HI Market View Commentary 11-04-2019

| Market Recap |

| WEEK OF OCT. 28 THROUGH NOV. 1, 2019 |

| Stocks ended broadly higher on Friday, bolstered by better-than-expected monthly jobs data and word from China that it has reached a consensus with the US in their trade negotiations.

The Bureau of Labor Statistics said non-farm payrolls rose 128,000 in October, topping the consensus of 90,000, according to Econoday. September’s print was revised to 180,000 from the previous result of 136,000. The unemployment rate edged up to 3.6% from 3.5% the month before, matching views. According to the agency, “notable job gains occurred in food services and drinking places, social assistance, and financial activities.” The BLS said employment fell in motor vehicles and parts manufacturing due to the six-week General Motors (GM) strike while the federal government shed jobs due to a fall in the number of temporary Census Bureau workers. “There is a lot to like about this job report,” said Leslie Preston, senior economist at TD Economics. “Even though the trend in the monthly jobs tally is cooling, it has held up better than we had expected, driven by a continued expansion in the share of Americans in the job market.” Meanwhile, China said the country reached a consensus with the US on core trade issues after Vice Premier Liu He spoke by telephone with US Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin. Five of the 11 Standard & Poor’s 500 sectors added more than 1%, led by the 2.5% surge in energy shares as crude-oil futures soared. West Texas Intermediate ended nearly 3.5% higher at $56.07 a barrel while international benchmark Brent gained 3.3% to $61.60. Exxon Mobil (XOM) rose 3% as the oil major’s quarter earnings beat views despite seeing its profit drop 49% from last year. Apache (APA) popped almost 10% while Helmerich & Payne (HP) added 7.1%. Industrials jumped almost 2.2%, led higher as Capterillar (CAT) rose 4.9%, 3M (MMM) gained 3.1%, and United Technologies (UTX) added 2.2% Materials ended 1.5% higher, driven by Dow’s (DOW) 3.6% rise. Freeport-McMoRan (FCX) advanced 7.1%, and Nucor (NUE) gained 2.8%. JPMorgan Chase (JPM) added 2.3% while Goldman Sachs (GS) rose 1.9%, to pull financials 1.4% higher. American Express (AXP) firmed 1.6%. In corporate news, Fitbit (FIT) surged almost 16% after announcing that it agreed to be acquired by Alphabet’s (GOOGL) Google unit. Alphabet rose more than 1%. American Axle & Manufacturing Holdings (AXL) soared nearly 22% after the driveline and drivetrain maker’s third-quarter earnings beat expectations, even as the GM strike weighed on results. Arista Networks (ANET) sank more than 24% after the cloud company’s fourth-quarter guidance came in lower than expectations after a major customer warned it of a “material reduction in demand” for its services. The Dow Jones Industrial Average ended 1.1% higher to end the week up 1.4%. The S&P 500 added almost 1% to end the five-day period about 1.5% higher. The Nasdaq Composite finished more than 1.1% higher, ending up 1.7% for the week. |

UAA did great on earnings !!

We had a $20 Long Put Nov -19 with the stock closing at $21.19ish on Friday

- Earnings per share: 23 cents vs. 18 cents expected

- Revenue: $1.43 billion vs. $1.41 billion expected

Should have been a beat BUTT (and it is a big Butt) They have been looked into again by DOJ and SEC for GAAP revenue revisions ( possible revisions)

This is a three year old ISSUE so what’s changed?

My Thoughts is that the DOJ said hey you haven’t fixed what you said you were going to

Answer we will fix it and do it the way you said

OR hey we’ve recently found the problem we originally thought you had made

We aren’t doing our accounting wrong

The trend line says $16.50 sell off protection and add 20%ish more shares

The yearly low sits at $16.52 so now I have a range to give it a shot for a bounce higher

Where will our markets end this week?

Up

COMP – Bullish

Where Will the SPX end Nov 2019?

11-04-2019 +2.25%

Earnings:

Mon: RACE, SOHU, UAA, GRPN, HTZ, UBER

Tues: AGN, CHK, EMR, TPR, DVN, NEM

Wed: GOLD, HUM, JELD, ODP, PZZA, WEN, FOSL, GDDY, ROKU, CVS, BIDU, MRO, SQ, TRIP, WYNN

Thur: AMC, CAH, NBL, RL, GPRO, MDR, YELP, DIS,

Fri: DUK,

Econ Reports:

Mon: Factory orders

Tues: Trade Balance, ISM Services

Wed: MBA, Productivity, Unit Labor Costs,

Thur: Initial, Continuing, Consumer Credit,

Fri: Michigan Sentiment, Wholesale Inventories

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Saturday/Sunday –

How am I looking to trade?

I’m preparing for earnings = Adding long puts

AAPL – 10/30 AMC

AOBC – 12/05 est

BIDU – 11/06 AMC

CVS – 11/06 BMO

CVX – 11/01 BMO

DIS – 11/07 AMC

FB – 10/30 AMC

MRO – 11/06 AMC

MRVL 11/26 est

TGT – 11/20 BMO

XOM – 11/01 BMO

www.myhurleyinvestment.com = Blogsite

support@hurleyinvestments.com = Email

Questions???

Trade Findings and Adjustments

Leap Long Calls on FB starting at $200 strike or above

AAPL longer term Bull calls 260/280 April or Jun

MSFT Leap long calls

Close 25% of the BIDU long calls to take some risk off the table

Pre earnings Leaps on BIDU and DIS

Under Armour shares crater on accounting probe, cut to 2019 revenue outlook

PUBLISHED MON, NOV 4 20196:40 AM ESTUPDATED 3 HOURS AGO

KEY POINTS

- Under Armour’s third-quarter earnings and sales top analysts’ estimates.

- But the company slashes its revenue outlook for the full year.

- The earnings report comes after Under Armour acknowledged it has been cooperating with the SEC and DOJ in a probe of its accounting practices.

Under Armour on Monday reported quarterly earnings and sales that topped analysts’ estimates, but the company trimmed its revenue outlook for the full year, citing “traffic challenges.”

It said its outlet stores and website in North America have proven to be weak spots. It also said, however, that the cut can partially be attributed to the fact that Under Armour plans to sell less through off-price channels, which is a longer-term strategy to boost profits.

The lowered guidance and Under Armour’s confirmation of a federal probe of its accounting practices sent the retailer’s shares plunging more than 18%. The stock, which once hovered around $50, closed Monday at $17.14.

Here’s what Under Armour reported for its third quarter ended Sept. 30 compared with what analysts were expecting, based on Refinitiv estimates:

- Earnings per share: 23 cents vs. 18 cents expected

- Revenue: $1.43 billion vs. $1.41 billion expected

Under Armour said it now expects revenue to be up roughly 2% in fiscal 2019, compared with a prior range of up 3% to 4%. Analysts had been calling for annual revenue growth of 3.1%.

“The shaved revenue guide indicates the company’s turnaround continues to struggle as competition remains fierce … while an accounting investigation isn’t helpful either,” Jefferies analyst Randy Konik said in a research note.

Net income during the quarter grew to $102.3 million, or 23 cents per share, compared with $75.3 million, or 17 cents a share, a year ago. That beat analyst expectations of 18 cents.

Net revenue dropped about 1% to $1.43 billion from $1.44 billion a year earlier. That beat expected sales of $1.41 billion.

Sales in North America, a trouble spot for the company, were down about 4%, totaling $1.01 billion.

The athletic apparel and sneaker maker has been struggling to grow sales on its home turf, in a crowded market with Nike, Adidas and Lululemon. Ahead of Monday’s earnings report, it was still calling for sales to decline slightly in North America in 2019. Last quarter, North American sales dropped 3%.

Under Armour said apparel sales overall were up 1% during the third quarter, while footwear revenues plunged 12%, and accessories sales grew 2%.

On Sunday night, the athletic-leisure clothing-maker said it has been cooperating with the Securities and Exchange Commission and Justice Department into whether the company used bad accounting practices to make its finances look healthier.

“The company began responding in July 2017 to requests for documents and information relating primarily to its accounting practices and related disclosures, and the company firmly believes that its accounting practices and disclosures were appropriate,” a company spokesperson told CNBC in an email.

The company issued the statement after The Wall Street Journal revealed the probes on Sunday.

Word of the federal probe came after CEO Kevin Plank, in a surprise move last month, announced he will step aside from the chief executive role on Jan. 1, to be succeeded by COO Patrik Frisk. Plank is expected to transition to executive chairman and brand chief. A decision Plank said had been planned by the company.

Meantime, Under Armour says it has been responding to requests for documents related to its accounting practices since 2017, which is about when an incredible sales streak came to an end. Until the end of 2016, it had reported more than 20 consecutive quarters of sales growth topping 20%, making it one of the fastest growing retailers in the U.S.

On Jan. 31, 2017, after missing sales expectations during the holiday quarter, Under Armour said its then-finance chief, Chip Molloy, was leaving after about a year on the job, citing “personal reasons.”

Brad Dickerson had previously been CFO, from 2008 to February 2016. David Bergman, who had been holding various other finance roles, was named permanent CFO in December 2017, taking over after Molloy.

During a call with analysts on Monday morning, Under Armour reiterated its previous statement regarding the probe.

“We have been fully cooperating with these inquiries for nearly two and a half years,” CFO Bergman said. “We firmly believe that our accounting practices and disclosures were appropriate.”

Under Armour shares are now down about 3% this year. The company is valued at roughly $7.7 billion. Nike shares are up over 20% in 2019, while Lululemon shares have surged more than 60%.

It’s getting to be the best time of year for stocks, and the Dow could soon set a new high

PUBLISHED FRI, NOV 1 20193:09 PM EDTUPDATED 6 HOURS AGO

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

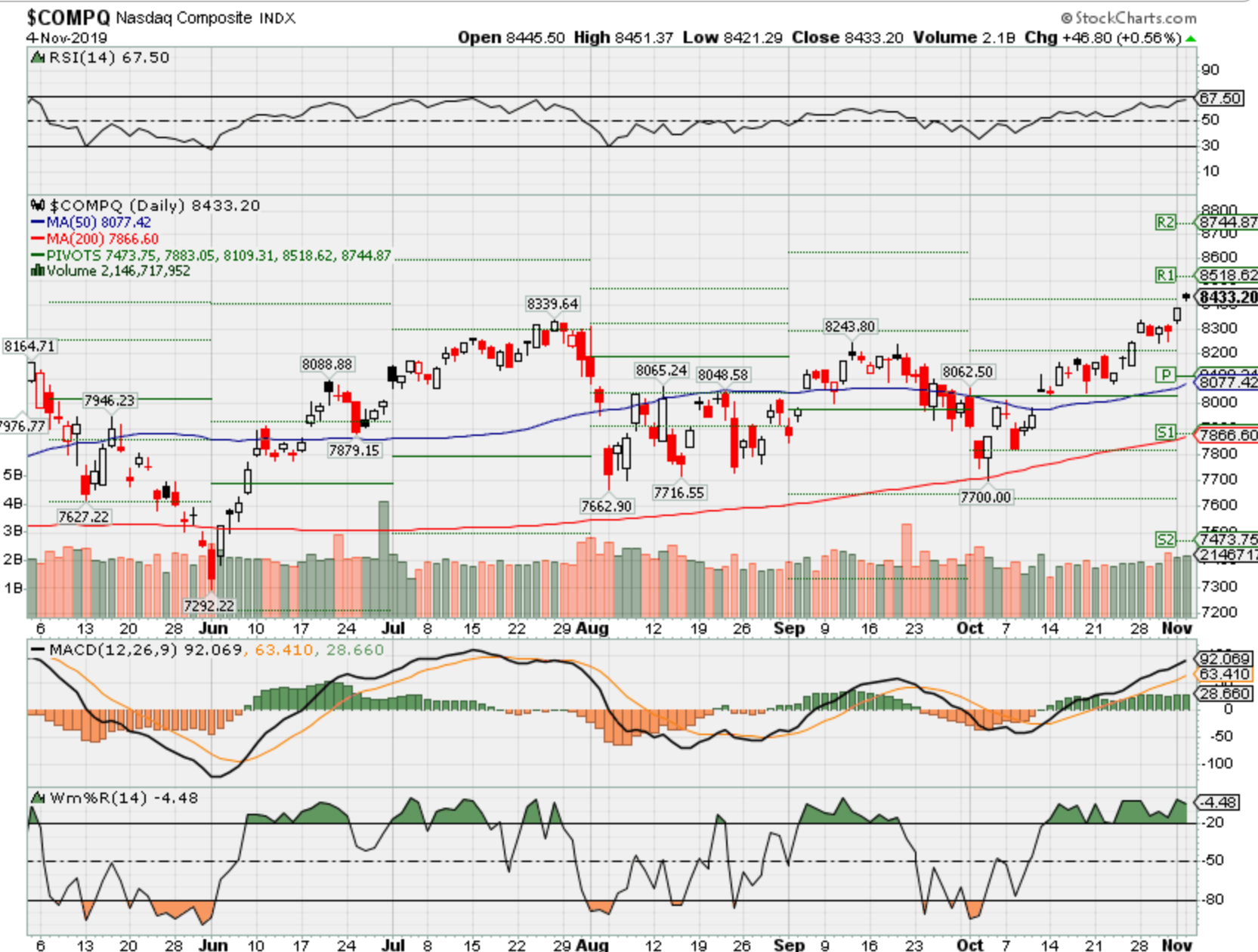

- The S&P 500 and Nasdaq both trade in record territory in the past week, and the Dow could be just days away from its own new high.

- The Dow’s record high is 27,398, and it was trading within a half percent of its high.

- Earnings results have been adequate enough to stoke a rally, and the market could move higher at what is normally a good time of year for stocks as long as trade talks move toward a deal.

- Industrials and other cyclicals are the best performers in November.

As November unfolds, stocks should continue to make gains in one of the best months of the year for the market, and it’s very likely the Dow will soon join other indexes in setting new highs.

The S&P 500 and Nasdaq both traded in record territory in the past trading week, boosted by some better economic news, a better-than-expected earnings season, and hopes that trade talks will soon lead to a first-phase deal between the U.S. and China. On Friday, China said it reached a consensus with the U.S. in principle after a phone call among high-level negotiators.

Analysts say stocks could follow the seasonal trends higher, barring problems in trade talks. The market is starting the best three months of the year historically, and it has a few catalysts in the week ahead. There are a number of economic reports, the most important of which will be the ISM services PMI on Tuesday.

Third-quarter earnings season continues, with about 80 S&P 500 companies reporting, including media companies Disney and News Corp. and chipmaker Qualcomm.

Top months ahead for stocks

November is the third-best month for the S&P 500, which has been higher two-thirds of the time since World War II with an average 1.3% gain, according to CFRA. As good as November has been, December is even better, and as the No. 1 month, it is up 76% of the time with an average 1.6% gain. November, however, is the month that has seen the most new highs for the S&P, on a percentage basis, according to CFRA.

“Investors likely remain too skeptical on the impact of Brexit, the U.S.-China trade talks and the impeachment hearings. They’re too skeptical that the market can advance,” said Sam Stovall, chief investment strategist at CFRA. Many strategists say the efforts by Democrats to impeach Trump is not hurting stock prices currently but it could if there are any developments that would put his re-election in doubt.

“I think November and December are pretty much going to buck the emotional trend right now. The market is telling us it wants to go higher,” Stovall said.

Of the more than 350 S&P companies that have reported earnings, 76% beat earnings estimates, according to I/B/E/S data from Refinitiv. Earnings are down about 0.8% for the quarter, based on companies that have reported already and estimates.

“This will be the 31st consecutive quarter in which actuals exceed estimates, but as much as earnings are coming in better for the quarter, they’re going down in terms of Q4 and 2020. That’s not good,” said Stovall. But he said stocks could be lifted by the end of the trade war, the impact of lowered interest rates and a possible tax cut from the White House.

“I think because the market is doing so well, it might be telling us we’re underestimating forward growth. Prices lead fundamentals,” he said.

The S&P and Nasdaq soared into record territory Friday after the October jobs report showed nonfarm payrolls grew by 128,000, much greater than expected. The number was weaker due to the strike against General Motors but not as weak as feared.

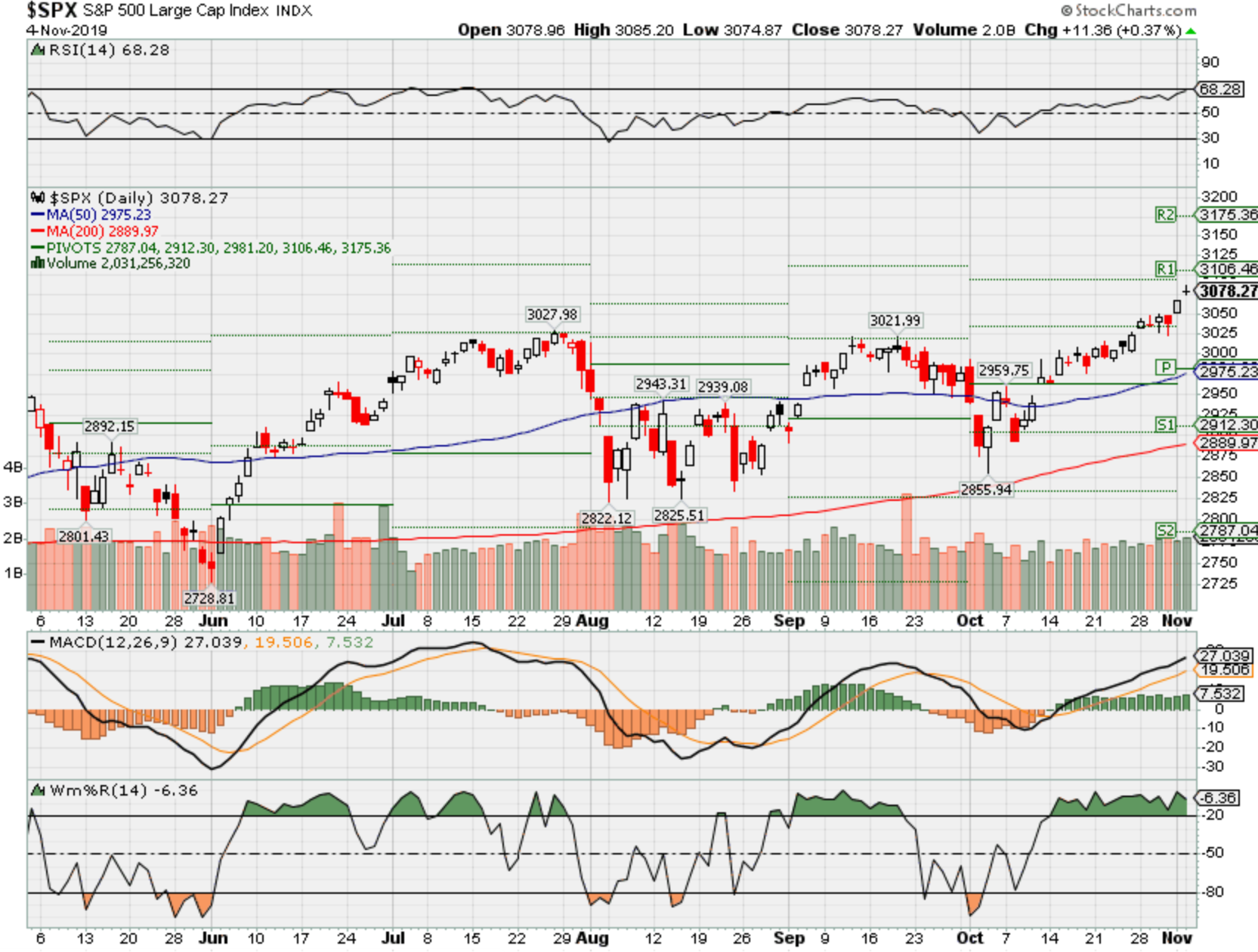

The Fed also added to positive sentiment with a rate cut on Wednesday, but the central bank went out of its way to signal a pause in policy.

“The rally is definitely broadening out. The measured move is 3,200 on the S&P 500 by year-end. In the last two sessions, we retested and spent some time above the 3,025 area. Today’s move showed some needed power, after a jobs report that was Goldilocks: It had something for everyone, not too strong to have the Fed as a headwind but strong enough to keep recession fears away,” said Scott Redler, partner with T3Live.com. “Today’s move lends some power to the bulls.”

Redler said Apple’s performance this week was a big boost to sentiment. It ended the week up 3.7%, at a new all-time high, after strong earnings. “Traders love when Apple leads the way,” he said.

The S&P 500 was higher for a fourth week in a row, its longest winning streak since March. The S&P ended the week at 3,066, up 1.5% for the week, while the Nasdaq closed at a record 8,386, up 1.7% for the week. The Dow gained 1.4% for the week, lifted by a 301-point bounce Friday. It finished the week at 27,347, 0.2% below its all-time high of 27,398.

Historically, industrials have had the best gains on average in November, going back to 1995. Industrial stocks have been up an average 2.9%, followed by materials, up 2.7%, consumer discretionary, up 2.6% and then technology, up 2.4%, according to CFRA data.

“The cliche thing is everyone is focused on the breakout. I think the key technical event that’s been developing for weeks, it’s really been this rotation toward cyclicals,” said Robert Sluymer, technical strategist at Fundstrat.

He said he expects the Dow to break to new highs soon. “We think the market is strong through year end and well into 2020. We continue to think the market cycle low developed in late 2018. This is the next leg up in the bull market,” he said.

What are bonds saying?

The bond market did not respond in the same way as stocks to the jobs number. Yields were slightly higher Friday but remained near or below the level they were at just prior to the Fed rate cut on Wednesday.

“We’re actually down on the week. That tells you what the bond market thinks about the economic landscape, particularly with the jobs report. I know there’s a lot of enthusiasm about it,” said Peter Boockvar, chief investment officer with Bleakley Advisory Group. “The bond market continues to send a very different message than the optimism in the equities market. The pace of job growth is still slowing, and this number is going to get revised multiple times. Everything is pointing to a slowdown in growth.”

The 10-year Treasury yield was at 1.73% Friday afternoon, and it had been at 1.80% at the end of the prior week.

“I think it’s a bit of moderation from the sell-off we saw last week. The Fed was pretty much in line with what people were expecting,” said Ben Jeffery, a rate strategist at BMO. “I think probably stocks are viewing it as the Fed is comfortable leaving rates on hold, so many recessionary fears are a bit overblown. You could make the argument the bond market is less convinced about that.”

However, Stovall said it’s a positive for stocks when the yield on the 10-year is lower than the yield on the S&P 500, now about 2%.

“I would say another positive for stocks is historically when the dividend yield on the S&P 500 has exceeded the yield on the 10-year note. The average 12-month return for the S&P has exceeded 22%,” he said.

Week-ahead calendar

Monday

Earnings: Occidental Petroleum, Uber, Prudential Financial, Shake Shack, Tenet Healthcare, Marriott, Consolidated Edison, Bausch Health, Groupon, Ryanair, Hertz Global, Tenet Healthcare, Under Armour

10:00 a.m. Factory orders

2:00 p.m. Senior loan officer survey

Tuesday

Earnings: Allergan, Becton Dickinson, Regeneron, Mylan, Arconic, Tapestry, Ratler Midstream, Hersha Hospitality, Caesars, MBIA, WW International, Whiting Petroleum, Assurant, Devon Energy, Virtu Financial, Diamondback Energy, Microchip Tech, Match Group

8:00 a.m. Richmond Fed President Thomas Barkin

8:30 a.m. International trade

9:45 a.m. Services PMI

10:00 a.m. ISM nonmanufacturing

10:00 a.m. JOLTS

12:40 p.m. Dallas Fed President Rob Kaplan

6:00 p.m. Minneapolis Fed President Neal Kashkari

Wednesday

Earnings: Qualcomm, CVS Health, Baidu, Wendy’s, Humana, Capri Holdings, Expedia, Adidas, Softbank, TripAdvisor, Square, Hostess Brands, Valvoline, Elanco Animal Health, Liberty Global, AXA Equitable, IAC/Interactive, Papa John’s

8:00 a.m. Chicago Fed President Charles Evans

8:30 a.m. Productivity and costs

9:30 a.m. New York Fed President John Williams

3:15 p.m. Philadelphia Fed President Patrick Harker

Thursday

Earnings: Disney, News Corp., Activision Blizzard, Zillow, Monster Beverage, Booking Holdings, Toyota, Air Products, AmerisourceBergen, Cardinal Health, Johnson Controls, Keurig Dr. Pepper, Teva Pharma, Norwegian Cruise Line, Discovery, NRG Energy, Ralph Lauren, Zoetis, Tradeweb Markets, Sturm Ruger, Cloudfare, Dropbox

8:30 a.m. Initial claims

1:05 p.m. Dallas Fed President Kaplan

3:00 p.m. Consumer credit

7:10 p.m. Atlanta Fed President Raphael Bostic

Friday

Earnings: Allianz, Ameren, Duke Energy, Honda

10:00 a.m. Consumer sentiment

10:00 a.m. Wholesale trade

11:45 a.m. San Francisco Fed President Mary Daly

8:30 p.m. Fed Governor Lael Brainard

A ‘market melt-up’ is becoming a real risk as stocks hit new highs, Wall Street bull Ed Yardeni warns

PUBLISHED SUN, NOV 3 20195:00 PM ESTUPDATED MON, NOV 4 20197:43 AM EST

Stephanie Landsman@STEPHLANDSMAN

Long-time market bull Edward Yardeni is concerned stocks are getting too expensive.

If the S&P 500 forward earnings multiple ticks to 19 or 20, the Yardeni Research president warns a it could spark a “nasty correction.” Right now, the index is at 17. The historic norm is 15 to 16.

“I just don’t want too much of a good thing here. I’d like this bull market to continue at a leisurely pace not in a melt-up fashion,” he told CNBC’s “Trading Nation” on Friday. “That’s actually the risk.”

Yardeni, who spent decades on Wall Street running investment strategy for firms such as Prudential and Deutsche Bank, expected 2019 to be a winning year — even as stocks were plunging last December.

His current call comes as the S&P 500 and Nasdaq are hitting new record highs, and with the Dow is less than a half percent from its all-time high.

On Friday, the S&P closed at 3,066, just one percent from Yardeni’s 3,100 year-end target. His 2020 target is 3,500.

“I may have to consider taking some profits”

“If the market gets ahead of itself and gets to 3,500 a lot sooner… I may have to consider taking some profits,” Yardeni said. “I’d much rather stay fully invested in this bull market and not be forced to jump out just because it is ridiculously overvalued.”

However, Yardeni suggests he wouldn’t be out for long.

“I’m sticking with this bull market. I think it’s going to continue to see higher levels,” said Yardeni, adding this forecast isn’t contingent on who wins next November’s 2020 presidential election.

Even though he says President Donald Trump will most likely win a second term, Yardeni doesn’t see irrevocable damage to the markets or economy if a democrat wins.

“I’m not convinced that if [President] Trump loses and a Democrat wins that it necessarily implies a bear market and a recession,” Yardeni said. “But I think initially the market would not react well to a change.”

Stocks making the biggest moves after hours: Uber, Shake Shack, Myriad Genetics and more

PUBLISHED 2 HOURS AGOUPDATED 39 MIN AGO

Check out the companies making headlines after the bell:

Shake Shack shares tumbled more than 14% during extended trading after the burger chain reported a third-quarter earnings beat but weaker-than-expected same-store sales. The company posted earnings of 26 cents per share, exceeding the earnings of 20 cents per share Wall Street expected, according to Refinitiv. Shake Shack matched revenue estimates at $157.8 million.

Same-store-sales increased by 2%, falling short of the 2.5% increase analysts had forecast. Shake Shack expects between 40 and 42 new domestic company-operated stores and between 20 and 25 new licensed stores to be opened, the company detailed in its 2020 fiscal year preliminary outlook.

Myriad Genetics shares plummeted more than 30% after the company reported first-quarter earnings that missed expectations, lowered its full-year outlook and issued weak guidance for its second quarter. The diagnostic company reported first-quarter earnings of 8 cents per share on revenue of $186.3 million, falling short of the 32 cent earnings per share and revenue of $202.1 million expected, according to Refinitiv consensus estimates.

“We had a challenging start to fiscal year 2020 as hereditary cancer revenue accrual from small payers was impacted by the deletion of the historical hereditary cancer CPT codes,” said President and CEO Mark Capone. “Despite this setback, we expect earnings to be significantly higher in the second half of the fiscal year and believe that a number of important upsides will materialize during the fiscal year generating momentum as we transition into fiscal year 2021.”

Shares of Uber dipped 5% after the company topped expectations for its third-quarter earnings. The ride-hailing giant reported a loss of 68 cents per share on revenue of $3.81 billion, better than the 81 cent loss per share and revenue of $3.69 billion analysts anticipated.

The company’s take rate, or adjusted net revenue as a percentage of gross bookings, also came in better than expected. Uber’s monthly active platform consumers (MPACs) and gross bookings, however, fell short of estimates.

Groupon shares tanked more than 8% after the online coupon marketplace reported third-quarter earnings that fell short of expectations. The company reported earnings of 1 cent per share on revenue of $496 million, while Wall Street expected earnings of 3 cents per share and $525 million in revenue, according to Refinitiv consensus estimates.

RealReal shares initially jumped 6% before settling near its closing price after the company reported a third-quarter earnings beat. The luxury consignment platform reported a loss per share of 27 cents on revenue of $80.5 million, which was better than the 31 cent loss per share and revenue of $75.9 million analysts expected, according to Refinitiv.

Shares of Marriott slipped more than 3% after the bell following the company’s mixed third-quarter earnings. The hotel giant posted earnings of $1.47 per share, falling just short of the $1.49 estimated. Revenue came in at $5.28 billion, exceeding the $5.13 billion in revenue analysts expected, according to Refinitiv consensus estimates.

Marriott’s revenue per available room increased by 1.5%, though the company also expects its full-year 2020 RevPAR to rise up to 2% worldwide.

Shares of Hasbro slipped nearly 3% after the toy-maker announced a new issuing of $875 million shares of its common stock. Hasbro said it will use the proceeds from the offering in its proposed acquisition of television production company Entertainment One. Bank of America Securities, J.P. Morgan Securities and Citigroup Global Markets will act as joint book-running managers for the offering, Hasbro detailed in a press release.

Adobe shares jumped more than 5% after the software giant announced its fiscal year 2020 outlook. The company expects about $13.15 billion in revenue and adjusted earnings of about $9.75 per share in fiscal year 2020. Adobe also raised its fourth-quarter digital media annualized recurring revenue target to about $475 million, an increase of $25 million above its prior target. Adobe’s shares are up about 23% year-to-date, and the company will report its fourth-quarter earnings on Dec. 12.

Reuters contributed to this report.

The stock market keeps setting new highs in a rally no one saw coming

PUBLISHED 5 HOURS AGOUPDATED 2 HOURS AGO

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Nearly everyone on Wall Street underestimated the strength of this year’s stock market.

- Of 17 analysts that CNBC tracks, only three have price targets ahead of where the S&P 500 traded Monday.

- Investors have been spooked this year by myriad headwinds, but the market has continued to set records, including a fresh high for the Dow industrials Monday.

Faced with an array of daunting headwinds and coming off a tough year, Wall Street took a dim view of stocks in 2019. As a result, many major analysts missed one of the best years of this history-making bull market that continues to make new highs.

Of the 17 forecasters that CNBC tracks for S&P 500 price, just three have targets that are above where the broad market index traded Monday. The median 3,000 target is 2.7% below midday levels with still nearly two months left in the year.

While the market’s path is always unknown and could come back down before the calendar turns to 2020, the year looks like an opportunity lost for those who bought into the pessimism. The S&P 500 continues to climb to new highs, while its sister index, the Dow Jones Industrial Average, also set a new high-water mark Monday.

The Dow is approaching an 18% gain for the year while the S&P 500 has climbed close to 23% and even the small-cap Russell 2000 is ahead more than 18%.

“I don’t think you can blame people for being a bit cautious or skeptical,” said Sam Stovall, chief investment strategist at CFRA Research. “If anything, earnings growth for this year has come down, and earnings expectations for next year have come down.”

Indeed, the S&P 500 is in the midst of an earnings recession that is on track to show the third consecutive quarter for negative year-over-year growth. Despite a 76% beat rate compared with expectations, earnings are still projected to show a 2.7% decline in the third quarter, according to FactSet.

But it’s been more than that this year.

A range of opinions

Wall Street has been spooked by concerns over a potential recession, the U.S.-China tariffs and multiple geopolitical concerns such as how Brexit will turn out.

Still, the market keeps going higher and defying the naysayers. The “most hated bull market in history” observation so often repeated on Wall Street may have become the worst cliche in bull market history as the averages continue to push into record territory.

“You do wonder what is causing the market to go higher. One [factor] is that the lack of alternatives continues,” Stovall said, citing the “TINA” belief that There Is No Alternative to U.S. stocks.

Stovall is among the many Wall Streeters who underestimated the market’s strength. He put a 2,975 target on the market, but was by far not the most pessimistic. UBS is the lowest on the Street with a 2,550 price target while Morgan Stanley has been consistently bearish with its 2,750 estimate.

In fact, Morgan Stanley is not only bearish on 2019 but believes low returns will continue for the next decade due to high valuations. Andrew Sheets, chief cross-asset strategist at the firm, said returns will be “challenging” considering the set-up from the trailing price-to-earnings ratio.

On the other side, though, are strategists including Piper Jaffray’s Craig Johnson, who has been one of Wall Street’s biggest bulls for years and holds a 3,125 target for the S&P 500. Though directionally right about the market’s moves, Johnson said “we weren’t perfect all along” in terms of timing, and he understands the skepticism about valuation.

“I think a lot of investors are struggling with valuation. The way this market has moved up, stocks have been pretty darn expensive,” Johnson said. “A lot of investors got caught off guard in Q4 last year. Those memories are still fresh in their minds about the big, dramatic selloff which wiped out a lot of bonuses for people last year. There’s that psychological impediment.”

Money to the mattresses

The fourth-quarter sell-off last year was fueled by weakening economic growth coupled with a Federal Reserve that seemed tone-deaf to what was happening, Two verbal miscues from Fed Chair Jerome Powell that pointed to tighter policy ahead fueled the belief that a year when the market fell 6.2% could bleed over into 2019.

Investors reacted by heading for cover.

Money market fund balances have surged this year to $3.5 trillion, the highest in a decade and up 23.7% year to date. Retail investors alone have pushed $324 billion into money markets in 2019, a 32% jump.

Sentiment has been turning of late, though, if not among the big Wall Street houses then at least with the mom and pop crowd that has been cheered by three Fed rate cuts and a macro scenario that no longer looks as gloomy as it did a few months ago. Bullishness, or the belief that the market will be higher in six months, was at a 12-week high of 35.6% in the most recent American Association of Individual Investors survey, while the bears fell to 28.3%.

Among professional investors, though, skepticism remains high.

The put-call ratio, a measure of sentiment among options traders, has remained above 1 since mid-September, a contrarian indicator that the market could be headed higher due to strongly negative sentiment.

“There’s worry that we are going to be disappointed by the trade issue, economic data and earnings,” said Quincy Krosby, chief market strategist at Prudential Financial. “Nothing stays the same forever. We’ve started to see an easing in all of the above. It doesn’t mean that’s the perfect scenario for the market, but it is perfect enough to get volume and breadth beginning to pick up.”

For the bulls, one of the big factors could simply be that the signs of a recession that had shot up during the summer have been tamed.

The bond curve inversion, where shorter-dated yields were higher than their longer-term counterparts, has since reverted. Inversions have preceded each of the last seven recessions, but there’s some sentiment that this time could be different due to unusual factors playing out in the bond market, even though fourth-quarter GDP growth looks like it will struggle to top 1%.

In any event, lack of a recession threat would be one huge load lifted from a market that has struggled to inspire confidence all year.

“The tug-of-war has not died down. There are those who still see that there is a recession looming and the market is oblivious to that,” Krosby said. “The fact of the matter is the market is suggesting there is not a recession that’s imminent, that the market was poised for recession for too long.”

Don’t celebrate the Dow record too much, Morgan Stanley predicts dismal returns the next decade

PUBLISHED MON, NOV 4 201910:07 AM ESTUPDATED MON, NOV 4 201912:40 PM EST

KEY POINTS

- The traditional investor portfolio — which is made up of 60% stocks and 40% bonds — will return just 4.1% over the next 10 years, Morgan Stanley strategist Andrew Sheets predicts using historical valuation analysis.

- Such a low portfolio return would come after a decade of massive multiple expansion for stocks and a flood of money into fixed income as central banks ease monetary policy to re-spark economic growth.

- The S&P 500 has returned 13.8% annually the last 10 years.

- Valuation proves “far more accurate than any other variable in determining what the 5- or 10-year experience of an investor will be,” Sheets says.

The Dow Jones Industrial Average jumped to a record Monday, bringing its gain for the year to nearly 18%. But Morgan Stanley has a message for investors: don’t expect anything near this return for the next 10 years.

The next decade could be a dismal one for both stocks and bonds, according to Morgan Stanley, which ran analysis on what current valuations for asset classes mean for future returns historically.

The traditional investor portfolio — which is made up of 60% stocks and 40% bonds — will return just 4.1% over the next 10 years, Andrew Sheets, chief cross-asset strategist at Morgan Stanley, calculated. That would be close to the 60-40 portfolio’s lowest rolling 10-year periods of the past 20 years. It also would be rare looking back further with an expected return this low only observed on 4% of rolling 10-year periods going back to 1950.

Why so low? Such a weak portfolio return is likely after a decade of massive multiple expansion for stocks and a flood of money into bonds as central banks ease monetary policy to re-spark economic growth. These measures have led to the second-longest bull market for stocks on record. The bull market is now more than 10 years old. Over that time, the S&P 500 has returned more 13.8% annually to investors. Moving forward, however, strong returns could be hard to come by as valuations are near historical highs.

Valuation is an accurate forecaster

Valuation proves “far more accurate than any other variable in determining what the 5- or 10-year experience of an investor will be,” Sheets said. “And at the moment, that experience looks challenging.”

The S&P 500′s trailing price-earnings ratio, Wall Street’s preferred valuation metric, has grown to 19.6 from 16.9 this decade. The ratio has also remained close to 20 in recent years, a level market experts see as elevated.

Bonds have also been on fire since 2010. The benchmark 10-year Treasury yield has fallen from about 3.8% in early 2010 to roughly 1.77% boosting prices in turn. The iShares 20+ Year Treasury Bond ETF (TLT), which tracks the performance of longer-term Treasurys, boasts a return of more than 100% in that time. The TLT is up 14% this year.

These high valuations are in part a byproduct of central bank measures to reinvigorate economic growth after the financial crisis. The Federal Reserve cut interest rates to zero and launched three asset-purchasing programs (quantitative easing) after the crisis. Other central banks, including the European Central Bank and Bank of Japan also used simulative tools to bolster their economies.

Bailed out again?

Sheets acknowledged investors could once again be “bailed out” from low returns by central banks in the next decade, but noted “these higher prices are simply pulling forward ever more future return to the present. That’s great for today’s asset owners, especially those close to retirement. It is much less good for anyone trying to save, invest or manage well into the future.”

For investors in search of investments with a more positive outlook in the next decade, Sheets suggested U.K. stocks and emerging market debt in hard currency. U.K. stocks “trade at a historically large discount to global markets” and show “little sign of over-earning or margin extension versus history.” On emerging market debt, Sheets notes it offers similar long-term returns than other similar assets “of similar volatility.”

— CNBC’s Michael Bloom contributed to this report.