HI Financial Services Mid-Week Commentary 11-30-2015

Dang it!!!! I think I made a mistake. – Kevin Hurley

December – Historical Facts of The S&P 500

- 87 December’s (1928-2015), 64 had positive returns a 74% upside occurrence. The best of any month.

- The average percentage increase was 3.00%.

- The average percentage decline was -2.90%, the least of any month.

- On average December returns 1.40%.

I do not have downside protection on F or DIS and DIS is down $7 in 5 days when last week I said I should probably protect DIS from a possible rate hike. Did I make a mistake? Today not sure but I might have been able to protect $7 down even though I do NOT have technical crossovers!!! Next week DIS could be back to $120 in which case I am allowing the stock to move within its “Trading Range”.

Where would you expect DIS to trade from here based on technicals? A Bounce higher

What’s happening this week and why?

Chicago PMI 48.7 vs est 55.0

Pending Home Sales 0.2 vs est 0.7

Yuan was voted in as a reserve currency in the “basket” of currency’s= It means that they cannot or should not have the ability to deflate the value of their currency as dramatic as they have in the past ie… this past summer. The vote was yes, even though China lies their butts off on the economic numbers, in hopes of stabilizing the second biggest and possible futures biggest economy currency

Where will our market end this week?

But we’ve had two down week and maybe the market is set for an up week ending up 250 points higher than the close today

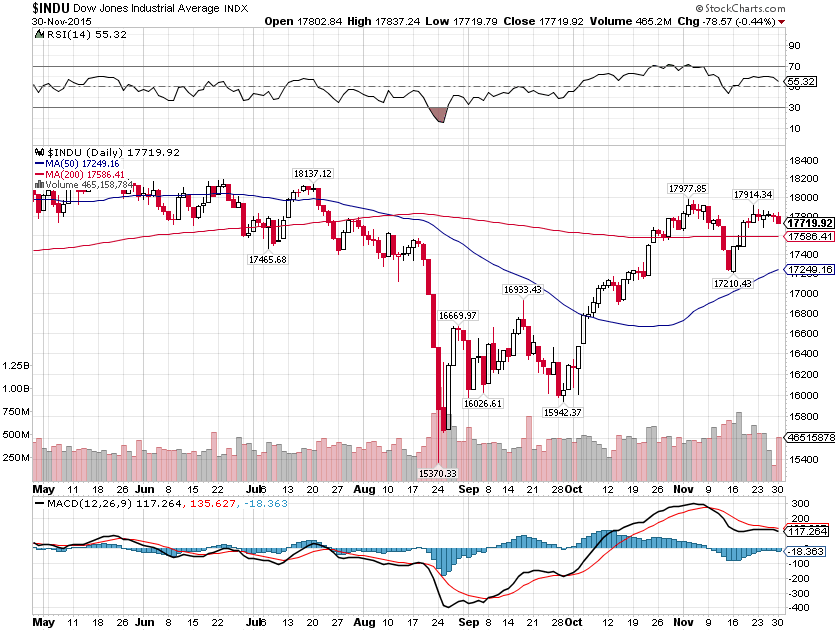

DJIA – Mixed signals but building a base above the 200 day SMA

SPX – Mixed signals but building a base above the 200 day SMA

COMP – Mixed but bouncing off a 50 SMA and testing the recent highs

Where Will the SPX end December 2015?

11-30-2015 Christmas Rally is on 2.5

11-24-2015 Christmas Rally is on 2.5%

What is on tap for the rest of the week?=

Earnings:

Tues:

Wed: ARO, AEO, BOX, PVH, TLYS

Thur: BKS, DG, FIVE, KR, MDT, SHLD, ZUMI

Fri: BIG, GCO

Econ Reports:

Tues: Construction Spending, ISM Index. Auto, Truck

Wed: MBA, ADP Employment, Productivity, Unit Labor Costs, Fed Beige Book 12:25 Janet Yellen Speaks

Thur: Initial, Continuing Claims, Challenger Job Cuts, Factory Orders, ISM Services, 10AM ET Janet Yellen Speaks

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Trade Balance

Int’l:

Tues – EMU:DE:FR: PMI Manufacturing, ALL: Global PMI Manufacturing

Wed – EMU: HICP Flash, JP: PMI Composite

Thursday –EMU:FR:DE: PMI Composite, EMU: ECB Announcement, ALL: Global Composite PMI, Services PMI

Friday – DE: Manufacturing Orders, EMU: GDP

Sunday –

How I am looking to trade?

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

HI Financial Services Mid-Week 06-24-2014