HI Market View Commentary 10-14-2019

| YCharts Weekly Market Pulse |

|

|

|

| Market Recap | |

| WEEK OF OCT. 7 THROUGH OCT. 11, 2019 | |

| The Standard & Poor’s 500 index rose 0.6% this week in a climb led by the materials and industrial sectors as investors grew more hopeful for a resolution to the trade dispute between the US and China. The market benchmark ended the week at 2,970.27, up from last week’s closing level of 2,952.01. This marks the S&P 500’s first weekly gain since the week ended Sept. 13.

The advance came as US President Donald Trump said trade talks between the US and China were going well ahead of a Friday meeting with Chinese Vice Premier Liu He. In a Friday post on Twitter, Trump said “good things are happening at China Trade Talk Meeting. Warmer feelings than in recent past, more like the Old Days.” After the meeting, Trump said the US has come to a “very substantial Phase One deal” with China that includes intellectual property, financial services and purchases of farm goods. The materials sector led the way higher with a 1.9% weekly rise, followed by a 1.5% increase in industrials; both of those sectors have been heavily impacted in recent months by investors’ concerns about how they would be hurt by increased tariffs amid the trade war. Just four sectors posted weekly declines: utilities, down 1.4%, followed by consumer staples, down 0.9%, real estate, down 0.6%, and health care, down 0.3%. The materials sector’s gainers included shares of paper-and-packaging companies. Shares of WestRock (WRK) jumped 7.3% this week while Packaging Corp. of America (PKG) added 5.8% and International Paper (IP) climbed 6.1%. In the industrial sector, American Airlines Group (AAL) shares rose 5.9% as the airline said it plans to return its fleet of grounded Boeing (BA) 737 Max airliners to service in mid-January. American said it expects FAA “recertification of the aircraft later this year and resumption of commercial service in January 2020.” On the downside, the utilities sector’s slump this week came as investors felt less of a need for the perceived safety of the sector, which often rises when investors are seeking to put their money into companies whose services tend to be in demand regardless of economic state. The utilities decliners included Evergy (EVRG), whose shares fell 3.1% on the week as BofA Merrill Lynch downgraded its investment rating on the stock to neutral from buy while lowering its price target on the shares to $67 from $71. Provided by MT Newswires |

HOW well do you know your stocks ?!?!?!?!???????

I was asked about WFC

Was at $100 down to 35-40 back down to $35 and now back up to $100?

Not interested

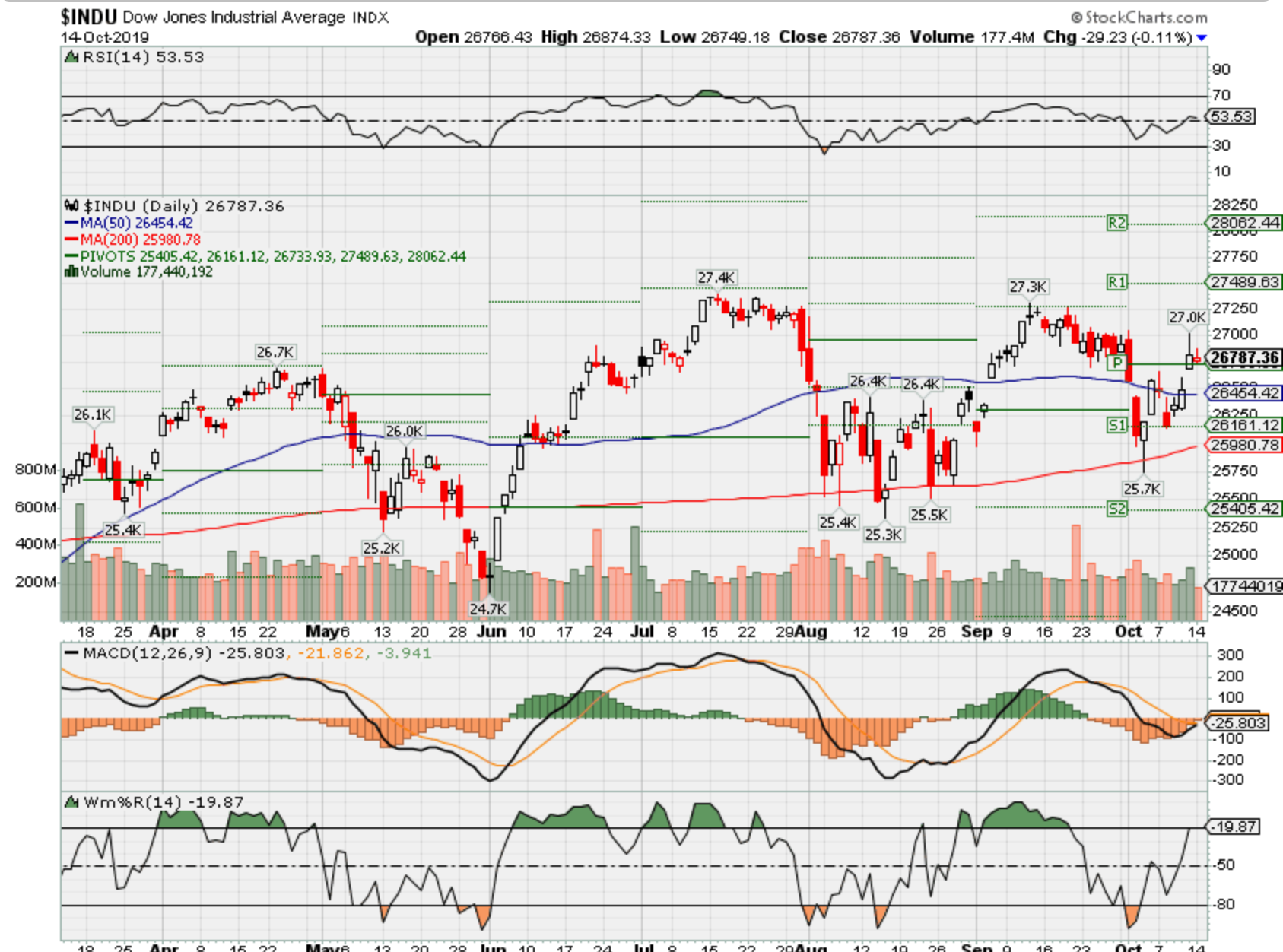

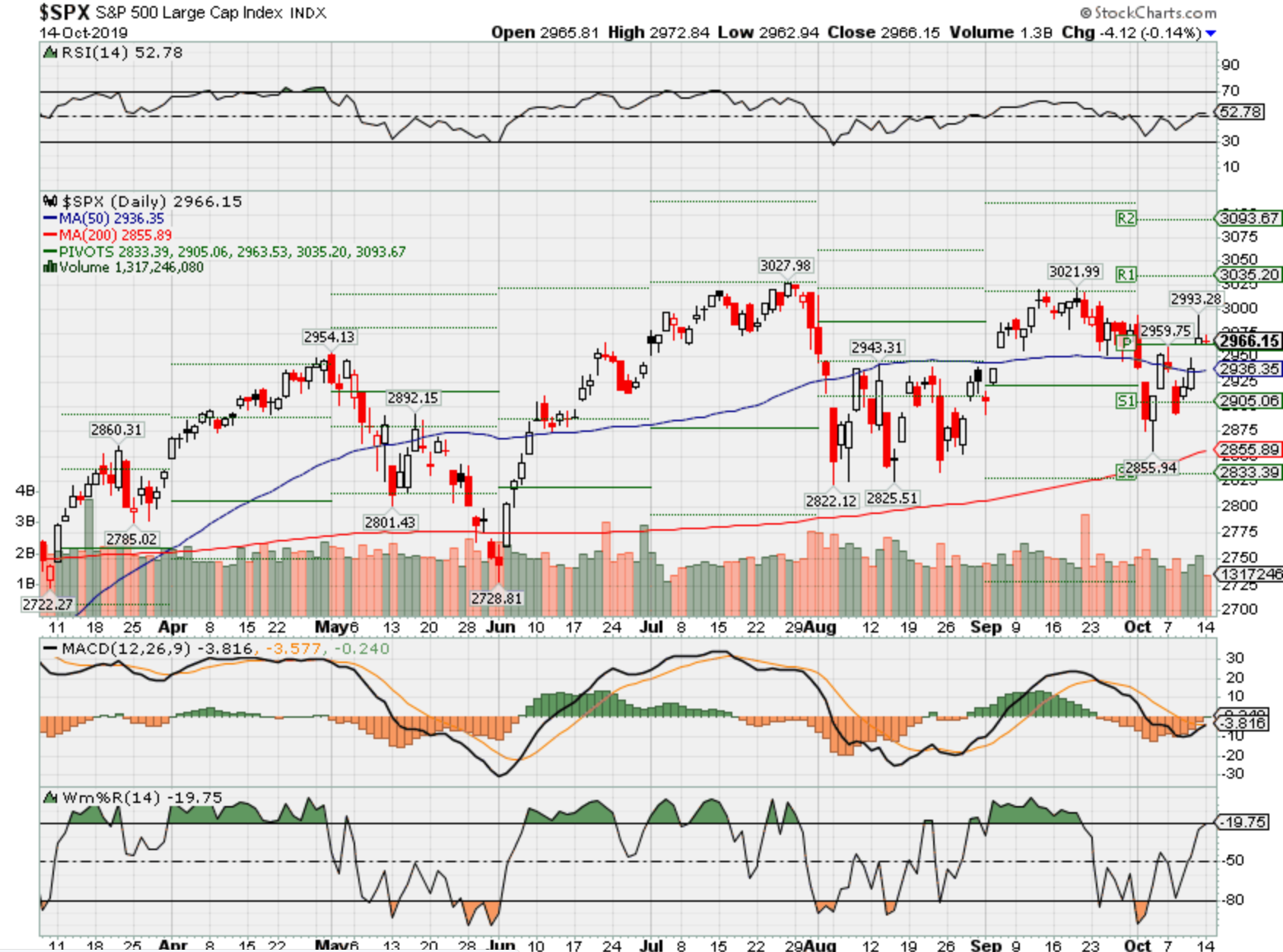

Where will our markets end this week?

Up – Based on Bank Earnings – Hoe sales over the quarter/ Trading in an sideways market since April

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end Oct 2019?

10-14-2019 +1.25%

10-07-2019 +1.25%

09-30-2019 +1.25%

Earnings:

Mon:

Tues: UNH, UAL, BLK, SCHW, C, GS, JNJ, JPM

Wed: ABT, FHN, PNC, USB, AA, CSX, IBM, KMI, NFLX, BAC

Thur: HON, KEY, MS, PM, SNA, UNP, ISRG

Fri: AXP, KO, SLB

Econ Reports:

Mon:

Tues: Empire

Wed: MBA, Retail, Retail ex-auto, Business Inventories, Beige Book, Net Long Term TIC Flows

Thur: Initial, Continuing, Housing Starts, Building Permits, Phil Fed, Industrial Production, Capacity Utilization

Fri: Leading Indicators, Monthly OPTIONS EXPIRATION

Int’l:

Mon –

Tues – CN: PPI, CPI

Wed –

Thursday –

Friday- CN: Retail Sales, Industrial Production, GDP (YoY) (QoQ)

Saturday/Sunday –

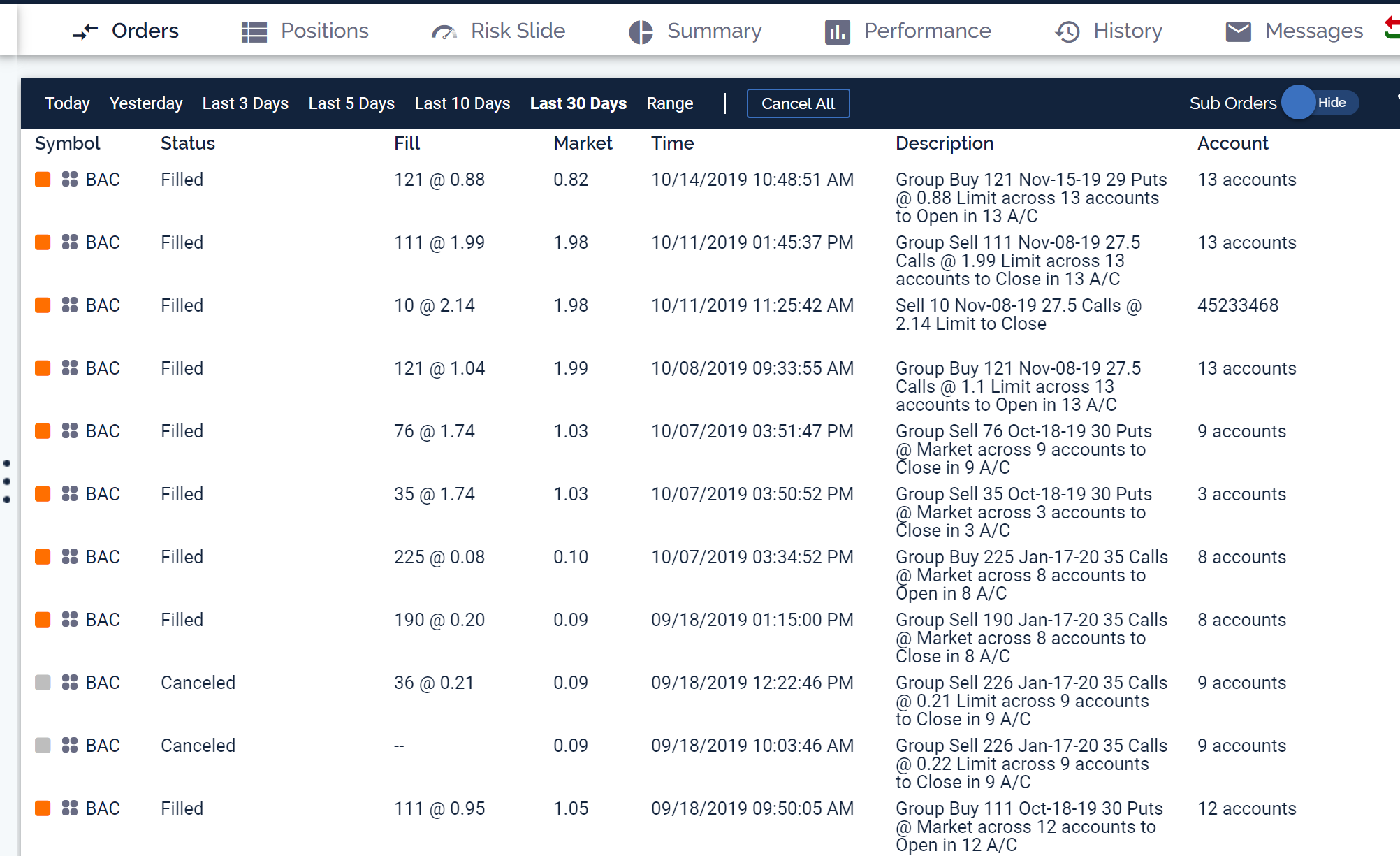

How am I looking to trade?

I’m preparing for earnings = Adding long puts

AA – 10/16 AMC

AAPL – 10/30 AMC

AOBC – 12/05 est

BA – 10/23 BMO

BIDU – 10/29 est

BAC – 10/16 BMO

CVS – 11/06 BMO

CVX – 11/01 BMO

DIS – 11/07 AMC

F – 10/23 AMC

FB – 10/30 AMC

FCX – 10/23 BMO

MRO – 11/06 est

MRVL 11/26 est

SLB – 10/18 BMO

TGT – 11/12 BMO

V – 10/24 AMC

XOM – 11/01 BMO

VZ – 10/25 BMO

ZION – 10/21 AMC

www.myhurleyinvestment.com = Blogsite

support@hurleyinvestments.com = Email

Questions???

Market may be expecting more rate cuts than the Fed will deliver, meeting minutes show

PUBLISHED WED, OCT 9 20192:00 PM EDTUPDATED WED, OCT 9 20194:02 PM EDT

Jeff Cox@JEFFCOXCNBCCOM@JEFF.COX.7528

KEY POINTS

- The Fed released minutes from its September meeting where the central bank approved a quarter-point rate cut.

- Fed minutes show that “a few participants” at the September meeting said prices in futures markets “were currently suggesting greater provision of accommodation at coming meetings than they saw as appropriate.”

- “It might become necessary for the Committee to seek a better alignment of market expectations regarding the policy rate path with policymakers’ own expectations for that path,” the minutes also said.

- Minutes showed that trade was the overriding concern. The issue garnered 28 mentions in the document, with members repeatedly expressing concerns about the impact tariffs were having on business activity.

Some Federal Reserve policymakers expressed concern at their most recent meeting that markets are expecting more rate cuts than the central bank intends to deliver, according to minutes released Wednesday.

The Federal Open Market Committee approved a quarter-point rate cut at the Sept. 17-18 meeting, putting the overnight funds rate in a target range of 1.75% to 2%.

But documents released after the meeting also showed sharp divisions among members about the future path of policy.

Minutes amplified those concerns, along with some worry that a market clamoring for easier monetary policy might be getting ahead of itself. The summary said that “a few participants” at the September meeting said prices in futures markets “were currently suggesting greater provision of accommodation at coming meetings than they saw as appropriate.”

As things stand, markets are heavily betting that the Fed will follow up its rate cuts of July and September with another in October. Markets also see more reductions on the way in 2020.

Because of the potential misunderstanding, “it might become necessary for the Committee to seek a better alignment of market expectations regarding the policy rate path with policymakers’ own expectations for that path,” the minutes said.

What they left out of statement

In addition, the minutes noted that “several” participants thought the committee, in its post-meeting statement, should provide some guidance as to how long the Fed would remain accommodative due to concerns over tariffs. The final statement did not include that type of language.

The “dot plot” of member expectations released at the meeting showed that five members favored the Fed not approving any additional cuts this year after the most recent move, five more seeing an increase ahead, and seven wanting an additional cut.

The final tally among the 10 voting members saw three dissents from Fed presidents – Eric Rosengren of Boston and Esther George of Kansas City, who favored holding the line, and James Bullard of St. Louis who wanted a half-point cut. That marked the most dissenters since December 2014.

In justifying the cut, Fed officials cited concerns over slowing global growth spilling into the U.S., the ramifications from the U.S-China trade war, and persistently low inflation that had been running below the Fed’s 2% target.

Trade a concern

Minutes showed that trade was the overriding concern. The issue garnered 28 mentions in the document, with members repeatedly expressing concerns about the impact tariffs were having on business activity.

Members said that while they saw U.S. growth as generally solid, the forecast risks “were tilted to the downside.”

“Important factors in that assessment were that international trade tensions and foreign economic developments seemed more likely to move in directions that could have significant negative effects on the U.S. economy than to resolve more favorably than assumed,” the minutes said.

“In addition, softness in business investment and manufacturing so far this year was seen as pointing to the possibility of a more substantial slowing in economic growth than the staff projected. The risks to the inflation projection were also viewed as having a downward skew, in part because of the downside risks to the forecast for economic activity,” the summary continued.

Officials also noted that “a clearer picture of protracted weakness in investment spending, manufacturing production, and exports had emerged” and members also were watching the yield curve inversion, a reliable indicator that a recession is ahead.

Still, members noted current conditions remain strong, with “robust” consumption and an employment picture that continued to improve.

Those who favored holding the line worried about financial stability risks that low interest rates posed. Others also stated concern that cutting rates now would leave the Fed little wiggle room the next time a slowdown emerged.

Repo discussion

Fed officials also discussed the recent upset in overnight lending markets that resulted in a spike in short-term rates. The central bank addressed the issue with several temporary liquidity actions aimed at stabilizing the market.

Members said future discussions about the proper size of bank reserves would be appropriate.

In a speech Tuesday, Fed Chairman Jerome Powell said the central bank likely will start repurchasing Treasury bills as part of a move to grow the balance sheet and reserves. Members also suggested looking into a standing repo facility to address funding issues.

The minutes stressed, as did Powell, the importance of distinguishing that type of balance sheet growth from the quantitative easing programs the Fed used during and after the financial crisis.

Trump says the US has come to a substantial phase one deal with China

PUBLISHED FRI, OCT 11 20193:39 PM EDTUPDATED FRI, OCT 11 20195:29 PM EDT

Kevin Breuninger@KEVINWILLIAMB

KEY POINTS

- The U.S. has come to a “very substantial phase one deal” with China in the high-stakes trade negotiations between the two economic superpowers, President Donald Trump says Friday.

- “Phase two will start almost immediately” after the first phase is signed, Trump says in the Oval Office alongside Chinese Vice Premier Liu He.

- Both sides in the long-running talks, which resumed at the top level this week, signal optimism.

The U.S. has come to a “very substantial phase one deal” with China in the high-stakes trade negotiations between the two economic superpowers, President Donald Trump said Friday.

“Phase two will start almost immediately” after the first phase is signed, Trump said in the Oval Office alongside Chinese Vice Premier Liu He.

The first portion of the trade deal will be written over the next three weeks, Trump said. It will address intellectual property and financial services concerns, along with purchases of about $40 billion to $50 billion worth of agricultural products by China, Trump said.

It’s a “tremendous deal for the farmers,” Trump said.

Asked what changed between these trade negotiations and prior discussions — talks broke down in May, for instance, leading to a sharp rise in tensions and the imposition of tariffs on billions of dollars worth of goods — Trump said it’s because this deal is “bigger.”

Liu, asked the same question by CNBC, summed up the difference as “cooperation.”

Asked what changed btwn April – the last time Pres Trump said deal was four weeks away – Trump said it’s bc this deal is “bigger.”

The Vice Premier, also asked to comment on what changed, did not interrupt Pres. Trump but leaned back in his chair and said to me: “Cooperation.”

Treasury Secretary Steven Mnuchin also announced in the Oval Office that the White House has scrapped a new round of tariffs on imports of Chinese goods, which were set to go into effect Oct. 15.

“We have a fundamental understanding of the key issues, but there is more work to do,” Mnuchin said, CNBC’s Eamon Javers reported.

Mnuchin said the U.S. will even be evaluating whether to rescind its decision in August to designate China a “currency manipulator.”

“We’ve made a lot of progress over the last two days,” Mnuchin said.

Both sides in the long-running talks, which resumed at the top level this week, have signaled optimism about coming to an agreement of some sort in the near future.

The Dow Jones Industrial Average jumped more than 300 points on the day.

Earlier Friday, Trump said in a tweet that Washington and Beijing are sharing “warmer feelings” during this round of talks than in the “recent past.”

The president later assured that “When the deal is fully negotiated, I sign it myself on behalf of our Country. Fast and Clean!”

One of the great things about the China Deal is the fact that, for various reasons, we do not have to go through the very long and politically complex Congressional Approval Process. When the deal is fully negotiated, I sign it myself on behalf of our Country. Fast and Clean!

David Dollar, a senior fellow at the Brookings Institution, told CNBC that “the two sides are not discussing a trade treaty that requires congressional approval.”

“It is a more informal agreement in which China will undertake to do certain things such as buy U.S. agricultural products and the administration will undertake not to follow through with the next rounds of tariffs. Since those tariffs do not require congressional approval, the administration can postpone or cancel without that approval,” Dollar said.

Massive Cash Shift Leads Hard-Asset Expert to Issue Rare Prediction

By Brian Mansfield | October 7th, 2019

Something strange is happening in the financial system…

And according to the Wall Street Journal, it’s causing some investors — including the world’s biggest banks — to move massive amounts of cash out of the banking system.

What exactly is going on and what does it mean for your money?

I recently met up with widely followed hard asset expert Bill Shaw at his firm’s east coast headquarters.

Over the past two decades, Mr. Shaw’s firm has grown from a tiny startup into a publishing powerhouse – serving more than a million readers in more than 150 countries.

Since 1999, the firm owes its legendary status as a trusted source of financial research to its eerily accurate track record of often controversial financial predictions, including:

- The Dotcom Crash

- The bankruptcy of General Motors

- The real estate bubble…

- The fall of General Electric…

- And the bankruptcy of Freddie and Fannie…

Recently, Bill revealed a brand-new prediction that has caught many by surprise.

He explained, “I’m not the kind of guy who gives in to hype and big predictions… that’s why I’ve waited nearly a decade — to make sure the timing is right for the biggest prediction of my career.”

He went on to explain that over the next few years, he sees a massive bull market developing in a sector of the economy that over the years has been completely ignored by nearly every investor in America.

The hard-asset expert said:

“Events happening around the world are about to come together at just the right time to create a perfect storm, causing some of the world’s biggest investors to dump cash and stocks – and pile into this long-hated asset.

In fact, it’s already begun.”

After dedicating hours to painstaking examination, this hard-asset expert has put together a free presentation to explain exactly what he sees coming… and to reveal the best way for Americans to prepare.

Past performance is not a predictor of future results. All investing involves risk of loss and individual investments may vary. The examples provided may not be representative of typical results. Your capital is at risk when you invest — you can lose some or all of your money. Never risk more than you can afford to lose.

I saved $300,000 by 26—and doing these 5 unusual things helped me save like crazy

Published Fri, Oct 11 201911:18 AM EDTUpdated Fri, Oct 11 20192:56 PM EDT

Jessica Byrne, Contributor@FIMECHANIC

When it comes to growing your savings, there are a handful of traditional ways to do it, such as investing in the stock market or in your 401(k). And then there are the more creative strategies, such as dumpster diving, couch surfing for a few months or buying and selling collectible coins.

Dumpster diving isn’t really my thing. But I’ve gone to extreme lengths to avoid wasting money, and they ended up paying off significantly: I recently reached my goal of saving $300,000 — all at the age of 26. (The majority of that money has gone into my retirement savings.)

This is how I did it.

An early start in my journey to $300,000

I started working as a babysitter when I was 12 until I left for college at 18. My rates climbed from $7 per hour to $12. At 14, I landed my first W-2 job earning minimum wage as a golf coach. The savings from my two jobs had grown to more than $8,000 by the time I left for college.

I also worked hard to earn scholarships and chose to go to an in-state school for financial reasons. But that, in addition to the job I took on as a research assistant, didn’t make school that much cheaper. To cover the $21,000 per year tuition, I did have some help from my parents and was able to graduate debt-free, which I consider an enormous privilege.

After college, I landed an internship at a biotech company that paid $32 an hour. Then, I moved on to a junior software engineering role that offered a $65,000 salary, along with a $10,000 signing bonus.

I immediately started saving a large chunk of my salary, spending only $20,000 per year while living in Portland, Oregon. While investing the rest of my money into retirement funds and stocks was what really pushed me to the $300,000 finish line, I also did many things — that many might consider unconventional or weird — to save like crazy:

1. Stayed in hostels with up to 15 people per room

I love to travel, but it can be expensive. On top of flights, ground transportation and daily excursions, you still have to pay for a place to sleep.

One way I was able to bring down the cost of accommodations was to stay in a hostel … which often meant sharing a room with a bunch of strangers. Even though there was always the option to book a private room, I saved hundreds of dollars per trip by sharing rooms with four — and sometimes up to 15 — people.

Few are willing to do that, but for me, the most exciting part about traveling is what I’m going to explore during my trip, rather than where I sleep at night.

I’ve stayed in hostels in a rainforest in Colombia with my partner and in Budapest while traveling solo. All of them had lockers to store belongings securely and kitchens to cook in (another frugal win!). I also met a lot of interesting travelers who gave great advice about what to do in the local areas.

On average, I’d spend less than $30 per night for a bunk. By not staying in hotels (which cost, on average, $135 dollars per night), I’ve been able to save more than $10,000 for all my travels combined.

2. Bought a used car and sold it for profit

According to car-buying site Carfax, a new vehicle loses 20% of its value in the first year, and then another 30% over the next four years. And with the average price of a new car at about $37,000, most new car owners will lose more than $17,000 to depreciation over the first few years after purchasing!

That’s why I decided to buy used car, with the intention of selling it later on. Rather than going through a dealership, I negotiated with a private seller I found through an online forum. The total price I paid up front was $12,150 (includes inspection, shipping, registration, title and license plate fees).

Two years later, after keeping it in great condition, I listed the car on Craigslist for $13,200. I decided I didn’t really need it and could bike to work instead. A buyer purchased the car for my full asking price, and I earned a $1,050 profit.

3. Shared a 700-square-foot apartment with my partner

For two years, my partner and I had been living in a 1,000-square-foot apartment in Portland, where the average apartment for that size is $1,335 per month, according to Smart Asset.

But we eventually realized that we didn’t need all that space (most of our time was spent cooking or lounging in the living room). So when we moved across the coast to Upstate New York, we agreed to downsize to a 700-square-foot, one-bedroom apartment.

It isn’t easy to live in such a cramped space, especially with one other person, but we made it work. The nice thing about that, however, is that splitting the costs has helped me save a lot of money. (Even without a partner, I would have gotten a roommate).

Overall, I’ve seen a dramatic spike in my savings rate since the move. My current rent is $507 per month (when split with my partner), as opposed to the $930 per month I was paying in Portland.

4. Switched jobs without all the ‘right’ qualifications

One surefire way to save more money is to make more money. I didn’t graduate with a degree in computer science, but I made the switch from mechanical engineering to software engineering.

The two aren’t as similar as they might sound; I spent a lot of time teaching myself how to code through learning websites like Leetcode and Hackerrank. I also studied the book “Cracking the Coding Interview” by Gayle Laakmann McDowell. Then, I started a personal project and made a website to showcase my portfolio.

It wasn’t easy, but the extra work was worth it. After working as a software engineer for two and a half years, I was able to double my salary from $65,000 to a little more than $130,000. While some might be hesitant about switching careers without the right qualifications, changing industries was critical to my savings growth.

5. Picked up a side hustle

The gig economy is booming, making it easier than ever to earn extra money on the side. Now, apps make it possible to monetize something you might currently do for free.

Every afternoon, I go for a long walk outside to get in some exercise. When I discovered dog-walking apps like Wag! and Rover, I signed up and immediately started walking dogs around the neighborhood. I’m also a huge dog lover, so it was a win-win.

By taking on at least two walks every week for about $25 per walk, you could make up to $2,400 a year. It might not sound like much, but I got huge returns by investing that money in stocks — and a new bike.

Jessica Byrne is a freelance writer and software engineer. She also runs Financial Mechanic, a site dedicated to financial literacy for young adults, and has been featured on MarketWatch and MSN Money.

These stocks could be the biggest winners if the US completes this phased trade deal with China

PUBLISHED FRI, OCT 11 20195:02 PM EDTUPDATED FRI, OCT 11 20197:01 PM EDT

KEY POINTS

- CNBC’s proprietary China Trade Index surges on the partial deal announcement. It tracks companies with biggest China exposure and most imports from China.

- Goldman Sachs screens Russell 1000 Index member companies for those with high revenue exposure to greater China.

- Another group of big winners are the retailers that are sensitive to tariffs.

The U.S. and China agreed to the first phase of a “substantial” trade deal that delays tariff hikes scheduled to kick in next week. These stocks are set to win the most from the resolution, if it can be completed.

CNBC’s proprietary “China Trade Index” jumped nearly 2.5% on Friday on the partial deal announcement. The 25 companies in the index are among those with the biggest China revenue exposure and the most imports from China. They could have more room to gain as the two countries finalize the agreement.

The index includes typical trade bellwethers Apple, Nike and Caterpillar and also contains many retail names such as Best Buy, Kohl’s and Honeywell.

Apple shares hit an all-time high on Friday.

Tariff-sensitive retailers

Another group of big winners is the retailers that are sensitive to tariffs. The group had been beaten down, as higher tariffs would stoke rising costs for the imported goods they sell. The removal of the tariff hike next week should give those retailers a boost.

UBS found retailers with a high percentage of merchandise exposed to Chinese duties based on company reports and conference calls.

Floor & Decor has about 45% products sold to China. Other retailers sensitive to tariffs include Advance Auto Parts and Restoration Hardware, whose stocks gained 1.6% and 2.8% respectively.

Big China exposure

Goldman Sachs screened Russell 1000 Index member companies for those with high revenue exposure to greater China, using 2018 company filings.

The list is concentrated in chipmakers Qorvo, Qualcomm, Micron Technology, Nvidia, Broadcom and Intel. Casino operators Wynn Resorts and Las Vegas Sands rely heavily on their revenue in China. The Yum spin-off Yum China generates all its sales from China, and its stock climbed 3.4% on Friday alone following the deal announcement.

‘Bigger tractors’

One particular stock, named by Trump himself, could win big in light of the deal.

As part of the deal, China would significantly step up purchases of U.S. agricultural products to about $40 billion to $50 billion, which is “three times what China has purchased at the highest point thus far,” Trump said on Friday.

The president said farmers will benefit from the “tremendous” amount of orders promised by China, adding they would need to buy bigger tractors from John Deere and other places.

“So I suggest farmers would have to go immediately buy more land and get bigger tractors. They will be available in John Deere and a lot of great distributors,” Trump said.

Deere & Co. shares added nearly 2% on Friday.

Vague US-China deal fails to ‘clear the air’ for companies to start spending and investing again

PUBLISHED 2 HOURS AGOUPDATED 2 HOURS AGO

Michael Sheetz@THESHEETZTWEETZ

KEY POINTS

- The U.S. and China view the early agreement on trade differently: President Donald Trump’s administration is calling it a deal, while Chinese negotiators view it as progress.

- “Overall, we don’t think this Phase 1 deal clears the air for global corporations,” Evercore says.

- “We believe it sets a floor for markets for at least the next 1-2 months,” Credit Suisse says.

- But the calendar third quarter earnings season is about to begin and expectations are gloomy. Companies could use the clarity to improve the profit outlook.

While President Donald Trump says he has a trade deal in place, the Chinese side is calling it progress – as corporate spending and investment hangs in the balance.

Wall Street analysts were largely skeptical of Trump’s announcement on Friday of a substantial trade deal, as Evercore ISI strategists noted that it “focused on the low-hanging fruit, with a lot vague or not addressed.”

“Overall, we don’t think this Phase 1 deal clears the air for global corporations to decide on what matters most – where to invest, produce, hire or source,” Evercore said in a note to investors.

China’s trade negotiators want to meet for more talks in the next couple of weeks, people familiar with the matter told CNBC’s Kayla Tausche on Monday. Before Chinese President Xi Jinping signs the “phase one” trad agreement, the nation’s negotiators want to add more detail.

Credit Suisse doubts this “mini-deal” will lead to the end of the U.S. trade war with China, saying it sees “daunting obstacles” to a full resolution. But Credit Suisse does see some good news in the early agreement.

“We believe it sets a floor for markets for at least the next 1-2 months,” Credit Suisse analysts Dan Fineman and Kin Nang Chik said.

Goldman Sachs chief economist Jan Hatzius told investors that, although the scope of the early agreement “looks roughly as expected,” the U.S. has yet to announce a decision regarding the Dec. 15 increased tariffs on Chinese goods. The Dec. 15 tariffs will be part of the next round of negotiations.

“At this point we continue to expect implementation of that tariff round … though likely with a delay into early 2020,” Hatzius said.

Treasury Secretary Steven Mnuchin told CNBC on Monday that if China doesn’t sign the phase one of the deal, then the tariffs scheduled for December will take effect.

Corporate earnings expected to drop as outlooks worsen

While Trump’s trade optimism briefly boosted U.S. stocks on Friday, the calendar third quarter earnings season is about to begin and expectations are gloomy. According to FactSet, a sizable percentage of S&P 500 companies have lowered expectations before reporting third quarter results.

“Of the 113 companies that have issued EPS [earnings per share] guidance for the third quarter, 83 have issued negative EPS guidance and 30 have issued positive EPS guidance,” FactSet senior earnings analyst John Butters wrote on Friday.

That means 73% of S&P 500 that have issued profit forecasts have a negative outlook. Additionally, FactSet estimates companies will report a year-over-year drop in third quarter earnings, down 4.6% from the same period last year.

A more concrete deal will be needed before the earnings outlook improves, analysts said.

– CNBC’s Michael Bloom contributed to this report.

Investor Ken Fisher loses $600 million contract after making sexist comments at summit

PUBLISHED SAT, OCT 12 20194:03 PM EDTUPDATED SUN, OCT 13 201910:43 AM EDT

KEY POINTS

- The state of Michigan has pulled $600 million of its pension fund from wealth management company Fisher Investments after the company’s founder and CEO Ken Fisher made sexist comments at a summit in San Francisco this week.

- At the Tiburon conference, Fisher talked about his wealth management strategy to picking up women for sex, made explicit remarks about genitalia and mentioned Jeffrey Epstein, the financier who was charged with trafficking girls.

- Fisher was initially defiant amid the backlash in an interview with Bloomberg, in which he said he had “given a lot of talks, a lot of times, in a lot of places and said stuff like this and never gotten that type of response.”

The state of Michigan has pulled $600 million of its pension fund from wealth management company Fisher Investments after the company’s founder and CEO Ken Fisher made sexist comments at a summit in San Francisco this week.

At the Tiburon conference, Fisher compared his wealth management strategy to picking up women for sex, made explicit remarks about genitalia and mentioned Jeffrey Epstein, the financier who was charged with trafficking girls this year before hanging himself in prison.

Michigan Chief Investment Officer Jon Braeutigam told the state’s investment board that its bureau of investments has fired Fisher Investments due to the chairman’s “completely unacceptable comments,” according to a letter obtained by CNBC.

Fisher was initially defiant amid the backlash in an interview with Bloomberg, in which he said that attendees had mischaracterized his comments, and that he had “given a lot of talks, a lot of times, in a lot of places and said stuff like this and never gotten that type of response.”

Fisher, whose Washington-based firm manages over $100 billion in assets, eventually apologized for his comments on Thursday in a statement from his representative.

“Some of the words and phrases I used during a recent conference to make certain points were clearly wrong and I shouldn’t have made them,” he said. “I realize this kind of language has no place in our company or industry. I sincerely apologize.”

In the audio obtained by CNBC, Fisher said at the Tiburon conference: “Money, sex, those are the two most private things for most people,” so when trying to win new clients you need to be careful.

“It’s like going up to a girl in a bar … (inaudible) …going up to a woman in a bar and saying, hey I want to talk about what’s in your pants,” he said.

Braeutigam in the letter said that Michigan’s Bureau of Investment decided to fire Fisher Investments after seeing news reports of his remarks.

″…All were in unanimous agreement that prompt termination is the correct course of action,” the letter said. “There is no excuse to not treat everyone with dignity and respect. We have high expectations of our managers (and staff), not just with regards to returns but also in how they exhibit integrity and respect to all individuals.”

Michigan Chief Investment Officer John Braeutigam’s full letter to board members, Oct. 10, 2019

Board Members,

This morning, the Michigan Department of Treasury’s Bureau of Investments (BOI) terminated Fisher Investments as their founder Ken Fisher made completely unacceptable comments to a conference group where he was a featured speaker. BOI became aware of this situation last night after reading an industry news article and, after leadership discussions this morning (and more verification), all were in unanimous agreement that prompt termination is the correct course of action. There is no excuse to not treat everyone with dignity and respect. We have high expectations of our managers (and staff), not just with regards to returns but also in how they exhibit integrity and respect to all individuals.

Fisher Investments was one of our long-time active domestic equities (managed funds for approximately 15 years) managers and they were responsible for managing over $600 million of State of Michigan Retirement Systems (SMRS) funds. Over the years, their performance has been good (beating the S&P 1500) and in staff’s interactions we have not previously witnessed or been aware of any type of similar comments along the lines of the founder’s recent statements. In our opinion, this history does not out-weigh the inappropriateness of the comments made by the founder. The securities Fisher Investments managed are all held in the retirement systems’ name and in the retirement systems’ custodial bank (State Street). These funds, will now be managed internally and over time will be liquidated and moved to cash in order to pay retirement benefits.

Sincerely, Jon M. Braeutigam

@realDonaldTrump

@realDonaldTrump

HI Financial Services Mid-Week 06-24-2014