HI Market View Commentary 12-06-2021

So my belief is inflation looks like it is here to stay for the next two cycles of earnings

Bottlenecked supply chain and mismanagement of the fed rates

What does well in the stock market with rising inflation?= Precious Metals, Financials, those stocks that can hold pricing power

AAPL, DIS, MU, Chips Manufactures, Pharma, Banks/Financials

Financials = MA, V, AXP, DFS, PYPL SQ should but they bombed their earnings

Does COST, UAA or F have pricing power

IS the Christmas Rally over? Dead

What about the Santa Cause Rally Dec 26-Jan3rd Probably not due to tax selling reasons

You could see a 5-7% drop in December to take profits now for tax reasons

Some things have protection and some things do not

I feel like our stocks this year were more of the dogs of the down, with my research and the for the upcioming environment into 2022 I feel like I like the current positions and stocks we are in today

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 03-Dec-21 15:43 ET

The end of the party is just getting started

The Q&A portion of Fed Chair Powell’s testimony on the Coronavirus and CARES Act before the Senate Banking Committee this week was chock full of market-moving insight. That was the case because it produced its fair share of surprises.

The comments that caught everyone’s attention — and which rattled the market — were his acknowledgment that it is time to retire the word “transitory” when talking about inflation and that he thinks it is time to talk about wrapping up the taper perhaps a few months sooner.

Admittedly, we didn’t expect to hear him say that this week, but regular readers know that we think he should have said that months ago.

Inflation on the Fed Chair’s Mind

Below are some of the observations from the Fed chair during his testimony:

–The risk of persistent inflation has risen.

–The factors pushing inflation upward will linger well into next year.

–Greater concerns about the virus could reduce people’s willingness to work in person, which would slow progress in the labor market and intensify supply-chain disruptions.

–High inflation is a risk to returning to full employment.

–Higher prices have spread more broadly.

–The inflation test we have articulated has clearly been met now.

–It is a good time to retire the word “transitory” for inflation.

–It is appropriate in my view to discuss at the next meeting about wrapping up the taper perhaps a few months sooner.

See any commonalities in the Fed chair’s inflation comments? We suspect you do, as it was clear in the fullness of his remarks on inflation that the Fed chair wanted to affect a shift in the market’s thinking about the Fed’s monetary policy path.

Missing the Mark

When news of the Omicron variant broke the Friday after Thanksgiving, and global equity markets were getting clobbered, there was a quick-footed assumption that it would compel the Fed to take a more cautious-minded approach with its tapering plan, and, by default, with its rate-hike timing.

What Fed Chair Powell did with his remarks, however, was put the market on notice that keeping inflation pressures in check is the new top priority. From our vantage point, satisfying the price stability side of the Fed’s dual mandate is now going to supplant achieving maximum employment as the main policy driver.

The Omicron variant is not a risk that has been embedded in the Fed’s current forecasts, but even so, Fed Chair Powell made it sound as if the bigger risk related to Omicron is more on the inflation side than on the labor market side of things. Hence, he made it a point to highlight in his prepared remarks that a reduced willingness to work in person could intensify supply-chain disruptions, from which we can infer that there is an expectation that it would contribute to inflation pressures lasting longer.

Effectively, then, the market had to re-think its Black Friday (or Red Friday) assumptions. The Fed, likely, will be adopting a plan to speed up the pace of its tapering plan, such that it is completed now by March or April, as opposed to June.

The Fed will do so to give it more optionality with the timing of its first rate hike off the zero bound, but it will do so because the Fed finally recognizes, with the inflation rate at a 30-year high of 6.2%, the unemployment rate at 4.2%, and the Atlanta Fed’s GDPNow model estimating 9.7% growth in Q4 real GDP, that it is ludicrous to still be buying Treasury and agency mortgage-backed securities and holding the target range for the fed funds rate at the zero bound.

We hope, at least, that is what the Fed is recognizing.

From our vantage point, the implication of the Fed chair’s remarks before the Senate Banking Committee is that the Fed knows it missed the mark with its transitory inflation view, that it needs to speed things up with its tapering plan, and that the shift is on from a dovish policy stance to a less dovish policy stance.

What It All Means

The candid observations from the Fed chair about inflation have changed the narrative by forcing a re-think of the dovish-minded view the market thought the Omicron variant might trigger at the Fed.

It is also forcing a re-think of lofty equity valuations, which has translated into some sizable losses for many high-multiple growth stocks. It is something we thought would happen with an abrupt shift in policy support.

The ironic thing is that the Fed hasn’t even done anything yet to follow through on Fed Chair Powell’s remarks. The sensitivity to Fed Chair Powell’s pivot, however, underscores just how inflated some stocks had gotten on the expectation that the Fed wasn’t anywhere close to raising the fed funds rate.

Now, with the Fed chair suggesting he thinks the tapering pace should happen faster, there is a residual expectation that rate hikes will follow relatively soon after the tapering is complete.

When the first rate hike does happen, the policy rate will still be extraordinarily low. Nonetheless, the abrupt pivot by Fed Chair Powell is tantamount to issuing the first signal that the “party like it’s 1999 vibe” is coming to an end.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| Market Recap |

| WEEK OF NOV. 29 THROUGH DEC. 3, 2021 |

| The S&P 500 index fell 1.2% last week, with communication services leading a broad drop, amid worries about the COVID-19 omicron variant and data showing a slowdown in US hiring last month. The market benchmark ended the week at 4,538.43, down from last Friday’s closing level of 4,594.62. This comes after the index had already fallen 2.2% last week; it is now down 3.4% from its closing level two weeks ago. However, the S&P 500’s performance is still strong on a year-to-date basis, up nearly 21% for 2021 with just four weeks remaining in the year. The week’s declines heading into Friday’s session came as new cases of the omicron variant were reported in a number of countries including the US. Some countries resumed restrictions, prompting more worries about the potential economic impact of the variant, which has many mutations and was designated last week by the World Health Organization as a variant of concern. It isn’t yet known how well existing vaccines are able to neutralize the variant. Friday, stocks fell further — with the S&P 500 logging a 0.8% drop for the day — as the US Labor Department reported November nonfarm payrolls rose by 210,000, well below the 550,000 jobs increase that was expected in a survey compiled by Bloomberg. October payrolls had a small upward revision to a 546,000 increase. Still, the data also showed the unemployment rate fell to 4.2% in November from 4.6% in October, compared with the 4.5% rate expected, while the labor force participation rate rose to 61.8% from 61.6% in the previous two months and the size of the labor force increased. All but two sectors were in the red for the week. Communication services had the largest drop, down 2.8%, followed by a 2.4% slide in consumer discretionary and a 2% decline in financials. The two sectors that managed to gain were utilities, up 1%, and real estate, up 0.1%. The decliners in communication services included ViacomCBS (VIAC), which said it would sell its CBS Studio Center in Los Angeles for about $1.85 billion as part of an initiative to redeploy resources toward higher-growth businesses such as streaming. The media conglomerate said the property is being sold to a partnership formed by Hackman Capital Partners and Square Mile Capital Management. Shares of ViacomCBS fell 4.7% on the week. Also in communication services, shares of Twitter (TWTR) fell 11% last week. The microblogging company disclosed Monday that Jack Dorsey, its co-founder and chief executive, was stepping down from the helm immediately. Chief Technology Officer Parag Agrawal was named to succeed Dorsey as CEO. The consumer discretionary sector was weighed down by travel-related stocks due to fresh travel restrictions being enacted by many countries amid the omicron variant. These included cruise operators Norwegian Cruise Line Holdings (NCLH), down 8.8%, and Carnival (CCL), down 4.2%, as well as resort operators Las Vegas Sands (LVS), down 9.5%, and Wynn Resorts (WYNN), down 6.5%. On the upside, the gainers lifting the utilities sector included NextEra Energy (NEE), whose shares rose 2.3% as the company said it will offload a 50% stake in a portfolio of renewable-energy assets as part of the clean energy company’s efforts to redeploy capital into new growth opportunities. Next week, inflation readings will be in focus as data are expected Friday on the November consumer price index and core inflation. The first reading of December consumer sentiment will also be released next Friday. Other data leading up to that will include the October trade deficit and consumer credit on Tuesday and weekly jobless claims as well as Q3 real household wealth on Thursday. Provided by MT Newswires |

Where will our markets end this week?

Higher

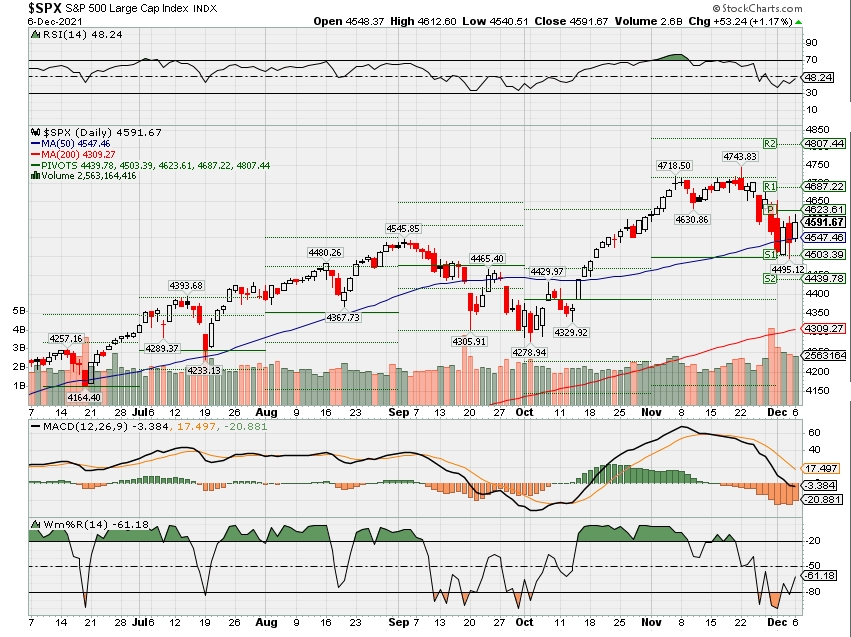

DJIA – Bearish

SPX – Bearish but the 50 SMA is holding

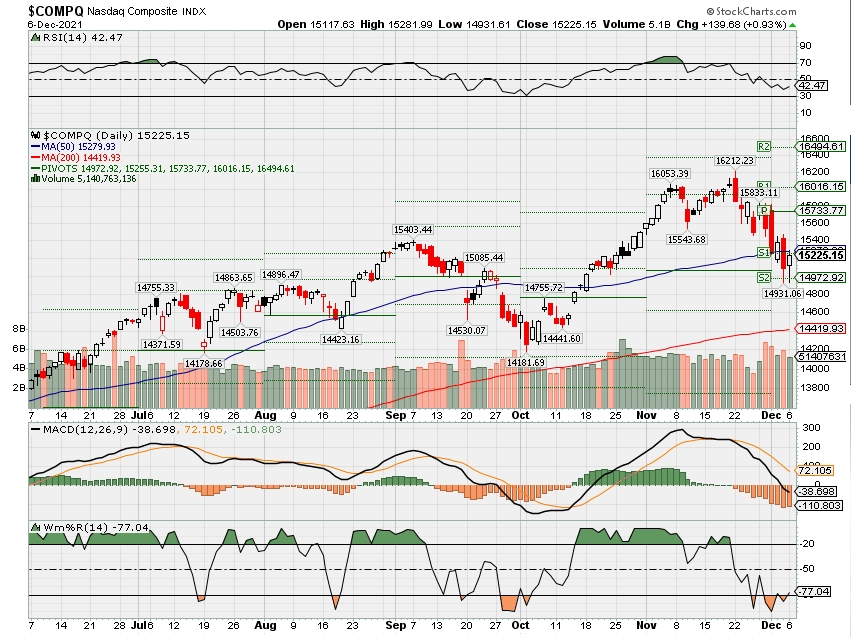

COMP – Bearish

Where Will the SPX end December 2021?

12-06-2021 -3.0%

11-29-2021 +1.0%

Earnings:

Mon:

Tues: AZO, TOL

Wed: CPB, GME, SPWH

Thur: HRL, AVGO, LULU, ORCL, MTN, COST

Fri:

Econ Reports:

Mon:

Tues: Productivity, Trade Balance, Unit Labor Costs, Consumer Credit

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Wholesale Inventories,

Fri: CPI, Core CPI, Michigan Sentiment, Treasury Budget

How am I looking to trade?

Long put protection has been added and getting ready for earnings

COST – 12/09

MU- 12/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Omicron will likely ‘dominate and overwhelm’ the world in 3-6 months, doctor says

PUBLISHED THU, DEC 2 20212:13 AM ESTUPDATED MON, DEC 6 20212:58 AM EST

KEY POINTS

- “Frankly, omicron will dominate and overwhelm the whole world in three to six months,” Singapore doctor Leong Hoe Nam told CNBC’s “Street Signs Asia.”

- New vaccines targeting omicron are a “nice idea” but won’t be practical because of the transmissibility of the strain, he said.

- Experts don’t know exactly how contagious the highly mutated omicron variant is, but the virus’ spike protein — which binds to human cells — has mutations associated with higher transmission and a decrease in antibody protection.

SINGAPORE — The new Covid variant omicron will likely “overwhelm the whole world” in the coming months, according to a Singapore-based infectious disease doctor.

While vaccines against the strain can be developed quickly, they need to be tested over three to six months to prove that they can provide immunity against the variant, Dr. Leong Hoe Nam of Mount Elizabeth Novena Hospital said Wednesday.

“But frankly, omicron will dominate and overwhelm the whole world in three to six months,” he told CNBC’s “Street Signs Asia.”

Delta, the strain that currently accounts for 99% of Covid infections, started becoming more common in the Indian state of Maharashtra in March 2021, and was dominant globally by July, according to Reuters.

Moderna CEO Stephane Bancel on Monday said it will take months to develop and ship a vaccine that specifically targets the omicron variant.

Pfizer CEO Albert Bourla also said shots could be ready in less than 100 days, or slightly over three months.

“Nice idea, but honestly, it is not practical,” Leong said of a vaccine that specifically targets omicron. “We won’t be able to rush out the vaccines in time and by the time the vaccines come, practically everyone will be infected [with] omicron given this high infectious and transmissibility.”

Experts don’t know exactly how contagious the highly mutated omicron variant is, but the virus’ spike protein — which binds to human cells — has mutations associated with higher transmission and a decrease in antibody protection.

“The profile of the mutations strongly suggest that it’s going to have an advantage in transmissibility and that it might evade immune protection that you would get,” U.S. infectious disease expert Dr. Anthony Fauci told NBC’s “Meet the Press” on Sunday.

Protection from current vaccines

That said, some doctors believe that the existing vaccines will be able to provide some protection against the new variant.

Our bodies generate a “whole host of different antibodies” in response to vaccines, said Dr. Syra Madad, a fellow at the Belfer Center for Science and International Affairs.

“I do think that our current vaccines will hold up to a certain extent, with this new variant,” she told CNBC’s “Capital Connection” on Wednesday, noting that the vaccines were able to provide protection against delta.

“It may reduce vaccine effectiveness by a couple of notches, but that is yet to be seen,” she said. Current vaccines, along with boosters should still provide a “good level of protection,” she added.

Leong agreed that a three-dose vaccine regimen would likely protect against severe disease, but pointed out that many countries still have low vaccination rates.

He said omicron is “threatening the whole world” with a sudden surge in cases, and health-care systems could be overwhelmed, even if only 1% or 2% of the cases end up in hospital.

Omicron was first detected in South Africa and was designated a variant of concern by the WHO last week. It has since been reported in several other places, including Hong Kong, the Netherlands and Portugal.

For now, however, Leong said we should continue to roll out vaccinations, keep our distance, wear masks, and not be overly concerned.

Madad echoed the same sentiment. “We continue to do the Covid-19 prevention measures on an ongoing basis,” she said. “Layering it up is really the best approach here.”

— CNBC’s Saheli Roy Choudhury, Spencer Kimball and Yen Nee Lee contributed to this report.

I can’t even afford to buy a cart of groceries’: Spiraling inflation leaves some grocery workers struggling

PUBLISHED FRI, DEC 3 202112:06 PM ESTUPDATED FRI, DEC 3 20216:50 PM EST

Leticia Miranda

San Francisco, Nov. 11, 2021.

David Paul Morris | Bloomberg | Getty Images

Two weeks ago, Mendy Hughes used $4 from her thinning bank account to pick up a family dinner from McDonald’s on her day off as a cashier at Walmart, the country’s largest grocery store chain. After 12 years with the company, Hughes makes $12.85 an hour as a full-time employee, which leaves about $200 every two weeks after monthly rent and utilities to cover essentials and food for herself and her three kids.

“Food — it’s stressful,” said Hughes, 47, of Malvern, Arkansas. “I think all day: ‘What am I going to buy when I get off [work] that I can afford? What am I going to get?’ It’s just hard.”

As prices have skyrocketed because of pandemic-driven price inflation, Hughes has found that her grocery budget has essentially dropped to zero, leaving fast food as the only affordable option to survive. The cost per pound of ground beef, for example, rose by about 19 percent nationwide from January to October, according to the Bureau of Labor Statistics, or BLS. But the last time Hughes got a raise was last year, when Walmart bumped her hourly pay by $1, which amounts to about an 8 percent increase. Walmart’s new wage increases, introduced in September, put her at just 85 cents above the company’s standard starting salary.

“It’s worse now because things have gone up so much,” Hughes said. “I can’t even afford to buy a cart of groceries.”

Walmart declined to comment on specific employees’ wages. In September, the company raised its starting wage to between $12 and $17 an hour, depending on the market, and it can go up to $34 for people in specialty roles, such as store baker. The average hourly wage at the company is now $16.40, the company said in a statement at the time.

Over the 12 months through October, consumer prices increased by 6.2 percent, according to the BLS. But according to the department’s latest figures, wages and salaries grew by only 4.2 percent in the 12 months that ended in September.

The gap between wage growth and price inflation doesn’t mean all consumers are feeling the impact of higher prices on their wallets — workers who make the lowest incomes are feeling it the most. In May of last year, the median hourly wage for retail sales workers was $13.02 an hour, or about $27,172 in full-time annual wages, while computer and IT workers made a median annual wage of $151,150, according to the most recent data from the BLS.

“The main takeaway for [the hospitality and retail] industries is that real wages are not keeping up with inflation and these jobs are barely treading water,” said Nela Richardson, the chief economist at the payroll processing company ADP. “As you make more money, price increases take up less of a bite of your budget. But if you’re making a smaller salary, inflation is a meaningful dent in your overall income.”

The pandemic highlighted an economic divide between people who can work from home and those who can’t. Those who couldn’t work from home — retail workers, bus drivers, delivery workers — were more likely to catch the coronavirus and less likely to have savings or benefits to support them if they became sick, and they were more likely to lose income, according to a report in September from a federal advisory group to the secretary of health and human services. According to data collected by the United Food and Commercial Workers International Union, 198 of 835,000 grocery workers died from Covid-19 and at least 43,900 were infected or exposed from March 2020 through August 2021.

Meanwhile, the grocery industry had a record sales year as people hunkered down at home to avoid the virus. The industry traditionally grows by 1 percent to 2 percent a year, according to the management consulting firm McKinsey and Co. But the North American grocery industry grew by a whopping 12 percent last year. Kroger had $135 billion in sales last year, up by 10.6 percent from $122 billion in 2019, according to the company. Costco’s sales grew by 9 percent last year, to about $163 billion, from $149 billion the year before. Walmart’s food sales grew by $3.6 billion in the third quarter of this year alone, the strongest quarterly growth in six quarters, Walmart’s chief financial officer told investors in an earnings call last week.

Bianca Agustin, the corporate accountability director for the nonprofit labor advocacy group United for Respect, said in an email that the strain of rising costs on low-wage earnings is “an urgent reminder for Congress to raise the federal minimum wage to at least $15.”

“This is the bare minimum to ensure essential workers and working families are included in the economic recovery,” she said.

There has been a wave of calls to raise the federal minimum wage as the grueling pandemic has thrown grocery workers like Hughes onto the front lines of the virus and driven political animosity toward safety protocols like masks. In response to the added work risk of contracting the virus, some retailers temporarily enhanced their sick leave benefits and rolled out hazard pay for front-line workers a few months into the pandemic last year. However, by June, Albertsons, Kroger and Fred Meyer were some of the grocers that ended their bonus pay for working through the pandemic.

As the pandemic lapped its one-year mark, retail workers began leaving the industry in droves because of low wages and burnout. The Labor Department reported that 730,000 retail workers quit their jobs in August and 685,000 in September. In response, retail companies rushed to increase wages to retain workers and enhanced benefits to draw in applicants to fill a growing list of open roles. Costco raised its minimum hourly wage to $17 last month. Natural Grocers said last month that it is raising its starting hourly pay to $14 to $18. Aldi announced in August that it is bumping its average hourly starting wage to $15.

“Wage increases have been hopeful signs,” said Gary Burtless, a senior fellow in economic studies at the Brookings Institution. “Although at the moment it’s not widespread enough to be reflected in the economy.”

At the same time, skyrocketing consumer demand for goods, a global supply chain crisis and labor shortages have fueled higher prices. Price inflation hit its highest point last month in more than 30 years, at 6.2 percent.

When it comes to wage gains, workers in the hospitality industry got a 1 percent increase in September compared to the year before, Richardson said. Trade and retail wages rose by 6.7 percent in September compared to a year ago, which means wages in the sector are barely keeping up with prices, she said.

The gap between hourly wages and the cost of food often means many grocery workers face the daily experience of being around food they can’t afford.

“It’s terrible checking out baskets and baskets of groceries knowing I can’t buy them,” Hughes said.

While job-switching has led to higher wages for some, leisure and hospitality and retail are unique segments, in that moving jobs is generally not as profitable as it is in other industries, Richardson said. The few benefits some workers get from their grocery employers are too valuable to give up for better-paying jobs with fewer benefits.

A supervisor for a Kroger store in Tennessee, who asked to remain anonymous because she isn’t permitted to speak to the media, said she often skips breakfast and eats a couple of crackers to stretch her budget. She makes $10 an hour working part-time while she attends community college. But for a college student supporting herself, the company’s benefits outweigh the low pay.

“I have looked into other jobs,” she said. “But Kroger has certain benefits that I want in case I ever need them, like health insurance, and if something with my school scholarship falls through, there is tuition reimbursement.”

Kristal Howard, a spokesperson for Kroger, said in an email that the company has invested $800 million in wages and training over the last three years. It is investing $350 million more this year to raise its average national wage to more than $16 an hour. It also rolled out one-time pandemic-related bonuses of $1,200 for part-time workers and $1,760 for full-time workers.

Hughes said that she has considered leaving Walmart but that she earned full-time status at the company only last year, which comes with long-term and short-term disability benefits.

“It’s hard to even pay my bills and make it through,” she said. “It’s just figuring out how to get through day to day and trying to budget how I’m going to afford food.”

First data on Covid omicron variant’s severity is ‘encouraging,’ Fauci says

PUBLISHED MON, DEC 6 20217:14 AM ESTUPDATED 4 HOURS AGO

KEY POINTS

- Preliminary data is starting to emerge that could give us a clearer picture of what we’re dealing with as experts pore over early omicron observations.

- The White House’s chief medical advisor, Dr. Anthony Fauci, said Sunday that early data was “encouraging,” but cautioned that more information was needed to fully understand the variant.

- The World Health Organization designated the new Covid omicron variant as being “of concern” less than two weeks ago.

Preliminary data about the severity of the Covid omicron variant is “a bit encouraging,” the White House’s chief medical advisor, Dr. Anthony Fauci, said Sunday, following early figures from South Africa that suggest it may not be as bad as initially feared.

However, Fauci cautioned that more data was needed to draw a complete picture of omicron’s risk profile. The World Health Organization said the variant was “of concern” on Nov.26, prompting a flurry of international travel bans and new Covid restrictions.

“Clearly, in South Africa, omicron has a transmission advantage,” Fauci told CNN, adding that “although it’s too early to make any definitive statements about it, thus far it does not look like there’s a great degree of severity to it.”

“But we’ve really got to be careful before we make any determinations that it is less severe, or really doesn’t cause any severe illness comparable to delta, but thus far the signals are a bit encouraging regarding the severity,” Fauci said.

At least 15 U.S. states have detected the omicron variant, as of Sunday, and that number is expected to rise, Centers for Disease Control and Prevention Director Dr. Rochelle Walensky told ABC News this weekend.

It comes as South Africa sees a rise in Covid cases attributed to the omicron variant, as well as an uptick in hospitalizations. Given the ongoing uncertainty surrounding the Covid omicron variant, experts are watching the real-world data coming out of South Africa closely.

Preliminary data

A report from the South African Medical Research Council, released Saturday, suggests that the strain could cause a milder infection. It’s too early to tell whether it poses a greater risk of death, however, given the relatively small amount of data and how recently the variant was detected.

The report also revealed that more younger people were being admitted to the hospital with Covid omicron infections, but this could be related to lower rates of vaccination among such age groups in South Africa.

The document details the situation over the last two weeks at the Steve Biko/Tshwane District Hospital Complex in the Gauteng province where omicron was first detected, and which is now seeing a rampant rise in Covid cases.

The main observation in the report was that the majority of patients were not oxygen dependent (as was common in previous waves, the report stated) and that most of the patients in the Covid wards were “incidental Covid admissions,” having had another medical or surgical reason for admission to the hospital.

These findings follow anecdotal reports from doctors in South Africa that the omicron variant could cause milder symptoms. The South African doctor who first spotted the virus said she had seen “extremely mild” symptoms among her own patients, but there has been no official data to back up those observations.

Age profile

However, the report — which only looked at a small number of patients — noted that: “what is clear though is that the age profile is different from previous waves.”

Analyzing 166 patients admitted to the hospital between Nov. 14 and 29, the report found that “the age profile differed markedly from the previous 18 months,” with far more younger adults and children being admitted to the hospital.

“In the last two weeks, no fewer than 80% of admissions were below the age of 50 years. This is in keeping with the age profile of admissions in all public and private hospitals in Tshwane and throughout the Gauteng Province in the last two weeks … Nineteen (19) percent were children aged 0-9 years and the highest number of admissions was in the age group 30-39 years, making up 28 percent of the total,” the report noted.

It said that the increase in younger admissions to the hospital could be a result of lower vaccination rates in younger people, stating, “it may be that this is a vaccination effect as 57% of people over the age of 50 have been vaccinated in the province compared to 34% in the 18-to-49-year group.”

There were no Covid-related deaths among 34 admissions in the pediatric Covid wards over the last two weeks, the report said.

It is important to note that the patient information presented in the report only represents the first two weeks of the omicron wave in the Tshwane district; the report itself cautioned that “the clinical profile of admitted patients could change significantly over the next two weeks, by which time we can draw conclusions about the severity of disease with greater precision.”

Still early days

While this early data may be encouraging, it’s important to keep it in perspective: it is based on preliminary findings from a small number of people.

When the omicron variant, or B.1.1.529 as it’s formally known, was first reported to the WHO (by South Africa on Nov. 24, with the first known sample dating back to Nov. 9) the U.N. health agency warned that some of the mutations found in the variant are associated with higher transmission and the ability to escape immune protection.

“We do see an increasing growth rate, we see increasing numbers of omicron being detected,” Maria Van Kerkhove, the WHO’s Covid-19 technical lead, said during a press briefing Friday. “There is a suggestion that there is increased transmissibility, what we need to understand is if it’s more or less transmissible compared to delta.”

She added that there was an increasing number of hospitalizations being recorded in South Africa, but that public health officials hadn’t seen an increased risk of death yet, although they were waiting on more data.

Experts and vaccine makers have noted it could take several weeks for the variant’s true risk profile to emerge, as well as its potential response to current Covid vaccines.

South African President Cyril Ramaphosa said in a statement Monday that there was an urgent need for citizens to get vaccinated, saying “scientific evidence shows that vaccination is the most effective means of preventing the spread of new infections, and that vaccines reduce severe illness, hospitalisation and death.”

“While we do not yet know what impact the omicron variant will have on hospital admissions, we have been preparing hospitals to admit more patients, and we are investigating how we can quickly secure medication for treating Covid-19,” he added.

Would you love to support Challenge Air for Kids

This is a worthwhile organization to help kids with disabilities all across the board enjoy the opportunity to enjoy a plane flight! It helps them for motivation, a unique experience and an unforgettable experience in their lives.

Please choose the Ft Lauderdale on the drop menu for the location

Please notify the following person(s) that a donation has been made: ENTER Jeff Shaffner

Thank you for helping the life of a child with special needs and we at Hurley Investments appreciates your donation at this special time of year !!!