HI Market View Commentary 02-16-2021

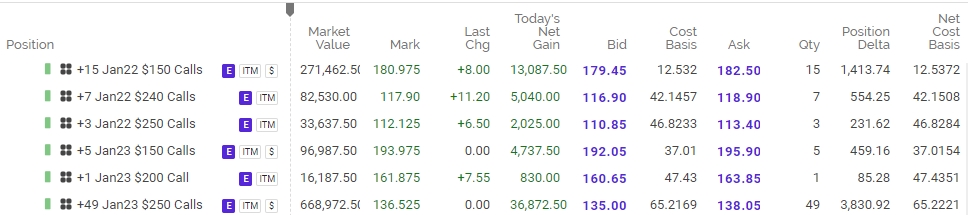

Lets Talk about a stock replacement strategy that replaces stock, leverages returns, and allows for new positions to be added to the portfolio

Long Call = The right to buy a stock at a certain price for a certain period of time

Let me show you how I leverage profits in the sale of stock ownership

So I bought BIDU for $144.90

I sold a short call = obligation to sell your stock for a certain period of time at a certain price $200= Credit of $12

IF BIDU in Jan 22 was higher than $200 I would have to sell my stock

Net Gain?= 200 – 144.90 +12 = $67.10

IF I book this profit I am no longer in the position.

Kevin What did you do?

I rolled the Jan 22 $200 short calls out to Jan 23 $200 short calls for a credit of $65.28 LOSING $10 to buy back the original Jan22 $200 position

Current position profits = 200 – 144.90 – 10 +65.28 = $110.38 per share *300= $33,114

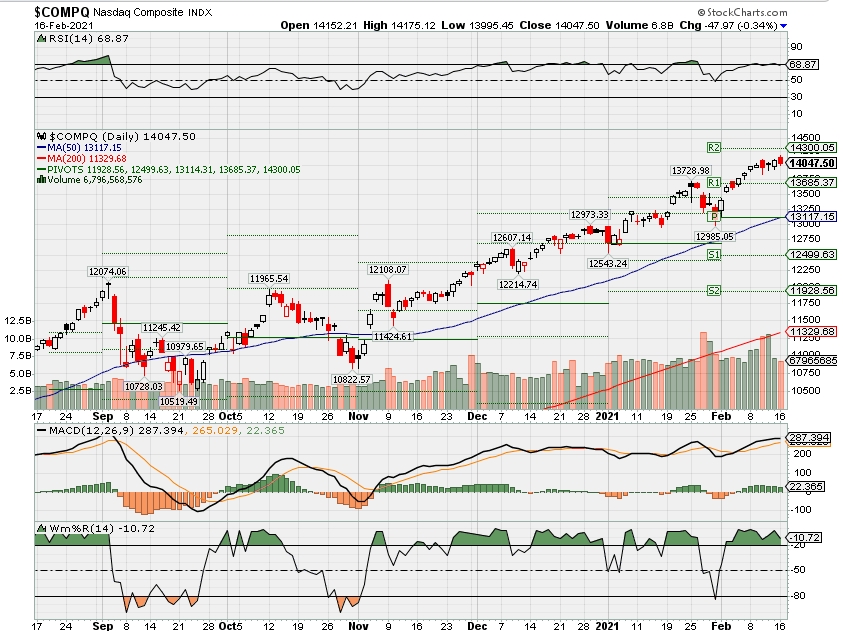

Where will our markets end this week?

Up

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end February 2021?

02-16-2021 +2.0%

02-08-2021 -2.0%

02-01-2021 -2.0%

Earnings:

Mon:

Tues: A, DVN, GWW

Wed: GRMN, HLT, CF, HLF, IQ, VMI, BIDU

Thur: GOLD, PPL, WMT, WM, DBY, ROKU, NEM

Fri: DE, VBR

Econ Reports:

Mon:

Tues: Empire

Wed: MBA, PPI, Core PPI, Retail Sales, Retail ex-auto, Business Inventories, Capacity Utilization, Industrial Production, NAHB Housing Price Index

Thur: Initial Claims, Continuing Claims, Building Permits, Housing Starts, Import, Export, Phil Fed,

Fri: Existing Home Sales, MONTHLY OPTIONS EXPIRATION

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2020/11/20/attention-robinhood-power-users-most-day-traders-lose-money.html

Attention Robinhood power users: Most day traders lose money

PUBLISHED FRI, NOV 20 20208:04 AM ESTUPDATED FRI, NOV 20 202010:04 PM EST

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Day traders have terrible track records.

Academics who study stock pickers have long observed that the vast majority of professional money managers – about 85% – underperform their benchmarks over a multiyear period.

Now those professionals are turning their sights on retail day traders, warning that the same poor results apply to them as well.

“I don’t confuse day traders with serious investors,” Princeton professor Burton Malkiel, author of “A Random Walk Down Wall Street,” wrote in a blog for Wealthfront, where he is chief investment officer. “Serious investing involves broad diversification, rebalancing, active tax management, avoiding market timing, staying the course, and the use of investment instruments such as ETFs, with rock bottom fees. Don’t be misled with false claims of easy profits from day trading.”

Backing up Malkiel is a large body of academic studies going back 20 years that consistently shows day traders and other very active traders have difficulty making money over anything more than short periods of time.

The most recent study, “Attention Induced Trading and Returns: Evidence from Robinhood Users,” was published in October and examined trading activity of Robinhood from May 2, 2018, to Aug. 13, 2020. They particularly studied “extreme herding events,” where Robinhood traders crowded into particular stocks.

They concluded that during these extreme “herding events,” “the top 0.5% of stocks bought by Robinhood each day experience return reversals on average of approximately 5% over the next month whereas the more extreme herding events have reversals of approximately 9%.”

The conclusion: “Large increases in Robinhood users are often accompanied by large price spikes and are followed by reliably negative returns.”

Why did that happen? The authors noted that most Robinhood investors are inexperienced, so they tend to chase performance. The layout of the app, which draws attention to the most active stocks, also causes traders to buy stocks “more aggressively than other retail investors.”

Finally, the ease of use of the site, and the fact that it is commission-free, may also encourage trading. “As evidenced by turnover rates many times higher than at other brokerage firms, Robinhood users are more likely to be trading speculatively and less likely to be trading for reasons such as investing their retirement savings, liquidity demands, tax-loss selling, and rebalancing.”

Why do stocks that spike when Robinhood traders pile in so quickly drop off? In addition to reversion to the mean, the authors suggest that short sellers are perfectly aware of Robinhood trading patterns. “These reversals seem to be well known as stocks Robinhood users herded into attracted significant short interest,” they wrote.

A Robinhood spokesperson declined to comment on the study, but in a statement emailed to CNBC said: ”[W]e see evidence most of our customers are buy and hold, and 98% of our customers are not pattern day traders.”

Still, other studies of day traders have come to similar conclusions.

A study published in June of almost 1,600 Brazilian day traders that tracked their activity for one year concluded that only 3% made money. The authors avoided claims that day traders can make money over short periods of time (a day or a week), and concentrated on day trading activity over longer periods.

Their conclusion: “We show that it is virtually impossible for individuals to day trade for a living, contrary to what course providers claim. We observe all individuals who began to day trade between 2013 and 2015 in the Brazilian equity futures market, the third in terms of volume in the world. We find that 97% of all individuals who persisted for more than 300 days lost money. Only 1.1% earned more than the Brazilian minimum wage and only 0.5% earned more than the initial salary of a bank teller — all with great risk.”

Yikes.

A 2011 study of Taiwanese day traders over a 15-year period, from 1992 to 2006, showed only slightly better results. Day trading is popular in Taiwan. In an average year, about 360,000 Taiwanese individuals engage in day trading, according to the authors.

Their conclusion: “Consistent with prior work on the performance of individual investors, the vast majority of day traders lose money.” They do note that a small group (about 15%) do earn higher returns net of fees, but that “some outperformance would be expected by sheer luck.”

A later version of the paper published in 2013 concluded: “Less than 1% of the day trader population is able to predictably and reliably earn positive abnormal returns net of fees.”

What about the tiny group that might do better than sheer luck? The authors speculate that “One way in which day traders could be earning profits is by supplying liquidity through passive limit orders to uninformed investors who are too eager to pay for quick execution.”

In other words, the tiny fraction of day traders who actually make money in Taiwan do so by trading with “dumb money” — other day traders and general investors.

An older study, going back to 2000, fared no better for day traders. Brad M. Barber and Terrance Odean of the University of California, Berkeley, analyzed 66,000 trading accounts at Charles Schwab from 1991 to 1996. They found that those who traded the most earned an annual return of 11.4%, while the market overall returned 17.9%.

Given this evidence, why does day trading persist, and why is it so popular? The authors concluded that very active traders seem to believe they know more than they really do. “Overconfidence can explain high trading levels and the resulting poor performance of individual investors,” the authors said.

Their conclusion echoes those of the other studies. “Our central message is that trading is hazardous to your wealth. … Those who trade the most are hurt the most.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Scientist Discovered Why Most Traders Lose Money – 24 Surprising Statistics

“95% of all traders fail” is the most commonly used trading related statistic around the internet. But no research paper exists that proves this number right. Research even suggests that the actual figure is much, much higher. In the following article we’ll show you 24 very surprising statistics economic scientists discovered by analyzing actual broker data and the performance of traders. Some explain very well why most traders lose money.

- 80% of all day traders quit within the first two years. 1

- Among all day traders, nearly 40% day trade for only one month. Within three years, only 13% continue to day trade. After five years, only 7% remain. 1

- Traders sell winners at a 50% higher rate than losers. 60% of sales are winners, while 40% of sales are losers.2

- The average individual investor underperforms a market index by 1.5% per year. Active traders underperform by 6.5% annually. 3

- Day traders with strong past performance go on to earn strong returns in the future. Though only about 1% of all day traders are able to predictably profit net of fees. 1

- Traders with up to a 10 years negative track record continue to trade. This suggests that day traders even continue to trade when they receive a negative signal regarding their ability. 1

- Profitable day traders make up a small proportion of all traders – 1.6% in the average year. However, these day traders are very active – accounting for 12% of all day trading activity. 1

- Among all traders, profitable traders increase their trading more than unprofitable day traders. 1

- Poor individuals tend to spend a greater proportion of their income on lottery purchases and their demand for lottery increases with a decline in their income. 4

- Investors with a large differential between their existing economic conditions and their aspiration levels hold riskier stocks in their portfolios. 4

- Men trade more than women. And unmarried men trade more than married men. 5

- Poor, young men, who live in urban areas and belong to specific minority groups invest more in stocks with lottery-type features. 5

- Within each income group, gamblers underperform non-gamblers. 4

- Investors tend to sell winning investments while holding on to their losing investments. 6

- Trading in Taiwan dropped by about 25% when a lottery was introduced in April 2002. 7

- During periods with unusually large lottery jackpot, individual investor trading declines. 8

- Investors are more likely to repurchase a stock that they previously sold for a profit than one previously sold for a loss. 9

- An increase in search frequency [in a specific instrument] predicts higher returns in the following two weeks. 10

- Individual investors trade more actively when their most recent trades were successful.11

- Traders don’t learn about trading. “Trading to learn” is no more rational or profitable than playing roulette to learn for the individual investor.1

- The average day trader loses money by a considerable margin after adjusting for transaction costs.

- [In Taiwan] the losses of individual investors are about 2% of GDP.

- Investors overweight stocks in the industry in which they are employed.

- Traders with a high-IQ tend to hold more mutual funds and larger number of stocks. Therefore, benefit more from diversification effects.

Conclusion: Why Most Traders Lose Money Is Not Surprising Anymore

After going over these 24 statistics it’s very obvious to tell why traders fail. More often than not trading decisions are not based on sound research or tested trading methods, but on emotions, the need for entertainment and the hope to make a million dollars in your underwear. What traders always forget is that trading is a profession and requires skills that need to be developed over years. Therefore, be mindful about your trading decisions and the view you have on trading. Don’t expect to be a millionaire by the end of the year, but keep in mind the possibilities trading online has.

Powerful corporate profits and forecasts of more to come have investors cheering

PUBLISHED FRI, FEB 5 20217:14 AM ESTUPDATED FRI, FEB 5 20217:43 AM EST

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Blowout earnings are forcing analysts to up estimates for 2021.

With a little more than half of companies reporting, earnings are proving to be a pleasant surprise for the trading community.

The GameStop/Robinhood fiasco is turning out to be a minor blip in the markets in the first weeks of 2021. The main theme that ended 2020 — the belief in the effectiveness of a vaccine — remains intact.

“The markets are advancing to new highs as Covid cases are dropping, stimulus is coming in at the higher end of expectations, and we are continuing to see very positive earnings surprises,” said Earnings Scout ’s Nick Raich.

Surprises and raised earnings

Stocks are expensive. The S&P 500 is trading at a historically high 22 times 2021 earnings. For stocks to keep advancing, two things had to happen: very large earnings beats for the fourth quarter and sufficiently clear corporate guidance that earnings estimates for Q1, 2, and 3 would keep rising.

Both of these conditions have been met. First, earnings are beating estimates by more than 17%, about five times the normal average and on a par with the third quarter. The reason: Analysts have underestimated the strength of the economic recovery.

Q4 earnings: halfway point (53% reporting)

- Beating: 83%

- Percentage above estimates: 17.3%

- EPS growth: up 1.6%

Second, earnings surprises are now translating into higher estimates for the first and second quarters.

S&P 500: Q1 2020 earnings estimates

- Jan. 1: up 16%

- Today: up 20.5%

S&P 500: Q2 2020 earnings estimates

- Jan. 1: up 45.7%

- Today: up 49.9%

Source: Refinitiv

Analysts typically are overly optimistic and start cutting estimates as the quarter wears on, but in the second quarter the opposite has happened.

“That’s an unusual occurrence; the Street is usually cutting numbers by this point in the current quarter,” DataTrek’s Nicholas Colas said in a recent note.

Technology, materials and real estate earnings have been particularly strong.

Sell the news?

With stocks this high, it’s little wonder that even strong earnings reports don’t move individual stocks much. Christopher Harvey, head of equity strategy at Wells Fargo, has noted that in the 24-hour period companies reported positive earnings beats, the average stock traded down 0.8%.

Ann Larson, senior analyst at Bernstein, noted that the S&P 500 had run up about 18% in the previous 2½ months, “perhaps discounting much of the good earnings results in advance.”

Low rates + strong earnings = stocks at new highs

Another factor pushing stocks to new highs is low interest rates.

“The U.S. has never begun an expansion with yields as low as today,” chief investment strategist Jim Paulsen of The Leuthold Group said in a recent note. “A combination of extremely low yields and strong EPS gains has historically proved to be a uniquely positive opportunity for stock investors.”

What could derail the earnings lollapalooza? Barring another out-of-left-field event like GameStop, it’s still all about the stimulus (go big is going to succeed, it appears) and the vaccine: “Covid is still a huge X-factor,” Raich said. “Will there be mutations and will the vaccines still be as effective as advertised? Barring that, stocks should continue to climb higher.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

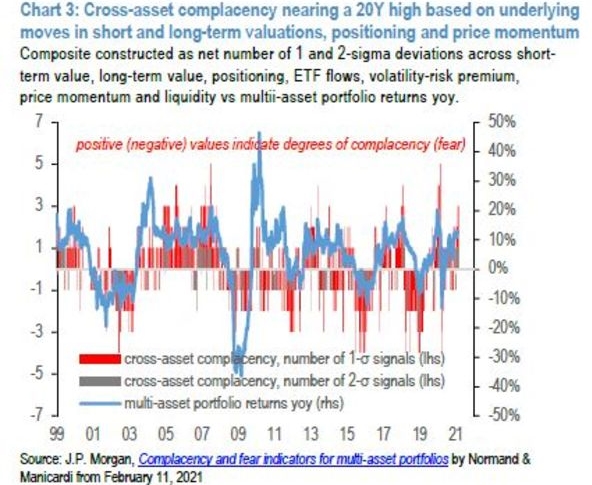

JPMorgan’s Barometer Says Markets Most Complacent in Two Decades

February 15, 2021, 5:02 AM MSTGlobal investors are the least fearful they’ve been in two decades, and perhaps the most greedy.

A JPMorgan Chase & Co. gauge of cross-asset complacency based on valuations, positioning and price momentum is nearing the highest level since the time the dot-com bubble burst and some companies found out burning cash faster than they made it wasn’t quite effective as a long-term survival strategy.

Some of that get-rich-quick spirit has already been in display in 2021 from Bitcoin’s flirting with the $50,000 mark to the craze for cannabis firms and speculative warfare over penny stocks. Global equities have added $7 trillion since New Year, digital currencies have ballooned to a market value of $1.4 trillion and high-yield bond sales are raking in records.While all that raises concerns of untenable valuations across asset classes, investors continue to pour money into them amid confidence that unprecedented monetary and fiscal accommodation will keep the party going for some more time.

JPMorgan strategists seem to agree. While a “pause” is likely now, they say, there’s no reason to expect a substantive pullback from the rally fueled by the trillions of dollars being unleashed. The main risk on the horizon is a taper of bond-buying by the Federal Reserve once employment and inflation return to targets, but that’s not likely until later in the year.

“We’ve been comfortable advising investors to stay long most markets,” strategists led by John Normand wrote in a Feb. 12 note to clients. “When growth is above trend, monetary policy is ultra-loose and fiscal policy is on overdrive, markets tend to exhibit the financial variant of Newton’s Law: they stay in motion until acted upon by another force.

Attention bitcoin investors: Top strategist sees a troubling trend amid record market inflows

Stephanie Landsman@STEPHLANDSMAN

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

As a record amount of money flows into the market, Wilmington Trust’s Meghan Shue sees a troubling trend.

Shue, who oversees almost $136 billion in assets, is concerned retail investors are rushing into stocks and cryptocurrencies that are high risk and offer few benefits — if any at all.

“It’s a little bit of chasing returns in the wrong areas. It’s also a little bit of chasing what’s already happened,” the firm’s head of investment strategy told CNBC’s “Trading Nation” on Friday. “One thing we have to be careful of is not to extrapolate what we’ve seen over the recent three months into the future.”

Shue’s warning comes after Bank of America’s latest weekly report found investor inflows hit an all-time high. Its latest data shows $58 billion went into global stocks.

“What we have seen from that Bank of America data are record inflows into U.S. large cap, in the tech sector,” said Shue, a CNBC contributor. “But less attention is being paid to areas that we think offer better potential for future returns.”

Shue’s concerns also apply to speculative assets involved in this year’s Reddit-induced retail trading mania pumping up lower quality stocks — as well as bitcoin. As of Friday’s close, the cryptocurrency is up about 65% since January 1 and 360% over the past 52-weeks.

“Money is coming off the sidelines and is looking more speculative than it has in years,” Shue said in a special note to “Trading Nation.”

Rather than piggybacking on areas that have already seen sharp moves higher, Shue urges investors to target economically sensitive stocks, small caps and emerging markets. Her investment timeline is 9 to 12 months.

“There’s more room to go in terms of long-term catch-up,” added Shue.

In the case of emerging markets, she contends the group typically performs strongly in the beginning stages of global economic expansions.

“You have to have more exposure to cyclicals and value than you did last year,” she said.

A market bull, Shue believes the Covid-19 vaccine deployment will accelerate over the next couple of months and help repair the economy faster than widely anticipated.

But she’s not ruling out a pullback along the way due to high levels of market euphoria. In that case, Shue recommends buying the dip and going small.

“In the U.S., the top trade is U.S. small cap,” Shue said. “If you look at early expansion periods, you tend to see U.S. small cap outperform large by a pretty large margin for a longer period than just a couple of months.”

5 Caribbean islands where it’s affordable to live

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

Belize – Ambergris Cay Island – San Pedro.

DEA / M. BORCHI | De Agostini | Getty Images

A new report from International Living, a website about living and retiring overseas, determined some of the best and most affordable Caribbean Islands to live on.

Amid the Covid-19 pandemic, interest in Caribbean islands has increased: Web traffic for International Living’s Caribbean island report was up 225% last month alone, says the website’s executive editor, Jennifer Stevens.

“Even though most folks are largely hunkered down, I think people are using this time at home to plan for where they’ll go once the world opens up again—and the idea of sun, sand and not-too-long a plane ride has its appeal,” Stevens says.

According to Travel Weekly, most Caribbean Islands have reopened to international tourists under certain Covid protocols (which differs for each island). Though the CDC is requiring all international passengers flying into the U.S. from the Caribbean to provide proof of a negative Covid test taken no more than 72 hours prior to the flight.

But with Covid vaccines being distributed around the world, many experts are optimistic that life could return to some semblance of normalcy by the end of the year.

So if you are thinking about moving to a Caribbean Island or just looking for a getaway, here are the top five most affordable Caribbean Islands, according to International Living.

Ambergris Caye, Belize

As the largest island in Belize, Ambergris Caye is known for housing the Belize Barrier Reef. The island is popular among expats for its reliable internet and cell phone coverage. Regular flights and water taxis also make it easy to head into town, to either Belize City or Chetumal, Mexico, according to International Living.

A couple can live comfortably for around $2,950 to $3,150 per month, which includes the rental of a house or apartment, according to International Living.

Roatan, Honduras

Roatan is just 50 square miles off Honduras’ northern coast. It’s popular due to its quiet and pristine beaches and the fact that it has no high-rise developments.

According to International Living, $175,000 could buy you a two-bedroom home in Roatan. While daily essentials are more expensive on the island because they have to be imported, an average couple can easily live on a budget of $2,000 to $2,500 a month.

However safety is something to keep in mind when it comes to Honduras.

Isla Mujeres, Mexico

Though Isla Mujeres is only about 8 miles from Cancun, it’s more laidback and cheaper, according to International Living.

For example, a one-bedroom, two-bathroom penthouse condo with a view starts at $230,000 to own, and rent for a one-bedroom apartment is around $700 to $1000 a month, according to the site.

While crimes rates in Mexico are high, Isla Mujeres and nearby Cancun are considered safe.

Las Terrenas, Dominican Republic

Las Terrenas is only a short flight from New York City (about three-and-a-half hours) and has some of the best beaches in the world.

A one-bedroom, one-bathroom loft apartment can cost as little at $100,000, according to International Living. And a couple can live comfortably for about around $2,000 to $3,000 a month.

Isla Colón, Panama

Though Isla Colón is known for tourism, it also has a laidback feel for locals, the report says.

Rent for a one-or-two bedroom home could range from as little as $600 to $1,200 a month.

HI Financial Services Mid-Week 04-29-2014