HI Market View Commentary 01-10-2022

YES we are looking for a better 2022 than 2021

Last Year Banks and F are the stocks that moved

COST stock replacement strategy also did well

AAPL, BA, CVS, V all stayed sideways

BIDU, DIS, SQ, UAA all were down basically

Good news we have $$$$ and we can add shares of DIS, UAA, BIDU and SQ leaps at any time they look bullish

Last Week I went over how to use valuations to determine a stock price !!!!

Stock Ticker Symbol Forward PE Range Next Yr EPS Expected Stock Price within 1 Yr

AAPL $172.17 32 – 34 $6.18 $197.76 – $210.12

BA $215.50 54 – 58 $4.87 $262.98 – $282.46 ALL $ 410

BAC $49.18 18 – 22 $3.18 $57.12 – $69.96

BIDU $153.33 8 – 12 $56.94 ($38) $304 – $456

COST $536.18 40 – 44 $13.97 $558.80 – $614.68

CVS $104.19 14 – 16 $8.26 $115.64 – $132.16

DG $238.27 22 – 23 $11.25 $247.50 – $253

DIS $157.83 34 – 36 – 44 $5.61 $190.74 – $213.18 – $246.84

F $24.44 13 – 14 – 15 $1.99 $25.87 – $27.86 – $29.85

JPM $167.16 16 – 18 $11.96 $191.36 – $215.28

SQ $141.54 125 – 135 $1.83 $228.75 – $247.05

UAA $19.85 28 – 32 $0.79 $22.12 – $25.28 – 27.50=34.4PE

V $216.96 32 – 36 $8.41 $269.12 – $302.76

FB $331.79 25 – 28 – 32 $14.23 $355.75 – $398.44 – $455.36

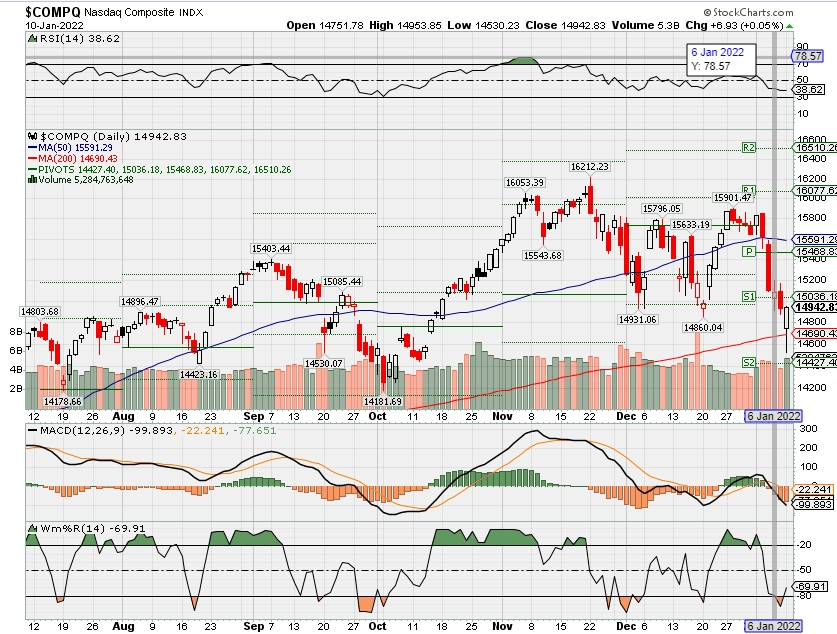

Kevin with higher interest rates doesn’t that kill Nasdaq stocks. Higher cost to borrow for R&D, Product Manufacturing, and Distribution

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 07-Jan-22 14:26 ET

2022 starts with an overdue thud after 2021 ended with a bang

It has been a tough start to 2022 for the stock market and particularly the growth stocks and mega-cap stocks. At the same time, it has been a tough start for the Treasury market, particularly longer-dated securities, yet nothing has been spared along the curve.

Market participants, however, shouldn’t be scratching their heads so much about the start to 2022 as they should have been shaking their heads about the end to 2021.

Then again, maybe enough did shake their heads while they were on holiday, which is why the stock and bond markets are off to such a shaky start in 2022.

Overdue Notice

From its low on December 20 to its high on December 30, the S&P 500 gained 6.1% in a span of just seven trading sessions. Not bad, eh? Well, it wasn’t as good as the Nasdaq Composite, which gained 6.8%. Even better was the Russell 2000, which surged 7.8%.

In that same span, Tesla (TSLA) soared 22.6%, NVIDIA (NVDA) rallied 12.2%, Microsoft (MSFT) jumped 8.1%, Apple (AAPL) increased 7.8%, and Alphabet (GOOG) gained, ho-hum, a mere 4.9%.

Let’s just keep this in mind before everyone pulls their hair out at the thought of the Nasdaq losing close to 5.0% this week and the Vanguard Mega-Cap Growth ETF (MGK) shedding close to 5%.

For a little more context bear in mind that, entering this week, the S&P 500 and Nasdaq Composite were up 113% and 128%, respectively, from their lows on March 23, 2020 (the day the Fed effectively went all-in with its policy accommodation).

Now, as for the 10-yr note yield, it went from 1.41% on December 20 to 1.51% on December 30. Seems like a decent-sized move, but then again, with a consumer inflation rate at 6.8%, a near $3.0 trillion budget deficit, and the Fed having signaled that it is going to pivot away from its uber-accommodative policy, it defied textbook reason that the 10-yr yield would only be 1.51%.

Well, it isn’t any longer. The 10-yr yield raced as high as 1.80% in this first week of 2022. That was an overdue move in our estimation just as much as the selling in the crowded mega-cap stocks was.

High Points

No one rings a bell at the top, but one must at least think things could be getting a little toppy for the near term.

At its high on Monday, Apple sported a $3 trillion market capitalization. If equated to nominal GDP, that would make Apple the fifth largest economy in the world. That same day we heard CNBC discuss how insider sales hit a record in 2021 (not at Apple, but in the overall stock market).

Also on Monday, Tesla saw its market capitalization increase as much as $150 billion (in less than a day!) on the news that it delivered 308,600 EVs in the fourth quarter — or 41,600 more cars than analysts expected, according to FactSet. Relative to the market cap increase, that equates to an allowance of roughly $3.6 million of added value per extra vehicle.

When the liquidity is flowing, it sure is flowing alright.

Monday was not only the high point of trading this week for Tesla, but it was also the high point for the market this week. The S&P 500 finished the session at a record closing high of 4796.56.

Since then, things have come off the boil so to speak. There has been a cooling down of the mega-cap stocks and the growth stocks, many of which were already entering the year on frigid terms with investors, trading 20%, 30%, 40% or even more off their 52-week highs.

That’s what happens when the excitement of a profitless story stock runs out of marginal buyers and also has to contend with a changing interest rate environment that forces the market to take a more sober view of valuations.

What It All Means

We had cautioned about these realities in recent columns published here:

- October 22, 2021: Bull market okay until interest rate push comes to shove

- November 12, 2021: An absurd monetary policy position is a risk we should all see coming

- November 19, 2021: A sign of old times for this dotcom Boomer

- December 10, 2021: 2022 stock market return expectations should get dialed down

- December 16, 2021: Fed Chair Powell delivers understatement of the year

Alas, Briefing.com subscribers might not be as surprised by the way 2022 has started as some others might be. The writing has been on the wall (and in this column) that this year promises to be more challenging on the return front than recent years.

That’s why we suggested in our 2022 market outlook that price returns at the index level should moderate, the speculative energy should lose some spark, volatility should be higher, and the back-and-forth rotation between growth and value should persist.

At the moment, the Russell 3000 Value Index is up 0.9% to start the year and the Russell 3000 Growth Index is down 4.6%.

It was quite a party in 2021 and it ended with a bang. Now, the market is confronted with the hangover and some of that pain was felt this week with heads pounding on the understanding that the Fed seems eager now to get out of its all-in position.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be posted the week of January 17)

| Market Recap |

| WEEK OF JAN. 3 THROUGH JAN. 7, 2022 |

| The S&P 500 index started the new year in the red, falling 1.9% in the first week of 2022, even as the energy sector jumped 11%. The S&P 500 ended Friday’s session at 4,677.03, down from last Friday’s closing level of 4,766.18. The index rose in its first trading session of the new year and hit a fresh intraday high on Tuesday but closed lower in each of the last four sessions. The rocky start to the year follows a 2021 in which the S&P 500 climbed 27%. The market benchmark is now up 22% from its year-ago level. The gains over the past year came amid the authorizations of COVID-19 vaccines and treatments while the US economy has been recovering from 2020’s pandemic-related closures. However, as the highly contagious omicron variant has prompted record daily COVID-19 case levels in the US in recent days, leading to staffing issues across industries, investors have seen that the virus still has the ability to disrupt business. December jobs data released Friday by the Labor Department showed last month had the smallest monthly jobs gain since December 2020. The increase in nonfarm payrolls for December amounted to 199,000, about half of the amount expected according to the Econoday consensus. This followed an increase of 249,000 in November, which was revised up by 39,000 jobs. Still, December’s unemployment rate fell to 3.9%, the lowest level since February 2020, from 4.2% in November, and surpassed expectations for a 4.1% rate. The larger-than-expected drop in the unemployment rate pushed market bets higher that the Federal Reserve’s Federal Open Market Committee will raise interest rates in March. Minutes released last week from last month’s FOMC meeting showed some participants suggested rate increases may begin sooner and at a faster pace than previously expected. The real estate sector had the largest percentage drop of the week, down 4.9%, followed by a 4.7% decline in technology and a 4.6% drop in health care. Other sectors in the red included communication services, consumer discretionary and utilities. However, there were still four sectors in the black, led by an 11% surge in energy and a 5.4% climb in financials. The other gainers were industrials and consumer staples. The real estate sector’s decliners included shares of Crown Castle International (CCI), which fell 6.7% as JPMorgan Chase downgraded its investment rating on the real estate investment trust’s stock to neutral from overweight. In technology, shares of Enphase Energy (ENPH) shed 21% as the supplier of micro inverter-based solar and battery systems said it completed its previously announced acquisition of ClipperCreek, a provider of electric vehicle charging stations. BofA Securities downgraded its investment rating on Enphase’s stock to neutral from buy while cutting its price target on the stock to $187 from $297. In health care, shares of Biogen (BIIB) slipped 3.1% as the biotechnology company said it exercised its option to obtain from Ionis Pharmaceuticals (IONS) a worldwide, exclusive, royalty-bearing license to develop and commercialize BIIB115/ION306 to treat spinal muscular atrophy. As a part of the option exercise, Biogen made a one-time $60 million payment to Ionis in Q4 of 2021. Future payments may include potential post-licensing development, regulatory and commercial milestone payments, and royalties on annual worldwide revenue. On the upside, the energy sector’s climb came as crude oil futures jumped amid unrest in Kazakhstan, which is a member of the OPEC+ alliance. Among the sector’s gainers, shares of Schlumberger (SLB) rose 17% while Halliburton added 14%. Next week, economic data on tap include the release of the December consumer price index on Wednesday, the December producer price index on Thursday, and December retail sales, import prices and industrial production on Friday. The Q4 earnings season will also kick off toward the end of next week, with Delta Air Lines (DAL) expected to release its Q4 financial results on Thursday, followed by reports from Wells Fargo (WFC), JPMorgan Chase (JPM) and Citigroup (C) on Friday. Provided by MT Newswires |

Where will our markets end this week?

Lower

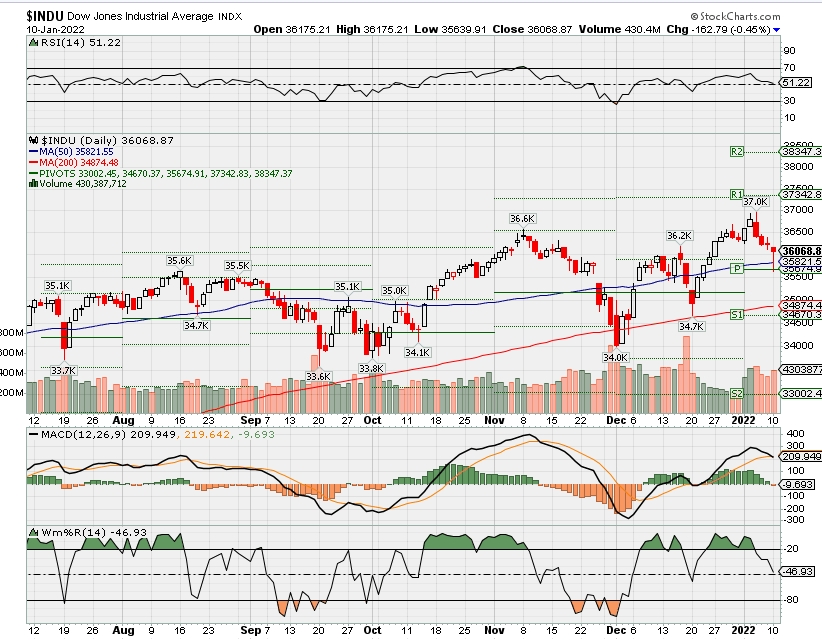

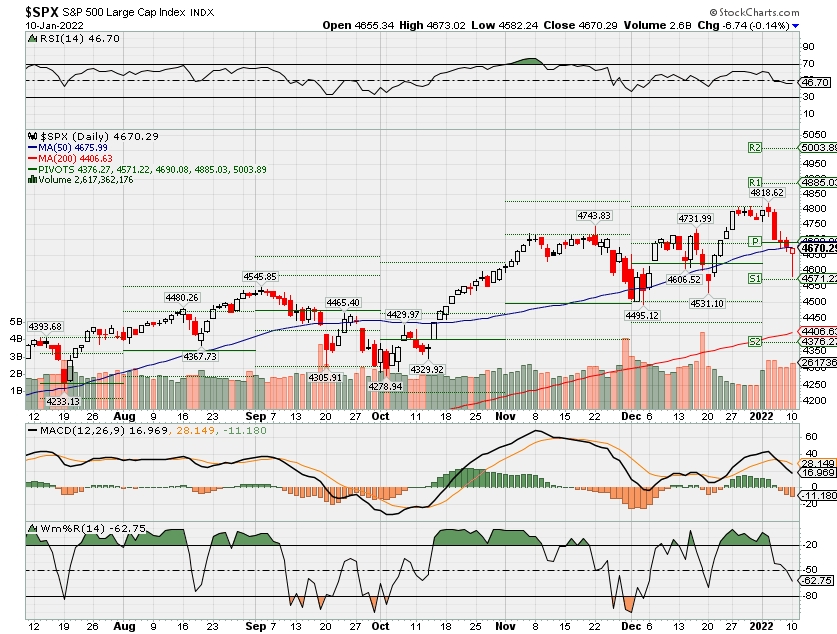

DJIA – Bullish

SPX – Bearish

COMP – Bearish

Where Will the SPX end January 2022?

01-10-2021 -3.0%

Earnings:

Mon:

Tues:

Wed: JEF, KBH

Thur: DAL

Fri: BLK, C, JPM, WFC

Econ Reports:

Mon: Wholesale Inventories

Tues:

Wed: MBA, CPI, Core CPI, Treasury Budget

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Retail Sales, Retail ex-auto, Business Inventories, Capacity Utilization, Industrial Production, Michigan Sentiment, Import, Export

How am I looking to trade?

Long put protection has been added to certain stocks

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Utah collected nearly $14B in tax revenue in 2021, a fiscal year record. Here’s why

By Emily Ashcraft, KSL.com | Posted – Dec. 29, 2021 at 9:16 p.m.

John Valentine, then president of the Utah Senate, at the Utah Capitol on Feb. 23, 2007. Valentine, now chairman of the state’s tax commission, says Utah received a record total of tax revenue in the 2021 fiscal year. (Laura Seitz, Deseret News)

SALT LAKE CITY — Utah’s tax revenue is up, despite and partially because of various COVID-19 policies and reactions. The Utah State Tax Commission’s annual report, released Wednesday, showed a total revenue of $13.97 billion in the 2021 fiscal year — an increase of $3.26 billion, or 30.5% over 2020 revenue.

John Valentine, Utah State Tax Commission chairman, said it is the highest amount the state has collected for taxes in a fiscal year.

This significant boost in tax revenue, he said, could lead to changes during the upcoming Utah legislative session. Gov. Spencer Cox has suggested a food tax credit, and reducing income tax rates was suggested by another Utah lawmaker, Valentine said.

One major component of the increase is the extended tax deadline to July 2020, which pushed some income tax revenue into the 2021 fiscal year; the 2021 extension was shorter and kept the taxes within the same fiscal year. However, there were other factors, including growth in Utah’s population and economy.

https://c2a36db3911051199783892d8491714d.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html “We had a very robust increase in 2021 where we rebounded faster than the rest of the national economy. Our income tax rebounded significantly, and candidly, our sales tax really didn’t have the big fall off that many places did,” Valentine said.

He said that shortly before COVID-19 hit, the Utah tax code changed to include taxes on remote sales, which helped the state not lose sales tax revenue. Valentine said Utah saw a 300% increase in online sales during the fiscal year.

Federal stimulus money allowed people to spend more, which also benefited sales tax revenue. Currently, Valentine said, the state is up 8% in just sales tax, which is one of the largest state revenue sources along with income tax.

Another factor causing the increased tax revenue was $720 million collected in delinquent taxes, which Valentine said is higher than normal. He said the commission found that a lot of this amount was back taxes that people paid in order to refinance their home. The stimulus money gave people more cash, and interest rates were extremely low which led more people to refinance their homes during the last fiscal year. When refinancing a home, people are required to release and pay any tax liens that were put on them from previous years.

The food tax credit suggested by Cox or reduced income tax rates suggested by others are among the options for use of the revenue that may be considered by the Utah Legislature in its upcoming session, which begins Jan. 18.

“The policymakers will be making choices as to how to restructure our tax code and to release burdens, and then how to spend significant increases in public education, higher education, public safety, health and human services. The governor’s recommendations in all those areas have had significant increases to reflect the fact that we’ve got a change in the economy,” Valentine said.

Of the 2021 fiscal year revenue, the report said that 49.2% was placed in the education fund, 21.2% in the general fund, 10.9% in the transportation fund, 16% in fiduciary funds and 2.6% in other funds.

Throughout this fiscal year there have been a lot of “surprises,” Valentine said, because of changes in federal and state law, including some that are still in the process of being implemented.

One of the year’s challenges for the tax commission has been addressing long lines at the Department of Motor Vehicles. Currently the goal is to get people in and out of the DMV in 20 minutes. They developed technology to transfer car titles online, but quickly had to develop an auditing system to make sure that the correct car price was reported.

Opinion: Why the bull market will stay alive in 2022 — plus 8 cheap stocks for your money now

Last Updated: Jan. 8, 2022 at 10:41 a.m. ETFirst Published: Jan. 5, 2022 at 7:08 a.m. ET

Michael Brush

3 top stock newsletter writers share their favorite picks for the year ahead

High level summary: Expect 5%-6% gains for the S&P 500 SPX, -0.14% this year, though Federal Reserve missteps on rate hikes could bring some selloffs. Value may outperform growth, where popular tech and electric vehicle names still seem overvalued. For more on this — and the eight reopening plays, banks and turnarounds these analysts favor — read on.

Value stocks over growth

Stock market outlook: The rolling U.S. market corrections last year made a lot of investors worried about inflation and Fed policy, and those concerns linger. But John Buckingham, editor of The Prudent Speculator, isn’t too worried about the stock market in 2022 because he expects economic growth to hang in there. “Historically, miserable stock performance has coincided with an earnings recession. So, if there is no expectation of an earnings recession, I don’t see how you can be bearish,” he says.

Buckingham expects global growth and solid earnings gains to push the S&P 500 up 6% this year. But value stocks should do much better, he predicts, since they tend to outperform in a rising interest rate environment with higher inflation. He expects the Russell 3000 Value Index to gain 9%-11%.

Buckingham cautions that parts of the U.S. market are risky because they are overvalued. He cites popular growth stocks such as Amazon.com AMZN, -0.66% and NVIDIA NVDA, +0.56%, as well as electric vehicle (EV) producers including Rivian Automotive RIVN, -5.61% and Tesla TSLA, +3.03%. Then there is the Omicron wild card. A broad lockdown in the U.S. would delay the recovery. But so far it doesn’t look like this will happen given that the variant seems relatively mild.

Favorite stocks: Here’s an important proviso. Like the other two newsletter writers below, Buckingham encourages investors to own a broadly diversified portfolio to reduce risk. But he’s OK with singling out a few that could be among your holdings, depending on what else you own.

First, he says, consider General Motors GM, -1.93%, as stealth EV play. Depending on the day, EV companies can be worth more than General Motors, notes Buckingham, referring to the outsized market values of Rivian and Tesla. “That’s insane, in my view,” he says. After all, GM is developing electric vehicles, too, and has a known track record in mass-producing and marketing cars. Yet the stock trades at just 10 times earnings. “They have plenty of upside potential,” Buckingham says of GM.

Next, consider the reopening play Zimmer Biomet ZBH, -0.98%, which sells medical devices, including implants used in joint and spine surgery. COVID-19 has patients and hospitals postponing elective surgeries. But if the pandemic’s variants continue to be less virulent, then elective surgeries can be expected to pick up again. So would demand for Zimmer’s implants and medical devices. Meanwhile, the stock looks cheap, trading recently at 16 times earnings compared to its historical range of 22-28.

Another reopening play to consider: Walt Disney Co. DIS, -0.78%. The stock is down significantly on concerns about theme park and movie theater attendance. If COVID-19 worries recede, these concerns will diminish and investors likely will bid up the stock again. Meanwhile, Disney holds a powerhouse of film characters it can continue to monetize via toy sales, Broadway shows and theme-park tie-ins.

“So much more thorough and easier to manipulate than the ‘plan’ created for me by my advisor. When something changes in my life or my thinking, bingo! I just change assumptions and make sure I still live longer than my money!” – Eric, 56

Stock yield reveals bargains

Stock market outlook: Inflation will continue to be an issue throughout 2022, driven in part by high energy prices. This will force the Fed to play catch up on interest rate hikes. That could be bad news for the U.S. stock market. “The Fed has a track record of always being late to the party,” says Kelly Wright, managing editor of Investment Quality Trends. “Then it over compensates, and it throws the market into spasms.” Wright says there’s even a risk the Fed might create a recession in 2022: “If we have a flat year…for the stock market, it will be a victory.”

Another challenge is that the market looks overvalued. Consider the market valuation intelligence we can glean from Wright’s stock selection system. To identify timely entries and exits in dividend yield stocks, Wright looks for historically high- and low yields. Historically high yields occur when a stock sells off a lot. (Yields rise when stocks fall.) The low-water marks for yields happen when a stock rallies hard. Over time, stock price moves tend to be bracketed by historically high and low yields. You can use the same valuation analysis for the stock market, overall. It is not reassuring.

Consider the Dow Jones Industrial Average DJIA, -0.45%. Historically, the Dow is “overvalued” when it rises enough so that its yield falls to 2%. The Dow’s yield is currently well below that, at 1.77%. The Dow would have to fall 12% just to get back to its normal historical “overvalued” yield of 2%. The Dow would have to tumble 50% to get to its historically undervalued yield level of 4%. “Our system is saying this is a high-risk period for stocks,” concludes Wright.

Favorite stocks: Barring a recession, banks may do well because they benefit from rising rates — as long as the yield curve stays upward sloping. In that scenario, rising rates mean they can earn more on loans (loan interest rates are linked the long end of the yield curve) compared to what banks pay on deposits (the short end). Despite this bullish outlook, some bank stocks still look inexpensive, by Wright’s system.

For example, First Merchants’s FRME, +0.07% repetitive high yield (indicating its stock has fallen enough to be undervalued) has been 2.6%. The stock trades around that level now. “Their economic value is significantly higher than their market value,” says Wright. Shares won’t be overvalued, based on its history, until the stock rises enough so that the yield falls to 1.5%. This suggests a move to $77 for the stock is possible; it closed on Jan. 4 at $43.32. Also consider Arrow Financial AROW, -1.32%. The shares historically have been overvalued when the stock is so strong that its yield falls to 2.35%. The current dividend yield is well above that at 2.9%, suggesting the stock could have to move to $50 from around $36 now, before the shares appear overvalued.

In healthcare, consider Merck MRK, +2.58%. Its stock looks more reasonably priced now, following a 14% decline since November. Merck looks historically undervalued when its yield rises to 4%, and it’s pretty close, with a dividend yield of 3.6%. It’s not overvalued until the stock rises enough to push the yield down to 2.35%. This implies a move up to $117 could happen. The stock recently changed hands at around $77. Merck stock may benefit from sales of its COVID-19 pill, molnupiravir, which was recently approved by the Food and Drug Administration. It also has blockbuster drugs like Keytruda for cancer, and a rich pipeline of more therapies on the way.

Turnaround candidates

Stock market outlook: “We don’t think the economy is going to into a recession,” says Bruce Kaser, chief analyst at the Cabot Turnaround Letter. Earnings will put in nice 8%-10% growth this year, he says. That’s the good news. But solid earnings growth may be offset by downward pressure on valuation multiples caused by Fed hikes and rising interest rates. Another headwind: The decline in fiscal stimulus out of Washington, D.C. The upshot, Kaser says, will be 5% gains for the S&P 500.

Favorite stocks: As the name of his stock letter suggests, Kaser likes “turnrounds,” meaning companies whose fortunes may be improving because of a change in leadership or strategy. One to consider is Nokia NOK, +1.15%, where turnaround efforts are starting to pay off. Sales and profitability are picking up as Nokia now sells 5G networking equipment. This makes it a play on a big-picture trend — a major upgrade in wireless networks.

Next, Kaser likes TreeHouse Foods THS, -1.93%, which makes the house-brand food and beverages you see in grocery stores. The company struggled because it made too many acquisitions, says Kaser, and it took on too much debt to make the buyouts. Last spring, activist hedge fund Jana Partners took a stake in TreeHouse. It boosted the position in the third quarter of 2021. Jana, which has a history of shaking things up in the food sector, has nominated two board members. TreeHouse now says it is “exploring strategic alternatives,” including the sale of part of its basic meal-prep ingredients business to focus on its higher growth snacks and beverages division.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned AMZN and TSLA. Brush has suggested AMZN, NVDA, TSLA, GM, ZBH, DIS, FRME and MRK in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.

Ford Motor declares $0.10 dividend

Jan. 10, 2022 4:41 PM ETFord Motor Company (F)By: Pranav Ghumatkar, SA News Editor9 Comments

- Ford Motor (NYSE:F) declares $0.10/share quarterly dividend, in line with previous.

- Forward yield 1.68%

- Payable March 1; for shareholders of record Jan. 31; ex-div Jan. 28.

Alibaba: Charlie Munger Is Teaching The Market A Lesson Again

Jan. 07, 2022 12:45 PM ETAlibaba Group Holding Limited (BABA)AMZN, PDD556 Comments69 Likes

Summary

- Charlie Munger doubled his stake in bruised e-Commerce enterprise Alibaba in the fourth-quarter.

- Shares of Alibaba ended the year 50% down.

- Undervalued prospects for international expansion and earnings growth imply massive rebound potential for Alibaba.

maybefalse/iStock Unreleased via Getty ImagesThere

is a valuable lesson to be learned when one of the most legendary investors of our time invests in a business that the market is avoiding. Based on a release about stock ownership positions in the investment portfolio of Daily Journal Corporation (DJCO), Charlie Munger increased his investment in Chinese e-Commerce powerhouse Alibaba (NYSE:BABA) by 100% in the fourth quarter. The timing of the acquisition is noteworthy and China-skeptical investors should take notice!

Alibaba’s significant drop in pricing in FY 2021

Shares of Alibaba went through a near-50% drop in pricing in FY 2021 as bad headlines piled up throughout the year for the e-Commerce company. The Chinese Communist Party fined tech monopolies for the abuse of their market positions and Alibaba cut its revenue forecast for FY 2022 due a post-pandemic market slowdown. Additionally, fears over an ADR delisting and Alibaba’s VIE structure impacted BABA’s pricing in a very negative way last year.

However, a mandatory 13F filing from the Daily Journal Corporation, dated January 4, 2022, revealed that one of the most legendary investors of our time, Charlie Munger, long-term confidante and business partner of Warren Buffett, bought shares of Alibaba by the truck-load in the last quarter. Charlie Munger is the vice chairman of Berkshire Hathaway and chairman of The Daily Journal Corporation.

The acquisition of Alibaba shares raises eyebrows because it occurred at a time when market sentiment regarding Alibaba is very bearish and the investment portfolio of the Daily Journal Corporation rarely shows any acquisition activity at all. The portfolio also consists of only 5 positions including Bank of America (BAC), Wells Fargo (WFC), Alibaba, U.S. Bancorp (USB) and Posco (PKX).

The Daily Journal Corporation acquired 300,000 shares of Alibaba in the fourth-quarter, effectively doubling its previous position size to 602,060 shares. The investment, based on a share price of $121.16, is valued at approximately $73M.

The reported price for DJCO’s Alibaba stake is $118.79, meaning the portfolio manager acquired shares near Alibaba’s 1-year low of $108.70. The portfolio weighting of the Alibaba stake increased from 20% in Q3’21 to 28% in Q4’21.

(Source: Dataroma)

What value does Charlie Munger see in Alibaba?

As an experienced value investor, Charlie Munger understands the large impact emotions had on Alibaba’s pricing. With a near-50% drop in pricing since January 1, 2021 and multiple problems stacking up on top of each other last year, the market is no longer rationally looking at Alibaba’s prospects for sustained e-Commerce growth in its core markets. For that reason, Alibaba’s platform value has been discounted too steeply.

Although negative factors continue to affect Alibaba’s share price to this day, the firm has the largest e-Commerce platform in the world with more than 1.2B active accounts and we can probably all agree that this has significant intrinsic value. Alibaba’s top line growth is moderating, but the e-Commerce platform will nevertheless draw a considerable number of new shoppers into its ecosystem going forward.

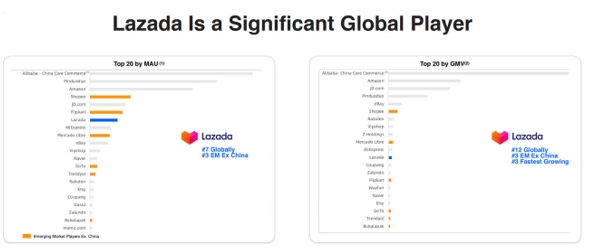

Growth is materializing especially in Alibaba’s retail marketplaces outside of China, with Lazada in Southeast Asia and trendyol in Turkey, whose businesses see strong customer acquisition. Alibaba is likely to add around 50M new customer accounts each quarter to its ecosystem this year and Alibaba could have 1.5B active customers on its platform by year-end. About 23% of Alibaba’s customer accounts are on platforms servicing customers outside of China, including Lazada, trendyol, Aliexpress and daraz.

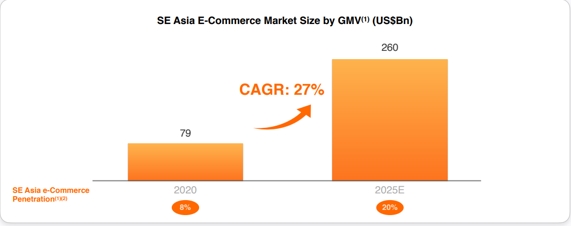

Lazada, headquartered in Singapore and active in key markets Indonesia, Malaysia, Thailand, Vietnam, Singapore and the Philippines, is already the seventh-largest e-Commerce platform in the world regarding monthly active users/MAUs and the brand has considerable potential to grow users and rise up in the rankings of top global e-Commerce companies. The reason for this is that Lazada’s e-Commerce penetration rate in Southeast Asia is relatively low at 11% and the market potential is far from being exhausted.

(Source: Alibaba)

While Lazada’s penetration rate in Southeast Asia is low, the addressable market is projected to expand rapidly. The SE Asian e-Commerce market is expected to grow 27% annually until FY 2025, creating an opportunity for Lazada and Alibaba to generate sustained user and gross merchandise value growth in one of the fastest growing parts of the world.

(Source: Alibaba)

Lazada saw a strong increase in accounts and monthly active users during the pandemic when more sales shifted online. In September 2021, Lazada had 159M MAUs, showing a factor increase of 1.7 X year over an eighteen months period.

(Source: Alibaba)

Alibaba’s risk-adjusted intrinsic value

Alibaba will continue to grow its top line, its free cash flow, and its bottom line moving forward, but key metrics may grow a little slower than in the past. Alibaba is expected to generate EPS of $9.67 in FY 2023 and $11.46 in FY 2024, implying year over year growth of 14% and 19% respectively. If we were to apply a risk factor discount of 20% to account for Alibaba’s larger than normal risks, we would get a risk-adjusted EPS of $7.74 for FY 2023 and $9.17 for FY 2024. Since Alibaba will still grow earnings and revenues at double digits over the next five years, an earnings multiplier factor/EMF of 25 is justified. Using the risk-adjusted forward EPS figure for FY 2023 and a 25 X EMF, then shares of Alibaba have a risk-adjusted fair value of around $195, implying 61% recovery potential. Based on FY 2023 EPS, risk-adjusted, Alibaba could revalue up to $223 before being overvalued.

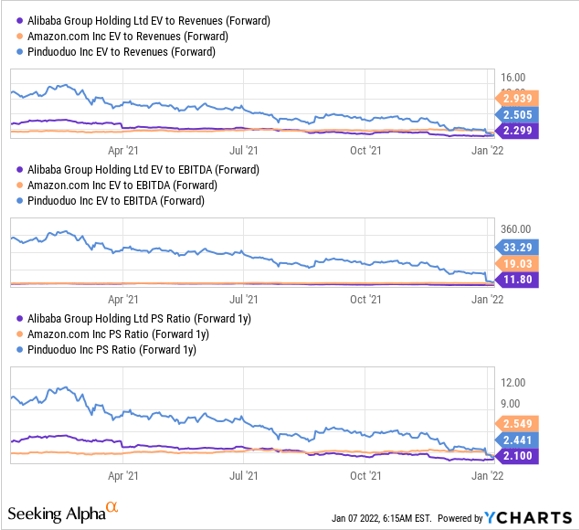

We can see that Alibaba’s e-Commerce growth potential has been discounted too steeply by comparing Alibaba’s multiplier factors to those of other e-Commerce companies, like Pinduoduo (PDD) or Amazon (AMZN).

Data byYCharts

Risks with Alibaba

Strengthening state control, resulting in a suppression of Alibaba’s e-Commerce growth or lower profitability are possibly the two largest risks that will determine how investors feel about owning shares of Alibaba. Should Alibaba’s revenue and EPS growth drastically slow, then I would change my opinion on the e-Commerce company.

Although many fear that Alibaba’s ADR shares will get delisted, I don’t see this as a large risk. The reason for this is that the China Securities Regulatory Commission allegedly considers greenlighting offshore IPOs without the need for VIE structures as long as certain compliance requirements are met. Companies that already use VIE structures, like Alibaba, would not be affected.

https://buy.tinypass.com/checkout/template/cacheableShow?aid=CWJjPp7cpu&templateId=OTSFX0312PII&offerId=fakeOfferId&experienceId=EXWTEW4YENQ8&iframeId=offer_b8d836eefa4eb076dca3-0&displayMode=inline&widget=template&url=https%3A%2F%2Fseekingalpha.com Final thoughts

Long term investors should take note: One of the most successful investors of all time doubled down on shares of Alibaba near 1-year lows while the market turned the other way. Charlie Munger is teaching the market a lesson here once again: focus on Alibaba’s e-Commerce possibilities in China and abroad, including the expanding addressable market and significant tailwinds for user growth in Southeast Asia. Alibaba’s sales and EPS are going to grow at double digits in the near future and the firm’s full intrinsic value is materially higher than Alibaba’s current share price!

Disclosure: I/we have a beneficial long position in the shares of BABA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

One unexpected way physicians invest like billionaires (and how you can too)

OCTOBER 31, 2021

The Power Law dictates that 1% of the world’s population holds 45% of the wealth.

And they’re only getting richer thanks to the rise of consumer technology during the global health situation.

In fact, the total net worth held by millionaires and billionaires grew by 61% during the pandemic—a staggering $3.9 trillion, according to Business Insider.

Despite above-average pay, 50% of American physicians aren’t millionaires. What most people don’t realize is that with the right moves, achieving millionaire status isn’t a matter of if, but when.

As long as you have an internet connection, you’ve got everything you need to be on your way to seven figures.

To break the million-dollar mark you need to invest like the rich. And there’s one place they’re all investing that most people overlook, alternatives.

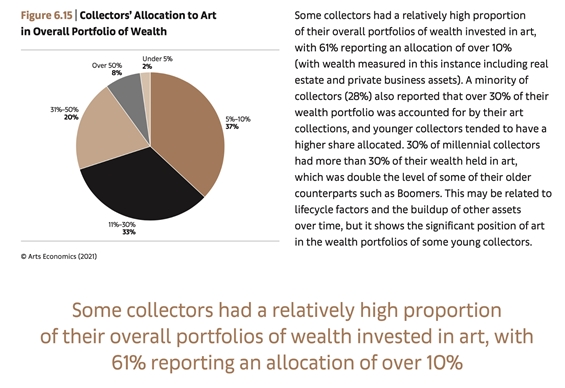

Millionaires invest 30% of their wealth in alternative assets on average. One of their favorites? Art.

You might be wondering, why art? Well, the “0.1% of the 0.1%” have used art to grow their fortunes and increase their status for centuries.

Jeff Bezos, Bill Gates, and Oprah Winfrey have built collections valued in the hundreds of millions. And before them, the Rockefellers amassed the world’s most valuable art collection ever sold—a staggering $835M.

And while that’s incredible, the value of art is only growing. Accounting firm, Deloitte, estimates the wealth held in art will increase by $1 trillion in less than five years.

Now, the super-rich are pouring more money into art than ever before. Here are a few key reasons why.

Consistent performance

Not many people ever talk about art as a financial asset. You’d probably think of it as something to make your waiting room look nicer, but art has quietly outperformed other asset classes.

For example, a Basquiat painting, which was originally purchased for $19,000, recently fetched $110,500,000 at auction. That’s a 5,814% gross return on investment. You don’t need a PhD from Harvard to know that’s pretty good.

Contemporary art has also outperformed the S&P 500 by nearly 3 fold from 1995-2020. That’s a huge difference… especially in the record bull market we all witnessed. On average, it appreciates in value by 14% annually. This alone makes art potentially a great addition to any investor’s portfolio.

Absolutely massive asset class

There’s a reason why experts call art to be the largest asset class to never be securitized. And with $64 billion in art traded every year, and the global art market expected to be worth over $2.7 by 2026, there’s a reason for that. And that’s not all.

Art has no correlation with the broader stock market according to Citi. Being uncorrelated to stocks makes art a useful hedge against market volatility.

That’s allowed art to trounce other conventional “safety hedge” investments like gold and real estate. Paintings go up in value even when the stock market crashes, making it a good diversification for an investment portfolio.

It’s no coincidence that 85% of wealth managers believe that art should be offered to clients.

Becoming an art investor

With some paintings selling for tens of millions, previously you’d need at least $100M to build a properly diversified portfolio of art. But there’s a little-known — and incredibly smart way — for everyday people like you and I to invest in contemporary. One that allows you to participate at a fraction of the cost.

It’s all thanks to Masterworks, the art investment platform. They’ve recently opened the doors to this exciting multi-trillion-dollar asset class. Masterworks makes million-dollar paintings investible the same way you can buy a company’s stock. Instead of buying a single painting, you can invest in shares of individual works.

How it works

Masterworks has an industry-leading research team that does extensive data analysis to find the right masterpiece for investors. Then, they will buy a piece of art, and register it with the SEC, sort of like investment banks take companies public.

After that, you can buy fractional shares representing an investment in that painting. This is all done securely on their platform. Masterworks holds the piece until it appreciates, and when they sell, you get a prorated portion of the profit. It’s that simple. And you have the option to sell your shares on their secondary market at any time if you’d like as well.

Early investors have already received a 32% annualized return from a Banksy sale last year — twice the S&P 500.

To date, Masterworks has securitized over $250 million dollars worth of art, and over 230,000 investors have signed up.

And what’s more incredible is the fact they already secured a valuation over $1 billion.

We partnered with Masterworks to give our readers priority access to their offerings. Click this link to skip their waitlist and invest in multimillion-dollar paintings today.

Lawrence Cummings is an economist. Please review Masterworks’ disclosures.

HI Financial Services Mid-Week 06-24-2014