTR) acquisition. Real estate stocks lost 5.6 on continued headwinds from rising mortgage rates. Equity Residential (EQR) and AvalonBay (AVB) were down 11% and 9%, respectively. The financial sector was down 4.6% from the prior week’s close as heavy losses in AON (AON) and Cincinnati Financial (CINF) overshadowed more modest gains in insurance stocks like Chubb (CB) and Comerica (CMA). Consumer staples were down 2.1% followed by a 2.5% loss in health care stocks. Led by a 15% drop in shares of General Electric, the industrials sector closed 2.8% in the red, while Comcast’s (CMCSA) 12% drop last week resulted in a 4.1% decline in the communications sector despite a rally in shares of Meta (FB). Economic data also contributed to the sour mood on Wall Street last week. The economy contracted 1.4% in the first quarter, the US Bureau of Economic Analysis said in a report, but the bad news was tempered by strong consumer spending. While personal income and spending improved in March, inflationary pressures on consumers remained high, fueling expectations that the Federal Reserve will need to raise interest rates by at least 50 basis points next week. The Federal Open Market Committee meeting on Wednesday, at which time the Fed is expected to deliver its second rate hike since 2018, and the April payroll data highlight economic data next week. The economy is expected to have created 385,000 jobs which will drive down the unemployment rate to 3.5%. Next week’s heavy economic calendar also includes the Institute for Supply Management and final S&P Global manufacturing and service sector PMIs for April, the durable goods report, JOLTS figures, the trade balance report, non-farm productivity and unit labor costs and the ADP employment report on private jobs. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end May 2022?

05-02-2022 -2.0%

Earnings:

Mon: JELD, CAR, CLX, DVN, MGM, RMBS,

Tues: BP, CMI, DD, HLT, PFE, MOS, AKAM, SWKS, SBUX

Wed: GOLD, LNG, JCI, MUR, YUM, EBAY, GDDY, TWLO, UBER, CVS, CHK,

Thur: CAH, COP, CROX, DKNG, K, PZZA, SHOP, HUBS, YELP, SQ, MNST

Fri: CI, UAA

Econ Reports:

Mon: Construction Spending, ISM Manufacturing Index

Tues: Factory Orders, JOLTS,

Wed: MBA, ADP Employment, Trade Balance, FOMC Rate Decision,

Thur: Initial Claims, Continuing Claims, Unit Labor Costs, Productivity

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Consumer Credit,

How am I looking to trade?

Currently protection on all core holding and making decisions on earnings,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Stocks move up, down and sideways = 1/3 chance or 33% of making money

Collar trading, Protective puts = 2/3 chance of making money in some direction

THIS does NOT mean your account will not go down

Buffett bought more Apple last quarter and says he would have added more if the stock didn’t rebound

PUBLISHED MON, MAY 2 20228:33 AM EDTUPDATED MON, MAY 2 202210:59 AM EDT

KEY POINTS

- Buffett, Berkshire Hathaway’s chairman and CEO, told CNBC’s Becky Quick he scooped up $600 million worth of Apple shares following a three-day decline in the stock last quarter.

- Apple is the conglomerate’s single largest stock holding with a value of $159.1 billion at the end of March.

Warren Buffett bought the dip in his No. 1 stock Apple during the tech giant’s sell-off in the first quarter.

Berkshire Hathaway’s chairman and CEO told CNBC’s Becky Quick that he scooped up $600 million worth of Apple shares following a three-day decline in the stock last quarter. Apple is the conglomerate’s single largest stock holding with a value of $159.1 billion at the end of March, taking up about 40% of its equity portfolio.

“Unfortunately the stock went back up, so I stopped. Otherwise who knows how much we would have bought?” the 91-year-old investor told Quick on Sunday after Berkshire’s annual shareholders meeting.

There have been plenty of buying opportunities for Buffett this year as Apple shares came under pressure amid fears of rising interest rates and supply chain constraints. The stock fell 1.7% in the first quarter with multiple three-day losing streaks throughout the period. Apple once declined for eight days in a row in January and the stock is down nearly 10% in the second quarter.

Berkshire began buying Apple stock in 2016 under the influence of Buffett’s investing deputies, Todd Combs and Ted Weschler. Berkshire is now Apple’s largest shareholder, outside of index and exchange-traded fund providers.

Buffett previously called Apple one of the four “giants” at his conglomerate and the second-most important after Berkshire’s cluster of insurers, thanks to its chief executive.

“Tim Cook, Apple’s brilliant CEO, quite properly regards users of Apple products as his first love, but all of his other constituencies benefit from Tim’s managerial touch as well,” Buffett’s 2021 annual letter stated.

The “Oracle of Omaha” said he is a fan of Cook’s stock repurchase strategy, and how it gives the conglomerate increased ownership of each dollar of the iPhone maker’s earnings without the investor having to lift a finger.

Apple said last week it authorized $90 billion in share buybacks, maintaining its pace as the public company that spends the most purchasing its own shares. It spent $88.3 billion on buybacks in 2021.

Cook was in attendance at Berkshire’s annual meeting over the weekend.

The conglomerate has also enjoyed regular dividends from the tech giant over the years, averaging about $775 million annually.

Warren Buffett gives his most expansive explanation for why he doesn’t believe in bitcoin

PUBLISHED SAT, APR 30 20224:10 PM EDTUPDATED MON, MAY 2 202212:51 PM EDT

Bitcoin has steadily been gaining acceptance from the traditional finance and investment world in recent years but Warren Buffett is sticking to his skeptical stance on the cryptocurrency.

He said at the Berkshire Hathaway annual shareholders meeting Saturday that it’s not a productive asset and it doesn’t produce anything tangible. Despite a shift in public perception about bitcoin, Buffett still wouldn’t buy it.

“Whether it goes up or down in the next year, or five or 10 years, I don’t know. But the one thing I’m pretty sure of is that it doesn’t produce anything,” Buffett said. “It’s got a magic to it and people have attached magic to lots of things.”

Even bitcoin enthusiasts tend to regard the cryptocurrency as a passive asset that investors buy and hold and hope to see increase in price over a long period. Buffett himself commented that there’s “nobody” that’s short bitcoin, everyone is a long-term holder.

For more sophisticated crypto investors, some coins offer a way for them to use their crypto productively — either through lending, or as collateral — to create additional portfolio benefits. However, they’re still young, highly speculative and haven’t broken into the mainstream like bitcoin.

Buffett elaborated on why he doesn’t see value in bitcoin, comparing it to things that generate other types of value.

“If you said … for a 1% interest in all the farmland in the United States, pay our group $25 billion, I’ll write you a check this afternoon,” Buffett said. ”[For] $25 billion I now own 1% of the farmland. [If] you offer me 1% of all the apartment houses in the country and you want another $25 billion, I’ll write you a check, it’s very simple. Now if you told me you own all of the bitcoin in the world and you offered it to me for $25 I wouldn’t take it because what would I do with it? I’d have to sell it back to you one way or another. It isn’t going to do anything. The apartments are going to produce rent and the farms are going to produce food.”

Investors for years have been puzzled over how to value bitcoin in part because of its potential to serve different functions. In Western markets it has been established as an investment asset, particularly in the past year as rates and inflation have been on the rise. In other markets, people still see enormous potential for its use as digital cash.

“Assets, to have value, have to deliver something to somebody. And there’s only one currency that’s accepted. You can come up with all kinds of things — we can put up Berkshire coins… but in the end, this is money,” he said, holding up a $20 bill. “And there’s no reason in the world why the United States government … is going to let Berkshire money replace theirs.”

Both Buffett and Charlie Munger have made hostile comments toward bitcoin in the past. Most famously, Buffett said bitcoin is “probably rat poison squared.” Munger doubled down on that sentiment Saturday.

“In my life, I try and avoid things that are stupid and evil and make me look bad in comparison to somebody else – and bitcoin does all three,” Munger said. “In the first place, it’s stupid because it’s still likely to go to zero. It’s evil because it undermines the Federal Reserve System … and third, it makes us look foolish compared to the Communist leader in China. He was smart enough to ban bitcoin in China.”

Disney executive Geoff Morrell, who helped craft response to ‘Don’t Say Gay’ law, leaves company after three months

PUBLISHED FRI, APR 29 20225:43 PM EDTUPDATED FRI, APR 29 20226:35 PM EDT

KEY POINTS

- Geoff Morrell, who took over for Zenia Mucha to lead Disney’s communications, has stepped down just three months after taking the job.

- Morrell helped Disney CEO Bob Chapek craft a response to Florida’s “Don’t Say Gay” legislation that has arguably backfired on the company.

- Kristina Schake, who Disney hired earlier this month, will lead Disney’s communications efforts

Geoff Morrell, the chief corporate affairs officer who helped architect Disney’s public response to Florida’s so-called “Don’t Say Gay” legislation, has decided to leave the company.

“After three months in this new role, it has become clear to me that for a number of reasons it is not the right fit,” Morrell said in a letter to his team that CNBC has obtained. “After talking this over with [Disney CEO] Bob [Chapek], I have decided to leave the company to pursue other opportunities.”

Kristina Schake, who Disney hired earlier this month, will lead Disney’s communications efforts and report directly to Chapek. Schake will have “oversight for corporate and segment communications and continue to be our chief spokesperson,” Chapek said in a note to Disney staff obatined by CNBC.

Morrell’s three-month tenure has been rocky. He took the job after years as the chief spokesman for oil and energy giant BP. Prior to that, he was a White House correspondent at ABC News and chief spokesperson for the U.S. Department of Defense under Presidents George W. Bush and Barack Obama.

According to people who worked with him, Morrell set out to be more transparent with Disney’s communication than his predecessor, Zenia Mucha, who was known to closely guard Disney’s image.

After starting his job Jan. 24, Morrell guided Disney and Chapek to publicly explain why it hadn’t taken a public stand on Florida’s controversial “Don’t Say Gay” legislation, which barred some elementary school instruction of sexual orientation and gender identity. Chapek wrote a letter to staff on March 7 explaining why Disney hadn’t publicly made a statement condemning the legislation.

“Corporate statements do very little to change outcomes or minds,” Chapek wrote. “Instead, they are often weaponized by one side or the other to further divide and inflame.”

Morrell’s thinking, according to people familiar with the matter, was based on setting precedent. He feared if Disney took a public stand against “Don’t Say Gay,” the company may also have to publicly fight future human rights issues, including potential offenses from China, an important market for Disney content. Morrell also feared potential 2024 presidential candidates Donald Trump and Florida Gov. Ron DeSantis, who has championed the bill, would use Disney as a punching bag if the company opposed the bill.

Morrell has been proven correct in recent weeks, after Disney quickly reversed its decision to stay silent amid large protests from Disney employees. Both Trump and DeSantis have come after Disney’s public challenge of “Don’t Say Gay.” DeSantis signed a bill earlier this month that removes certain privileges granted to Disney decades concerning the land surrounding its Disney World theme park.

But by explaining Disney’s decision not to take a stand on “Don’t Say Gay,” rather than simply not taking a public position, Morrell’s strategy opened up the company to months of protest that could have been avoided. Disney employees have held walkouts and run social media campaigns with the hashtag “FireChapek” after the company’s dithering response.

Disney’s brand is arguably its most important asset, and the company has largely avoided these types of public relations missteps in the past. Morrell appears to be taking the fall for the past two months by announcing his immediate resignation.

The Fed could cause a stock market ‘flush out’ and create a buying opportunity, Evercore ISI says

PUBLISHED MON, MAY 2 20223:16 PM EDTUPDATED 3 HOURS AGO

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

The Federal Reserve could cause a “cathartic flush out” in stocks this week, taking the market to a tradeable low and creating a buying opportunity, according to Evercore ISI’s Julian Emanuel.

The Fed is widely expected to raise interest rates by a half-percentage point Wednesday afternoon, following its two-day meeting. That would be the second rate hike in three years, after the quarter-point increase in March.

Emanuel, who heads equity, derivatives and quantitative strategy at Evercore ISI, said the central bank’s message is going to be a difficult one to communicate and for the market to digest. Fed officials are expected to reinforce that more hikes are coming, against a backdrop where last week’s report of negative U.S. gross domestic product spooked some investors.

“If I’m a retail investor, I could see negative GDP and I see huge inflation, and I think stagflation,” Emanuel said, adding investors may not be considering the one-off hit to net exports. That makes the Fed’s communications efforts more complicated.

First-quarter GDP contracted by 1.4%, while economists had expected a gain. Overall foreign trade reduced growth by 3.2 percentage points, according to JPMorgan. But economists expect a bounce back and an average growth rate of 3.2% in the second quarter, according to a CNBC/Moody’s Analytics survey of economists.

Fed Chair Jerome Powell is expected to reiterate the central bank’s message that it will be open to raising rates at a more aggressive pace, if necessary, to combat inflation. The Fed also is expected to announce its plans to pare back its nearly $9 trillion balance sheet, opening another avenue of policy tightening.

“When you think about the task that Powell has to do, it literally is like walking across Niagara Falls on a tight rope in a thunderstorm,” Emanuel said.

Emanuel expects whatever message the Fed delivers could rattle already nervous retail investors. That could create a “cathartic flush out whereby very underinvested institutional investors perceive values in an environment where the U.S. economy is not going into a recession despite the fact that external weakness from both China and Europe has been rising.”

He said he would be a buyer at that point since earnings continue to grow. “We’re buyers of that because basically earnings continue to be only modestly affected by the external shocks going on. That’s a function of the insularity of the U.S. economy, which continues to be strong,” he said.

VIX 1-year chart

Emanuel said rising bond yields could also cause more selling. The benchmark 10-year Treasury yield on Monday traded above the psychological important 3% level for the first time since late 2018.

A first sign of the stock market flush out would be a jump in the VIX above 40, he said. The Cboe Volatility Index, which is based on puts and calls in the S&P 500, rose to more than 36 on Monday.

Emanuel said he has no specific target for a low in the S&P 500, should the Fed trigger a downdraft.

“Trying to pick an exact number is very difficult. We have consistently said if the market were to get defensive enough, you could in theory trade down to a price where we think the Fed’s put is located, which is 3,670,” Emanuel said, noting that was not his base case. “Our base case is this week you’re making a tradeable low, which is in the context of a year-end price target of 4,800.”

S&P 500 3-year chart

Emanuel said investors could add some stocks now but should look to buy more after a bottom is struck. He favors value stocks over the longer term.

Evercore ISI created a list of stocks that could provide some buying opportunities. These names have high short interest and have raised their earnings guidance. They also have been trading toward the low end of their five-year valuations.

Tech stocks on the list include Qualcomm, NXP Semiconductors and Arrow Electronics; industrial names Ryder System and XPO Logistics were also included.

Companies on the list from the hard-hit consumer discretionary sector include PulteGroup, Williams-Sonoma and AutoNation. Health-care companies include Laboratory Corporation of America Holdings and ICU Medical.

Perfect contrarian indicator? Jim Cramer declares the bear market is over

Published: March 28, 2022 at 5:20 a.m. ET

Steve Goldstein

The stock market has climbed a pretty sizeable wall of worry over the last two weeks, with the S&P 500 rising 8% during a period of continued war in Ukraine and Federal Reserve rate hikes.

Jim Cramer, the CNBC commentator, seemed to be in a triumphant mood on Friday.

“There are 600 companies that came public in the last 18 months. There’s like seven of them that trade north of nine bucks. This is the bear market, just like 2001, except for we have rates much lower,” he said.

“You remember those days, those companies were all jokes,” he continued. “I’m looking at all the companies under $10, many of them are actually making money. We are in some weird market, that is a bear market, and that no one called it as a bear. And I think the bear market is over.”

So, that’s a lot to unpack. The generally acccepted definition of a bear market is one where prices have dropped 20% or more from a recent high. That occurred first in the small-cap Russell 2000 RUT, +1.01%, and then the tech heavy Nasdaq Composite COMP, +1.63%, though not the S&P 500 SPX, +0.57%.

Cramer’s reference to stocks under $10 is a reference to special purpose acquisition companies, that are typically priced at that level. According to Tuttle Capital Management, there were 613 SPAC IPOs last year, and another 52 so far this year. Companies that de-SPACed — that is, merged with a target — have seen an average return of -33.7%, according to the Tuttle data.

On social media, the talk was of whether Cramer has just jinxed the market.

A website called the Inverse Cramer ETF tracks calls the popular maven has made that have gone awry.

HI Financial Services Mid-Week 06-24-2014