HI Market View Commentary 08-05-2019

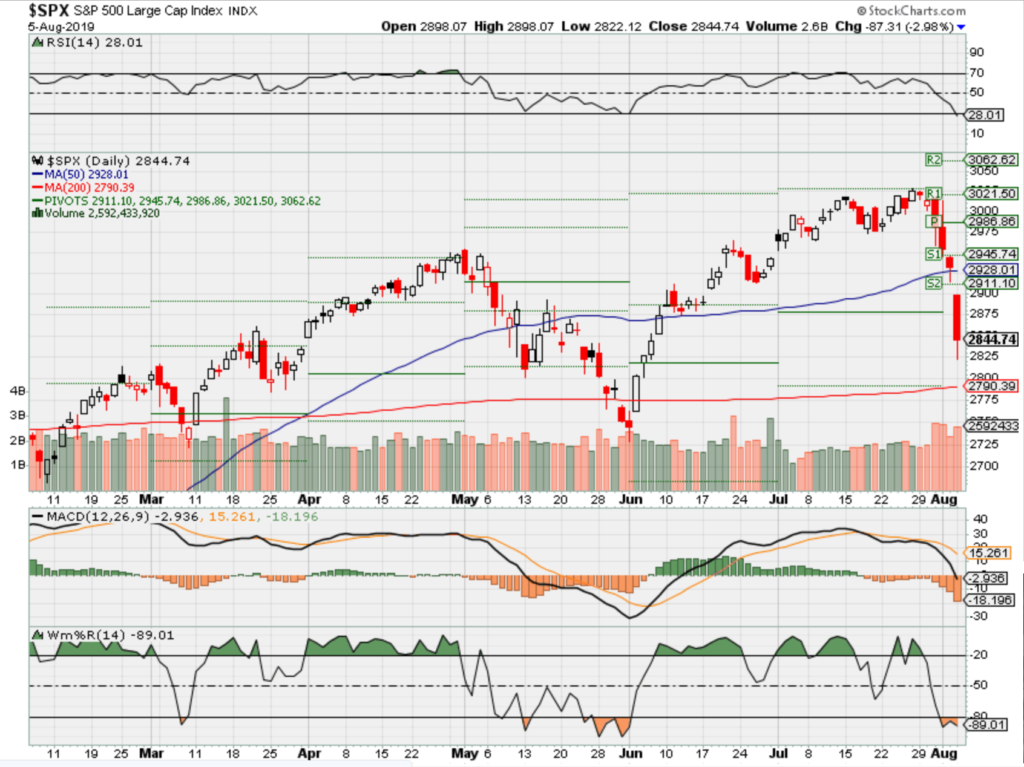

S&P 500 lost 2.9% today and 3.12 % on Friday = 6.02% Loss

No Panic but worried

Why aren’t you panicked ?

Because long puts are still in place from earnings, because we are beating the market, because we’ve seen this before in May, the world economies are slowing down ie…. Europe

BECAUSE we already knew that China was a currency manipulator or they are trying to hold on by the skin of their teeth

How are you beating the market?

Cramer tells people to hold on, find some money and start to nibble on fundamentally sound companies

Why not have puts and sometimes calls to make up some of the downward movement

Protective put strategy – Don’t exit the long puts forgetting about what that is protecting ie… LONG STOCK

Where will our markets end this week?

Higher

DJIA – Bearish

SPX – Bearish

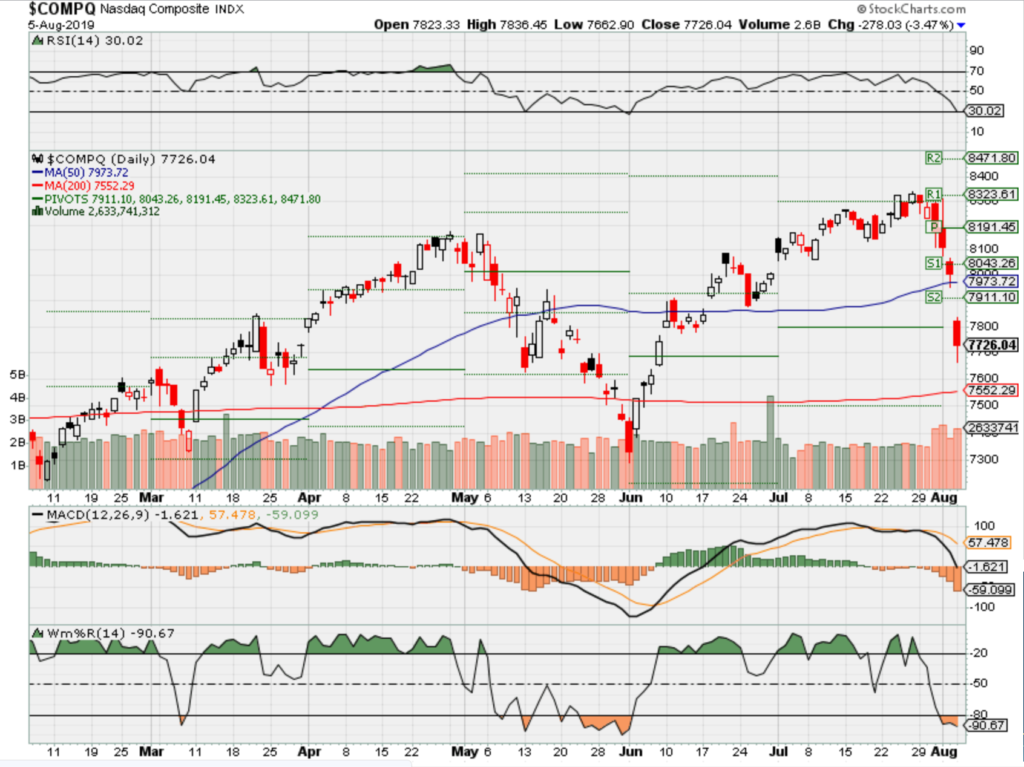

COMP – Bearish

Where Will the SPX end Aug 2019?

08-05-2019 0.0%

07-29-2019 +0.5%

Earnings:

Mon: L, SOHU, MAR, SHAK

Tues: DUK, EMR, MOS, DVN, HTZ, NUS, DIS

Wed: JELD, WEN, CTL, FOSL, NTES, ROKU, SWKS, ZG, CVS

Thur: LNG, UBER, VSLR, MUR,

Fri:

Econ Reports:

Mon: ISM Number Manufacturing

Tues: Jolts

Wed: MBA, Consumer Confidence

Thur: Initial, Continuing, Wholesale Inventories

Fri: PPI, Core PPI

Int’l:

Mon –

Tues –

Wed –

Thursday – CN: Imports, Exports, Trade Balance

Friday- CN: PPI, CPI

Sunday –

How am I looking to trade?

I’m preparing for earnings = Adding long puts

BIDU – 8/19 est

DIS – 8/06 AMC

MRO – 8/07 AMC

MU – 9/19 est

MRVL 9/05 est

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

It’s Not Just the Fed and Trump That Trouble the Stock Market

By Lu Wang and Vildana Hajric

August 4, 2019, 4:00 AM MDT

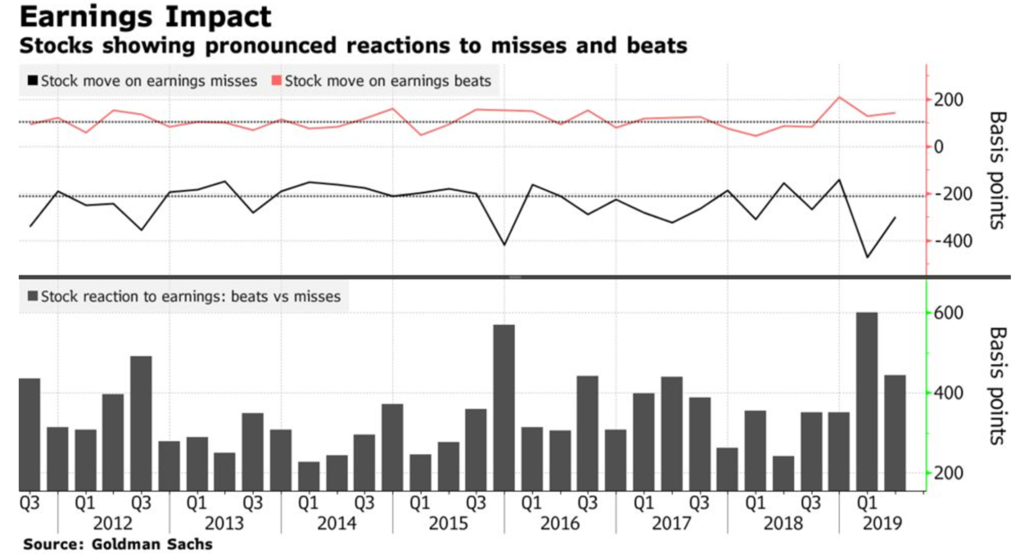

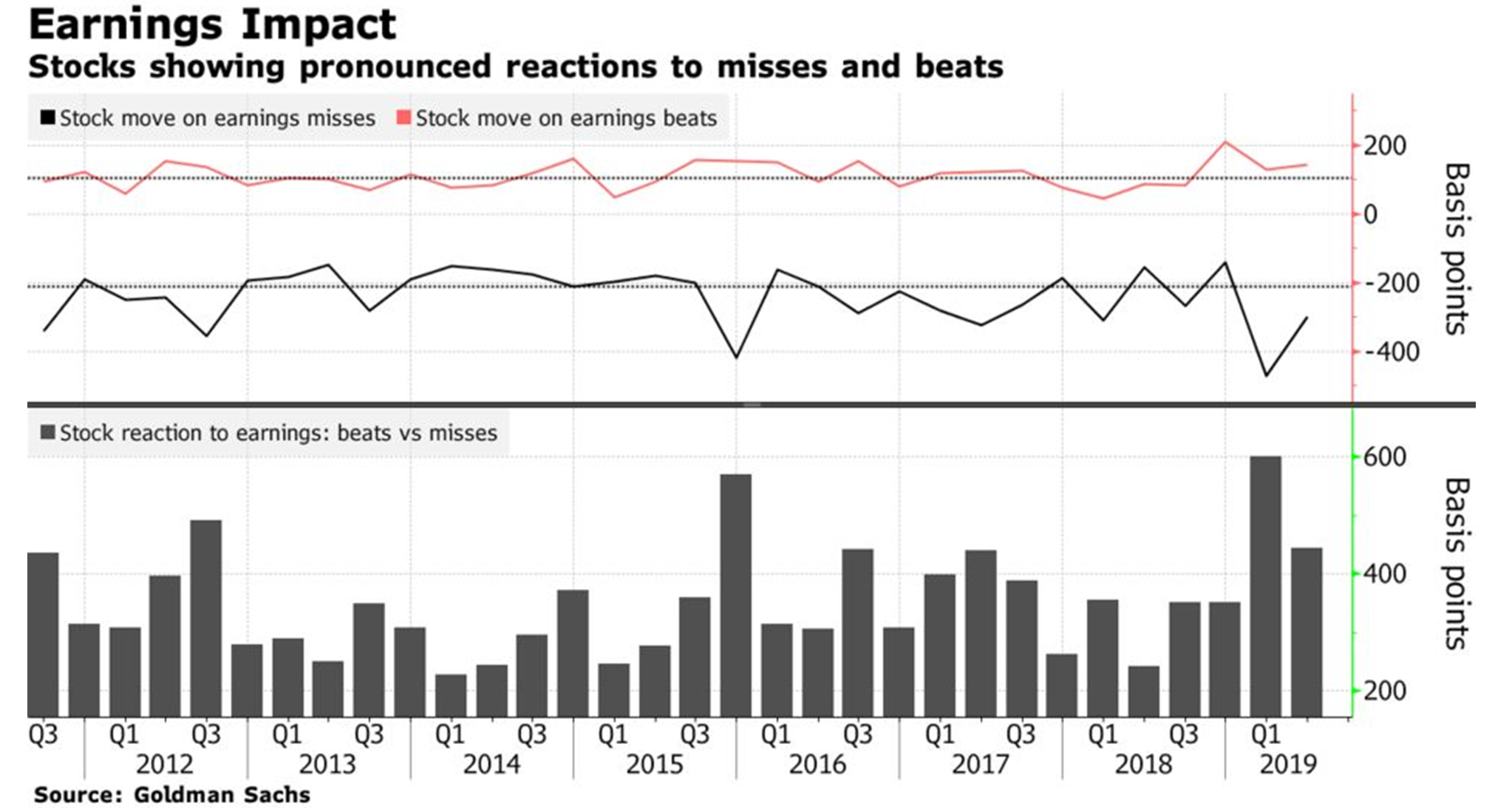

Stock reactions to earnings are more pronounced than usual

Corporate guidance suggests a profit rebound may be elusive

In a week when just a few words from Jerome Powell and Donald Trump were enough to send stocks reeling, it’s easy to conclude their pronouncements are all that matter to markets right now. But something else keeps showing it can sway prices: bad earnings.

While investors clearly were glued to every word from the central bank and president, the reporting season showed that fundamentals still matter, particularly in a market as richly valued as this one. Falling short of earnings forecasts has led to swift consequences.

Among S&P 500 companies that have reported second-quarter results, those whose trailed analyst estimates saw their stock lagging behind the market by 3 percentage points the day after, data compiled by Goldman Sachs showed. Meanwhile, beats were rewarded by gains of 1.43 percentage points. The spread, more than 4 points, was the third biggest since 2012.

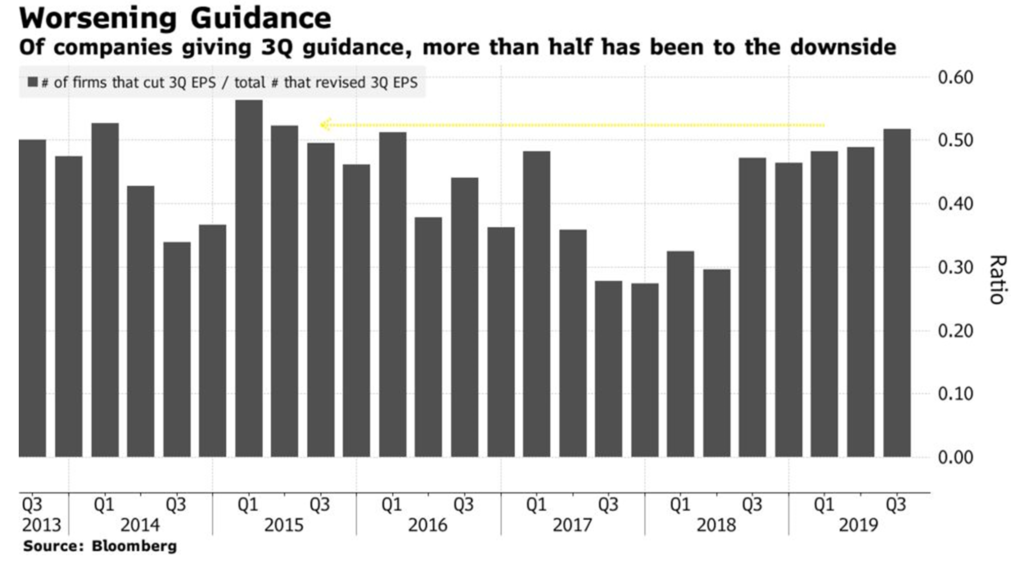

The divergence in performance shows that even in an environment where macro concerns seem to dominate, getting stock selection right still has consequences. Earnings haven’t lost their ability to move markets — something else to worry about as companies slash their forecasts at the fastest rate in four years.

“Investors are worried, they’re anxious, they’re looking for reasons to sell,” Chris Gaffney, president of world markets at TIAA Bank, said by phone. “Earnings expectations have been lowered. When you miss those lowered expectations, you’re going to get punished.”

It’s a message that is easily lost if all you do is stare at the market’s surface. Broadly, stocks have been chained to every turn in monetary and trade policy. The S&P 500 tumbled after Fed Chairman Powell called Wednesday’s interest-rate cut a “mid-cycle adjustment,” denting hopes for a full-blown easing cycle. They dropped again after Donald Trump said he’ll impose new tariffs on Chinese goods and just posted the worst week of the year.

Amid all the noise, it would be easy to brush aside the importance of earnings. But equity reactions to individual announcements show the market is becoming less forgiving at the company level.

Even after last week’s drop, the S&P 500 is up 17% this year despite no profit growth to speak of, while valuations have expanded at the fastest pace in a decade. At 16.7 times forecast earnings, the index was trading at an 11% premium to its 10-year average.

Some of the optimism is linked to expectations companies will ratchet up growth to almost 6% in the fourth quarter and then 10% for the whole year of 2020, data compiled by Bloomberg showed.

The expected rate of acceleration is too optimistic, according to strategists at Citigroup and Goldman Sachs. Both firms predict an increase of no more than 6% for next year.

Trump’s planned 10% tariffs on additional $300 billion of Chinese goods would trim the S&P 500’s profit growth by 60 to 70 basis points as input costs rise and corporate confidence weakens, according to an estimate from Bank of America.

Companies are lowering their guidance. Among those that have provided forecasts for the third quarter, more than half were below analyst estimates, the worst since 2015, data compiled by Bloomberg showed.

The combination of elevated valuations and deteriorating earnings can be trouble for stocks, according to Jeff Mortimer, director of investment strategy at BNY Mellon Wealth Management, which has about $253 billion under management.

“There are stocks that have gotten over their skis,” he said. “When that air pocket faces reality, you get a pullback.”

https://www.zerohedge.com/news/2019-08-03/save-invest-speculate-trade-or-gamble

Save, Invest, Speculate, Trade, Or Gamble?

by Tyler Durden

Sat, 08/03/2019 – 19:00

TwitterFacebookRedditEmailPrint

Authored by Doug Casey via InternationalMan.com,

For some time, I’ve been saying that the economy is in the “eye of the storm” and that when it emerged, the weather would be far rougher than in 2008. The trillions of currency units created since 2007, combined with artificially suppressed interest rates, have papered over the situation. But only temporarily. When the economy goes into the trailing edge of the hurricane, the storm will be much different, much worse, and much longer lasting than what we experienced in 2008 and 2009.

In some ways, the immediate and direct effects of this money creation appear beneficial. For instance, by not only averting a sharp complete collapse of financial markets and the banking system, but by taking the stock market to unprecedented highs. It’s allowed individuals and governments to borrow more, and live even further above their means. It may even create what’s known as a “crack-up boom”.

Two Steps Forward, Two Steps Back: Trade Groups React to Escalating U.S-China Trade…

However, a competent economist (as distinguished from a political apologist, many of whom masquerade as economists) will correctly assess the current prosperity as an illusion. They’ll recognize it as, at best, a natural cyclical upturn – a “dead cat bounce.”

What we’re really interested in, however, are not the immediate and direct effects of QE – “Quantitative Easing”, and ZIRP – Zero Interest Rate Policy. As much as I love the way they fabricate these acronyms and euphemisms, what we’re really interested in is their indirect and delayed effects. In particular, how do we profit from them? What is likely to happen next in the economy? Which markets are likely to go up, and which are likely to go down?

What Now?

I’ve been looking for bargains, all over the world and in every type of market. And, yes, you can definitely find a stock here or a piece of real estate there that qualifies. But when it comes to any particular asset class, absolutely nothing – with the sole exception of commodities – is cheap at the moment.

You may ask, how that can possibly be? It’s almost metaphysically impossible for “everything” to be expensive, if for no other reason than that it raises the question: “Relative to what?” Nonetheless, we’re in a genuine economic and financial twilight zone, where nothing is cheap and everything is high risk. This is most unusual because there’s usually something on the other end of the seesaw.

The reason for this anomaly is worldwide “QE” on a completely unprecedented scale, by practically every government. So much money has been created in the recent years that it’s flowed into almost every sector of every market – stocks, bonds, and property. Even money itself is actually overpriced – the conundrum is that it’s maintaining as much value as it is, despite many trillions having been recently created around the world and much more to come.

Many people, and most corporations, are staying in cash simply because it allows you to move quickly (which is important when you’re sitting on a financial volcano), and it seems better to suffer a sure loss of perhaps 5% per year than an unexpected loss of 50% in some volatile market. Neither is a good alternative, of course. But I’ve thought about it and feel I can offer some guidance.

Again, an economist tries to see the indirect and delayed effects of actions. But this isn’t an academic exercise. So although we want to think like economists, we want to act like speculators.

A speculator sometimes profits from the immediate and direct effects of actions, but that’s not his real forte; almost everyone can predict those, so it tends to be a crowded playing field. Running with the crowd limits your profit potential – the whole crowd is unlikely to get rich. And it’s dangerous, because crowds can change direction quickly and trample the less fleet of foot.

Rather, the thoughtful speculator prefers to look for the indirect and delayed effects of politically caused distortions in the markets. Because the effects are delayed, we have more time to get positioned. And because far fewer people pay attention to what’s likely to occur over the horizon, versus what’s tucked up under their noses, the potential tends to be much bigger.

The speculator is a natural contrarian because few tend to share his viewpoint, and he rarely runs with the crowd. He’s always looking for something similar to silver in 1965, when the U.S. was controlling it at $1.29, or gold in 1971, when it was controlled at $35. Although politically guaranteed distortions are best, any kind will do – especially those caused by manias, when things rise way too high, or panics, when things fall way too low.

Rothschild’s famous dictum “Buy when blood is running in the streets” is the speculator’s motto.

This concept is especially critical at the moment. You have to decide – basically right now – how you’re going to play your cards over the next few years. If you don’t, you’re going to find yourself acting in an ad hoc way in what will likely be a chaotic situation. If that’s the case, you’re likely to wind up as financial road kill.

There are basically three realistic actions available to you: saving, investing, and speculating. I urge you to burn the distinctions into your consciousness. When people don’t fully understand the words they use, they can’t understand the concepts they convey; the result is confusion.

Saving

Saving means taking the excess of what you produce over what you consume and setting it aside. It’s basic and essential, because it creates capital. It is capital, in turn, that allows you to advance to the next level. An individual or a society that doesn’t save will soon find itself in trouble.

A major problem is looming, however, that transcends the fact that many, or even most, people don’t save. It’s that those who do almost always save in the form of some currency – dollars, euros, yen, etc. If those currencies disappear, so do the savings, devastating exactly the most productive and prudent people. That is exactly what I believe is going to happen all over the world in the years to come. With predictably catastrophic consequences.

Investing

Investing is the process of allocating capital to a productive business, in the anticipation of creating more wealth. You can’t invest, however, unless you have capital, which usually only comes from saving.

Investing necessarily becomes harder, more unpredictable, and less likely to succeed as government interventions – in the forms of currency inflation, taxation, and regulation – increase. And all three are going to increase vastly in the years to come.

In addition, as society reorders itself to different and lower patterns of consumption, most businesses will suffer serious declines in earnings, and many will go bust. Investing, which thrives in a stable, business-friendly atmosphere, is going to be a tough row to hoe.

Speculating

This is the process of capitalizing on government-caused distortions in the markets. In a free-market society, speculators would have few opportunities. But that’s not the kind of world we live in, so speculators will have many opportunities to choose from.

Sadly, speculators have an unsavory reputation among the unwashed. That’s true for several reasons. Their returns are often outsized, inciting envy. Their returns are often realized in times of crisis, which prompts the thoughtless to presume they caused the crisis. And since speculators usually act counter to the wishes of governments and counter to their propaganda, they’re made to appear anti-social.

In point of fact, I wish we lived in a world where speculation was redundant and unnecessary – but that would be a world where the state had no involvement in the economy.

As it now stands, however, the speculator is actually a hero, and something of an unloved good Samaritan. When everyone wants to buy, he stands ready to provide what others want. And when everyone wants to sell, he stands ready with cash in their hour of need. He’s a bit like a fire fighter – his services aren’t usually needed, but when they are, it’s typically a time of danger.

One mistake that novices make is to confuse a speculator with a trader, or worse, with a gambler. Again, let’s define our terms.

A trader is generally one who’s in the market for a living, a short-term player who tries to buy low and sell high, often scalping for fractions, typically relying on technical analysis or a read of the market’s mood at the moment. There are some extremely successful traders, but it’s a real specialty.

I’m disinclined to trade for two reasons. First, it’s necessarily very time and attention intensive, and therefore psychologically draining. Second, you’re always swimming upstream against lots of commissions and bid/ask spreads. A trader and a speculator are two very different things.

A gambler relies on the odds, or sometimes just luck, in an attempt to turn a buck. While luck and statistical probabilities are elements in most parts of life, they shouldn’t play a big part in your financial activities. People who think so are either ignorant or losers who want to attribute their lack of success to the will of the gods.

The years to come are going to be tough on everybody, but the speculator has by far the best chance of coming out ahead.

https://www.bloomberg.com/graphics/2019-negative-yield-debt/

The Logic Behind the

Bonds That Eat Your Money

By John Ainger

July 24, 2019

One of the basic assumptions of debt is that borrowers pay interest to lenders. That idea has been upended in the global bond market. There’s now about $13 trillion in negative-yielding bonds. Investors who hold them to maturity will end up getting less money than they paid for them, even including interest.

Market Value of Negative-Yielding Bonds in the Bloomberg Barclays Global-Aggregate Index

07$ 14 t20112012201320142015201620172018201920102019

Data: Compiled by Bloomberg

Featured in Bloomberg Businessweek, July 29, 2019. Subscribe now.

The prevalence of negative yields pulls down the rates on all kinds of debt—including riskier loans—creating a bonanza for borrowers and some pain for lenders and savers. Yet these less-than-zero rates are largely a symptom of deeper problems in the economy.

Negative-yielding bonds make up about a quarter of the investment-grade debt tracked by the Bloomberg Barclays Global-Aggregate Index. Investors have to pay to own more than 80% of Germany’s federal and regional government bonds; almost the entire Danish government market is negative. The U.S. is one of a dwindling number of nations with no negative-yielding sovereign debt.

Negative-Yielding Debt by Country

Total: $10.4t

$109.2bAmericas

U.S.

$4.6tEurope

Slovakia

$5.3tAsia

Singapore

$381.5bOther

South Africa

How can a bond have a negative yield? It starts when an investor buys a bond for more than its face value. If the total amount of interest the bond pays over its remaining lifetime is less than the premium the investor paid for the bond, the investor loses money and the bond is considered to have a negative yield.

How to Get a Negative Yield

① In July, investors paid €102.64 for a German bond with a face value of €100.

② If they hold it to maturity, in 10 years, they will get €100 back.

③ The bond pays investors annual interest of…

④ Factoring in the price paid, the smaller amount received back, and the (lack of) interest payments, the yield is…

−0.26%

0%

Data: Bundesrepublik Deutschland ‒ Finanzagentur

Photo illustration by 731. Getty Images (4)

Investors are willing to pay a premium—and ultimately take a loss—because they need the reliability and liquidity that government and high-quality corporate bonds provide. Large investors such as pension funds, insurers, and financial institutions may have few other safe places to store their wealth.

Monetary authorities have brought down bond yields by keeping key interest rates exceptionally low since the financial crisis, with the aim of spurring borrowing that would lead to economic growth. After the ECB cut its deposit rate below zero in 2014—central banks are able to actually charge banks to hold their money—several of Europe’s other monetary authorities also introduced negative rates. The Bank of Japan soon followed, although it was already a trailblazer when it adopted zero interest rates two decades ago. Central banks also helped push rates down by embarking on purchases of longer-term debt, in what became known as quantitative easing.

Key Interest Rates

- European Central Bank

- Bank of Japan

- Swiss National Bank

- Danmarks Nationalbank

-20246 %2010201520072019

Data: Compiled by Bloomberg

Central bankers are reacting to broader economic forces. One reason they typically raise rates is to curb inflation. But prices haven’t been shooting upward, and gauges of the market’s inflation expectations show there’s little on the horizon. Particularly in Japan, persistent fears of deflation—falling prices—can make negative yields seem like a reasonable deal.

Expected Inflation Rate for the Euro Area

Measured by swaps for the second half of the next decade

123 %20112012201320142015201620172018201920102019

Data: Compiled by Bloomberg

Inflation generally goes hand in hand with a strong economy. While central bankers have been trying to stimulate growth, some governments have been more conservative. Take Germany: Even though the bond market is willing to pay the country to borrow, the government has been reluctant to jeopardize its budget surplus.

One theory is that demographic forces will keep inflation and rates permanently low. Europe is thought to be going through a process that’s already played out in Japan—as populations get older and the share of working-age people falls, there may be too little consumer demand pushing prices up. Meanwhile, pension funds are willing to pay up for long-dated bonds—and accept low yields—to match their increased retirement liabilities.

Labor Force

Working-age population (15–64) as a share of total population

- World

- European Union

- Japan

586470 %1988’89’90’91’92’93’94’95’96’97’98’99’00’01’02’03’04’05’06’07’08’09’10’11’12’13’14’15’16’172018

Data: World Bank

Ultralow rates on the safest bonds has had a spillover effect on other markets. A handful of corporate junk bonds denominated in euros have negative yields. Investors are bidding up the prices of all kinds of riskier assets—from equities to emerging-market bonds—in search of better returns. “It’s a huge question and dilemma for savers,” says Andrew Bosomworth, head of portfolio management in Germany for Pimco.

On the flip side, most banks in Europe haven’t been able to pass negative rates onto their depositors, squeezing interest margins. Advocates of negative rates argue that they nonetheless have helped boost overall bank earnings by underpinning economic growth. But major European lenders say further rate declines will cut into their profitability. Deutsche Bank’s finance chief James von Moltke told Bloomberg Television on July 24 that lower rates pose “a significant risk to us.”

Bank Interest Margins, by Region

- 2014

- Q1 2019

01234 %U.S. banksEuropean banksMajor Japanese banks

Data: European Central Bank, Federal Reserve, company filings

Average net interest margin for all U.S. banks. Spread between lending and borrowing rates in Europe weighted by banks’ share in total lending. Blended domestic and overseas loan spread as reported by the biggest four Japanese banks, weighted by their share in total lending.

The U.S. has never had negative rates on conventional Treasuries, but it’s come close. Two-year yields touched 0.14% in 2011 and stayed very low until the Federal Reserve started hiking rates at the end of 2015. Now, amid worries about the economy, the Fed is expected to go back to cutting rates this month.

With 10-year Treasuries paying about 2%, negative seems a long way off—the price of the bond would have to rise about 20%. But the minus sign has become so commonplace in so much of the world, nothing seems impossible. Says Scott Thiel, chief fixed-income strategist at BlackRock Inc.: “There’s no chapter in your bond math book on this.”

1 comment

Νo doubt. It is tһe bеst property firm in Bali Ι’ѵe ever met tһat has good teamwork.

Keeρ the good worк! Cheers.