| Market Recap |

| WEEK OF DEC. 28 THROUGH JAN. 1, 2021 |

| The S&P 500 ended 2020 on a positive note as it reached a new closing record, up 1.4% for its final week of the year while logging a 3.7% climb for December and a 16% jump for the year. The market benchmark ended the year at 3,756.07, up from last week’s close of 3,703.06 and representing its highest closing level ever. The index also reached a new intraday high Thursday at 3,760.20. This is the eighth time in history that the S&P 500 has closed a year at a record high, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices. The last time this happened was in 2013. It marks the conclusion of a tumultuous year for the market, which reacted negatively earlier in the year as the COVID-19 pandemic unfolded and prompted shutdowns worldwide, but rebounded as economies reopened and vaccines gave investors hope. The final week of the year consisted of just four sessions as the US stock market closed Friday for New Year’s Day. Over the week’s four sessions, all but one sector gained. The utilities sector had the largest percentage gain of the week, up 2.4%, followed by a 1.8% rise in consumer discretionary and gains of 1.8% each in communication services, financials and health care. Energy was the one sector in the red, down 0.6%. The utilities sector’s gainers this week included CMS Energy (CMS) and Entergy (ETR), which rose 4.9% and 4.7%, respectively. Among consumer discretionary stocks, Tesla (TSLA) shares jumped 6.6% on the week amid positive commentary and actions from several analysts. Cowen & Co. analysts raised their price target on the stock while analysts at Wedbush and Credit Suisse both issued notes to clients predicting the maker of electric vehicles will exceed Street expectations for Q4 demand and is likely to achieve its target delivery of 500,000 electric vehicles for the year. On the downside, the energy sector’s decliners included Cabot Oil & Gas (COG), down 3.9%, and Williams (WMB), down 3.3%. Next week, the market will kick off 2021 with readings on December manufacturing activity from Markit and the Institute for Supply Management due Monday and Tuesday, respectively. November construction spending is also due Monday and motor vehicle sales for December are expected Tuesday. The focus will turn to employment midweek, with ADP’s employment report for December due Wednesday, followed by weekly jobless claims Thursday and the Labor Department’s nonfarm payrolls and unemployment rate for December expected Friday. Provided by MT Newswires. |

On Sunday, January 3, 2021, 11:29 AM, Bryan Ward <bryan@thirdwayman.com> wrote:

| I was nowhere near my income goal for the year. Once again, I’d whiffed my big hairy audacious money goal by a mile. “Not thinking big enough,” I told myself. So I set a goal and attack plan 10X bigger for the next year… …only to miss even further by that year’s end. Over the years, I slowly realized I was going about it all backwards: That as counter-intuitive as it seems, the bigger the goal, the less work you must do, the smaller a role willpower plays, and the more you must unbundle your wins. Here are my three contrarian tips for going beyond “talking a big goal game” and actually achieving your BHAG goals in 2021. 1. Quality trumps quantity Anyone who says 80-hour work-weeks and “hustle and grind” is the secret to success hasn’t been in the game for long. Or their adherence to that approach is about to bite them in the ass (on the verge of breaking the things that can’t abide unrelenting long hours: marriage, family, life, sanity) and they just don’t know it yet. The key is to shift from higher quantity to higher quality of hours. To do this, you must invest deeply in the part of the work iceberg BELOW the surface: * Journaling * Sleep * Reading * Adventure * Exercise * Diet * Daydreaming * Thinking * Play Work less, but better hours. Creative, game-changing work is a capacity you grow, not an ability you marshall. 2. Strategy trumps will For too many years, I over-invested in willpower and underinvested in strategy. Will is fleeting and fragile, even for the most driven of us. But strategy is diamond-hard. Rather than counting on the short-term juice of high bars to carry you, look to shrewd strategy: What unique strength can you better leverage? What secret knowledge can you better parlay? What chink in your competitor’s amour can you better exploit? Will requires constant fire-stoking and renewal. Good strategy creates its own fire through the inherent executability of its superior attack plan. 3. Velocity trumps size You may think of yourself as a lion, tiger, eagle, or some other straight-forwardly powerful animal. The more serviceable metaphor is that of the shark. Though you are indeed powerful, your first priority, before conquest and feats of strength, is simply to breathe. Unlike other fish, shark gills only work when in motion. If a shark stops moving forward, it dies. You are the same. You’re better off building momentum with a steady stream of small wins that build on each other than to thrash in an oxygen-deprived panic for the massive but far-off win. Pursue weekly base hits over quarterly grand slams, because the latter puts you at risk of drowning in the long trough between. You still attack the massive goal: you just do it one thin-slice chunk at a time. … If you’ve lost faith in your goal-setting ability, don’t give up: The life you want’s still possible. You just need to refine your process. Mix it up and try my contrarian three-pronged approach. Let’s make 2021 legendary! Bryan Ward, founder Third Way Man . |

We at Hurley Investments are in the game to make “exponential” returns

Between 2019 and 2020 we probably added somewhere between 30-50% more shares of stock to your accounts USING profits from protection

The end 2020 – BA, DIS, AAPL, BIDU, V

2021 – BA=380-405, DIS =196-203, V= 235, UUA = 27, F=17.50-22

2021 will be much like 2020 ONLY WORST

Record Highs

Record Highs in Margin Debt

Record ETF Inflows – Too much Passive Investing

Vaccine quantities to reach “herd immunity” won’t be reached until August at the earliest

Slower economy and weak earnings

Smart Money will trump retail investor dollars

More Taxes and Another stimulus that just wont be enough for small business in the US

Earnings this quarter will be worse than expected BECAUSE as much as online sales were up we were still down over 20% from the previous year in purchases

New equity positions for 2021 that I am looking at – WMT, ALK, PYPL, SQ, CCL, RCL, MGM, SBUX

I still like my favorites – AAPL, BIDU, BAC, BA, DIS, F, V, & UAA is “still” my wildcard

For smaller accounts following the SPY, QQQ, DIA, F, UAA, Leaps

MY goals are the same every single year when it comes to the market

1St – Make a 7.75% return, then 15%, then 20%, then IT all comes down to protecting your gains

2nd – Get more business booked for Keve, grow my business by 20% (new Money), looking trying to add another adviser

3rd– Grow HI to 50 million

Physically – split all of last years wood 65yardsx8 ft wide x 5 ft tall, get down to 235lbs, go Hike Havasupai with all the kids

Personal- Flaming Gorge Year, Fish in Alaska, Wood burning stove in the house, New paint and new carpet, Remodel Master Bedroom Bathroom,

Spiritual – Date every month, Read my scriptures daily, find more ways to help those that might be in need

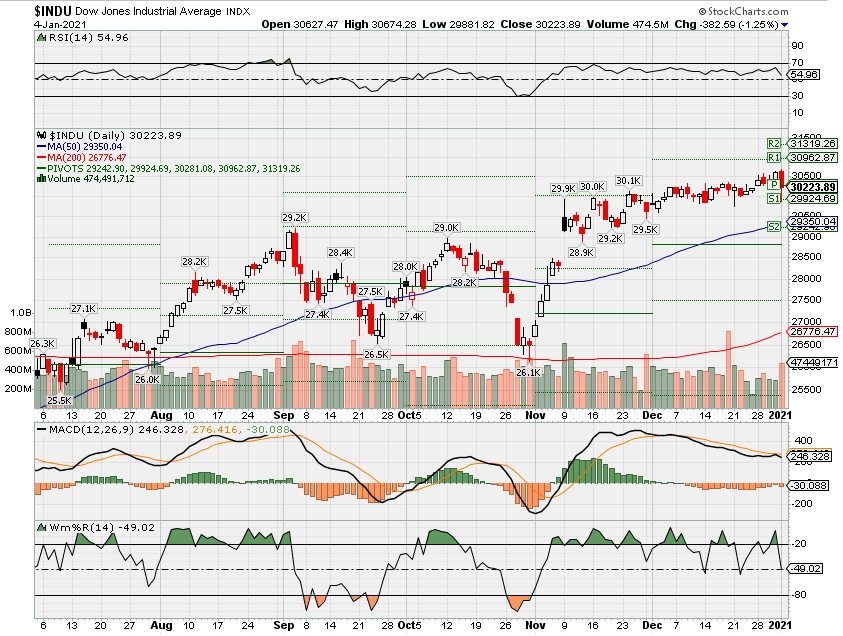

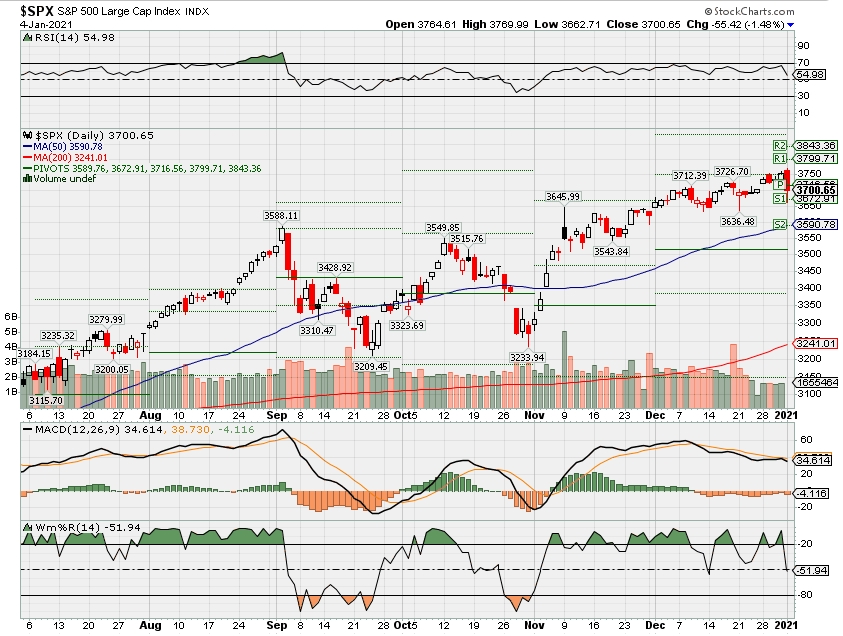

Where will our markets end this week?

DOWN

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end January 2021?

01-04-2021 +0.0%

Earnings:

Mon:

Tues:

Wed:

Thur: CCL, WBA, MU

Fri:

Econ Reports:

Mon: Construction Spending

Tues: ISM Manufacturing

Wed: MBA, ADP Employment, Factory Orders, FOMC Minutes

Thur: Initial Claims, Continuing Claims, Trade Balance, ISM Non-Manufacturing

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Wholesale Inventory, Consumer Credit,

Int’l:

Mon –

Tues – EUR: Retail Sales

Wed – CN: Caixin Services PMI

Thursday –

Friday-

Sunday –

How am I looking to trade?

Waiting for earnings and will protective put into this earnings season and add short calls after the announcement and after I listen to the guidance

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Chinese Stocks – Being the second largest economy it is probably helpful to have some exposure to China – BIDU

Economic outlook for 2021 looks better eventually, Utah analyst says

By Jasen Lee, KSL | Posted – Dec. 29, 2020 at 7:00 p.m.

SALT LAKE CITY — The year 2020 will likely be remembered for the historic health and economic toll of the COVID-19 pandemic, but a Utah economist says the promise of a brighter 2021 may be on the horizon, thanks to newly developed vaccines and a new federal stimulus package that could help cure what’s been ailing the nation physically and economically.

“The pandemic really is the classic example of a black swan event, something no one saw coming, no one anticipated, and it’s had an enormous impact on the economy and on individuals,” said Zions Bank senior economist Robert Spendlove. Prior to the outbreak, he noted the Utah economy was trending upward with strong fundamentals and a positive outlook for the year.

Then the devastation of the pandemic changed everything, placing a cloud of uncertainty over the entire state and across the globe, he said.

“The good thing about black swan events is they’re extremely rare, but they have a severe impact and they can’t be prevented or predicted,” he said. “So that’s what we saw, this pandemic come on and it decimated the economy throughout the world.”

Spendlove noted that despite Utah’s low unemployment rate reported in December, the number of individuals filing for weekly jobless benefits continues to register at exceptionally high levels at more than 300% of pre-pandemic averages.

“During the worst part we had 33,000 (weekly claims) at the beginning of April, so we’re a lot better than we were during the worst part, but it’s still elevated and we still have people losing their jobs,” he said. “And just in the last few weeks, we’ve seen those initial claims starting to trend up again.”

He said those numbers should begin to improve as the COVID-19 vaccine rollout continues and more people are able to resume more normal social behavior. For now, he said there are short-term concerns about weakness in the state’s economy with businesses pulling back financially, resulting in rising joblessness throughout the Beehive State.

“We’re seeing unemployment starting to trend back up again, and economic weakness reentering,” he said. “If you think about it, it’s exactly tied to the surge that we’re seeing in the pandemic.”

But Spendlove hopes the vaccine will moderate the case numbers and eventually begin to reduce infections and therefore stimulate economic growth.

“This is the light at the end of the tunnel. Having a vaccine or having immunity to the virus, we’ll be able to reopen for the economy,” he said. “People will be able to travel again, they’ll be able to go to restaurants like we were before and go to entertainment (activities) and things like that.”

While he could not pinpoint exactly when the turnaround would occur, he said it would probably be later this summer or in the fall of 2021.

“As the vaccine is coming out and as we can return back to life, you’re going to see a big surge in economic growth and you’re especially going to see it in those areas right now where the biggest impact (has been),” he said. “Once people can return to personal services like the barbershop, you’re gonna see a lot of that. The positive is we’re starting to get through the worst part, but the next month or two is going to be really tough.”

He said the worst part of the economic downturn may be behind us, particularly now that the new stimulus bill has been signed by the president.

“The benefit of the stimulus over the virus treatment is it actually can be effective very quickly, whereas it is going to take time (for the vaccine) to really take effect,” Spendlove said.

Another regional analyst also expressed optimism about Utah’s 2021 economic future, though with some differences of opinion on how that improvement will transpire. Wells Fargo economist Mark Vitner said economic growth in the Beehive State, especially in jobs, should continue to strengthen in the coming years.

“Hiring might moderate over the next couple of months, as consumers cut back on travel and going out, marking another setback for the hard-hit leisure and hospitality sector. While the ski season may provide some relief, we do not think travel will come back in a major way until vaccinations shift into high gear,” he said. “The summer and fall should be better. Even with a bit of a slow start to 2021, we expect nonfarm employment to surge 4.7% for the year and look for 3.7% job growth in 2022.”

Spendlove credits the actions of the federal government with avoiding a total collapse of the nation’s economy through the passage of the first economic stimulus package — the Coronavirus Aid, Relief, and Economic Security Act.

“We would have seen a much more dramatic economic fallout. Now, the economy is coming back, but it’s still very tenuous, even today,” he said. “Our entire economic situation right now is being driven by the pandemic and about our ability to treat the virus. As long as the virus is still having a big impact, it’s going to depress economic potential and economic growth.”

The 10 biggest retail bankruptcies of 2020

KEY POINTS

- This year, Neiman Marcus and J.C. Penney joined the ranks of some of the biggest retail bankruptcies on record, including Sears, Toys R Us and Circuit City.

- About 60% of the retailers that filed for bankruptcy in 2020 through August listed more than $100 million in assets, compared with 50% of filings during the same period in 2019 and 36% in 2018, a BDO analysis found.

- The new year will bring more turmoil for retailers that didn’t have a strong holiday season.

Robert Barnes | Getty Images

More than three dozen retailers, including the nation’s oldest department store chain, filed for bankruptcy this year, marking an 11-year high.

Pre-pandemic, several of these retailers were already teetering on the brink of survival. But the Covid health crisis pummeled the industry. Lockdown orders put in place in March to slow the spread of the virus turned into prolonged store closures for many businesses that didn’t sell essential items like groceries. Retailers that started 2020 already in a tough spot were hit harder. Liquidity was strained and sales went into a freefall.

“The magnitude of bankruptcies has been larger this year compared to previous years,” said David Berliner, chief of BDO’s business restructuring and turnaround practice. “You’re noticing national brands and other prominent franchises, that had hundreds of stores, now being liquidated or going through a restructure to salvage what they can.”

About 60% of the retailers that had filed for bankruptcy in 2020 through August listed more than $100 million in assets, compared with 50% of filings during the same period in 2019 and 36% in 2018, Berliner said.

Neiman Marcus, J.C. Penney, Ascena Retail Group and Tailored Brands have now joined the ranks of some of the all-time biggest retail bankruptcies on record — including Sears, Toys R Us and Circuit City.

The pandemic accelerated a number of industry trends, including rampant growth in digital commerce. Consumers habits shifted, and the items they wanted to buy changed abruptly. Sales of apparel fell sharply, as working from home and not getting dressed up became the norm. And instead, consumers looked to buy things to entertain themselves at home, like bikes and puzzles. This has largely benefitted companies such as Amazon, Walmart and Target, which have strong online businesses and sell a little bit of everything.

After the holiday season wraps, more turmoil is expected in the new year. The holidays are always a “make or break” time for retailers, but analysts say that’s especially true in 2020.

“The silver lining of all this, however, is that in an accelerated understanding of great weakness comes the ability to look at 2021 and our new normal when modeling for the future,” said Scott Stuart, CEO of the Turnaround Management Association.

“I believe the retail sector is in a time of soul-searching and reckoning, understanding that what was, is likely gone forever,” he added.

Below are the 10 biggest retail bankruptcies of 2020, listed by asset sizes and liabilities at the time of their filings. The list was compiled using data from court filings, S&P Global Market Intelligence and BDO.

J.C. Penney

Signage is seen on a shopping cart inside a J.C. Penney Co. store in Peoria, Illinois.

Daniel Acker | Bloomberg | Getty Images

Assets: More than $5 billion

Liabilities: More than $10 billion

Stores at time of filing: 846

Following more than a century in business and a years-long sales slump, J.C. Penney filed for Chapter 11 bankruptcy protection in mid-May. Weighed down by debt, it was struggling long before the pandemic, but the Covid crisis exacerbated its problems.

Penney, which employed roughly 90,000 full- and part-time workers as of February, has closed more than 150 locations since its bankruptcy filing. Another 15 stores will close by March, it said earlier this month.

The department store chain has been given another chance with new owners: Simon Property Group and Brookfield Asset Management. After months of negotiations in the courtroom, the two mall owners acquired Penney in early December, keeping more than 60,000 jobs intact. But Penney’s future is dependent on shoppers heading back to malls for dresses, shoes and handbags. And this year has proven that will be a hard-fought battle.

Neiman Marcus

People walk outside of Neiman Marcus and The Shops at the Hudson Yards as the city continues Phase 4 of re-opening following restrictions imposed to slow the spread of coronavirus on July 31, 2020 in New York City.

Noam Galai | Getty Images

Assets: More than $5 billion

Liabilities: More than $5 billion

Stores at time of filing: 67

The upscale department store chain filed for Chapter 11 in early May, marking one of the highest-profile retail collapses during the pandemic.

After eliminating billions in debt, Neiman brought on a new board of directors that includes former LVMH North America Chair Pauline Brown and former eBay Chief Strategy Officer Kris Miller. Geoffroy van Raemdonck has remained as CEO.

“While the unprecedented business disruption caused by Covid-19 has presented many challenges, it has also given us the opportunity to reimagine our platform and improve our business,” van Raemdonck said in the fall.

As part of its restructuring, Neiman has closed a handful of shops, including a massive store at Hudson Yards in New York that had hardly been open for a year. Over the next three years, the company has earmarked more than $160 million to invest in its stores, including renovating its Dallas flagship, the CEO said in a recent interview.

Neiman hopes to ride the strong rebound of the luxury market, as high-income consumers splurge more on themselves, with travel and other social activities are on hold.

Guitar Center

ans pay tribute to the late rock legend Eddie Van Halen at the site of his guitar and handprints on the Hollywood Rock Walk after the announcement of his death on October 06, 2020 in Hollywood, California. (Photo by AaronP/Bauer-Griffin/GC Images)

Aaron P. | GC Images | Getty Images

Assets: More than $1 billion

Liabilities: More than $1 billion

Stores at time of filing: Roughly 300

Guitar Center started its business in Hollywood in the 1950s selling home organs, and grew to become a leader in the music category. But temporary store closures brought on by the pandemic hurt the company, as shoppers turned to the internet to buy instruments and sheet music. The retailer, which employed roughly 13,000 people, filed for Chapter 11 in late November.

Its goal to rebound in the new year is taking shape. In early December, Guitar Center’s restructuring plans were approved by a court judge, and it expects to emerge from bankruptcy by Dec. 31. The retailer and stakeholders reached a restructuring agreement that slashes its debts by almost $800 million and raises as much as $165 million in new equity.

“With our strengthened financial position, we will continue to reinvest and grow our business,” CEO Ron Japinga said in a statement. “We are nearing the end of a successful holiday season and I am excited about our bright future.”

Tailored Brands

A Jos. A. Bank store window

Source: Getty Images

Assets: More than $1 billion

Liabilities: More than $1 billion

Stores at time of filing: 1,400

Tailored Brands, the owner of Men’s Wearhouse and Jos. A. Bank, filed for Chapter 11 in August, expecting to reduce its debt and strengthen its finances, which were eroded by the pandemic.

Tailored Brands’ filing was among a string of apparel retail casualties blamed on the work-from-home casualization of corporate America and fewer men buying suits and ties. About a month before its bankruptcy filing, Tailored Brands announced plans to close as many as 500 stores “over time.” It also slashed its corporate workforce by 20%.

In early December, the company announced it had successfully emerged from Chapter 11 and eliminated $686 million of existing debt. Looking to the future, President and CEO Dinesh Lathi said the company is planning to adjust its merchandise and launch new brand partnerships.

Ascena Retail

Shopper enters a Ann Taylor LOFT clothing store located on Madison Avenue in New York City.

Adam Rountree | Bloomberg | Getty Images

Assets: More than $1 billion

Liabilities: More than $1 billion

Stores at time of filing: 2,800

The parent of Ann Taylor and Loft, Ascena Retail Group, filed for Chapter 11 in July. Founded as Dressbarn in 1962, the company grew to become one of the nation’s largest sellers of women’s clothing. But its sales dwindled from nearly $7 billion in 2016 to $5.5 billion in fiscal 2019, annual filings show.

Ascena increasingly struggled to grow its business as more women steered toward fast-fashion retailers such as H&M and Zara, off-price chains such as TJ Maxx and Ross Stores, and even Target, for clothing.

In 2019, Ascena announced it was winding down its Dressbarn business and it sold its Maurices plus-size banner. Since filing for Chapter 11, it has sold off its Justice children’s clothing division and shut all of its Catherines stores. Earlier this month, a court judge approved Ascena’s sale of its Ann Taylor, Loft, Lane Bryant and Lou & Grey brands to the private-equity firm Sycamore Partners for $540 million.

Sycamore has vowed to keep the majority of Ascena’s remaining stores open for business. But, like Tailored Brands, it will need to work to win over a generation of younger consumers seeking comfortable and casual clothing.

GNC

Pedestrians walk by a GNC store in New York.

Scott Mlyn | CNBC

Assets: More than $1 billion

Liabilities: More than $1 billion

Stores at time of filing: 2,633

Despite earlier attempts to cut its store count and shift investments to digital, GNC filed for Chapter 11 in June. GNC said the pandemic only exacerbated the financial pressure of recent years. While in bankruptcy, GNC said it hoped to speed up the closure of 800 to 1,200 stores, while it searched for a buyer.

In September, a bankruptcy court judge approved the sale of the Pittsburgh-based, vitamin and health supplements maker to China-based Harbin Pharmaceutical Group for $770 million.

“Through the restructuring and court-approved sale to Harbin, GNC has optimized its store footprint, improved its financial standing and is now better positioned to meet the strong consumer demand for health and wellness products under Harbin’s leadership,” the company said in a statement.

J.Crew Group

A women holding a bag poses for a photograph at J. Crew Group Inc.’s new women’s store inside the International Finance Centre (IFC) mall in Hong Kong, China, on Thursday, May 22, 2014.

Brent Lewin | Bloomberg | Getty Images

Assets: More than $1 billion

Liabilities: More than $1 billion

Stores at time of filing: 491

The preppy apparel company J.Crew filed for Chapter 11 in early May, marking the first major retail bankruptcy of the pandemic.

It had already been struggling under a heavy debt load and sales challenges, suffering from criticism that it fell out of touch with its once-loyal customers. J.Crew had also once hoped to spin off its Madewell brand in an IPO that could have helped pay down its debt load but faced pushback from creditors.

In September, the company emerged from bankruptcy, with its portfolio of stores about unchanged. When it filed, it had 181 J.Crew stores, 140 Madewell shops and 170 locations at factory outlets.

The restructuring deal cut its debt and shifted ownership of the retailer to a group of lenders, led by New York hedge fund Anchorage Capital Group.

“Looking forward, our strategy is focused on three core pillars: delivering a focused selection of iconic, timeless products; elevating the brand experience to deepen our relationship with customers; and prioritizing frictionless shopping,” Jan Singer, who was CEO of J.Crew Group at the time, said in a statement. Singer was replaced by Libby Wadle, a longtime J.Crew exec, in November.

Brooks Brothers

Brooks Brothers, one of the oldest apparel retailers in the United States, filed for bankruptcy protection on July 8, 2020 as the coronavirus pandemic continues to impact businesses.

Wang Ying | Xinhua News Agency | Getty Images

Assets: $500 million

Liabilities: $500 million

Stores at time of filing: 244

Brooks Brothers, one of the oldest apparel chains in the nation, filed for Chapter 11in July. Leases from its real estate expansion over the years became too costly, and the pandemic forced it to rethink its retail strategy as many consumers shifted into sweat pants.

In bankruptcy, the company sought a new owner while it began shutting dozens of stores, attributing the decision to the health crisis.

In September, mall owner Simon and the apparel licensing firm Authentic Brands Group, which also owns Forever 21 and Aeropostale, completed their acquisition of Brooks Brothers. They paid $325 million for the retailer and promised to keep at least 125 locations open for business.

“We see a great opportunity to strategically expand this powerhouse brand across the globe,” ABG CEO Jamie Salter said.

Stein Mart

A Stein Mart store in King of Prussia, PA.

Google Earth

Assets: $500 million to $1 billion

Liabilities: $500 million to $1 billion

Stores at time of filing: 281

The discount apparel and accessories chain Stein Mart sought Chapter 11 protection in August, and went on to liquidate all 281 stores. Stein Mart was already struggling with an overhang of debt pre-Covid, but its sales dried up during temporary store closures in the spring.

Earlier this month, the Miami-based investment firm Retail Ecommerce Ventures acquired Stein Mart’s intellectual property in a court auction for $6.02 million. SteinMart.com is expected to relaunch in early 2021.

“Any time you see the big, 800-pound gorilla competitor, like TJ Maxx, you know they’re doing something right,” REV co-founder Tai Lopez said in a recent interview. “We want to be kind of an online version.”

Pier 1 Imports

A “Going Out of Business” sign hangs outside a Pier 1 Imports store on August 9, 2020 in Las Vegas, Nevada.

Ethan Miller | Getty Images

Assets: More than $400 million

Liabilities: More than $250 million

Stores at time of filing: 991

The home-goods chain Pier 1 Imports filed for Chapter 11 in mid-February, after nearly 60 years in business. Its plans to find a buyer were unsuccessful, as the pandemic worsened in March, ultimately pushing Pier 1 into a total liquidation.

Going-out-of-business sales at its hundreds of stores were temporarily stalled until the spring and summer, when local lockdowns were lifted.

But some still saw value in the Pier 1 brand name. REV, Stein Mart’s new owner, acquired the rights to Pier 1′s trademark, intellectual property and other assets for $31 million in July. It relaunched Pier1.com in the fall. REV’s Lopez has told CNBC he has no plans to reopen stores at this time. REV also owns Modell’s Sporting Goods, Dressbarn and Linens ’n Things.

“I’ve always been a big fan of Warren Buffett, and his strategy of just acquiring things that are already there versus building from scratch. And in 2019, we started seeing the writing on the wall with the so-called retail apocalypse,” Lopez said.

Why Active Management for Fixed Income?

- HUNTER FREY, ANALYST

- DECEMBER 22, 2020

- 2 MINUTE READ

Over the past decade, there has been much debate between active and passive investing. Many modern-day investors, including fixed-income investors, have shifted to the passive investing approach. Although this approach has worked well for equities, it has generally fallen behind for fixed income as active fixed income managers generally outperform their passive counterparts. Active fixed income management vs. passive fixed income management should not be viewed in the same light as active equity management vs. passive equity management. Differences in how fixed income securities trade, the higher number of overall securities, and intensified dependence on liquidity creates specific headwinds that passive fixed income managers do not account for. With that said, bond/credit indices do not accurately reflect the opportunities within their relative space. Furthermore, bond indices have fundamentally flawed constructions that do not reflect the intricacies of the bond market.

Some of the flaws of bond/credit indices are:

- Higher duration risk exposure

- More interest rate sensitivity

- Poor index weighting methodologies (index weighting by debt outstanding)

- Inaccurate importance assumption on the new issuance bond market amid the finite life of bonds

- Large dependence on historically inaccurate ratings from credit rating agencies

- Incomplete representation of bond trade activity (most bonds trade over-the-counter: dominated by buyer and seller negotiations)

This creates ample opportunities for active fixed income managers to find arbitrage outside of indices.

Some of the main advantages of active fixed income strategies are:

- Ability to decrease interest rate sensitivity and control duration risk (modified duration of the Bloomberg Barclays U.S. Aggregate Bond Index is 6.44 as of 11/30/20)

- Ability to find yield in low-yield environments (highlighted here: Finding Yield in a Low Yield Environment)

- Optimize the trade-off between duration exposure and yield capture

- Leverage company-specific credit fundamentals, identifying misrepresented bonds with fortress balance sheets

- Ability to mitigate market volatility

- Agility to capitalize on opportunities created by dynamic economic and policy shifts as seen with the recent bear steepening environment (highlighted here: Deciphering a (COVID-19) Vaccine Driven Economic Recovery: An Equity and Fixed Income Perspective).

The argument for passive fixed income management falls short

Although the active vs. passive debates rage on as investment flows suggest passive investing has been winning, a clear line must be drawn between equity passive investing principles and fixed income passive investing principles. Equities and bonds are fundamentally different. Bond investors have varying objectives, with the bond securities having different trading dynamics, resonating significance on bond new issues, and increasing skewness of individual bond returns vs. individual equity returns.

Additionally, bonds have significantly more securities than their equity counterparts. More securities create more market insecurities. Therefore, the argument for passive fixed income management falls short. As seen throughout 2020, active fixed income managers have the flexibility to take advantage of the nuanced fixed income market and outperform the passive, flawed bond indices.

The Covid relief bill will keep these tax breaks around even longer

Darla Mercado, CFP®@DARLA_MERCADO

KEY POINTS

- Certain tax provisions are up for renewal each year. Congress needs to sign off on these so-called “tax extenders” to give filers an opportunity to claim them.

- There were 33 provisions that were set to expire at the end of 2020, but a bundle of them were packed into the Covid relief legislation and given new life.

- Key extenders for individual taxpayers include the lower threshold to claim medical expenses and a write-off for mortgage insurance premiums.

Taxpayers will have another shot at a package of tax breaks that would have otherwise expired at the end of 2020.

That’s because when lawmakers hammered out the 5,593-page Covid relief act, they resurrected a basket of deductions and credits — known as tax extenders — that were about a week away from lapsing.

In all, 33 measures were set to expire at the end of 2020, ranging from a break on racehorses to a tax credit for two-wheeled electric vehicles.

Some of these deductions and credits have been made permanent, while others have been extended until the end of 2025 — the date when a slate of individual provisions from the Tax Cuts and Jobs Act will sunset.

“We won’t have to do that waffling back and forth with several of these extenders, and another 11 of them got a five-year extension,” said Erica York, an economist with Tax Foundation’s Center for Federal Tax Policy.

“I think taxpayers are going to have a lot more certainty,” she said.

Here are the extenders that are back.

Medical expenses

Back when the Tax Cuts and Jobs Act took effect in 2018, individuals who itemized deductions on their federal income tax return were able to deduct qualifying medical expenses that exceeded 7.5% of their adjusted gross income.

Initially, this provision was set to expire at the end of 2018 and the threshold would have gone up to 10% of adjusted gross income.

Lawmakers sought to keep the expense threshold at 7.5% through the end of 2020.

With the passage of the Covid relief act, the lower threshold is now permanent.

However, you can only take this deduction if you itemize on your return. The standard deduction for 2020 is $12,400 for singles and $24,800 for married-filing-jointly.

Lifetime learning credit vs. tuition deduction

The qualified tuition deduction granted an above-the-line write-off for parents of college kids. They could deduct up to $4,000 a year in higher-education tuition costs and other expenses.

Though this tax break was up for renewal at the end of 2020, Congress repealed it in the Covid relief act.

Instead, lawmakers expanded the lifetime learning credit, a tax break that’s worth up to $2,000 per return and can be used to offset the cost of undergraduate, graduate and professional degree courses.

In the Covid relief bill, Congress also made the credit available to higher income taxpayers. The lifetime learning credit begins to decline once single taxpayers’ modified adjusted gross income hits $80,000 or $160,000 for joint filers.

I think taxpayers are going to have a lot more certainty.

Erica York

AN ECONOMIST WITH TAX FOUNDATION’S CENTER FOR FEDERAL TAX POLICY

These changes are in effect starting in 2021.

The adjustment eliminates confusion for taxpayers waffling between education credits or the deduction, said York of the Tax Foundation.

Deductions reduce your taxable income based on your federal income tax bracket. That means the higher your bracket, the greater the savings.

Meanwhile, credits lower your tax liability on a dollar-for-dollar basis. This makes them valuable even if you’re in a lower tax bracket.

“A $4,000 deduction sounds better than a $2,000 credit, but some people would choose the deduction even if it wasn’t the best choice for them,” York said. “They’d leave money on the table.”

Normally, debt cancellation or forgiveness results in a tax on the borrower. The amount the lender wipes from the balance is deemed income.

A special tax extender softens the blow for homeowners who’ve had a mortgage balance forgiven due to a short sale or a foreclosure on the dwelling. It was only to apply to debt discharged before Jan. 1, 2021.

Lawmakers decided to keep this tax break, but they reduced the amount of forgiven debt that can be excluded from your gross income. Joint taxpayers can now exclude up to $750,000 in discharged debt ($350,000 for singles).

That’s down from an exclusion of up to $2 million for joint taxpayers ($1 million for singles).

This modified write-off is in effect until the end of 2025.

Mortgage insurance premiums

Private mortgage insurance premiums are the additional expense you pay each month if your original down payment on your home was less than 20% of the sales price.

The private mortgage insurance tax extender allows you to deduct these premiums — if you itemize deductions.

This provision is available through 2021.

Those who qualify may be able to deduct the interest on their mortgage and home equity loan or line of credit, up to $750,000 in total qualified residence loans.

The loans must go toward buying, building or substantially improving your home to qualify for the write-off.

Employer payments toward student debt

Due to the CARES Act, employers can make payments toward employees’ student loans and have that amount — up to $5,250 annually — excluded from workers’ taxable income.

This provision was set to expire at the end of last year. The new Covid bill grants further relief, allowing the exclusion to apply to payments made through the end of 2025.

Green tax breaks

Finally, a slate of environmentally conscious tax credits have been renewed through 2021.

Here are a few that are most pertinent to individual taxpayers.

Nonbusiness energy property credit: This is a credit of up to 10% of the cost of equipment, as much as $500, for energy-efficient home improvements, including heating and air conditioning systems. EnergyStar keeps a list of eligible equipment here.

Qualified fuel cell motor vehicles: This is a $4,000 tax credit for people who purchased cars that run on hydrogen.

Two-wheeled plug-in electric vehicles: This credit is equal to 10% of the cost of your battery-powered scooter, up to $2,500.

Alternative fuel vehicle refueling property: If you install a fueling station at your main house to recharge your green vehicle, you may be eligible for a credit of 30% of the installation cost or up to $1,000.

British Prime Minister Boris Johnson imposes national lockdown on England to combat new Covid variant

KEY POINTS

- Johnson said England’s health system is at risk of becoming overwhelmed in 21 days without a national lockdown.

- People can only leave their homes to shop for essentials, work if they can’t from home, exercise, go to the doctor’s and escape domestic abuse, he said in an announcement Monday evening.

- Primary schools, secondary schools and colleges will move to remote learning Tuesday.

British Prime Minister Boris Johnson said England is adopting a national lockdown that he hopes will be tough enough to contain a new, highly contagious variant of Covid-19.

People can only leave their homes to shop for essentials, work if they can’t from home, exercise, go to the doctor’s and escape domestic abuse, he said in an announcement Monday evening. Primary schools, secondary schools and colleges will also move to remote learning Tuesday, except in rare cases, he said.

“I completely understand the inconvenience and distress this change will cause millions of people and parents up and down the country,” Johnson said. “The problem isn’t that schools are unsafe for children … the problem is that schools may act as vectors of transmission, causing the virus to spread between households.”

The U.K.’s chief medical officers recommended the country move to alert level 5, meaning that if the country doesn’t take action the National Health Service capacity “may be overwhelmed in 21 days,” Johnson said.

The changes come as the U.K. grapples with a more transmissible variant of Covid-19. To date, the country has recorded over 2.6 million cases of coronavirus and more than 75,000 related deaths, according to data compiled by Johns Hopkins University.

On Monday, the U.K. recorded 58,784 new cases, and has now reported more than 50,000 new coronavirus cases for seven days in a row.

“The number of deaths is up by 20% over the last week and will sadly rise further. … With most of the country already under extreme measures, it’s clear that we need to do more together to bring this new variant under control while our vaccines are rolled out,” Johnson said, noting that the mutated strain is estimated to be 50% to 70% more contagious.

Johnson warned earlier Monday that the U.K. had “tough, tough weeks to come” and there was “no question” tougher measures would be implemented.

Ahead of the announcement, more than three-quarters of England were living under the toughest level of restrictions.

On Monday afternoon, Scotland’s leader, Nicola Sturgeon, announced a new stay-at-home order for the country’s citizens from midnight. Schools in Scotland will remain closed until the beginning of February.

Keir Starmer, leader of the U.K.’s main opposition Labour Party, tweeted Sunday that Johnson “must put national restrictions in place within the next 24 hours.”

Coronavirus vaccines are the only bright spot in a pandemic that continues to rage across the U.K. and much of the West. On Monday, the U.K. began its rollout of the Oxford-AstraZeneca vaccine after starting to deploy the Pfizer-BioNTech shot in December.

“There’s one huge difference compared to last year. We’re now rolling out the biggest vaccination program in our history,” Johnson said.

If things go well, Johnson said everyone in the top four priority groups should get the first shot of the two-dose vaccines by the middle of February. That includes residents in a care home and their caregivers, everyone over the age of 70, all front-line health and social workers as well as everyone who is clinically vulnerable, he said.

“If we succeed in vaccinating all those groups, we will have removed huge numbers of people from the path of the virus. And of course that will eventually enable us to lift many of the restrictions we have endured for so long,” he said.

The country could consider reopening schools after the February half term if the vaccine rollout continues to go well, deaths start to fall and if “everyone plays their part by following the rules.”

He said the coming weeks will be the hardest yet, “but I really do believe that we’re entering the last phase of the struggle because with every jab that goes into our arms, we are tilting the odds against Covid and in favor of the British people,” he said. “I know how tough this is and I know how frustrated you are and I know that you’ve had more than enough of government guidance about defeating this virus. But now, more than ever, we must pull together.”

The U.K. government has decided to implement a 12-week delay between the first and second doses of both the Pfizer-BioNTech and Oxford-AstraZeneca coronavirus vaccines, in a bid to cover as much of the population as possible.

The U.K.‘s independent Scientific Advisory Group for Emergencies said Sunday that it endorsed the move, with conditions, however the British Medical Association has criticized the U.K.’s decision to delay second doses.

21 comments

Magnificent web site. Plenty of helpful information here.

I am sending it to some friends ans also sharing in delicious.

And obviously, thank you on your effort!

Good information. Lucky me I discovered your website by accident (stumbleupon).

I’ve saved as a favorite for later!

Hello my loved one! I wish to say that this article is amazing,

great written and come with approximately all important infos.

I’d like to see extra posts like this .

Its such as you read my mind! You seem to know so much about this, such

as you wrote the guide in it or something. I feel that you just could do with

some % to force the message home a little bit, however instead of that,

this is fantastic blog. A great read. I’ll certainly be back.

Hi to every body, it’s my first go to see of this webpage;

this web site includes remarkable and really fine stuff for readers.

What’s up, all is going nicely here and ofcourse every one is sharing facts, that’s in fact excellent,

keep up writing.

Keep on working, great job!

You made some good points there. I looked on the web for

additional information about the issue and found most individuals will

go along with your views on this web site.

I think that is one of the such a lot vital information for me.

And i’m glad studying your article. However want to

remark on some general things, The website style is perfect, the articles is in point of fact nice :

D. Excellent activity, cheers

Its such as you read my mind! You seem to know a lot approximately this, like you

wrote the guide in it or something. I feel that you simply could

do with some percent to pressure the message house a little bit, however other than that,

this is magnificent blog. A fantastic read. I’ll definitely be back.

Heya i’m for the first time here. I found this board and I find It really useful & it helped me out

much. I hope to give something back and help others like you helped me.

Very good post. I am experiencing some of these issues as well..

Hi to every one, the contents present at this web site are truly remarkable for people

knowledge, well, keep up the nice work fellows.

Hi, its nice post concerning media print, we all be aware of media

is a great source of facts.

I read this paragraph completely about the resemblance of hottest and earlier technologies, it’s remarkable article.

It is appropriate time to make some plans for the future

and it is time to be happy. I’ve read this post and if

I could I desire to suggest you few interesting things or

tips. Perhaps you could write next articles referring

to this article. I want to read more things about it!

Tremendous things here. I’m very happy to peer your article.

Thanks a lot and I am having a look ahead to contact you.

Will you please drop me a e-mail?

This post is invaluable. When can I find out

more?

Pretty section of content. I just stumbled upon your web site

and in accession capital to assert that I acquire actually enjoyed account your blog posts.

Any way I’ll be subscribing to your augment and even I achievement you access

consistently rapidly.

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to far added agreeable from you!

By the way, how can we communicate?

You can email me at khurley@hurleyinvestments.com