HI Market View Commentary 08-09-2021

What two new issues ran our headlines today?

Climate change and US Infrastructure package

Climate Change – 6 inches of seashore water growth in the next 30 years, melting polar ice caps, 3 degree temperature raise in the next 20 years, more droughts and the “world is on fire” = Global friendly stocks

The infrastructure package is about 20% of what Biden’s administration wants, which means there is more to come on a partisan agreement with the democrats holding the tie breaking vote = Infrastructure Bill for many stocks in many different sectors

The stock market has so many risks yet still is going up?!?!?!??!!????

IF you ask 20 experts what the most important sector is in the US economy ? Technology, financials, transportation, energy, real estate

My research on the energy crashes = corrections and they overlap with other or secondary reasons the market should go down

The market is difficult because of quick timing manipulation from many different areas/sectors

Covid worse that its ever been and death rates are spiking, hospitals are full again and new variant means old vaccines won’t fight the new variant nearly as well as the old variant

The markets should not be heading up right now

I BELIEVE we have a “government induced Monetary Crisis” = too much free money in a covid world with no-place better than the US stock market to put your money into. A monetary crisis means we should expect the opposite of what normal market indicators are telling us = The money covers up the real problem

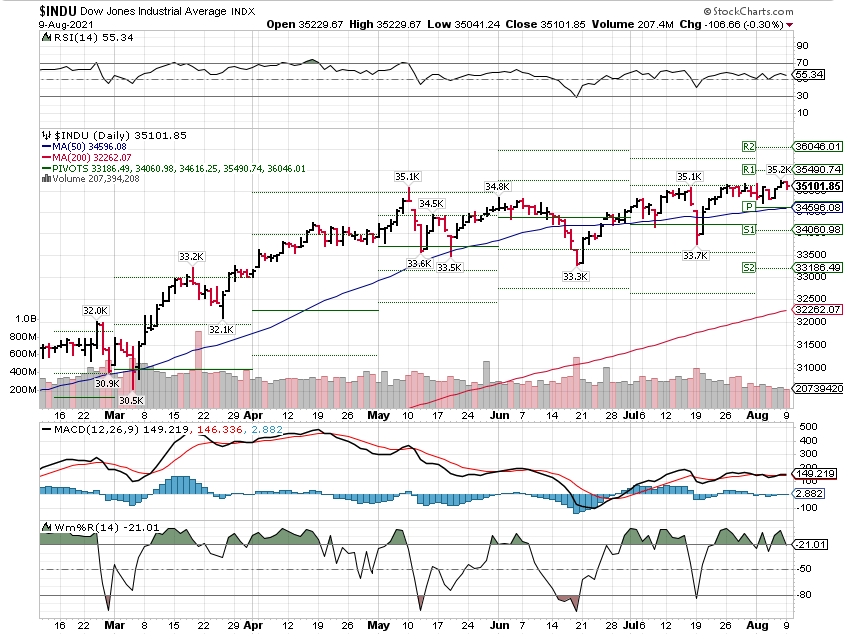

But in this cash rich environment we could see on the DOW – 42,000 next year, 5 years down the road 65,000

S&P 500 – 5,500 next year and 5 years 10,000

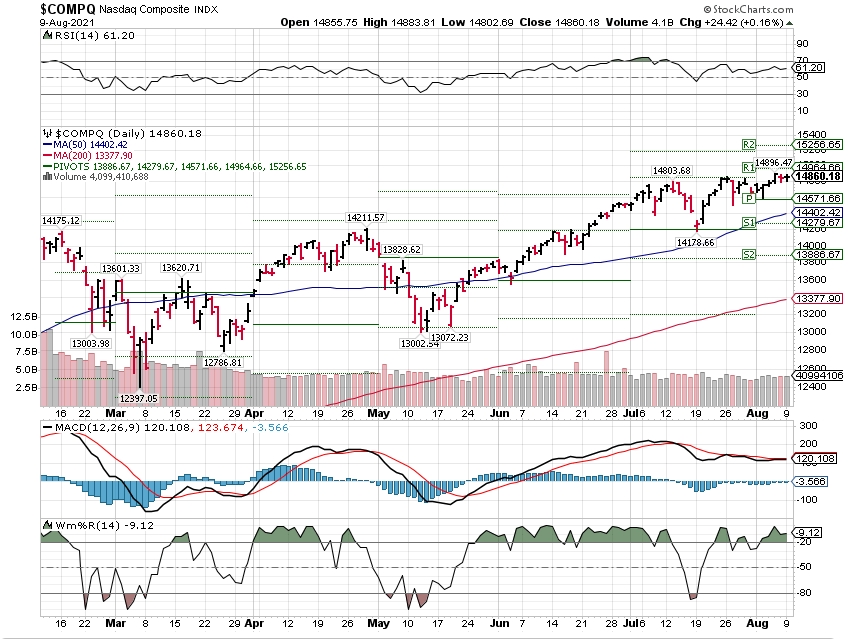

Nasdaq – 19,000 next year, 5 years 45,000

Money flows are foreign investments into the US stock market and US economy by way of GDP investment

Money flows are greatest right now internally = FREE CASH

| Market Recap |

| WEEK OF AUG. 2 THROUGH AUG. 6, 2021 |

| The S&P 500 index rose 0.9% this week, hitting fresh records in a broad climb led by the financial sector as most quarterly earnings results continued to come in above expectations and July payrolls showed stronger-than-anticipated job growth. The market benchmark ended the week at 4,436.52, up from last Friday’s closing level of 4,395.26 and marking its highest closing level ever. The index, which also reached a new intraday high Friday at 4,440.82, is now up 18% for the year to date. The week’s gains more than erased last week’s 0.4% decline, which had come amid concerns that the economic recovery may be slowing, especially amid impacts from the delta variant of COVID-19. However, investors shifted their focus this week back to corporate earnings results and economic data, where they found signs of hope. Friday, the Labor Department’s jobs report for July showed nonfarm payrolls rose by 943,000 last month, topping June’s revised level of 938,000. Analysts polled by Econoday had been expecting an increase of 900,000. The US unemployment rate fell by 0.5 percentage point to 5.4% in July, better than the 5.7% rate expected, while the labor force participation rate and the size of the labor force grew. The financial sector had the largest percentage increase of the week, up 3.6%, followed by a 2.3% rise in utilities. Technology climbed 0.9% while communication services and health care added 0.7% each. Just one sector ended Friday’s session in the red versus last week: consumer staples, which edged down 0.5%. Among the financial sector’s gainers, shares of Franklin Resources (BEN) climbed 7.1% on the week as the investment firm reported fiscal Q3 adjusted earnings per share and revenue that were up year on year and above Street views. In the utilities sector, American Water Works (AWK) shares rose 4.3% as the water and wastewater utility company reported Q2 earnings per share above year-earlier results and analysts’ expectations. On the downside, the decliners in consumer staples included Clorox (CLX), whose shares fell 10% as the consumer products company released disappointing fiscal Q4 results and fiscal 2022 guidance. The company’s fiscal Q4 sales dropped 9% amid a pullback in consumer demand for cleaning supplies. It projected more declines in fiscal 2022 and issued earnings guidance for the fiscal year below analysts’ expectations. Next week’s lineup of companies releasing quarterly results includes Tyson Foods (TSN), eBay (EBAY), DoorDash (DASH) and Airbnb (ABNB). The schedule of economic data to be released next week features preliminary reports on Q2 productivity and unit labor costs on Tuesday, the July consumer price index on Wednesday, the July producer price index on Thursday, and the University of Michigan’s early August reading on consumer sentiment on Friday. |

Earnings Dates

BABA – 08/19 est

BIDU – 08/12 BMO

COST – 09/23 AMC

DIS – 08/12 AMC

GM – 08/04 AMC

TGT – 08/19 BMO

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2021?

08-09-2021 0.0%

08-02-2021 0.0%

07-26-2021 0.0%

Earnings:

Mon: GOLD, DISH, DDD, AMC

Tues:

Wed: WEN, EBAY,

Thur: DDS, DASH, BIDU, IQ, DIS

Fri:

Econ Reports:

Mon: JOLTS,

Tues: Productivity, Unit Labor Costs,

Wed: MBA, CPI, Core CPI, Treasury Budget

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Import, Export, Michigan Sentiment

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Added protection for earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

The IRS has seized $1.2 billion worth of cryptocurrency this fiscal year – here’s what happens to it

MacKenzie Sigalos@KENZIESIGALOS

KEY POINTS

- The U.S. government regularly holds auctions for its stockpile of bitcoin, ethereum, litecoin and other cryptocurrencies it seizes and then holds in crypto wallets.

- It really kicked off with the 2013 takedown of Silk Road, a dark web marketplace trading in illegal goods, where bitcoin was often used for payment.

- Interviews with current and former federal agents and prosecutors suggest the U.S. has no plans to step back from its side hustle as a crypto broker.

In June, the U.S. government casually auctioned off some spare litecoin, bitcoin and bitcoin cash.

Lot 4TQSCI21402001 — one of 11 on offer over the four-day auction — included 150.22567153 litecoin and 0.00022893 bitcoin cash, worth more than $21,000 at today’s prices. The crypto property had been confiscated as part of a tax noncompliance case.

This kind of sale is nothing new for Uncle Sam. For years, the government has been seizing, stockpiling and selling off cryptocurrencies, alongside the usual assets one would expect from high-profile criminal sting operations.

“It could be 10 boats, 12 cars, and then one of the lots is X number of bitcoin being auctioned,” explained Jarod Koopman, director of the IRS’ cybercrime unit.

Koopman’s team of IRS agents don’t fit the stereotypical mold. They are sworn law enforcement officers who carry weapons and badges and who execute search, arrest and seizure warrants. They also bring back record amounts of cryptocash.

“In fiscal year 2019, we had about $700,000 worth of crypto seizures. In 2020, it was up to $137 million. And so far in 2021, we’re at $1.2 billion,” Koopman told CNBC. The fiscal year ends Sept. 30.

As cybercrime picks up — and the haul of digital tokens along with it — government crypto coffers are expected to swell even further.

Interviews with current and former federal agents and prosecutors suggest the U.S. has no plans to step back from its side hustle as a crypto broker. The crypto seizure and sale operation is growing so fast that the government just enlisted the help of the private sector to manage the storage and sales of its hoard of crypto tokens.

Knowing what you don’t know

The 2013 takedown of Silk Road — a now-defunct online black market for everything from heroin to firearms — is where federal agents really cut their teeth in crypto search and seizure.

“It was totally unprecedented,” said Sharon Cohen Levin, who worked on the first Silk Road prosecution and spent 20 years as chief of the money laundering and asset forfeiture unit in the U.S. Attorney’s Office for the Southern District of New York.

Silk Road, which operated on the dark web, dealt entirely in bitcoin. It was good for users, because it promised them some degree of anonymity. Despite the reputational hit, it was good for bitcoin at the time, helping to pump up its price by giving the token a use case beyond programming circles.

When the government began to dismantle Silk Road, federal agents had to figure out what to do with all the ill-gotten bitcoin.

“There was a wallet with approximately 30,000 bitcoin in it, which we were able to identify and seize. At the time, it was probably the largest bitcoin seizure ever, and it sold for around $19 million,” said Levin.

“No one had ever done anything like it. In fact, there weren’t really companies that you could go to in order to sell the assets. The Marshals Service stepped up and conducted their own auction of the assets where they took bids,” she said.

That bitcoin batch went to billionaire venture capitalist Tim Draper. “It seemed like a large sum of money at the time, but if the government had retained those bitcoins, it would be worth way more today.”

The cache of coins sold in 2014 would be worth more than $1.1 billion as of Wednesday morning. But hindsight is 20/20, and the government isn’t in the business of playing the crypto markets.

https://art19.com/shows/bcd08fc3-8958-4c47-bf8e-524432adcd77/episodes/149a8f0a-a930-4072-93a8-0dd69247dc1a/embed What this entire exercise did accomplish, however, was to establish a workflow that remains in place today, one that uses legacy crime-fighting rails to deal with tracking and seizing cryptographically built tokens, which were inherently designed to evade law enforcement.

“I’ve just observed that the government is usually more than a few steps behind the criminals when it comes to innovation and technology,” said Jud Welle, a former federal cybercrime prosecutor of 12.5 years.

“This is not the kind of thing that would show up in your basic training. But I predict within three to five years … there will be manuals edited and updated with, ‘This is how you approach crypto tracing,’ ‘This is how you approach crypto seizure,’” Welle said.

″‘Follow the money’ is not new. Seizure is not new. What we’re just doing is trying to find a way to apply these tools and techniques to a new fact pattern, a new use case,” he said.

Chain of custody

There are three main junctures in the flow of bitcoin and other cryptocurrencies through the criminal justice system in the U.S.

The first phase is search and seizure. The second is the liquidation of raided crypto. And the third is deployment of the proceeds from those crypto sales.

In practice, that first stage of the process is a group effort, according to Koopman. He said his team often works on joint investigations alongside other government agencies — think government arms such as the Federal Bureau of Investigation, Homeland Security, the Secret Service, the Drug Enforcement Agency, and the Bureau of Alcohol, Tobacco, Firearms and Explosives.

“A lot of cases, especially in the cyber arena, become … joint investigations, because no one agency can do it all,” said Koopman, who worked on the two Silk Road cases and the 2017 AlphaBay investigation, which culminated in the closure of another popular and massive dark web marketplace.

Koopman explained that his division at the IRS typically handles crypto tracing and open source intelligence, which includes investigating tax evasion, false tax returns, and money laundering. Other agencies that have more money and resources focus on the technical components.

“Then we all come together when it’s time to execute any type of enforcement action, whether that’s an arrest, a seizure or a search warrant. And that could be nationally or globally,” he said.

During the seizure itself, multiple agents are involved to ensure proper oversight. That includes managers who establish the necessary hardware wallets to secure the seized crypto. “We maintain private keys only in headquarters so that it can’t be tampered with,” Koopman said.

Once a case is closed, the U.S. Marshals Service is the main agency responsible for auctioning off the government’s crypto holdings. To date, it has seized and auctioned more than 185,000 bitcoins. That cache of coins is currently worth nearly $7 billion, though many were sold in batches well below today’s price.

It’s a big responsibility for one government entity to take on, which is part of why the Marshals Service no longer shoulders the task alone.

The U.S. General Services Administration, an agency that typically auctions surplus federal assets such as tractors, added confiscated cryptocurrencies to the auction block earlier this year.

And just last week, following a more than yearlong search, the Department of Justice hired San Francisco-based Anchorage Digital to be its custodian for the cryptocurrency seized or forfeited in criminal cases. Anchorage, the first federally chartered bank for crypto, will help the government store and liquidate this digital property. The contract was previously awarded to BitGo.

“The fact that the Marshals Service is getting professionals to help them is a good sign that this is here to stay,” said Levin.

The process of auctioning off crypto, in blocks, at fair market value, likely won’t change, according to Koopman. “You basically get in line to auction it off. We don’t ever want to flood the market with a tremendous amount, which then could have an effect on the pricing component,” he said.

But other than spacing out sales, Koopman said, trying to “time” the market to sell at peak crypto prices isn’t a thing. “We don’t try to play the market,” he said.

In November, the government seized $1 billion worth of bitcoin linked to Silk Road. Because the case is still pending, those bitcoins are sitting idle in a crypto wallet. Had the government sold its bitcoin stake when the price of the token peaked above $63,000 in April, coffers would have been a whole lot bigger than if they liquidated at today’s price.

Where the money goes

Once a case is closed and the crypto has been exchanged for fiat currency, the feds then divvy the spoils. The proceeds of the sale are typically deposited into one of two funds: The Treasury Forfeiture Fund or the Department of Justice Assets Forfeiture Fund.

“The underlying investigative agency determines which fund the money goes to,” Levin said.

Koopman said the crypto traced and seized by his team accounts for roughly 60% to 70% of the Treasury Forfeiture Fund, making it the largest individual contributor.

Once placed into one of these two funds, the liquidated crypto can then be put toward a variety of line items. Congress, for example, can rescind the money and put that cash toward funding projects.

“Agencies can put in requests to gain access to some of that money for funding of operations,” said Koopman. “We’re able to put in a request and say, ‘We’re looking for additional licenses or additional gear,’ and then that’s reviewed by the Executive Office of Treasury.”

Some years, Koopman’s team receives varying amounts based on the initiatives proposed. Other years, they get nothing because Congress will choose to rescind all the money out of the account.

Tracking where all the money goes isn’t a totally straightforward process, according to Alex Lakatos, a partner with DC law firm Mayer Brown, who advises clients on forfeiture.

The Justice Department hosts Forfeiture.gov, which offers some optics on current seizure operations. This document, for example, outlines a case from May where 1.04430259 bitcoin was taken from a hardware wallet belonging to an individual in Kansas. Another 10 were taken from a Texas resident in April. But it is unclear whether it is a comprehensive list of all active cases.

“I don’t believe there’s any one place that has all the crypto that the U.S. Marshals are holding, let alone the different states that may have forfeited crypto. It’s very much a hodgepodge,” said Lakatos. “I don’t even know if someone in the government wanted to get their arms around it, how they would go about doing it.”

A Department of Justice told CNBC he’s “pretty sure” there’s no central database of cryptocurrency seizures.

But what does appear clear is that more of these crypto seizure cases are being trumpeted to the public, like in the case of the FBI’s breach of a bitcoin wallet held by the Colonial Pipeline hackers earlier this spring.

“In my experience, folks that are in these positions in high levels of government, they may be there for a short period of time, and they want to get some wins under their belt,” said Welle.

“This is the kind of thing that definitely captures the attention of journalists, cybersecurity experts, right, a lot of chatter around it.”

Why your Social Security money you’re planning on might not be guaranteed

By Ryan Thacker and Tyson Thacker for B.O.S.S. Retirement Solutions | Posted – Aug. 4, 2021 at 8:00 a.m.

This story is sponsored by B.O.S.S. Retirement Solutions.

When you picture retirement, you may be dreaming about long-awaited vacations, endless hours on the golf course, and extra time to spend with family and friends. But if you’re banking on Social Security to see you through those freedom-filled years, you may be in for an unpleasant surprise.

Before the pandemic, many Americans were skeptical about Social Security. But now 70% of them believe their benefits will be cut or eliminated by the time they retire, according to MarketWatch.

It’s an easy thing to worry about, given that the Social Security Administration itself estimates that the system’s fund reserves will become depleted by 2034. After that, continuing tax income is expected to pay 76% of scheduled benefits. While Social Security won’t be eliminated entirely, it’s safe to say that you shouldn’t rely on it as your sole source of income.

The truth is, there are many things that could be affecting the amount of money you’ll have in retirement. Your current income, the kind of lifestyle you hope to lead, and your investment decisions are some of them. Luckily, there are simple steps you can take today that can make a huge financial impact.

Even if you think you’ve saved enough, overlooking this one thing could be costing you tens or hundreds of thousands of dollars. Here’s what you should know if you want to have plenty of money saved up by the time you retire.

Case Study: Tax preparation vs. tax planning

If you hope to have plenty of money on hand in retirement, simply accounting for taxes won’t be enough. You’ll need to learn how to optimize your finances. To illustrate the cost of not planning effectively for the future, consider the following case study:

Craig and Laurie are a recently retired married couple. Craig spent his entire career as a grocery store manager while Laurie worked 20 years as a registered nurse. Their combined retirement income (including savings, pensions, IRAs, and 401(k)s) totaled $1.5 million.

While that may sound like an impressive chunk of cash, here’s the catch: Without strategic tax planning, Craig and Laurie will have to pay $940,120 in taxes. However, with the help of a professional financial advisor, they could pay just $299,661 in taxes.

That’s a difference of $640,459 in tax savings!

Unfortunately, too many people wind up in the first scenario. Why? Because they do tax preparation instead of tax planning. Tax preparation focuses on complying with state and federal tax laws, but tax planning takes things a step further.

According to NerdWallet, “Tax planning is the analysis and arrangement of a person’s financial situation in order to maximize tax breaks and minimize tax liabilities in a legal and efficient manner.”

Simply put: Tax planning is a smart idea if you want to save a lot of money in the long run.

The world is nowhere near the end of the Covid pandemic, says famed epidemiologist Larry Brilliant

KEY POINTS

- The Covid-19 pandemic is not coming to an end soon, said Larry Brilliant, a top epidemiologist.

- Brilliant, part of the World Health Organization team that helped eradicate smallpox, said the delta variant of coronavirus is “maybe the most contagious virus” ever.

- Only 15% of the world’s population has gotten a Covid vaccine.

The pandemic is not coming to an end soon — given that only a small proportion of the world population has been vaccinated against Covid-19, a well-known epidemiologist told CNBC.

Dr. Larry Brilliant, an epidemiologist who was part of the World Health Organization’s team that helped eradicate smallpox, said the delta variant of the coronavirus is “maybe the most contagious virus” ever.

In recent months, the U.S., India and China, as well as other countries in Europe, Africa and Asia have been grappling with a highly transmissible delta variant of the virus.

WHO declared Covid-19 a global pandemic last March — after the disease, which first emerged in China in late 2019, spread throughout the world.

The good news is that vaccines — particularly those using messenger RNA technology and the one by Johnson & Johnson — are holding up against the delta variant, Brilliant told CNBC’s “Street Signs” on Friday.

Unless we vaccinate everyone in 200 plus countries, there will still be new variants.

Larry Brilliant

EPIDEMIOLOGIST

Still, only 15% of the world population has been vaccinated and more than 100 countries have inoculated less than 5% of their people, noted Brilliant.

“I think we’re closer to the beginning than we are to the end [of the pandemic], and that’s not because the variant that we’re looking at right now is going to last that long,” said Brilliant, who is now the founder and CEO of a pandemic response consultancy, Pandefense Advisory.

“Unless we vaccinate everyone in 200 plus countries, there will still be new variants,” he said, predicting that the coronavirus will eventually become a “forever virus” like influenza.

Probability of ‘super variant’

Brilliant said his models on the Covid outbreak in San Francisco and New York predict an “inverted V-shape epidemic curve.” That implies that infections increase very quickly, but would also decline rapidly, he explained.

If the prediction turns out be true, it means that the delta variant spreads so quickly that “it basically runs out of candidates” to infect, explained Brilliant.

There appears to be a similar pattern in the U.K. and India, where the spread of the delta variant has receded from recent highs.

But I do caution people that this is the delta variant and we have not run out of Greek letters so there may be more to come.

Larry Brilliant

EPIDEMIOLOGIST

Daily reported cases in the U.K. — on a seven-day moving average basis — fell from a peak of around 47,700 cases on July 21 to around 26,000 cases on Thursday, according to statistics compiled by online database Our World in Data.

In India, the seven-day moving average of daily reported cases has stayed below 50,000 since late June — far below the peak of more than 390,000 a day in May, the data showed.

https://datawrapper.dwcdn.net/HrBHT/3/ “That may mean that this is a six-month phenomenon in a country, rather than a two-year phenomenon. But I do caution people that this is the delta variant and we have not run out of Greek letters so there may be more to come,” he said.

The epidemiologist said there is a low probability that a “super variant” may emerge and vaccines don’t work against it. While it’s hard to predict these things, he added, it’s a non-zero probability, which means it cannot be ruled out.

“It’s such a catastrophic event should it occur, we have to do everything possible to prevent it,” said Brilliant. “And that means get everyone vaccinated — not just in your neighborhood, not just in your family, not just in your country but all over the world.”

Covid vaccine boosters

Some countries with relatively high vaccination rates such as the U.S. and Israel are planning booster shots for their population. Others, such as Haiti, only recently secured their first batch of vaccine doses.

WHO has called on wealthy countries to hold off on Covid vaccine boosters to give low-income countries a chance to vaccinate their people.

But in addition to boosting vaccination in countries with a low inoculation rate, Brilliant said one group of people needs a booster shot “right away” — those who are 65 years and above, and were fully vaccinated more than six months ago but have a weakened immune system.

“It is this category of people that we’ve seen create multiple mutations when the virus goes through their body,” said the epidemiologist.

“So those people, I would say, should be given a third dose, a booster right away — as quickly as moving the vaccines to those countries that haven’t had a very high chance to buy them or have access to them. I consider those two things about equal,” he added.

— CNBC’s Rich Mendez contributed to this report.

Correction: This article has been amended with the correct TV show that Dr. Larry Brilliant made his appearance on.

There are about 1 million more job openings than people looking for work

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- There are 8.6 million people considered out of work in the U.S. and nearly 10 million job openings.

- Employers are using a number of incentives, including pet insurance and signing bonuses, to fill those positions.

- “One of the biggest factors is employers are essentially having to buy back job applicants’ Covid lifestyle,” said one HR executive.

Employers in the U.S. face an interesting challenge ahead – how to fill nearly 10 million job openings with about a million fewer workers than there are positions available.

How successful they are will go a long way in determining whether the recent strong of outsized job gains can continue.

The Department of Labor reported Friday that there are some 8.7 million potential workers who have been looking for jobs and are counted among the unemployed. At the same time, job placement site Indeed estimates there are about 9.8 million job vacancies as of July 16, or just a few days after the government’s sample period for the monthly numbers.

Companies have been using a variety of techniques, including signing bonuses, higher salaries and flexible working arrangements, to entice people. That likely will have to continue as the Covid-19 pandemic changes the jobs market, perhaps permanently.

“This is one of the most complex labor markets in recent memory,” said Scott Hamilton, global managing director for the human resources and compensation consulting practice at Gallagher, a global insurance brokerage, risk management and consulting firm. “One of the biggest factors is employers are essentially having to buy back job applicants’ Covid lifestyle.”

A just-released survey from Gallagher shows the extent to which employers are willing to go to entice workers in the pandemic era.

Some 41% of employers responding said they are offering enhanced benefits. One such enticement: 19% say they are offering pet insurance, a perk that is expected to rise to 27% of companies in the next two years.

They’re also providing discount programs, legal services and identity theft protection, though 71% of respondents said medical and pharmacy benefits remain atop the most important added benefits they’re offering.

Job growth has been surging in recent months, with July’s number, reported Friday, showing an addition of 943,000, the biggest spike since August 2020. That came on top of respective gains of 938,000 and 614,000 in the previous two months, for an impressive three-month average of 832,000.

Still, there’s a lot more work to be done, as there are still 6.1 million fewer Americans working now than in February 2020, just before the pandemic hit.

“Labor force participation is flat, so this is just job regrowth,” Hamilton said. “All the big jobs numbers are great, but we’re still growing into lost jobs. So it’s going to get slower as folks are coming back into the market with changed expectations and changed lifestyles.”

Unemployment benefits could be key

One important factor looming ahead is the September expiration of enhanced unemployment benefits.

Indeed reports that in past months, many workers had refrained from taking jobs they didn’t want because they had enough financial cushion to wait. Even with concerns about the virus, the need to get back to work will start to grow.

“Money issues seem to be a rising concern among unemployed workers not searching urgently” Nick Bunker, Indeed’s economic research director, said in a recent report. “More of them said the end of [unemployment insurance] benefits or financial cushions running low were major milestones that could prompt them to take a job.”

Enhanced benefits, child care issues and fear over the pandemic and, now its delta variant, have long led the list of things keeping people out of their jobs. Each could continue to play a role, though renewed precautions over the delta strain are likely to become front and center.

“They’re all important, they’re all interconnected,” said Joseph LaVorgna, chief economist for the Americas at Natixis and former chief White House economist during the Trump administration. “So I guess it’s dependent on what happens in the fall. Are schools going to reopen? If they’re not going to reopen, if people are limited in their ability to send their kids to school, some people are going to be hard-pressed to go back to the labor market.”

July’s nonfarm payrolls report provided a raft of good news across a variety of areas.

While the total employed is well below its pre-pandemic level, it did improve by 1.04 million. Labor force participation inched up, at least, to 61.7% as the unemployment rate slid to 5.3%. And a gauge that measures the employment level compared to the total working-age population – a metric critically important to Federal Reserve policymakers – rose to 58.4%, its best since March 2020 and now just 2.7 percentage points below its peak.

Heading into the end of the summer, the unusual burden of convincing workers to fill a historically high level of job openings will be critical for the economy.

“We have a lot of cloudy skies, and that’s largely tied to delta and delta-plus,” said Beth Ann Bovino, chief U.S. economist at S&P Global Ratings. “There’s still a lot of moving parts. I wouldn’t call the game over yet.”