HI Financial Services Mid-Week 02-17-2015

“I worried with the results people have gotten on a flat year in the stock market. Why are people playing a catastrophic crash, bear or bullish when the trend is opposite and why are so many overleveraged in at the beginning of the year?” – Kevin Hurley

Phycology of trading part II

What is a successful trade? =one makes money, one that breaks even, one that loses a very little bit

What is an unsuccessful trade? = max loss, hold on too long (directional trade) and book a large loss, unplanned traded with – no primary or secondary exits, NO IDEA what break evens, technical levels or information to set exits = Almost always an unsuccessful trade is OVER-Leveraging the account

How did you know trading was or was not for you?

Was’s = Makes money, FUN, Made it work, Understood the process – Don’t win every time but the winners Far outweigh the losers, you are trading with money that you can afford to lose,

Was Not’s = Too emotional and unable to reign in the emotions, at the cost of your marriage, home, lifestyle, etc…, If you can’t follow a process ( each process is different for each individual risk tolerance), trading on luck,

The trading process takes time to learn what YOU are best at and what best works for you.

What’s happening this week and why?

Holiday on Monday

Empire Manu 7.0 vs est 9.0

NAHB 55 vs est 58

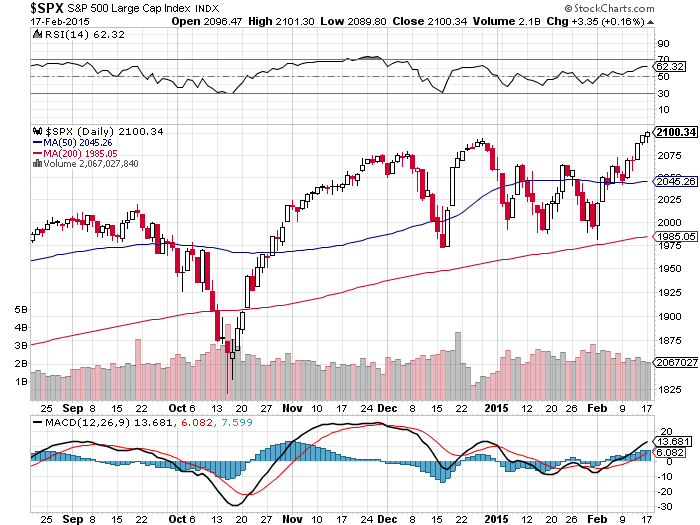

Record Intra-day highs on S&P – Above 2100

Still have headline risk – Oil, Greece, Interest rates, Stimulus

Where will our market end this week?

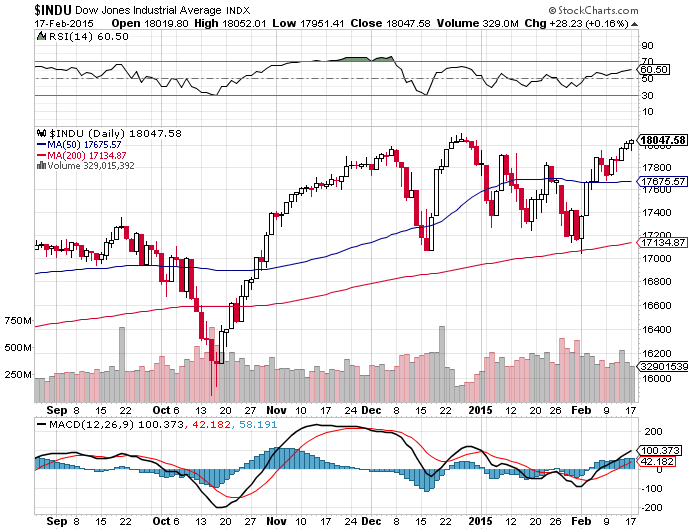

DJIA – Bullish

SPX – Bullish with All-time highs

COMP – Very Bullish almost to overbought territory

Where Will the SPX end January 2015?

02-17-2015 Feb will finish at new market highs

02-10-2015 Feb will finish at new market highs

02-03-2015 Feb will finish at new market highs

01-27-2015 Feb my guestimate is 2050 or slightly positive

What is on tap for the rest of the week?=

Earnings:

Tues: A, CF, DVN, JACK, RAX, S, VMI, WM

Wed: DENN, DUK, FLR, SCTY, VA, YNDX

Thur: LINE, LNCO, LNG, HRL, NBL, NDLS, JWN, TMUS, TRSO, WMT

Fri: DE

Econ Reports:

Tues: Empire Manu, NAHB Housing index, TIC flows,

Wed: MBA, Crude, Housing Starts, Building Permits, PPI, Core PPI, Industrial Production, Capacity Utilization, FOMC Minutes

Thur: Initial Claims, Continuing Claims,

Fri: OPTIONS EXPIRATION

Int’l:

Tues –

Wed – GB: BOE minutes, JP: Merchandise Trade, All Industry Index,

Thurs – EMU:DE:FR: PMI Composite, EMU: EC Consumer Confidence Flash

Friday – GB: Retail Sales

Sunday –

How I am looking to trade?

Still Have BIDU, NVDA, with Wednesday earnings. Most of my stocks are thru earnings:

I have some stock only positions – DIS, AAPL, F, MS, SBUX, D,

I have Protective puts on AAPL, LNCO, ZION, NVDA (w/ short puts against longs)

Still IN collars for – BABA, BIDU, FB, SNDK, MU

Covered Calls on – VZ, WBA, BAC, C,

Extra set of Puts with a 2 to 1 ratio of puts to stock ownership on – BABA

1st I am creating my earnings list so I don’t miss an earnings for a company I trade

CLDX – 03/02 BMO

LNCO – 02/19 BMO

NVDA – 02/11 AMC

WBA – 03/24

PCLN – 02/19

NKE – 3/19

RHT – 3/26

MU- 4/2

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 04-29-2014