HI Market View Commentary 08-30-2021

How do you deal with market uncertainty = add protection

Protection make money in two out of the three ways the markets move up/down

IF the market is sideways we are overpaying for protection

Methodology = 1. It has to work over time

2. It has to work more often than not

3. It has to appeal to the market weaknesses

Qualifications for a successful trading/investing methodology

Protection during downturns, clear rules for entry and exits, adjustments, proven, understandable, good execution, repeatable

HI qualifications

2000, 2008 profitability, have to work 40 hours a week and sometimes more, you have to be able to run the calculations, you have to have gone thru almost every education possible, you have to have your own money working the same process, mentally able to follow the methodology, willing to not have certain clientele, willing to make adjustments based on market conditions/fundamentals

| Uncertain |

Federal Reserve Chair Jerome Powell said on Friday that while the bank could begin to reduce its monthly bond purchases this year, it would be in no hurry to hike rates. His comments came as there are increasing signs that the pace of the U.S. recovery is slowing as consumers put off spending and businesses delay plans for a return to normal operations. This week economists will be looking to Friday’s payrolls report for a guide as to whether there is any slowdown, with early estimates suggesting 750,000 new positions added in August.

The harm the Fed wants to avoid

Sam Ro

Illustration: Annelise Capossela/Axios Fed chair Jerome Powell isn’t in a hurry to dial back loose monetary policy because he doesn’t want to cause “lasting harm” to the economy.

Why it matters: With the economy progressing, everyone wants to know when the Fed will taper its monthly purchases of $120 billion worth of bonds, an emergency policy intended to keep interest rates low and financial markets liquid during the pandemic.

Driving the news: Speaking at the Kansas City Fed’s Economic Policy Symposium in Jackson Hole on Friday, Powell reiterated his position that the Fed “could” begin to taper its asset purchases by the end of this year.

- He stopped short of formally announcing the timing and pace of that taper, in line with what economists were broadly expecting.

What they’re saying: Powell spent a good deal of his speech explaining why he thinks the forces driving up inflation in recent months are transitory. At one point, he even warned of the perils of dialing back loose monetary policy after misreading inflation signals, a discussion that multiple Fed-watching economists characterized as dovish.

- “If a central bank tightens policy in response to factors that turn out to be temporary, the main policy effects are likely to arrive after the need has passed,” Powell said. “The ill-timed policy move unnecessarily slows hiring and other economic activity and pushes inflation lower than desired.”

State of play: The personal consumption expenditures price index excluding food and energy (core PCE), is the Fed’s preferred measure of inflation and it was up 3.6% year over year in July. This is well above the Fed’s average inflation target of 2%.

- However, total employment remains about 5.7 million jobs below pre-pandemic levels.

- “Today, with substantial slack remaining in the labor market and the pandemic continuing, such a mistake [of an early policy move] could be particularly harmful,” Powell said. “We know that extended periods of unemployment can mean lasting harm to workers and to the productive capacity of the economy.”

The big picture: Despite all of this caution, Powell said “it could be appropriate to start reducing the pace of asset purchases this year” as the trajectory of the labor market suggests employment will continue to rise at a robust rate.

What to watch: The next U.S. jobs report will be released on Sept. 3. If the number is strong, we could hear the Fed announce the timing of tapering as soon as its next Federal Open Market Committee meeting on Sept. 22.

IN SIMPLE ENGLISH – We are in multiple bubbles

| https://go.ycharts.com/weekly-pulse |

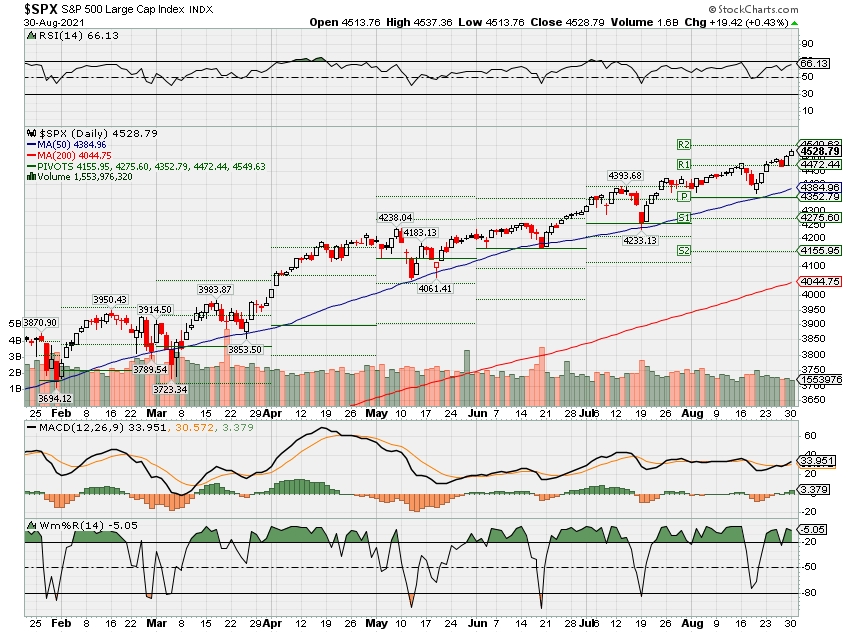

| WEEK OF AUG. 23 THROUGH AUG. 27, 2021 The S&P 500 index rose 1.5% last week in a rally that sent the market benchmark above the 4,500 level for the first time as investors were relieved by comments from Federal Reserve Chairman Jerome Powell that they interpreted as a sign the central bank isn’t rushing to begin tapering its bond buying stimulus program. The S&P 500 ended Friday’s session at 4,509.37, up from last Friday’s closing level of 4,441.67 and marking a fresh closing high. The index also reached a new intraday high Friday at 4,513.33. It is now up 2.6% for the month of August, with just two sessions remaining in the month. It is up 20% for the year to date. The weekly climb was boosted by a 0.9% Friday increase as Federal Reserve Chair Jerome Powell said while the central bank could begin scaling back its asset purchases by the end of the year if the economy performs as expected, he anticipates rising inflation will prove transitory and sees the delta variant of the coronavirus as posing near-term risk. The central bank thus “will be carefully assessing incoming data and the evolving risks,” Powell said. Investors saw the comments by Powell as an indication that the central bank isn’t in a rush to begin tapering its stimulus efforts even as it still anticipates beginning tapering the bond buying by year-end. This helped ease the worries of investors who were concerned about how soon the Fed’s Federal Open Market Committee might begin the tapering. The energy sector had the largest percentage increase last week, up 7.3%, followed by financials, up 3.5%. Other strong gainers included communication services, consumer discretionary, materials and industrials, up by more than 2% each. Technology climbed 1.4%. Just four of the S&P 500’s 11 sectors were in the red for the week, led by a 2.1% drop in utilities. The other declining sectors included consumer staples, down 1.4%; health care, down 1.2%; and real estate, off 0.3%. The energy sector was boosted by a jump in crude oil futures amid shrinking US inventories of oil and gas. Among the gainers, shares of Devon Energy (DVN) climbed 18% while receiving slight increases to its price targets from analysts at Morgan Stanley and Wells Fargo. In the financial sector, shares of Zions Bancorp (ZION) rose 8.7% on the week as the financial services company said its board authorized an additional $200 million of share repurchases for Q3, boosting its total buyback authorization for the quarter to $325 million, or 3.5% of the company’s market capitalization. On the downside, the utilities sector’s decliners included shares of Pinnacle West (PNW), whose principal subsidiary is Arizona Public Service, a provider of retail electricity service in Arizona. The company’s shares, which received an investment rating downgrade last week to sell from neutral from Goldman Sachs, fell 3.6% last week. Next week, as the month of August wraps up, all eyes will be on the August employment data, including private sector data from ADP on Wednesday, the Labor Department’s weekly jobless claims on Thursday and the monthly nonfarm payrolls and unemployment rate to be reported Friday by the Labor Department. Other economic data being released next week will include July pending home sales on Monday, August consumer confidence on Tuesday, August manufacturing data from Markit as well as the Institute for Supply Management on Wednesday, and August readings on the services sector from Markit as well as the Institute for Supply Management on Friday. |

Earnings Dates

COST – 09/23 AMC

Where will our markets end this week?

Higher

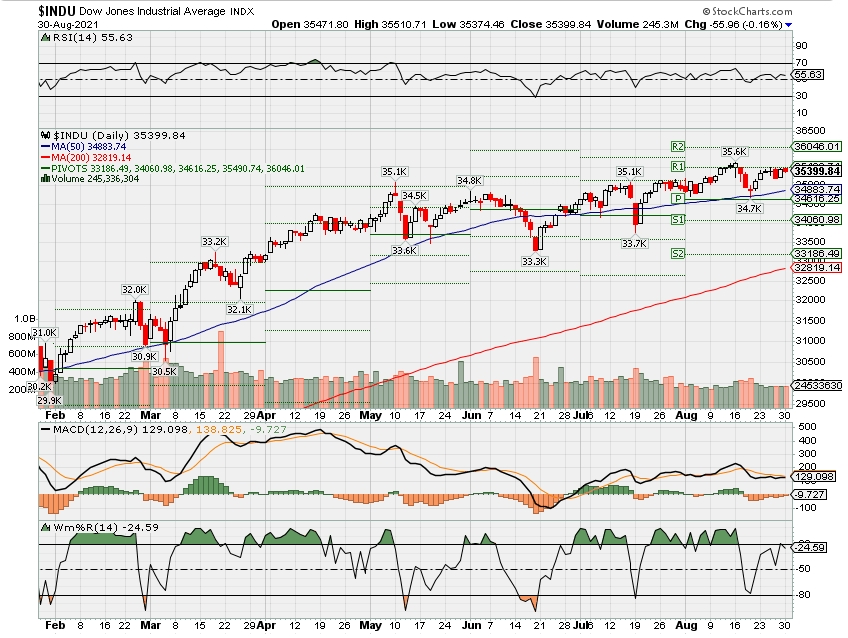

DJIA – Bearish

SPX – Bullish

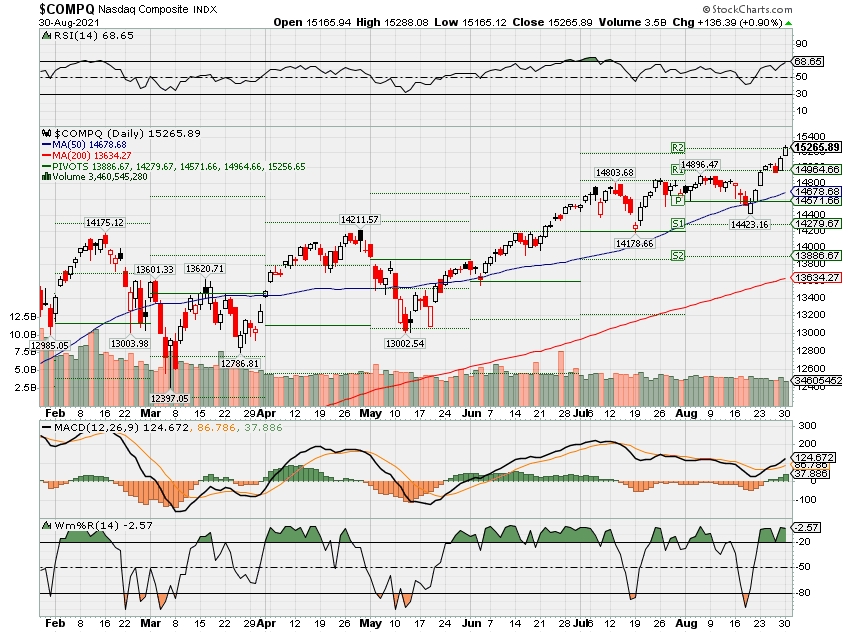

COMP – Bullish

Where Will the SPX end September 2021?

08-30-2021 -1.0%

08-23-2021 -1.0%

Earnings:

Mon: ZM

Tues: NTES, HRB, PVH

Wed: CPB, CHWY, SWBI

Thur: AEO, GCO, HRL, AVGO, DOCU, HPE, TCOM

Fri:

Econ Reports:

Mon: Pending Home Sales,

Tues: FHFA Housing Price Index, Case-Shiller, Chicago PMI, Consumer Confidence

Wed: MBA, ADP Employment, ISM Manufacturing, Construction Spending

Thur: Initial Claims, Continuing Claims, Productivity, Factory Orders, Trade Balance, Unit Labor Costs

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, ISM Services

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Running stock higher until the seasonal pull back AND taking long put protection off some stocks that seem to be at a bottom

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Market’s biggest bull warns software is a crowded trade and delivers a new top play

Stephanie Landsman@STEPHLANDSMAN

The market’s biggest bull predicts the S&P 500 will rally another 7%, but he warns a popular trade won’t be along for the ride.

Wells Fargo Securities’ Chris Harvey recently cut software to underweight from neutral and declared it a crowded trade. He based the decision on technicals and earnings fundamentals and high valuations.

“From a valuation point of view, you’re paying about a 75% premium to the market for software and that’s too rich,” the firm’s head of equity strategy told CNBC’s “Trading Nation” on Friday.

The Dow Jones US Software Index is up 28% over the last five months.

“It is a work from home play,” said Harvey. “We just don’t think there’s a whole lot of opportunity in the short term.”

He finds the opposite is true for media and entertainment.

“When we downgraded software, we did upgrade media and entertainment,” said Harvey. “If we look at the media and entertainment space, you’re seeing better upward revisions, better growth opportunities. But you’re only paying a 15% premium.”

He boosted his media and entertainment group rating to overweight from neutral and listed it as his top market play.

“There’s a lot of money to be spent. There’s still a lot of pent-up demand,” he said. “The media and entertainment space offers a much better opportunity to capitalize on that reopening play.

Not only does he see strong fundamentals and improving sentiment, Harvey contends advertising is making a comeback in the diverse group, which includes everything from cable companies and big cap tech names.

The S&P 500 Media & Entertainment Index is up 4% over the last month and 34% so far this year.

‘We want to get more aggressive’

“Opportunities still abound, and we want to get more aggresssive on that cyclical trade,” added Harvey.

Last Tuesday, Harvey increased his S&P 500 year-end price target to 4,825 from 3,850, a Wall Street high. Despite his bullishness for the final four months of the year, he gave a less optimistic outlook for 2022 — delivering a 4,715 target. Harvey believes a the record year will be followed by a hangover of sorts.

But for now, he’s firmly in the risk-on camp.

“We want more cyclical exposure,” Harvey said. “We want more exposure to what we consider high Covid-beta plays because we do think the economy is going to move forward.”

On Friday, the S&P 500 and tech-heavy Nasdaq closed at all-time highs. The S&P 500 closed over 4,500 for the first time. Meanwhile, the Dow is about a half percentage point away from its record high.

Powell sees taper by the end of the year, but says there’s ‘much ground to cover’ before rate hikes

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Federal Reserve Chairman Jerome Powell indicated Friday that the central bank is likely to begin tapering before the end of the year.

- But he said rate hikes aren’t imminent as there is still “much ground to cover” before the economy hits full employment.

- The speech was part of the Fed’s annual Jackson Hole, Wyoming, symposium.

Federal Reserve Chairman Jerome Powell indicated Friday that the central bank is likely to begin withdrawing some of its easy-money policies before the end of the year, though he still sees interest rate hikes off in the distance.

In a much-anticipated speech as part of the Fed’s annual Jackson Hole, Wyoming, symposium, Powell said the economy has reached a point where it no longer needs as much policy support.

That means the Fed likely will begin cutting the amount of bonds it buys each month before the end of the year, so long as economic progress continues. Based on statements from other central bank officials, a tapering announcement could come as soon as the Fed’s Sept. 21-22 meeting.

However, it does not mean that rate increases are looming.

“The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test,” Powell said in prepared remarks for the virtual summit.

He added that while inflation is solidly around the Fed’s 2% target rate, “we have much ground to cover to reach maximum employment,” which is the second prong of the central bank’s dual mandate and necessary before rate hikes happen.

Markets reacted positively to Powell’s comments, sending major stock indexes to record highs while government bond yields moved lower.

Later in the day, Fed Vice Chairman Richard Clarida said he agrees with Powell’s remarks and expects tapering to being this year so long as the pace of labor gains continues, though neither official set a specific date for when the process will begin.

“I think that if that materializes, then I would support commencing a reduction in the pace of our purchases later this year,” Clarida told CNBC.

Powell also devoted an extensive passage in the speech to explaining why he continues to think the current inflation rise is transitory and will drop eventually to the target level.

The Fed has used the term “substantial further progress” as a benchmark for when it will start tightening policy. Powell said that “test has been met” for inflation while there “has also been clear progress toward maximum employment.” He said he and his fellow officials agreed at the July Federal Open Market Committee meeting that “it could be appropriate to start reducing the pace of asset purchases this year.”

That question over “tapering” of the minimum $120 billion of monthly bond purchases has had the market’s attention as much for what it means on a mechanical level as for what it signifies when the Fed will start hiking rates.

In an effort to resuscitate the economy during the early days of the Covid-19 pandemic, the Fed took its benchmark rate down to near zero and accelerated its bond buying, or quantitative easing, program to where its balance sheet is now at nearly $8.4 trillion, about double where it was in March 2020.

At last year’s Jackson Hole summit, also held virtually, Powell outlined a bold new policy initiative in which the Fed committed to full and inclusive employment even if it meant allowing inflation to run hot for a while. Critics have charged that the policy is partially to blame for current price pressures at their highest levels in about 30 years.

However, Powell defended the policy Friday and stressed the importance of the Fed not making an “ill-timed policy move” in response to temporary economic gyrations like the action this year in inflation.

“Today, with substantial slack remaining in the labor market and the pandemic continuing, such a mistake could be particularly harmful,” he said. “We know that extended periods of unemployment can mean lasting harm to workers and to the productive capacity of the economy.”

The unemployment rate for July stood at 5.4%, down from the April 2020 high of 14.8% but still reflective of a jobs market that remains well off where it stood before the pandemic. In February 2020, unemployment was 3.5% and there were 6 million more Americans working and 3 million more considered in the labor force.

Powell noted that the delta variant of Covid “presents a near-term risk” to getting back to full employment, but he insisted that “the prospects are good for continued progress toward maximum employment.”

He added that some of the factors that pushed inflation higher are starting to abate, though several regional Fed presidents have told CNBC in recent days that they see lasting pressures in their districts.

“Inflation at these levels is, of course, a cause for concern. But that concern is tempered by a number of factors that suggest that these elevated readings are likely to prove temporary,” he said.

House Democrats clear path toward passing $3.5 trillion budget bill and infrastructure plan after breaking stalemate

KEY POINTS

- The House voted to approve a $3.5 trillion budget resolution, advance a bipartisan infrastructure bill and move forward with sweeping voting rights legislation.

- After centrists threatened to derail Democrats’ economic agenda by pushing for swift approval of the Senate-passed infrastructure plan, party leaders pledged to vote on it by Sept. 27.

- Democrats are trying to pass their $3.5 trillion proposal to expand the social safety net without a vote from Republicans, who oppose the spending and the proposed tax increases to pay for it.

House Democrats forged ahead with President Joe Biden’s economic plans Tuesday after they broke a stalemate that threatened to unravel the party’s sprawling agenda.

In a 220-212 party-line vote, the chamber passed a $3.5 trillion budget resolution and advanced a $1 trillion bipartisan infrastructure bill. The vote allows Democrats to write and approve a massive spending package without Republicans and puts the Senate-passed infrastructure plan on a path to final passage in the House.

The measure includes a nonbinding commitment to vote on the infrastructure bill by Sept. 27, which aims to appease nine centrist Democrats who pushed the House to consider the bipartisan plan before it took up the Democratic budget resolution. The vote also advances a sweeping voting rights bill, which Democrats aim to pass as soon as Tuesday.

In a statement Tuesday, House Speaker Nancy Pelosi, D-Calif., said she is “committing to pass the bipartisan infrastructure bill by September 27” and would “rally” her caucus to pass it. She also stressed that she aims to pass a budget reconciliation bill that could get through the Senate — meaning it may prove smaller than House progressives want.

The opposition from the nine holdout Democrats threatened an agenda that supporters say will boost the economy and provide a lifeline to working-class households. Democratic leaders have cast the budget plan as the biggest expansion of the American social safety net in decades and the infrastructure bill as an overdue refresh of transportation and utilities.

“The bottom line is, in my view, we are a step closer to truly investing in the American people, positioning our economy for long-term growth and building an America that outcompetes the rest of the world,” Biden said Tuesday after the vote. “My goal is to build an economy from the bottom up and middle out, not just the top down.”

Pelosi has pushed to pass the bipartisan and Democratic plans at the same time in order to ensure centrists and progressives back both measures. The nine Democrats withheld their support, leaving Pelosi and her top deputies scrambling to find a path forward to salvage the party’s economic plans.

All the Democrats ended up voting with their party Tuesday. In a statement after the vote, the Democrats led by Rep. Josh Gottheimer of New Jersey said their deal with party leaders “does what we set out to do: secure a standalone vote for the bipartisan infrastructure bill, send it to the President’s desk, and then separately consider the reconciliation package.”

The vote to advance the measures preserves the party’s hopes to push through massive economic proposals this year. Democrats still need to overcome several hurdles — and write a budget bill that can win support from spending-wary centrists and progressives alike — to get the proposals through a narrowly divided Congress.

Underscoring the challenges ahead, House leaders face pressure to write and pass the reconciliation plan before they approve the infrastructure bill — which Pelosi pledged to do in about a month. In a statement Tuesday, Congressional Progressive Caucus Chair Pramila Jayapal, D-Wash., said the two proposals are “integrally tied together, and we will only vote for the infrastructure bill after passing the reconciliation bill.”

Democrats in the Senate and House hope to write their bill to strengthen the social safety net and invest in climate policy in the coming weeks. The budget measure calls for expanding Medicare, child care and paid leave, extending strengthened household tax credits passed last year, creating universal pre-K and making incentives for green energy adoption.

While the resolution allows for up to $3.5 trillion in spending, centrists will likely try to trim the price tag.

Many Republicans have supported the bipartisan infrastructure bill, saying it will jolt the economy. But they have opposed the trillions more in spending proposed by Democrats and the tax hikes on businesses and wealthy individuals the Democrats hope to use to pay for it.

The GOP has also argued the Democratic plan would increase inflation, which White House officials have disputed.

The shipping crisis is getting worse. Here’s what that means for holiday shopping

By Hanna Ziady, CNN Business | Posted – Aug. 23, 2021 at 7:37 p.m.

ATLANTA — The vast network of ports, container vessels and trucking companies that moves goods around the world is badly tangled, and the cost of shipping is skyrocketing. That’s troubling news for retailers and holiday shoppers.

More than 18 months into the pandemic, the disruption to global supply chains is getting worse, spurring shortages of consumer products and making it more expensive for companies to ship goods where they’re needed.

Unresolved snags, and the emergence of new problems including the delta variant, mean shoppers are likely to face higher prices and fewer choices this holiday season. Companies such as Adidas, Crocs and Hasbro are already warning of disruptions as they prepare for the crucial year-end period.

“The pressures on global supply chains have not eased, and we do not expect them to any time soon,” said Bob Biesterfeld, the CEO of C.H. Robinson, one of the world’s largest logistics firms.

The latest obstacle is in China, where a terminal at the Ningbo-Zhoushan Port south of Shanghai has been shut since Aug. 11 after a dock worker tested positive for COVID-19. Major international shipping lines, including Maersk, Hapag-Lloyd and CMA CGM have adjusted schedules to avoid the port and are warning customers of delays.

The partial closure of the world’s third-busiest container port is disrupting other ports in China, stretching supply chains that were already suffering from recent problems at Yantian port, ongoing container shortages, coronavirus-related factory shutdowns in Vietnam and the lingering effects of the Suez Canal blockage in March.

Shipping companies expect the global crunch to continue. That’s massively increasing the cost of moving cargo and could add to the upward pressure on consumer prices.

“We currently expect the market situation only to ease in the first quarter of 2022 at the earliest,” Hapag-Lloyd chief executive Rolf Habben Jansen said in a recent statement.

The cost of shipping goods from China to North America and Europe has continued to climb over the past few months, following a spike earlier in the year, according to data from London-based Drewry Shipping.

The pressures on global supply chains have not eased, and we do not expect them to any time soon.

–Bob Biesterfeld, the CEO of C.H. Robinson

The company’s World Container Index shows that the composite cost of shipping a 40-foot container on eight major East-West routes hit $9,613 in the week to Aug. 19, up 360% from a year ago.

The biggest price jump was along the route from Shanghai to Rotterdam in the Netherlands, with the cost of a 40-foot container soaring 659% to $13,698. Container shipping prices on routes from Shanghai to Los Angeles and New York have also jumped.

“The current historically high freight rates are caused by the fact that there is unmet demand,” Soren Skou, CEO of container shipping giant Maersk, said on an earnings call this month. “There’s simply not enough capacity,” he added.

Port congestion

The terminal shutdown in Ningbo will add to bottlenecks arising from the closure in June of Yantian, a port about 50 miles north of Hong Kong, after coronavirus infections were detected among dock workers.

While a partial reopening of Yantian took only a few days, a return to normal services took nearly a month to achieve, according to S&P Global Market Intelligence Panjiva, as the congestion spilled over to other ports.

That spells trouble for retailers and consumer goods companies trying to restock inventories heading into the crucial year-end holiday shopping season. “The closure at Ningbo is now particularly sensitive as it may hold up exports for the peak season of deliveries into the U.S. and Europe which typically arrive from September through November,” S&P Global Panjiva said in a research note on Aug. 12.

Drewry Shipping said Friday that congestion at nearby ports Shanghai and Hong Kong is “spiking” and spreading elsewhere in Asia, as well as in Europe and North America, “particularly the West coast” of the United States.

Some 36 container ships are anchored off the adjacent ports of Los Angeles and Long Beach, according to a report Thursday from the Marine Exchange of Southern California.

That’s the highest number since February, when 40 container ships were waiting to enter. Ordinarily, there would be just one or zero container ships at anchor, according to the Marine Exchange.

The congestion in California is starting to spread to “pretty much every port in the (United States),” according to Biesterfeld of C.H. Robinson. “The chances of your vessel arriving on time are about 40%, when it was 80% this time last year,” he told CNN Business.

The backlog at ports will have a ripple effect on jammed warehouses and stretched road and rail capacity. Logistics networks have been running at maximum capacity for months, thanks to stimulus-fueled demand led by U.S. consumers and a pickup in manufacturing. Truck driver shortages in the United States and United Kingdom have only exacerbated supply disruptions.

U.S. imports in March and May exceeded levels seen in October 2020, typically the peak of the shipping season, said Eric Oak, supply chain research analyst at S&P Global Panjiva.

“This means that logistics facilities have been running flat out for most of the summer,” he added.

It’s not just ports that are under pressure. Air terminals are receiving increasingly large amounts of freight as companies turn to alternative methods to transport their goods. At some of the larger U.S. airports such as Chicago, there are delays of up to two weeks to claim cargo, according to Biesterfeld.

Efforts to contain COVID-19 outbreaks have recently disrupted traffic at Shanghai Pudong and Nanjing airports in China.

Retailers brace for impact

“Name almost anything and it seems like there’s a shortage of it somewhere,” Biesterfeld added. “Retailers are struggling to replenish inventory as fast as they’re selling, let alone prepare for holiday demand.”

Supply chains were discussed on nearly two-thirds of some 7,000 company earnings calls globally in July, up from 59% in the same month last year, according to an analysis by S&P Global Panjiva.

Consumer goods producers are taking drastic steps to meet demand — such as changing where products are made and moving them by plane instead of boat — but companies such as shoemaker Steve Madden say they’re already missing out on sales because they simply don’t have enough goods.

The company has moved half the production of its women’s range to Mexico and Brazil from China in an attempt to shorten delivery times.

“In terms of the supply chain … we could talk about this all day. There are challenges throughout the globe,” CEO Edward Rosenfeld said on an earnings call last month. “There is port congestion, both in the U.S. and China. There are COVID outbreaks at factories. There are challenges getting containers. We could go on and on.”

It’s one of several major apparel brands hit by factory shutdowns in Vietnam over the past month. Data from S&P Global Panjiva shows that nearly 40% of the volume of goods imported into the United States by sea over the 12 months to July came from the Southeast Asian country.

Adidas CEO Kasper Rorsted said the sportswear company will be unable to fully meet the “strong demand” for its products in the second half of the year due to the shutdowns, despite switching production to other regions.

Supply chain difficulties have been “leading (to) significant delays and additional logistics costs, particularly as we have been making more use of airfreight,” he said on a recent earnings call.

Andrew Rees, the CEO of Crocs, said that transit times from Asia to most of the company’s leading markets are approximately double what they were historically. “That’s been the case for some time, and we’re expecting (to) live with that,” he told investors last month.

To ensure product availability during the holiday season, Hasbro, which makes Monopoly and My Little Pony, said it is increasing the number of ocean carriers it works with, utilizing more ports to expedite deliveries and sourcing more products earlier from multiple countries.

For consumers, the supply chain crunch is likely to mean higher prices. Hasbro, for example, is increasing prices to offset rising freight and commodities costs. The company is projecting that its ocean freight expenses will be on average four times higher this year than last, according to chief financial officer Deborah Thomas.

Shoppers should also brace for longer than normal delivery times and may need to have several different gift ideas up their sleeves.

“As we’ve been forecasting for months, shoppers are going to see some bare shelves at the holidays,” said Biesterfeld. “And if you buy most of your presents online, get it done early. Delivery time may be four to six weeks.”

This story is for CNBC PRO subscribers only.)

Apple is “optimistic about the trend of satellite communications” and “will likely” include the ability to connect to extraterrestrial networks in its coming iPhone 13, TFI Securities analyst Ming-Chi Kuo predicted in a note to investors on Sunday.

“If Apple enables the relevant software functions, iPhone 13 users can call and send messages via satellite when not within 4G/5G coverage,” Kuo wrote.

Kuo is considered to be one of the top analysts on Apple, reliably describing unreleased products and features. He focuses on Apple’s supply chain in Asia. The iPhone 13 is expected to be released in September.

The company “has been setting up a specific team in charge of the research and development of related technologies and applications for some time,” Kuo noted. He believes that the satellite company “most likely to cooperate with Apple” on the new feature is Globalstar, which has an existing satellite phone network of 24 satellites in low Earth orbit.

Shares of Globalstar jumped 27% in premarket trading on Monday, up from its previous close of $1.43 a share. The company has a market value of $2.6 billion, according to FactSet.

Satellite communications — which has several existing networks that support specialized, purpose-built phones — is undergoing a new era of investment. Companies including Elon Musk’sSpaceX, Amazon, Canada’s Telesat, and the British firm OneWeb are each building new low Earth orbit (LEO) networks, capable of supplying high-speed internet to consumers, companies and more.

Kuo said the mobile network industry “is facing two revolutions” with LEO satellites and 5G.

“Suppose Apple can leverage these two new network technologies. In that case, it can enhance the user experience of existing hardware products and provide innovative user experiences that can be integrated with new products (head-mounted display (HMD), Apple Car, and IoT accessories) in the future,” Kuo said.

A customized chip

Apple adding satellite connection support to the iPhone 13 would mean users could call or text even outside of areas without 4G or 5G mobile network coverage on the ground.

Kuo’s research shows that the iPhone 13 is using a customized Qualcomm chip, called X60, to add the satellite support. He noted that other smartphone companies “will have to wait until 2022” to add satellite support, as other firms will need Qualcomm’s X65 chip.

The connection to Globalstar comes through Qualcomm existing relationship with the satellite company, Kuo noted. Qualcomm currently “expects to support Globalstar’s” network frequency “in future X65 baseband chips.” The relationship is why Kuo predicted Globalstar is Apple’s “most likely partner” for iPhone 13 satellite support.

“There are many potential scenarios for Apple’s business model cooperation with Globalstar. The simplest scenario is that if the user’s operator has already teamed with Globalstar, the user can directly use Globalstar’s satellite communication service on the iPhone 13 through the operator’s service,” Kuo said.

Iridium connection

William Blair analyst Louie DiPalma highlighted Kuo’s report in a research note on Sunday, and added that he believes Apple may also “embed Iridiumconnectivity in iPhones down the road.” The satellite company in recent years completed deployment of the 66 satellites of its Iridium NEXT network in LEO.

“Iridium has discreetly dropped hints at four different investor events that it is pursuing embedding its LEO satellite connectivity into smartphones,” DiPalma wrote.

Iridium shares rose 5% in premarket trading on Monday from its previous close of $40.62. William Blair has an outperform rating on the stock.

China’s regulatory crackdown has wiped billions off tech stocks — here are the risks ahead

KEY POINTS

- China has introduced a slew of regulation in the past few months, in part aimed at the tech sector — a move that’s spooked investors and wiped out billions of dollars in market value from the country’s internet giants.

- But with most of the landmark legislation passed and visibility increasing on the requirements of companies, investors are now wondering if it’s time to jump into Chinese technology stocks.

- Experts who spoke to CNBC flagged a number of risk including continued regulatory scrutiny, geopolitics and uncertainty on the impact of business models.

GUANGZHOU, China — Chinese authorities have introduced a slew of legislation in the past few months, largely aimed at the tech sector — a move that’s spooked investors and wiped out billions of dollars in value from the country’s internet giants.

The legislative onslaught began in November last year when the huge initial public offering of billionaire Jack Ma’s financial technology company Ant Group was suspended.

Since then, regulators have introduced anti-monopoly legislation focused on the so-called “platform economy” which broadly refers to internet companies operating a variety of services from e-commerce to food delivery. Regulations have also aimed at bolstering critical data security and protection laws.

As a result, high-profile technology companies have faced investigations and punishments.

E-commerce titan Alibaba was fined $2.8 billion in an anti-monopoly probe, and China’s largest ride-hailing firm Didi was forced to stop user registrations while regulators conduct a cybersecurity review of the company, just days after its U.S. listing.

https://art19.com/shows/bcd08fc3-8958-4c47-bf8e-524432adcd77/episodes/2d72ab21-b016-4a1b-a5b8-e6e58406ac24/embed But with most of the landmark legislation passed and visibility increasing on the requirements of companies, investors are now wondering if it’s time to jump into Chinese technology stocks.

Still, sentiment remains mixed.

“I think of the current sentiment toward Chinese tech stocks, at least among English-speaking investors, as split between two extremes: those who see sorts of regulatory changes / risks as an example of why they will not invest in Chinese stocks versus other investors who see this as a buying opportunity in higher quality Chinese names whose actual future earnings will be impacted far less than the magnitude of this year’s sell-off,” Tariq Dennison, wealth manager at Hong Kong-based GFM Asset Management, told CNBC.

So what are the risks for investors in Chinese tech stocks ahead?

Regulatory uncertainty

While China has passed a lot of marquee laws, there is still a risk of the market being surprised, leading to uncertainty.

“The wave of new regulations has cascaded and grown since the initial response to the Ant Group IPO,” Brian Bandsma, emerging markets equity and Asia-Pacific portfolio manager at Vontobel Quality Growth, told CNBC. “At the time and into the following weeks, there was no indication this would expand in so many different directions. Each time it seemed like we were near the end, something new came along.”

There is some calmness in the Chinese markets now from the lack of negative news. However, confidence is extremely fragile now.

Dave Wang

PORTFOLIO MANAGER, NUVEST CAPITAL

“So I would say it is risky at this point to bet that the worst is behind us,” he said.

Last week, Chinese technology stocks saw a huge one-day rally. Funds under Ark Investment Management, which is founded by Cathie Wood, purchased some shares of JD.com last week. After the rally, tech stocks fell again on subsequent trading days, highlighting the cautious approach from investors wary of regulatory risks.

“Policy uncertainty remains [in] the forefront. There is some calmness in the Chinese markets now from the lack of negative news. However, confidence is extremely fragile now,” Dave Wang, portfolio manager at Nuvest Capital, told CNBC.

“Thus, if the Chinese authorities continue to release bits and pieces of negative news and worse another unexpected policy, we could see a renewed sell off.”

Geopolitics

Chinese technology firms have been caught in the geopolitical battle between the U.S. and China since the administration of President Donald Trump.

Gaming giant Tencent, TikTok owner ByteDance and telecommunications company Huawei, were all dragged into geopolitics and that remains a risk for Chinese technology companies.

One risk is “foreign governments imposing more sanctions on Chinese stocks,” said Dennison from GFM Asset Management.

Meanwhile, Chinese companies listed on U.S. stock exchanges could face stricter listing and auditing rules.

Gary Gensler, the chairman of the U.S. securities and Exchange Commission (SEC) told Bloomberg this week that Chinese companies already listed in the U.S. need to better inform investors about regulatory and political risks.

Many U.S.-listed Chinese companies including Alibaba and Baidu carried out secondary listings in Hong Kong to hedge against these risks.

Change to business models

There are also concerns that technology companies will have to change their business practices ahead of landmark policies coming into effect. Such regulations include those aimed at data collection practices, online content and the use of algorithms to target users.

When Alibaba was fined in an anti-monopoly probe earlier this year, regulators said they were investigating a practice that forces merchants to choose one of two e-commerce platforms, instead of allowing them to work with both. China’s market regulator said the practice stifles competition.

“Companies will certainly have to be much more cautious about certain activities,” said Bandsma from Vontobel.

“Acquisitions, especially of businesses that may be perceived as a competitive threat, will be scrutinized more. Exhibiting pricing power, especially with small merchants or consumers, will be more difficult to implement.”

But it’s still unclear whether this could have a meaningful impact on business models, and ultimately profit.

Where does this leave China’s tech giants?

Short term speed bumps may be ahead for China’s internet companies.

Ultimately, analysts said, these tech giants — which have a history of quickly adapting to new regulatory environments — will be able to handle the slew of new rules.

“The more diversified giants know how to handle new data regulations better than anyone, and know-how to pivot to different ways of monetizing their users than anyone,” Dennison said. “On the upside, more Chinese rules will further protect Chinese tech companies from any aspiring foreign competition.”

Such regulations could also provide an opportunity to long- and short-term investors.

“There are a number of companies on extremely strong footing and can play the long game. Regulations are broad-based and ultimately will increase the barriers to entry too. Investors who have patient capital will benefit greatly in picking the right ones,” Nuvest Capital’s Wang said, referring to long-term capital.

“Professional traders who are much shorter term can also seek to benefit on the volatility and volatility premiums that come with it.”

One expert warned, however, that the regulatory uncertainty could mean foreign capital is not as willing to fund Chinese technology companies. SoftBank CEO Masayoshi Son said this month that the company would cut back on new investments in China.

“Now, what would that mean in terms of the continued sustained competitiveness of the Chinese tech industry, or even other industries, if foreign capitals are becoming more and more aware of the risks, that will be involved, and then they are pulling back now?” Charles Mok, founder of Tech For Good Asia, a tech advocacy group, told CNBC’s “Beyond the Valley” podcast.

“I would think that that is an issue of concern in the long term.”

HI Financial Services Mid-Week 06-24-2014