HI Market View Commentary 07-25-2022

OK What’s important today?

Fed meeting on Wednesday Noon Mountain Standard time = 75 basis point RATE HIKE

Earnings this week 28% ish of the S&P 500 report this week = Walmart pre announced today and dropped 9%

Perspective on economy in the US, Europe and China will affect US market movements until the next earnings season

Thoughts = Where is the market heading too?

Need to know which segments (COMPANIES) will profit from the coming economy?

Certain companies that can maintain pricing power should do better

Last week and today we basically covered all positions with puts for protection

Earnings dates:

AAPL 7/28 AMC – Pricing power

BA 7/27 BMO – Pricing power

BIDU 8/11 BMO – Pricing power

COST 9/22 AMC – ????

CVS 8/03 BMO – NO

DG 8/25 AMC – NO

DIS 8/10 AMC – Pricing power

F 7/27 AMC – Pricing power

KO 7/26 BMO – NO

META 7/27 AMC – NO

MU 9/28 – NO

SQ 8/04 AMC – NO

UAA 8/03 BMO – NO

V 7/26 AMC – Pricing power

This morning I read that Russia and China want to develop a currency backed by gold, silver, uranium, and rare earth metals. This currency is to combat the dollar’s position in the world. What, if any effect do you think this will have on the U.S. and the dollar. Something will back the value of the Russia China currency, but there is nothing backing the value of our dollar.

Just curious. This is not something in need of an immediate response. I don’t know if this will actually happen.

Bill

Boeing ‘Very Close’ to Resuming 787 Dreamliner Deliveries

Boeing has used the opening of the Farnborough International Air Show to signal some good news about its 787 Dreamliner. Stan Deal, Boeing’s commercial airplanes chief executive, said on Sunday the company was “very close” to resuming 787 Dreamliner deliveries after a two-year hiatus to address manufacturing problems, The Wall Street Journal reported.

- Deal said he expects the regulatory process to win approval for resolving various production defects with the wide-body jets was close to finished, with Deal using a press conference to say: “I don’t think there will be extra innings added,” the Journal reported.

- Farnborough is one of the world’s biggest air shows to take place in-person following cancellations because of the pandemic in 2020. It kicked off outside of London Monday, and is typically a time when airlines and aircraft lessors place orders for new jets.

- Vertical Research Partners analyst Rob Stallard wrote in a recent research report: “With a three-year air show hiatus, and many airlines revving up their fleet planning post Covid, we’re expecting a pretty robust year.”

What’s Next: Regardless of how orders turn out at Farnborough, Boeing sees big demand for aircraft in coming years. In conjunction with the air show, Boeing released its commercial market outlook on Friday. The company projects about 39,000 commercial aircraft and freighters needed over the coming 20 years. Simply put, that works out to about 1,950 jets a year for Boeing and Airbus to battle over.

—Al Root

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 22-Jul-22 14:34 ET | Archive

Stock market goes back to the future

1.21 gigawatts. That is what it took to get Marty McFly back to the future.

Do you know what it took to get the stock market back to the future? The start of earnings season, some news on hiring activity, a fund manager survey, and a string of disappointing economic data.

Growth Concerns

To understand the stock market’s performance this past week, one has to take their DeLorean, phone booth, or hot tub time machine back to the past. One does not have to go that far either. In fact, all one needs to do is go back to the first half of 2022.

That was a dark time for the stock market. Inflation was surging, interest rates were rising, oil and gas prices were soaring, Russia was invading Ukraine, Covid-19 was still raging, and stock and bond prices were reeling.

The first half of 2022 was the worst first half of a year for the S&P 500 since 1970!

There were a lot of factors contributing to that dour start. Collectively, they could be boiled down to one thing: growth concerns.

The market was looking ahead to a period of lower economic growth and lower earnings growth, while providing some added allowance for a potential recession and actual decline in earnings growth. Accordingly, there was some significant multiple compression as investors doubted the achievability of prevailing earnings growth estimates.

At the same time, they were coming to grips with the reality that the animal spirits running wild in the stock market — and the cryptocurrency market for that matter — in 2021 needed to be tamed.

And what better taming mechanism was there than the knowingness that the Federal Reserve was shifting from friend to foe with its monetary policy.

Acting Better

Thus far, the second half of the year has gotten off to a much better start. As of this writing, the Nasdaq Composite is up 7.6%, the Russell 2000 is up 6.6%, the S&P Midcap 400 is up 6.4%, the S&P 500 is up 4.9%, and the Dow Jones Industrial Average is up 3.9%.

The irony is that the stock market has gotten better as the economic and earnings news has gotten worse. Some will interpret that as a sign that the stock market has hit a bottom. Others will simply call it a bear market rally. That is, things fell so much that they were due for a bounce, yet the continued deterioration in economic and earnings growth should lead to a resumption in selling interest.

What we know for certain is that more companies are prepping for a period of slower growth, if not an actual recession.

That was evident with about every bank reporting earnings raising its provision for loan losses. It has been evident in leading companies, like Microsoft (MSFT), announcing that they plan to slow their hiring activity. Bloomberg reported that Apple (AAPL) plans to slow hiring and spending for some divisions next year as it prepares for a potential downturn. Notably, Apple did not refute that report.

More companies are highlighting macro uncertainty; retailers are starting to discount more; homebuilders are seeing a moderation in demand; and consumer spending activity is weakening.

A recent BofA Global Fund Manager Survey revealed that half of investors would like to see companies refrain from returning cash to shareholders and boosting capital spending plans in favor of strengthening their balance sheets.

The biggest nugget in the fund manager survey, though, was the disclosure that equity allocations had reached their lowest level since the Lehman Bros. crisis and that cash levels had hit their highest level since 2001. Talk about your contrarian catalysts.

Market participants jumped on that news as a rally catalyst, seemingly ignoring the non-contrarian news of disappointing economic data.

This past week alone:

- The July NAHB Housing Market Index fell to 55 from 67, registering its biggest monthly drop on record outside of the drop seen in April 2020.

- June housing starts were weaker than expected and building permits (a leading indicator) for single-unit dwellings fell in every region.

- Existing home sales were weaker than expected in June and declined for the fifth straight month.

- Initial jobless claims topped 250,000 for the first time since mid-November 2021.

- The July Philadelphia Fed Index fell to -12.3 from -3.3, paced by a sharp decline in the new orders index.

- The June Leading Economic Index decreased 0.8%, which was the fourth consecutive decline, prompting the Conference Board to suggest that a U.S. recession around the end of this year and early next year is now likely.

- The preliminary July IHS Markit Manufacturing PMI slipped to 52.3 from 52.7 while the IHS Markit Services PMI slumped to 47.0 from 52.7 (a number below 50.0 is indicative of a contraction in business activity).

What It All Means

A few months ago, the reaction would have been entirely different. It would have been more negative. As it so happens, the stock market traded higher this past week.

It was not undone by the earnings disappointments and weakening economic data. We would submit that it held up as well as it did because it knew this bad news was coming. That is what the selloff in the first half of the year signaled.

There wasn’t any profound disappointment registered with the arrival of bad news, with the clear exception of Snap (SNAP). Instead, there was an added appreciation for “better-than-feared” news like the earnings reports from Netflix (NFLX) and Tesla (TSLA). As of this writing, they were up 17% and 14%, respectively, for the week. It would be remiss not to add that they are still down 63% and 22%, respectively, for the year.

In turn, the bad economic news became good news in the stock market’s mind from the standpoint that it might compel the Federal Reserve to take less aggressive rate-hike steps in coming months.

Economic growth is clearly slowing. The inverted yield curve reflects that understanding and is a market-based signpost of recession concerns. The 2-yr note yield sits at 2.97%, down 16 basis points for the week, and the 10-yr note yield sits at 2.76%, down 17 basis points for the week.

There will be weaker earnings growth that coincides with the weaker economic growth. An earnings recession cannot be ruled out either.

In a period of weak growth, it is the growth stocks that should be exhibiting relative strength. That much has held true so far in the second half of the year. The Russell 3000 Growth Index is up 6.7% versus the Russell 3000 Value Index, which is up 3.3%.

The recent outperformance stems in part from the vast underperformance of the growth stocks in the first half of the year, which had mostly to do with correcting their vast overvaluation. It also stems in part from falling long-term rates.

With valuations less demanding now, an environment of slower growth should work in favor of quality growth stocks more so than the profitless growth stocks. The latter should remain subject to the whims of day-trading and swing-trading sentiment, whereas higher quality growth stocks should be drawing more attention from fund managers underexposed to equities and searching for better return prospects in a low-growth/no-growth environment.

This week was an informative week as it brought to light what was expected in the past. Well, the past is now present, and the present is beginning to offer a glimpse of the future.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse Market Recap WEEK OF JUL. 18 THROUGH JUL. 22, 2022 The S&P 500 index rose 2.5% last week, led by strong gains in the consumer discretionary, materials and industrial sectors as many companies reported Q2 results above analysts’ expectations despite inflation and supply chain concerns. The market benchmark ended the week at 3,961.63, up from last Friday’s closing level of 3,863.16. The index is now up 4.7% for the month to date but down 17% for the year to date. The weekly climb came as a number of companies reported Q2 earnings above consensus estimates, sending their shares higher despite impacts from macroeconomic factors such as inflation, supply chain issues and the ongoing COVID-19 pandemic. By sector, consumer discretionary had the largest percentage increase last week, up 6.8%, followed by gains of 4.1% each in materials and industrials. Technology was also strong, up 3.6%, followed by energy, up 3.5%. Three sectors fell on the week: Communication services declined 1.2%, utilities shed 0.5% and health care edged down 0.3%. The consumer discretionary sector’s gainers included shares of Tesla (TSLA), which jumped 13% on the week as the electric vehicle manufacturer reported Q2 adjusted earnings per share above expectations. Its chief financial officer said a 50% growth in deliveries in 2022 “remains possible with strong execution” even though the task “has become more difficult” due to a loss of output this year amid COVID-19 shutdowns in China. In the materials sector, shares of Nucor (NUE) climbed 8.6% as the steel company reported Q2 earnings per share and revenue up from the year-earlier period and above analysts’ mean estimates. Nucor said it expects Q3 profitability to be down from Q2 yet the company still anticipates “another strong quarter of profitability” for Q3 and believes 2022 “will be the most profitable year in Nucor’s history.” In industrials, CSX (CSX) shares gained 7% as the rail transportation company reported Q2 earnings and revenue above year-earlier results and analysts’ mean estimates. Following the results, Loop Capital upgraded its investment rating on CSX to buy from hold, while analysts at firms including Barclays, Raymond James, Stephens and Credit Suisse all raised their price targets on the stock. In communication services, shares of AT&T (T) fell 11% even as the telecommunications company reported Q2 adjusted earnings per share and revenue above analysts’ mean estimates and raised its full-year mobility revenue outlook. Chief Executive John Stankey said the company cut its full-year free cash flow guidance to the $14 billion range from $16 billion “to reflect heavy investment in growth and working capital impacts related to timing of collections.” Next week’s list of earnings reporters features heavyweights Microsoft (MSFT), Google parent Alphabet (GOOGL), Visa (V), McDonalds (MCD), United Parcel Service (UPS), Facebook parent Meta Platforms (META), Boeing (BA), Apple (AAPL), Amazon.com (AMZN), Pfizer (PFE) and Exxon Mobil (XOM). Economic reports will be heavy on housing data earlier in the week, but a Federal Open Market Committee meeting concluding Wednesday will be center stage, followed by June inflation and consumer spending data later in the week. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bullsih

SPX – Bullish

COMP – Bullish

Where Will the SPX end July 2022?

07-25-2022 -2.0%

07-18-2022 -2.0%

07-11-2022 -2.0%

07-05-2022 -2.0%

Earnings:

Mon: FFIV, WHR, NEM

Tues: MMM, GLW, GE, GM, KMB, MCD, PHM, UPS, GOOG, CB, JNPR, MSFT, ZION, KO, V,

Wed: BSX, BMY, GRMN, HLT, KHC, SPOT, TMUS, WM, LC, QCOM, BA, F, META

Thur: MO, BUD, ARCH, CMCSA, HOG, HSY, HTZ, HON, IP, MA, MRK, PFE, LUV, IP, MA, MRK, PFE, LUV, VLO, BZH, FSLR, INTC, ROKU, SKYW, X, VFC, AUY, AAPL

Fri: XOM, PSX

Econ Reports:

Mon:

Tues: Consumer Confidence, New Home Sales

Wed: MBA, Durable Orders, Durable ex-trans., Pending Home Sales, FOMC Rate Decision

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator,

Fri: Personal Income, Personal Spending, PCE Prices, Employment Cost Index, Chicago PMI, Michigan Sentiment

How am I looking to trade?

Currently protection on all core holding and making decisions on earnings,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Walmart cuts profit outlook as inflation forces shoppers to spend more on necessities

KEY POINTS

- Walmart shares fell after the company cut its profit expectations as inflation forces shoppers to spend more on food and less on electronics and other discretionary categories.

- CEO Doug McMillon said aggressive markdowns on items such as clothing are also hurting margins.

- Walmart shares fell, as did the stocks of other retailers, including Target, and e-commerce giant Amazon.

Walmart on Monday cut its quarterly and full-year profit guidance, saying inflation is causing shoppers to spend more on necessities such as food and less on items like clothing and electronics.

That shift in spending has left more items on store shelves and warehouses — forcing the big-box retailer to aggressively mark down items that customers don’t want.

The company’s stock fell in after-hours trading following the announcement. Shares of other retailers, including Target and e-commerce giant Amazon, also fell.

Walmart said it now anticipates adjusted earnings per share for the second quarter and full year to to decline around 8% to 9% and 11% to 13%, respectively. It had previously expected them to be flat to up slightly for the second quarter and to drop by about 1% for the full year.

Inflation has grown at the fastest pace in four decades. As consumers face higher prices at the gas pump, grocery store and restaurants, some consumers are choosing where to spend money and where to pull back. In some cases, they are prioritizing experiences they missed during the pandemic — such as splurging on a vacation or dinner at a restaurant.

Walmart, which is the biggest grocer in the U.S. and often considered a bellwether for the overall economy, said more customers are turning to its stores, which are known for low prices, to fill their pantries and fridges. But they are skipping over general merchandise that they can live without.

Walmart said it now expects same-store sales in the U.S. to rise by about 6% in the second quarter, excluding fuel, as customers buy more food at its stores. That’s higher than the 4% to 5% increase that the company previously expected.

However, that merchandise mix will weigh on the company. Groceries have lower profit margins than discretionary items, such as TVs and clothing.

“The increasing levels of food and fuel inflation are affecting how customers spend, and while we’ve made good progress clearing hardline categories, apparel in Walmart U.S. is requiring more markdown dollars,” CEO Doug McMillon said in a news release.

He said the company is seeing strong back-to-school sales in the U.S., but anticipates people will pull back on buying general merchandise in the second half of the year. That could be warning sign for retailers ahead of the holiday shopping season.

The sharp change in consumer spending could jeopardize other aspects of Walmart’s strategy, too. The company wants grow its subscription service, Walmart+, but that could be a tougher sell if Americans scour their bills for fees to cut. It has launched a growing number of general merchandise brands, particularly in apparel and home, which could now wind up on the clearance rack.

Yet McMillon has said Walmart can gain market share and more of customers’ wallets during the inflationary period by emphasizing good value. Over the past several quarters, he has stressed that the discounter will keep prices low.

Target also slashed its forecast for the second quarter. Last month, the retailer said its profit margins would take a hit as it canceled orders and marked down merchandise. The company largely attributed the revised forecast to having too much merchandise, including a lot of bulky items such as small home appliances that saw a drop in demand.

Shares of Walmart fell over 9% after hours. Target was down by more than 6%. Amazon fell more than 3%. Macy’s, Kohl’s and Nordstrom each slipped more than 3% after hours, as investors looked to get out of stocks that sell primarily apparel and home goods. Gap dropped around 2%.

Walmart will report its fiscal second quarter results Aug. 16.

Read the full Walmart release here.

— CNBC’s Lauren Thomas contributed to this report.

Facebook’s stumbling ad business lies at the center of tech earnings week

Jonathan Vanian@JONATHANVANIAN

KEY POINTS

- Facebook parent Meta will report second-quarter earnings on Wednesday, sandwiched in between the other Big Tech companies on Tuesday and Thursday.

- Facebook’s online ad business has been hurt by Apple’s iOS update and a weakening economy.

- Snap reported disappointing earnings last week, raising concern about what’s in store for Meta.

It’s earnings palooza week for Big Tech, with the four most valuable U.S. companies plus Meta all reporting quarterly results.

Alphabet and Microsoft kick off the action on Tuesday, with Apple and Amazon wrapping things up on Thursday. Sandwiched in between them is Meta on Wednesday.

Investors in all five names are hurting this year as surging inflation, rising interest rates and fears of recession have hammered the tech sector. Within the mega-cap group, Meta has suffered the most, losing half its value as Facebook’s struggling ad business has yet to show signs of a rebound.

When Meta reports second-quarter numbers, Wall Street will be looking closely for indications that growth is poised to return. It also needs to see improved trends when it comes to users, who have fled the company’s apps in recent quarters in favor of rivals like TikTok.

“They’re starting to get tired of it,” said Debra Aho Williamson, an analyst at research firm Insider Intelligence. “Users are definitely gravitating towards other platforms or they’re engaging with Facebook less, and when you start to see that happening in bigger and bigger quantities, that’s when the advertisers really start to take notice.”

Facebook is expected to show its first year-over-year revenue drop ever for the second quarter, and analysts are projecting mild acceleration in the third quarter with mid-single-digit growth. The mood in the mobile ad industry is dour headed into the report.

Last week, Snap reported disappointing second-quarter results, missing on revenue and earnings and announcing plans to slow hiring. Snap blamed a difficult economy and Apple’s iOS privacy change as significant hurdles, alongside competition from TikTok and others.

Barton Crockett, an analyst at Rosenblatt Securities, told CNBC that in terms of revenue, Snap and Meta are “both at the same place.”

“They are not growing, but not really falling off a cliff right now,” said Crockett, who has a hold rating on both stocks.

From a user standpoint, Snap is holding up better. The company said last week that daily active users grew 18% year over year to 347 million. Facebook’s DAUs increased 4% in the first quarter to 1.96 billion, and analysts are expecting that number to hold, according to FactSet, which would represent about 3% growth from a year earlier.

“Snap is in a stronger position in terms of user growth,” Crockett said.

Like Snap, Facebook has been hit hard by Apple’s iOS update, which makes it difficult for advertisers to target users. Much of Facebook’s value to marketers is targeting capabilities and the ability to track users across multiple third-party sites.

With the stock’s 50% drop this year, Meta’s market cap has sunk below $500 billion, making the company worth less than Tesla, Berkshire Hathaway and UnitedHealth, in addition to its Big Tech peers.

Amazon has fallen 27% in 2022, while Alphabet has dropped 25%, Microsoft is down 23% and Apple has slid 13%.

The last time Meta reported results, revenue fell shy of estimates. CEO Mark Zuckerberg said some of the challenges were due to the iOS change as well as “broader macro trends, like the softness in e-commerce after the acceleration we saw during the pandemic.”

The rise of TikTok poses a growing threat to Facebook and Snap, because the popular short video app is reeling in the lucrative market of teenagers and young adults.

Meanwhile, Meta continues to spend billions of dollars creating the metaverse, a digital world that people can access with virtual reality and augmented reality glasses.

Meta is currently the leader in the nascent metaverse space, according to CCS Insight analyst Leo Gebbie. Based on a recent survey about VR and AR that Gebbie’s firm conducted, Meta is the company that most people associate with the idea of the metaverse, underscoring the significance of its investments and marketing efforts.

But the metaverse is still years away from going mainstream and potentially generating profits. Gebbie said he’ll be looking to see whether Zuckerberg spends much time on the earnings call discussing the futuristic metaverse or if he concentrates on addressing Meta’s real-world challenges.

“I think we’ll definitely see more of a focus on telling the story that Meta is a sensible company,” Gebbie said.

40% of workers are considering quitting their jobs soon—here’s where they’re going

More than 4 million people have left their jobs each month in the U.S. so far this year — and according to new research, this record-breaking trend isn’t going to quit anytime soon.

About 40% of workers are considering quitting their current jobs in the next 3-to-6 months, a report from McKinsey and Co. published last week, which surveyed more than 13,000 people across the globe, including 6,294 Americans, between February and April, has found.

“This isn’t just a passing trend, or a pandemic-related change to the labor market,” Bonnie Dowling, one of the authors of the report, says of the elevated quit rates. “There’s been a fundamental shift in workers’ mentality, and their willingness to prioritize other things in their life beyond whatever job they hold. … We’re never going back to how things were in 2019.”

Such conversations about “The Great Resignation” often focus on why people quit — low pay, few opportunities for career advancement, an inflexible work schedule — but what we hear less often is what happens after people leave their jobs.

McKinsey and Co. also spoke with more than 2,800 people in six countries — the U.S., Australia, Canada, Singapore, India and the United Kingdom — who left their full-time jobs within the last two years to find out where workers are going.

Nearly half of job-leavers are switching industries

About 48% of people who quit have pursued new opportunities in different industries, the report found.

Dowling points to two factors driving this exodus: pandemic-induced burnout and better odds of securing a higher-paid role in a tight labor market.

“A lot of people realized just how volatile, or unsafe, their industry was during the pandemic, especially those working on the frontlines,” Dowling says.

At the same time, companies are still struggling to attract and retain employees — a pattern that had undoubtedly caused a lot of headaches for HR departments throughout the U.S., but has also opened the door for job-seekers to take advantage of new opportunities that might have been out of reach before the pandemic.

“More employers have opened up their aperture in order to meet the yawning talent gap that they’re facing,” Dowling adds. “They’re prioritizing skills over educational background or previous job experience, which is creating more opportunities across sectors for job-seekers.”

Some industries are losing talent faster than others: More than 60% of workers who quit jobs in the consumer/retail and finance/insurance fields either switched industries or quit the workforce entirely, compared to 54% of workers in health care and education who made such a switch.

Others are quitting to start their own business, or pursue non-traditional employment

Of the people who quit without a new job in hand, close to half (47%) chose to return to the workforce — but only 29% went back to a traditional, full-time job, the report notes. These percentages come from a March McKinsey & Co. survey of 600 U.S. workers who voluntarily left a job without another one lined up.

The remaining 18% of people either found a new role with reduced hours through temporary, gig or part-time work or decided to start their own business.

“People aren’t tolerating toxic bosses and toxic cultures anymore, because they can leave and find other ways to make money without being in a negative situation,” Dowling says. “There are more opportunities for work now than ever before with our increased connectivity.”

More people are choosing to be their own boss: Over the course of the pandemic, new business applications grew by more than 30%, with almost 5.4 million new applications in 2021 alone, the White House said in an April press release.

It’s not just about escaping a toxic work environment, either. Such non-traditional pursuits also fulfill people’s growing desire for flexibility. The freedom to work from anywhere, or choose your own hours, has become the most sought-after benefit during the pandemic — so much so that people value flexibility as much as a 10% pay raise, according to research from the WFH Research Project.

Rapid quitting could continue through 2022 unless companies make ‘meaningful’ changes

Even with a possible recession on the horizon, Dowling expects that people will continue to quit and change jobs at elevated rates in the months ahead.

Much of the trend has been powered by a “drastic” change in social norms around quitting. “For a long time, you didn’t leave a job unless you had another one lined up — that’s what everyone was taught and what people did,” she says. “But that has changed so dramatically over the last 18 months. … Now, people’s attitude is, ‘I’m confident that when I want to work, there will be something for me.’”

Instead of lamenting the ongoing labor shortage, companies need to look at the shifting economic landscape in the U.S. as an opportunity to reshape how we work and build a better model, Dowling says.

“It’s everything from embedding flexibility in our credo to re-assessing how we value our employees and provide them with the resources they need to do their job … all employers have the capacity to make these meaningful changes,” she adds. “But we have to start taking action, as opposed to sitting back and hoping that things are going to return to a ‘pre-pandemic norm’ — because all signs point to the fact that they won’t.”

Correction: McKinsey surveyed 13,382 global workers for its report on quitting and hiring trends. The firm corrected its information after an earlier version of this article had been published.

SPACs wipe out half of their value as investors lose appetite for risky growth stocks

SPACs, once Wall Street’s hottest tickets, have become one of the most hated trades this year.

The proprietary CNBC SPAC Post Deal Index, which is comprised of SPACs that have completed their mergers and taken their target companies public, has fallen nearly 50% this year. The losses more than doubled the S&P 500′s 2022 decline as the equity benchmark fell into a bear market.

Appetite for these speculative, early-stage growth names with little earnings has diminished in the face of rising rates as well as elevated market volatility. Meanwhile, a regulatory crackdown is drying up the pipeline as bankers started to scale back deal-making activities in the space.

“We believe SPACs will need to continue to evolve in order to overcome challenges,” said James Sweetman, Wells Fargo’s senior global alternative investment strategist. “General market volatility in 2022 and an uncertain market environment resulting in losses in the public markets have also dampened enthusiasm for SPACs.”

The biggest laggards this year in the space include British online used car startup Cazoo, mining company Core Scientific and autonomous driving firm Aurora Innovation, which have all plunged more than 80% in 2022.

SPACs stand for special purpose acquisition companies, which raise capital in an IPO and use the cash to merge with a private company and take it public, usually within two years.

Some high-profile transactions have also been nixed given the unfavorable market conditions, including SeatGeek’s $1.3 billion deal with Billy Beane’s RedBall Acquisition Corp.

— CNBC’s Gina Francolla contributed reporting.

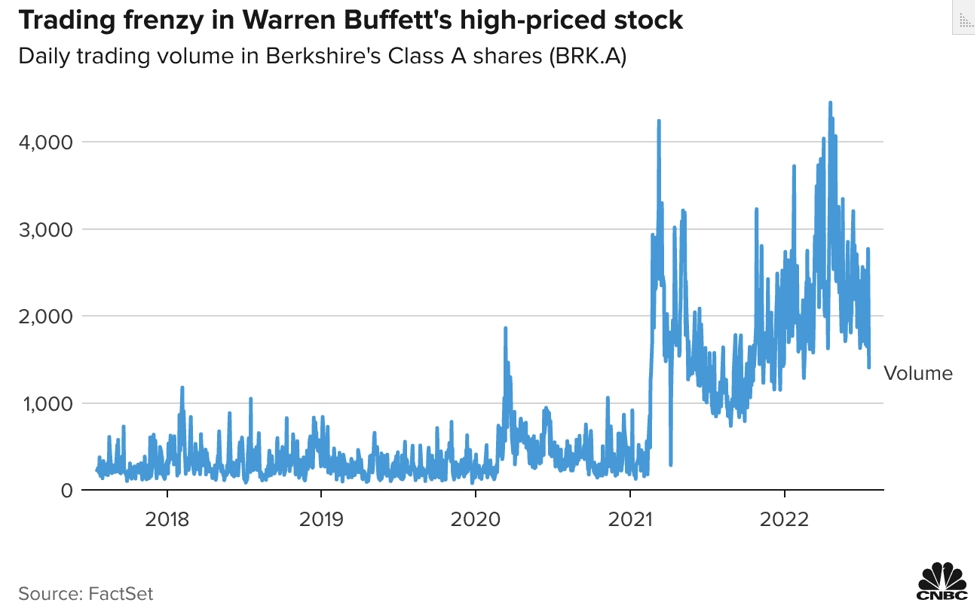

The reason behind a mysterious trading surge in stocks like Berkshire Hathaway has been revealed

Berkshire Hathaway’s Class A shares are among the market’s most expensive stocks priced above $400,000 apiece and therefore it was often one of the least traded well-known companies. So a surge in volume that began over a year ago left many scratching their heads.

Now new research released Wednesday has shed light on this trading frenzy and concluded that a change in how Robinhood and other online brokers report fractional trading data was a culprit.

“This volume is due to the interaction of a well-intentioned but misguided FINRA reporting rule, Robinhood trading, and fractional shares,” wrote the authors — Robert Bartlett at University of California, Berkeley, Justin McCrary at Columbia University and Maureen O’Hara at Cornell University.

In 2017, the Financial Industry Regulatory Authority started requiring brokers to report fractional trades — sometimes just 1/100th of a share — as if they were for one whole share, which the authors coined as the “Rounding Up” rule.

The effect of this rule change went pretty much unnoticed until the spring of 2021 when Covid pandemic-driven trading mania by retail investors boosted the use of fractional trading.

With more tiny trades being reported as full shares, trading volumes for many stocks became massively inflated. In Berkshire’s case, the authors said this reported “phantom” volume now represents 80% of the Class A shares’ daily trading volume.

Shares of Warren Buffett’s Omaha, Nebraska-based conglomerate hit a record high above half a million dollars in March and have since retreated more than 20% to about $430,000 apiece amid a sell-off in the broader market.

Trading volumes for this pricey name surged more than tenfold in March 2021 from its average daily volume of just 375 shares over the past decade, according to the study. Volumes have stayed at these elevated levels.

“FINRA is already actively working on the issue, and is engaged in ongoing discussions with firms and regulators,” a FINRA spokesperson told CNBC on Wednesday. “The current trade reporting systems (other than the Consolidated Audit Trail) do not support the entry of a fractional share quantity. FINRA’s guidance on trade reporting needs to be understood in that context.”

The Wall Street Journal first reported on the new study earlier Wednesday.

Mortgage demand drops to a 22-year low as higher interest rates and inflation crush homebuyers

Diana Olick@IN/DIANAOLICK@DIANAOLICKCNBC@DIANAOLICK

KEY POINTS

- Surging inflation and interest rates are hammering American consumers and weighing on the housing market.

- Mortgage demand fell last week, hitting the lowest point since 2000, according to the Mortgage Bankers Association.

- Buyers have lost considerable purchasing power as rates have almost doubled since earlier this year.

The pain in the mortgage market is only getting worse as higher interest rates and inflation hammer American consumers.

Mortgage demand fell more than 6% last week compared with the previous week, hitting the lowest level since 2000, according to the Mortgage Bankers Association’s seasonally adjusted index.

Applications for a mortgage to purchase a home dropped 7% for the week and were 19% lower than the same week in 2021. Buyers have been contending with high prices all year, but with rates almost double what they were in January, they’ve lost considerable purchasing power.

“Purchase activity declined for both conventional and government loans as the weakening economic outlook, high inflation and persistent affordability challenges are impacting buyer demand,” said Joel Kan, an economist for the MBA.

While buyers are less affected by weekly moves in interest rates, the broader picture of rising rates has already taken its toll. Mortgage rates moved higher again last week after falling slightly over the past three weeks.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.82% from 5.74%, with points increasing to 0.65 from 0.59 (including the origination fee) for loans with a 20% down payment. That rate was 3.11% the same week one year ago.

Demand for refinances, which are highly rate sensitive, fell 4% for the week and were 80% lower than the same week last year. Those applications are also at a 22-year low, but the drop in demand from homebuyers caused the refinance share of mortgage activity to increase to 31.4% of total applications from 30.8% the previous week.

Mortgage interest rates haven’t moved much this week, but that could change very soon due to increasing bond market volatility. The Federal Reserve is expected to hike rates by another 75 basis points next week, and other central banks are taking similar action against inflation. A basis point equals 0.01%.

“This is especially true next week as markets digest the newest Fed policy announcement next Wednesday, but Thursday’s policy announcement from the European Central Bank could also cause enough of a stir to impact U.S. rates,” noted Matthew Graham, chief operating officer of Mortgage News Daily.

A Goldman Legend, Crypto Star and Top Banker Warn of Next Big Risk

Abby Joseph Cohen, Sam Bankman-Fried and Ken Moelis share their views on the end of globalization, the pandemic and the fading American dream. By

July 17, 2022 at 4:00 PM MDT

In a year in which Russia’s invasion of Ukraine is sending shock waves through global politics and markets, inflation is soaring worldwide and supply chains are unraveling, the largest investors are assessing the long-term consequences of the events they didn’t see coming.

We asked three market visionaries about the next big risk in the coming five to 10 years: Abby Joseph Cohen, the former Goldman Sachs Group Inc. strategist known for bold market calls who now teaches at Columbia University; FTX Chief Executive Officer Sam Bankman-Fried, who’s boosting his charitable and political giving while his cryptocurrency exchange is becoming a lender of last resort in his industry; and Ken Moelis, the billionaire whose investment bank advises some of the world’s largest companies.

Their comments have been edited for length and clarity. https://imasdk.googleapis.com/js/core/bridge3.522.0_en.html#goog_736572239 Fading American Dream

ABBY JOSEPH COHEN

Columbia Business School professor and former Goldman Sachs Group Inc. senior investment strategist

The secret sauce for US growth has been that we’ve had strong population growth and strong gains in the labor force. I’m concerned about that right now.

One of the reasons the US economy has outperformed the economies of other developed nations for the last 30 or 40 years has been that we’ve had faster labor force growth. It’s a very simple arithmetic equation: More workers, more GDP. And in the US we have been very dependent on immigration. That’s not new. This has been a nation of immigrants since its founding. If we’re not viewed as welcoming to talent from around the world, we’ll have a problem going forward in terms of long-term growth.When we look at the information from individual companies and industries, we see that there is a labor shortage at all ends. We all know, for example, that right now one of the reasons behind the rise in service inflation has to do with an inadequate number of workers at airports, in hotels, in restaurants and so on.

I spent a lot of time looking at the other end. Do we have enough new scientists? Do we have enough new engineers? Do we have enough new doctors? And the answer is: No, we don’t.

Keep in mind you have to also create a pipeline, right? The students who are now K-12 are the future pipeline of scientists and engineers and doctors. And we’re not doing a very good job with them right now in terms of their skills.

The promise of the American dream has to be defined. And that is: Is every generation doing better than the previous generation? Does every new family in the US have the opportunity to do better than their parents did? And what we have seen over the last 30 or 40 years is that median household income in the US adjusted for inflation has not risen.

That is a problem. It creates a sense of political discord. It creates a sense of unease among people in the US. And it is worrisome because we have to think about how we get out of this.

One way is to focus on the industries that we think can create good paying jobs, and to protect our workers in that way. The standard role of 19th century, early 20th century protectionism — accomplished through tariffs and so on — it’s a Band-Aid. It doesn’t really fix the long-term problem of staying ahead of the curve, making sure that the industries that you’re supporting are creating jobs. And those jobs are paying well enough that individuals and households feel they are moving forward and not falling behind.

Investment comes from the government, but also from private enterprise. And we have seen that private companies in many industries are very actively investing in the future. They’re investing in cap-ex. They’re investing in research and development. And they’re now investing — because of tight labor markets — in worker training to try to reduce attrition and increase the skill set of their workers. All of that is terrific.

Many economists, myself included, believe the so-called golden era of the 1950s, 1960s US economy was linked to our willingness to invest heavily in the future. As a percentage of GDP, we were dramatically above every other nation, we were No. 1 in that category for a century. We no longer are. There are almost a dozen other countries that are outspending us relative to their own GDP. That to me is worrisome.

Another thing that concerns me is there’s some discussion now that any kind of interference by the government is bad news. That’s clearly not the case. We have a history in the US in which the government provide some guidance so there’s not unfettered competition and an absence of protection for consumers. For example, in the two or three years following the introduction of OSHA (Occupational Safety and Health Administration), productivity went up in the US. Profit margins went up. What happened is workers felt more comfortable that the equipment they’re using is safe. That the company is looking out for them. So I think we have to recognize that good regulation is very good news for long-term economic wealth.

The strength of economic growth and long-term prosperity — not talking about stock market prosperity, I’m talking about the prosperity of the people in the nation — is very much tied to the health of the middle class, and to whether the wage increases for those families are adequate. What has happened is that this rise in inflation has pulled apart the curtains. Now we see much more clearly where these problems are and where the issues are.

I, for one, am happy to see that wages are now rising. I’m happy to see that workers have more flexibility in how they want to conduct themselves. That’s a good start. It’s not the end solution. We need to recognize that a 40-year problem is not going to be corrected in four months. It’s going to take longer.

HI Financial Services Mid-Week 06-24-2014