HI Market View Commentary 09-09-2019

So what do you do when you don’t know what to do?

I take a flying leap off a very deep cliff – Lance

My best guess or ask for help – Lee

Do what fast money is doing (CNBC) – David

Day trade and lose my ass – Dave

I go to one of my many newsletters and copy a trade – Mary

How would you feel if I was doing one of these above mentioned things while trading your money?

I would kill you!!! – Lance

I would expect better – Lee

I would expect you to do more than follow someone else – Mary

Why is it ok for you to do that to your money but not me?

It’s NOT – Lance

It’s the best I know so I hire you – Lee KEVIN You’re the expert

So what do I do (the expert) when I don’t know what to do?

I sit on my hands or most likely will do nothing

I do try to learn from losing positions – Adjusting, looking over the decision making process

Where will our markets end this week?

Higher

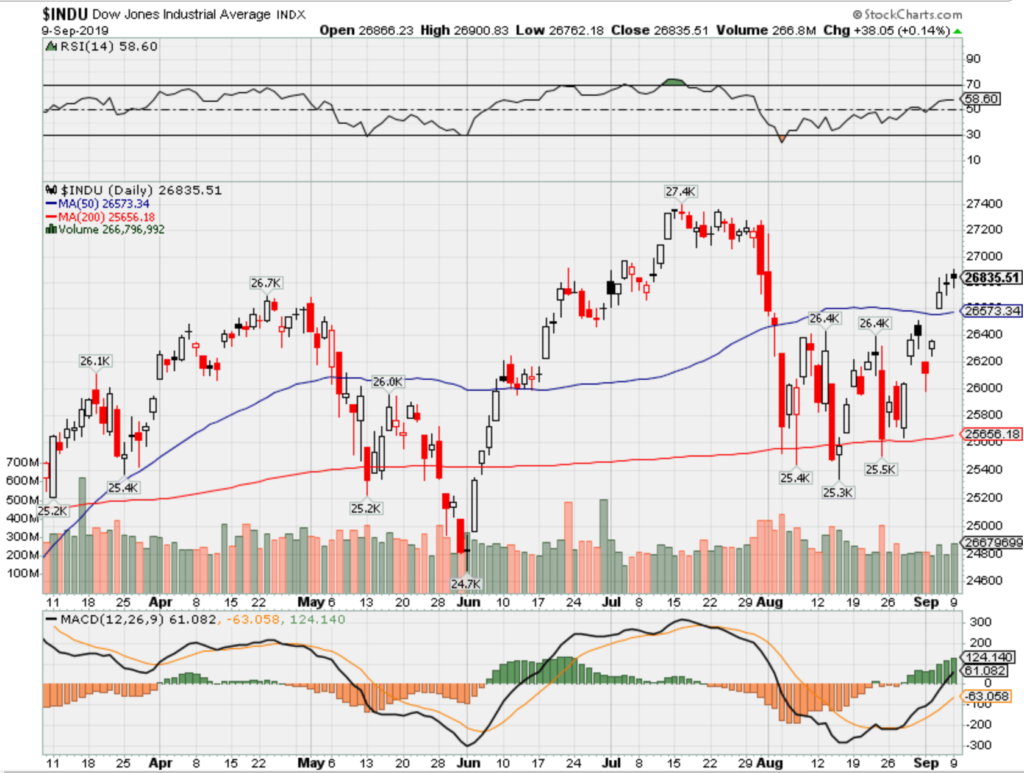

DJIA – Bullish

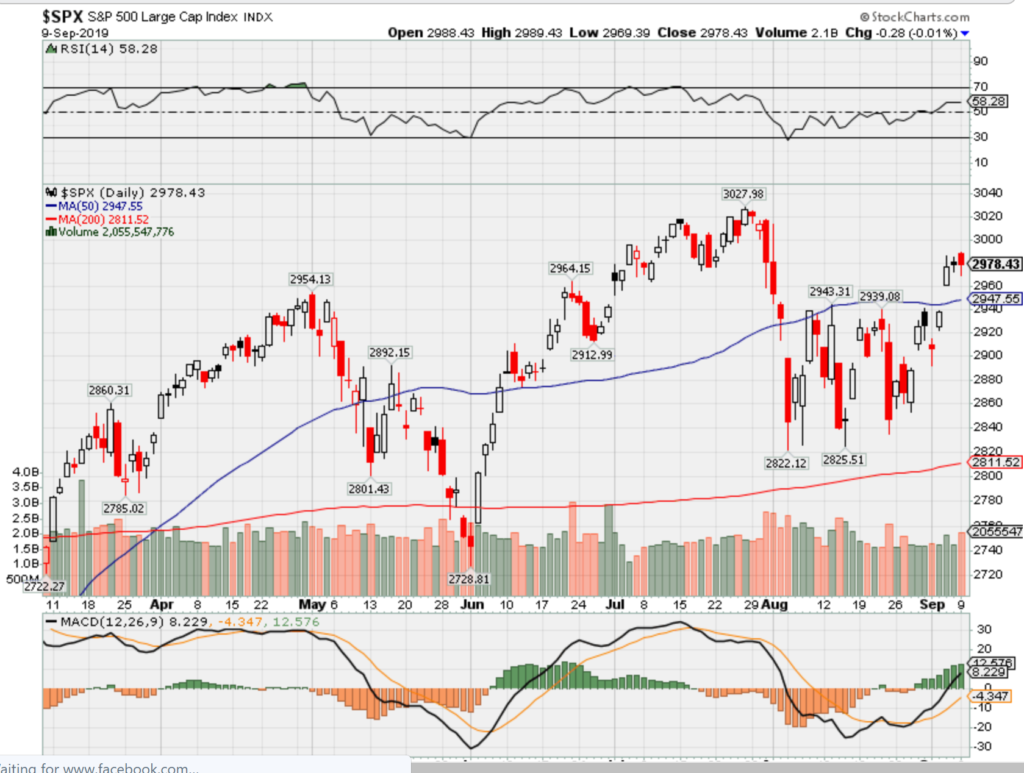

SPX – Bullish

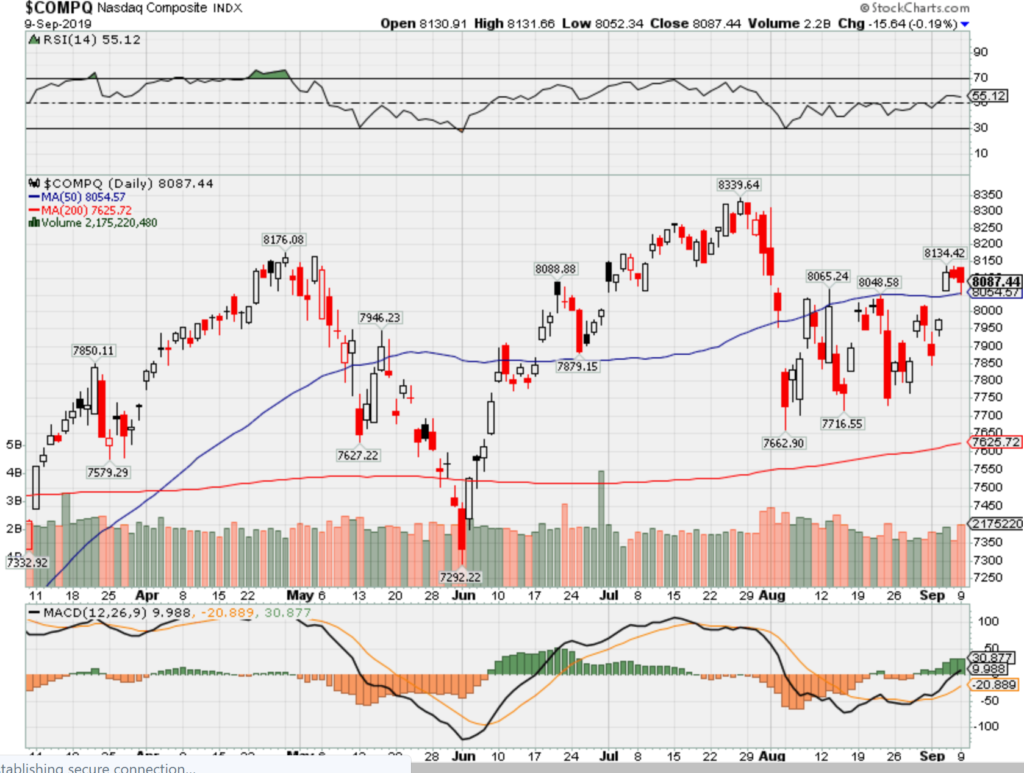

COMP – Bullish

Where Will the SPX end Sept 2019?

09-09-2019 -1.0%

09-02-2019 -1.0%

08-26-2019 -1.0%

Earnings:

Mon:

Tues: PLAY, GME

Wed:

Thur: AVGO, ORCL, KR

Fri:

Econ Reports:

Mon: Consumer Credit

Tues: NFIB Small Business Optimism, Jolts

Wed: MBA, PPI, Core PPI, Wholesale Inventory

Thur: Initial, Continuing, CPI, Core CPI, Treasury Budget

Fri: Retail Sales, Retail ex-auto, Michigan Sentiment, Import, Export, Business Inventories,

Int’l:

Mon –

Tues – CN: CPI, PPI

Wed –

Thursday – ECB: Interest Rate Decision

Friday-

Saturday/Sunday –

How am I looking to trade?

Long term and start to protect early for earnings in October

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

This S&P 500 chart just sent a screaming sell signal—here’s how to trade it

PUBLISHED MON, SEP 2 2019 11:00 AM EDTUPDATED TUE, SEP 3 2019 9:55 AM EDT

Stocks are sending a sell signal.

So says widely followed strategist Sven Henrich, founder and lead market strategist at NorthmanTrader, who told CNBC’s “Fast Money” on Thursday that one S&P 500 chart is showing the market heading for a major drop.

Many market watchers have taken notice of the technical “megaphone” pattern the S&P has been forming since mid-2018, a formation made during times of heightened volatility that is also known to some as a broadening wedge.

Digging deeper, Henrich discovered a new element forming within the megaphone: a rising wedge. Technical analysts use rising wedges to try and predict trend reversals in a given security.

“What happened in August is that rising wedge actually broke to the downside,” Henrich said. “That’s kind of your … classic warning sign. And so markets will have to repair that, or face risk of further downside to come.”

To “repair” the trend, in Henrich’s book, the S&P would have to break above the upper trend line of its megaphone pattern, make that trend line its new floor of support and then, potentially, enjoy a “massive rally.”

But there’s still a lot of room for error, the strategist warned.

“What we’re looking at here short term is there’s a possibility the VIX goes up to 28-30” in the coming months, he said, referring to the CBOE Volatility Index, also known as the stock market’s “fear gauge.”

“There’s currently a pattern on the VIX that suggests that is a distinct possibility. We may have a buyable dip,” Henrich said. “Otherwise, with a break of 2,700, for example, you’re starting to risk that this pattern goes active. And the ultimate target [on] that one is 2,100.”

That would represent a nearly 28% drop for the S&P from its Friday levels. And while that sounds dramatic, Henrich said the market is actually already offering some support for this theory.

“Ironically, that’s kind of what the bond market’s been signaling. The 10-year [U.S. Treasury yield is] already back to the levels of the U.S. election in 2016,” he said. “You have nine major economies around the globe already either in recession or at the verge of a recession.”

That’s what’s been causing the increasingly “violent” swings in the stock market, and the longer the U.S.-China trade debacle drags on, the riskier the environment gets, Henrich warned.

“I think the market is getting impatient,” he said. “The market wants this resolved, and to the extent that this, again, gets pushed into next year, perhaps, I think markets will lose patience as we see Europe, for example, overtly flirting … with recession at this point.”

Worse, if global central banks continue to “intervene when markets [get] into any sort of trouble” with accommodative monetary policy, their ability to step in during a full-fledged crisis may become muted, if not ineffective, Henrich said.

“The Fed actually is cutting rates here with financial conditions being the loosest in 25 years. It’s unfathomable. When you have loose financial conditions, typically, central banks raise rates,” he said. “What are they trying to accomplish here by going even looser than what we’ve seen before?”

“Look at the housing data you’re getting with mortgage apps,” he said. “With yields collapsing, the 30-year making all-time lows, we don’t really see any growth here in the housing market. So, what’s the end game here in terms of efficacy? And I worry that, obviously, we are reaching a point where central banks can only do so much.”

Warren Buffett says this is ‘the ultimate test of how you have lived your life’—and Bill Gates agrees

Published Sun, Sep 1 2019 9:00 AM EDTUpdated Tue, Sep 3 2019 10:40 AM EDT

Tom Popomaronis, Contributor@TPOPOMARONIS

Warren Buffett is one of the richest people in the world, but money isn’t a factor when it comes to measuring the quality of his life.

In 2017, when Buffett and Microsoft co-founder Bill Gates shared the stage for a talk at Columbia University, one student asked: “Are there any major life lessons that you two have learned about relationships through your personal experiences?”

“Well, it’s a very important question. You will move in the direction of the people that you associate with,” Buffett answered. “So it’s important to associate with people that are better than yourself.”

‘The ultimate test’

Buffett, who just turned 89 on Saturday, August 30th, 2019, has given similar advice in the past.

“Basically, when you get to my age, you’ll really measure your success in life by how many of the people you want to have love you actually do love you,” he said in 2001 during a speech at the University of Georgia.

“I know people who have a lot of money, and they get testimonial dinners and hospital wings named after them. But the truth is that nobody in the world loves them,” Buffett continued. “If you get to my age in life and nobody thinks well of you, I don’t care how big your bank account is — your life is a disaster. That’s the ultimate test of how you have lived your life.”

Choose your life partner wisely

Out of all the people who love you back, the most important person by far, according to Buffett, is your spouse. “I can’t overemphasize how important that is,” he said in his 2017 conversation with Gates.

In the 2017 HBO documentary “Becoming Warren Buffett,” the billionaire said that he owes some of his greatest qualities to his first wife Susan. “I just got very, very, very lucky. I was a lopsided person. And it took a while, but she just stood there with a little watering can and nourished me along and changed me,” he recalled.

In many ways, Susan did help Buffett become the man that he is today: She got him interested in civil rights, feminism, encouraged him to become more of a public figure and to donate more of his money during his lifetime.

If you get to my age in life and nobody thinks well of you, I don’t care how big your bank account is — your life is a disaster.

Warren Buffett

CEO, BERKSHIRE HATHAWAY

While they never got divorced, Susan moved away from Omaha and the two remained very close, according to the documentary. She also helped orchestrate Buffett’s relationship with Astrid Menks, whom he married after she died. (Buffett and Astrid tied the knot on August 30, 2006, the same day he turned 76 — and have since been together for 13 years.)

Bill Gates agrees with Buffett

In their conversation at Columbia University, Gates, who has been a longtime friend of Buffett’s, said that “some friends do bring out the best in you, so it’s good to invest in those friendships. It’s really through Melinda and seeing other people that I realized, okay, it’s really worth the investment to have those people, as you’re always there to help them and vice versa.”

Gates also commented on his marriage with Melinda last year, in a Facebook Live talk: There’s a certain type of intensity when you’re raising a family together, said, “but we’re very lucky because we mostly see things the same way. Our goals are very much the same.”

It takes all kinds

In many ways, Buffett’s words of wisdom sounds a lot like the warnings we received from our parents when we were younger about not hanging out with the wrong crowd.

Buffett’s own experience with friendships and love is proof that the people we let into our lives — the people who truly love and care about us — are the ones who push us to live successful, happy and meaningful lives.

Researchers have even found that people who have a strong support system in place (a.k.a. your friends and life partners) are less likely to suffer from depression and social isolation, which has in turn been associated with poorer health outcomes.

That’s more than enough reason to take Buffett’s advice into consideration by reflecting on the strength of your personal relationships by asking yourself questions like: Do the people who care about me really love me back? Do they make me a better person?

As Gates once said, “That’s about as good a metric as you will find.”

Tom Popomaronis is a commerce expert and proud Baltimore native. Currently, he is the Senior Director of Product Innovation at the Hawkins Group. His work has been featured in Forbes, Fast Company and The Washington Post. In 2014, he was named one of the “40 Under 40” by the Baltimore Business Journal.

The Big Short’s Michael Burry Explains Why Index Funds Are Like Subprime CDOs

September 4, 2019, 4:41 AM MDT

Investor from ‘The Big Short’ is worried about passive funds

‘The longer it goes on, the worse the crash will be’

For an investor whose story was featured in a best-selling book and an Oscar-winning movie, Michael Burry has kept a surprisingly low profile in recent years.

But it turns out the hero of “The Big Short” has plenty to say about everything from central banks fueling distortions in credit markets to opportunities in small-cap value stocks and the “bubble” in passive investing.

One of his most provocative views from a lengthy email interview with Bloomberg News on Tuesday: The recent flood of money into index funds has parallels with the pre-2008 bubble in collateralized debt obligations, the complex securities that almost destroyed the global financial system.

Burry, who made a fortune betting against CDOs before the crisis, said index fund inflows are now distorting prices for stocks and bonds in much the same way that CDO purchases did for subprime mortgages more than a decade ago. The flows will reverse at some point, he said, and “it will be ugly” when they do.

“Like most bubbles, the longer it goes on, the worse the crash will be,” said Burry, who oversees about $340 million at Scion Asset Management in Cupertino, California. One reason he likes small-cap value stocks: they tend to be under-represented in passive funds.

Here’s what else Burry had to say about indexing, liquidity, Japan and more. Comments have been lightly edited and condensed.

Index Funds and Price Discovery

“Central banks and Basel III have more or less removed price discovery from the credit markets, meaning risk does not have an accurate pricing mechanism in interest rates anymore. And now passive investing has removed price discovery from the equity markets. The simple theses and the models that get people into sectors, factors, indexes, or ETFs and mutual funds mimicking those strategies — these do not require the security-level analysis that is required for true price discovery.

“This is very much like the bubble in synthetic asset-backed CDOs before the Great Financial Crisis in that price-setting in that market was not done by fundamental security-level analysis, but by massive capital flows based on Nobel-approved models of risk that proved to be untrue.”

Liquidity Risk

“The dirty secret of passive index funds — whether open-end, closed-end, or ETF — is the distribution of daily dollar value traded among the securities within the indexes they mimic.

“In the Russell 2000 Index, for instance, the vast majority of stocks are lower volume, lower value-traded stocks. Today I counted 1,049 stocks that traded less than $5 million in value during the day. That is over half, and almost half of those — 456 stocks — traded less than $1 million during the day. Yet through indexation and passive investing, hundreds of billions are linked to stocks like this. The S&P 500 is no different — the index contains the world’s largest stocks, but still, 266 stocks — over half — traded under $150 million today. That sounds like a lot, but trillions of dollars in assets globally are indexed to these stocks. The theater keeps getting more crowded, but the exit door is the same as it always was. All this gets worse as you get into even less liquid equity and bond markets globally.”

It Won’t End Well

“This structured asset play is the same story again and again — so easy to sell, such a self-fulfilling prophecy as the technical machinery kicks in. All those money managers market lower fees for indexed, passive products, but they are not fools — they make up for it in scale.”

“Potentially making it worse will be the impossibility of unwinding the derivatives and naked buy/sell strategies used to help so many of these funds pseudo-match flows and prices each and every day. This fundamental concept is the same one that resulted in the market meltdowns in 2008. However, I just don’t know what the timeline will be. Like most bubbles, the longer it goes on, the worse the crash will be.”

Bank of Japan Cushion

“Ironically, the Japanese central bank owning so much of the largest ETFs in Japan means that during a global panic that revokes existing dogma, the largest stocks in those indexes might be relatively protected versus the U.S., Europe and other parts of Asia that do not have any similar stabilizing force inside their ETFs and passively managed funds.”

Undervalued Japan Small-Caps

“It is not hard in Japan to find simple extreme undervaluation — low earnings multiple, or low free cash flow multiple. In many cases, the company might have significant cash or stock holdings that make up a lot of the stock price.”

“There is a lot of value in the small-cap space within technology and technology components. I’m a big believer in the continued growth of remote and virtual technologies. The global retracement in semiconductor, display, and related industries has hurt the shares of related smaller Japanese companies tremendously. I expect companies like Tazmo and Nippon Pillar Packing, another holding of mine, to rebound with a high beta to the sector as the inventory of tech components is finished off and growth resumes.”

Cash Hoarding in Japan

“The government would surely like to see these companies mobilize their zombie cash and other caches of trapped capital. About half of all Japanese companies under $1 billion in market cap trade at less than tangible book value, and the median enterprise value to sales ratio for these companies is less than 50%. There is tremendous opportunity here for re-rating if companies would take governance more seriously.”

“Far too many companies are sitting on massive piles of cash and shareholdings. And these holdings are higher, relative to market cap, than any other market on Earth.”

Shareholder Activism

“I would rather not be active, and in fact, I am only getting active again in response to the widespread deep value that has arisen with the sell-off in Asian equities the last couple of years. My intention is always to improve the share rating by helping management see the benefits of improved capital allocation. I am not attempting to influence the operations of the business.”

Betting on a Water Shortage

“I sold out of those investments a few years back. There is a lot of demand for those assets these days. I am 100% focused on stock-picking.”

— With assistance by Heejin Kim

The Big Short’s Michael Burry Sees a Bubble in Passive Investing

By Heejin Kim and Myungshin Cho

August 28, 2019, 8:28 AM MDT Updated on August 28, 2019, 8:59 PM MDT

Rush into index funds has punished small-cap value stocks

‘There is all this opportunity, but so few active managers’

Michael Burry shot to fame and fortune by betting against mortgage securities before the 2008 crisis, a trade immortalized in “The Big Short.”

Now, Burry sees another contrarian opportunity emerging from what he calls the “bubble” in passive investment. As money pours into exchange-traded funds and other index-tracking products that skew toward big companies, Burry says smaller value stocks are being unduly neglected around the world.

In the past three weeks, his Scion Asset Management has disclosed major stakes in at least four small-cap companies in the U.S. and South Korea, taking an activist approach at three of them.

“The bubble in passive investing through ETFs and index funds as well as the trend to very large size among asset managers has orphaned smaller value-type securities globally,” Burry, whose Cupertino, California-based firm oversees about $343 million, wrote in an emailed response to questions from Bloomberg News.

Active money managers have bled assets in recent years as investors rebelled against high fees and disappointing returns — a trend that prompted Moody’s Investors Service to predict that index funds will overtake active management in the U.S. by 2021. The shift has coincided with a multiyear stretch of underperformance by value stocks and, more recently, by small-caps.

“There is all this opportunity, but so few active managers looking to take advantage,” wrote Burry, who was played by Christian Bale in the film version of Michael Lewis’s book on the collapse of the U.S. housing bubble and ensuing financial crisis.

Read more on the shift to passive from active funds

While Burry is best known for his bearish wagers, he said his passion is “long-oriented investing in undervalued and overlooked situations.” He said he’s turning to activism in some cases because there’s not a “critical mass of smaller value-seeking active managers like me” and to help companies make themselves more attractive to investors.

This month Burry petitioned GameStop Corp., a video-game seller, and Tailored Brands Inc., a menswear retailer, to buy back stock. Shares of Tailored Brands climbed 7.6% and GameStop 4.9% in New York on Wednesday. Scion also recently increased its positions in two South Korean small-cap companies — Ezwelfare Co. and Autech Corp. — and disclosed its intention to engage with management at Autech, a delivery truck and ambulance maker in which Burry’s firm now owns a nearly 10% stake.

Burry said he’s also “watching” developments at CJ Group, a South Korean conglomerate, without providing more details in his email to Bloomberg. Listed preferred shares of CJ Corp. rose as much as 2% in Seoul on Thursday morning.

“Korea has so much potential,” Burry wrote, citing the country’s technological prowess and high education levels. “Yet Korean stocks are almost always cheap, and management teams are to blame because they do not treat shareholders equally as owners.”

While activists including Elliott Management’s Paul Singer have recently pushed South Korean companies to boost stockholder returns, the market still trades at one of the most depressed valuations worldwide. The benchmark Kospi index has dropped about 5% this year, compared with a 16% gain in the S&P 500.

“I have seen the mistakes Americans make with activism over the years, especially in Asia,” Burry said. “My first instinct is friendly advice. It may occasionally evolve to a more hostile situation, but that is not what I want. I most want a productive conversation.”

— With assistance by Sam Mamudi

https://finance.yahoo.com/news/armageddon-stock-traders-stare-familiar-201001676.html

A Year After Armageddon, Stock Traders Stare Into a Familiar Abyss

Elena Popina and Vildana Hajric

BloombergSeptember 6, 2019

View photos

(Bloomberg) — Nobody knew it then, but this time last year, the rallying U.S. stock market was about to begin a plunge that would erase $5 trillion from share values and convince a lot of people a recession was at hand.

Then, as now, a trade war was raging, earnings in doubt and manufacturing losing steam. In the stock market, swings were getting violent — even as the S&P 500 was pulling itself over 2,900 and flirting with an all-time high. Fast-forward to today, and the picture bears an eerie similarity.

Two things stand out in the comparison. One, a recession never came. Forecasting the economy is hard, something the market gets wrong as often as humans. Two, shock waves from last year’s plunge are still being felt, cementing Federal Reserve Chairman Jerome Powell in his role as the main lifeline for risk assets.

“He’s on a tight rope like no other central banker has been before,” Chad Morganlander, a fund manager at Washington Crossing Advisors. “His message and his signal has been one to take a more balanced approach in the central bank’s behavior. Yes, the probability of a recession has increased, but it’s not flashing a warning light.”

It’s a message investors seem willing to accept, at least for now, and at least for as long as Trump limits his tweet tirades, amid the best two weeks of the quarter in the S&P 500. Credit the Powell Put or the fool-me-once effect, but they’re acting a little less panicked while staring into a familiar abyss. Markets gyrate, but so far every dip has been met with buyers.

Speaking in Zurich Friday, Powell said the most likely outlook for the U.S. and world economy is continued moderate growth, but the central bank was monitoring significant risks.

“We’re going to continue to watch all of these factors, and all the geopolitical things that are happening, and we’re going to continue to act as appropriate to sustain this expansion,” the chairman said. “Our main expectation is not at all that there will be a recession.”

A variety of things feed the case for a downturn, with most of the attention focused on the U.S.-China trade dispute, contractions in global manufacturing and the signal from bond markets.

On Tuesday, a key U.S. factory gauge, the Institute for Supply Management’s purchasing manager’s index, unexpectedly contracted for the first time since 2016. In the Treasury market, yields sit at half their level of a year ago and short-term rates have intermittently risen above longer ones, an inversion with a good record of signaling recessions.

At the same time, easing credit conditions, a strong consumer and unemployment near 50-year low paint a brighter picture that has lifted stocks. Data Thursday showed the services sector is expanding, hiring continues apace and durable goods are being bought. Friday’s employment report trailed forecasts in terms of jobs added but did little to suggest a recession is at hand.

“If you take a step back, you see that the economy isn’t in a terrible shape, just like a year ago,” said Candice Bangsund, portfolio manager at Fiera Capital. “What’s clear is that the central bank isn’t going anywhere and it’s going to backstop the economy.”

After gaining 1.9%, the S&P 500 ended the week roughly one big rally away from its July record of 3,025.86. The index has clocked 12 records in 2019. By this time last year it had closed at 19. While the market’s record of buoyancy is intact, predictions that the country and world are poised for big economic trouble have only gotten louder.

Ray Dalio, the billionaire founder of Bridgewater Associates, said there’s about a 25% chance of a U.S. recession this year and in 2020 and that central bankers will be limited in addressing it. DoubleLine Capital’s Jeffrey Gundlach forecasts a 40%-45% chance of recession in the next six months and 65% in the next year.

Standing against those views are the actions of the Fed, whose willingness to pump stimulus has helped push the S&P 500 up 19% in 2019. Policy makers cut rates in July for the first time in more than a decade and investors are all but certain another cut is coming this month. Traders are betting the central bank will cut rates by 50 basis points by the end of the year, with a 44% chance of an additional quarter-point cut.

“The biggest difference is the Fed,” said Arthur Hogan, chief market strategist at National Securities Corp. “As an operating body, they have changed the tone in the way they look at the world.”

–With assistance from Emily Barrett.

To contact the reporters on this story: Elena Popina in New York at epopina@bloomberg.net;Vildana Hajric in New York at vhajric1@bloomberg.net

To contact the editors responsible for this story: Jeremy Herron at jherron8@bloomberg.net, Chris Nagi

For more articles like this, please visit us at bloomberg.com

©2019 Bloomberg L.P.

Negative Interest Rates Threaten the Financial System

Markets may need to be rebuilt on a new set of assumptions, but we don’t know what those should be or how they would work. By Jim Bianco

September 3, 2019, 3:00 AM MDT

Former Federal Reserve Chairman Alan Greenspan recently said he wouldn’t be surprised if yields on U.S. bonds turned negative and if they do, it wouldn’t be “that big a of a deal.” That seems to be a sentiment widely held in central banking circles these days, but it’s wrong. Negative interest rates represent a threat to the financial system.

To understand why, let’s start with the existing fractional reserve banking system, which is more than a century old. For every dollar that goes into a bank, some set amount (usually about 10%) must go into a reserve account to be overseen by the central bank. The rest is either lent out or used to buy securities.

In other words, the fractional reserve banking system is leveraged to interest rates. This works when rates are positive. Loans are made and securities bought because they will generate income for the bank. In a negative rate environment, the bank must pay to hold loans and securities. In other words, banks would be punished for providing credit, which is the lifeblood of an economy. As German bankers recently explained to the European Central Bank:

We already have a devastating interest rate situation today, the end of which is unforeseeable,” Peter Schneider, who represents public-sector savings banks in the southern German state of Baden-Wuerttemberg, said on Wednesday. “If the ECB aggravates this course, that would hit not only the entire financial sector hard, but especially savers.

And to make matters worse, the German government is considering outlawing negative deposit rates. In a negative rate world, forcing rates on short-dated debt to zero would keep the yield curve permanently inverted. The fractional reserve banking system cannot operate properly in this environment.

Valuation models are another area of finance that need to be tweaked in a negative rate environment. Nobel prizes have been awarded to economists that developed concepts such as the efficient frontier, the Capital Asset Pricing Model and the Black-Scholes option pricing model. But when a negative value is assumed for the risk-free rate in these types of models, fair value results shoot off toward infinity. With trillions of securities and derivatives dependent on these models, valuation is critical.

In a similar vein, pensions use a discount interest rate to determine if they are properly funded. If one plugs in a negative interest rate as the discount rate, all pensions would technically be underfunded. The only pensions that would be properly funded would be those with assets exceeding expected liabilities. No pension is set up this way. Negative rates on fixed-income securities also means there is no way pension funds can ever generate enough income to meet their obligations.

When repurchase, or repo, rates go negative, lenders of securities must pay rather than receive income. Why would anyone lend out their securities if they also must pay for the privilege of doing so? Repos are the basic plumbing of the financial system, enabling the trade and settlement of securities transactions. If this market becomes dysfunctional, it is akin to the pipes in your walls leaking.

To see the results of low or negative rate environments, look no further than the euro zone and Japan. They account for 87% of the negative rates worldwide. Europe is essentially in recession with negative GDP in Italy, Germany and elsewhere. Its banking system is a mess, thanks to negative rates. As the chart below shows, European banks are trading at the lowest levels in more than 30 years.

Under Pressure

Europe bank stocks are at their lowest levels in more then 30 years

Source: Bloomberg

Japan is not doing much better. Economists are projecting negative GDP in the fourth quarter and the Japanese banking system is even worse than Europe’s, trading at some of the lowest since the early 1980s.

No Better

Many years of ultra-low rates have weighed on Japanese bank shares

Source: Bloomberg

These are not isolated occurrences. The first instances of modern negative interest rates arrived in Switzerland in the 1970s. As Bloomberg Opinion Columnist Stephen Mihm recently detailed, the results were not pretty.

The U.S., UK, Canada, Australia and New Zealand are the only developed bond markets that do not have negative rates anywhere on their yield curves. Should these countries join the rest of the developed world in moving to negative rates, the financial system will be under much more stress. If negative rates become more widespread across the globe, then the financial system needs to be rebuilt on a new set of assumptions. The problem is we do not yet know what those should be or how they would work.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the

author of this story:

Jim

Bianco at jimb@bloomberg.net

https://seekingalpha.com/article/4290428-apple-go-time

Apple: It’s Go Time

Sep. 8, 2019 10:47 PM ET

Summary

New iPhones to be announced on Tuesday.

Trade war evolution likely to impact pricing.

Apple TV could be the “one more thing”.

It is that time of year again. The second week of September can be named “iPhone week” as it has become the time where technology giant Apple (AAPL) unveils its newest smartphones. On Tuesday, the company is holding a major event where we are likely to see a number of new announcements. While I discussed a few major questions to ask last month, there have been some developments since that are worth diving into.

The highlight of the show will certainly be the new set of iPhones, perhaps to be the “11” line. While I won’t cover every expectation we’ve seen already, you can do that here, we are going to see updates to last year’s three versions. Other than the usual upgrade to the chipset and perhaps some new colors, the big thing expected is major camera changes. The XR successor is reportedly getting a dual-camera rear setup, while the two updated versions of the XS are supposed to get a three camera rear setup.

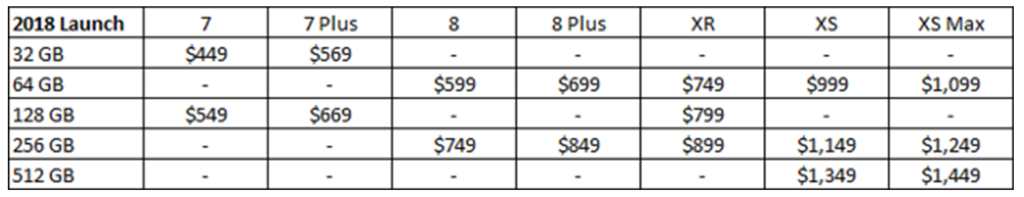

The biggest question for many has been in regards to pricing, given last year’s raise for the entry level pushed away some consumers. Given the new camera setups, plus the XR successor perhaps getting a boost to 4 GB of RAM memory, I don’t believe all those rumors of it being a “budget device”. I think we’ll still see the entry level model come in at $749. As a reminder, here is what the lineup looked like last year, after older models received their usual discounts with the launch of the new models.

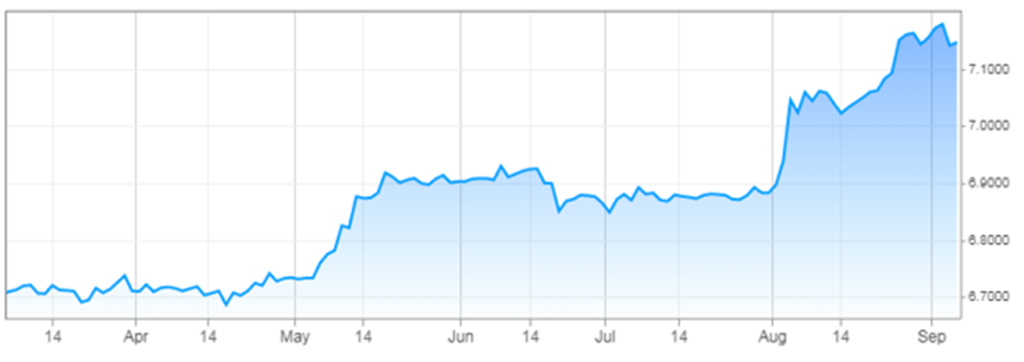

Even though there were some hopes last week of a potential US / China meeting in October, the trade war is still progressing. New tariffs went into effect on September 1st, which are likely to impact the Apple Watch and AirPods. Tariffs could impact the iPhone in the US if no deal is reached by December, but that shouldn’t have too much of an impact this week. I will also be interested to see product pricing for China, given the dollar’s rally against the Yuan over the last month as seen below.

(Source: cnbc.com, real-time quote seen here)

Although the Apple Watch and AirPods have been huge growth drivers for revenues in recent years, I could see a scenario where the company eats the tariffs. Why raise prices when global economies are starting to slow? Even if there is a little bit of a margin impact, it’s not like we are talking about a tariff on the iPhone just yet. That issue might be one to debate in a few months. Management would likely earn some goodwill with consumers if it keeps pricing the same, especially after what happened last year with the iPhone. It’s a big year for the Apple Watch, now that the App Store has come, and you don’t need a paired smartphone.

Former Apple leader Steve Jobs was known for “one more thing”, a surprise announcement that usually came at the end of the event. A month ago, I would have said that a second generation of the HomePod was perhaps that likely add-on, but recent news has changed my opinion. There have been rumors of an update to Apple TV, and with the company set to launch its streaming and gaming services this fall, I think we could see a major update to this product. The timeline fits since the last three versions were launched in 2013, 2015, and 2017. There are some out there that believe the TV update might be part of the “regular” event this week, and they are hoping for something else big to be the one more thing, like AR glasses or some other surprise.

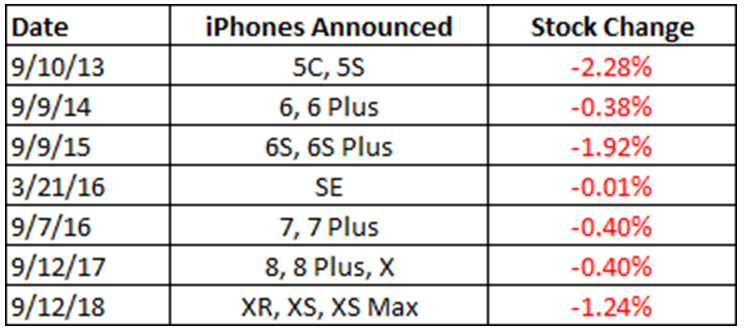

Interestingly enough, the iPhone event day has not been a good one for Apple shares in recent years. As the table below shows, the stock has declined during each of the last 7 iPhone announcement days. Perhaps expectations are just too high going in, and the day becomes a “buy the rumor, sell the news” event. The overall average is a decline of 0.95%, but if we exclude the SE day, the average September event sees an average loss of 1.10%. Apple shares have rallied recently into the event, so another decline could be possible.

(Source: Announcement dates from respective iPhone wikipedia pages, seen here, with price data taken from Yahoo! Finance)

For technology giant Apple, the start of the holiday season rush comes this week as the company gets set to launch its latest series of iPhones. The major draw this year will be major upgrades to the camera setups, which hopefully won’t mean another price raise. New Apple Watches are also expected, with perhaps an Apple TV update as the company gets ready to launch its streaming services this fall. After the 2018 iPhone series saw its sales disappoint, investors are looking to see if things can rebound this year, or if weakness will continue as consumers wait for next year’s major 5G iPhone launch. With Apple shares just a stone’s throw from their all-time high, investors are betting that this holiday period will be much better than last year’s was.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.