HI Market View Commentary 11-16-2020

| Market Recap |

| WEEK OF NOV. 9 THROUGH NOV. 13, 2020 |

| The S&P 500 index rose 2.2% last week to a fresh closing high despite COVID-19 cases and hospitalizations also reaching new highs in the US, as vaccine hopes and post-election relief spurred strong gains led by the energy and financial sectors. The market benchmark ended the week at 3,585.15, up from last Friday’s close of 3,509.44 and surpassing the previous closing high of 3,580.84 that had been recorded in early September. This marks the measure’s second week of gains in a row. It is now up 9.6% for November as the passage of the US presidential election — with Joe Biden becoming the president-elect — sparked a relief rally. The week’s climb came despite a continued rise in COVID-19 cases and hospitalizations as investors appeared hopeful for an effective vaccine and a Biden presidency to make the US economy stable again. Encouraging vaccine study data earlier in the week from Pfizer (PFE) and BioNTech (BNTX) boosted sentiment. The energy sector had the largest percentage increase of the week, up 17.1%, followed by an 8.3% increase in financials. Other strong gainers included industrials, up 5.4%, and real estate, up 5.3%. Only one sector declined this week: technology, down 0.3%. The jump in energy stocks came as crude-oil futures climbed on the vaccine data, with investors hoping an effective vaccine could bring a big boost to oil consumption. Among the sector’s gainers this week, Diamondback Energy (FANG) shares soared 36% and Valero Energy (VLO) rallied 33%. In the financial sector, shares of American Express (AXP) jumped 19% this week as UBS upgraded its investment rating on the payments company’s stock to neutral from sell while boosting its price target on the shares to $116 from $90. Among other strong gainers in financials, Citigroup (C) added 14% and Hartford Financial Services Group (HIG) rose 15%. On the downside, decliners in consumer discretionary included some of the stocks that have benefited from stay-at-home trends as the vaccine news had some investors reversing their pandemic-related bets. Among them, Pool Corp. (POOL) fell 11%, Whirlpool (WHR) shed 6.4% and Amazon.com (AMZN) slipped 5.5%. The drop in the technology sector also came amid the reversal of bets on companies receiving pandemic-related demand. Adobe (ADBE) shares fell 5.1%. Adobe said it has struck a deal to acquire Workfront, a work management platform for marketers, for $1.5 billion. Next week, the housing market will come into focus as the November home builders index will be released Tuesday, followed by October housing starts and building permits Wednesday, and October existing home sales Thursday. Retail sales, import prices and industrial production for October are also expected Tuesday. Provided by MT Newswires. |

How do you make the best decisions in trading ?

There is a BIG difference in making the best vs the correct because nobody can predict the future

Make investing and trading as simple as possible = Admitting when I am wrong, looking longer term

What is the probability of making money in the stock market ? 1 out of 3 chance

33% of guessing the direction correctly, 66% of losing money

You need to define what your version of fun, safe trading, living expenses, investing is?!?!!?!?

IF you need 120K to live off of you should have a 3.6 Million dollar portfolio

Some people think that losing tens of thousands of dollars is an education

You make the best decision with the information you have in front of you AND looking longer term makes the decision process in trading easier

Some people never lock in or take a profit. Why? Don’t want to pay the taxes

Where will our markets end this week?

Depends on Election results – Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end November 2020?

11-16-2020 +3.0%

11-09-2020 +2.0%

11-02-2020 +2.0%

Earnings:

Mon: PANW, TSN, IQ, AMC, BIDU

Tues: KSS, WMT,

Wed: LOW, TJX, JACK, LB, TGT, NVDA

Thur: M, NTES, SINA, INTU, ROST

Fri: BKE, FL,

Econ Reports:

Mon: Empire

Tues: Import, Export, Retail Sales, Retail ex-auto, Capacity Utilization, Industrial Production, Business Inventories, NAHB Housing Market Index

Wed: MBA, Building Permits, Housing Starts

Thur: Initial Claims, Continuing Claims, Phil Fed, Existing Home Sales, Leading Indicators,

Fri: Monthly OPTION EXPIRATION

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

The big decision how far to let stocks run into a Christmas Rally ?!?!?!?!?

EARNINGS

BIDU 11/16 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Preet Bharara Is a Candidate to Run SEC, Putting Bankers on Edge

By Benjamin Bain and Robert Schmidt

November 13, 2020, 12:01 AM MST Updated on November 13, 2020, 7:42 AM MST

Joe Biden’s presidential transition has barely started but already banks and investment firms are anxious about two names they fear are in the running to lead the U.S. Securities and Exchange Commission.

The uneasiness started late last week, when news broke that Gary Gensler — a scourge of Wall Street when he led the Commodity Futures Trading Commission — had been tapped to examine financial regulators for the president-elect. That fueled concerns that Gensler himself might be in line for the top job at the SEC or another agency he’s reviewing.

Then Washington lobbyists and industry trade groups got wind of another SEC contender who they would find potentially more alarming: Preet Bharara, Manhattan’s former top federal prosecutor. Bharara loomed large over Wall Street in the decade following the 2008 financial crisis, when he aggressively investigated insider trading and contributed to SAC Capital Advisors, Steven Cohen’s old hedge fund firm, shutting its doors.

Biden’s transition team didn’t respond to requests for comment, nor did Gensler or Bharara.

Gensler and Bharara are among many names Biden advisers are discussing as possible SEC candidates, according to more than a dozen people familiar with the conversations who asked not to be named in sharing private communications. But the deliberations are in their early stages and Biden has suggested he may not even start offering nominees for higher-profile cabinet positions — like Treasury secretary and attorney general — until next month.

Still, the financial industry chatter about an SEC pick highlights the job’s importance to banks, asset managers and stock exchanges.

Wall Street was already on edge over the internal battle over appointees between moderate and progressive Democrats, worried that liberal Senator Elizabeth Warren and other lawmakers would pressure Biden to select tough regulators. Those fears grew when the president-elect filled his landing teams — aides who examine federal agencies — with several industry critics. While Biden has said little about his plans for financial regulators, the move signaled he’s open to nominating candidates in the mold of Gensler and Bharara.

One preferred candidate among progressives, according to people familiar with the matter, is former SEC Commissioner Kara Stein, who clashed with Wall Street banks during her tenure. Allison Lee, a current SEC commissioner who’s likely to become acting chair under Biden, is also favored by some liberal Democrats to get the post permanently.

Michael Barr, a former top aide to ex-Treasury Secretary Timothy Geithner, is in the mix, too, according to two people familiar with the matter. Barr, who was one of the main authors of the Dodd-Frank Act, gained a reputation during the Obama administration as an unyielding negotiator who often dismissed Wall Street’s lobbying demands. The University of Michigan law professor is also on the Biden transition group reviewing the Treasury Department.

Georgetown University Law Professor Chris Brummer, whose work has focused on global regulatory issues, financial inclusion and industry innovation, is also said to be in the running. Brummer, who would be the first African-American SEC chairman, recently published a study about the lack of diversity among U.S. regulators. Like Barr, Brummer is part of the team examining the Treasury Department for Biden.

A candidate favored by moderate Democrats is former SEC Commissioner Robert Jackson Jr., who opposed many of the Trump-era rule cuts during his stint at the agency. Jackson, who’s now a law professor at New York University, wrote a New York Times op-ed in 2018 with Bharara arguing that insider-trading laws needed to be clarified to better protect investors.

All of the potential SEC nominees named in this article either declined to comment or didn’t respond to requests for comment.

Read More: Wall Street’s Best Progressive Defense Is Trump’s Holdovers

Gensler, who is known for his hard-charging leadership style, has already reached out to high-level SEC officials to get a sense of what’s happening at the agency, said a person familiar with the matter. His appointment as head of the transition team examining the Federal Reserve and banking and securities regulators has set off a stir among SEC workers, some of whom are wondering if it gives him an edge in being nominated for chairman, this person added.

Along with his policy work that includes jobs in Bill Clinton’s Treasury Department, Gensler has clashed with Wall Street in the enforcement arena, spearheading global investigations into the manipulation of Libor that resulted in banks paying billions of dollars in penalties. Still, it’s not clear that Gensler, who led the CFTC under President Barack Obama, would want the SEC job, particularly if a cabinet post or a prominent White House position is on the table.

Bharara, who became U.S. attorney for the Southern District of New York in 2009, might also view the SEC as a consolation prize, as he’s been mentioned as a possible contender to lead the Justice Department. Fired by President Donald Trump in 2017, Bharara was once a top aide to Senate Minority Leader Chuck Schumer.

It’s standard practice for an SEC chairman to step down when an administration changes. Once the head of the agency leaves, one of the commissioners is installed as the acting leader until a permanent replacement is appointed by the president and confirmed by the Senate.

Trump’s SEC Chairman, Jay Clayton, hasn’t yet announced whether he plans to resign or what he might do next after leaving the regulator. Before joining the SEC in 2017, he was a law partner at Sullivan & Cromwell, where his clients included big banks and hedge funds.

— With assistance by Greg Farrell, Jennifer Epstein, and Saleha Mohsin

(Updates with Jackson op-ed in 11th paragraph)

Apple is breaking a 15-year partnership with Intel on its Macs — here’s why

PUBLISHED TUE, NOV 10 20205:17 PM ESTUPDATED TUE, NOV 10 20206:35 PM EST

KEY POINTS

- Apple’s new laptops and desktop uses its own chips, instead of processors from Intel.

- Apple is making the move because it already makes its own phone and tablet processors, and it says it can improve laptop battery life.

- Intel has also fallen behind on manufacturing, and Apple’s chip manufacturing partner is more advanced, analysts say.

Apple announced three new Mac computers on Tuesday: a MacBook Air, a 13-inch MacBook Pro, and a Mac Mini. They essentially look the same as their predecessors.

What’s new this time is the chip that runs them. Now they’re powered by Apple’s M1 chip instead of Intel processors. Tuesday’s announcement marks the end of a 15-year run where Intel processors powered Apple’s laptops and desktops, and a big shift for the semiconductor industry.

Apple is the fourth-largest PC maker measured by shipments, according to a Gartner estimate, so its plan to use its own chips in its entire lineup of laptops and desktops, first announced in June, is a blow for Intel.

“We believe Intel-powered PCs—like those based on 11th Gen Intel Core mobile processors—provide global customers the best experience in the areas they value most, as well as the most open platform for developers,” Intel said in a statement.

Apple’s chips are based on ARM technology, as opposed to the x86 architecture that Intel’s chips use. ARM was originally designed for mobile devices, and chips built with ARM designs are consistently more efficient, leading to longer battery life. On a laptop, that could mean several extra hours away from the plug.

But that’s only one reason why Apple is switching out the brains of its laptops. Here’s a rundown of why Apple made the move:

Apple’s strategy of owning core technologies. Apple CEO Tim Cook has frequently said that the company has a “long-term strategy of owning and controlling the primary technologies behind the products we make.”

For a computer hardware company, there are few technologies less essential than the silicon processors that the machines run on.

Apple has invested heavily in its silicon department, including major purchases, starting with a $278 million purchase of P. A. Semi in 2008, which started the department, and most recently, $1 billion for part of Intel’s modem business in 2019. It’s been building its own A-series chips for iPhones, iPads, and Apple Watches since 2010. Now it’s essentially bringing the same technology to laptops and desktops, meaning that all Apple computers basically run on the same framework.

“Apple Silicon is totally in keeping with the strategic goal of Apple to really control an entire stack,” CCS Insight research director Wayne Lam said. “Now in computing, they own everything from silicon to the software to how the user moves the mouse around, so it’s tremendously integrated.”

Controlling its own technologies helps Apple integrate its products more deeply. It also means that it runs its own schedule — chips take 3 years to develop, Apple senior vice president Johny Srouji said last year — and has more control over costs.

“Apple thinks they can innovate faster than the standard business model of Intel or Qualcomm doing the development on chips and then they build on top of it,” Lam said.

Intel is falling behind in manufacturing. Apple proudly said on Tuesday that the M1 chip in the new Macs uses 5-nanometer transistors.

“Five-nanometer is the leading edge of process technology right now and there are only a few products out at this point,” Gartner research director Jon Erensen said. Currently, Intel is shipping chips with 10-nanometer transistors.

In general, the more transistors a chipmaker can fit into the same space, the more efficient the chip is. Currently, Intel ships chips only with 10-nanometer transistors.

Intel famously controls its own factories, called “fabs,” around the world, compared to Apple, which contracts with companies in Asia to manufacture chips to its own specifications. But Apple’s chip manufacturing partner, TSMC, can make 5-nanometer chips while Intel can’t.

“Intel’s had some challenges over the last couple of years on the manufacturing side. And I think those challenges have opened a window or opportunity for ARM-based designs for come in. Apple is one of the the best ARM-based processor designers out there,” Erensen said.

Earlier this year, Intel CEO Bob Swan said that it was considering outsourcing its manufacturing, like what Apple does.

“With the challenges that Intel has had moving to 10-nanometer and 7-nanometer while foundries like TSMC and Samsung have pushed more aggressively, it’s taken one of Intel’s key advantages and leveled the playing field a bit,” Erensen said.

More battery life, potentially better performance, and laptops that work like phones. Apple says that the M1 Macs are better products than the older models, mainly because Apple claims its chips enbable better performance and longer battery life than it could achieve using Intel’s chips.

It’s clear that the new Macs will have improved battery life. Apple’s previous chips have been used in smartphones and tablets, which have significantly smaller batteries.

During Apple’s launch event on Tuesday, the company emphasized how it mainly evaluates chips on performance per watt, not raw performance.

On the entry-level MacBook Air, Apple says that it can manage 15 hours of web browsing on one charge, nearly 30% more than the advertised 10 to 11 hour battery life of the previous Intel-based model.

The new Macs also work more like phones or tablets, Apple said, with features like the ability to wake up from sleep instantly. The new M1 Macs can even run iPhone apps, if the developer takes a few steps to make them available on Apple’s App Store.

However, analysts warn that Apple’s performance claims, like that it is faster than comparable PCs, will need to be tested once the computers hit shelves next week.

“Performance of the new M1 chip is nearly impossible to gauge as the company didn’t provide any detailed substantiation around any of the performance claims made,” Moor Insights founder Patrick Moorhead said.

Apple did not stop selling Intel laptops on Tuesday, and its highest-end laptops are still Intel-based, suggesting that there are still performance advantages to some Intel chips.

U.S. prepares for worst four months of the pandemic as it stares down the ‘darkest’ days yet

PUBLISHED WED, NOV 11 20208:42 AM ESTUPDATED THU, NOV 12 20209:22 AM EST

Berkeley Lovelace Jr.@BERKELEYJR

KEY POINTS

- Epidemiologists, scientists and public health officials are warning that the United States has yet to see the most difficult days of the coronavirus outbreak.

- “We have not even come close to the peak, and as such, our hospitals are now being overrun,” said Dr. Michael Osterholm, a member of President-elect Joe Biden’s Covid task force.

- The upcoming holidays set the country up for a lethal winter and spring since hospitalizations and deaths lag newly diagnosed infections by a few weeks.

Ohio has had an “unprecedented spike” in Covid-19 hospital admissions. ICU beds in Tulsa, Oklahoma, are full. North Dakota’s hospitals don’t have enough doctors and nurses. And hospital administrators in Iowa are warning that they are approaching their limits.

The U.S. is heading for a “dark winter,” a “Covid hell,” the “darkest days of the pandemic.” However you describe it, the next few months of the coronavirus pandemic will be unlike anything the nation has seen yet.

Even as drug manufacturers make progress on a vaccine and treatments, epidemiologists, scientists and public health officials are warning that the United States has yet to see the most difficult days of the outbreak. Those are projected to come over the next three to four months.

“What America has to understand is that we are about to enter Covid hell,” Dr. Michael Osterholm, director of the Center of Infectious Disease Research and Policy at the University of Minnesota, said in an interview with CNBC’s “Squawk Alley” on Monday, hours after Pfizer announced promising news about its vaccine. “It is happening.”

Osterholm, who was appointed to President-elect Joe Biden’s coronavirus advisory board, correctly predicted months ago that there would be an “astronomical” increase in new cases after Labor Day. He now says “this number is going to continue to increase substantially.”

“We have not even come close to the peak and, as such, our hospitals are now being overrun,” Osterholm said. “The next three to four months are going to be, by far, the darkest of the pandemic.”

The U.S. is now reporting an average of more than 120,000 new Covid-19 cases a day — a staggering number that sets a deadly tone heading into the holiday season, medical experts say. The sheer volume of new cases cannot be explained by increased testing alone, because daily new cases are outpacing the rise in testing, health officials acknowledge.

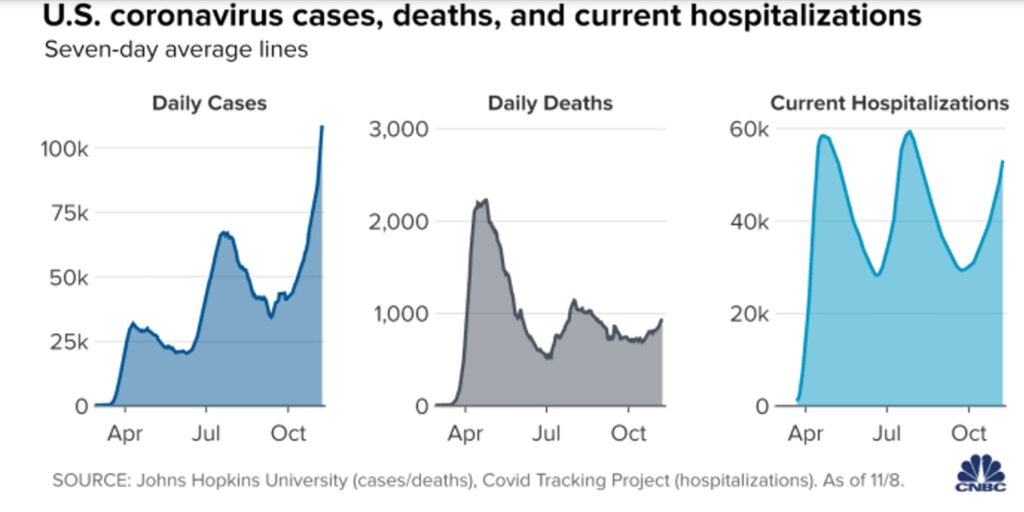

Cases are also rising at a faster pace, with a roughly 33% jump in the seven-day average over the past week, according to a CNBC analysis of data compiled by Johns Hopkins University. The number of people currently hospitalized across the U.S. also stands at record 61,964, according to the COVID Tracking Project, which is run by journalists at The Atlantic.

‘Worst days ahead’

The approaching holidays set the country up for a lethal winter and spring since hospitalizations and deaths lag newly diagnosed infections by a few weeks, said Dr. Isaac Bogoch, an infectious disease specialist at the University of Toronto.

“The upcoming holidays of Thanksgiving, Diwali, Christmas, Hanukkah and New Year’s create the potential for innumerable super-spreading events across the country,” he said. “This has the potential to introduce and reintroduce the virus to new areas and to further exacerbate community transmission.”

More lives will be lost in December than the U.S. saw in March and April, said Ali Mokdad, a professor of global health at the Institute for Health Metrics and Evaluation at the University of Washington. The country was reporting around 20,000 to 30,000 new cases and more than 2,000 deaths a day this spring.

The Centers for Disease Control and Prevention is also warning that daily deaths are on the rise. It says “newly reported COVID-19 deaths will likely increase over the next four weeks, with 4,600 to 11,000 new deaths likely to be reported in the week ending” Nov. 28.

Based on current trends, Mokdad’s forecasting team, which has provided Covid-19 projections for the White House, estimates that the country will see more than 2,100 Covid deaths per day this winter. That figure could change if more restrictions are put in place to curb the spread of the virus or if state and local officials ease up.

‘Take over hospitals’

“Unfortunately, the worst days are ahead of us,” Mokdad said. “We are starting from a worse position, because we didn’t do a good job in the summer to bring it down and then we see right now a rapid rise in cases, so the surge of fall and winter has started. That’s why the worst days are ahead of us.”

To be sure, the U.S. has more tools to fight the virus than ever before. Pfizer and BioNTech released early data from their late-stage vaccine trial on Monday that indicated it was more than 90% effective. If authorized, the vaccine could be available to a limited number of people as early as December, said Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases. Pfizer said it can make enough doses of its two-dose vaccine to immunize about 25 million out of roughly 331 million Americans before the end of the year.

Doctors also have an arsenal of treatments that weren’t available at the outset of the outbreak. Treatments like the antiviral drug remdesivir and the steroid dexamethasone have helped hasten recovery and save lives. But the outbreak today looks starkly different from what the U.S. was dealing with earlier in the pandemic. Cases are running so high that some hospitals are already operating at max capacity and setting up Covid-19 tents in Illinois, Texas and other parts of the country to handle the surge in patients.

“This virus is now spread across the entire United States. When the first surge came, it was localized to the Northeast in New England, New York, New Jersey. In the second wave, it was the South and Southwest,” said Dr. Megan Ranney, an emergency physician at Brown University. “But now we’re seeing it literally take over hospitals across the country.”

‘Bad in a different way’

In the spring and summer, the federal government marshaled scarce resources like personal protective equipment, ventilators and trained health workers to hard-hit areas New York, New Jersey, Florida and Texas. But now, with so many communities in dire straits, it won’t be easy to reallocate those resources, Ranney said.

The virus is quickly overwhelming parts of the country that weren’t hit all that hard this spring and summer, said Christine Petersen, an epidemiologist at the University of Iowa. In many rural states like Iowa, she said, hospitals and health workers aren’t equipped to handle a surge in Covid patients as large medical centers in bigger cities were earlier in the crisis.

While the medical community knows a lot more about how to effectively treat the disease than before, there’s still a steep learning curve for places that haven’t seen widespread outbreaks and don’t have a lot of experience treating the disease.

“That doesn’t mean that the doctor in northeastern Iowa has seen this disease. They’re seeing it now,” Petersen said.

She also said the outbreak is “going to be bad,” but in a different way than it was this spring in New York City.

“Instead of having these pictures of morgue trucks and densely populated areas with a lot of patients, this is going to be lots of smaller places,” she said. “So it’s going to be harder to see the obvious impact because it’s so spread out in these really small town hospitals, but they’re really going to be struggling.”

Exhaustion

New York City in the spring and Arizona in the summer got a lot of help from travel nurses and doctors who volunteered to treat patients in the hot spots. But with the virus surging everywhere across the country, there may not be a lot of idle medical workers ready to deploy to hard hit areas, said Dr. Lewis Kaplan, president of Society of Critical Care Medicine and a surgeon at the hospital of the University of Pennsylvania.

Health workers may be the next scarce resource in the pandemic, and many of the most experienced doctors and nurses are already exhausted, Kaplan said. He worries about whether they can keep up with the pace of the virus.

“We rely on having those seasoned individuals when we stand up novel ICUs again and have people who don’t normally work in the ICU work alongside them. The floor nurse is now going to provide critical care under the guidance of the seasoned ICU nurse,” he said. “What happens when that seasoned ICU nurse says, ‘I’ve had enough.’ That’s a potentially very scary future.”

Dr. Angela Hewlett, an infectious diseases specialist at the University of Nebraska Medical Center, said her hospital is “under a significant degree of stress” with beds filling up as fast as they are open. The hospital recently cleared an entire floor with 48 beds for Covid patients. That hit capacity in a matter of days, she said.

“This is not like a natural disaster where you can have this influx of health-care workers coming from all over to help manage this. Everyone is dealing with surges of patients with Covid-19, particularly here in the Midwest,” she said. “And so there’s not an emergency crew of health-care workers that will swoop down and come in and save us.”

Morgan Stanley names internet companies that will be hit by China’s proposed anti-monopoly rules

PUBLISHED WED, NOV 11 20209:36 PM ESTUPDATED THU, NOV 12 202012:36 AM EST

KEY POINTS

- China’s draft anti-monopoly rules will likely hit the country’s major internet companies, which were already fighting off rivals that were taking away chunks of their market share, Morgan Stanley said in a report.

- China’s bureau for regulating monopolies — the State Administration for Market Regulation (SAMR) — issued draft rules on Tuesday to stop anti-competitive practices in the internet space.

- Shares of major Chinese internet names including Alibaba, Tencent and Meituan fell sharply on Wednesday.

SINGAPORE — China has drafted a slew of new anti-monopoly laws that will likely hit the country’s major internet companies, says Morgan Stanley.

It comes as the competitive landscape in China intensifies and tech giants continue to fend off new rivals that are taking away chunks of their market share, according to a report by the investment bank.

China’s bureau for regulating monopolies — the State Administration for Market Regulation (SAMR) — issued draft rules on Tuesday to stop anti-competitive practices in the internet sector. It said the laws are aimed at protecting fair competition in the market and safeguarding consumers’ interest.

SAMR is seeking public feedback on the draft rules until Nov. 30.

“We believe potential implementation of the new antitrust regulations has negative implications for major Internet companies with dominant positions across segments,” Morgan Stanley analysts said in a note on Wednesday.

It is likely due to rising risks of competition, lower barriers to entry, and higher hurdles for industry consolidation from future mergers and acquisitions.

“That said, competition has already intensified in recent years, with ‘incumbents’ (e.g., Alibaba, Tencent) losing market share to ‘disruptors’ (e.g. Pinduoduo, Bytedance), so the consequences will likely be less meaningful given reduced dominance across segments compared to a few years ago,” they added.

Chinese tech shares took a beating on Wednesday, a day after the draft regulations were announced, and the biggest tech names saw $280 billion wiped off their market value within days.

Here are five internet companies that will be negatively impacted by China’s potential anti-trust laws, according to Morgan Stanley.

Alibaba

There have been periodic complaints of merchant exclusivity on e-commerce platforms, including on Alibaba’s Tmall platform. The Financial Times reported earlier this year that some merchants were told they would be pushed off Tmall if they used a rival platform — a local home appliance manufacturer even sued Alibaba over it, according to a 2019 report from Chinese media Caixin.

But the new proposed regulations will not have as much impact on the e-commerce giant today as it would have had years ago, Morgan Stanley pointed out.

“This is because of the already fierce competitive environment in e-commerce nowadays,” the analysts said, adding that some of Alibaba’s market share have already been chipped away by competitors.

The draft law mentions the use of subsidies and discounts may potentially deter fair competition, which could affect “Alibaba’s promotional activities, although to what extent such subsidies will be regarded as a violation of antitrust rules remains uncertain,” the analysts said.

Tencent

Tencent has dominant presence in areas like online gaming, social network, online music, video and online reading through China Literature.

The company’s “focus on online entertainment involves a wide range of content innovation and can be less relevant to antitrust scrutiny,” the Morgan Stanley analysts said. “Thus, the impact on Tencent could be relatively manageable except for the potential misuse of user data across platforms, or blocking competitors access to the WeChat ecosystem.”

China’s most popular messaging app WeChat — which has over 1.15 billion monthly active users — is owned by Tencent. Though the app started out as a messaging service, users can now do everything on it from making payments to hailing a ride, or even booking flights.

Rising competition from video-sharing app ByteDance has reduced the amount of time users spend on Tencent’s platforms, which could also alleviate “certain concerns over Tencent capturing a majority of user mind share in China,” the analysts wrote.

Still, the new rules could create more hurdles for Tencent when it comes to future mergers and acquisitions — “an effective method” for the company to build up its ecosystem of various services and platforms.

Pinduoduo

Pinduoduo is the fast-growing challenger to Alibaba and JD.com in China’s hypercompetitive online shopping market.

“Should the rules eventually limit the use of subsidies provided by platforms, we think that the potential limitation will affect Pinduoduo in particular, because ‘Rmb10bn subsidy’ is one of its central strategies to drive user engagement,” the Morgan Stanley analysts said.

Pinduoduo said last year that it launched a 10-billion-yuan ($1.5 billion) initiative with sellers and gave out coupons and subsidies to customers on its platform.

JD.com

JD.com, another major e-commerce name in China, also employs a subsidy plan as part of its promotional activities but it does not play as crucial a role for the company as it does for Pinduoduo, according to the analysts.

Still, they said, the new anti-monopoly rules could reduce JD.com’s bargaining power over its suppliers in the future.

Meituan

Meituan is an online platform with services ranging from food delivery to ticketing.

The company solidified market share in the food delivery business, competing against Alibaba-owned Ele.me, by capturing a higher portion of exclusive restaurants on its platform, according to the Morgan Stanley analysts.

“We note the potential implementation of new antitrust regulations could also weigh on Meituan’s take rate charged to merchants,” they said, adding, “On the other hand, Meituan has been shifting gears to focus on promoting a food delivery membership program to cultivate user behavior and raise order frequency.”

With fewer restaurants in China opting for platform exclusivity, it could mitigate certain concerns about the new antitrust regulations, according to the analysts.

Correction: This article has been updated to reflect the new name for Meituan, which was renamed in 2020.

What a Democrat-controlled SEC might look like and what it would mean for markets

PUBLISHED WED, NOV 11 202012:24 PM ESTUPDATED THU, NOV 12 202011:28 AM EST

What would a Democrat-controlled Securities and Exchange Commission look like? It’s early, but speculation is already raging on Wall Street.

Who will be SEC commissioner? Gary Gensler, who aggressively implemented the Dodd-Frank Act when he was the Obama administration’s chairman of the Commodities Futures Trading Commission, is in charge of the Biden transition team’s review group of the Federal Reserve and banking and securities regulators, which would include the SEC.

There are no obvious choices, but given that Democrats are historically aggressive on regulation to protect consumers and enforcement of those regulations, some feel it’s likely that a prosecutor-type would get serious consideration.

“Inspections and enforcement actions will likely increase, because they have not been very high under the current administration,” said David Franasiak, an attorney with Williams & Jensen specializing in corporate law.

(Note: according to the SEC, cases brought from 2017-2020 were about the same as those brought from 2013-2016, and examinations, on average, were greater during the 2017-2019 period than 2015-2016.)

Nick Morgan, a partner at Paul Hastings LLP and a former SEC senior trial counsel, told Law360 that “given Preet Bharara’s history with President Trump, he seems a likely candidate.” President Donald Trump fired Bharara as U.S. attorney in Manhattan in 2017 when he refused to resign.

Others agree that an “aggressive” candidate stood a good chance of approval. “Maxine Waters is in charge of the House Financial Services Committee, and they (the Democrats) will look to her for regulatory guidance,” said Pat Healy of Issuer Advisory Network. “I think she will be a swing vote in who gets appointed.”

What would the SEC priorities be?

“You will see more climate-related and ESG related policies,” said Jim Angel, associate professor of finance at Georgetown University. “They will look at ESG disclosures, like climate and risk disclosure — how much carbon and greenhouse chemicals are you putting into the air?”

Indeed, expansion and standardization of environmental, social and governance principles was the most commonly referenced priority when I spoke with SEC watchers. More involvement in corporate governance, climate change, worker pay, worker treatment, diversity and health care.

SEC Commissioner Allison Herren-Lee, a Democrat who could be interim chair as a new chair is considered, has recently argued that the agency should consider standardized reporting by public companies and investment funds regarding climate risk. What does the SEC have to do with climate risk? In a recent speech to the Practicing Law Institute, Herren-Lee argued that the SEC is tasked with protecting investors, facilitating capital formation and maintaining fair, orderly and efficient markets.

“Broadly, we must ensure that we work with fellow regulators to understand and, where appropriate, address systemic risks to our economy posed by climate change,” she said. “To assess systemic risk, we need complete, accurate, and reliable information about those risks,” which she said starts with public company disclosure.

She went on to encourage the development of more standardized disclosures around ESG in general.

To many observers the requirement to “disclose” risks around climate change masks a broader agenda: “What is the goal here? Is it to get companies to disclose environmental risk, or is the goal to use disclosure requirements to require companies to take climate action?” one longtime SEC observer who asked to remain anonymous told me.

Another longtime observer, who also asked to remain anonymous, echoed that sentiment: “Disclosure is used as the hook. The way this is advanced is, ‘Oh, it’s just disclosure.’ And then if you don’t have a policy around, say, climate change or diversity, it becomes a shaming exercise for companies that don’t have procedures that fit with a certain line of thinking.”

“These are matters not germane to the SEC,” the same person went on to say. “They are trying to bootstrap social agenda items into investor protection and disclosure, but it’s not the SEC’s role to solve these problems.”

A bigger push for public markets?

The SEC has recently moved to make it easier for some people to invest in private companies. Tyler Gellasch, executive director of Healthy Markets, said the Democrats will likely try to pull more companies — particularly large ones that have remained private for years — into the public markets.

“The SEC has been aggressive in expanding the pool of private markets, making it easier to raise money,” he said. “A huge part of the market has gone dark, in private equity hands. The Democrats would likely try to reverse those trends. They would say once you are a big enough company, you should be a public company. You can’t go through an endless round of fundraising to stay private.”

Regulation Best Interest

Regulation Best Interest, known as Reg BI, was a 2019 rule that required broker-dealers to recommend only financial products that were in their clients’ “best interest” but not require that they act as fiduciaries.

That did not sit well with Democrats. “They don’t describe a fiduciary standard, but they would likely make everyone including brokers a fiduciary,” Franasiak said.

“The big fight is likely over compensation schemes,” Angel said. “The pro-fiduciary crowd [the Democrats] basically wanted to eliminate sales commissions, and said advice should either be charged by the hour, or as a percentage of assets under management. The anti-fiduciary crowd didn’t want to change anything, and realized that any new regulations would increase their compliance costs.”

Shareholder proposal rule

The SEC also recently adopted new rules for shareholder proposals. Under the old rule, a shareholder was required to have continuously held for one year at least $2,000 in market value, or 1% of a company’s voting securities, to be for inclusion in the proxy materials.

The new rule requires a shareholder to have continuously held voting securities with the following market values for these periods:

- $2,000 for at least three years;

- $15,000 for at least two years;

- $25,000 for at least one year.

“The shareholder proposal rule is right up there with some of the regulations the Democrats would like to roll back,” said Chris Nagy, president and founder of KOR Trading, noting that both Democratic commissioners dissented from that proposal.

Don’t expect quick changes

Those expecting quick movement on a new chairperson are likely to be disappointed, Nagy said.

“Don’t look for immediate appointment of a new chairman,” Nagy said. “The Republicans will not want to have a quick nomination early. Right now [assuming Chairman Clayton resigns] you have a 2-2 commission, so if you had a Democratic chairperson appointed, you would have a 3-2 SEC commission, with Democrats in the majority. The Republicans want to drag that out as long as possible.”

Biden Covid advisor says U.S. lockdown of 4 to 6 weeks could control pandemic and revive economy

PUBLISHED WED, NOV 11 20204:23 PM ESTUPDATED FRI, NOV 13 20208:15 PM EST

KEY POINTS

- Dr. Michael Osterholm, a coronavirus advisor to President-elect Joe Biden, said a nationwide lockdown would help bring the virus under control in the U.S.

- He said the government could borrow enough money to pay for a package that would cover lost income for individuals and governments during a shutdown.

- “We could really watch ourselves cruising into the vaccine availability in the first and second quarter of next year while bringing back the economy long before that,” he said.

Shutting down businesses and paying people for lost wages for four to six weeks could help keep the coronavirus pandemic in check and get the economy on track until a vaccine is approved and distributed, said Dr. Michael Osterholm, a coronavirus advisor to President-elect Joe Biden.

Osterholm, who serves as director of the Center of Infectious Disease Research and Policy at the University of Minnesota, said earlier this week that the country is headed toward “Covid hell.” Cases are rising as more people grow tired of wearing masks and social distancing, suffering from so-called “pandemic fatigue,” he said Wednesday. Colder weather is also driving people indoors, where the virus can spread more easily.

A nationwide lockdown would drive the number of new cases and hospitalizations down to manageable levels while the world awaits a vaccine, he told Yahoo Finance on Wednesday.

“We could pay for a package right now to cover all of the wages, lost wages for individual workers, for losses to small companies, to medium-sized companies or city, state, county governments. We could do all of that,” he said. “If we did that, then we could lock down for four to six weeks.”

In an interview with NBC News on Thursday, Osterholm clarified his comments, saying “it was not a recommendation. I have never made this recommendation to Biden’s group. We’ve never talked about it.”

“My only point was if we are going to keep making restrictions state-by-state, there is no compensation for the businesses that are being impacted,” he added. “What we’re doing right now is not working.”

A Biden transition official told NBC News that a shutdown “is not in line with the president-elect’s thinking.”

Osterholm was appointed to Biden’s 12-member Covid “advisory board” on Monday. The panel of advisors is co-chaired by former Surgeon General Vivek Murthy, former Food and Drug Administration Commissioner David Kessler and Dr. Marcella Nunez-Smith of Yale University. Other task force members include Dr. Atul Gawande, a professor of surgery and health policy at Harvard, and Dr. Rick Bright, the vaccine expert and whistleblower who resigned his post with the Trump administration last month.

A representative for Biden did not respond to CNBC’s request for comment.

Osterholm on Wednesday referenced an August op-ed he wrote with Minneapolis Federal Reserve President Neel Kashkari in which the two argued for more restrictive and uniform lockdowns across the nation.

“The problem with the March-to-May lockdown was that it was not uniformly stringent across the country. For example, Minnesota deemed 78 percent of its workers essential,” they wrote in The New York Times. “To be effective, the lockdown has to be as comprehensive and strict as possible.”

On Wednesday, Osterholm said such a lockdown would help the country bring the virus under control, “like they did in New Zealand and Australia.” Epidemiologists have repeatedly pointed to New Zealand, Australia and parts of Asia that have brought the number of daily new cases to under 10 as an example of how to contain the virus.

“We could really watch ourselves cruising into the vaccine availability in the first and scond quarter of next year while bringing back the economy long before that,” he said Wednesday.

On the current trajectory, Osterholm said the U.S. is headed for dark days before a vaccine becomes available. He said health-care systems across the country are already overwhelmed in places such as El Paso, Texas, where local officials have already closed businesses and the federal government is sending resources to handle a surge in deaths caused by Covid-19.

Osterholm said the country needs leadership. The president-elect is up to the task of providing that leadership, Osterholm said, adding that it could also come from local and state officials or those in the medical community. He referenced the fireside chats broadcast over radio during former President Franklin D. Roosevelt’s terms, through which Roosevelt addressed the country on issues ranging from the Great Depression to World War II.

“People don’t want to hear that El Paso isn’t an isolated event. El Paso, in many instances, will become the norm,” he said. “I think that the message is: How do we get through this? We need FDR moments right now. We need fireside chats. We need somebody to tell America, ‘This is what in the hell is going to happen.’”

HI Financial Services Mid-Week 06-24-2014