HI Market View Commentary 11-30-2020

| Market Recap |

| WEEK OF NOV. 23 THROUGH NOV. 27, 2020 |

| The S&P 500 index rose 2.3% last week to a new record closing high amid encouraging progress in COVID-19 vaccine candidates and the beginning of the transition to President-Elect Joe Biden’s team from the Trump administration. The market benchmark ended the week at 3,638.35, up from last Friday’s closing level of 3,557.54. The new closing high was reached just two sessions after its previous closing high of 3,635.41 had been recorded. The gains were posted in a short week as the market was closed all day Thursday for the Thanksgiving holiday and ended Friday’s regular trading session three hours earlier than usual. The market’s highs this week came despite COVID-19 hospitalizations also reaching a new record above 90,000. Investors have been focusing more in recent days on the progress being reported for COVID-19 vaccine candidates. Candidates being developed by Moderna (MRNA) as well as by Pfizer (PFE) and BioNTech (BNTX) have had efficacy rates of 90% or more in studies reported in recent weeks, while data released this week by AstraZeneca (AZN) showed the COVID-19 vaccine candidate the company is developing with the University of Oxford had, on average, a 70% efficacy rate. While the efficacy rate reported by AstraZeneca wasn’t as strong as the others, its data were complicated by an error that forced the trial to change dosing regimens. Meanwhile, investors continue to be optimistic as Morgan Stanley said the company’s vaccine will be “an important part of the solution” given that its manufacturing is straightforward and low-cost and that the company can manufacture more than 3 billion doses by next year. Investor sentiment also was boosted this week as General Services Administration Administrator Emily Murphy, who had been resisting giving the green light to Biden’s team, finally started the transition of power at the White House. This helped relieve investors’ concerns about political instability while the market also approved Biden’s pick for Treasury secretary, former Federal Reserve Chair Janet Yellen. Among sectors, the energy sector had the largest percentage gain of the week, up 8.7%, followed by financials, which rose 4.8%, and consumer discretionary, which climbed 3.0%. Only one sector fell as real estate shed 0.3%. The energy sector’s climb came as crude oil futures also rose amid the optimistic market sentiment. Among the sector’s gainers, Occidental Petroleum (OXY) shares jumped 23% while Apache (APA) rose 22%. In the financial sector, gainers included Wells Fargo (WFC), which climbed 12% as Raymond James upgraded its investment rating on the banking company’s stock to outperform from underperform. The consumer discretionary sector’s gainers included Dollar Tree (DLTR), whose shares rose 16% as the dollar store operator reported fiscal Q3 earnings per share and sales above year-earlier results and analysts’ expectations. On the downside, decliners in real estate included Equinix (EQIX). Shares of the digital infrastructure provider fell 3.8% this week. The company said it will spend $55 million to build its third international business exchange data center in Osaka, Japan. Data due early next week include manufacturing statistics for November, pending home sales for October and motor vehicle sales for November. However, the November employment figures due Friday are likely to get the most attention. Provided by MT Newswires. |

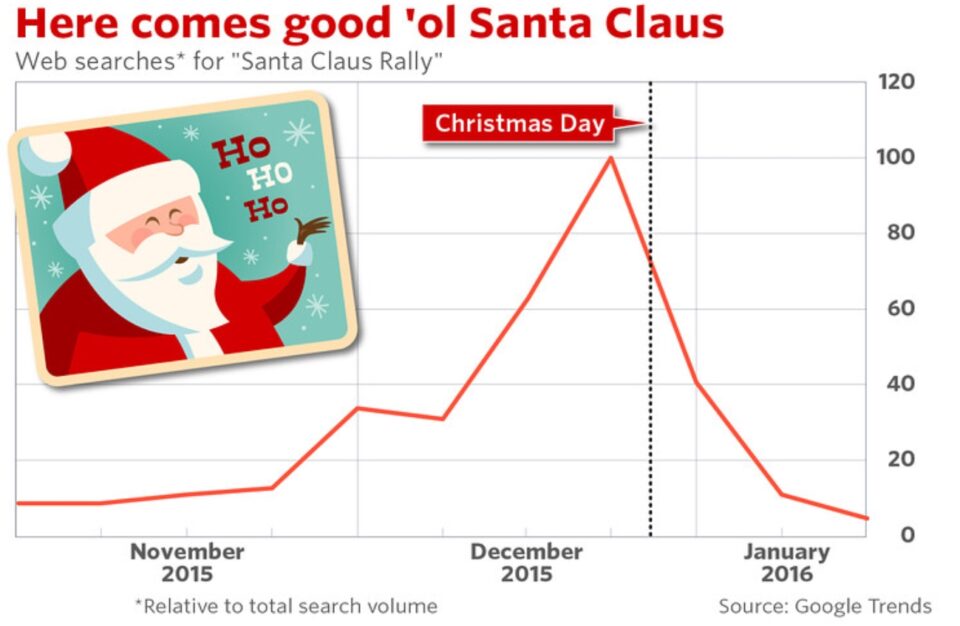

So what is going to happen the next 4 weeks “historically speaking”

Santa Cause Rally – Personal Spending (GDP) goes through the roof

BUT End of the year tax sell off and/or rebalancing

Where will our markets end this week?

Higher

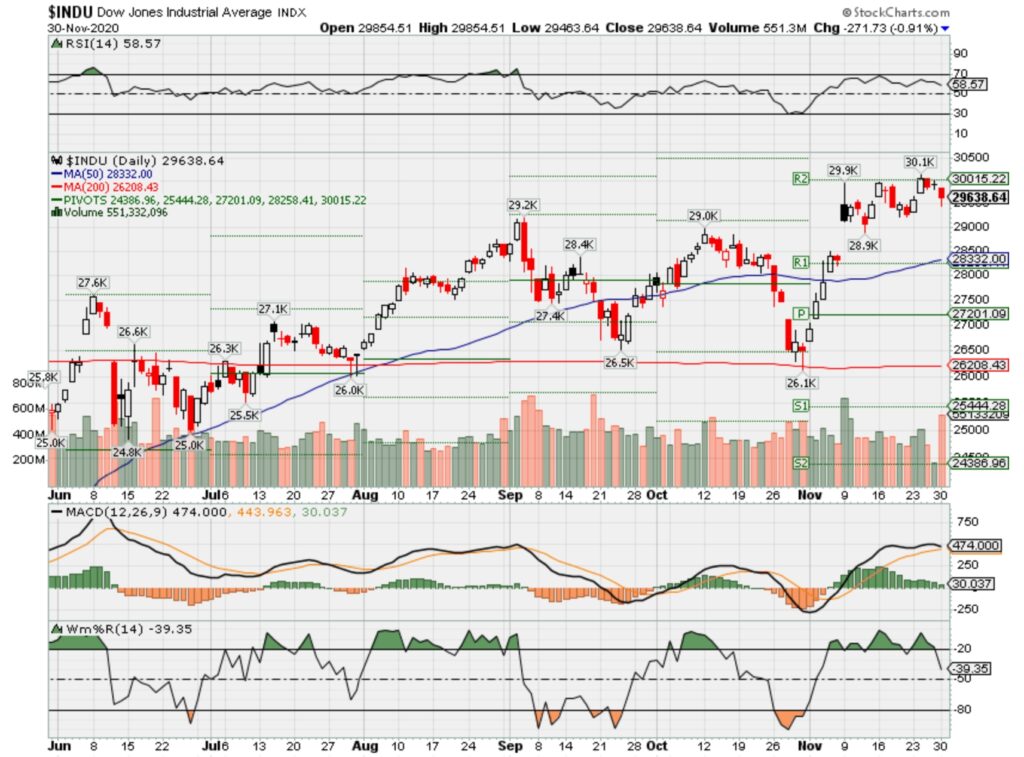

DJIA – Bullish

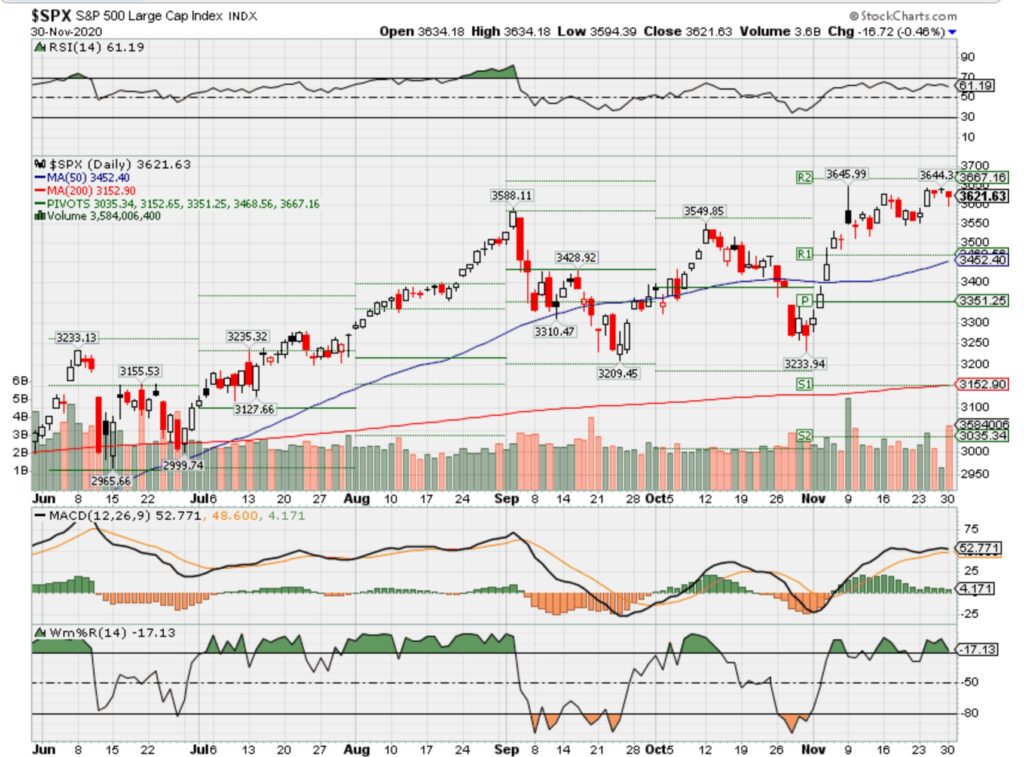

SPX – Bullish

COMP – Bullish

Where Will the SPX end December 2020?

11-30-2020 +2.5%

Earnings:

Mon: ZM

Tues: NTAP, CRM, HPE

Wed: FIVE, GES, PVH

Thur: CCL, DG, KR, MIK, DOCU, SWBI, ULTA

Fri: BIG, GCO

Econ Reports:

Mon: Pending Home Sales, Chicago PMI

Tues: Auto, Truck, Construction Spending

Wed: MBA, ADP Employment,

Thur: Initial Claims, Continuing Claims, ISM Manufacturing

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, Trade Balance, Factory Orders,

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

The big decision how far to let stocks run into a Christmas Rally ?!?!?!?!?

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.newsmax.com/finance/streettalk/aaa-rated-bonds-tumbling-china/2020/11/23/id/998448/

These AAA-Rated Bonds Are Tumbling as China Default Fears Spread

(Alexlmx/Dreamstime)

Monday, 23 November 2020 08:59 PM

A string of defaults by Chinese state-owned companies has sent shockwaves across the world’s second-largest credit market.

But some bonds have fared much worse than others as investors clamber to avoid the next potential blowup. Among the most notable losers: notes issued by Pingdingshan Tianan Coal Mining Co., Jizhong Energy Group Co., Tianjin TEDA Investment Holding Co. and Yunnan Health & Culture Tourism Holding Group.

While none of the companies have missed debt payments, and all four are rated AAA by Chinese domestic ratings firms, their bonds have tumbled by at least 14% since Nov. 10. That’s when a surprise default by a state-owned Chinese coal producer cast fresh doubt on the implicit guarantees that have long underpinned government-backed borrowers.

“Most of the onshore bonds hit hardest this time share a common symptom: their profitability has lagged far behind their debt growth,” said Li Yunfei, credit analyst at Pacific Securities Co. “Repricing of some onshore bonds, though it occurred abruptly and quickly, is a rational outcome of the recent defaults.”

Pingdingshan Tianan Coal said in a written reply to Bloomberg News that the company was aware of declines in some of its bonds, but declined to comment further. An official in charge of information disclosure from Yunnan Health & Culture Tourism didn’t answer calls or respond to an an email seeking comment.

An official in charge of Tianjin Teda Investment’s bond issuance department declined to comment when reached by phone. Multiple calls made to Jizhong Energy’s general line were not answered.

Here’s why some investors are worried:

Two days after Yongcheng Coal & Electricity Holding Group Co.’s default on Nov. 10, Pingdingshan Tianan Coal held a meeting to assuage investor concerns following a bond slump. It later wired funds to meet early redemptions on a 500 million yuan ($76 million) bond.

But investors remain cautious about its liquidity. The company’s so-called “quick ratio,” which measures its abilities to use liquid assets to meet short-term debt obligations, fell to 0.6 at the end of September from 0.69 a year ago, according to Bloomberg data. A quick ratio of 1 or above is typically considered healthy.

Jizhong Energy, the top state-run coal producer in Hebei province, suffered its eighth consecutive year of net losses last year. Its total debt, the majority of which carries short-term maturities, surged by 102% to 165.7 billion yuan between 2012 and 2019, according to Bloomberg data. Its quick ratio dropped to 0.48 at the end of June from 0.57 a year ago.

The company has 31.7 billion yuan of bond repayments due by the end of 2021, Bloomberg data show.

Tianjin TEDA Investment, a local government financing vehicle from the northern port city, also faces funding pressure. Its quick ratio was 0.49 at the end of June, compared with 0.46 at the end of 2019, Bloomberg data show. It faces 17.6 billion yuan of bond repayments by the end of 2021. In September, Caixin magazine reported that the Tianjin municipal government held a meeting with various local financial institutions to discuss how to support the indebted firm.

Yunnan Health & Culture Tourism, an LGFV from the southern Yunnan province that is being transformed to focus on cultural tourism and health services from infrastructure building, is awaiting further injection of state capital after having received 16 billion yuan as of the end of October.

Fitch Ratings downgraded it to BBB- from BBB amid signs of uncertainties over the firm’s future ownership in late March, before withdrawing its ratings shortly after, citing “insufficient information”.

China Lianhe Credit Rating Co. maintained its AAA rating on the firm in October. The LGFV’s quick ratio dropped to 0.24 at the end of September, the lowest since 2016, Bloomberg data show.

© Copyright 2020 Bloomberg News. All rights reserved.

Market bull predicts holiday season surge will boost stocks another 10%

PUBLISHED SUN, NOV 29 20205:00 PM EST

Stephanie Landsman@STEPHLANDSMAN

One of Wall Street’s biggest bulls expects another market breakout.

Capital Wealth Planning’s Jeff Saut sees the S&P 500 hitting 4,000 before year-end — a 10% gain from Friday’s close and an 83% gain from the March 23 low.

“Earnings are going to continue to come in better than most people think,” the firm’s advisory board member and market strategist told CNBC’s “Trading Nation” last week.

Despite the S&P 500 and Dow’s all-time highs, Saut considers this the most hated bull market he’s ever seen.

“Most individual investors — they’re scared to death, and they’re sitting on way too much cash,” said Saut, who also runs market analytics firm Saut Strategy. “They’re going to be forced to pay up in this strongest seasonal period of the time between Thanksgiving and New Year’s.”

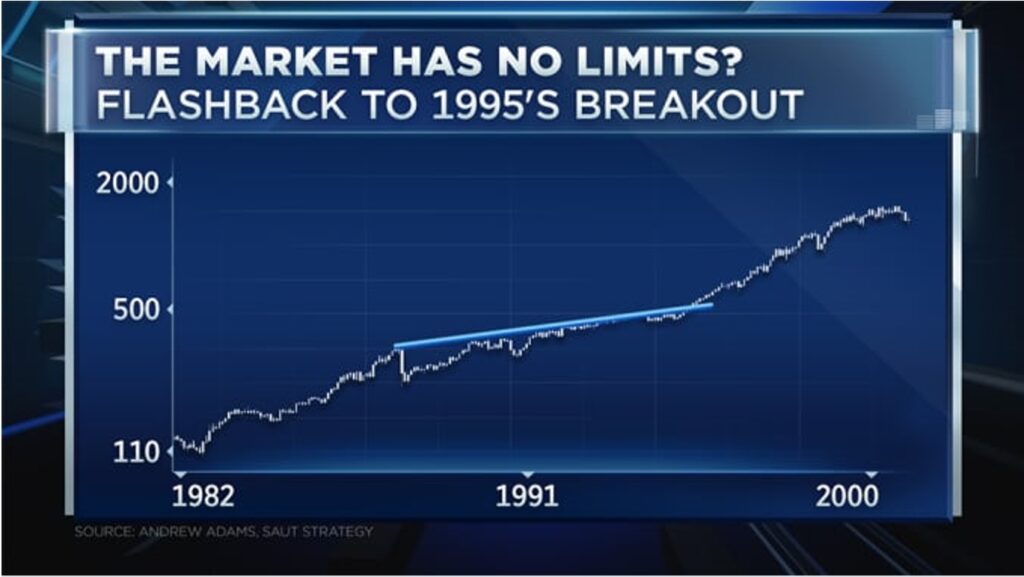

According to Saut, the S&P 500′s record run is relative to the market breakouts between 1949 to 1966 and notably 1982 to 2000, the period which included the 1987 crash.

“It’s interesting to me when we had that 37%, 38% pullback [this year,] a bunch of bears came out of the woodwork, and said… ‘we’re in a bear market,’ and they obviously don’t know what a secular bull market is,” said Saut. “The primary trend of this market has been up since March of ’09.”

In 1995, Saut notes the S&P continued to push through resistance even when investors thought there was little gas left. According to Saut, it marked the index’s greatest five year run in history. He believes history could repeat itself because there are few imminent dangers.

“The biggest risk for the market would be a geopolitical event like a nuclear incident with North Korea. Second on my list would be a policy mistake out of Washington,” said Saut, who’s been on Wall Street for more than five decades. “But I don’t see either one of those occurring.”

Absent from his list: The coronavirus pandemic as a top market risk.

“It’s a mistake to try to trade the wiggles here. I think the most important thing in a secular bull market is not to lose your stock positions,” Saut said. “We have at least another four-plus years left in this and nobody believes it.”

From Tesla and Rivian to Ford and GM: Take a look at the electric trucks automakers are planning

Published Thu, Nov 26 202010:00 AM ESTUpdated Sun, Nov 29 202010:37 AM EST

A promotional shot of Tesla’s Cybertruck.

handout

From electric car startups to the old-school Detroit auto giants, the automotive industry is gearing up for a battle royale as companies race to deliver the first all-electric pickup truck to the mass market.

The best-selling vehicle in the U.S. is a pickup truck (Ford’s F-150). Meanwhile, electric vehicle sales have been steadily rising for years, with some analysts expecting those numbers to jump by nearly 40% globally in 2021, topping 3 million electric vehicles sold around the world.

So, it was just a matter of time before automakers began flooding the market with electric trucks.

On Monday — after selling out reservations for its first set of R1T pickups — Rivian opened another round of pre-orders. Elon Musk and Tesla generated buzz with the wild (and smashing) unveiling of the Tesla Cybertruck in November 2019. And, Ford has also said the electric version of its best-selling F-150 will finally be available in 2022.

Here’s a look at some of the most anticipated electric pickups set to hit the market over the next few years.

Rivian

Rivian is a startup that’s looking to take down major players in the electric vehicle market. The Irvine, California-based electric automaker has raised roughly $6 billion from investors that include the likes of Amazon and Ford (which is partnering with Rivian on electric battery technology). Amazon has ordered 100,000 Rivian electric delivery vans, and the e-commerce giant plans to start deploying the vehicles in 2022.

Rivian R1T electric truck

Source: Rivian

Meanwhile, the Rivian R1T could be the first electric pickup to hit the market when it’s expected to arrive in early- to mid-2021. The pickup will have a base price of $69,000 and a top speed of 125 miles per hour (like the Hummer EV, it will also go from zero to 60 MPH in 3 seconds). The truck will also come with three different battery options, offering a low-end range of 240 miles per charge and a high-end range of more than 400 miles.

Rivian said recently that the company had sold out its reservations for the first set of R1T pickups to be delivered in 2021 (customers who pre-ordered the trucks had to plunk down a $1,000 deposit), though the company hasn’t revealed how many pre-orders its received in total. For Rivian’s current round of pre-orders for pickups, customers can customize their trucks by color and battery size (and can even add a pull-out camping kitchen for $5,000). But those pickups likely won’t be delivered at least the beginning of 2022 due to limited production capacity, the company recently told Bloomberg.

Ford F-150

Ford’s F-150 pickup truck has been the best-selling vehicle in America for nearly four decades (the company’s F-series trucks sold nearly 900,000 vehicles in 2019), so it’s no surprise that the truck’s electric version is highly anticipated. The company has already unveiled plans for electric versions of other Ford vehicles, including the iconic Mustang sports car and an electric transit van.

Set to hit the market in the middle of 2022, Ford has promised that the electric F-150 will be “a very fun truck” to drive and that it will feature dual electric motors and a large front trunk with hundreds of pounds of storage capacity. The company also boasted about the electric truck’s power in 2019 by tweeting a video of an electric F-150 prototype towing a payload of double-decker rail cars containing 42 pickups weighing a total of 1.25 million pounds.

Ford has not yet revealed the full extent of the electric F-150′s specs, or how much the electric pickup will cost.

18:03

The race between Tesla, GM, Rivian and others to dominate electric pickup trucks

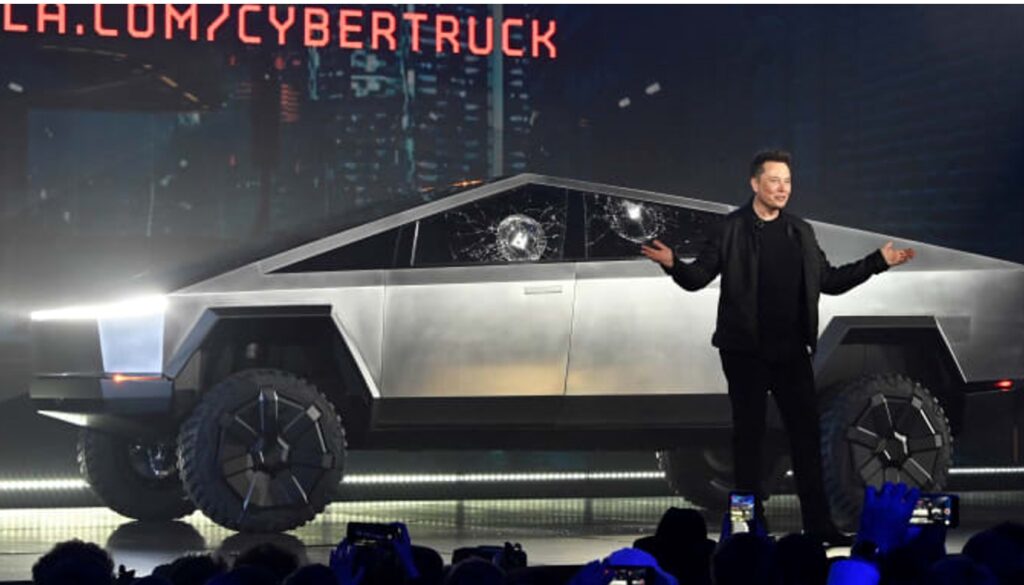

Tesla Cybertruck

Tesla CEO Elon Musk unveils the Cybertruck at the TeslaDesign Studio in Hawthorne, Calif. The cracked window glass occurred during a demonstration on the strength of the glass.

Robert Hanashiro | USA TODAY | Reuters

Musk unveiled the much-anticipated Cybertruck (with a futuristic design inspired by two films: “Blade Runner” and “The Spy Who Loved Me”) a year ago at a press event that also saw him accidentally shatter two of the electric truck prototype’s supposedly unbreakable windows with a steel ball.

The Cybertruck has a starting price of $39,900 for a single-motor version of the pickup that is expected to begin production in late-2022. The single-motor Cybertruck will have a range of 250 miles per charge, while a more expensive three-motor version will have a range of 500 miles. Dual motor and three-motor versions of the Cybertruck (that will start at $49,000 and $69,000, respectively) will begin production in late-2021, according to Tesla.

General Motors

Not looking to get left behind in the battle to dominate the electric vehicle market, General Motors said this month that it plans to spend $27 billion on all-electric and autonomous vehicles through 2025. In October, GM unveiled a prototype for an electric Hummer, which the company described as “the world’s first supertruck.”

Expected to begin production at the end of 2021, the GMC Hummer EV pickup will start at $112,595 and will have a top range of 350 miles per charge, as well as the ability to accelerate from zero to 60 MPH in just 3 seconds, according to the company.

2022 GMC Hummer EV sport utility truck “Edition 1”

GM

Meanwhile, GM also recently confirmed that the company’s Chevrolet brand will produce an electric pickup truck to compete with rivals like Ford and other electric pickups. While full details are not yet known, the company announced plans this summer to produce an electric pickup, called the Chevrolet BET Truck, that will get more than 400 miles of range per charge.

GM had also considered an investment in Rivian, but that partnership fell through when GM wanted exclusive rights to the startup’s technology, CNBC previously reported.

Others

Other competitors in the electric pickup market expected to launch in the coming years include Ohio-based Lordstown Motors, which plans to begin delivering its all-electric Endurance pickup by September 2021. The pickup has a starting price of $52,500, a range of more than 250 miles and an engine with 600 horsepower.

Michigan-based startup Bollinger Motors also plans to release its all-electric B2 pickup in 2021, with a starting price around $125,000 and a roughly 200-mile range on 614 horsepower.

Nikola Motor Company Badger pickup truck

Source: Nikola Motor Company

Meanwhile, Phoenix-based startup Nikola has promised its own electric Badger pickup will begin production by 2022, though the company has been mired in controversy since founder Trevor Milton stepped down in September amid accusations of fraud and sexual abuse. (Milton has denied all allegations of both fraud and sexual abuse.) The company, which went public in June, still has a valuation of more than $10 billion, and a potential $2 billion investment from General Motors reportedly could still be finalized in December.

CORRECTION: This article has been corrected to show that the single-motor version of Tesla’s Cybertruck will begin production in late-2022, not 2021. Instead, the dual motor and three-motor versions of the electric truck will begin production in late-2021.

Thanksgiving Day online sales hit record $5.1 billion, up 21.5% from last year, Adobe says

PUBLISHED FRI, NOV 27 202010:13 AM ESTUPDATED FRI, NOV 27 202011:35 AM EST

KEY POINTS

- Thanksgiving Day spending rose by nearly 22% year over year to $5.1 billion, hitting a new record, according to Adobe Analytics data.

- Nearly half of the online purchases were made on a smartphone, Adobe found.

- The strong online shopping data reflects a trend that many retailers and industry watchers expected: More consumers are avoiding malls and buying gifts from their couch during the coronavirus pandemic.

Some shoppers may be avoiding stores during the coronavirus pandemic, but they’re still putting many items in the virtual shopping cart.

Thanksgiving Day spending rose by 21.5% year over year to $5.1 billion, hitting a new record, according to Adobe Analytics data. Online sales were $4.2 billion on Thanksgiving Day in 2019. The company analyzes traffic on retail websites and transactions from 80 of the top 100 U.S. online retailers.

Nearly half of those purchases were made on a smartphone, according to Adobe.

Retailers that offer curbside pickup had a 31% higher conversion rate of traffic to their sites — a reflection of how popular it’s become for people to buy online and retrieve purchases without stepping into stores.

The strong online shopping data reflects a trend that many retailers and industry watchers expected: More consumers are avoiding malls and buying gifts from their couch during the pandemic.

Like just about every aspect of 2020, the global health crisis has shaken up holiday shopping. Retailers, including Walmart and Target, kicked off sales in mid-October to coincide with Amazon Prime Day. They’ve stretched out one-day sales events, giving shoppers less of a reason to rush to the store this Black Friday.

One of the country’s top retail trade groups said the global health crisis won’t dampen enthusiasm for shopping. The National Retail Federation estimated holiday sales will rise between 3.6% and 5.2% year over year, amounting to between $755.3 billion and $766.7 billion. Last year, they rose 4% to $729.1 billion, NRF said. On average, holiday sales have increased 3.5% for the past five years.

The trade group, however, said it expects more of those dollars will be spent online, rather than in stores. It projected a 20% to 30% jump in online and other non-store sales compared to last year.

Adobe said it anticipates Black Friday and Cyber Monday to be the two largest online sales days in history. It expects Black Friday sales will add up to between $8.9 billion and $10.6 billion and online sales for the full holiday season will add up to $189 billion.

‘Good riddance’: Tech’s flight from San Francisco is a relief to some advocates

PUBLISHED SUN, NOV 29 20201:15 PM EST

David Ingram

When Chirag Bhakta saw a headline recently that said tech workers were fleeing San Francisco, he had a quick reaction: “Good riddance.”

Bhakta, a San Francisco native and tenant organizer for affordable housing nonprofit Mission Housing, is well-versed in the seismic impact that the growth of the tech industry has had on the city. As software companies expanded over the past decade, they drew thousands of well-off newcomers who bid up rents and remade the city’s economy and culture.

He said the sudden departure of many tech workers and executives — often to less expensive, rural areas where they can telecommute during the coronavirus pandemic — reveals that their relationship with San Francisco was “transactional” all along.

“They used their capital to radically shift the makeup of poor, working-class communities,” Bhakta said. “We’re left with ‘for sale’ signs and price points that are still out of reach for most people.”

Many urban centers have seen residents move out in large numbers since the start of stay-at-home orders in March, but the shift has been especially dramatic for San Francisco, a city that was already experiencing rapid change because of the tech industry.

Software engineers, CEOs and venture capitalists have chosen to jump from the Bay Area to places such as Denver, Miami and Austin, Texas, citing housing costs, California’s relatively high income tax and the Bay Area’s general resistance to rapid growth and change.

The scale of the departures is visible in vacant high-end apartments, moth-balled offices and quieter streets in neighborhoods popular with tech workers. And while no one is exactly celebrating, especially as Covid-19 has devastated the incomes of many people, some residents were ready to take a break from the rich.

“The gentrification pressure has been at least momentarily relieved,” said John Elberling, executive director of Todco, an affordable housing nonprofit that operates in the South of Market neighborhood alongside the shuttered headquarters of countless tech companies and startups.

Over the years, San Francisco residents tried a variety of tactics to protest the tech industry’s effects on the city: blocking corporate buses, halting expensive new condo buildings, proposing tax increases and even threatening to limit office cafeterias.

Affordable housing advocates, local politicians and longtime San Francisco residents hoped the well-off newcomers would contribute more to their new community, or if they didn’t, then perhaps leave.

Elberling, who before the pandemic spearheaded new restrictions on skyscrapers in San Francisco, is among those who believe the city was being overrun by people who arrived for one reason.

“The motivation got to this get-rich-quick attitude,” he said. “And that isn’t what our city is about. You can make a lot of money here, obviously, but that’s not the persona of San Francisco.”

San Francisco has a history of boom-and-bust cycles, stretching back to the 1849 gold rush and including multiple tech bubbles. But that’s not why people stay, Elberling said.

“If all you care about is money, I suggest you go to Texas,” he said.

Some have taken that advice. Joe Lonsdale, a venture capitalist at the firm 8VC, wrote in an op-ed in The Wall Street Journal that California had “fallen into disrepair,” with problems ranging from expensive housing and rising property crime to scheduled blackouts needed to prevent wildfires.

“The electricity turns on and off, as in Third World countries,” he wrote from his new base in Austin.

Such moves have been described as an “exodus” of tech workers “fleeing” San Francisco — words that Bhakta said amount to a parting insult, as if tech workers had been slaves in Egypt.

″‘Exodus’ is a weighted term for people escaping oppression. From what I can tell, tech workers weren’t being oppressed in San Francisco,” he said.

People who resisted the influx of tech during the most recent mega-expansion for the industry said they do not expect a revival of San Francisco’s legendary bohemian past, affordable to nearly anyone. Rents may have fallen 20 percent or more from a year ago, but they’re still high by national standards, and many artists left the city a long time ago.

Although some companies such as Pinterest have canceled leases, Google is expanding its offices in San Francisco, a sign of the tech industry’s attachment to the city despite the local hostility and the predictions of a permanent work-from-home culture.

Eventually, the trend of moving out might reverse.

“When the trend got out there that you could save a lot of money for a year while you could live elsewhere, people started to pick up on the trend and a lot of them did that,” said Janan New, executive director of the San Francisco Apartment Association, a trade group for landlords.

But the concerns about tech-fueled gentrification have also been compounded by deeper worries about the impact that tech products are having on elections and democracy. Just because some tech workers have left the area doesn’t mean the industry will face less criticism here, even if the protests are no longer over bus fleets.

On Thursday, a committee of the San Francisco Board of Supervisors is scheduled to vote on a resolution that would “condemn” the naming of a city hospital after Facebook CEO Mark Zuckerberg and his wife, Priscilla Chan, who gave $75 million to the hospital in 2015.

And recently, protesters demonstrated outside the couple’s San Francisco house over Facebook’s role in politics, including its decision not to fact-check political ads.

“No matter where the big tech companies are located, people have really seen that leaving them to regulate themselves has left our society exposed to a rampant amount of disinformation and hatred and conspiracy theories,” said Andrea Buffa, an organizer of several Facebook protests.

Tracy Rosenberg, executive director of Media Alliance, a San Francisco nonprofit that is often critical of the power of tech companies, said she wonders whether tech workers will want to return to a place where they’ve received a mixed welcome.

“The level of tech blowback in San Francisco and the Bay Area was going up in intensity,” she said. “I think there’ll be sort of a reluctance to come back and face that, because that was reaching a level that was hard to live with — when you are the cause of all social problems, in the eyes of a significant part of the population, at least.”

Ford Can Be Fixed. Why Its Stock Could Double.

Ford Motor is the fifth-largest auto maker in the world based on the number of vehicles it sold last year, but it barely cracks the top 15 in stock market value. The gap says everything about how Ford is viewed today—and the potential opportunity for investors.

Once near the pinnacle of global auto-making in reputation, revenue, and profits, Ford these days is considered by many investors and Wall Street analysts as an also-ran. It’s trailing far behind some of its rivals in the race to produce electric and autonomous vehicles….

Under Armour launches a brand with NBA star Steph Curry to better compete with Nike’s Jordan

KEY POINTS

- Under Armour announced the official launch of the Curry Brand with NBA star Stephen Curry.

- The banner could be for Under Armour what the Jordan Brand is for Nike.

- “We’re so excited to see one of our athletes being so involved in the product,” Under Armour CEO Patrik Frisk told CNBC.

Under Armour announced Monday the launch of the Curry Brand with NBA star Stephen Curry, a long-time Under Armour athlete, in a bid to reach younger consumers and compete with Nike and its Jordan Brand.

The new line, which launches on CurryBrand.com this week, features shoes and clothes for a number of sports including basketball and golf. Over time, the brand will be expanded to more categories including running and women’s. Performance basketball footwear will be available on Dec. 11, in time for holiday gift giving.

“We wanted to make sure we did this as close as possible to the NBA season finally launching … and the fact that we’re launching in between Black Friday and the holidays we think is very opportune,” Under Armour Chief Executive Patrik Frisk told CNBC in an interview.

“This also gives Stephen something to really engage in … he’ll be actively involved in the development of the product. And we’re so excited to see one of our athletes being so involved in the product,” he said.

Curry, who plays point guard for the Golden State Warriors, signed with Under Armour in 2013. Curry has won three NBA championships with the Warriors. At 31 years old, sports analysts have called him the greatest shooter in NBA history, with his jersey consistently being a top seller.

The launch of the Curry Brand could help Under Armour gain momentum against its rivals, especially with younger consumers, where it has lost ground.

Nike has maintained its No. 1 spot as the favorite apparel brand among teens for a decade, according to Piper Sandler’s biannual survey. And for a year now, Under Armour has been No. 1 on a list of brands “no longer worn” by male teens surveyed by Piper Sandler.

Nike is also still No. 1 in footwear, while Under Armour dropped to eleventh place from ninth in Piper Sandler’s fall “Taking Stock with Teens” report.

Under Armour’s brand image has also been hurt by heavy discounting in department stores and at other off-price chains. Its brand is typically associated with high performance traits, for intense activities, but shoppers have mostly been seeking out fashion when they shop for activewear, boosting Lululemon and Gap’s Athleta.

In its latest reported quarter, Under Armour sales were about flat from a year earlier, at $1.43 billion. In North America, revenue fell 5% to $963 million, while international sales increased 18% to $433 million.

From 2018 to 2019, Under Armour’s revenue rose 1% to $5.3 billion. Meanwhile, Nike has seen more robust growth in recent years. But in its latest fiscal year, which ended May 31, Nike’s business was hurt by the onset of the Covid pandemic, and revenue fell 4% to $37.4 billion.

Nike has grown its Jordan Brand, created for former NBA star Michael Jordan, to bring in more than $3.5 billion annually, reaching consumers both young and old. More recently, Nike’s focus has been on expanding the Jordan Brand to reach more women.

Part of the Curry Brand’s mission, according to the company and to Curry, is to make sure that kids have more access to sports, particularly in lower-income households. They cited a decline in youth participation that has been compounded by the pandemic, as a factor in their decision to focus on this cause.

Starting in Oakland, California, the Curry Brand will work with the Oakland Unified School District to launch basketball at each middle school, and it will also partner with a nonprofit organization, Positive Coaching Alliance, to bring professional coaching to all of the youth sports coaches in the area.

“What we want to try to do is change the game for good. And that’s how Stephen is thinking about it, and we truly believe that is an opportunity for us,” Frisk said. “So it goes beyond the actual sales of product. But, the sales of product are important because we’re going to take part of the sales and actually invest that back into this program.”

“It’s a new way for us to think about how we financially can drive an initiative, and we think that’s also an exciting business model going forward,” he said.

As of Friday’s market close, Under Armour shares are down almost 23% this year. The company has a market cap of $7.6 billion. Meanwhile, Nike shares, which have a market value of $210.7 billion, have gained nearly 33% since January.

HI Financial Services Mid-Week 06-24-2014