HI Market View Commentary 02-22-2021

OK what are we currently doing at Hurley Investments?

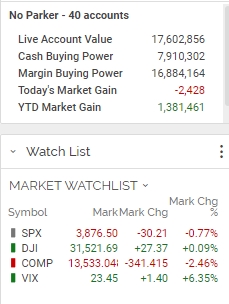

So a couple of weeks ago the question was asked how do we match up with the S&P 500 on up and down days? IT really comes down to this IF we are off by ½ of 1% then I look to see if we are overleveraged or underleveraged ?!!

How do you decide to take long put profits and convert them to shares?

I’m looking for support levels

What we do is a repeatable process that makes up some of the downward movement to dollar cost averages your shares without asking for more money to be put into the account. We make our best educated guesses and when we are wrong we usually have protection to make the wrongs a right !!!!

Sometimes we are in risk free trades !!!!

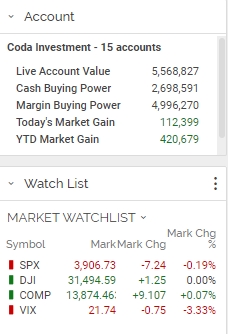

Where will our markets end this week?

Up

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end February 2021?

02-22-2021 +2.0%

02-16-2021 +2.0%

02-08-2021 -2.0%

02-01-2021 -2.0%

Earnings:

Mon: MRO,

Tues: CROX, HD, M, DDS, FLS, INTU, MYGN, SQ, TOL

Wed: LNG, LOW, ODP, SINA, SIX, TJX, LB, NVDA, PSA, VVNT

Thur: AES, BBY, DPZ, TREE, NTES, NCLH, PZZA, ADT, AMC, DELL, FSLR, HPQ, MNST

Fri: CNK, FL

Econ Reports:

Mon: Leading Indicators

Tues: FHFA Housing Price Index, Consumer Confidence, S&P Case Shiller

Wed: MBA, New Home Sales,

Thur: Initial Claims, Continuing Claims, Durable Goods, Durable ex-trans, GDP, GDP Deflator, Pending Home Sales

Fri: Personal Income, Personal Spending, PCE Prices, Chicago PMI, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

| Good news on vaccine, bond selloff deepens, and oil supply debate heats up. Result The first real-world indication that immunization will curb transmission of the coronavirus comes from Israel, which is leading the world in the vaccine race. There, the Pfizer Inc. and BioNTech SE Covid-19 vaccine appeared to stop the vast majority of recipients becoming infected. In the U.K., an aggressive program to distribute the jab is driving rare outperformance in markets as its population prepares for a slow easing of rules. Prime Minister Boris Johnson is set to announce schools will reopen from March 8 as part of his roadmap for exiting the nation’s third lockdown. Yields Breakout Market reflationistas are winning the day as bond yields spike from Australia to the U.S. A key part of the Treasuries curve — the gap between 5- and 30-year yields — touched the highest level in more than six years. There are real-life indications of price pressures to back up the market moves. Figures last week showed U.S. retail sales surging and U.K. prices picking up — both nations that are moving fast with vaccinations. Even in Europe, the prospect of inflation is being entertained. It’s a bad time to be a bond bull: HSBC strategists Steven Major and Lawrence Dyer abandoned their recommendation to buy U.S. long bonds, saying they “cannot ignore” the reflation trade, even as they remain skeptical of it. Oil Politics Saudi Arabia and Russia are at loggerheads as they head into an OPEC+ meeting that’s renewing the debate on global oil supply. Riyadh is said to prefer keeping output steady while Russia wants to proceed with an increase. Iran is also set to take part as the Islamic Republic engages in a diplomatic back-and-forth that could eventually lift sanctions on its crude exports. Attention will also remain on Texas as the state tries to recover from the extreme weather. West Texas Intermediate crude traded around $60, just off a one-year high. Markets Bonds saw a deepening selloff and metals rallied as investors priced in bets for inflation and faster economic growth. Overnight, the MSCI Asia Pacific Index fell 0.7% while Japan’s Topix index closed 0.5% higher. In Europe, the Stoxx 600 Index had lost 0.7% as of 5:40 am as investors questioned whether strong growth will lead governments to pull back on stimulus. Copper vaulted above $9,000 a ton. Coming up… The Chicago Fed National Activity Index for January is at 8:30 a.m., while the Dallas Fed Manufacturing survey for February is at 10:30 a.m. Among companies reporting earnings today are Royal Caribbean Cruises Ltd., Discovery Inc. and Ingersoll Rand Inc. What we’ve been reading This is what’s caught our eye over the last 24 hours. Biden’s $1.9 trillion stimulus plan enters three-week Congress dash What to do if you didn’t get your full stimulus check Inflation angst is about to rewrite stock market playbook If the flood comes, homeowners will be on their own Erdogan’s fallen economy czar breaks silence Bitcoin rally faces falling market liquidity Africa and the Antarctic offer glimmer of hope for travel industry The two hours that nearly destroyed Texas’s electric grid And finally, here’s what Joe’s interested in this morning Gold is having a bad run and Bitcoin is having a great run. And so there’s this narrative getting out there that Bitcoin is stealing gold’s mojo and that in a world with no Bitcoin, gold would be on a tear. It’s a nice-sounding meme. Digital gold winning hearts and minds. Gen-Z and Millennials putting their money with the (not)-shiny new thing. And there’s definitely a lot of bug-on-bug warfare that’s enjoyable to watch on Twitter. But the evidence doesn’t stack up. There’s good reason to think that even if Bitcoin didn’t exist, gold would be in the dumps in this macro environment. To start, here’s a chart of gold (yellow line) versus 10-year real interest rates (the white line, flipped over). Ten-year real rates hit their lows twice over the last year, at the beginning of August and in the beginning of January. Both times saw peaks in gold. Obviously the chart is far from a perfect correlation, but you can see that in periods where real rates were declining (white line going up), it was good for gold. And vice versa. You don’t need Bitcoin to explain the action. |

| Before it’s here, it’s on the Bloomberg Terminal. Find out more about how the Terminal delivers information and analysis that financial professionals can’t find anywhere else. Learn more. |

https://seekingalpha.com/article/4407391-disney-primed-for-success

Disney: Primed For Success

Feb. 19, 2021 9:39 AM ETThe Walt Disney Company (DIS)47 Comments1 Like

Summary

- Disney+ provides them with a strong base for future growth.

- The pandemic has made them rethink their cost structure and this cost-consciousness will serve them well going forward.

- Virus trajectory is changing and reopening will be a boost to Disney’s other divisions.

Disney (NYSE:DIS) just posted a great quarter last week that shows it is making awesome progress and resilience in the face of a tough pandemic period. We examine 3 things that build a stronger bullish case: the golden goose that is Disney+, cost consciousness, and the vaccine and virus trajectory. We wrote previously about how Disney was gearing up for war. A year later, we are happy to see that Disney is winning the war to survive and is set itself up nicely for future success.

Disney+: The Goose That Lays the Golden Eggs

The shift to Disney+ provides them with a strong base for future growth. They are riding the trend where “streaming and sharing video content is becoming a way of life for millennials in the same way as playing video games has become” as Corsair (CRSR) CEO Andy Paul put it. The company recognized early that they had to shift to online streaming. Looking back, the move to take back all their content from Netflix and invest heavily in streaming was a masterstroke that has seen them thrive in a pandemic that would have surely severely dented them. The intention was to take control of the distribution of their IP and make the most of it. They have a sexy IP and they know it:

The wealth of IP from our unrivaled collection of brands and franchises provides us with an incredible breadth and depth of storylines and characters to mine for Disney+ and our other streaming services…We’re excited to continue exploring the endless possibilities that this unique ecosystem provides – CEO Bob Chapek.

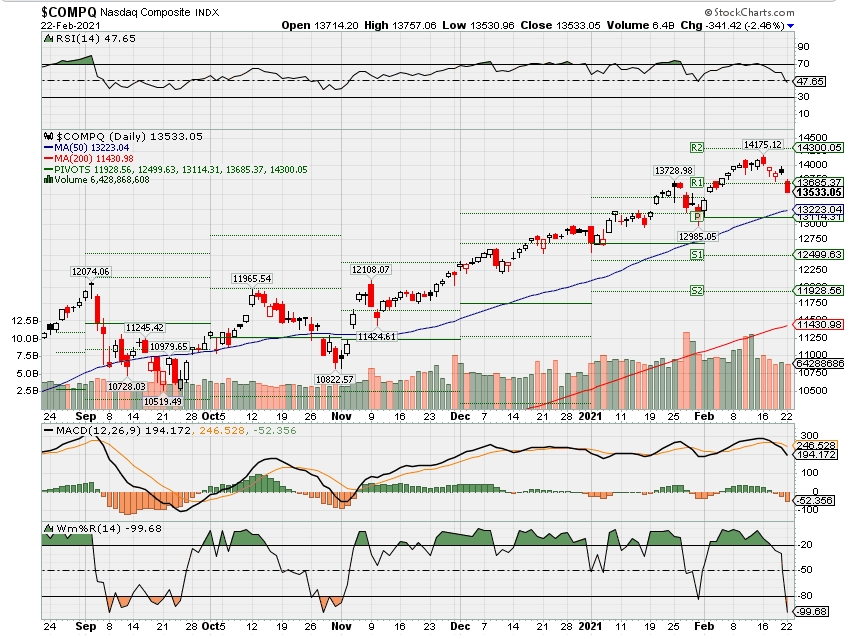

In the latest earnings results, Disney+ hit 94.9m subscribers versus a consensus estimate of 90.7m. Mind you 90m was the upper bound of the target they were to hit by 2024. Importantly, 30% of the Disney+ subs came from the Hotstar bundle. The other streaming platforms also grew with ESPN+ up 83% YoY to 12.1 million and Huluup 30% YoY to 39.4 million. In total, Disney has 146 million total paid subscriptions across their streaming services. Compare this with Netflix’s 203.7 million subscribers at the end of 2020. The new target for Disney+ is hitting 260million paid subs by end of 2024 and to achieve profitability for Disney+ by then. Disney is well armed to topple Netflix as the top streaming giant and this has Netflix a bit worried.

Source. TSOH

The SVOD market is growing fast and Disney is taking a big chunk of that growing market. Think of Disney+ as Netflix at the beginning of its switch to streaming but without the need to learn from scratch. They are taking the Netflix playbook and perfecting it. They are making maximum use of their IP content and monetizing it. It is worth noting that the Netflix team considers Disney+ such a serious competitor that in their earnings calls since they talked about their admiration of the execution at Disney+ and their aim to catch them especially in animation:

Look, it’s super impressive what Disney has done. It’s the incredible execution for an incumbent to pivot and taking on an insurgent, so that’s great. And it shows that members are interested in willing to pay more for more content because they’re hungry for great stories, and Disney does have some great stories. And so it gets us fired up about increasing our membership, increasing our content budget and it’s going to be great for the world that Disney and Netflix are competing show by show, movie by movie and we’re really fired up about catching them in family animation, maybe eventually passing them – Netflix (NFLX) CEO Reed Hastings

According to data from Antenna, subscribers in the Premium SVOD market grew 23% in 220 with Disney getting 32% of the net subscriber adds in 2020. It shows that Disney is winning not only against Netflix but also against the rest of the SVOD providers. The aggressiveness in the market in terms of promotions is very high. For instance, Paramount Plus is offering a 50% discount for an entire year! We do see an opportunity for consolidation in this market for sure.

Source: Antenna Q4 2020 Streaming Report

The ARPU at Disney+ fell by 28% to $4.03. Excluding Disney+ Hotstar in India, it would have been $5.37 which would be above last quarter’s $4.52 and just below last year’s $5.56. As such, the international growth with the launch of Disney+ Hotstar in India and Indonesia and the higher mix shift of the Disney bundle in the U.S were the culprits here. To offset the rising costs and the decreasing ARPU, the company is going to make a $1/month price increase this quarter. It is clearly exercising its pricing power and surprisingly, the customers are receiving this price increase well (see quote below) as Disney continues on delivering thrilling and consistent content regularly leveraging the strong relationship they have created with the families over the years.

We’re very comfortable with the price-value relationship that we’re offering. So we think that the $1 increase will be well-received. And we believe that our current and future pricing offers attractive value to consumer – CFO Christine McCarthy

Moreover, the Disney+ subscription added to its programming unlimited access to TV and film from Disney Marvel, Pixar, Lucas Films, and NatGeo extending to up to 4 screens which is a competitive edge. It is hard to imagine where Disney would be today given the pandemic without Disney+. When compared to the aggressive promotional activity from such companies like HBO Max, you appreciate Disney+’s performance even more.

Overall, the hot DTC segment revenues were up a hopping 73% YoY to $3.5B. In the parks, experiences, and products segment, revenues fell 53% YoY to $3.58 billion while Media and Entertainment was down 5% YoY to $12.66B. Beyond this, the company had a superb quarter posting a profit of $0.32 per share way better than the expected loss of $0.41 cents per share and revenues of $16.25 billion versus the expected $15.9 billion.

A Changing Cost Structure

The pandemic has made them rethink costs and the cost-consciousness will serve them well going forward. We strongly believe the cost-conscious behavior that they have adopted is greatly underappreciated. This quarter, the operating income came in at $600 million above estimates which were mostly attributed to lower expenses. We see a significant part of these lower expenses proving to be sticky post-pandemic. They made cost cuts of close to 1B+ during the pandemic. They are taking this opportunity afforded by COVID to do things differently and one of these things is paying very keen attention to the cost and cost structure and this is bound to stay with them post-pandemic:

Now what do we learn from it? We learned that we have to take the opportunity that this crisis is presenting, and that’s really looking at how we operate our businesses. The cost structure of our businesses is just something that we as well as any large corporate is taking a look at that I know of. And we’re also knowing that people can work differently – CFO Christine McCarthy

It was, of course, sad to lay off close to 100,000 of its workforce at the height of the pandemic but given that the re-opening of the parks is not a question of if but when some of these costs especially the variable expenses like wages will definitely increase. Very significantly, the parks and resorts that were open during the quarter provided an incremental positive contribution for the quarter:

Our parks and resorts that were opened during the quarter all operated at significantly reduced capacities, yet all achieved a net incremental positive contribution for the periods during which they were open, meaning that revenue exceeded the variable costs associated with opening – CFO Christine McCarthy

A Promising Virus Trajectory

Something that many seem to forget is that Netflix is only a streaming company but Disney is much more than just Disney+ so even though currently Netflix is above Disney in terms of valuation, once the economy reopens, things might change. Given the vaccine dissemination trajectory is progressing positively with the US is disseminating 1.6 million vaccines per day and there are lower cases and deaths with, reopening of parks and theatres (its core business before the pandemic) is not so far away.

In terms of the outlook for the parks for the rest of the year and the capacity, it’s really going to be determined by the rate of vaccination of the public. That to us seems like the biggest lever that we can have in order to either take the parks that are currently under limited capacity and increase it or open up parks that are currently closed – CEO Bob Chapek.

Just this week, White House Press Secretary Jen Psaki said they are increasing the vaccine supply from 11 million to 13.5 million doses per week. The projection is that 75% of the population will be vaccinated by the fall. This is remarkable progress. The infection rate is also dropping as can be seen in the graph below:

Source: Bloomberg

A promising virus trajectory will definitely prove to be positive for Disney as demand for their products recovers even as COVID-19 vaccines are distributed and the pandemic restrictions begin to ease later this year. Theme Parks stands to benefit the most. Once successful vaccination has taken place and measures loosened thereby allowing lenient public visits to parks, Disney will experience higher bookings. One would expect reopening to be gradual. Some silver lining is that the company saw the rate of reservations increase signifying some green shoots:

We continue to be pleased with the rate of reservation bookings we are seeing in the current quarter and consumer sentiment around visiting our domestic theme parks over a longer period of time remains strong” – CFO Christine McCarthy.

A few risks to keep in mind

Even if Disney+ is proving to be punching at the weight levels of Netflix in streaming, there are still a few risks to keep in mind, though these are not enough to keep our eyes away from this prized possession. The highest risk we can think of is that online streaming may not be as sustainable if a majority of the subscribers return to office workspace and most of their time taken by initial busy schedules. The key thing to remember is that given how useful Disney has proved to be as a baby-sitter in the pandemic, its usefulness will outlive the pandemic as it keeps the content fresh enough to mitigate the churn. Churn should also not worry you though as the company reported last September that they have a finger on its pulse:

We have a lot of data on how people are consuming, when they consume. We know if someone is churning. Is it because they just don’t use it. But the churn that we have experienced is in the range of what we had expected. And we’re pretty pleased – CFO Christine McCarthy

Conclusion

We are very enthusiastic about the solid ground that Disney has laid in terms of investing in Disney+ and paying attention to their cost structure and see that the virus trajectory will provide them with a solid foundation to

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in DIS over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

New $1,400 stimulus checks could be coming. What we know about how soon they may arrive

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Lawmakers on Capitol Hill are working on a new coronavirus relief bill expected to include new direct payments of $1,400 per person.

- The legislation is currently on pace to be finalized in early to mid-March, at which point the government would start deploying the money.

- This time, the payments coincide with tax season. Here’s what you want to consider if you’re concerned about how much you will receive and when.

As Congress works to hammer out a deal for a new coronavirus relief bill, that could mean new stimulus checks for millions of Americans.

New $1,400 direct payments are among the aid expected to be included in the package. The proposal also includes other measures to help Americans get through the ongoing pandemic, such as more enhanced federal unemployment benefits and raising the federal minimum wage to $15 per hour.

Currently, the terms call for direct payments of $1,400 per individual, or $2,800 per married couple, plus $1,400 for both child and adult dependents.

The payments would be based on the same income thresholds as the first two checks. Individuals with up to $75,000 in adjusted gross income, heads of household with up to $112,500, and married couples who file jointly with up to $150,000 would get full payments.

But the checks would be phased out for those with incomes above those levels. This time, they would be capped for individuals earning $100,000, heads of household with $150,000 and married couples with $200,000.

The coronavirus stimulus package is working its way through the House and Senate under budget reconciliation. That process will prevent big alterations to the plan, although final numbers could change.

Some lawmakers have pushed for lowering the income phase outs to $50,000 or $60,000 in order to better target those who need the money.

“These details are not yet final and could see further adjustment,” Ed Mills, Washington policy analyst at Raymond James, wrote last week, “but so far have received little pushback from moderate Democrats who sought a greater degree of targeting for upper-income payment recipients.”

Prospective $1,400 payments timeline

The legislation is expected to become final around early to mid-March.

At that point, the IRS will be deep into tax-filing season, which could make it more challenging for the tax agency to process both payments and incoming returns, said Howard Gleckman, senior fellow at the Urban-Brookings Tax Policy Center.

Last year, the first $1,200 stimulus checks were also authorized during tax season. Ultimately, the tax filing deadline was extended to July 15 from April 15 .

Still, the IRS was able to get the bulk of those $1,200 payments out within a few months.

“They did an amazing job, much better than we ever imagined they would do, getting particularly that first round of economic impact payments out,” Gleckman said.

This time, Democrats have proposed for the checks to be based on either 2019 or 2020 returns.

That could create an incentive to file early, particularly if your income dropped in 2020, which could increase the size of your check, Gleckman said.

If instead the IRS uses your 2019 information and you qualify for more money based on your 2020 income, you may have to wait a full year until next tax-filing season to get the rest of what you are due, he said.

Alternatively, if your income was less in 2019 than in 2020, you could get a bigger check if the IRS uses last year’s filing.

As with the first two stimulus checks, the bulk of the payments will likely be sent via direct deposit to those who have their bank information already on file with the IRS. Based on past checks, that money could start to arrive within days of the legislation getting finalized.

The rest of the direct payments will go out by mail either as debit cards or checks. Those payments may take several weeks to arrive.

“The good news is that there is a bit more infrastructure and a more formalized process to do this than this time last year, because they’ve been through it twice,” said Garrett Watson, senior policy analyst at the Tax Foundation.

One wild card that could affect the IRS’ workload is a proposal to expand the child tax credit. If that gets passed along with the current relief bill, the IRS may send families who qualify monthly payments of up to $300 per child.

On Tuesday, the IRS said it had sent out all “legally permitted” first and second stimulus checks and is now focusing on the tax-filing season.

The tax agency sent more than 160 million $1,200 stimulus checks that totaled more than $270 billion. It has also sent more than 147 million $600 direct payments totaling more than $142 billion.

Some Texans use 2021 Ford F-150 hybrid pickup trucks to power homes amid winter storm

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Some 2021 Ford F-150 hybrid pickup owners in Texas are using it to power their homes during the winter storm that’s left millions without electricity and heat.

- The truck’s PowerBoost onboard generator “gives you the ability to use your truck like a mobile generator,” according to Ford.

- Jerry Hall, 73, told CNBC on Thursday that “the truck saved the day.”

When Randy Jones of Katy, Texas, bought his new Ford F-150 pickup truck a few weeks ago, he didn’t think he’d be using it to keep the lights on in his house during a historic winter storm that left millions without power.

The 2021 hybrid’s onboard generator “gives you the ability to use your truck like a mobile generator” that can produce up to 7.2 kW of power, according to Ford.

Jones, 66, said in a phone interview with CNBC on Thursday that he bought the truck in part because of that feature, adding that he often loses power due to hurricanes and other storms. When he lost power Sunday night, he decided to get out a few extension cords and put the generator to the test.

“Without it I would have been in the dark and cold like everybody else in the neighborhood,” the retired refinery worker said, adding that he helped neighbors charge their phones and laptops. “Quite a few of the neighbors said, ‘Hey, I’m getting one,’ like, ‘I’m trading my Dodge or GMC,’ because, South Texas, with hurricanes and things like that, we’re always having power outages.”

Jones said he used the truck’s onboard generator to power appliances in his home for three days, until his power was restored Wednesday.

He’s not alone. Jerry Hall, 73, bought his new F-150 at the end of January. It turned out to be perfect timing, he said.

“The truck saved the day,” the Kerrville, Texas, resident said Thursday in a phone interview. Hall said his home lost power Sunday evening through early Thursday. “It would have been three miserable days without the truck.”

Hall said he and his wife still spent those days without heat, but they were able to run extension cords from the truck into the house to power lights, the refrigerator, television and other luxuries.

“It kept us connected with the outside world,” he said.

Hall said “the main reason” he bought the truck was its onboard generator. He said the rough weather last spring led to some blackouts in his part of the state and he knew he wanted to get some kind of generator. It just made sense, he said, to get a new truck with a generator built in.

Other truck owners have been posting similar stories in an online forum for F-150 owners. Photos from the forum spilled over onto Twitter, where Ford CEO Jim Farley took notice, tweeting, “The situation in the SW US is so difficult. Wish everyone in Texas had a new F150 with PowerBoost onboard generator….” https://platform.twitter.com/embed/Tweet.html?creatorScreenName=WillFOIA&dnt=false&embedId=twitter-widget-0&frame=false&hideCard=false&hideThread=false&id=1362215396892360707&lang=en&origin=https%3A%2F%2Fwww.cnbc.com%2F2021%2F02%2F18%2Fsome-texans-use-2021-ford-f-150-hybrids-to-power-homes-amid-winter-storm.html&siteScreenName=CNBC&theme=light&widgetsVersion=889aa01%3A1612811843556&width=550px

Death Toll Hits 500,000 in U.S. as Vaccinations Race Virus

By Reg Gale and Ros Krasny

February 22, 2021, 2:48 PM MST Updated on February 22, 2021, 4:36 PM MSTA half-million Americans are now dead as a result of the novel coronavirus that first hit U.S. shores just a little more than a year ago, a sad milestone that’s left families mourning nationwide.

U.S. deaths passed the 500,000 mark on Monday. Global deaths related to Covid-19 have surpassed 2.46 million, with the U.S. leading all countries with more than twice the number recorded by the next closest, Brazil, according to Bloomberg’s virus tracker.

Hospitalizations and deaths have fallen since peaking in early January as treatments have improved, a rising number of Americans have gotten natural immunity from surviving the virus, and more people are getting shots of vaccines produced by either Moderna Inc. or the Pfizer Inc.–BioNTech SE team. There’s still a growing threat, though, from swift-moving mutations that have emerged from the U.K., South Africa and Brazil, and are now increasingly seen in the U.S.“Half a million deaths,” said Anthony Fauci, the U.S.’s top infectious disease doctor, on CNN’s “State of the Union” broadcast on Sunday. “It’s terrible. It is historic. We haven’t seen anything even close to this for well over a hundred years since the 1918 pandemic of influenza.”

https://www.bloomberg.com/graphics/2020-coronavirus-dash/ President Joe Biden, in remarks before a candle-lighting ceremony at the White House honoring the Americans who died of the virus, called the loss a “heartbreaking” milestone.

“That’s more Americans who’ve died in one year in this pandemic than in World War I, World War II and the Vietnam War combined,” he said. “That’s more lives lost to this virus than any other nation on earth.”

About 657,000 in the U.S. died during the 1918 influenza pandemic with no vaccines available and no antibiotics to treat secondary infections, according to the U.S. Centers for Disease Control and Prevention. At least 50 million died worldwide.

In the beginning of March 2020, only three coronavirus-related deaths had been recorded in the U.S. By mid-April, the seven-day average for deaths topped 2,000. There have been more than 88,200 deaths just in the last month.

While less than 1% of the U.S. population lives in nursing homes and other long-term care facilities, about 35% of deaths have occurred there as of Feb. 18, according to the Long-Term Care COVID Tracker. The need to isolate residents to protect them from infection came at a high cost as families couldn’t talk with and care for older parents and grandparents, and sometimes left them unable to say goodbye.

Turnaround

Lately, though, there’s been the sense that a turnaround may be possible. Weekly deaths in long-term care centers fell to 4,239 as of Feb. 18 after reaching more than 7,000 a month earlier.

The number of hospital beds occupied by Covid-19 patients on Feb. 18 fell to the lowest number since Nov. 18, according to the U.S. Department of Health & Human Services. Still, the overall number remain high at 63,523.

At the same time, more Americans have now received at least one dose of a vaccine than have tested positive for the virus since the pandemic began. As of Sunday, 63.1 million doses had been given to people in the U.S., a number that leads the world. In the last week, an average of 1.33 million doses a day were administered.

Speed Up

To speed up vaccinations after a rocky start, the U.S. government on Jan. 12 began encouraging states to start immunizing all residents 65 and older, along with those ages 16 and older with certain medical conditions.The changes would open vaccinations up to more than a third of the U.S. population. The Biden administration has said that it’s working to expand the supply of vaccines to help meet that goal.

By speeding up vaccination, health officials hope to cut off the spread of the mutations emerging from the U.K., South Africa and Brazil, the latter two of which have shown an ability to weaken — though not yet overcome — the Pfizer vaccine.

Swift-Moving Variants

The mutation that emerged from the U.K. has been particularly aggressive, identified in 1,523 cases in 42 states as of Thursday. Federal officials have expressed concern it could soon become dominant nationwide.

The variant from South Africa, first identified in the U.S. on Jan. 28, has now infected 21 Americans in 10 states, according to the CDC, with Idaho joining the list as the 11th on Friday. The mutation that emerged from Brazil is the latest to reach U.S. shores. It’s now been identified in five cases in four states — Maryland, Florida, Oklahoma and Minnesota.

It’s not yet clear any of these highly-contagious mutations are necessarily deadlier. But the increased level of contagion alone is a problem, with more transmissions potentially leading to further surges before the vaccination campaign can take hold.

— With assistance by Drew Armstrong

HI Financial Services Mid-Week 06-24-2014