HI Financial Services Commentary 08-22-2017

You Tube Video Link: https://youtu.be/TDaiRFn-JV8

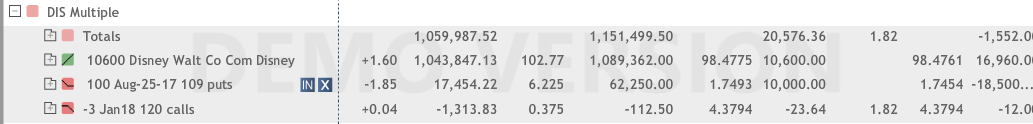

Let’s talk Disney

I lost money on a big up day for Disney. WHY??

Long puts lost more than the stock gained

What can you tell me about the long puts = They are roughly 4.50 ITM or profitable? YES

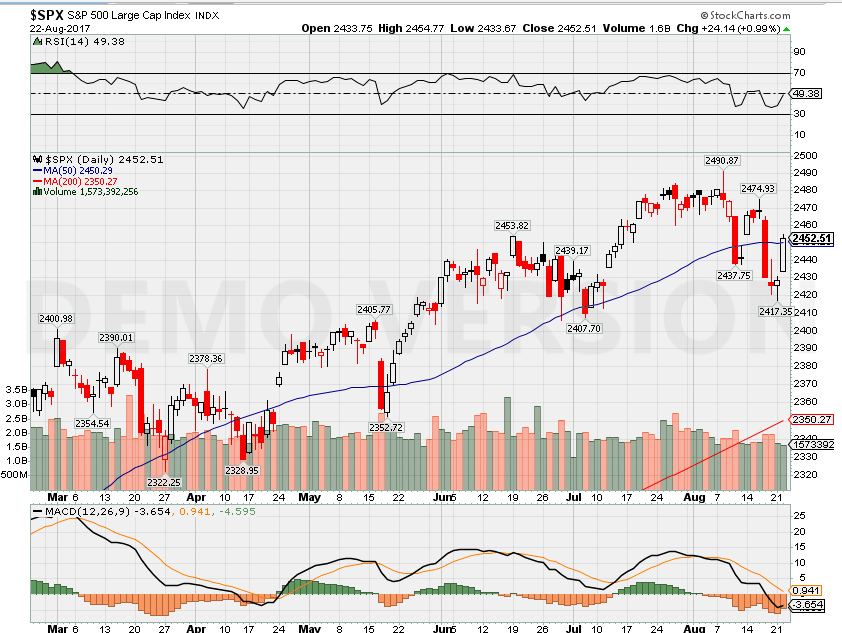

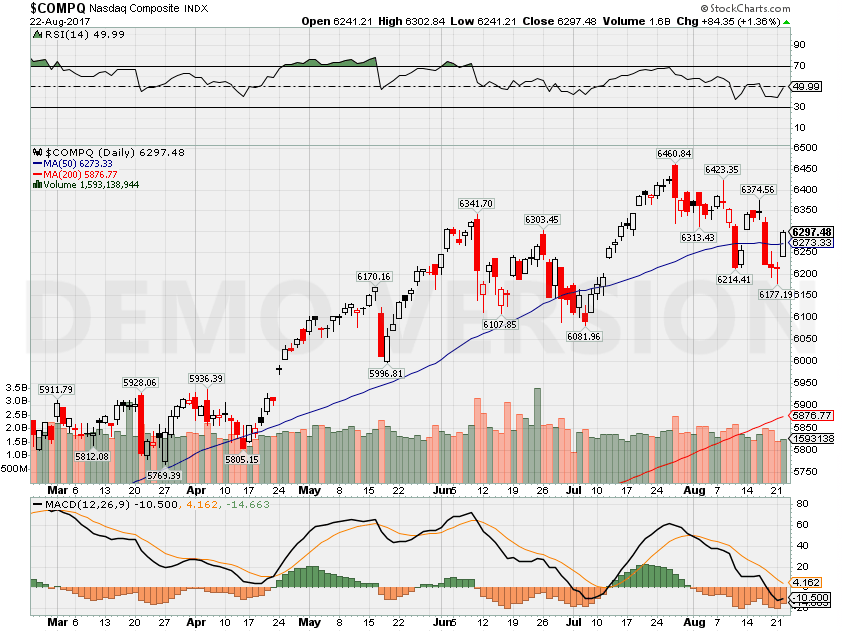

Indexes are still bearish with only one day above the 50 SMA

Yes, I have AAPL, BIDU, F, BAC, DHI, AOBC with stock only positions

FB, V, NVDA, with only covered calls

DIS still has Long puts

What’s happening this week and why?

Last week of Retail earnings and pretty slow on Economic reports. YELLEN speaks on Friday which could spook the market

Where will our market end this week?

It all depends on holding the 50 SMA Higher

DJIA – Still Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end August 2017?

08-22-2017 +1.0%

08-08-2017 +2.0%

08-01-2017 +2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: TOL, JASO, CREE, INTU, KIRK, CRM

Wed: AEO, LOW, EXPR, HPQ, PVH, GES

Thur: ANF, BURL, DLTR, SHLD, SPLS, TIF, NVMW, GME, MRVL, AVGO

Fri: BIG

Econ Reports:

Tues: FHFA Housing Price Index

Wed: MBA, New Home Sales

Thur: Initial, Continuing Claims, Existing Home Sales

Fri: Durable Goods, Durable ex-trans, Yellen Speaks

Int’l:

Tues –

Wed –

Thursday –

Friday –

Sunday – CN: Industrial Profits

| China : Industrial Profits | ||||||||

|

||||||||

| Definition Industrial profits are calculated as total revenue of enterprises gained from principal business operations minus the total costs incurred. The survey covers enterprises above a designated size, namely those with revenue from principal activities of more than CNY20 million. As well as aggregate data, more detailed data are reported for various industries and according to the nature of the enterprise’s ownership. |

||||||||

| Why Investors Care Profits are the income of an enterprise and a key factor that determines the extent to which it can undertake investment spending. When profits are strong, enterprises will be able to increase their capital spending. This could allow better growth prospects for an enterprise and is likely to increase its underlying value. When profits decline or grow at a slower pace, then capital spending tends to decline or weaken.Profits also reveal the health of an enterprise. When an enterprise’s profits are anemic during economic expansion, it suggests that the enterprise is not performing efficiently. When a enterprise’s profits are relatively strong, even during an economic downturn, it usually means that the enterprise is well-managed. For publicly listed companies this will have a large impact on the company’s stock price. In China, many major enterprises are owned by the government, and the strength of profits provide an important measure of their performance and the extent to which they are supporting or weakening government finances. Looking at the detailed data for industrial profits can also reveal information about the relative performance on different industries. |

How I am looking to trade?

I am letting a couple of things run right now

Earnings List:

AOBC 9/7 est

C 10/12 BMO

COST 10/5 AMC

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

https://www.cnbc.com/2017/08/14/buffetts-berkshire-sells-entire-stake-in-general-electric.html https://www.cnbc.com/2017/08/14/buffetts-berkshire-sells-entire-stake-in-general-electric.html

Buffett’s Berkshire dumps GE but bets further on banking sector

- Berkshire previously had 10.6 million shares in GE, recently had a new CEO take over.

- Buffett’s conglomerate also loaded up on shares of Bank of New York Mellon and Synchrony Financial in the second quarter, a filing shows.

- Berkshire took additional shares of General Motors.

Published 4:26 PM ET Mon, 14 Aug 2017 | Updated 10:58 AM ET Tue, 15 Aug 2017CNBC.com

Warren Buffett’s Berkshire Hathaway sold its stake in General Electricas of the end of June, according to a regulatory filing on Monday.

The conglomerate had previously held 10.6 million shares of GE, according to its regulatory disclosure in May. John Flannery became CEO of General Electric on Aug. 1 after Jeff Immelt stepped down after 16 years. Flannery was previously president and CEO of GE Healthcare.

Berkshire appears to be keeping its hand in a legacy part of GE. It reported a 17.5 million share stake in Synchrony Financial, the financing arm of GE that was spun out in a 2014 initial public offering. Shares of Synchrony are down more than 18 percent this year, but they bounced up over 4 percent in after-hours trading Monday.

Berkshire also increased its holdings of Bank of New York Mellon by 52.2 percent, to 50.2 million shares.

Buffett has embraced the financial sector, which many believe is poised for growth after years of historically low interest rates and extra regulation. In June, Berkshire announced it would convert warrants it has in Bank of America to 700 million common shares, which will make it the bank’s biggest shareholder once that conversion is complete.

Omaha, Nebraska-based Berkshire also raised its stake in General Motors by 20 percent in the second quarter, to 60 million shares. The automaker’s shares are up 1.8 percent this year after battling a proxy contest by activist hedge fund Greenlight Capital, run by David Einhorn. GM shareholders voted overwhelmingly in support of the company in June, a defeat for Einhorn. Greenlight reported it held 59.7 million shares of GM at the end of June

Berkshire’s GE holdings were just 0.12 percent of the outstanding shares. GE shares are down nearly 20 percent this year.

Buffett struck a deal during the financial crisis to invest $3 billion in GE and later converted warrants to common shares in the blue chip company in a deal similar to those he reached with Goldman Sachs and Bank of America.

Disney: The Force Is Strong

Aug. 22, 2017 4:13 PM ET

Summary

Disney stock price looks compelling at these levels.

2018 pipeline looks strong.

Theme Park and Studio performance continue to plow forward.

Management continues to align the Company for future success.

In the article below, I divulge into The Walt Disney Company’s (DIS) most recent earnings release, and also take a look at their current valuation to see if the stock is worthy of a buy. I have had Disney on my watch list for some time now, and with the 9.5% year to date decline in the stock’s value, I thought it would be a good time to take a deeper look into the Company’s fundamentals and future for growth. Disney peaked at $120 in late 2015 and quickly retreated off those highs down to $88. Being a Shareholder of Disney stock for the past couple years has felt more like a ride on California Screamin’, with the constant peaks and valleys thrill ride the stock has taken you on. As I write this article, Disney stock currently sits at $100.70.

Most Recent Earnings Release (Q3 2017)

On August 8, Disney released their Q3 FY’17 earnings. Disney beat Wall Street’s EPS expectations, $1.58 vs. $1.55; however the Company failed to beat Wall Street’s revenue estimates, $14.2B vs. $14.4B. Revenue was flat YOY, while Diluted EPS decreased 5% and Segment Operating Income decreased 10%. On a positive note for the quarter, Free Cash Flow increased 33% compared to Q3 ’16.

Source: Created by the author with data from Disney’s Q3 earnings release”

The large decrease in Segment Operating Income was related to the Media Networks segment seeing higher programming costs related to new NBA contracts. In addition, the segment saw lower advertising revenue due to continued lower viewership and two less NBA Finals games (prior year was 7 games compared to only 5 this year). As described in the Q3 earnings call by Christine McCarthy, CFO, $400M of the $600M “Year One Set Up Costs” related to the new NBA contracts were incurred in Q3.

Parks and Resorts continue to be on fire, with 12% growth in Revenues compared to Q3 ’16, and 18% growth in Operating Income over the same period. The Company has been hitting on all cylinders within this segment with double digit growth each quarter of 2017 to date. Year to date the segment is up 17% compared to this time last year, which is definitely a big bright spot for the Company going forward. The main growth has been attributable to the Company’s International operations, whereas the Domestic operations were comparable to prior year. As mentioned in the Q3 conference call, about 8% of the increase was related to the Easter holiday falling entirely in Q3 2017 compared to Q2 2016. Disneyland Shanghai brought in over 13 million guests in just its first full year of operations, which exceeded Company expectations. Domestic parks saw an 8% increase in traffic during the quarter, largely due to the timing of Easter, which accounting for “about 3% of the growth”, as mentioned in the Q3 conference call by Christine McCarthy, CFO. In addition to the higher attendance during the quarter, the Company saw an increase in spending of 2%. Spending was also up 8% at Domestic Hotels during the quarter. As CEO Bob Iger mentioned in the Q3 conference call, growth in the Parks and Resorts segment continue to be a big focus:

Over the last decade, we’ve transformed Disney California Adventure, doubled the size of our Cruise fleet, brought the phenomenal world of Pandora to life in Orlando, and opened the spectacular Shanghai Disney Resort, which has already welcomed more than 13 million guests.

Studio Entertainment saw Revenues and Operating Income decrease 16% and 17%, respectively. As many of you may already know, 2016 results in the Studio Entertainment segment were amazing for the Company, and a tough comparable, so do not read too much into a decrease in 2017. Year to date the segment has brought in Operating Income of $2.1M, which is only off 8% from 2016. Looking into the remainder of the year and beyond, the movie pipeline is quite strong for the Company, which will prove to be another strong growth driver in the future.

Overall, the Company had mixed results in Q3, with ESPN troubles still hanging over their head, but Parks and Resorts proving to be a bright spot, and the Studio Entertainment segment continuing to perform well.

Looking Ahead

As some of you may have seen, Disney announced a strategic shift in the way they will be distributing content. The Company announced it will not be renewing its contract with Netflix (NFLX) for its “Disney-branded” content starting in 2019. CEO Bob Iger described the shift as follows:

These announcements marked the beginning of what will be an entirely new growth strategy for the company, one that takes advantage of the opportunities the changing media and technology industries provide us to leverage the strength of our great brands.

Shifting content away from Netflix in order to start their own streaming service can be both a risk and a huge growth driver. One of the main risks is not getting the number of subscribers the Company’s management envisions in the future, due to the fact consumers are getting overwhelmed with the amount of streaming services available. Right now, a consumer can use a DirecTV Now service from AT&T (T), but then also have to subscribe to CBS All-Access (CBS) in order to obtain those channels, HBO Go, in order to watch HBO movies, and now a Disney service (in the future) in order to watch Disney branded content. The other risk is the Company recouping the nearly $3B the Company invested in streaming video company BAMtech, which is a video platform created by Major League Baseball 17 years ago. Disney now has 75% control of the Company, and plan to use this to launch their streaming service in the future. Looking at the possible rewards, based on the content the Company has in its back pocket, I feel as if people will in fact take well to this service and subscribe once it is available. Like you have heard people say for so long when referring to Disney, Content is King. I have always said I would be happy if I just had a sports package, and not only will Disney’s service have all the sports I need, but they will also have Disney Jr and kids related films for my daughter, so we will both be happy. Disney is not putting all its marbles in one basket with BAMtech, as the new streaming service will hold exclusive rights to movies produced under The Walt Disney Company and Pixar brands. In listening to the Q3 conference call, Bob Iger was non-committal on the plans for both Marvel and Lucasfilms.

Looking at the Parks and Resorts segment, the Company continues to make improvements in order to draw higher attendance, which in turn will hopefully lead to higher spending. By year 2020, all of Disney’s Domestic parks will have undergone major improvements. Such improvements include two new lands being added; Pandora Land recently opening at the Animal Kingdom and Star Wars Land is projected to open at Disneyland in 2019. A Star Wars-themed hotel is also set to open in Orlando. The Company has also doubled their cruise fleet. A lot of new attractions and completely new “Lands” are being added to the parks, which should increase attendance in the future.

The last major segment to look at is one the Company is very excited about, that being the Studio Entertainment segment. One of the most anticipated films is set to open later this year, Star Wars: The Last Jedi will be in theaters this December. Other planned Star Wars films include: Hon Solo origin story next year, and Episode 9 in 2019. The Company has four Marvel movies coming in 2018, those being: Thor: Ragnarok, Black Panther, Avengers: Infinity War, and Ant-Man and the Wasp. As for animation movies, the Company has the following films set for 2018 release dates: Pixar’s Coco and The Incredibles 2. Additionally, highly-anticipated sequels to Frozen, Wreck-It Ralph, and Toy Story are in production. Other films mentioned for future release include: A Wrinkle in Time from Disney Live-Action as well as live-action versions of Mulan, Dumbo, and The Lion King. Disney management has stated that the studio slate is the strongest they have ever had. This segment has a lot going for it and will continue to be a growth driver for the Company going forward.

Valuation

Currently, as I am writing this article, Disney’s stock price is sitting at $100.70. The stock price is sitting at a Current P/E of 17.8 (using diluted TTM EPS), while the forward P/E is just 15.5, using Yahoo’s 2018 average EPS estimate of $6.51. In the past four years, Disney stock has had an average P/E of 18.7, so both from a current P/E and Forward P/E metric, the stock appears to be undervalued. Price/FCF is 18.07, which is the stocks lowest level since 2013. These metrics seem reasonable based on the Company’s future potential for earnings growth. Based on these couple of metrics through Q3, the stock seems undervalued when taking a long-term approach. We will dive deeper into all Disney metrics at the conclusion on Q4.

Overall, Disney may feel a short-term squeeze the remainder of the year, but the future looks strong behind various growth channels noted above. As stated above, the Studio segment is set up for a solid 2018, as is the Parks and Resorts segment with the opening of new attractions and lands within the parks. Looking at a combination of the Fundamentals and valuation, I feel the stock is primed for expansion in the next 12 months.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

HI Financial Services Mid-Week 06-24-2014