HI Financial Services Commentary 01-30-2018

You Tube Link: https://youtu.be/aO_jjtxt1XE

What I want to talk about today?

Let’s go over if the “style” of trading allows you to overcome days like Monday and Tuesday?

Spread trader – can you adjust and do you have the mental fortitude to weather the storm?

Stop losses killed them and most today were trigger and placed a loss more than 50%

Stop loss is a market order when the equity triggers the market order based on price movement below a certain point

$100 stock set a $90 stop loss what happens if the stock opens at $90? The order get triggered and the end of the day the stock is trading back at $100

$100 stock has a $90 stop loss and the market open with the stock at $75? It sells at $75 and at the end of the day it trades back up to $90.

Swing traders, day traders, e-mini, futures, forex, all got killed with just a little volatility increase!!!

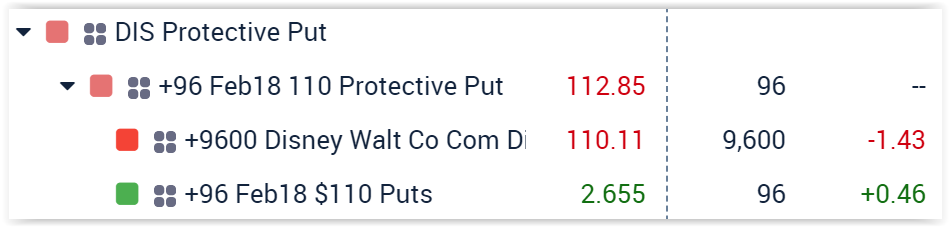

What worked today was collar trades, bearish trades and protective put trades.

What happening this week and why?

Earnings, FOMC Rate decision, Union president Trump, Economic reports, NAFTA agreement negotiations

Where will our markets end this week?

Higher

SPX – Bullish

COMP – Bullish

Where Will the SPX end February 2018?

01-31-2018 +0.5%

What is on tap for the rest of the week?=

Earnings:

Tues: AKS, CIT, GLW, MCD, NUE, PFE, PHG, PHM, AMD, EA, JNPR

Wed: ADP, BA, LLY, JCI, SIRI, T, X, EBAY, PYPL, QCOM, DHI, FB

Thur: BABA, BSX, CME, IP, MA, MDC, RL, TWX, UPS, VLO, GOOG, GPRO, MAT, MO, AAPL, V

Fri: CVX, XOM, EL, MRK, PSX, S, CLX

Econ Reports:

Tues: Consumer Confidence

Wed: MBA, ADP Employment, Pending Home Sales, Employment Cost Index, FOMC Rate Decision

Thur: Initial, Continuing Claims, Productivity, ISM Index, Unit Labor Costs, Construction Spending, Auto, Truck

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Factory Orders, Michigan Sentiment

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

Questions???

What about fed? Not rate hike in Jan but confirm the hike in Mar

State Union Address – Infrastructure, Bragging about what he thinks he’s done, and hopefully positive news in general

Opinion on AMZN is that it is way over valued and I would never feel comfortable trading or investing in accompany with no real profits and such a high valuation

NFLX – I wish I hadn’t gotten called out at $75

What’s my market outlook for 2018? More volatility but a better year than last year

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

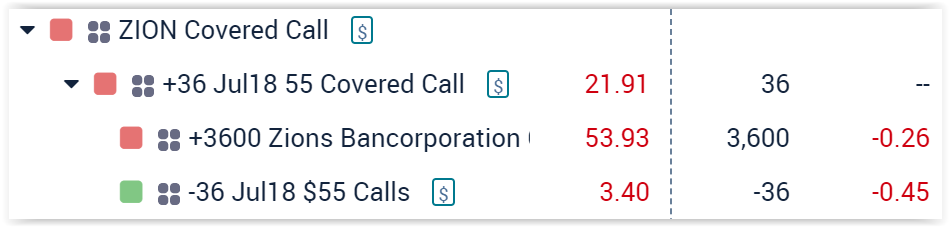

How am I looking to trade?

I now have long calls on BAC, V and I want more stock ownership in AAPL!

AAPL has the opportunity for a “one time” dividend could be $30 a share

A covered call DITM only gives you a little protection to add long puts for real protection

A covered call DITM only gives you a little protection to add long puts for real protection

I choose to protect with a protective put At riak ?= 2.4% protecting 97.6% of my total invested capital

Protective puts

250/230 Bear put = $20 of downside protection

AAPL – 02/01 AMC

AOBC – 03/01

BIDU – 2/22

CLX – 02/02 BMO

DHI – 01/31 BMO

DIS – 02/06 AMC

FB – 01/31 AMC

FCX – 01/25 BMO

MO – 02/01 BMO

KMX – 04/04 BMO

SODA 02/14

V – 02/01 AMC

https://www.cnbc.com/2018/01/02/home-prices-are-set-to-soar-in-2018.html

Home prices are set to soar in 2018

- Sales prices jumped 7 percent annually in November, according to a new report from CoreLogic.

- Low supply and high demand are fueling the gains and neither of those is expected to ease up anytime soon.

Published 9:59 AM ET Tue, 2 Jan 2018

Updated 3:08 PM ET Tue, 2 Jan 2018

The temperature may be frigid across much of the nation, yet home prices are sizzling and sellers are in the hot seat.

Sales prices jumped 7 percent annually in November, according to a new report from CoreLogic.

That is the third straight month at that pace, far higher than the price gains in the first half of 2017. Low supply and high demand are fueling the spurt and neither of those is expected to ease up anytime soon.

Supply is actually falling even more now, and a strengthening economy is pushing demand. This will have potential buyers out early this year, trying to get a jump on the spring market.

“Rising home prices are good news for home sellers, but add to the challenges that home buyers face,” said Frank Nothaft, chief economist at CoreLogic, in the report. Nothaft said the limited supply is the worst at the lower end, and will hit the growing number of first-time buyers hardest.

Half the homes are overvalued

The largest metropolitan areas are seeing the biggest gains.

In the nation’s top 50 markets, half of the housing stock is now considered overvalued, based on market fundamentals, like income and employment. CoreLogic defines an overvalued housing market as one in which home prices are at least 10 percent higher than the long-term, sustainable level.

Las Vegas led the November report as not only being overvalued, but showing a double-digit annual price gain of 11 percent.

San Francisco was not far behind at 9 percent, and Denver came in third at 8 percent.

Las Vegas and Denver are both considered overvalued, but San Francisco is not, as incomes in the tech capital far exceed the national level.

Of the nation’s 10 major markets with the biggest price gains, seven are overvalued. These include Washington, D.C., Houston and Miami. Boston and Chicago are still seeing price gains but are considered at value.

Without a significant jump in home construction, prices will remain high and likely move higher. Mortgage rates could also move slightly higher, and new tax policy limiting mortgage and property tax deductions, is hitting homeowners in some states hard.

All will combine to make housing less and less affordable in the new year.

Three events in the next 24 hours that could determine whether the sell-off continues

- The stock market’s worst enemy this week has been the bond market and rising interest rates, and now three big events could push those rates even higher in the next 24 hours.

- The first is President Donald Trump’s State of the Union speech. The second is the Treasury’s funding announcement, scheduled for 8:30 a.m. ET Wednesday, which should provide details on auction sizes.

- And finally the Federal Reserve holds its two-day meeting and is expected to issue a statement at the end of its meeting Wednesday that could sound slightly more hawkish.

Published 1 Hour Ago

Updated 7 Mins Ago

The jump in interest rates to four-year highs is the biggest catalyst behind the stock market’s sell-off, and there are three big events that could send those rates even higher in the next 24 hours.

The first is President Donald Trump‘s State of the Union address Tuesday evening. On the surface, it appears harmless and possibly positive, but bond strategists say there are several risk factors associated with it.

One is that the president’s plan to spend on infrastructure could end up increasing the national debt. The U.S. is already expected to double the size of its debt issuance this year, to nearly $1 trillion, and that is a factor that’s been weighing on Treasury prices, which move opposite yields.

“It’s $200 billion of actual spending, enhanced by private capital and municipal spending. Munis aren’t really in a position to do that. It sounds better on paper than it is in practice,” said George Goncalves, head of fixed income strategy at Nomura.

The second event and the one strategists see as the biggest wild card, is the Treasury‘s refunding announcement, scheduled for 8:30 a.m. ET Wednesday. It will include details on the first-quarter Treasury auctions and possibly on other funding needs for 2018.

The government’s bigger debt requirement is the result of more spending from the tax cuts and also an increase in entitlement spending. While usually a minor event, this week everyone in markets is watching the refunding announcement.

“That’s huge. There’s a lot of talk about that. We differ from the consensus so we think supply is at least going to pickup in the very long end, the 30-year bond. A lot of people think there will only be increases in the short end,” said Michael Schumacher, director of rates at Wells Fargo.

Briggs said he expects the auction size for 10-year notes and 30-year bonds to increase by $1 billion each, but any surprise could cause Treasury yields to move. He said the announcement should add supply across the curve, meaning an increase in Treasury bills at the short end all the way to the 30-year bond at at the long end.

The 10-year Treasury yield was at 2.72 percent in afternoon trading Tuesday, a big move from the 2.40 percent at the end of December. The 30-year was close to crossing the psychological 3 percent threshold.

When interest rates rise, they can become a challenge for stocks because they offer higher yielding investment alternatives and also make for higher borrowing costs for corporations. The closely watched benchmark 10-year Treasury yield impacts a whole range of borrowing rates from small business loans to home mortgages.

Goncalves said the government funding announcement will be important, particularly since it comes after the State of the Union focus on spending.

“Wednesday morning we may wake up and realize there’s more debt coming down the road. Then we see the government estimates for its borrowing needs,” he said. “That could be the one-two punch that brings us to near-term highs in rates for at least the week and maybe for the next month.”

The final event is normally the one that would have the most potential to be market moving, but it is not expected to have much impact this week. The Federal Reserve meeting, underway Tuesday, concludes Wednesday and the Fed issues its statement at 2 p.m. ET.

While the central bank is not expected to raise rates at Fed Chair Janet Yellen’s final meeting, it could indicate that the economy is improving and comment on inflation, which is running below its target.

But in the run-up to the meeting, the market is also beginning to expect a fourth rate hike for this year on top of the three the Fed is currently forecasting. If the statement sounds hawkish, that could pressure shorter-term rates, like the two-year. On Tuesday the two-year was at 2.12 percent.

“I feel like we have this crescendo moment if everything lines up like I suspect,” said Goncalves.

There are other factors impacting bond yields this week, including Friday’s jobs report, which could drive yields higher if wages rise more than expected.

“Technically, the charts show rates are stretched, and they’re due for a pullback. We have month end which will coincide with the day after the president’s speech,” Goncalves said.

Strategists also say there could also be political risk this week around the State of the Union.

“I think the only risk is if his trade rhetoric is aggressive, not just on NAFTA but on China,” said John Briggs, head of strategy at NatWest Markets.

Trump could also venture into another area that would make the market nervous — the investigation into Russian efforts to influence the 2016 election, and now the expected release of a GOP memo that some House Republicans think shows FBI bias against Trump.

“I’m not sure much can salvage what’s going on with sentiment now — all this chatter about the memo and concern about the just what’s going to happen with the Russia probe. The negative is if he fires [special counsel Robert] Mueller, it doesn’t go away. It just gets worse,” said Tom Simons, chief money market economist at Jefferies.

“It kind of casts a cloud over the State of the Union. If he’s going to talk about infrastructure, it’s not going to have much effect. He’s going to talk about getting bipartisan cooperation in Congress. It’s just like a fantasy to think that’s something he can really expect.”

https://seekingalpha.com/article/4141444-apple-keep-calm-buy-dip

Jan.30.18 | About: Apple Inc. (AAPL)

Summary

Apple has lost almost 10% from its 52-week highs on concerns about a softer holiday quarter and 2018 guidance.

Rumors are spreading that the company is going to halve its production for the iPhone X, leading investors to sell the stock.

The holiday quarter always is Apple’s strongest, so it should be no surprise that production will be cut for the subsequent quarter.

Apple will release earnings February 1. And while all eyes will be on its Q4 results and guidance, I’m more interested in the dividend announcement and remarks on repatriated overseas cash.

America’s largest (in terms of market cap) and most profitable company, Apple (NASDAQ:AAPL), will announce its highly anticipated FY2018/Q1 (Apple’s holiday quarter) results on February 1, 2018, after the bell.

Following rumors from Nikkei Asian Review sources that Apple is planning to cut its iPhone X production by 50% to 20 million units for Q1 CY18, the markets sent the stock down. The stock is currently trading around 10% off its 52-week high.

This sell-off appears to follow a common pattern and provides a welcome dip before the stock sets off to $200 again.

What’s going on at Apple?

Wiping out almost $60 billion in market cap may sound alarming. But for a company as big as Apple, it is not worrying. In fact, potential production cuts should not be a surprise given that the holiday quarter has always been Apple’s strongest, and as such, announcing a reduction in production for its flagship model is nothing new.

The same thing happened in 2017. The same source (Nikkei) suggested Apple trimmed production of its iPhone family by around 10% in the first quarter of 2017, which came on top of earlier iPhone 7 production cuts of around 20%. Citing “sluggish sales,” Nikkei concluded that it will be a difficult year for Apple and was already looking forward to the (back then) upcoming anniversary iPhone edition.

What happened afterwards was that Apple reported iPhone unit sales of 78.29 million (+5% Y/Y) and guided slightly below consensus of $53.94 billion with its $51.5-$53.5 billion range for the fiscal Q1 report. The stock reacted very positively to this news and raced from $120 to $140 within a month.

For its fiscal Q2 report, the company then recorded iPhone growth of +1%, and despite not meeting the market’s expectations, the return to iPhone growth was a very positive sign for the rest of the year.

In fiscal Q3, Apple crushed market expectations with iPhone growth of 3% and guidance easily exceeding consensus. That trend continued in fiscal Q4 2017 with iPhone growth of 3% Y/Y, upbeat guidance on the holiday quarter and the return to revenue growth in Greater China.

In a nutshell, it was anything but a difficult year for Apple. The company returned to iPhone growth in key geographic areas and globally, and production cuts lingering on the stock as it approached fiscal Q1 2017 earnings were not mentioned anymore.

The current market reaction to news about production cuts generally resembles what happened in early 2017. Investors are selling their shares to take some profits as they await earnings of the market’s highly capitalized stock. Or is everything different this year?

When Apple releases earnings, it is always a “big quarter,” and even if the company tops expectations for the quarter it reports on, then the focus immediately shifts to guidance for the next quarter. If the guidance is in line with expectations, then questions will arise on what comes next and so forth.

Still, it should be noted that very high hopes are placed on the iPhone X, and Apple further nurtured these expectations when it was guiding for the “biggest quarter ever.” The iPhone X is by far the most expensive iPhone ever, and as such, analysts are expecting a record average selling price of $737, up around $40, or 6%, from the prior year. This is a bold claim given that next to the iPhone X, Apple also released the iPhone 8, which is only marginally better than the considerably cheaper iPhone 7, with the iPhone 6 series still selling pretty well. This high degree of uncertainty regarding internal competition is clearly not comparable to the prior year.

And if in the worst case the iPhone X is not the success it was hyped to be and Apple decides to stop production later in the year, this is no reason to panic as well.

Apple is not only the largest and most profitable company, but also the one with the highest cash reserves. Sitting on a cash hoard of $268.9 billion and with corporate tax reform, the company has all the possibilities in the world to further innovate on its products and invest massive amounts via share buybacks into its stock, particularly if earnings disappoint and the current dip continues.

As a long-term investor, I do not freak out about quarterly sales of Apple’s current iPhone or guidance for the next quarter. What’s more important is how the company plans to innovate and how it plans to use its repatriated cash going forward. A potential “buyback bazooka” could provide lots of downside protection for investors and bolster confidence, depending on Apple’s business outlook for all its businesses.

Furthermore, although Apple has traditionally announced its dividend hike in the subsequent quarter, given the unique and one-off nature of the tax reform, the company may also provide some color on its future dividend plans.

Apple is an excellent dividend stock with five consecutive years of high-single digit dividend growth and an ultra-low 23% payout ratio, currently boasting a yield of 1.5%.

Takeaway

Another seemingly big quarter for Apple is on the table, and every negative or potentially negative news regarding the stock is widely sold. This is the same procedure as last year, and despite the iPhone X being special compared to previous iPhone series, I’m not worried about unit sales and production cuts.

For long-term investors, it is key to gauge how Apple plans to use its repatriated cash and how its outlook on its various businesses is, instead of quarter-over-quarter iPhone sales.

Certainly, the company could have a negative surprise in the bag. But even if that happens and the stock dips further, these dips should be welcomed as more attractive entry opportunities. Apple stock is supported by a giant buyback program, and as in the past, I have all the confidence that management will step in if the current dip persists. The current sell-off is a buying opportunity, and investors should not ignore that Apple is significantly growing amid all that iPhone X production cut mania. For fiscal Q3, iPad and Mac grew by around 10%, iPhone by +3% and Services by a booming 34%.

https://seekingalpha.com/article/4141417-apple-swims-systemic-risk-tidal-wave

Apple Out-Swims A Systemic Risk Tidal Wave

Jan. 31, 2018 7:30 AM ET

Gold, ETF investing, macro, VIX

Summary

Passive equity investing has become immensely more popular over the past several years.

Fund flows out of active and into passive strategies helped fuel active manager underperformance and Apple’s price run.

Active manager underperformance has led to more flows from active to passive, creating a vicious cycle and potentially excessive systemic risk to Apple and the S&P 500 that could overwhelm fundamentals.

If the fund flow cycle reverses, the stock market could experience a massive correction.

The U.S. equity market performed remarkably over the past few years, and even more impressive was the lack of volatility. During these times of plenty, it is easy to understand the passive investing trend. Passive investing is just like burning coal for heat – it’s easy, it’s cheap, and it has performed well; but if it continues much longer, the results can be extremely damaging. Risk never goes away in investing, it just changes form; and during the recent “riskless” rally, the move from discerning investment to passive buying has likely traded short-term volatility for a growing buildup of systemic risk.

Volatility Has Been Falling While Equities Have Rallied

Source: Bloomberg

How have stock pickers and active equity managers fared in this environment? Unless you put all of your eggs in one FAANG basket, the SPX been hard to beat. We will explore why this has been the case.

For an active equity manager to achieve consistent outperformance, two things need to happen:

- They need to discover companies whose perceived values are below intrinsic values.

- The market then needs to realize the intrinsic value is above the current price and thus increase demand and the price for the stock.

An active manager benchmarked to the S&P 500 has two methods with which to attempt to produce outperformance. The manager can either buy a stock that is not in the index, or they can change the weightings of stocks to a level unequal to the index.

When you buy a stock not in one of the most popular indices you face the harsh reality that investors have been pulling money out of discriminant stock-selecting managers and allocating the capital to indiscriminate, buy-at-any-price, index funds1.

Investor Flows: Active vs. Passive1 2006-2016

Source: PWL Capital, Morningstar Direct

This trend has caused money to flow out of non-index stocks (or non-popular indices) and into stocks, such as Apple (NASDAQ:AAPL), that are included in popular indices. This is not to say that Apple hasn’t backed up the flows with strong fundamentals, but the selling dynamics on non-SPX stocks can be brutal.

To find a buyer for a company not in a popular index, you likely must trade with another active manager (who may also be facing outflows) or a personal investor who may not have the time to determine intrinsic values for numerous securities, or institutions who are making a similar transition from active to passive management2. On the flip side, every dollar flowing into S&P 500 index funds makes its way to only 500 stocks. With billions of dollars rushing to this strategy, in-index equities are in a state of constant windfalls of purchases, and prices have just kept climbing higher. Evidence of the potential of index inclusion is referenced in many academic studies. Recently, a Kempen Capital study shows the change in price when a security first gets included in the S&P 500 index. Their study showed that between 2006 and 2016, stocks announced for inclusion (close of business 5 days previous to inclusion) outperformed the general market by almost 2% in the following 8 trading days3, as discerning price makers lose ground to swarms of price takers.

Excess Stock Performance: S&P 500 Index Additions 2006 – 20163

Source: Kempen Capital Management

If instead of going out of index, your outperformance strategy consists of re-weighting the S&P 500 Index securities, you will have to fight the fact that the S&P 500 index is market cap weighted. Since mutual funds must hold more than twenty companies, active managers are forced to own other stocks. However, market cap weighting indices assure the largest companies get the biggest slice of passive fund inflows; the largest 5 companies in the S&P 500 receive almost 12% of the these inflows, with Apple commanding about 4% by itself. Since average daily volumes aren’t directly proportionate to market cap, the largest companies could see their P/E multiples expand from the rush of bids. As the prices for the largest stocks increase faster than the index, they begin to command an even larger weighting in the index and thus an even larger allocation of future inflows, starting a monster-stock-creating feedback loop.

Source: Bloomberg

In this system where the largest companies are getting bought the most, it has been difficult to outperform the S&P 500 unless you doubled down and further overweighted the most overweight companies. This difficulty is expressed in the 2017 SPIVA study that showed 88% of active managers benchmarked to the S&P 500 index over the 5 year period ending 20164underperformed.

% of U.S. Large Cap Managers Underperforming the S&P 5004

Source: SPIVA S&P DJ Indices

Underperformance has led to even more capital switching to the passive strategies, and the trend has been accelerating. According to Bloomberg and ICI data, the first half of 2017 saw the largest capital shift yet from active to passive5.

Net Flow Out of Active and Into Passive Q1 & Q2 Each Year5

Reviewing the recent poor performance and subsequent outflows from active managers, one must ask the question – has all of the stock-pickers’ detailed analytic work been wrong? Probably not. Professionals may be correct more often than not in their company theses, but fall victim to less and less others noticing the dislocation themselves due to increased passive mandates. The other unsettling possibility in a passive-dominant markets is that a moderate sell-off in the market could lead to a feedback loop that is much less fun in reverse. What if the current trend continued and 100% of all equity investing becomes long-passive S&P 500? With human decision making out of the picture, all trades would be algorithmically based on similar formulas, which could lead to index fund providers trying to sell the same securities, at the same time. This is not the case yet, but as of December 31st 2016, there was $3 Trillion dollars passively tracking the S&P 500 index6 in which Apple currently makes up about 4%. If Apple were to be reconstituted to a 3% position because of a lower market cap, current levels suggest $30 Billion of the stock would have to be sold just for rebalancing purposes. Is the proliferation of low-cost index investing good for the market, or is it coiling dangerous systemic risk?

This information is not intended to be investment advice. Past performance does not guarantee future results.

Sources

- The Passive vs. Active Fund Monitorby PWL Capital Inc.

- After Shift to Passive Investing, Endowments Now Are Staying Puton Bloomberg

- The relationship between stock performance and their inclusion to or exclusion from the MSCI or S&P 500by Jeroen Reuling, Kempen Capital Management

- SPVA Report Card End 2016

- Active vs. Passive Investingon Bloomberg

- S&P Dow Jones Indices Annual Survey of Assets Dec 2016

HI Financial Services Mid-Week 06-24-2014