HI Financial Services Mid-Week 03-10-2015

What’s happening this week and why?

Big down day due to strong dollar, lower oil prices and fed interest rates hike.

Strong dollar – Is it really bad? (check the CNBC online news podcasts)

BAD – On selling items overseas, EM have to pay back at a higher exchange rate and with a lesser valued currency, ie…..Brazil

GOOD – Money worth more to buy imports cheaper, Commodities are cheaper or the price to build anything is less,

If you go to CNBC for the “Lunch” there are cases for both a strong and weak dollar for a Bullish and/or bearish market.

Corporations can borrow money cheaper overseas and low interest in the US comparatively speaking

Lower oil prices – GOOD for everyone except the poor balance sheet oil companies – More money to consumers for higher GDP, Cheaper for transportation, cheaper to run business (in general), Bigger oil companies buy lands, other companies at a cheaper price,

It is a good thing because it is a supply issue not a demand issue

Fed interest rates – NOT raising this time or in June most likely – September is you hold the Fed to its comments

Bad or Good? Good thing because – Should mean better economy that can handle, financial sector, is making more money

BAD – Last 16 rate hike cycles according to CNBC 13 pullbacks, 4 turned out to be corrections, 3 turned out to be bear market

ALL Markets around the world were down today starting with China

WE (United States) are no longer a global fed or an Isolated Economy

THIS IS the unwinding of the fed stimulus – Over supply will equal and over correction

IS the back half of the year the time to gain all or most of the profits in 2015

Today in my opinion was a Euro/Dollar Forex Culprit or cause of today’s losses

Stimulated Economies give to stimulated Valuations (over-priced or fair Valued) = Volatility

Where will our market end this week?

Probably down following the trend

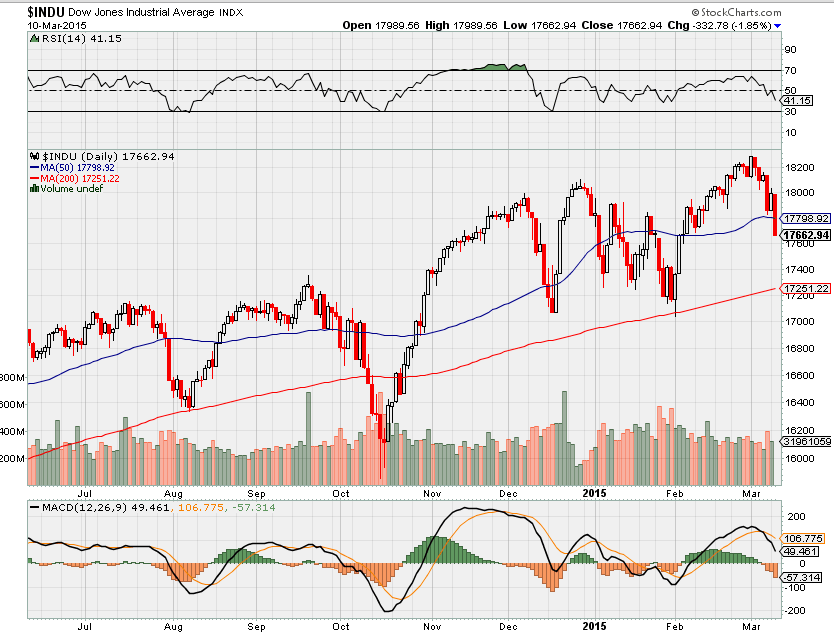

DJIA – Bearish with 3.3% or close to a 4% pullback

SPX – Bearish with a 3.5% pullback

COMP – Almost have the three crossovers

Where Will the SPX end March 2015?

03-10-2015 March will finish flat with a 3.5% move down and back up

03-03-2015 March will finish flat with a 3.5% move down and back up

02-25-2015 March will finish flat with a 3.5% move down and back up

What is on tap for the rest of the week?=

Earnings:

Tues: BKS, WB

Wed: KKD, MW, SHAK

Thur: ARO, DG, LOCO, GCO, JMBA, MTN

Fri: BKE,

Econ Reports:

Tues: Jolts – Job Openings, Wholesale Inventory

Wed: MBA, Crude, Treasury Budget

Thur: Initial Claims, Retail Sales, Retail ex-auto, Import, Export, Business Inventories

Fri: PPI, Core PPI, Michigan Sentiment

Int’l:

Tues – JP: Machine Orders, PPI

Wed – CN: Industrial Production, Retail Sales, JP: Tertiary Index

Thurs – EMU: Industrial Production

Friday –

Sunday –

How I am looking to trade? Let me Show you what I changed and why?

Most of my stocks are thru earnings:

I have some stock only positions – DIS, NVDA, F, SBUX, D,

I have Protective puts on LNCO, ZION, AAPL

Still IN collars for – BIDU, FB,

Covered Calls on – VZ, WBA, SNDK, P

Bull Puts – DIS, NVDA

Bear Puts – LNCO

Naked Puts –V ( 8 naked at 272.50 Mar 15

BABA I have 80 % of the share covered (400) with long puts and all shares covered with a bear put spread 80/70

AAPL Bear put calendar with long puts

1st I am creating my earnings list so I don’t miss an earnings for a company I trade

WBA – 03/24

PCLN – 02/19

NKE – 3/19

RHT – 3/26

MU- 4/2

Questions???

Collar trade BUT I use earnings as the catalyst – Being in cash is probably a good thing right now !!

Buying opportunity knowing past performance NEVER guarantees future performance

Jan 2014 6.5%, April 4%, July/Aug 4%, October 7%, Dec 5%

ANYTHING you make on the way down is a profit in collar trading as the stocks come back

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 04-29-2014