HI Market View Commentary 12-07-2020

| Market Recap |

| WEEK OF NOV. 30 THROUGH DEC. 4, 2020 |

| The S&P 500 index rose 1.7% last week, setting fresh record highs amid optimism for COVID-19 vaccines to help contain the spreading pandemic. The market benchmark ended the week at 3,699.12, up from last Friday’s closing level of 3,638.35 and marking a new record closing high. The index also reached a new intraday high Friday at 3,699.20. The energy sector posted the largest weekly percentage gain, up 10.5%, followed by advances of 2.6% in health care, 2.1% technology, and a 2.4% rise in communication services. Only one sector fell on the week: Utilities shed 0.7%. The gains came even as COVID-19 case counts, hospitalizations and deaths continued to reach new heights in the US. The global death toll from COVID-19 is now above 1.5 million. However, investors are hopeful the pandemic will be brought under control with the release of COVID-19 vaccines. The UK granted emergency-use authorization Wednesday for Pfizer (PFE) and German partner BioNTech’s (BNTX) vaccine, and the market is anxiously anticipating a similar approval soon by the US Food & Drug Administration. Friday, the Labor Department reported weaker-than-expected job growth for November. Non-farm payrolls rose by 245,000 last month, the Bureau of Labor Statistics said, well under the Econoday consensus estimate of 500,000. Still, the unemployment rate slipped 0.2 percentage point from October to 6.7%, better than the Street’s view for 6.8%, and investors are hopeful the slow jobs growth may become good impetus for more stimulus efforts. The energy sector’s climb came as crude oil futures rose. Among the gainers, Chevron (CVX) shares added 2.2% this week while Exxon Mobil (XOM) rose 3.7%. In health care, Pfizer shares gained 8.4% amid the news that the UK regulator has granted it and BioNTech’s (BNTX) COVID-19 vaccine candidate a temporary authorization for emergency use in the country, the first such approval in the world. It was followed by a Friday approval in Bahrain for an emergency use authorization there of the COVID-19 vaccine candidate. In the technology sector, shares of Micron Technology (MU) jumped 14% as the computer memory and data storage company boosted its revenue, gross margin and earnings per share guidance for its fiscal Q1 ended Dec. 3. Shares of other chip makers were also strong, with Intel (INTC) climbing 9.6%. On the downside, in utilities, shares of PPL (PPL) fell 1.7% as BofA Securities downgraded its investment rating on the stock to neutral from buy. Next week, the economic data calendar includes the release of October consumer credit figures Monday, Q3 productivity and unit labor costs Tuesday, and October wholesale inventories Wednesday. November consumer prices are due Thursday, followed by November producer prices Friday. The first reading on December consumer sentiment is also on the docket for Friday. Provided by MT Newswires. |

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end December 2020?

12-07-2020 +2.5%

11-30-2020 +2.5%

Earnings:

Mon: TOL

Tues: AZO, GME

Wed: ADBE

Thur: AVGO, COST, PLAY, LULU, ORCL, MTN

Fri:

Econ Reports:

Mon: Consumer Credit

Tues: Productivity, Unit Labor Costs

Wed: MBA, Wholesale Inventory

Thur: Initial Claims, Continuing Claims, CPI, Core CPI

Fri: PPI, Core PPI, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

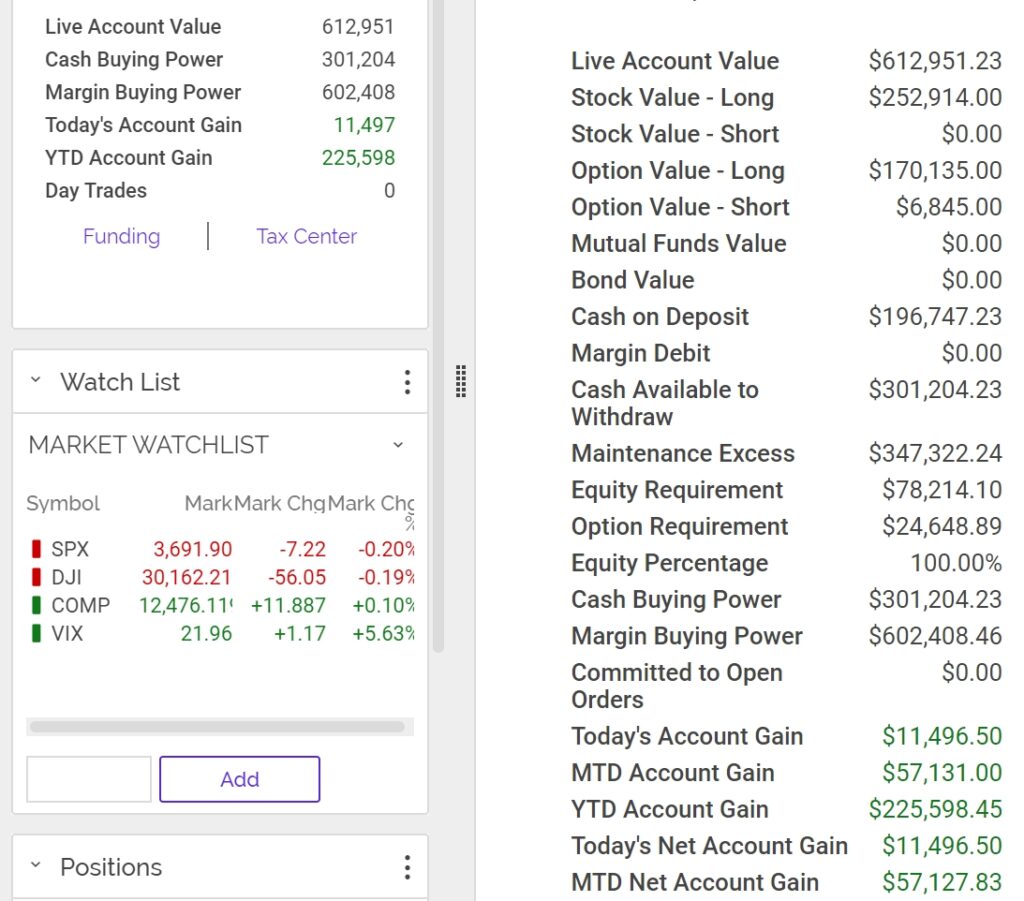

How am I looking to trade?

The big decision how far to let stocks run into a Christmas Rally ?!?!?!?!?

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Your movie theater experience is going extinct

KEY POINTS

- AT&T’s WarnerMedia announced Thursday that its entire slate of 2021 theatrical releases will debut free for U.S. subscribers of HBO Max at the same time they hit theaters.

- It’s the boldest move from a major movie studio grappling with theater shutdowns due to the Covid-19 pandemic.

- Other studios have done various experiments with movie releases this year, but the signs are clear that theaters’ exclusive windows for movies are going extinct.

The theatrical window isn’t broken, but it is full of cracks.

Like so many other digital trends that have been accelerated by Covid-19, the way we watch theatrical releases saw big changes throughout 2020. The most significant shake-up: On Thursday, AT&T’s WarnerMedia announced that all 2021 theatrical releases from Warner Bros. will debut simultaneously on HBO Max for U.S. subscribers at no extra cost.

That means if you’re already an HBO Max subscriber, you’ll get to watch blockbusters like “Dune,” “The Matrix 4″ and “The Suicide Squad” from your living room couch instead of risking a trip to the theater next year. (WarnerMedia previously announced that “Wonder Woman 1984” will debut on HBO Max on Christmas Day.)

Everyone saw this coming. With the rise of streaming video, interest in going to a theater and spending all that time and money to watch a two-hour movie plummeted except for the biggest blockbusters. The smartest thinkers in media saw a not-to-distant future where lining up outside a theater for a movie release would become a niche event only for the most dedicated cinephiles. And then Covid hit, theaters were forced to close and studios had to dream up innovative ways to get eyeballs on their slate of 2020 releases.

There’s been a lot of experimentation throughout the year from various studios. Early on in the pandemic, Disney released its Pixar animated movie “Onward” directly on its Disney+ streaming service, for example. And several movies, like Universal’s “Trolls: World Tour” and “King of Staten Island” were released straight to on-demand platforms.

But as it became clear that theaters would remain closed for months or reopen with strict capacity restrictions, studios were forced to get even more creative as 2020′s blockbuster movies saw delay after delay.

To recap:

- After several delays, Disney released its $200 million film “Mulan” on Disney+ for a one-time, $30 fee. Disney hasn’t reported revenue for “Mulan” yet, but executives promised more details on its theatrical release strategy at the company’s investor day set for Thursday. It’ll be interesting to see how Disney’s 2021 plans compare to WarnerMedia’s bold move this week.

- NBCUniversal negotiated a smaller theatrical window with major theater chains like AMC and Cineplex, so movies can go straight to on-demand platforms in a month or less, down from the standard 90-day window.

Keep in mind that the studios are careful to say these moves are all temporary, and that they would like to keep their relationships with theaters once the pandemic is over and it’s safe to go out to the movies again.

“Everyone should take a breather,” WarnerMedia CEO Jason Kilar told CNBC’s Alex Sherman in an interview Thursday. “Let’s let the next six, eight, ten months play out. And then let’s check back in.”

But Kilar also left room to maintain the disruptive model he announced on Thursday.

“Certainly this is pandemic-related,” Kilar said. “That’s why we’re doing it. We haven’t spent one brain cell on what the world looks like in 2022.” He also declined to predict where things will stand a year from now.

And the market sees the reality of the situation. AMC shares tanked 16% on Thursday following WarnerMedia’s announcement, a sign that investors think the straight-to-home releases of movies is a trend other studios will jump on and consumers will prefer.

“Clearly, WarnerMedia intends to sacrifice a considerable portion of the profitability of its movie studio division, and that of its production partners and filmmakers, to subsidize its HBO Max start-up,” AMC CEO Adam Aron said in a statement Thursday. “As for AMC, we will do all in our power to ensure that Warner does not do so at our expense. We will aggressively pursue economic terms that preserve our business.”

On the other hand, there’s a risk for the studios. Is it worth spending $100 million or more on a blockbuster that’ll be released directly to customers in their homes at no extra cost if they’re subscribers of any given streaming service? Even if we’re trending toward a majority-streaming future for movies, theaters are where studios make a lot of their money, especially in international markets. The economics just don’t work out.

“Pushing your best content into a subscription window caps the upside on the truly mega hits that drive all of the profit,” Moffett Nathanson analysts wrote in a note Friday reacting to the WarnerMedia announcement. “And the move into HBO Max undoubtedly will have downstream impacts on home video and rental revenue streams, as well.”

“Assuming these factors lead to lost revenue of $1.2 billion, HBO Max’s annual average subscriber base would need to be 8.4 million higher than status quo to restore current revenue levels,” the analysts said.

In other words, WarnerMedia will have to hope millions more sign up for HBO Max next year if it wants to make up the expensive production costs of its upcoming movies. And if WarnerMedia continues down its path, it’ll have to take on more debt to produce movies for HBO Max, with the hopes AT&T’s investors will believe its building the next Netflix. That’d be a hard sell to the execs at AT&T considering the company is already saddled with loads of debt from its Time Warner acquisition.

In the meantime, we’ll continue to see a lot of experimentation from studios as the pandemic rages on. It might be a hybrid model, where you pay a one-time fee to watch a movie through a given streaming service. (The Disney “Mulan” model.) Or go straight to on-demand services after a shorter-than-normal theatrical window. (The NBCUniversal model.) Or just give the movies away for free, hoping it convinces more people to subscribe to a streaming service. (The WarnerMedia model.)

But the signs are clear that we’re in the early innings of theatrical windows going away for good.

“We have a hard time believing the messaging that this is only a temporary 2021 plan, however, even if that might be the current plan today,” the Moffett Nathanson analysts wrote. “Once the windows change, it will be hard to go back.”

Discolsure: NBCUniversal is the parent company of CNBC.

Buffett indicator: Why Investors are Walking into a Trap Why Investors Are LANCE ROBERTS, CHIEF INVESTMENT STRATEGIST, RIA ADVISORS

Lance Roberts, Chief Investment Strategist, RIA Advisors

After having been in the investing world for more than 25 years from private banking and investment management to private and venture capital; Lance has pretty much “been there and done that” at one point or another. His common-sense approach, clear explanations and “real world” experience has appealed to audiences for over a decade. Lance is also the Chief Editor of the Real Investment Report, a weekly subscriber-based newsletter that is distributed nationwide. The newsletter covers economic, political and market topics as they relate to your money and life. He also writes the Real Investment Daily blog, which is read by thousands nationwide from individuals to professionals, and his opinions are frequently sought after by major media sources. Lance’s investment strategies and knowledge have been featured on CNBC, Fox Business News, Business News Network and Fox News. He has been quoted by a litany of publications from the Wall Street Journal, Reuters, Bloomberg, The New York Times, The Washington Post all the way to TheStreet.com. His writings and research have also been featured on several of the nation’s biggest financial blog sites such as the Pragmatic Capitalist, Credit Write-downs, The Daily Beast, Zero Hedge and Seeking Alpha.

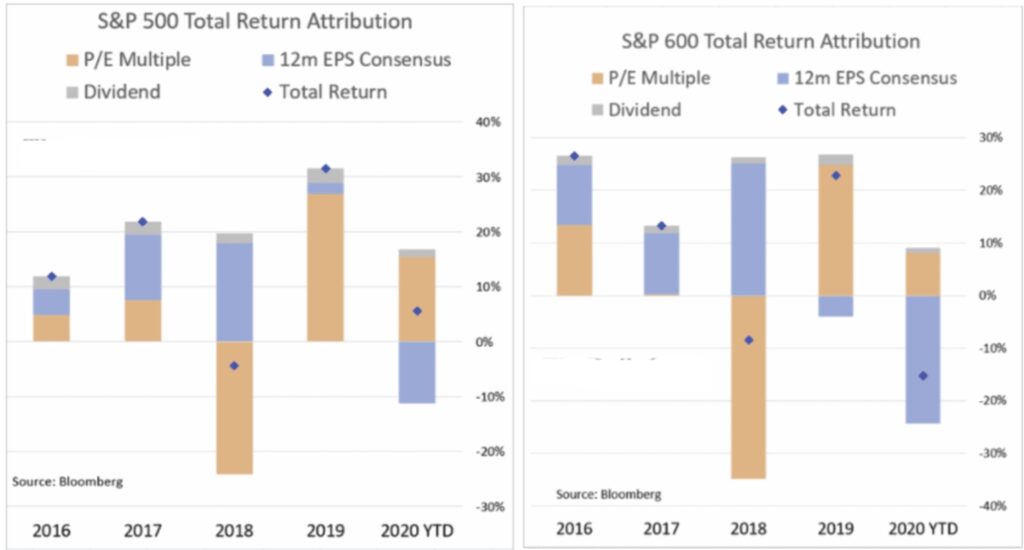

“The stock market is not the economy.” Such has been the “Siren’s Song” of investors over the last couple of years as valuation expansion has been the sole driver of the market’s performance. However, given that corporations derive their revenue from economic activity, the “Buffett Indicator” suggests investors may be walking into a trap.

Read Part 1 For More on This Chart

Billionaire investor Paul Tudor Jones forecasts the economy will see an ‘absolute supersonic boom’ in 2021

Dec. 3, 2020, 09:54 PM

- Billionaire investor Paul Tudor Jones told Yahoo Finance the economy will see an explosion of growth next year as the coronavirus vaccine unleashes pent-up demand from consumers and investors.

- “I have four kids in their 20s. And, it’s like a horse at the beginning of a race,” said Jones. “They’re just ready to get out and go crazy, like I think everyone else in the world.”

- The investor added that the stock market is on a “combination of fiscal monetary pulse that we’ve never seen before in history,” resulting in sky-high multiples.

- Visit Business Insider’s homepage for more stories.

Billionaire investor Paul Tudor Jones told Yahoo finance there will be an “absolute, supersonic boom” in the economy in the second and third quarters of 2021 as the coronavirus vaccine unleashes pent-up demand across the US.

“The vaccine is going to bring us back. We’re going to have an incredible growth rebound,” Jones said.

“I have four kids in their 20s. And, it’s like a horse at the beginning of a race,” he added. “They’re so ready to get to see their friends, to get to restaurants, to vacation. They’re just ready to get out and go crazy, like I think everyone else in the world,” he added.

The founder of Tudor Investment Corporation cited the beaten-down retail industry as one area that will experience a “second-quarter explosion” as more people are inoculated and resume their pre-COVID lifestyles.

Jones also said that fiscal and monetary policies are pushing stock valuations to levels higher than the dotcom era. And with interest rates at historic lows, investors have no choice but to put their cash into stocks to generate returns, he said.

“I think the stock market’s on a combination of fiscal monetary pulse that we’ve never seen before in history, nothing like this,” the investor said.

As the economy booms with pent-up demand from consumers and investors, he sees commodities rallying, inflation ticking higher, and bonds pointing lower.

Jones is watching the outcome of the Georgia runoff races that will determine which political party holds the Senate. He said the results are a “50/50 toss up,” but the post-vaccine economy will rally regardless of which party controls the Senate.

Black Friday weekend card payments rose 15% Y/Y – JPMorgan

Dec. 04, 2020 12:26 PM ETJPMorgan Chase & Co. (JPM)By: Liz Kiesche, SA News Editor9 Comments

- JPMorgan Chase (JPM +0.8%) processed 15% more card payments during Black Friday weekend than it did a year ago, driven by a 27% jump in online and mobile payments on Cyber Monday.

- In-store card payments declined by 12% over the weekend, another sign of shoppers avoiding brick-and-mortar stores over COVID-19 concerns.

- Meanwhile, Visa (NYSE:V) said credit card use declined 5% during the month of November even as card-not-present transactions, excluding travel, increased 27% Y/Y; card present fell 7%.

- The pandemic continues to accelerate some trends that already were in play, in this case consumers embracing online and mobile shopping.

- Many retailers kicked off their holiday promotions early this year, often in October, in an effort to reduce the chances of in-store sales becoming super-spreader events.

- JPMorgan’s merchant-services group handled ~$1.5T in payments last year.

HHS Chief Sees Vaccine for All Americans by Second Quarter

By Susan Decker

December 6, 2020, 8:31 AM MST

Azar comments ahead of FDA decision expected this week

Warp Speed head expects Pfizer-BioNTech vaccine green light

Sign up here for our daily coronavirus newsletter on what you need to know, and subscribe to our Covid-19 podcast for the latest news and analysis.

All Americans who want to get a Covid-19 vaccine should be able to do so by the second quarter of next year, Health and Human Services Alex Azar said.

With the U.S. Food and Drug Administration due to decide as early as Thursday on emergency authorization for a shot developed by Pfizer Inc. and BioNTech SE, Azar and Moncef Slaoui, the head of the government’s program to accelerate a vaccine, expressed confidence that the FDA would clear the way.

“I’ve not heard of any red flags,but I’ll have to leave that to the career scientists at the FDA who were digging through all the data,” Azar said on “Fox News Sunday.”

“Based on the data that I know, I expect the FDA to make a positive decision,” Slaoui, who heads the Trump administration’s Operation Warp Speed program, said on CBS’s “Face the Nation.”

Plans to roll out vaccines against the coronavirus linked to more than 280,000 deaths in the U.S. are gaining urgency as cases reach new highs nationwide, straining hospital care and the economy particularly in urban hot spots.

Holiday Parties

Asked about news reports that the White House and State Department are planing large year-end holiday parties, Azar says the same health recommendations apply to them as in any other setting.

“Our advice remains the same in any context, which is wash your hands, watch your distance, wear face coverings when you can’t watch your distance and be careful of those indoor settings,” he said. “The best thing is distance and so certainly limiting the number of people at gatherings also can be important.”

Slaoui said his group plans to have its first meeting with President-elect Joe Biden’s transition team this week.“And I feel confident that once we will explain it, everything in detail, I hope the new transition teams will understand that things are well planned,” said Slaoui, a former head of GlaxoSmithKline Plc’s vaccines division.

While the most at-risk people in line for early vaccination may see an impact in January and February, “for our lives to start getting back to normal, we’re talking about April or May,” Slaoui said.

He defended the proposed immunization schedule for the first 40 million doses of Pfizer-BioNTech vaccine, which requires two shots three or four weeks apart. If all of the doses were used up to give 40 million people an initial shot, that would create the risk of shortfalls for the required second shot, Slaoui said.

— With assistance by Yueqi Yang

New Ford Bronco Sport may have broad appeal with its off-road chops and on-road comfort

KEY POINTS

- The new Ford Bronco Sport is arriving in dealerships nationwide ahead of the larger, more capable Bronco next summer.

- While the resurrected Ford Bronco has received much of the attention, the Bronco Sport, or “Baby Bronco,” is expected to outsell its larger sibling, according to IHS Markit.

- Both vehicles are part of a highly anticipated “Bronco family” of vehicles for Ford, including the possibility of a pickup truck in the coming years.

HOLLY, Mich. – Jovina Young smiles as she reminisces about driving across 1,250 miles of Nevada and California desert this fall in a new Ford Bronco Sport SUV for an off-road vehicle rally.

Young, who worked in the beer industry before becoming marketing manager last year of the Bronco Sport, had never participated in off-roading before but wanted to experience the capabilities of the new SUV for herself.

The journey took eight days, a lot of camping gear and GPS units were not allowed. It was something she never imagined being a part of until she began working at Ford Motor.

“I wanted to make sure I was being authentic in the message I was talking about with Bronco Sport,” the 42-year-old mother of two told CNBC about the Rebelle Rally – an all-female vehicle event.

While an off-road novice may not seem like the ideal candidate for such a vehicle, it’s people like Young who are expected to be key to the success of the new Bronco Sport, which is arriving in Ford dealerships nationwide. While off-road vehicles are becoming increasingly more popular, it’s outdoorsy, mainstream buyers who are largely driving sales of such vehicles.

“It’s really about choice. Right now outdoor activities and off-road-oriented vehicles are striking a nerve with a number of consumers whether they take them off-road or not,” said Stephanie Brinley, principal automotive analyst at IHS Markit.

The 2021 Bronco Sport is a balance of off-road capability and on-road comfort more than its larger, more expensive Bronco sibling, which is scheduled to go on sale in the summer. The Bronco Sport features the styling of the Bronco but is built more like a car or crossover than a truck, allowing for a smoother ride.

“We wanted to make sure we had a balance,” Eddie Khan, engineering manager of the Bronco Sport, said during a media event for the vehicle at an off-road event in suburban Detroit. “We were not tuning this vehicle with the on-road or off-road in mind. We were tuning it with both in mind.”

The Bronco and Bronco Sport are part of a new highly anticipated “Bronco family” of vehicles for Ford, including the possibility of a pickup truck in the coming years.

Outsell Bronco?

While the Bronco SUV has received much of the attention, the Bronco Sport is expected to outsell its larger sibling thanks to it being more approachable, yet capable, as well as its comfort and lower price.

“We expect Bronco Sport is going to be higher volume than Bronco,” Brinley said. “It’s more affordable and it meets the needs of more people. The capability of the Bronco Sport is more in line with what people need on a given day.”

Ford executives have said the company can produce more than 200,000 vehicles a year at the assembly plant in Michigan where the Bronco will be built alongside the Ford Ranger. The company has declined to discuss projected sales or capacity for the Bronco Sport, which is being produced in Hermosillo, Sonora, Mexico.

The Bronco Sport features the styling of the larger Bronco SUV, standard 4×4 capability and a range of models – from a standard model for under $27,000 to a top-tier “Badlands” model, which Young drove in the rally, starting at about $33,000. That pricing compares with the Bronco’s range of $28,500 to $50,000. Pricing for both vehicles exclude a limited first-edition model.

“Especially getting started in off-roading, it’s a great entry point for anyone who looks to do that,” Young said, adding the Bronco Sport has off-road technologies to assist novice drivers and the overall capability to satisfy more experienced off-roaders.

Gateway vehicle

The Bronco Sport, or “Baby Bronco,” marks the first time Ford has used the Bronco name since the original vehicle was discontinued after 31 years in 1996. It’s also the first Bronco model to exclusively come in four doors (the 2021 Bronco is available in two- and four-door models).

Having a more obtainable, entry-level model is similar to Fiat Chrysler’s Jeep brand, which is the leader in off-road vehicle sales and Ford’s main rival for the Bronco lineup.

“We do see Bronco Sport as almost like an entry point into the Bronco family,” Young said.

The Bronco Sport is Ford’s first direct rival to Jeep since the original Bronco. The company’s closest competitor since then has been a full-size, off-road version of the F-150 pickup called the Raptor, but Jeep does not offer such a vehicle.

Ford is currently the top cross-shopped brand to Jeep, according to Lisa Drake, Ford’s chief operating officer for North America.

“It’s a huge addressable market for us,” she said last week during a Credit Suisse conference. “And as the number one cross-shopped brand for Jeep, we think we’re in a strong position to aggressively pick up some share. So, very excited about this.”