HI Financial Services Mid-Week Commentary 10-06-2015

Tomorrow is the reward for safe driving today – Utah Department of Transportation

Tomorrow is the reward for safe (trading) today – Hurley Investments

What’s happening this week and why?

ISM Services 56.9 vs est 58.0

Trade Balance -48.3 B vs est -44.5B

Bulls are coming back but earning will prove the rally

Still have worry over the Fed, China, Emerging markets, Europe, Middle east, Oil,

Where will our market end this week?

Headline risk but we appear to have the ability to continue to melt up 1%

DJIA – Bullish with 1 day above the 50 SMA

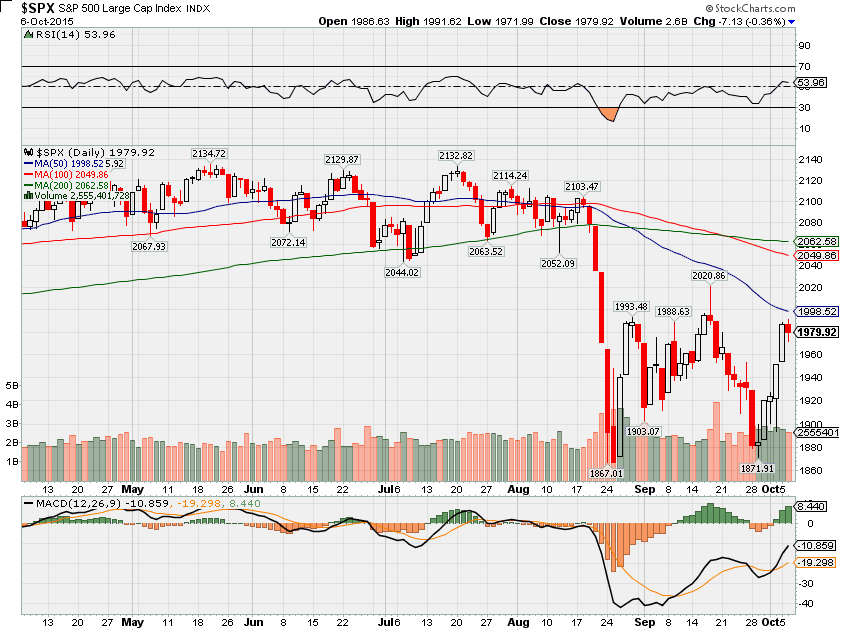

SPX – Three bullish crossovers but we hit resistance at the 50 SMA

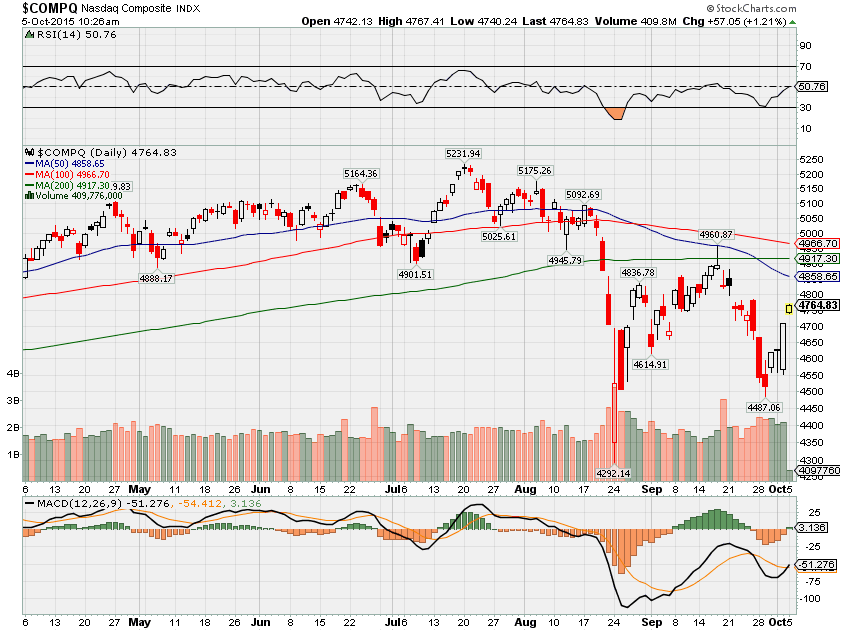

COMP – Still not crossed over on anything yet

Where Will the SPX end October 2015?

10-06-2015 I think the market will give us a 2% increase as the market bottoms, earnings take the stage and we have a Christmas Rally

What is on tap for the rest of the week?=

Earnings:

Tues: PEP, YUM

Wed: MON

Thur: AA, DPZ

Fri:

Econ Reports:

Tues: Trade Balance

Wed: MBA, Consumer Credit,

Thur: Initial Claims, Continuing Claims, FOMC Minutes

Fri: Import, Export, Wholesale Inventories

Int’l:

Tues – JP: BOJ Announcement

Wed – DE:GB: Industrial Production, JP: Machine Orders

Thursday –EMU: ECB Minutes, GB: BOE Announcement

Friday – FR: Industrial Production

Sunday –

How I am looking to trade?

Currently in Protective puts or collars except for a couple of stocks – F, NVDA, D. When earnings come around AA October 8th, I will cash in profits on Long puts and place my puts ATM for the opportunity to catch a Christmas bounce higher

AAPL – 10/27 AMC

ADBE – 12/10 estimated

BABA – 11/04 estimated

BIDU – 10/29 estimated

CLDX – 11/04 estimated

D – 10/29 estimated

DIS – 11/05 AMC

F – 10/27 BMO

FB – 11/04 AMC

NVDA – 11/05 AMC

SNDK – 10/21 AMC

V – 10/28 estimated

VZ – 10/20 BMO

WBA – 10/28 BMO

ZION – 10/19 AMC

SBUX – 10/29 estimated

MS – 10/19 BMO

NKE 12/17 estimated

RHT 12/17 estimated

If you can’t do it I can for you !!!

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014