HI Market View Commentary 09-08-2020

| Market Recap |

| WEEK OF AUG. 31 THROUGH SEP. 4, 2020 |

| The S&P 500 index fell 2.3% last week, led lower by the energy and technology sectors as investors booked profits following five weeks of stock market gains. The drop came even as Friday’s employment data for August showed the US added 1.37 million jobs last month, near economists’ expectations. The data also showed the unemployment rate fell to 8.4% from 10.2% in July, better than expectations for an unemployment rate of 9.8%. However, the unemployment rate is still much worse than the 3.5% rate recorded in February just before being impacted by the pandemic. The S&P 500 ended Friday’s session at 3,426.96, down from last week’s closing level of 3,508.01, which had been a fresh record close at the time. The index moved even higher this week, reaching an intraday high Wednesday of 3,588.11 and a record closing high Wednesday of 3,580.84. However, it tumbled 3.5% in Thursday session as investors booked profits and grew skittish ahead of Friday’s jobs report, and slipped another 0.8% in Friday’s session. Despite August’s payroll gains, 881,000 people filed initial jobless claims in the seven days that ended on Aug. 29. Still, that was down from 1.01 million the previous week. Investors are hoping Republicans and Democrats can reach a deal later this month on a second stimulus package to provide relief to consumers and businesses suffering from the ongoing COVID-19 pandemic. The energy sector had the largest percentage drop of the week, down 4.3%, followed by technology, down 4.1%. The rest of the S&P 500’s sectors also fell, with two exceptions: materials rose 0.8% and utilities edged up 0.5%. The energy sector’s decline came as crude-oil futures fell amid continued concerns about the pandemic’s impact on demand. Shares of Diamondback Energy (FANG) slid 11.5% on the week while Pioneer Natural Resources (PXD) shed 6.2%. In the technology sector, Apple (AAPL) shares dropped 3.1% for the week. The stock had an 8.0% tumble in Thursday’s session that was notable for marking the largest one-day loss in market capitalization — $179.92 billion — for a US-listed company on record. However, Apple shares are still up 46% in the last three months and 65% for the year to date as the pandemic has boosted demand for the consumer technology company’s products and services. On the upside, the materials sector’s gainers included Eastman Chemical (EMN), whose shares rose 6.1% as Tudor Pickering raised its price target on the stock to $86 per share from $83. The firm has a buy investment rating on the stock. The utilities sector’s gainers included FirstEnergy (FE), whose shares rose 3.9% this week as RBC Capital Markets upgraded its investment rating on the stock to outperform from sector perform. RBC also boosted its price target on the stock to $37 per share from $36. The firm said “fear of the unknown is keeping the stock price down,” and it ultimately believes “that the stock price undervalues the company’s earnings power.” Next week, the market will be closed Monday for the Labor Day holiday in the US. Tuesday, investors will get readings on small business activity in August and consumer credit in July. Other data highlights next week include inflation data, with the producer price index for August due Thursday and the consumer price index for August due Friday. Provided by MT Newswires. |

When have such upside exuberance we get the same reaction time 2 on the way down

Question of the day? Why haven’t you sold off our profitable stock positions as well?

It will create a taxable event “HUGE”

I got this from the CNBC 3 types of investors video

In the last 40 years:

If you missed the 5 best days in the market you missed 30% of the gains

If you missed the 30 best days in the market you missed 70% of the gains

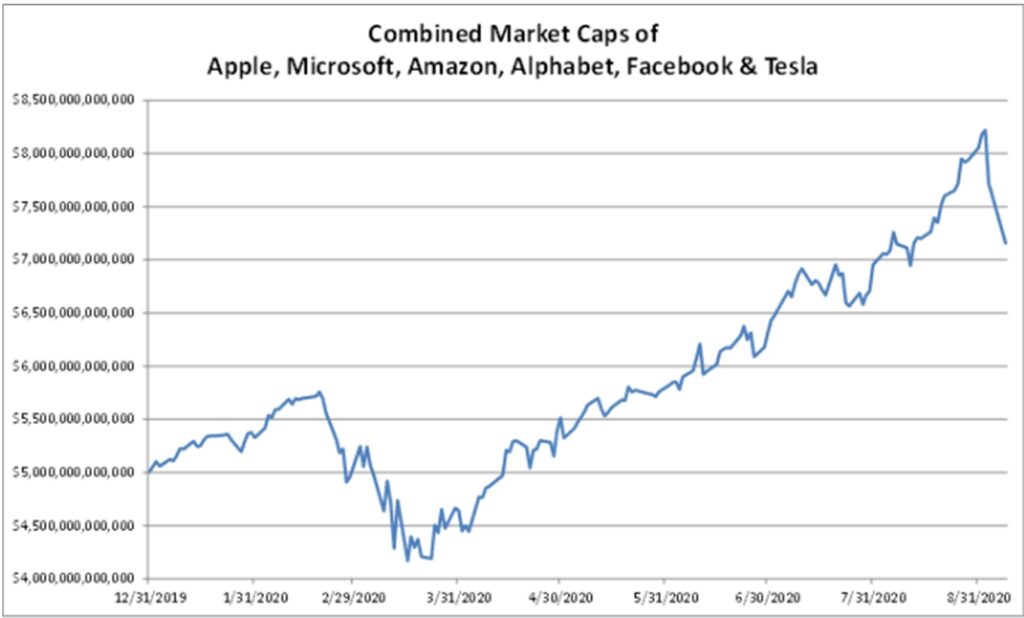

The six biggest tech stocks have lost more than $1 trillion in value in three days

KEY POINTS

- The six biggest tech stocks have lost more than $1 trillion over the last three days alone, but it’s really just a dent coming off a huge rally that peaked last week.

- Apple, which hit a $2 trillion market cap on Aug. 19, is down about $325 billion in that time period.

- “To help put that in perspective, that’s about 1.5 Salesforces, and equivalent to Apple’s projected revenues for the next calendar year. Jefferies’ Jared Weisfeld told CNBC’s Fast Money on Tuesday.

The six biggest tech stocks have lost more than $1 trillion over the last three days alone, but it’s really just a dent coming off a huge rally that peaked last week.

Apple, which hit a $2 trillion market cap on Aug. 19, is down about $325 billion in that time period. Microsoft’s down $219 billion, Amazon fell $191 billion, Alphabet cratered by $135 billion, and Tesla, which fell 21% on Tuesday to mark its worst single-day loss in its history, is down $109 billion in the last three days. Finally, Facebook is off by $89 billion.

“In general, if you think about the market cap loss over the last 3 days for Apple, it’s about $325 billion. To help put that in perspective, that’s about 1.5 Salesforces, and equivalent to Apple’s projected revenues for the next calendar year,” Jefferies’ Jared Weisfeld told CNBC’s “Fast Money” on Tuesday.

Despite the huge number, it’s worth keeping in perspective given the tech giants’ massive rise in value this year.

At the beginning of 2020, the six largest tech companies were worth about $5 trillion. On Wednesday, Sept. 2, they peaked with a value of $8.2 trillion. After Tuesday’s close, they have a combined market cap of $7.1 trillion. While it’s a big loss over a few days, these six companies are still worth $2.1 trillion more than they were at the beginning of the year — despite the global coronavirus pandemic and record job losses in the U.S.

CNBC

“I certainly haven’t sensed any panic with clients and investors I’ve spoken with over the past couple of days… but no doubt about it the large cap tech has led us lower and today’s action was certainly dramatic evidenced by Apple dropping below the $2 trillion market cap,” Weisfeld said.

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end September 2020?

09-08-2020 -5.0%

08-31-2020 -5.0%

Earnings:

Mon:

Tues: CBRL, SINA, ADBE, FDX, HTZ

Wed:

Thur:

Fri:

Econ Reports:

Mon:

Tues: Consumer Credit, NIFB Small Business

Wed: MBA, JOLTS

Thur: Initial Claims, Continuing Claims, PPI, Core PPI, Wholesale Inventories

Fri: CPI, Core CPI, Treasury Budget

Int’l:

Mon –

Tues – CN: Trade Balance

Wed – CN: CPI, PPI

Thursday –

Friday-

Sunday –

How am I looking to trade?

Still letting most thing run but preparing for protection to get us through Oct and then new protection for the election. I’m also looking to take profits from those leap call positions and be more cash heavy for an opportunity to buy in lower. ALL DONE AND MOSTLY PROTECTED

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Worries grow over a K-shaped economic recovery that favors the wealthy

PUBLISHED FRI, SEP 4 20201:41 PM EDTUPDATED SAT, SEP 5 20205:35 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- As the economy struggles to shake off the pandemic effects, worries are growing that the recovery could look like a K.

- That would be one where growth continues but is uneven, split between sectors and income groups.

- One obvious area of concern is the dichotomy of the stock market vs the real economy, especially considering that 52% of the market is owned by the top 1% of earners.

- “Let’s not get lost on different letters of the alphabet,” Treasury Secretary Steven Mnuchin said. “There are certainly parts of the economy that need more work.”

The story for much of the past generation has been a familiar one for the U.S. economy, where the benefits of expansion flow mostly to the top and those at the bottom fall further behind.

Some experts think the coronavirus pandemic is only going to make matters worse.

Worries of a K-shaped recovery are growing in the alphabet-obsessed economics profession. That would entail continued growth, but split sharply between industries and economic groups.

It’s a scenario where big-box retail and Wall Street banks benefit and mom-and-pop shops and restaurants and other service profession workers lag. Though not readily visible in GDP numbers for the next several quarters that will look gaudy in historical terms, the uneven benefits of the recovery pose longer-term risks for the national economic health.

“The K-shaped recovery is just a reiteration of what we called the bifurcation of the economy during the Great Financial Crisis. It really is about the growing inequality since the early 1980s across the country and the economy,” said Joseph Brusuelas, chief economist at RSM. “When we talk K, the upper path of the K is clearly financial markets, the lower path is the real economy, and the two are separated.”

Indeed, one of the simplest ways to envision the current K pattern is by looking at the meteoric surge of the stock market since late March, compared to the rest of the economy. While the market soared to new heights, GDP plunged at its most ever at an annualized rate, unemployment, while falling, remains a problem particularly in lower income groups, and thousands of small businesses have failed during the pandemic.

That in itself exacerbates inequality at a time when 52% of stocks and mutual funds are owned by the top 1% of earners.

But it’s not just about asset ownership, it’s the nature of those assets.

The stock market gains have been largely the result of a handful of stocks. Excluding newcomer Salesforce.com, Apple, Microsoft and Home Depot have contributed more points to the Dow Jones Industrial Average this year than the other 27 stocks on the index combined.

That’s why Wall Street when looking for the proper letter — V, W, U or variations thereof — is beginning to see K as more of a possibility.

“The K-shaped narrative is gaining traction as the tale of two recoveries conforms well with the ongoing outperformance of risk assets and real estate while front-line service sector jobs risk permanent elimination,” Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, said in a note.

The dominating stocks, in fact, help tell a story about a shifting economy that is leaving those behind with less access to the technology that will shape the recovery.

“We believe this is now settled and that we are seeing a ‘K-shaped’ recovery,” wrote Marko Kolanovic, global head of macro quantitative and derivatives research at JPMorgan Chase.

Kolanovic, who has foreseen a number of major market changes, said the rapid evolution of society during the pandemic has triggered movements that have exacerbated inequality.

“The use of devices, cloud and internet services was bound to skyrocket while the rest of the economy took a nose dive (airlines, energy, shopping malls, offices, hospitality, etc.),” he said. “This has created enormous inequality not just in the performance of economic segments, but in society more broadly. On one side, tech fortunes reached all-time highs, while lower income, blue collar workers and those that cannot work remotely suffered the most.”

Federal Reserve Chairman Jerome Powell has bemoaned the momentum that lower earners had just begun to see prior to the pandemic.

That’s one of the reasons the central bank last week adopted a major policy shift in which it will allow inflation to run above the Fed’s 2% goal for a period of time after it has run below the mark. More than just a philosophical statement about inflation, codifying the approach allows the Fed to keep interest rates low even after the jobless rate drops below what had once been considered full employment.

Fed officials believe that keeping policy loose when the unemployment rate hit a 50-year low over the past year helped contribute to the wider distribution of income gains, and should be the approach going forward.

“It’s a good start that the Federal Reserve, based on two decades of structural change in the economy and a rapidly changing demographic structure in the United States, decided to walk back its long-held preference to act to preventatively against inflation, when expectations were clearly anchored,” Brusuelas said.

The Fed, though, has taken some of the blame for the inequality by implementing policies that seem to benefit asset holders and ignore the rest of the population. While loans to smaller businesses have been slow to get out, the central bank has been buying junk bonds and debt of big companies like Apple and Microsoft to support market functioning. The inflation pivot and an accompanying change on the approach to the unemployment rate, then, is seen as a way to focus policy more broadly.

A variety of paths

To be sure, the actual shape of the recovery depends on a number of factors, high among them the direction of the virus and the extent to which Congress and the White House come through with more fiscal aid.

This downturn is unique in that it did not follow one of the usual paths lower, such as a credit crunch or an asset bubble. Instead, this was a government-induced recession, a byproduct of efforts to contain the pandemic by purposely keeping people away from their jobs and subsequently greatly reducing the ability of businesses to operate.

That’s why predicting the path of recovery is difficult.

“Every business cycle since 1990 has been one where there’s been some ‘K’ characteristics to it,” said Steven Ricchiuto, U.S. chief economist at Mizuho Securities. “Because they’ve been credit cycles, rising waters don’t always lift all boats the same way. Some boats are tiny little lifeboats without much baggage, and some other boats have heavier bags that need more energy to lift. Those are the ones that have credit problems.”

In the current situation, credit is not the problem and the Fed has backstopped any of those issues that may arise through its myriad lending and liquidity facilities.

Ricchiuto sees a “more traditional recovery environment” that will turn into a “swoosh,” or one where an initial burst levels off. That also is a popular view.

“Clearly some areas are going to be slower to come back. That’s going to be true even when the vaccine comes about,” said Yung-Yu Ma, chief investment strategist at BMO Wealth Management. “I don’t buy into the K shape so much. I think it’s more a matter where there will be some industries that take an extra six to nine months to really pick up economic momentum. But once that happens, everything will go together in the same general trajectory.”

Economic data generally reflects a multi-speed recovery. The Citi Economic Surprise Index, which measures data points against Wall Street expectations, is well above any level that it had seen pre-crisis. Hiring finally has picked up in bars and restaurants as well as retail establishments, but is well behind pre-pandemic levels and dependent on a slew of intangibles ahead.

“We went into this downturn without having severe imbalances in the economy that needed to be corrected,” Ma said. “The external shock, yes, it’s dramatic and one that requires a lot of effort to get past and a lot of time and resources. But it’s not the case that the underlying fundamentals of the economy were distorted.”

Still, worries that uneven growth could accelerate wealth disparities are on the minds of some economists and elected officials, in the latter case becoming particularly acute as the heat turns up on election season.

The subject came up on multiple occasions during a hearing Treasury Secretary Steven Mnuchin had before a House panel on the coronavirus earlier this week.

“Rather than a V-shaped recovery, economists have warned we face an uneven K-shaped recovery, where the wealthy quickly bounceback to pre-pandemic prosperity while lower-income families continue to suffer economic harm,” Rep. James Clyburn (D-S.C.) told Mnuchin.

The Treasury secretary said the administration is sensitive to the issue though he insisted that “we are set for a very strong recovery.”

“I just want to assure you the president and the administration thinks there is more work to be done,” Mnuchin said. “Let’s not get lost on different letters of the alphabet. Let’s move forward on a bipartisan basis on areas we can agree upon. Because there are certainly parts of the economy that need more work.”

Softbank identified as the ‘Nasdaq whale’ that bought billions in stock options, betting on higher prices for the biggest names in tech

PUBLISHED FRI, SEP 4 20201:04 PM EDTUPDATED SUN, SEP 6 202011:59 AM EDT

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

- SoftBank was the buyer of billions of dollars in technology company options in the past month, according to the Financial Times.

- Analysts said the activity in call options, those that bet on stocks rising, added to market froth as sellers of the options bought stocks.

- The Wall Street Journal said SoftBank bought $4 billion in options on stocks it owned, like Amazon and Microsoft, but also in other names.

Japan’s SoftBank was reportedly the “Nasdaq whale,” that bought billions of dollars in individual stock options in big tech companies over the past month, driving up volumes and contributing to a trading frenzy.

Softbank declined comment on a Financial Times story that quoted unnamed sources who said it was buying equity derivatives on a massive scale. Rumors had circulated in the market that there were large players behind the frenzied activity in the options market for big tech and internet stocks, and SoftBank was one named mentioned in connection with extreme volumes in some out-of-the-money calls.

SoftBank, through its $100 billion Vision Fund, has made big investments on privately held technology start ups. The big investments in the options market is new territory for the investment firm.

Investors have been watching extraordinary activity in out-of-the-money calls which some analysts had seen as a contrarian warning about a pending Nasdaq sell off. Some of the names with high amounts of activity, include Apple, Tesla, Zoom, and Nvidia.

According to the Wall Street Journal, SoftBank had made regulatory filings showing it bought nearly $4 billion in shares of Amazon, Microsoft, and Netflix, plus a stake in Tesla. The paper quoted a source saying that SoftBank spent roughly $4 billion buying call options tied to its stock holdings, but also in other names. It then could profit from the run up in stocks and subsequently unload its position to other parties.

SoftBank was trading in names that are among the key drivers of the stock market. Apple, Amazon , Microsoft, Facebook and Google equal about a quarter of the S&P 500, and they have been drivers of a big chunk of its gains. One options trader explained that those names can be proxies for the market, and can be hedged against the S&P 500 and vice versa.

The options market activity was credited by analysts for adding froth to the stock market itself. Some of that is now reversing. Nasdaq fell sharply Thursday, declining 5%, and was down another 2.5% Friday. The Nasdaq, from its March low to intraday high this week, was up 83%.

“It’s just a trip to the casino,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group. “If they’re supposed to be an investment company taking a long-term horizon, then trying to juice your short-term return through options, you’ve turned into a hedge fund.”

Boockvar said the question now is whether SoftBank unloaded its positions. “We’ll see if they’re reversing it. A lot of the call buying was an upward lift to the market. The sellers of those calls, then had to buy stocks and hedge and it becomes a self-fulfilling prophecy on the upside,” he said.

The Financial Times said the trading volumes in single stocks had surged beyond the average daily volumes of calls on the broader stock market indices.

Traders had been monitoring the unusual activity, which may help explain why the stock market had been climbing at the same time the VIX was rising. The VIX is the CBOE’s Volatility Index, which is calculated based on trading in puts and calls on the S&P 500. The VIX serves as the market’s so-called fear gauge and typically moves higher when stocks are falling, not rising.

Tech investor Roger McNamee said the SoftBank report was disturbing. “If it’s true that SoftBank is doing that, it would be more signs that the fundamental picture here is decoupled from stock prices,” he said on CNBC.

‘We’re certainly in a bubble,’ strategist warns — but don’t expect it to pop anytime soon

PUBLISHED MON, SEP 7 20208:03 AM EDTUPDATED 5 HOURS AGO

KEY POINTS

- The S&P 500 tech sector fell more than 4% for the week, intensifying speculation that the stock market shakeout was likely not over yet.

- The space had largely been responsible for the broader market’s strong comeback off its coronavirus lows.

- “I think we are certainly in bubble territory,” Jonathan Bell, chief investment officer at Stanhope Capital, told CNBC’s “Street Signs Europe” on Monday.

Tech stocks are unequivocally in “bubble” territory, a chief investment officer told CNBC on Monday, but that’s not to say the recent “tech wreck” is going to continue in the short term.

U.S. stocks closed lower for the second consecutive session on Friday, bringing an end to a volatile trading week ahead of the long Labor Day weekend.

The S&P 500 tech sector fell more than 4% for the week, intensifying speculation that the stock market shakeout was likely not over yet. The space had largely been responsible for the broader market’s strong comeback off its coronavirus lows.

“I think we are certainly in bubble territory,” Jonathan Bell, chief investment officer at Stanhope Capital, told CNBC’s “Street Signs Europe” on Monday.

Bell suggested there had been “so many good reasons” for investors to own the likes of Google-parent company Alphabet, Amazon, Apple, Microsoft and Facebook, pointing to their combined outperformance in the wake of the pandemic as something “everyone is talking about.”

“It’s not that these businesses aren’t great businesses that are going to carry on going, it is just the exuberance related to them,” Bell warned.

Shares of Amazon have shot up 78% so far this year, leading the so-called “FAANG” stocks. Shares of Apple and Netflix have skyrocketed 65% and 59%, respectively, while shares of Facebook and Alphabet have risen 38% and 19%, respectively, this year.

Bell pointed out that the so-called “big five” tech stocks already represent around 20% of the U.S. stock market, and given how big the U.S. market is globally, the tech giants amount to 12% of the MSCI World Index.

“You’ve got exuberance on just a very small number of stocks. That’s certainly bubble territory,” Bell added.

‘Irrational exuberance’

When discussing whether the tech bubble he had described could burst in the near future, Bell drew a comparison to comments made by former Federal Reserve Chair Alan Greenspan in 1996.

Greenspan, in a now-iconic observation, warned at the time that there were signs of “irrational exuberance” in financial markets.

Stocks continued to rise for some time after Greenspan delivered his speech, but the line is often cited as a warning shot for the dot-com bust that would occur toward the end of that decade.

“I would be saying to people that this is a bubble-type territory, but it doesn’t mean that it is going to deflate now. What we have seen in the last week or so is only an unwinding of the rise of the previous two weeks,” Stanhope Capital’s Bell said.

“There’s still a lot of reasons to own these but be really careful, trim holdings … Look at the percentage weighting you’ve got. If you’ve got 15% or 20% and you’re overweight those then be aware of that, but if you’ve got 30% or 40% of your portfolio in there, then that’s a really big risk you’re taking,” he concluded.

His comments come after Leo Grohowski, chief investment officer at BNY Mellon Wealth Management, described last week’s sell-off as “a good wake-up call and a reminder that there are risks out there.”

“In August, we did take a little bit off the table,” Grohowski said.

Steve Massocca, managing director at Wedbush, said last week that “it doesn’t take much” to trigger a downturn in tech, adding: “These stocks are very stretched to the upside.”

“The wind direction just has to change,” Massocca said.

— CNBC’s Patti Domm contributed to this report.

https://seekingalpha.com/article/4372177-yes-crash-is-coming

Yes, The Crash Is Coming

Sep. 2, 2020 3:58 PM ET

Summary

Ah, Where to begin?

Is it Tesla’s $450 billion valuation and its pre-split adjusted price of around $2,500?

How about the fact that Apple is now worth more than the entire FTSE 100?

Retail investors going wild on Robinhood and other trading apps is certainly a troubling sign.

If you think this is madness, just look at what this all-important market gauge is implying the future has in store.

You Know The Crash Is Coming, Right?

The S&P 500/SPX (SP500), Nasdaq, as well as other major market averages and ETFs continue to hit new all time highs/ATHs, after new ATH essentially on a daily basis.

SPX futures

Source: Think or Swim, Ameritrade

Despite an exploding number of COVID-19 cases, continued civil unrest, uncertainty about the November Presidential election, as well as other detrimental factors, SPX futures continue to move relentlessly higher at an extremely rapid pace. SPX futures are now at around 3,550, which is roughly 5% above pre-COVID-19 ATHs. Moreover, SPX futures are now about 60% above their mid-March lows, which are astounding gains in fewer than a 6-month period. This makes me think, how much longer can this rally last without a significant correction?

S&P 500

Since I am writing this article in pre-market Wednesday September second, the nearly 1% gain in SPX futures is not factored into this chart. Nevertheless, just look at some of these technical indicators. The RSI is at round 79, but once the market opens it should surge to over 80. This implies that the SPX and stocks in general are drastically overbought right now.

When have we seen the RSI at similar levels? That’s right, shortly before the market crashed in early 2020. Other “troubling” technical indicators like the CCI sloping downward, the full stochastic being above 80 for a very extended period of time, and volume decreasing lately are also flashing red signals.

Overall, there are a lot of yellow, and even red flags on the technical front. Furthermore, cracks are materializing in the fundamental image as well. Now, this does not mean that the market is going to crash today, tomorrow, or even a week from now. In fact, I believe that despite all the “madness”, irrational exuberance may continue to propel this rally for several more weeks, possibly to mid-fall even. But then, the crash will come in my view, and it could get grizzly.

The stock market surged remarkably fast to new ATHs despite a faltering and/or stagnating economy. Many if not most investors did not expect the SPX to surge by over 60% in fewer than 6 months, and it is very likely that many investors are not prepared for the swift and violent market downturn that is likely to occur in early to mid-fall in my view.

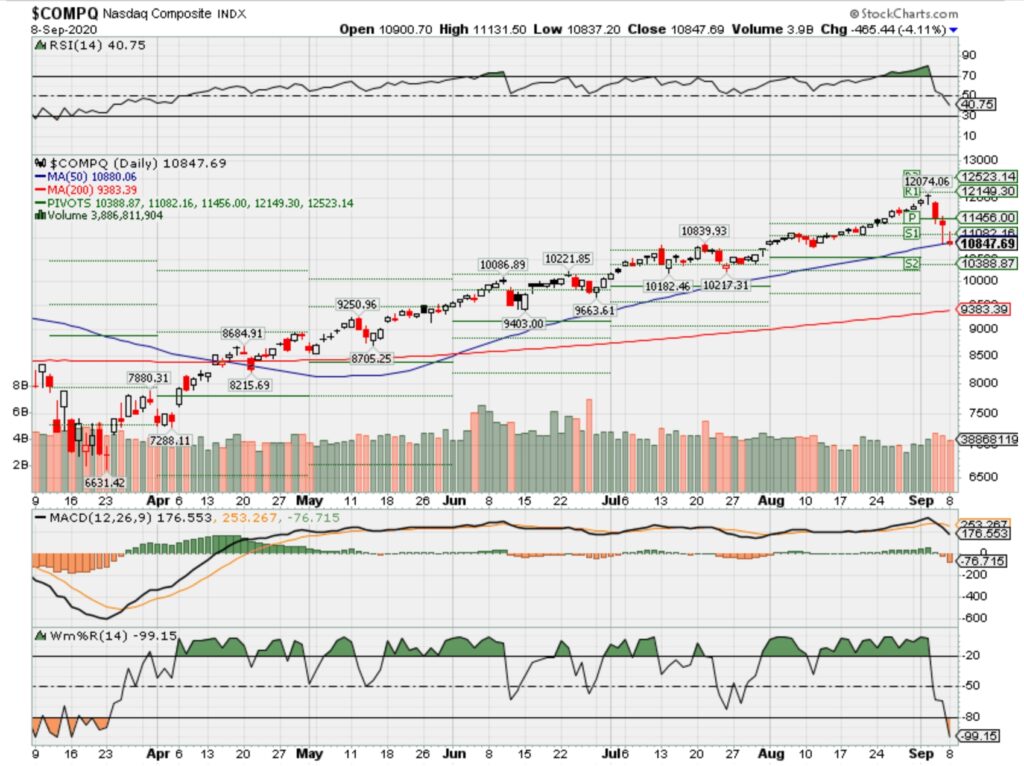

Now, Let’s Talk About The Nasdaq for a Minute

If you think the SPX is running hot, just look at the Nasdaq:

We see a somewhat similar technical image as in the SPX. The RSI is approaching 80, volume is declining, the CCI and full stochastic are starting to look negative, etc. Once again, since I am writing this article in the pre-market the Nasdaq futures’ roughly 1% gain is not factored into the underlying chart.

So, let us look at Nasdaq futures

Nasdaq futures are at around 12,500 now, which is about an 11% gain over the last 9 trading sessions alone. This is quite remarkable indeed, but if we look back a bit we see that Nasdaq futures are now around 28% above their pre-COVID-19 ATHs, and have skyrocketed by a remarkable 87% since their mid-March bottom. That’s nearly a double in under 6 months. However, I would not be surprised if the Nasdaq continues its run based on hype, hope, and QE unlimited until it is up by around 100% from its lows, before the Nasdaq and stocks in general begin to crumble again.

A Few “Interesting Facts”

Tesla (TSLA) now has a market cap of NEARLY $450 BILLION, and if we took away its recent 5-1 stock split, shares would be worth close to $2,500. I’ve been a Tesla bull for years, and I expect it to become a trillion dollar company eventually, but I did not expect the rise to nearly half a trillion to be this rapid.

In fact, I believe the company’s valuation is unjustified and unreasonable at this point, is largely driven by short covering and FOMO, mostly from the retail investor side. This will likely end badly in the near future (meaning Tesla could decline by 25-50% in the upcoming crash in my view).

I remember not so long ago market participants were saying “wow, how can Tesla be worth more than Ford (F), then General Motors (GM)”. Well, now Tesla’s market cap is more than Toyota (TM), Volkswagen (OTCPK:VWAGY), Honda (HMC), Ford, General Motors, and a few other auto makers combined.

Apple (AAPL) is now worth more than the entire FTSE 100, which are essentially the 100 biggest companies in Great Britain. Apple’s market cap is now AROUND $2.3 TRILLION, and the company is trading about 36 times next year’s consensus EPS estimates, making it extremely frothy in my view.

Is Apple a growth company all of a sudden? I think not (at least not for long), as it is largely a cyclical hardware manufacturer for the most part (aside from its services business) and its projected revenue growth for this year is only around 5%. Next year’s 12.5% consensus estimates cannot be trusted in my view as it is unclear whether the “recovery” will be as robust as many market participants envision.

The Retail Investor

Typically, retail investors pile into stocks towards the top in the market and this is what we are seeing right now. In fact, we appear to be seeing the “smart money” preparing for a crash, but the retail guys, not so much. Retail investors seem to be buying stocks hand over fist on apps like Robinhood (which is under SEC investigation), and others. Moreover, the buyers seem oblivious to valuations and economic cracks forming beneath the surface of the U.S. economy and other major economies around the globe.

The VIX Divergence

The VIX, or the volatility/fear index is creeping higher despite the SPX hitting new ATHs day after day. Such a divergence is rare and typically occurs before a market meltdown, as option traders load up on put options for protection/or just to short the market. I believe this is a major red flag that implies the smart money is expecting a market crash of roughly 20% sometime this fall.

The Bottom Line

There are simply too many red flags to ignore at this point. Markets have come too far too fast, and it is only a matter of time until the next correction, or meltdown begins.

How much time? I believe we may go through a mild pullback or a consolidation phase in the very near future, possibly just days away. However, the real crash will likely come in late September/early October. Uncertainty about the Presidential election, a possible second wave of the coronavirus, a slower than expected recovery, worsening corporate profits, extremely overbought market conditions, very frothy valuations, and other detrimental factors could cause the current rally to do a rapid 180. This could result in “corrections” of 20% or more in the SPX, Nasdaq, and other major indexes in my view.

Remember, a wise man once said, “be cautious or even fearful when everyone seems greedy, and be greedy when everyone is fearful” – Warren Buffett. I believe this is a very appropriate time to be extremely cautious, and you will very likely get the chance to be greedy when most are panic selling and fearful in the fall, leading up to the Presidential election.

All the best to everyone and have a great day!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article expresses solely my opinions, is produced for informational purposes only and is not a recommendation to buy or sell any securities. Please always conduct your own research before making any investment decisions.

Tesla could be the most dangerous stock on Wall Street, investment researcher says

Tesla shares may be up 400% this year, but one investment researcher is sounding the alarm on the stock.

New Constructs CEO David Trainer calls Tesla the most dangerous stock on Wall Street and says the fundamentals do not support such a high price and valuation.

“Whatever best-case scenario you want to paint for what Tesla’s going to do – whether they’re going to produce 30 million cars within the next 10 years, and get in the insurance business and have the same high margins as Toyota, the most efficient car company with scale of all-time – even if you do believe all that is true, the stock price is still implying that profits are going to be even bigger than that,” Trainer told CNBC’s “Trading Nation” on Thursday.

He notes that the stock price is implying anywhere from a 40% to 110% market share based upon the average selling price. At its current average selling price of $57,000 and assuming 10.9 million car sales by 2030, that implies 42% market share, Trainer says. Tesla trades at 159 times forward earnings.

“We think this is a big, big – one of the biggest of all time – houses of cards that’s getting ready to fold,” said Trainer.

He adds that its recent stock split could also prove dangerous to new investors getting into the stock.

“Stock splits are inconsequential to value. They’re not changing the size, they’re just dividing it up into more pieces. Honestly, I look at the stock split as a way to lure more unsuspecting, less sophisticated traders into just trying to chase this stock up and that is not a real strategy,” said Trainer.

Tesla split its stock five to one on August 31 – shares rallied 12% on the session. However, the stock ended last week down more than 5% after the company’s largest outside shareholder Ballie Gifford trimmed its stake. The stock was also caught up in a broader sell-off that punished some of the market’s high momentum names.

A more realistic valuation, says Trainer, would be far lower than current levels.

“I think around a 10th of what it is is probably appropriate if you look at, you know, kind of a reasonable level of profits,” he said. “Tesla doesn’t rank in the top 10 in market share or car sales in Europe for EVs and that’s because the laws changed in Europe that have strongly incentivized the incumbent manufacturers to crank up hybrids and electric vehicles. The same is coming in the United States. I think realistically we’re talking about something closer to $50, not $500, as a real value.”

Trainer does credit Tesla CEO Elon Musk and the company for accelerating the trend and making electric vehicles more mainstream. A focus on fundamentals, though, makes Tesla a no-touch for him.

Tesla did not respond to a request for comment.

China accuses U.S. of ‘bullying’ as it touts new global data security push

KEY POINTS

- China’s Foreign Minister Wang Yi launched a global data security initiative on Tuesday, and outlined the principles that should be followed in areas from personal information to espionage.

- The initiative comes as the U.S. continues to put pressure on China’s largest technology companies and convince countries around the world to block them.

- There are eight key principles in the initiative, ranging from how data should be stored to how it should be used.

GUANGZHOU, China — China launched a global data security initiative on Tuesday outlining principles that should be followed in areas from personal information to espionage.

The initiative, announced by Foreign Minister Wang Yi in Beijing, comes as the U.S. continues to put pressure on China’s largest technology companies and convince countries around the world to block them.

China’s initiative has eight key points including not using technology to impair other countries’ critical infrastructure or steal data, and making sure service providers don’t install backdoors in their products and illegally obtain user data.

Wang also said the initiative looks to put an end to activities that “infringe upon personal information” and oppose using technology to conduct mass surveillance against other states.

Companies should also respect the laws of host countries and stop coercing domestic firms to store data generated overseas in their own territory, the initiative added.

Many of those points appear to address some of Washington’s accusations.

https://art19.com/shows/bcd08fc3-8958-4c47-bf8e-524432adcd77/episodes/1830d3dc-0ca3-4f40-a12e-17b1ac01bc27/embed The U.S. has accused China’s technology companies of posing national security threats by collecting user data and sending them back to Beijing. Companies including Huawei and ByteDance have denied those allegations.

“We have not and will not ask Chinese companies to transfer data overseas to the government in breach of other countries’ laws,” Wang said.

Anyone signing up to the pledge should also respect the sovereignty, jurisdiction and governance of data of other states and avoid asking companies or individuals located in other countries to provide data without permission.

China has its own rules around censorship and data. A system known as the Great Firewall effectively blocks services like Google and Facebook, while China’s censors regularly tell the country’s internet companies to take down content. Meanwhile, countries like Australia have raised concerns about two pieces of Chinese legislation that appear to compel companies to hand over data to Beijing if asked.

It is unclear if any country has signed up to China’s initiative and how it will be implemented and policed. But the world’s second-largest economy has been looking to increase its role in setting standards around the world from areas from data to telecommunications.

… a certain country keeps making groundless accusations against others in the name of ‘clean’ network and used security as a pretext to prey on enterprises of other countries who have a competitive edge.

Wang Yi

CHINA’S FOREIGN MINISTER

Wang took a swipe at the U.S. in his speech when he announced the initiative.

“Bent on unilateral acts, a certain country keeps making groundless accusations against others in the name of ‘clean’ network and used security as a pretext to prey on enterprises of other countries who have a competitive edge,” he said. “Such blatant acts of bullying must be opposed and rejected.”

Last month, the U.S. unveiled its “Clean Network” initiative, a program aimed at “safeguarding the nation’s assets including citizens’ privacy and companies’ most sensitive information from aggressive intrusions by malign actors, such as the Chinese Communist Party.”

The U.S. State Department says more than 30 countries have joined, but did not name them. Some companies are also on board its program.

Meanwhile, Washington has been upping the pressure on Chinese technology firms. In August, the U.S. amended a rule that looked to effectively cut Huawei off from key semiconductor supplies. And in the same month, President Donald Trump signed an executive order banning transactions with TikTok owner ByteDance and WeChat owner Tencent.

Other countries have also blocked Chinese technology firms.

Huawei will not be playing a role in the next-generation 5G networks in Australia and the U.K. Recently, India banned 118 Chinese apps over rising tensions related to a dispute over the Himalayan mountain border in the region of Ladakh.

‘Tenet’ scores $20 million in biggest domestic opening since pandemic upended movie industry

KEY POINTS

- Christopher Nolan’s “Tenet” garnered an estimated $20.2 million in ticket sales over Labor Day weekend.

- The spy thriller inched closer to $150 million globally.

- Disney’s “Mulan” also debuted in some international markets this weekend, hauling in nearly $6 million.

After months of delays Christopher Nolan’s “Tenet” finally landed in U.S. theaters over the weekend, cashing in more than $20 million in ticket sales.

The spy thriller, distributed by Warner Bros., inched closer to $150 million globally, the company reported, garnering an estimated $78.3 million from foreign markets over the holiday weekend. This includes $30 million from China.

The domestic debut comes one week after “Tenet” opened internationally and marks the highest-grossing opening weekend for a film in the U.S. since the pandemic began.

“Tenet” in pre-covid times would have been expected to tally between $35 million and $55 million during its opening weekend, on par with other Nolan films like “Interstellar” and “Inception.” The $20 million is reflective of a 50% cap on attendance at theaters and that only around 65% of cinemas have reopened to the public.

”‘Tenet’ is just getting started in North America and with more theaters to open in the coming weeks and as people start to feel more comfortable in going to communal indoor spaces, the film will likely see a steady progression toward even bigger and better box office results,” Paul Dergarabedian, senior media analyst at Comscore, said. “In this pandemically-challenged marketpalce this is indeed all about the marathon not the sprint.”

Dergarabedian noted that top markets like New York City, Los Angeles, Baltimore and Detroit have not yet reopened theaters.

Disney’s “Mulan” also debuted in some international markets this weekend. The film, which went to Disney+ for $30 in countries that have access to the streaming service, hauled in nearly $6 million after opening in Croatia, the Czech Republic, the Middle East, Slovakia, Turkey, Malaysia, Singapore, Taiwan and Thailand.

Next weekend the film will be released in China and Russia. It is currently unclear how much Disney garnered from its premium sales of the film online.

Mulan debut allows Disney to ‘flex’ its muscle,′ trader says. Here’s why

Disney could have unveiled a bit of magic.

Disney debuted its live-action blockbuster Mulan on its Disney+ streaming platform ahead of the long weekend. The film is available for a premium price months after its expected premiere back in March. Investors hope for another streaming smash hit similar to its Hamilton release earlier in the summer.

Gina Sanchez, CEO of Chantico Global says the house of mouse is about to make a very valuable move.

“Disney+ has a lot of legs,” said Sanchez on CNBC’s “Trading Nation” on Friday. “Right now it’s a new shiny toy, and I think it’s going to remain that way. … I think this could be a very valuable move for Disney, and also to flex the muscle of their Disney+ streaming channel.”

Disney has made a steady climb back from its March lows, but is still down nearly 9% for the year. The company was forced to shut the doors temporarily on many of its parks due to the Coronavirus pandemic, but Sanchez says that once things get back to normal, Djsney could outperform again.

“If you look at the things holding them back … the inability to open their parks, the challenges they have around sports,” said Sanchez. “Within the next six to12 months, we’re going to see some changes there that are going to be very beneficial to Disney, so I would actually think that as soon as we get back to a more normal situation, Disney could participate significantly more than the market.”

Matt Maley, equity strategist at Miller Tabak, points out that although the stock is lagging, you shouldn’t count Disney out.

“The stock actually hasn’t been acting all that badly,” Maley said during the same segment. “Even though it hasn’t been as aggressive in its rally as a lot of other stocks, it has still been making a series of “higher lows” and “higher highs” in a nice upward sloping trend channel.”

Maley does point out that Disney is reaching some overbought levels, which is why it’s pulling back with the rest of the market.

“One of the good things that could take place in the next week or two is that it would see a golden cross with the 50-day moving average moving above its 200-day moving average. 2 out of the last 3 times that has happened, the stock has rallied dramatically after that has taken place, and the 3rd time, it didn’t go down, it just didn’t rally quite as dramatically. It still went up about 5% over the next month. So either way, it was a positive move.”

Mitch McConnell says Senate will vote on coronavirus stimulus plan as soon as this week

KEY POINTS

- Senate Majority Leader Mitch McConnell said the Senate plans to vote on what he called a “targeted” coronavirus stimulus bill as soon as this week.

- He did not specify what the relief legislation will include, but said it will focus on health care, education and the economy.

- Democrats have opposed the developing Senate plan as the parties stand divided over how best to provide aid during the pandemic.

The Senate will vote on a coronavirus stimulus bill as early as this week, Majority Leader Mitch McConnell said Tuesday.

In a statement, the Kentucky Republican said the chamber aims to take up what he called a “targeted proposal, focused on some of the very most urgent healthcare, education, and economic issues.” He did not specify what the legislation would include.

CNBC previously reported that the GOP was considering a roughly $500 billion proposal to address enhanced unemployment insurance, new small business loans, school funding, and money for Covid-19 testing, treatment and vaccines. It is unclear how much the package will resemble the plan that was developing late last month.

The bill likely will not garner the 60 votes needed to get through the Senate or receive support in the Democratic-held House. In a joint statement Tuesday, House Speaker Nancy Pelosi, D-Calif., and Senate Minority Leader Chuck Schumer, D-N.Y., said “Senate Republicans appear dead-set on another bill which doesn’t come close to addressing the problems and is headed nowhere.”

“Democrats want to work on bipartisan legislation that will meet the urgent needs of the American people but Republicans continue to move in the wrong direction,” they added later in the statement.

Democrats and the Trump administration have failed to break an impasse over coronavirus relief since talks between the sides collapsed late last month. Democratic leaders have pushed for the White House to offer at least $2.2 trillion in federal funding to boost the U.S. economy and health-care system during the pandemic. Republicans so far have not agreed to go higher than $1.3 trillion.

Congress has failed to pass a fifth coronavirus aid package even after a $600 per week extra jobless benefit, a federal moratorium on evictions and the window to apply for Paycheck Protection Program small business loans lapsed. The expiration of those lifelines has left millions made jobless by the virus struggling to cover costs, even as the overall labor market rebounds.

Last month, Republicans considered reinstating the extra unemployment insurance at a reduced $300 to $400 per week as part of their proposal, CNBC reported. Pelosi and Schumer criticized the legislation in particular because reports said it did not include relief for state and local governments, money for rental and mortgage assistance, emergency funding for the U.S. Postal Service or additional food aid.

Democrats have pushed for more than $900 billion in new aid for states and municipalities, some of which will have to cut services if they receive no more assistance. The White House, which charges that cities and states run by Democrats want funds to cover for financial mismanagement before the pandemic, has offered no more than $150 billion in new money.

The bipartisan National Governors Association has asked for at least $500 billion in relief.

Senate Republicans released their first pass at a fifth coronavirus relief package in late July. The bill, valued at roughly $1 trillion, countered the more than $3 trillion House Democratic legislation passed in May. It kick-started the stimulus negotiations, which have since made little progress.

While most GOP senators now acknowledge the need for another relief bill, some have argued against spending any more federal money at all to combat the pandemic.

Dow drops 600 points as tech stocks fall again, Nasdaq down 10% in 3 days

Stocks fell sharply on Tuesday as another massive drop in tech put the Nasdaq Composite in correction territory and led to the S&P 500′s worst three-day stretch in months.

The Nasdaq Composite dropped 4.1% to end the day at 10,847.69. Tuesday’s drop put the tech-heavy Nasdaq down 10% over the past three days. It marks the Nasdaq’s worst three-day stretch since August.

The Dow Jones Industrial Average plunged 632.42 points, or 2.3%, to 27,500.89. The S&P 500 slid 2.8% to 3,331.84. The broader-market index was down nearly 7% over the past three days, its worst three-day stretch since June.

Tesla plunged 21.1% — its biggest one-day drop on record — after the S&P Dow Jones Indices failed to add the surging and speculative stock to the S&P 500 after the bell Friday. Investors were betting on inclusion of the stock into the S&P 500, hoping for the stamp of approval on the rally by S&P. The snub shows the risks to the overheating Nasdaq trade.

Apple dropped 6.7% to lead tech lower. Over the past three sessions, the Dow component has plunged more than 14%. According to Bespoke Investment Group, that’s the stock’s worst three-day stretch since October 2008.

Facebook and Amazon were both down more than 4%. Microsoft fell 6.7%. Netflix closed 1.8% lower and Alphabet lost 3.6%. Zoom Video fell by 5.1%. The S&P 500 tech sector dropped 4.6% and closed Tuesday’s session more than 11% below an all-time high set on Sept. 2.

“High valuations in the mega-cap stocks are stretched far beyond historical levels,” said Bruce Bittles, chief investment strategist at Baird. “The technical indicators – high margin debt, fully invested mutual funds, CBOE options data showing record call volume, Wall Street letter writers at bullish levels — pointed to excessive optimism in the market which often suggests a consolidation/correction phase is likely.”

Shares of Softbank dropped 7% on Monday in Japan as it was identified as the big options buyer making a bet in the billions on tech stocks continuing to surge. The tech trade could lose some of its firepower if Softbank were to curb those bets.

Semiconductor stocks were under pressure amid simmering U.S.-China trade tensions. Nvidia and Micron fell 5.6% and 3.2%, respectively. Applied Materials dropped 8.7%. Advanced Micro Devices pulled back by 4%. The VanEck Vectors Semiconductor ETF (SMH) closed 4.4% lower.

China accused the U.S. of “bullying” as it launched a global data security initiative on Tuesday. That came as Washington continues to pressure China’s largest tech firms and lobby countries around the world to block them. President Donald Trump also recently entertained the idea of “decoupling” from China, or refusing to do business with the country.

Wall Street was coming off its first weekly decline in six weeks after a big reversal in major technology stocks. Steep losses in Amazon, Apple, Microsoft and Facebook — 2020′s market leaders — drove the tech-heavy Nasdaq Composite to its worst week since March 20. The Dow and S&P 500 posted their biggest weekly losses since June.

Many on Wall Street believe the weakness derived from worries that the massive tech run-up pushed valuations to unsustainable levels. Even with last week’s pullback, the Nasdaq is up more than 70% from its March bottom.

“Given how extreme many of the indicators we follow had become by early this past week, we believe it will take more than just a mild decline to work off those conditions,” Matt Maley, chief market strategist at Miller Tabak, said in a note on Sunday. “Therefore we still believe a correction of more than 10% is probable.”

Maley pointed to the extreme overbought conditions in some of the mega-cap tech names as well as the elevated valuation levels for the S&P 500.