HI Market View Commentary 11-08-2021

From 60-40 Bonds to Buffer ETFs: An all-weather strategy for volatile markets

Thursday, November 11, 2021 | 2:00 PM Eastern Standard Time

Funds that offer buffers against market declines are becoming more popular among investors. But what are they and how do they work? How do they fit into a 60/40 allocation? Learn all about them from Douglas Yones, Head of Exchange Traded Products for the New York Stock Exchange, Bruce Bond and John Southard, co-founders of Innovator, the creator of Buffer ETFsTM and other Defined Outcome ETFsTM.

Learning Objective:

Learn a potential solution enabling clients to reduce downside risk through a built-in buffer, but also maintain the upside potential of the market. The goal is for the investor to be exposed, but stay “out of the fray” and focus on long-term financial goals, rather than short-term noise.

Content Outline:

- Market Perspective

- What is Defined Outcome Investing?

- How does it work?

- Where does it fit in portfolios?

Here at HI we pick the most likely, fundamentally sound stocks that through their PE Ratios can double in two years

IF we are wrong we add the long put as protection when stocks are most likely (83%) can move 10% or more in 30 days

What we also gives us the opportunity to dollar cost average without having to bug you for more money

https://www.briefing.com/the-big-picture

Last Updated: 29-Oct-21 14:35 ET

A pathetic situation is unfolding in the Treasury market

The Treasury market is a bit of a riddle, wrapped in a mystery, inside an enigma these days. We say that knowing that there has been a rampant repetition from corporate America about supply chain pressures, rising input costs, labor shortages, and price increases to help offset the higher costs of doing business.

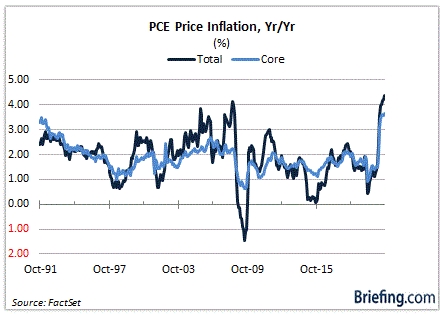

We learned this morning, too, that the PCE Price Index and core PCE Price Index, which excludes food and energy, sit at a 30-year high, and that, according to the University of Michigan Index of Consumer Sentiment, there hasn’t been as much uncertainty about the year-ahead inflation rate as there is now among consumers in nearly 40 years.

In brief, there is a lot of inflation, a lot of attention on inflation pressures, and elevated inflation expectations yet yields on longer duration Treasury securities are… falling?

The Takeaway

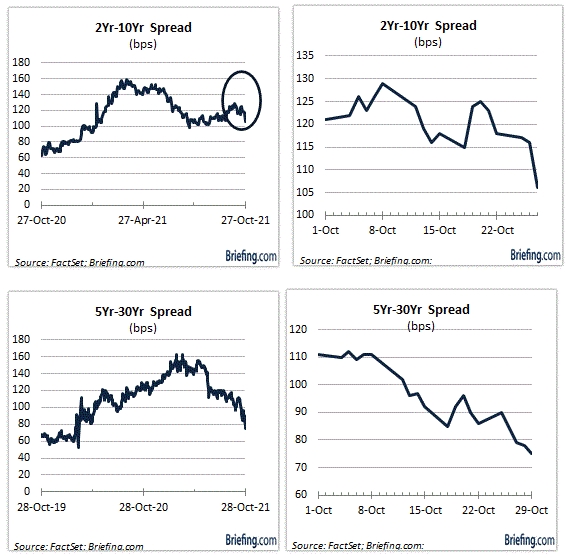

The yield on the 10-yr note has dropped nine basis points this week to 1.56% while the yield on the 30-yr bond has dropped 14 basis points to 1.95%.

At the same time, the yield on the 2-yr note has increased four basis points to 0.50%, but it had been up as many as 10 basis points to 0.56%.

The takeaway for market participants is that the yield curve is flattening, with the 2-yr note yield up 21 basis points this month and the 10-yr note yield up just four basis points. Similarly, the yield on the 5-yr note has risen 21 basis points this month to 1.20% while the yield on the 30-yr bond has dropped 14 basis points, leading to the narrowest spread for that pair since March 2020.

This flattening action is typically associated with an expectation for slower growth, if not an actual growth shock.

It is running counter to the narrative that Q4 GDP growth should accelerate from the tepid 2.0% growth in Q3, as the headwinds of the Delta variant dissipate and transportation bottlenecks, which have snarled supply chains and crimped sales prospects, become less bottlenecked.

However, with yields on shorter-dated securities rising faster than yields on longer-dated securities as inflation pressures persist, there is conjecture that the Treasury market is sniffing out a policy mistake by the Fed.

What would that policy mistake be? Tightening policy too aggressively to rein in inflation and choking off growth prospects in the process.

What It All Means

Currently, the CME FedWatch Tool shows a heightened probability (i.e., greater than 50%) of at least two hikes in the fed funds rate in the latter half of 2022. Assuming any rate hike would come in 25 basis point increments, that would leave the target range for the fed funds rate at 0.50-0.75% by the end of 2022.

It seems utterly ridiculous that there is such a nervous stir about growth prospects getting squished with a policy rate below 1.00%.

If anything, it goes to show how hooked the market has gotten on a policy rate at the zero bound if it thinks 50 basis points of tightening is going to sink the economy in a way that also takes care of the inflation pressures.

It’s a pathetic situation, but it is the reality of a market that has been awash in liquidity and has looked a gift horse in the mouth too long.

If 50 basis points of tightening off the zero bound ultimately turns into a policy mistake, as some think it might, then the neutral rate will be starkly lower for longer, and savers — especially those unable or unwilling to commit to the stock market — will continue to be penalized with pathetically paltry interest rates for a long time.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of November 8)

| https://go.ycharts.com/weekly-pulse |

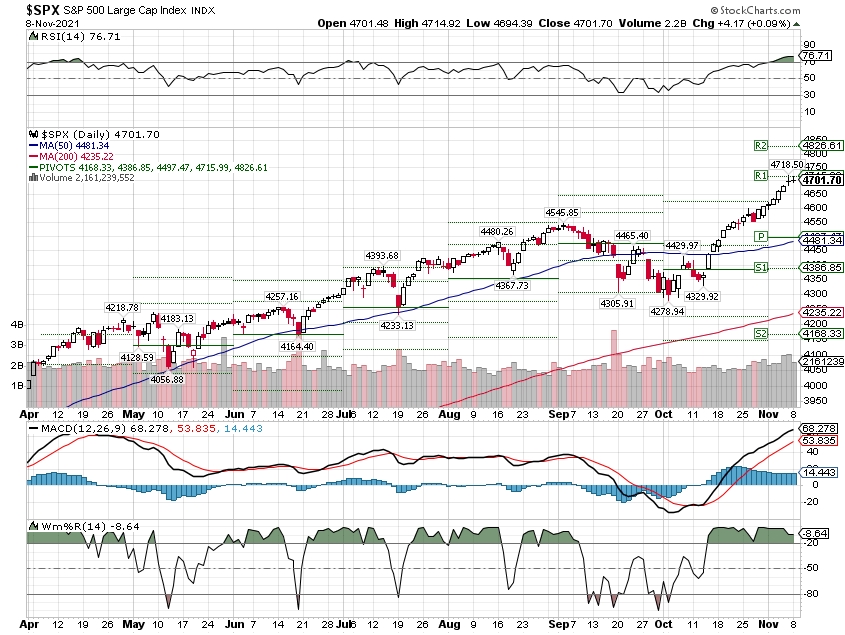

| Market Recap WEEK OF NOV. 1 THROUGH NOV. 5, 2021 The S&P 500 index rose 2% in the first week of November, setting new highs for the seventh session in a row as Q3 earnings continued coming in above analysts’ estimates while October jobs data also topped expectations. The market benchmark ended Friday’s session at 4,697.53, up from last Friday’s closing level of 4,605.38 and marking its seventh consecutive record closing high in a row. The index is now up 25% for the year to date. The S&P 500 also reached a new intraday high Friday at 4,718.50. The winning streak has come on better-than-expected Q3 results. While supply-chain challenges, the continuation of the COVID-19 pandemic and inflation concerns have persisted, in many cases these issues haven’t dented profits by as much as analysts and investors had feared. Investors also received encouraging data on October employment last week. Wednesday, ADP data on the private sector showed a larger-than-expected increase in jobs last month. Thursday, the Labor Department reported a lower-than-expected number of jobless claims for last week that also reflected a fifth-consecutive decline in weekly jobless claims. Friday, the Labor Department’s monthly report for October showed nonfarm payrolls rose by 531,000, which was more than the 450,000 jobs increase expected in a survey compiled by Bloomberg, while September payrolls saw a large upward revision to a 312,000 increase. The unemployment rate fell to 4.6% in October from 4.8% in September, compared with the 4.7% rate expected. Also in focus last week, the Federal Reserve’s Federal Open Markets Committee announced that it would start tapering its bond-buying support program. The move had been widely anticipated, while the FOMC kept its benchmark lending rate near zero. By sector, the consumer discretionary sector had the largest percentage increase of the week, up 5%, followed by a 3.3% rise in technology and a 3.2% boost in materials. There were just two sectors in the red for the week: Health care slipped 0.7% while financials edged down 0.6%. The consumer discretionary sector’s gainers included shares of Under Armour (UAA), which raised its 2021 outlook for sales and earnings as demand for the athletics apparel brand was better than the company expected in the most recent period, driving a jump in year-on-year results. Shares jumped 14% on the week. In technology, shares of Arista Networks (ANET) soared 30% as the networking technology company reported Q3 adjusted earnings per share and revenue above year-earlier results and analysts’ expectations and forecast Q4 revenue ahead of the Street consensus estimate at the time. In the materials sector, DuPont (DD) shares climbed 16% as the technology-based materials company reported Q3 adjusted EPS and revenue above year-earlier results and analysts’ mean estimates and announced plans to acquire engineered materials company Rogers Corp. (ROG) for $5.2 billion. DuPont said the deal should improve its standing in advanced materials used in electric vehicles, advanced driver assistance systems, 5G telecommunications and clean energy. Shares of Rogers surged 34%. On the downside in health care, Moderna (MRNA) shares fell as the COVID-19 vaccine maker reported Q3 sales and earnings that missed expectations and slashed its product sales projections for 2021. Moderna’s stock fell further on Friday after Pfizer (PFE) said its antiviral drug Paxlovid reduced the likelihood of death or hospitalization from the illness by 89%. Moderna’s shares ended the week down 31%. Next week, the earnings calendar features Zynga (ZNGA), PayPal Holdings (PYPL), D.R. Horton (DHI), Wendy’s (WEN) and Walt Disney (DIS), among other companies reporting quarterly results. Economic data next week are expected to include the October consumer price index and producer price index as well as a preliminary reading on consumer sentiment for November. Provided by MT Newswires |

Earnings Dates

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end November 2021?

11-08-2021 +2.5%

11-01-2021 +2.5%

Earnings:

Mon: MCFE, VAC, DDD, PYPL, TME, ZNGA, AMC

Tues: ADT, DHI, DASH, WYNN, PRPL

Wed: WEN, BZH, BYND, DIS

Thur: TPR, RMAX

Fri:

Econ Reports:

Mon:

Tues: PPI, Core PPI, NFIB Small Business Optimism

Wed: MBA, CPI, Core CPI, Wholesale Inventories, Treasury Budget

Thur: Initial Claims, Continuing Claims,

Fri: Michigan Sentiment, JOLTS

How am I looking to trade?

Long put protection has been added and getting ready for earnings

BIDU – 11/16

DIS – 11/10 AMC

COST – 12/09

TGT – 11/17 BMO

MU- 12/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Warren Buffett’s equity portfolio is tied up in just 4 stocks. Here’s what they are

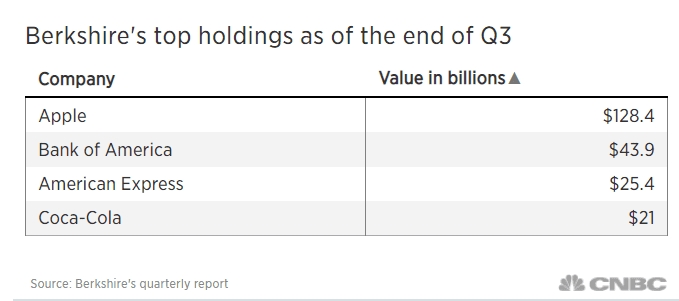

Berkshire Hathaway reported another strong quarter on Saturday, and Warren Buffett revealed that about 70% of its equity portfolio was tied up in just four names.

Here’s a look at these high-conviction bets from the legendary investor.

Apple was still Berkshire’s biggest common stock investment as of the end of the third quarter with a market value of $128.4 billion. Buffett first bought Apple in 2016.

The tech giant has gained a modest 14% this year after an 80% rally in 2020 as investors embraced pandemic plays and the safety of the megacap giant.

Apple reported disappointing quarterly revenue last week amid larger-than-expected supply constraints on iPhones, iPads, and Macs.

American Express and Bank of America were among Berkshire’s biggest bets at the end of September. Other than these two financial bets, Berkshire exited a couple big positions in the sector recently, including JPMorgan Chase, Wells Fargo and PNC Financial.

Buffett’s longtime bet Coca-Cola had a market value of $21 billion at the end of the third quarter. The stock underperformed the broader market significantly this year, however, up only 3.7%. But Coca-Cola last week reported stronger-than-expected earnings and sales in the third quarter and hiked its annual outlook.

The return from Berkshire’s equity investments slowed down last quarter, totaling $3.8 billion compared to a $24.8 billion gain a year ago. Buffett stressed that investors shouldn’t focus on the quarterly changes in its investment gains or losses, calling them “usually meaningless.”

‘This is going to be one of the best Christmas seasons ever,’ market bull Ed Yardeni says

Stephanie Landsman@STEPHLANDSMAN

Long-time market bull Ed Yardeni is delivering a dose of optimism into year-end.

Yardeni, who’s known for running investment strategy for Prudential and Deutsche Bank, expects the holidays to boost stocks deeper into record territory.

“This is going to be one of the best Christmas seasons ever,” the president of Yardeni Research told CNBC’s “Trading Nation” on Friday. “People are coming out of this pandemic still mentally, and they need to spend. And, I think they realize they have to spend now because if you get too close to Christmas, a lot of the merchandise may be out of stock.”

He expects a willingness to spend despite the inflation spike.

“Consumer confidence has been weak, and inflation has been eating into the wage gains,” said Yardeni. “But the reality is some of the lowest income workers in America are seeing some of the best wage increases they’ve had maybe ever.”

He speculates higher income workers with robust savings are adding to consumers’ capacity to offset inflation pressures.

Yardeni’s base case is stocks will continue to rise, and price pressures will ease once supply chain troubles get worked out

“Companies are doing a great job of hammering away and getting at costs and keeping profit margins at all-time record highs,” he said. “It’s very, very impressive.”

The Dow, S&P 500 and tech-heavy Nasdaq closed the week at record highs. The S&P 500 is at 4,697.53, up 25% so far this year. It’s also 2% away from Yardeni’s year-end target.

‘The market is moving pretty quick here’

“I have a 4,800 for the S&P 500 by the end of this year or the end of next week. I’m working on the timing. The market is moving pretty quick here, and then 5,200 by the end of next year,” said Yardeni, who’s also author of the new book “In Praise of Profits!.”

Yardeni’s latest positivity comes 17 months after his “ray of sunshine” market call on “Trading Nation.” In the midst of Covid-19 lockdowns in Spring 2020, he predicted a “pretty broad bull market” was ahead.

Now, he suggests the biggest hardships associated with the pandemic are behind the United States.

“Enough people have been vaccinated that the economy is performing just fine. It’s really not seeing that the pandemic is getting in the way of economic growth,” said Yardeni. “It’s probably another reason why we’re having yet another move to record highs in the market.”

Yardeni continues to recommend overweighting stocks. Over the next 12 months, he likes the value mid and small cap stocks offer to investors. He also lists technology, financials and energy as his top picks within the S&P 500.

“We’re looking at a continuation of the bull market,” Yardeni said.

Ford attracts younger and more female buyers with new $20,000 Maverick pickup

KEY POINTS

- Ford says the 2022 Maverick – about the length of a Toyota full-size sedan but far cheaper – is already succeeding in attracting new, younger and female buyers to the company.

- About a quarter of buyers are female compared to nearly 90% being male for the overall truck market, Ford said.

- A quarter also are between the ages of 18 and 35 – double the industry average for that age group.

Rebecca and Shane Phillips are accustomed to getting looks when driving around California in their 1985 Mercury Colony Park or 1978 Lincoln Continental with longhorns on the front. But the newest head turner in their collection has been somewhat unexpected.

“The looks we’re getting are pretty neat. Everybody I’ve run into they’re like, ‘I’ve never seen something like this,’” said Rebecca, 31. “It’s always fun to drive by and somebody gets surprised about what it actually is and what it looks like.”

It’s not a classic vehicle, sports car or electric vehicle. It’s the new 2022 Ford Maverick, a small pickup truck that recently went on sale as the automaker’s least expensive vehicle in its entire lineup of cars and trucks at about $20,000.

While the vehicle has only been on sale for slightly over a month, Ford Motor says the compact truck – about the length of a Toyota full-size sedan but priced at far less than that and many other smaller cars – is already succeeding in attracting new, younger and more cost-conscious buyers like the Phillips’.

“We really are seeing a new customer coming into Ford. And that was really our ambition with Maverick was to appeal to a younger, more diverse customer. And we’re certainly seeing that,” Todd Eckert, Ford truck marketing manager, told CNBC.

Ford sold more than 4,100 Mavericks during the vehicle’s first full month of sales in October. Eckert said the company will continue to ramp-up production of the truck at the automaker’s Hermosillo plant in Mexico.

Non-truck people

The importance of Maverick isn’t just about sales, but in attracting new customers to Ford. It may act as a gateway vehicle for customers to step into larger, pricier Ford pickups such as the midsize Ranger and full-size F-150.

Early Maverick buyers are skewing younger and more female than the traditionally male-dominated truck market, according to Ford.

Ford said a quarter of the Maverick’s buyers are women compared with 84% being male for the full-size pickups, according to J.D. Power. The company reports more than a quarter of buyers also are between 18 and 35 years old – double the industry average for that age group. The average age of a new vehicle buyer is 48, according to J.D. Power.

The Phillips’ said they aren’t “big truck people” or even new car people but they were attracted to the Maverick because of its price, features and fuel economy.

It’s a similar story for Christopher Molloy II, who purchased a Maverick as his first new vehicle in early October. He traded in a compact Chevy Cruze sedan for the pickup.

“I wasn’t first looking for a Maverick. I didn’t know it existed,” said the 23-year-old Oregonian. “I was looking for more SUV-type. I wasn’t really expecting to get a new truck because they’re so expensive until I saw the Maverick was coming out.”

Ford surprised many with the Maverick’s low price as well as its standard 2.5-liter hybrid engine that can achieve more than 40 mpg during city driving. A Maverick with an optional 2.0-liter four-cylinder turbocharged engine that gets a combined 26 mpg combined, including 30 mpg highway and 23 mpg city, starts at about $21,000.

The top vehicles Maverick buyers also look at are other small pickups such as the Toyota Tacoma and Ford Ranger as well as small crossovers and even the Honda Civic sedan, according to auto research firm Edmunds.

‘Hit the target’

The lower pricing is a welcomed change for consumers, as vehicle prices reach record highs of roughly $44,000, including a rapidly rising offering of pricey pickup trucks that can top more than $100,000.

“In 25 years of being in this business, I don’t know that I’ve seen a manufacturer bring a product out that hit the target this well,” said Derek Lee, general manager of Long McArthur Ford in Kansas. “What we are seeing in buyers is a younger buyer. We’re seeing first-time car buyers. We are having import car buyers.”

2022 Ford Maverick

Ford

The early average price customers are paying for the Maverick is $29,749, according to Cox Automotive. That includes dealers and customers selecting higher priced trims and options on the truck.

Lee said his dealership has more than 400 Mavericks on order. He said initial demand is the highest he’s seen for the store, which specializes in larger Super Duty pickups.

Keeping prices low

The Phillips’ and Molloy said dealers didn’t mark up the price on their Mavericks, even though it’s a new vehicle and inventory levels at near-record lows due to an ongoing shortage of semiconductor chips.

Some dealers, who can legally sell a car for whatever price they choose above the manufacturer’s suggested retail price, or MSRP, have been exploiting the low inventory levels and marking up vehicles thousands, if not tens of thousands of dollars, according to reports and dealer websites.

The Maverick hasn’t been completely free of markups. Lee said his dealership will not mark up a Maverick if it’s ordered by a customer, but if someone cancels their order and it goes on the dealer lot, they have been pricing them about $2,500 over MSRP.

“If a vehicle gets here and somebody turns it down, yes, we look at what the market is. We still work to be the lowest price in the market,” Lee said. “I know there’s some out there at $5,000 over, I know there’s some out there at $10,000 over. We felt like $2,500 over was a very, very fair price.”

Eckert said Ford can’t control how dealers price their vehicles, but they’ve communicated to dealers the importance of pricing for this vehicle and its target customers.

“We’ve talked about the overall proposition and who these cars buyers are and how we want to attract them,” he said. “They control markup or no markup, but we feel like affordability was one of the keys.”

House passes $1 trillion bipartisan infrastructure bill that includes transport, broadband and utility funding, sends it to Biden

KEY POINTS

- The House passed a more than $1 trillion bipartisan infrastructure bill, sending it to President Joe Biden for his signature.

- The legislation would put $550 billion in new funding into transportation, broadband and utilities.

- The bill passed after a last-minute scramble to reach a consensus between progressive and centrists on how to pass the infrastructure package and a larger Democratic social spending plan.

The House passed a more than $1 trillion bipartisan infrastructure bill late Friday, sending it to President Joe Biden’s desk in a critical step toward enacting sprawling Democratic economic plans.

The Senate approved the revamp of transportation, utilities and broadband in August. The legislation’s passage is perhaps the unified Democratic government’s most concrete achievement since it approved a $1.9 trillion coronavirus relief package in the spring.

The measure passed in a 228-206 vote. Thirteen Republicans supported it, while six Democrats voted against it. Biden could sign the bill within days.

Washington has tried and failed for years to pass a major bill to upgrade critical transportation and utility infrastructure, which has come under more pressure from extreme weather. The White House has also contended passage of the bill can help to get goods moving as supply-chain obstacles contribute to higher prices for American consumers.

The vote Friday followed a day of wrangling over how to enact the two planks of the party’s agenda. The push-and-pull exemplified party leaders’ months long struggle to get progressives and centrists — who have differing visions of the government’s role in the economy — behind the same bills.

Democrats entered the day planning to pass both the infrastructure legislation and the party’s larger $1.75 trillion social safety net and climate package. A demand from a handful of centrists to see a Congressional Budget Office estimate of the social spending plan’s budgetary effects delayed its approval. Progressives sought assurances the holdouts would support the bigger proposal if they voted for the infrastructure bill.

After hours of talks — and a Biden call into a progressive caucus meeting urging lawmakers to back the infrastructure bill — the party’s liberal wing got assurances from centrists that they would support the larger package. The social and climate plan then cleared a key procedural hurdle early Saturday morning.

Congressional Progressive Caucus Chair Rep. Pramila Jayapal, D-Wash., said the group reached a deal to back the infrastructure plan in exchange for a commitment to take up the safety-net bill “no later than the week of November 15.” A group of five centrists separately issued a statement saying they would back the Build Back Better legislation pending a CBO score that assuages their concerns about long-term budget deficits.

In a statement after the House vote, Biden said the legislation would “create millions of jobs, turn the climate crisis into an opportunity, and put us on a path to win the economic competition for the 21st Century.” He also noted that the procedural vote on the second Democratic bill will “allow for passage of my Build Back Better Act in the House of Representatives the week of November 15th.”

The House is out of Washington next week, and it could take the CBO days or weeks to prepare a score of the legislation.

The bills together make up the core of Biden’s domestic agenda. Democrats see the plans as complementary pieces designed to boost the economy, jolt the job market, provide a layer of insurance to working families and curb climate change.

Biden and Democrats have looked for a signature achievement they can point to on the 2022 midterm campaign trail as the president’s approval ratings flag. Biden will welcome Friday’s developments, as House passage of the bill followed a strong October jobs report and approval of Pfizer’s Covid vaccine for 5-to-11-year-olds in the U.S.

While Biden could sign the infrastructure bill soon, the safety net and climate package will likely take weeks longer.

The House will have to wait for a CBO score. The Senate may pass a different version of the plan, which would require another House vote. Senate Majority Leader Chuck Schumer has set a Thanksgiving target to pass the larger Democratic bill.

The bipartisan Infrastructure Investment and Jobs Act would put $550 billion in new money into transportation projects, the utility grid and broadband. The package includes $110 billion for roads, bridges and other major projects, along with $66 billion for passenger and freight rail and $39 billion for public transit.

It would put $65 billion into broadband, a priority for many lawmakers after the coronavirus pandemic highlighted inequities in internet access for households and students across the country. The legislation would also invest $55 billion into water systems, including efforts to replace lead pipes.

Before the vote, Transportation Secretary Pete Buttigieg told MSNBC that “the moment the president signs this, then it’s over to our department on the transportation pieces to get out there and deliver.” It can take years to complete major projects after Congress funds them.

Republicans helped to write the bill in the Senate, and it garnered 19 GOP votes in the chamber. A range of congressional Republicans opposed the plan because they considered it too closely tied to Democrats’ larger proposal, which they are passing without Republicans through the budget reconciliation process.

Many Democrats considered the infrastructure bill inadequate because it did not address issues including child care, pre-K education, Medicare expansion and the enhanced child tax credit. Those policies, priorities for Biden and top Democrats, made it into the House version of the social safety net bill.

Democratic leaders tied the proposals together in an effort to keep centrists and progressives on board with both plans. A thorny legislative process has unfolded for months as Democrats try to get disparate groups with varied visions of the federal government’s role in the economy to back both packages.

The chaos Friday was only the latest stumble in the process to approve the bills.

“Well, the whole day was a clusterf***, right,” progressive Rep. Mark Pocan, D-Wisc., said Friday night.

Still, he said lawmakers worked in a “congenial” way to try to reach a solution.

Many Democrats will be relieved to have one bill passed after a chaotic day — and an achievement that has eluded Washington for years.

The U.S. is about to lift a nearly 20-month international travel ban. Here’s what you need to know

KEY POINTS

- The U.S. on Monday will lift a pandemic travel ban on international visitors from more than 30 countries after 19 months.

- New rules will replace the ban, requiring international visitors to show proof of vaccination and a recent negative Covid test.

- Exceptions include travelers under age 18 and those traveling from countries with low vaccine availability.

International arrival and departure halls have been among the sleepiest parts of U.S. airports since Covid-19 was declared a pandemic in March 2020.

That’s set to change Monday when the U.S. lifts pandemic travel restrictions that have barred many international visitors since early last year, measures that have driven down revenue at hotels, retailers, restaurants and airlines.

First instated by the Trump administration and later expanded to include more countries by President Joe Biden earlier this year, the restrictions prohibited most visitors from the EU, U.K., South Africa, India, Brazil and China from flying into the U.S.

The reopening of the border to many international visitors comes with a new set of rules, such as vaccination requirements.

Airlines have reported a jump in bookings to the U.S. and expect an immediate surge in travelers, even before peak holiday periods.

United Airlines said it expects 50% more international inbound passengers on Monday from a week earlier, when it carried 20,000 people. Delta Air Lines said it expects many of its international flights on Monday to be full and strong demand in the next few weeks. Airfare-tracking site Hopper said international flight searches to the U.S. have more than quadrupled since the Biden administration in September announced it would lift the restrictions.

Airlines have brought back more international flights, though schedules are still below pre-pandemic levels. United airline will fly 69% of its 2019 international schedule next month, up from 63% this month and its trans-Atlantic schedule will be 87% restored in December. American Airlines’ international capacity for November and December is set to be more than double that of a year ago and down 28% from 2019.

Here is what you need to know about international travel to the U.S. starting Nov. 8:

Proof of vaccination

Under the new rules, inbound non-citizens will have to show proof that they are fully vaccinated against Covid-19 before they fly into the U.S. That means the second of a two-dose vaccine must have been completed two weeks prior to departure. Documentation can be shown as a paper certificate, a photo of the document or a digitized version. It will be reviewed by airline personnel.

Accepted vaccines are those approved or authorized by the Food and Drug Administration and those listed for use by the World Health Organization: Johnson & Johnson, Pfizer/BioNTech, Moderna, AstraZeneca, Covishield, Sinopharm and Sinovac.

Covid tests

The U.S. will also require proof of a negative Covid test from within the past three days for all vaccinated travelers. The country has required that since January for all arrivals, including U.S. citizens.

If a traveler is not vaccinated, including a U.S. citizen, the Covid test must have been taken from within one day of departure.

Both rapid antigen and PCR test results will be accepted.

Minors and other vaccine exemptions

The U.S. has outlined a number of exemptions to the new rules. Those include international travelers under the age of 18, as some countries haven’t yet authorized vaccines for children or have low vaccine availability.

International visitors over the age of 2, traveling with vaccinated adults must still show proof of a negative Covid test taken within three days of departure. If they are traveling unaccompanied they must show proof of a test taken within one day.

The U.S. is also exempting vaccination requirements for visitors from 50 countries that have low vaccine availability and vaccination rates, including much of Africa as well as Afghanistan, Haiti, Iraq and Armenia.

Visitors who haven’t been vaccinated for medical reasons will need to present a letter to the airline from a medical professional. There are also limited exceptions for visitors who need to travel to the U.S. for humanitarian reasons or an emergency, which will require a State Department letter before departure.

U.S. citizens

U.S. citizens are not required to present proof of vaccination before departure. However, if they do not, they will have to show proof of a negative Covid test taken within one day, instead of three days for travelers with a Covid vaccination record.

Contact tracing

All U.S.-bound travelers will be required to provide contact information such as e-mail, phone number and address to airlines in the case of an outbreak following arrival.

Elon Musk faces a $15 billion tax bill, which is likely the real reason he’s selling stock

KEY POINTS

- Elon Musk faces a tax bill of more than $15 billion in the coming months on stock options.

- Musk asked his 62.7 million Twitter followers over the weekend whether he should sell 10% of his Tesla holdings.

- The looming tax bill makes a sale of Tesla stock this year likely regardless of the outcome of the Twitter vote.

Tesla CEO Elon Musk faces a tax bill of more than $15 billion in the coming months on stock options, making a sale of his Tesla stock this year likely regardless of the Twitter vote.

Musk asked his 62.7 million Twitter followers over the weekend whether he should sell 10% of his Tesla holdings. “Much is made lately of unrealized gains being a means of tax avoidance, so I propose selling 10% of my Tesla stock,” he tweeted.

The Tesla CEO said he would “abide by the results of this poll, whichever way it goes.” The results were 58% in favor of selling and 42% against, suggesting he will sell the shares.

https://platform.twitter.com/embed/Tweet.html?creatorScreenName=robtfrank&dnt=false&embedId=twitter-widget-0&features=eyJ0ZndfZXhwZXJpbWVudHNfY29va2llX2V4cGlyYXRpb24iOnsiYnVja2V0IjoxMjA5NjAwLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X2hvcml6b25fdHdlZXRfZW1iZWRfOTU1NSI6eyJidWNrZXQiOiJodGUiLCJ2ZXJzaW9uIjpudWxsfSwidGZ3X3NwYWNlX2NhcmQiOnsiYnVja2V0Ijoib2ZmIiwidmVyc2lvbiI6bnVsbH19&frame=false&hideCard=false&hideThread=false&id=1457064697782489088&lang=en&origin=https%3A%2F%2Fwww.cnbc.com%2F2021%2F11%2F07%2Felon-musk-faces-a-15-billion-tax-bill-which-is-likely-the-real-reason-hes-selling-stock.html&sessionId=8e345d98edb5037e2dc123155f607c49b18a6956&siteScreenName=CNBC&theme=light&widgetsVersion=f001879%3A1634581029404&width=550px No matter the results of the poll, Musk would have likely started selling millions of shares this quarter. The reason: a looming tax bill of more than $15 billion.

Musk was awarded options in 2012 as part of a compensation plan. Because he doesn’t take a salary or cash bonus, his wealth comes from stock awards and the gains in Tesla’s share price. The 2012 award was for 22.8 million shares at a strike price of $6.24 per share. Tesla shares closed at $1,222.09 on Friday, meaning his gain on the shares totals just under $28 billion.

The company has also recently disclosed that Musk has taken out loans using his shares as collateral, and with the sales, Musk may want to repay some of those loan obligations.

As Tesla noted in its third-quarter Securities and Exchange Commission 10-Q filing this year: “If the price of our common stock were to decline substantially, Mr. Musk may be forced by one or more of the banking institutions to sell shares of Tesla common stock to satisfy his loan obligations if he could not do so through other means. Any such sales could cause the price of our common stock to decline further.”

The options expire in August of next year. Yet in order to exercise them, Musk has to pay the income tax on the gain. Since the options are taxed as an employee benefit or compensation, they will be taxed at top ordinary-income levels, or 37% plus the 3.8% net investment tax. He will also have to pay the 13.3% top tax rate in California since the options were granted and mostly earned while he was a California tax resident.

Combined, the state and federal tax rate will be 54.1%. So the total tax bill on his options, at the current price, would be $15 billion.

Musk hasn’t confirmed the size of the tax bill. But he tweeted: “Note, I do not take a cash salary or bonus from anywhere. I only have stock, thus the only way for me to pay taxes personally is to sell stock.”

Since CEOs have limited windows in which to sell stock, and Musk would likely want to stagger the sales over at least two quarters, analysts and tax experts have been expecting Musk to start selling in the fourth quarter of 2021.

At an appearance at the Code conference in September, Musk said: “I have a bunch of options that are expiring early next year, so … a huge block of options will sell in Q4 — because I have to or they’ll expire.”

Musk, of course, could also borrow more against his Tesla shares, which now total over $200 billion. Yet he has already pledged 92 million shares to lenders for cash borrowing. When asked at the Code conference about borrowing against such volatile shares, he said, “Stocks don’t always go up, they also go down.”

Musk is still racking up options beyond those granted via Tesla’s 2012 pay package. In March 2018, Tesla’s board of directors granted him an unprecedented “CEO Performance Award” consisting of 101.3 million stock options (adjusted for the 5-for-1 stock split in 2020) in 12 milestone-based tranches.

—CNBC’s Lora Kolodny contributed to this report.

HI Financial Services Mid-Week 06-24-2014