HI Financial Services Mid-Week Commentary 09-01-2015

When trading directional you have a 1 out of 3 chance to win or a 33% probability. That means you have a 67% chance to lose!!!! – Common Sense and plain Mathematics

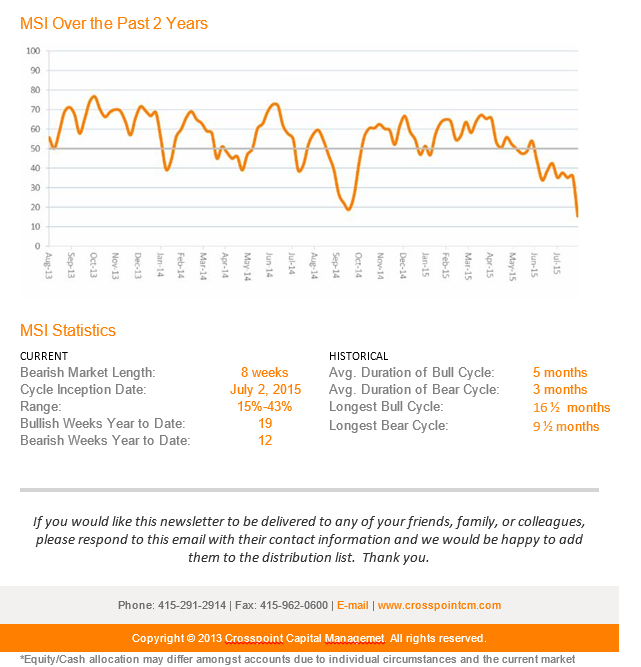

Let’s go over an email I received to see what my competition is doing right now

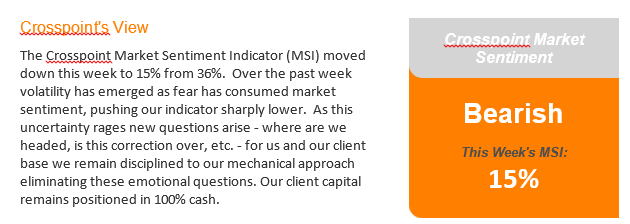

If you are with Crosspoint you are out of the market which means:

They will miss the upside, are charging for doing nothing, have a 1 out of 3 chance to win

OK the next question I got was how are you doing this today when the market was down 469 points or 58.33 points on the S&P?

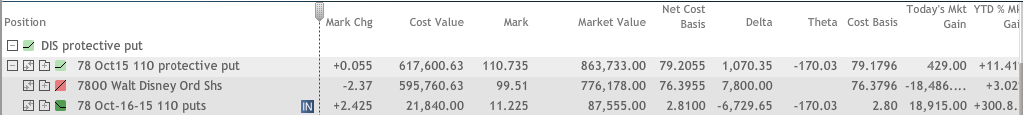

I am excited to add shares to DIS and I love making more on the long put than the stock loses in a day

Visa has been protected as well

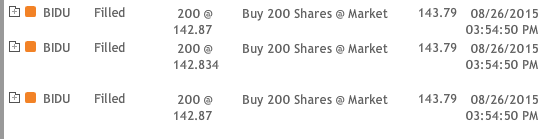

But what about your newly purchased BIDU shares

![]()

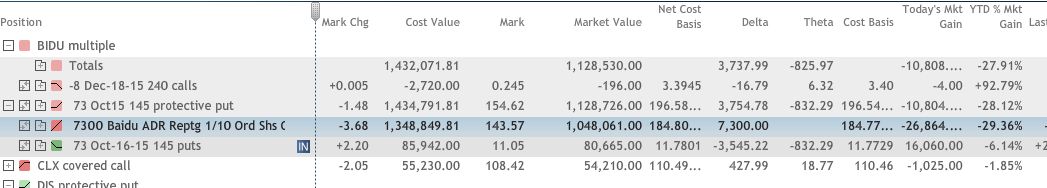

And then all the shares of BIDU were protected wtih a 145 Oct 15 Long Put

What’s happening this week and why?

Holiday week which means low volume and possible higher swings in the market

China PMI came in at a number that shows contraction in their economy

Our markets have known for a while China was at risk of having a “hard” landing

Is the bottom in and will it be a V shaped recovery = NO WAY

Where will our market end this week?

????

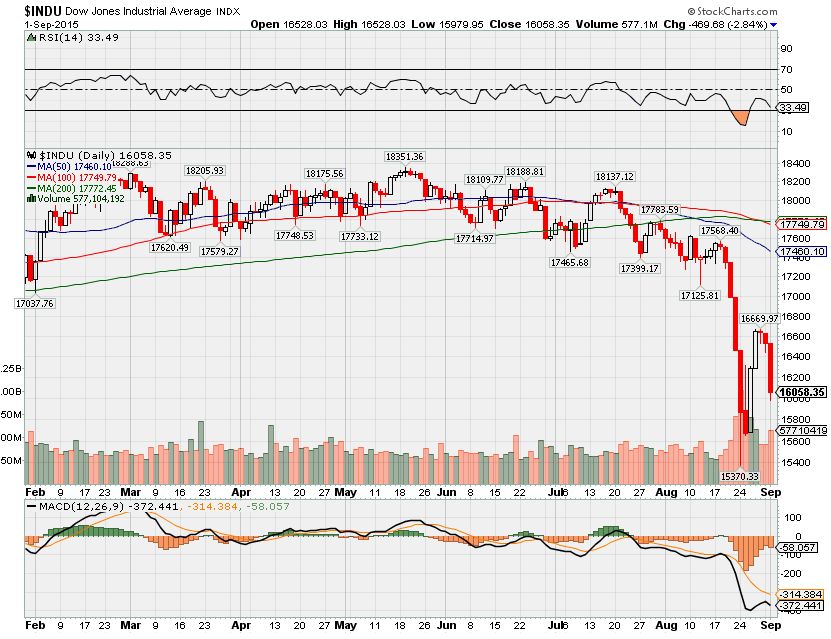

DJIA – Clearly bearish, No V shaped recovery and looks like the market wants to test the lows

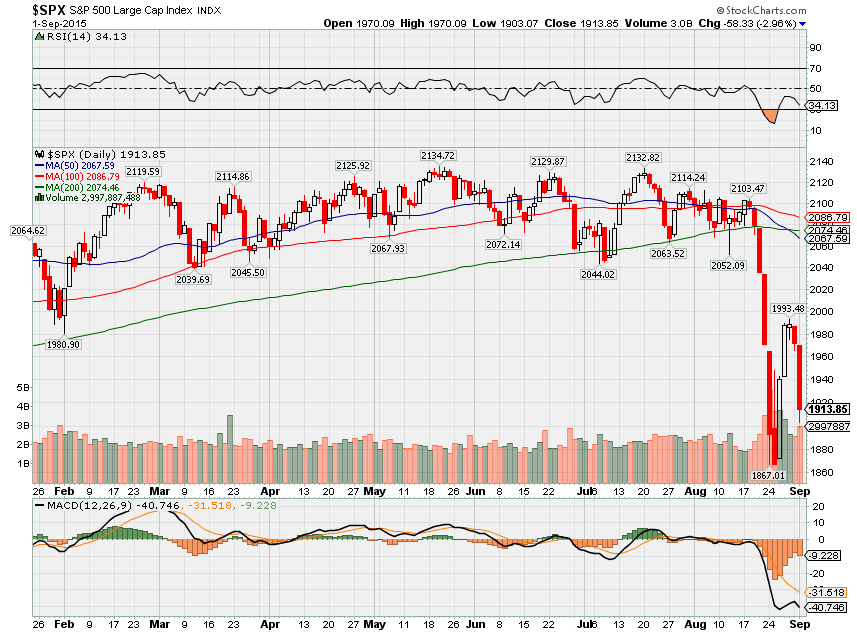

SPX – Clearly bearish, No V shaped recovery and looks like the market wants to test the lows

COMP – Clearly bearish, No V shaped recovery and looks like the market wants to test the lows

Where Will the SPX end September 2015?

09-01-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

08-25-2015 I think the market will give us a 2% decline as the market bottoms in September for an end of the year rally

What is on tap for the rest of the week?=

Earnings:

Tues: HRB, QIHU

Wed: FIVE

Thur: GCO, JOY

Fri:

Econ Reports:

Tues: ISM Index, Construction Spending, Auto, Truck

Wed: MBA, ADP Employment, Productivity, Unit Labor Costs, Factory orders, Fed Beige Book

Thur: Initial Claims, Continuing Claims, Challenger Job Cuts, Trade Balance, ISM Services

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate

Int’l:

Tues – FR:DE:EMU: PMI Manufacturing

Wed – JP:CN: PMI Composite

Thursday – FR:DE:EMU: PMI Composite

Friday – DE: Manufacuring Orders

Sunday –

How I am looking to trade?

Cashed in some of my collar profits and bought more stock. In protective put trades for the new positions created by adding more share. Have Oct long put collar trades where I am getting ready to cash in on those profits around another test of the lows of the stocks and the market indexes

If you can’t do it I can for you !!!

Questions???

www.hurleyinvestments.com

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014