HI Market View Commentary 10-18-2021

OK let’s talk about what is happening today !!!

General Powell Passed Away

China testes a ballistic missile Because now we have a better chance of getting “blow away” as we try to protect Taiwan

Chanos is betting against IBM and a Barclays downgrade hit DIS by -3%

Industrial production came in at -1.3% est to be +0.3

The AAPL event to show the new products for Christmas

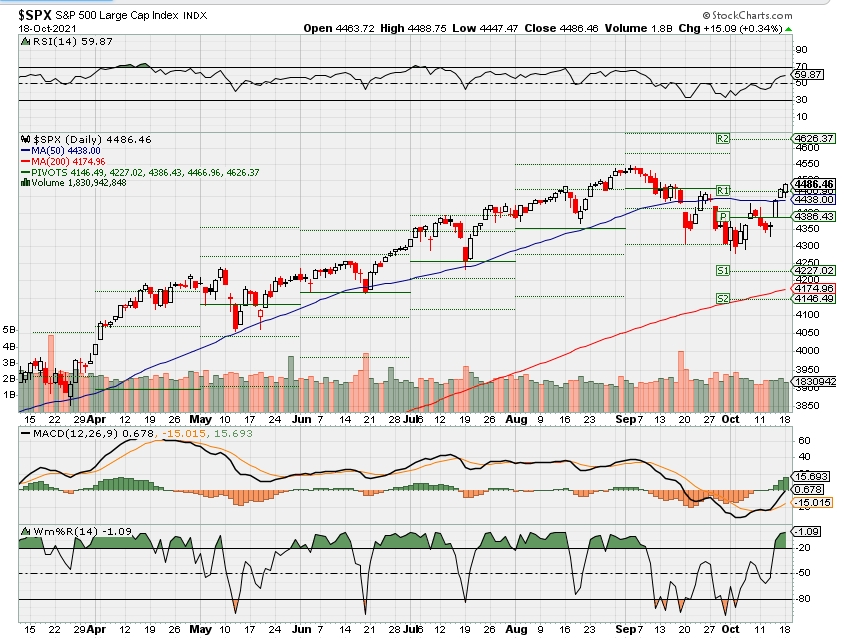

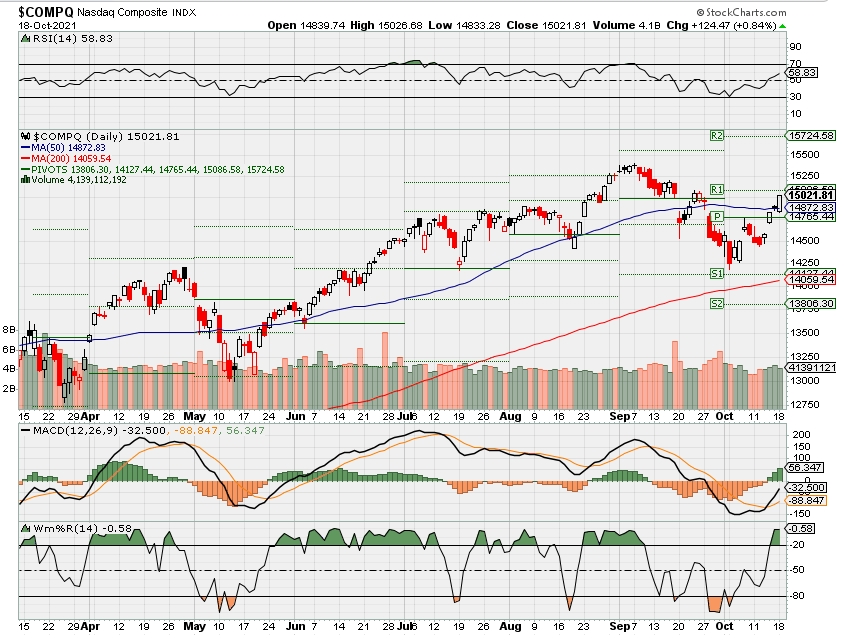

SO today we can justify the move higher as a crossing above the 50 SMA = Technical Bounce

This give me hope, technical justification, fundamental justification for a Christmas Rally

Earnings Guidance is going to filled with?= Shortages and bottleneck for supplies

Most likely we will see products go quickly, for higher prices and there will be a shortage

Higher interest rates into the beginning of next year= lower returns and prices for currently held bonds

Loved seeing DIS come back above 171 and seeing BIDU trade higher than 171

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 15-Oct-21 14:50 ET

A real world view of inflation

You don’t need an official Consumer Price Index report to tell you that there is inflation in our midst. It’s all around in varying degrees, and there aren’t six degrees of separation. Everyone is experiencing it up close.

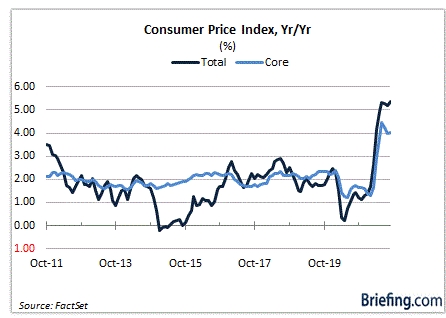

The proof is in headline inflation itself. Total CPI was up 5.4% year-over-year in September. Core CPI, which excludes food and energy, was up 4.0%.

Funny thing about that exclusion is that we don’t get the benefit of excluding food and energy in our daily lives. Both are a staple in one form or another, and both are more expensive than a year ago along with a host of other items and services.

Still, for the sake of argument, let’s look at the unadjusted year-over-year price changes for the special aggregate indexes, which show exclusions for one thing or another. No matter the exclusion(s), it is clear consumers are being confronted with inflation pressures.

| Aggregate Indexes | Yr/Yr |

| All items less food | 5.5% |

| All items less shelter | 6.5% |

| All items less food and shelter | 7.0% |

| All items less food, shelter, and energy | 4.6% |

| All items less food, shelter, energy, and used cars and trucks | 3.4% |

| All items less medical care | 5.9% |

Source: Bureau of Labor Statistics

The Fed might think “the market’s” inflation expectations are still reasonably well anchored, but no matter what the financial instruments capturing “the market’s” expectations are saying, that isn’t the case on Main Street.

Inflation is all around on Main Street, and consequently, the inflation expectations of consumers are not well anchored.

A Rapid Rate of Change

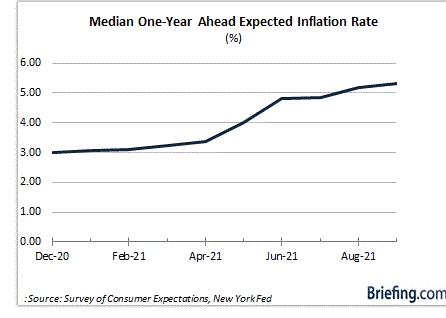

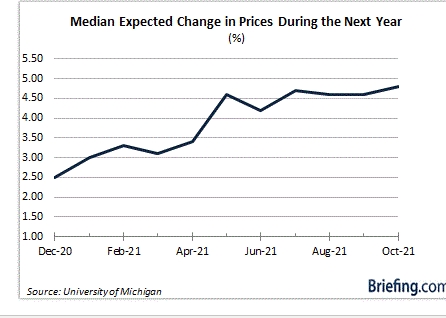

Inflation expectations for consumers have risen appreciably this year.

According to the Survey of Consumer Expectations conducted by the Federal Reserve Bank of New York, the median one-year ahead expected inflation rate has jumped from 3.00% at the end of 2020 to 5.30% today. That is the highest reading since the inception of the survey in 2013.

A similar trend has unfolded in the survey of consumers completed by the University of Michigan. It shows the median expected change in prices during the next year rising from 2.50% at the end of 2020 to 4.80% today.

That’s a rapid rate of change that speaks to the consumer’s experience in the real world right now, which is filled with rising prices. It is only natural, then, for a consumer to think that prices are going to remain high or even go higher since they are being seen for most items.

The key thing, however, is that higher prices are being seen for essential items paid for with a higher degree of frequency.

We’re not talking items like used cars, furniture, airfare, and major appliances. We’re talking things like shelter, food, drinks, haircuts, apparel, footwear, gasoline, and electricity. Those costs have all gone up (as seen in the table below) and they are the primary driver of the escalating inflation expectations among consumers.

| Item | Yr/Yr (%) |

| Beef and veal | 17.6 |

| Pork | 12.7 |

| Poultry | 6.1 |

| Fish and seafood | 7.1 |

| Eggs | 12.6 |

| Fruits and vegetables | 3.0 |

| Cereals and bakery products | 2.7 |

| Baby food | 4.4 |

| Milk | 1.8 |

| Nonalcoholic beverages | 3.7 |

| Alcoholic beverages | 2.8 |

| Food away from home | 4.7 |

| Unleaded gasoline | 43.3 |

| Electricity | 5.2 |

| Piped gas service | 20.6 |

| Water, sewer, and trash services | 3.7 |

| Motor vehicle insurance | 4.8 |

| Cable and satellite TV | 4.7 |

| Men’s and boy’s apparel | 4.4 |

| Women’s and girl’s apparel | 0.6 |

| Footwear | 6.5 |

| Pet food | 1.6 |

| Cigarettes | 7.0 |

| Shelter | 3.2 |

| Day care and preschool | 2.4 |

| Haircuts | 5.0 |

| Prescription drugs | -1.6 |

| Nonprescription drugs | -1.7 |

Source: Bureau of Labor Statistics

Consumer Is Not the Market

A secondary driver of inflation expectations is the news.

Turn on a TV and you’ll hear “gas prices keep climbing.” Read a newspaper (people still do that by the way) and you’ll learn that supply chain pressures and transportation bottlenecks are going to make holiday gifts more expensive this year. Listen to a business podcast and you’ll hear how one company after the next is talking about raising prices to offset higher costs. Venture onto social media and you’ll first see misleading images of just how perfect everyone’s life is and then you’ll see reports about skyrocketing home prices.

One doesn’t have to look very far to know that inflation is a problem. What is unclear is just how long a problem it will be.

Some call it a transient problem. Others refer to it as something that is episodic. And still others say it is going to be persistent.

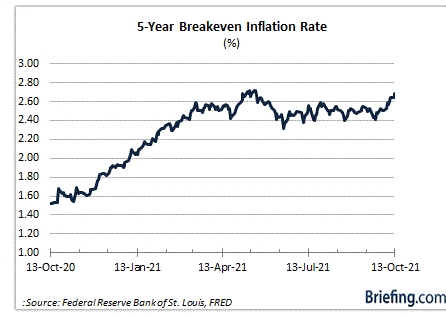

“The market” seems willing to accept that it is a transient problem that will get resolved as working conditions return to normal with adequately staffed, and fully functioning, manufacturing plants, transportation lines, and distribution facilities.

We say that looking at an inflation-sensitive 10-yr note yield sitting close to 1.55% even as the latest CPI report showed inflation up 5.4% year-over-year. We say that recognizing that the 5-year breakeven inflation rate is at 2.68%, albeit pressing the upper bounds of what might be considered “reasonably well anchored” for a Federal Reserve that is aiming for an average inflation target of 2.0% after seeing inflation run mostly below 2.0% for the last decade.

Most people, though, don’t see things through the market’s virtual reality lens. They see what is right in front of them in the real world, which is why consumers’ near-term inflation expectations are what matter more.

Consumers go to the gas station and the grocery store. They pay their rent. They eat out. They take Ubers. They go to the barber and the salon. They — “the consumers” — are not “the market.”

What It All Means

Consumers aren’t worried about what they might pay for something five years from now. They are worried more about what they are paying today and what they might have to pay in coming months.

Surveys of consumers’ inflation expectations clearly show an expectation that price pressures will persist in the next year. That view of the world is apt to invite higher wage demands, which, if met, just might change the market’s inflation expectations, and/or view of corporate earnings prospects, for the worse.

Time will tell what happens there, but consumers right now know that their cost of everyday living is going up appreciably. If the consumer’s income growth does not keep up with inflation, then consumer spending is going to suffer, and that’s something that just might get Wall Street’s attention since it would reduce earnings prospects.

For now, though, the market appears placated by the idea of what it thinks inflation will be while Main Street is stuck with the reality of what it is.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| Market Recap WEEK OF OCT. 11 THROUGH OCT. 15, 2021 The S&P 500 index rose 1.8% last week, marking its largest weekly gain since July, as the Q3 earnings reporting season began with better-than-expected results while economic data also topped consensus views. The market benchmark ended the week at 4,471.37, up from last Friday’s closing level of 4,391.34. The index is now up 19% for the year to date. The week began with declines in the S&P 500 on Monday and Tuesday, but the index edged up Wednesday as Q3 reports began trickling in. Thursday, more earnings reports, as well as economic data, topped expectations, resulting in the S&P 500’s largest one-day gain since March. The positive momentum continued Friday as earnings and economic reports continued to surpass estimates. The week’s strong earnings reports came from companies including health insurance company UnitedHealth Group (UNH), financial services company Bank of America (BAC) and pharmacy retail company Walgreens Boots Alliance (WBA). The upbeat economic data included a drop in weekly jobless claims to the lowest level since March 2020, a smaller-than-expected rise in the producer price index for September and an unexpected increase in September retail sales. The materials sector had the largest percentage increase of the week, up 3.6%, followed by gains of 3.5% each in consumer discretionary and real estate. The technology sector was also strong, up 2.6%. There was just one sector in the red for the week: communication services, which slipped 0.4%. In the materials sector, shares of Air Products & Chemicals (APD) added 10% last week as the company and Louisiana Gov. John Bel Edwards unveiled an agreement to build a $4.5 billion clean energy complex in Ascension Parish. Air Products will build, own and operate the complex, which will produce more than 750 million standard cubic feet of blue hydrogen per day. In consumer discretionary, shares of MGM Resorts International (MGM) rose 7.9% as Credit Suisse upgraded its investment rating on the casino operator’s stock to outperform from neutral. The firm said the market isn’t giving the stock full credit for four transactions MGM has announced since May. The real estate sector’s gainers included Extra Space Storage (EXR), whose shares rose 7% last week. Morgan Stanley boosted its price target on the self-storage management company’s shares to $160 from $157. On the downside, the decliners in communication services included Comcast (CMCSA), whose shares fell 1.2% last week as Raymond James downgraded its investment rating on the stock to market perform from outperform while cutting its price target on the shares to $60 each from $65. Goldman Sachs and Deutsche Bank also lowered their price targets on Comcast’s stock last week. Next week, Procter & Gamble (PG), Johnson & Johnson (JNJ), United Airlines Holdings (UAL), Verizon Communications (VZ), Intel (INTC) and American Express (AXP) are among the companies expected to report quarterly results. Economic data expected next week include September industrial production and capacity utilization on Monday, September building permits and housing starts on Tuesday, weekly jobless claims and September existing home sales on Thursday, and Markit’s early October purchasing managers indexes on both the manufacturing and services sectors on Friday. Provided by MT Newswires |

Earnings Dates

Where will our markets end this week?

Higher

DJIA – Bullish and we bounced above the 50 SMA

SPX – Bullish and follow through for a 50 SMA bounce

COMP – Bullish with the same technical bounce above the 50 SMA

Where Will the SPX end October 2021?

10-18-2021 -2.5%

10-11-2021 -2.5%

10-04-2021 -2.5%

Earnings:

Mon: ZION, FNB

Tues: HAL, JNJ, PM, PG, NFLX, UAL, ISRG,

Wed: ABT, FHN, WGO, CSX, DFS, IBM, KMI, LVS, TSLA, VMI, VZ,

Thur: T, ALK, CROX, FCX, KEY, NUE, LUV, UNP, VLO, SAM, CME, INTC, SNAP, WHR

Fri: AXP, ALV, HON, SLB, VFC

Econ Reports:

Mon: Capacity Utilization, Industrial Production, NAHB Housing Index, Net Long Term TIC Flows,

Tues: Building Permits, Housing Starts

Wed: MBA, Fed Beige Book

Thur: Initial Claims, Continuing Claims, Existing Home Sales, Leading Indicators

Fri:

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Long put protection has been added and getting ready for earnings

AAPL – 10/28 AMC

BA – 10/27 BMO

BIDU – 11/16

DIS – 11/10 AMC

F – 10/27 AMC

FB – 10/25 AMC

COST – 12/09

SBUX – 10/28 AMC

SQ – 11/04 AMC

TGT – 11/17 BMO

UAA – 11/02 BMO

V – 10/26 AMC

MU- 12/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Cramer says he will sell half of his ether if regulators approve bitcoin ETFs (cnbc.com)

Cramer says he will sell half of his ether holdings if regulators approve bitcoin ETFs

Matthew J. Belvedere@MATT_BELVEDERE

The seal of the U.S. Securities and Exchange Commission (SEC) is seen at their headquarters in Washington, D.C., U.S., May 12, 2021. Picture taken May 12, 2021.

Andrew Kelly | Reuters

CNBC’s Jim Cramer said Thursday he would be a seller of digital currencies if the Securities and Exchange Commission were to approve any of the pending applications to start bitcoin exchange-traded funds.

“The moment the funds start should be a short-term peak” in crypto prices, Cramer said on CNBC’s “Squawk Box.” “I will sell half my ethereum the day all this stuff is approved.”

Cramer said he still loves ether but taking some profits would be a price play.

At a Financial Times conference a few weeks ago, SEC Chairman Gary Gensler repeated his support for bitcoin ETFs that would invest in futures contracts instead of the world’s biggest digital currency itself. The Wall Street Journal reported Thursday the SEC could decide as early as next week on several applications to become among the first bitcoin ETFs to trade in the U.S.

In recent weeks, bitcoin and other cryptos have mounted a comeback.

- Early Thursday, bitcoin traded as high as $58,488, its highest level since May 10. Bitcoin hit an all-time high in April near $65,000. It was then gutted, sinking below $29,000 in June.

- Ether, the No. 2 digital coin, followed a trading pattern similar to that of bitcoin this year. It traded Thursday at just under $3,800, highs back to September.

Cramer has been talking up cryptos for a while now. He revealed earlier this year that he bought bitcoin and sees it as an alternative to large cash positions.

- In April, Cramer said he paid off a mortgage using profits from his investment in bitcoin. In June, he said, “Sold almost all of my bitcoin,” fearing China’s crypto crackdown.

- In May, Cramer said he owned “a lot” of ether, explaining he initially bought it to bid in Time magazine’s nonfungible token auction. Later that month, he said, “I sold half my ethereum … and I put some money down to own a Hummer.”

Sign up here for the new CNBC Investing Club newsletter to follow Jim Cramer’s every move in the market, delivered directly in your inbox.

— Reuters contributed to this report.

Companies with pricing power are a great place to hide out as inflation hits, Wolfe Research says

Maggie Fitzgerald@MKMFITZGERALD

A delivery truck driver unloads Coca-Cola Co. soft drinks in Lawrenceburg, Kentucky, U.S., on Monday, Feb. 10, 2020.

Luke Sharrett | Bloomberg | Getty Images

As inflation heats up, Wolfe Research recommends investors look at shares of companies with the ability to pass those cost increases onto consumers.

“We expect inflation to be the #1 market driver from here on out,” Wolfe Research chief investment strategist Chris Senyek said. “We believe that inflation trends and their influence on the Fed will be the most important drivers of overall market returns, sector rotation, and thematic performance in the months ahead.”

On Wednesday, the Labor Department said the September consumer price index jumped 5.4% year over year, the biggest jump since 1991.

Senyek said that, in terms of positioning, investors should look to companies that have strong pricing power. Pricing power shows the effect that a price change in a given product has on the demand of that product. If a company with strong pricing power raises prices, that increase may not have a negative effect on demand, if it has a unique value proposition.

Wolfe Research screened for S&P 500 stocks it believes have the largest amount of pricing power, which hones in on companies with high gross margins.

“The screen below includes S&P 500 companies that (1) have produced gross margins in the top quintile of their industry group over the past three years, and (2) reported a gross margin during 2Q21 earnings season that was higher than their pre-pandemic gross margin reported in 2Q19,” Senyek said.

Take a look at the list here:

https://dwc.cnbc.com/4Csfl/index.html Several retailers show up on Wolfe Research’s screen including Coach-parent company Tapestry, Ralph Lauren and e-commerce retailer eBay.

Plus, food companies that made the list include Coca-Cola, McDonald’s, Walmart and Constellation Brands. Coca-Cola CEO James Quincey told CNBC earlier this year that the beverage giant will raise prices to offset higher commodity costs.

Facebook, Adobe and NetApp are the technology names that Wolfe Research think have the most pricing power. Adobe has the highest gross margins of any stock on the list.

Advance Auto Parts also earned a spot on Wolfe Research’s list.

— with reporting from CNBC’s Michael Bloom.

Global chip shortage may persist for another 2-3 years, says Hisense (cnbc.com)

Global chip shortage may persist for at least 2 more years, says China’s Hisense

President of Hisense, Jia Shao Qian, one of China’s largest TV and household goods makers, says the chip shortage can be resolved in 2 to 3 years if there are “no big issues” with global trade disputes. But if economic and trade sanctions persist, it will be hard to estimate when the crunch will end.

THU, OCT 14 202110:04 PM EDT

JPMorgan exceeds profit expectations on $1.5 billion boost from better-than-expected loan losses

KEY POINTS

- Here are the numbers: earnings of $3.74 per share vs. $3 per share estimate of analysts surveyed by Refinitiv.

- Revenue: $30.44 billion vs, $29.8 billion estimate.

JPMorgan Chase on Wednesday posted third-quarter results that exceeded expectations on a $1.5 billion boost from better-than-expected loan losses.

The gain came after the bank released $2.1 billion in reserves and had $524 million of charge-offs in the quarter, New York-based JPMorgan said in a release.

The bank produced $3.74 per share in earnings, which includes a 52 cent per share boost from reserve releases and a 19 cent per share benefit tied to a tax filing. JPMorgan shares dipped 2.7%, giving up gains in premarket trading.

Here are the numbers:

- Earnings: $3.74 per share vs. $3 per share estimate of analysts surveyed by Refinitiv.

- Revenue: $30.44 billion vs $29.8 billion estimate.

The bank “delivered strong results as the economy continues to show good growth – despite the dampening effect of the Delta variant and supply chain disruptions,” CEO Jamie Dimon said in the statement. “We released credit reserves of $2.1 billion as the economic outlook continues to improve and our scenarios have improved accordingly.”

Dimon reiterated a message from previous quarters, which also benefited from reserve releases, that managers didn’t consider the gain to be fundamental to their business. The firm set aside billions of dollars for losses last year after the onset of the coronavirus pandemic, and this year has been releasing those funds after the losses didn’t arrive.

Indeed, analysts have said that banks have exhausted most of the benefit from releases and must now rely on core activities like growing loans and rising interest rates to boost profits.

Companywide revenue rose 2% to $30.4 billion, mostly driven by booming fees in the firm’s investment banking and asset and wealth management divisions. Net interest income of $13.2 billion edged out the $12.98 billion StreetAccount estimate on higher rates and balance sheet growth.

Fixed income revenue dropped 20% to $3.67 billion, below the $3.73 billion StreetAccount estimate. But equities trading revenue more than made up the shortfall, producing $2.6 billion, beating the $2.16 billion estimate.

Robust levels of mergers and IPO issuance in the quarter helped the firm’s investment bank. The company posted a 50% increase in investment banking fees to a record $3.28 billion, exceeding the estimate by half a billion dollars.

For most of the pandemic, booming trading revenue across Wall Street has benefited JPMorgan’s investment bank. But that was expected to moderate in the third quarter. Last month, JPMorgan executive Marianne Lake said that trading revenue will be 10% lower than a year ago, which was an unusually strong quarter.

The firm’s asset and wealth management division posted a 21% increase in revenue to $4.3 billion on higher management fees and growth in balances. Assets under management rose 17% to $3 trillion on rising equity markets.

Companywide loan growth has stabilized and should pick up next year, driven by higher spending and increased revolving of debts by credit-card users, CFO Jeremy Barnum told analysts during a conference call.

Executives were asked about the bank’s acquisition strategy after a string of recent deals. Last month, it acquired restaurant review service the Infatuation and college planning platform Frank. That followed three acquisitions of fintech start-ups in the past year.

Barnum hinted that the bank’s deals will likely continue, saying that “acquisitions are still potentially on the horizon” next year.

Shares of JPMorgan have climbed 30% this year before Wednesday, trailing the 37% increase of the KBW Bank Index.

Apple’s new MacBooks, AirPods get mild response from investors

Oct. 18, 2021 5:33 PM ETApple Inc. (AAPL)Intel Corporation (INTC)By: Rex Crum, SA News Editor12 Comments

Nikada/iStock Unreleased via Getty Images

Apple (NASDAQ:AAPL) ended Monday with mild gains following a company event in which it unveiled a revamped MacBook Pro laptop and the next model of its wireless AirPods. Apple (AAPL) shares rose 1.2%, to close at $146.55 following the event which was widely anticipated to feature something new involving the Mac. At the center of the event were the two new MacBook Pros, which come with either a 14-inch screen starting at $1,999, or a 16-inch screen, with an initial $2,499 price tag. The MacBooks come with either Apple’s new M1 Pro or M1 Max processors, as the company continues to focus on using its own proprietary chip technology and move away from its long-time chip partner, Intel (NASDAQ:INTC). The newest models of AirPods include enhanced sound technologies, improved battery life and will start at $179. All of the new products will be available starting next week. Dan Ives, managing director with Wedbush, said Apple “did not disappoint” with its new MacBooks and AirPods, and that company is banking on a new product upgrade cycle to boost its business, even during a period of component shortages in the tech sector. “Both of these products have been long anticipated and it’s a statement that Apple is announcing these key hardware innovations into holiday season despite the chip shortage overhang,” said Ives, who has an outperform rating and $185-a-share price target on Apple’s stock. With Monday’s event, Apple has filled out its product line in time for the end-of-the-year holiday shopping season. In September, Apple rolled out four new versions of the iPhone 13, new iPads and the next version of the Apple Watch to get consumers excited to fill their holiday shopping lists.

https://variety.com/2021/film/news/disney-delays-doctor-strange-thor-black-panther-1235091673/

Disney Delays ‘Doctor Strange 2,’ ‘Thor 4,’ ‘Black Panther’ Sequel and ‘Indiana Jones 5’

Courtesy Marvel Studios

Marvel fans, prepare to wait a little bit longer to see Doctor Strange, Thor and Black Panther return to theaters.

Disney has delayed release plans for several upcoming films, including “Doctor Strange in the Multiverse of Madness” from March 25 to May 6, “Thor: Love and Thunder” from May 6 to July 8 and “Black Panther: Wakanda Forever” from July 8 to Nov. 11. With the “Black Panther” sequel jumping to November, “The Marvels” has been postponed to early 2023 and “Ant-Man and the Wasp: Quantumania” was bumped from Feb. 17 to July 28, 2023.

Along with the deluge of Marvel delays, Disney has moved the fifth “Indiana Jones” installment back nearly a year. The still-untitled film, starring Harrison Ford as the fedora-wearing, swashbuckling archaeologist, will open on June 30, 2023 instead of July 29, 2022.The major release date shuffle comes after Marvel’s “Shang-Chi and the Legend of the Ten Rings” cemented its place as a pandemic-era box office hit and ahead of “Eternals,” the MCU entry that is scheduled for Nov. 5. The scheduling overhaul is related to production and not box office returns, according to sources at Disney. The next “Black Panther” entry, for one, is still filming in Atlanta. Since Marvel has become an interconnected and meticulously planned universe — which spans dozens of film and several new television series — any production delay causes a domino effect on the rest of the franchise. As for “Indiana Jones,” the 79-year-old Ford sustained a shoulder injury on set in June, requiring the actor to take a break from filming while he healed. Though director James Mangold continued to shoot without Ford, there are a limited amount of scenes that don’t involve the adventurer. Ford has since recovered and returned to set.

Four untitled 2023 movies from Marvel, 20th Century and Disney’s live-action division, have been removed from the calendar, while one untitled Marvel movie has relocated from Nov. 10 to Nov. 3, 2023.

COVID-19 has shaken up the way studios release their biggest movies, with many major tentpoles bucking tradition to land simultaneously in theaters and on digital platforms. After putting “Black Widow” starring Scarlett Johansson, “101 Dalmatians” prequel “Cruella” and animated adventure “Raya and the Last Dragon” on Disney Plus on the same day as their respective theatrical premieres, the studio has reaffirmed its commitment to the big screen — for now. The movies on schedule for 2021 will play exclusively in theaters for 45 days before moving to digital platforms. However, Disney has not solidified plans for 2022 and beyond.

See the updated release calendar below:

“Doctor Strange in the Multiverse of Madness” (Disney) previously dated on 3/25/22 moves to 5/6/22

“Thor: Love and Thunder” (Disney) previously dated on 5/6/22 moves to 7/8/22

“Black Panther: Wakanda Forever” (Disney) previously dated on 7/8/22 moves to 11/11/22

“Untitled Indiana Jones” (Disney) previously dated on 7/29/22 moves to 6/30/23

“Untitled Disney Live Action” (Disney) previously dated on 7/14/23 is removed from schedule

“The Marvels” (Disney) previously dated on 11/11/22 moves to 2/17/23

“Ant-Man and the Wasp: Quantumania” (Disney) previously dated on 2/17/23 moves to 7/28/23

“Untitled Marvel” (Disney) previously dated on 7/28/23 is removed from schedule

“Untitled Marvel” (Disney) previously dated on 10/6/23 is removed from schedule

Untitled 20th Century” (20th) previously dated on 10/20/23 is removed from schedule

“Untitled Marvel” (Disney) previously dated on 11/10/23 moves to 11/3/23

HI Financial Services Mid-Week 06-24-2014