RECORDING Market Commentary 04-06-2016

HI Financial Services Commentary 04-06-2016

Don’t let fear of failure discourage you. Don’t let the voice of critics paralyze you – whether that voice comes from the outside or the inside. – Deter F. Uchtdorf

I’m going to go over that quote – I’m shocked at what people have done year to date

#1 Selling out in February for more than a ytd 10% loss and #2 still haven’t put 10% of their portfolio back into market

#3 Lost 50% of their 7 figure portfolio spread trading without ever adjusting I SAY OVER AND OVER trading is a process.

DON’T just place a trade and wait to see if it works – THAT’S STUPID !!!!!!!!!!!!!!

#4 Lost hope in the process and went to asset allocation funds

I’m shocked we are back to break even on the markets !!!!!

I Think that we are still the best house in a really, really ugly global neighborhood.

NOW: Our view of SPX turns NEUTRAL today, despite only one close below the 5DMA. We’re taking this step because:

- The 10DMA is now falling after 33 days of ascent

- MACD is falling. The hourly chart also has bearish divergence on at the 4/4 peak.

- The April 1 rally was probably a false bullish signal because it resulted from the start of Q2.

- The index is near resistance at the late-Dec high around 2081

- Earnings season starts in 2-3 weeks with financials, many of which have already warned of poor results.

- Junk bonds and energy in general are also looking weak. HYG and XLE have both made lower highs since mid-March. These have been canaries in the coal mine that have led the SPX.

- The collapse of the PFE-AGN deal adds to political risk in the healthcare space and mergers in general. Political risk hasn’t been a significant ingredient in this market for years but it could increase as elections approach.

Levels:

- Support is at 2034 on /ES or $203.90 on SPY.

- Next support is a zone between 2012 and 2020 on /ES, the lows of 3/24 and 3/29. This matches $201.65 to $202.50 on SPY. If SPX begins a skid lower we would expect the lower end of this zone to be tested and not rush buying the top.

- Below this, SPX likely has support somewhere around 2000 because this level has served as a pivot at various times since August 2014.

- First resistance is the same as yesterday, around 2049.50 on /ES or $205.40 on SPY. This kept the index in check overnight.

- There is potential resistance at 2060 or $206.40 on SPY, the intraday breakdown level on 4/4.

- The highest resistance is around 2071.50 on /ES or $207.60 on SPY. This roughly matches the highs of 4/1 and 4/4.

GAME PLAN: We won’t have a game plan because we are NEUTRAL. However, there may be follow-through to the upside if SPY breaks $205.40 and downside on a move below$203.90.

5-day chart w/15min candles

ECODATA & CALENDAR:

Crude-oil inventories are due at 10:30 a.m ET. Last night’s API report was strong at -4.3mln vs +2.9mln est.

The biggest item is FOMC minutes at 2 p.m. ET, although voting member Loretta Mester also speaks at 12:20 p.m. (She was hawkish on 4/1).

- Thursday: Retailer comp sales, jobless claims, natgas inventories. Key earnings: CAG KMX RAD | RT

- Nothing

WHAT WILL CHANGE OUR OUTLOOK:

- We will go BULLISH if SPX closes above the 4/4 close of 2073.

- We will go BEARISH if the 20DMA on SPX turns negative.

LONG TERM VIEW: Our longer-term view is NEUTRAL, with the potential for new highs or new lows depending on the economy.

- SPX is in a range between 1812 and 2130. The Feb 2014 low around 1730-1740 is the next likely support if it breaks.

- Long-term momentum is neutral, with SPX range bound and moving averages convoluted.

- We see strength in the economy — especially after the March regional Fed indexes and ISM beat estimates. Nonetheless, there remains a widespread belief to the contrary.

- We also see the likelihood of earnings to improve as the USD weakens and inflation rises. We believe this is not yet priced in an could serve as a positive catalyst as we work through earnings season.

- SPX probably needs to retest at least 2000 and possibly 1950. It is also due for a pullback to its 50DMA.

What’s happening this week and why?

Fed minutes said “global concerns” justify waiting to raise rates

Factory Orders -1.7 vs est -1.7

Trade Balance 47.1 vs est 46.2

ISM Services 54.5 vs est 54.0

Where will our market end this week?

Continue higher but not a lot higher

DJIA – Double bottom, bullish and now bouncing off over bought on the RSI

SPX – Ditto the DJIA

COMP – Bullish but defending the 200 SMA and still has room to run

Where Will the SPX end April 2016?

04-06-2016 +2.5%

What is on tap for the rest of the week?=

Earnings:

Tues: CREE, DRI, WBA

Wed: APOL, STZ, BBBY, MON, QIHU

Thur: KMK, CAG, RT, PSMT

Fri:

Econ Reports:

Tues: Trade Balance, ISM Services

Wed: MBA, Crude, FOMC Minutes

Thur: Initial, Continuing Claims, Consumer Credit

Fri: Wholesale Inventories

Int’l:

Tues – FR:DE:EMU: PMI Composite

Wed – DE: Industrial Production

Thursday – EMU: ECB Minutes

Friday –

Sunday – JP: Machine Orders, CN: PPI, CPI

How I am looking to trade?

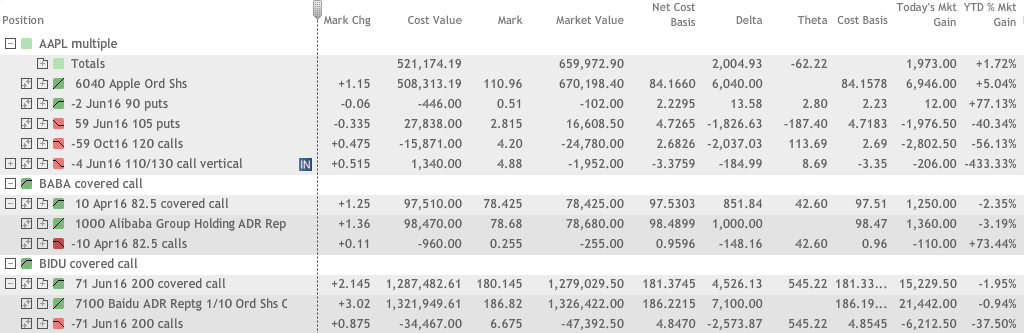

AAPL set for earnings and I will let half the shares get called away

BABA can also get called away for all I care

BIDU June 200 calls that were put on when it was closer to $155 a share

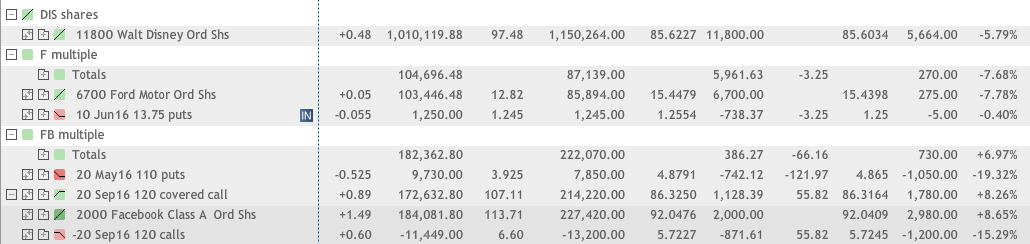

DIS – Protective put for earnings out to June

F – Protective Put for earnings out to June

FB – Already set for earnings

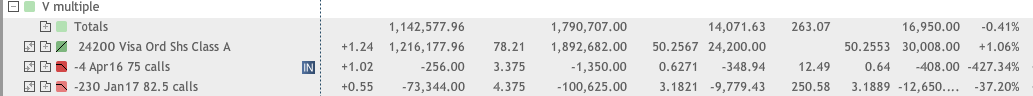

V – I will collar out to June long puts at $77.50 and roll the short calls to the Jan 17 85 strike

Just for fun I places a Sept 20/28 VIX Bull call for $1.70 and I placed it when the VIX was at 13.44

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Diversifying Disney: Delights And Drawbacks $DIS

http://www.seekingalpha.com/article/3963563

Smart Money Sees Google Differently Than Facebook

Expanding Our Horizon: Visa

http://seekingalpha.com/article/3776006-visa-wonderful-company-fair-price-long-term-investor

Keep Your Eye On The Prize Offered By Driverless Cars

Ford’s Valuation: 2009 All Over Again

U.S. auto sales forecast to increase 8% in March

Despite What You Read, Facebook Is Not A Short

http://seekingalpha.com/article/3961680-facebook-322-billion-valuation-high#alt1

Consumer spending on services on the rise

It’s Better To Buy Shares Of Baidu Than Of Yandex

It’s not a bull or a bear market, it’s a ‘bunny’

http://www.cnbc.com/id/103491080

| Baidu: Cruisin’ In The USA |

Continued Good News For Ford

Will Apple Get Imagination?

Apple: Better, Faster, Cheaper Is Not Disruptive Innovation, But Is That OK?

7 traits successful people share

http://www.cnbc.com/id/103462563

Invest In A Recession-Proof Business: Disney

Facebook: Trading At A 10% Discount?

5 things you don’t know about your 401(k) plan

http://www.cnbc.com/id/103480865

BIDU: Will Baidu Stock Go Higher?

Can Apple Sustain Its Growth In This Rapidly Growing Market?

http://seekingalpha.com/article/3959256-can-apple-take-india#alt1

HI Financial Services Mid-Week 06-24-2014