HI Market View Commentary 07-19-2021

HOW many of you panicked today?

Today I had three phone calls: One for moving money over, two for the need to withdraw 600K from Coda and 800K from HI

Both let us know the money would come back and it would increase over the next two months

OK I feel the need to go over THREE INVESTING FACTS with you today.

What is the probability/odds of making money in the stock market ?

Simple odds stocks go up, down and sideways

You make money when the fund, stock, ETF, position goes up = 33% or 1/3

You lose some money when it goes sideways or down = 67% or 2/3

TAKE profits !!!! Book the gains, pay your taxes (long term) and find new opportunities

Change the odds into your favor = 2/3 or giving you a 67% chance of making money over time

Averages are not your friend !!! I Can’t believe I feel the need to go over this again

IF you gain 50% then lose 50% of a portfolio for a 0% “Annualized” return how much is each $1 worth that was invested

Randy & Didi says $1

AND I just pulled the wool over your eyes and lied like a stock broker does

$1 = $1.50 = $0.75

Annualized returns = a linear gain on your investments = compounding interest on your investments

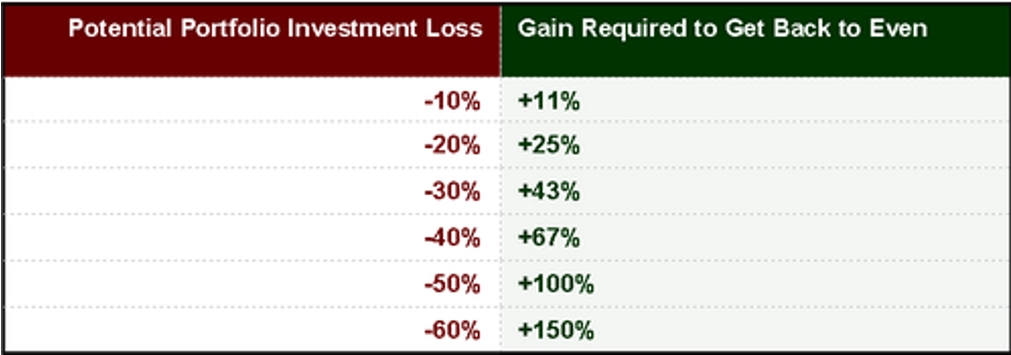

Do stocks go down faster than they go up?

Of course they do

SO how much do I have to make up to get back to break even

Adding shares or making up something on the way down is the key to beating the market long term and doubling portfolios.

IF you add another 10-20% more shares of stock as they fall you now have 10-20% more shares of stock as they come back

The Hurley Investment “methodology” is to collar trade, add shares for a higher percentage return as stocks bounce up when things come back.

Protection beats market risk and timing risk

WE DO NOT get it right every time nor do we have too to beat the market and double portfolios in 4.5 to 5.5 years

| https://go.ycharts.com/weekly-pulse Market Recap WEEK OF JUL. 12 THROUGH JUL. 16, 2021 The S&P 500 index fell 1% last week despite an upbeat start to the Q2 earnings reporting season, as worries about inflation and potential changes in monetary policy weighed on the sentiment of consumers and investors. In its first weekly decline since the week ended June 18, the S&P 500 ended the week at 4,327.16, down from last Friday’s closing level of 4,369.55, which was a fresh closing high at the time. The index set an even higher closing record Monday at 4,384.63 but hasn’t closed above that since then. Last week, which marked the unofficial kickoff to US companies’ Q2 reporting season, featured better-than-expected reports from companies including Goldman Sachs (GS) and JPMorgan Chase (JPM). However, worries continue about inflation and how the Federal Reserve’s policy-setting committee may respond. Data released Friday showed the inflation concerns contributed to a decline in consumer sentiment in early July. Concerns about COVID-19 cases again being on the rise also kept a lid on the stock market’s upward attempts last week. The energy sector had the largest percentage drop of the week, tumbling 7.7%, followed by a 2.6% decline in consumer discretionary. Only three of the S&P 500’s 11 sectors rose last week: The utilities sector climbed 2.6%, followed by a 1.2% rise in consumer staples and a 0.7% increase in real estate. The energy sector’s drop came as crude oil and natural gas futures also fell. Weighing on the commodities, the Energy Information Administration reported gasoline stocks rose in what is usually the peak driving weekend of the year and on reports that Saudi Arabia and the United Arab Emirates reached an agreement on a dispute that led to the collapse of OPEC+ talks earlier last month and could increase supply to sate rising demand. The energy sector’s decliners included Occidental Petroleum (OXY), down 14% on the week, and APA (APA), down 13%. In consumer discretionary, shares of cruise operators fell amid the higher COVID-19 cases, which could delay the companies’ plans to resume normal cruising. Shares of Norwegian Cruise Line (NCLH) shed 16% while Carnival (CCL) shares were down 14% and Royal Caribbean Group (RCL) slipped 12%. The utilities sector’s gainers included American Water Works (AWK), whose shares rose 3.7% on the week as Barclays raised its price target on the stock to $174 per share from $170. Barclays kept its investment rating on the shares at equal-weight. In consumer staples, PepsiCo (PEP) shares climbed 4.2% as the beverage company reported better-than-expected Q2 results. In a note to clients, Morgan Stanley said the results confirmed that organic sales growth has “sustainably accelerated” and that there’s a short-term earnings per share upside compared with the company’s “conservative” 2021 guidance. Next week’s companies reporting quarterly results will include International Business Machines (IBM) on Monday, Netflix (NFLX) on Tuesday, Johnson & Johnson (JNJ) and Coca-Cola (KO) on Wednesday, American Airlines (AAL) and AT&T (T) on Thursday, and American Express (AXP) and Kimberly-Clark (KMB) on Friday. On the economic data calendar, housing data will be the focus earlier in the week, with the National Association of Home Builders home builders’ index for July due Monday and June building permits and housing starts due Tuesday. June existing home sales are also set to be released Thursday, as well as weekly jobless claims, followed by Markit’s manufacturing and services purchasing managers’ indexes for July on Friday. |

Earnings Dates

AAPL – 07/27 AMC

BA – 07/28 BMO

BABA – 08/19 est

BIDU – 08/12 est

COST – 09/23 AMC

DIS – 08/12 AMC

F – 07/28 AMC

FB – 07/28 AMC

FSLR – 07/29 AMC

GE – 07/27 BMO

GM – 08/04 AMC

JPM – 07/13 BMO

MU – 06/30 AMC

TGT – 08/19 BMO

UAA – 08/03 BMO

V- 07/27 AMC

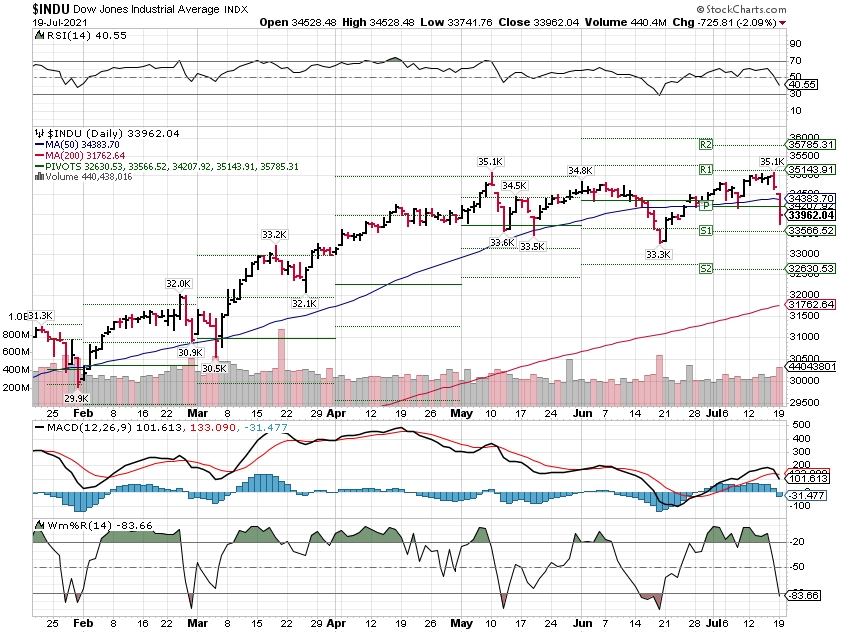

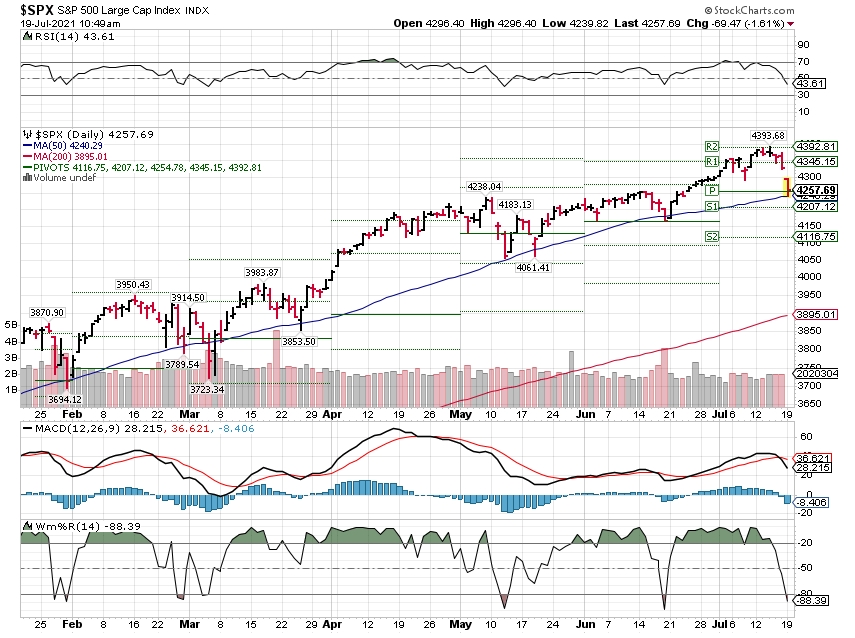

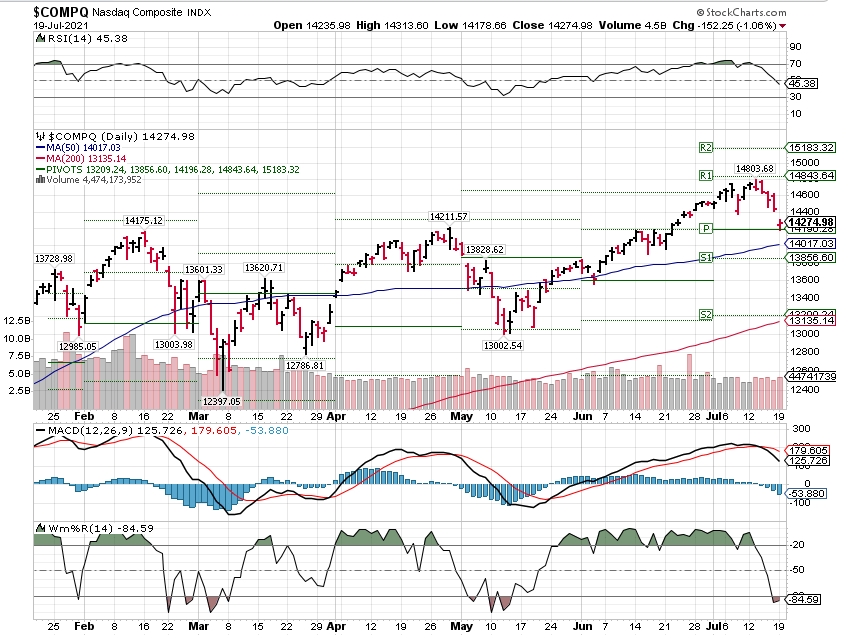

Where will our markets end this week?

Lower

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end July 2021?

07-19-2021 3.0%

07-13-2021 3.0%

07-06-2021 3.0%

06-28-2021 3.0%

Earnings:

Mon: IBM, ZION

Tues: HAL, KEY, PM, IBKR, ISRG, NFLX, UAL,

Wed: HOG, JNJ, CSX, DFS, KMI, LVS, TXN, VMI, KO, VZ

Thur: ABT, ALK, AAL, T, BX, CROX, DHI, NEM, NUE, LUV, UNP, SAM, INTC, SNAP, TWTR

Fri: AXP, HON, KMB, SLB

Econ Reports:

Mon: NAHB Housing Market Index,

Tues: Building Permit, Housing Starts,

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Existing Home Sales, Leading Indicators

Fri:

Int’l:

Mon –

Tues –

Wed –

Thursday – ECB Interest Rate Decision

Friday-

Sunday –

How am I looking to trade?

Added protection for earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

The co-creator of dogecoin explains why he doesn’t plan to return to crypto: It’s ‘controlled by a powerful cartel of wealthy figures’

Published Wed, Jul 14 20214:52 PM EDTUpdated Wed, Jul 14 20217:18 PM EDT

A view of dogecoin commemorative coins, Yichang, central China’s Hubei province, May 9, 2021.

Costfoto/Barcroft Media via Getty Images

Jackson Palmer, the co-creator of the meme-inspired cryptocurrency dogecoin, made a rare return to Twitter on Wednesday with some harsh words about crypto in general.

“I am often asked if I will ‘return to cryptocurrency’ or begin regularly sharing my thoughts on the topic again. My answer is a wholehearted ‘no,’” Palmer tweeted on Wednesday.

In 2013, Palmer and Billy Markus created dogecoin as a joke based on the “Doge” meme, which portrays a shiba inu dog. Markus and Palmer didn’t intend for dogecoin to be taken seriously.

But the coin has recently taken off, and dogecoin is currently one of the top 10 cryptocurrencies by market value. Earlier this year, it hit an all-time high of nearly 74 cents. Despite its recent surge in popularity, Markus and Palmer haven’t profited, as they both sold out before dogecoin’s meteoric rise.

In his Twitter thread, Palmer criticized those in power in the cryptocurrency space, saying that it is “controlled by a powerful cartel of wealthy figures” who “have evolved to incorporate many of the same institutions tied to the existing centralized financial system they supposedly set out to replace.”

Palmer also criticized how crypto is shared and marketed. In another tweet, he alleged that “the cryptocurrency industry leverages a network of shady business connections, bought influencers and pay-for-play media outlets to perpetuate a cult-like ‘get rich quick’ funnel designed to extract new money from the financially desperate and naive.”

Palmer admits this type of “financial exploitation” existed before cryptocurrency, but says he still believes that the crypto industry hurts the “average” people who join it. He also believes it is susceptible to fraud, similar to other cryptocurrency critics.

Supporters of cryptocurrency see things differently. For example, bitcoin, the largest cryptocurrency by market value, was made to be a decentralized, peer-to-peer financial system. It is seen by its holders as a hedge against inflation, among other things.

In response to Palmer’s thread, Markus, dogecoin’s other co-creator, tweeted that Palmer’s “points are generally valid.”

“There’s a lot of terrible people who are involved in the crypto space, and I completely understand why he would feel negative about it,” Markus wrote. “I understand his perspective and we both saw mostly the negative side of all this,” he said in another tweet.

Markus has been much more active on social media, despite not currently being involved with dogecoin’s development.

“The crypto community can be pretty elitist and not very inclusive, and we wanted to make a community that was more fun, lighthearted and inclusive,” Markus previously told CNBC Make It about creating dogecoin. “It worked, and is why the dogecoin community consistently maintains a presence.”

Wall Street analysts see these risks causing a ‘growth scare’ for global markets

PUBLISHED THU, JUL 15 20212:02 AM EDT

KEY POINTS

- In a research note Monday, the British lender suggested hedging remains warranted for investors given the swirling crowd of downside risks, but argued that the recent sharp reversal of the reflation trade was “overdone.”

- In a note Tuesday, Citi analysts said a “last hurrah” value rally was likely as economies continue to reopen, particularly with Europe lagging the U.S.

LONDON — With Covid-19 cases on the rise due to the surging delta variant and a range of macroeconomic shifts occurring, the global market narrative has moved from “goldilocks to growth scare,” according to Barclays.

In a research note Monday, the British lender suggested hedging remains warranted for investors given the swirling crowd of downside risks, but argued that the recent sharp reversal of the reflation trade was “overdone.”

“The combination of data no longer delivering positive surprises, burgeoning evidence that supply and labour shortages could mean stickier inflation, China’s increasingly determined crackdown on various industries, and increasing risk from the COVID delta variant have coincided with enough force to give markets a growth scare,” said Emmanuel Cau, head of European equity strategy at Barclays.

Cau highlighted that the prospect of lower growth and higher inflation is driving large and somewhat erratic moves in asset prices, with the recent dramatic fall in yields being the most obvious indicator.

“Equities so far have held up relatively well, but this belies large risk off rotation underneath the surface, which has largely washed out the positive returns from reflation trades,” he said.

What’s more, poor summer liquidity and mixed messages from central banks is adding to market confusion and likely exacerbating the sharp moves, Cau added.

A ‘choppy summer’

In recent weeks, the U.S. Federal Reserve has discussed plans to taper its quantitative easing program and projected two interest rate hikes in 2023, while the European Central Bank has opted for a far more dovish tone, and China’s central bank has indicated a readiness to re-stimulate the world’s second-largest economy.

Barclays believes it is “far too early” to call the end of the cycle or to call the combination of lower growth ahead with stickier inflation “stagflation,” which it said would require much lower growth and much higher inflation.

“However with vaccines, reopening and U.S. fiscal stimulus behind us, and only Q2 earnings season ahead as an obvious catalyst to reconnect markets with healthy fundamentals, we could be in for a choppy summer,” Cau said.

While Covid vaccines are successfully reducing the rates of death and hospitalization, the increasing dominance of the delta variant and the risk of others, and the potential impact on countries with lower vaccine rates, continue to cloud the outlook, Barclays said.

Having been bullish on European equity markets throughout the year, Barclays analysts recently reviewed their stance to suggest the risk-reward for owning “equities has become more balanced, which warrants a more balanced sector/style allocation and hedging with cheap volatility.”

‘Last hurrah’ for value, but careful ahead

In a June survey of its institutional clients, Citi found that investors had a clear preference for value stocks — those deemed cheap relative to the company’s financial fundamentals and performance — in particular European equities, commodities and hydrocarbons.

In a note Tuesday, Citi analysts said a “last hurrah” value rally was likely as economies continue to reopen, particularly with Europe lagging the U.S.

However, Citi chief U.S. equity strategist Tobias Levkovich suggested that with U.S. share prices on average up 40% between June 2020 and June 2021, a risk-reward review was needed.

“We perceive downside (risk) of 10% as opposed to 1-2% gain potential. However, many portfolio managers we talk with are increasingly bullish, intimating that the qualitative backdrop syncs well with our quantitative metrics,” Levkovich said.

He added that investors seemed “overly comfortable with valuation being solely a function of low interest rates, even as equity risk premiums are firmly above typical levels prior to the global financial crisis.”

Equity risk premiums measure the excess return an investor can expect from investing in the stock market over a risk-free rate of return.

“While the ERP has fallen from highs last year, the numbers are still elevated, as accommodative central bank policies have an ultimate cost and investors are aware of it,” Levkovich said.

“Moreover, interest rate suppression implies that Fed or ECB forecasts for durable GDP expansion are not particularly compelling.”

Inflation just jumped the most in years, yet markets are largely ignoring it. Here’s why

PUBLISHED TUE, JUL 13 20219:54 AM EDTUPDATED TUE, JUL 13 20211:59 PM EDT

KEY POINTS

- A hot June 2021 consumer price index may not be cause for alarm thanks to a dizzying, but isolated, rise in used car prices.

- “The headline CPI numbers have shock value, for sure; however, once you realize that a third of the increase is used car prices, the transitory picture becomes more clear,” wrote Jamie Cox, managing partner at Harris Financial Group.

- The Labor Department reported on Tuesday that its CPI rose 5.4% from a year ago, the largest jump since August 2008.

Consumer prices just posted their largest one-month jump in nearly 13 years, a fact that might tempt some to conclude that a white-hot U.S. economy is on the brink of runaway inflation.

But a spike in the June 2021 consumer price index reading may, in fact, be little cause for alarm.

That’s because a significant reason for the overall prices increase is thanks to a dizzying rise in one isolated area of the economy: used car prices.

“The headline CPI numbers have shock value, for sure; however, once you realize that a third of the increase is used car prices, the transitory picture becomes more clear,” wrote Jamie Cox, managing partner at Harris Financial Group. “Inflation is rising, but things are well behaved and have not changed materially.”

Cox’s comments came just minutes after the Labor Department published its June 2021 CPI report, which showed that prices paid by consumers increased 5.4% from a year ago, the largest jump since August 2008. Core CPI, which strips out volatile food and energy components, rose 4.5%, the sharpest move for that measure since September 1991.

Markets, which have in recent months grown wary of rising prices and whether they will cause the Federal Reserve to act, appeared to keep their cool over inflation on Tuesday.

The S&P 500 was essentially unchanged shortly after the open and the 10-year Treasury yield actually fell, not the reaction one would expect from such a hot inflation report.

The uptick in inflation in recent months is thanks to a mismatch between a vast amount of pent-up demand and limited supply of goods and services that Covid-19 made unavailable for almost all of 2020. Thousands of Americans hoping to finally travel in 2021 have helped drive up the price of oil and gasoline, as well as airfares.

That desire for travel and road trips has also fueled a historic appetite for used automobiles.

This was the largest monthly increase ever reported for the used cars and trucks index, which was first published in January 1953.

Ian Lyngen, head of U.S. rates strategy at BMO Capital Markets, echoed Cox’s assessment of the June inflation numbers. He noted that used car and truck prices climbed more than 10% month over month and about 45% over the last 12 months.

Those sorts of figures, while impressive, are more of a distorting outlier than reflective of a broader uptick in prices across all sectors, Lyngen noted.

June’s reading makes “the last three months 10.0%, 7.3% and now 10.5%,” he wrote. “Overall, a continuation of the pandemic-specific pockets of inflation — although questions regarding the ‘transitory’ characterization are sure to emerge in the wake of yet another stronger-than-expected inflation print.”

Surging prices for used cars, gasoline, food and airfares are driving the jump in inflation

PUBLISHED TUE, JUL 13 20212:30 PM EDTUPDATED TUE, JUL 13 20219:03 PM EDT

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- A jump in used car sales as well as car rentals led the increase in overall prices.

- For the 12-month period, used car and truck prices leaped 45.2%, while car and truck rental costs skyrocketed 87.7%, the Labor Department reported.

- Public transportation, which includes airline fares, recorded a 17.3% jump year over year, while lodging away from home including hotels and motels saw a 16.9% year-over-year burst.

Price increases in used cars, car rentals — as well as a rebound in airfares, lodging and food — are behind the biggest inflation surge since 2008 as the U.S. economy reopens.

The consumer price index jumped 5.4% from a year earlier, the largest increase since before the worst of the financial crisis, the Labor Department reported Tuesday. Excluding the volatile food and energy categories, inflation increased 4.5%, the largest move since September 1991. On a monthly basis, headline and core prices rose 0.9% against 0.5% Dow Jones estimates.

Looking at item-level data provided by the Bureau of Labor Statistics, prices of used cars and car rentals led the increase in overall prices. The pandemic kept many Americans home last summer, but car rental and sale prices have skyrocketed as many consumers are venturing out of their homes for the first time in months. A global shortage in auto parts and components also exacerbated the price pressures.

For the 12-month period, used car and truck prices leaped 45.2%, while car and truck rental costs skyrocketed 87.7%, the Labor Department reported.

“Consumers have cash in their pockets and rental car companies are looking to rebuild fleets at a time when auto output is being constrained by component shortages,” ING Economics chief international economist James Knightley said in a note.

Bank of America economists believe this may be the peak of used car-price strength as the increase in sticker prices for consumers has now exceeded the jump in wholesale used car prices, which started to moderate in June.

Additionally, multiple types of fuel including gasoline, fuel oil and other motor fuels were among the categories that saw the biggest price increases. Gasoline futures have climbed more than 60% this year as Americans have gone on a post-pandemic driving spree.

Pricing rebound in airfares, food and lodging

Meanwhile, categories tied to the broad economic comeback from the pandemic also contributed to the surge in inflation.

Public transportation, which includes airline fares, recorded a 17.3% jump year over year, while lodging away from home including hotels and motels saw a 16.9% year-over-year burst.

During Memorial Day weekend, air traveler volumes hit the highest levels since before the coronavirus pandemic began. And air travel demand is expected to rebound amid the peak vacation season in the summer.

Excluding price increases in used cars, new cars, lodging and transportation services, the core CPI would have risen only by 0.18% month over month, which in normal times would be a relatively healthy increase in prices, according to Bank of America.

Certain grocery and food item also experienced a price increase as of late. Notably, fresh fruits, limited service meals and snacks and food from vending machines all recorded at least a 5% increase year over year.

PepsiCo and Conagra Brands said Tuesday they plan to pass along higher input costs to customers as inflation accelerates. The two cited rising costs for some ingredients, freight and labor.

Cracks in the Great Wall-Part One: The CCP at 100 Years

The Chinese Communist Party recently celebrated its 100th birthday, which came accompanied by grand celebrations and a stirring speech by Chinese President Xi Jinping. In the speech Xi recounted the history of the party and the achievements of the People’s Republic of China. He also reiterated some of China’s top priorities such as continuing to modernize its military, maintaining economic growth, preserving its political model, and resisting foreign attempts to curtail its objectives.

While China has certainly made great strides both economically and politically, a look past the soaring rhetoric reveals more problems than strengths.

Many China experts in the United States certainly took alarm at Xi’s speech such as Gordan Chang, who was quoted in Fox News when they wrote,

“Xi Jinping talked about how the ‘Communist Party of China and the Chinese people, with their bravery and tenacity, solemnly proclaim to the world that the Chinese people are not only good at taking down the old world, but also good at building a new one,’” Chang said. “That is ominous because this harks back to what Xi Jinping has been talking about for more than a decade … that the world really should be ruled by the Chinese. My sense is that really was the most critical line in the speech and it didn’t get attention.”

The narrative of an ascendant and threatening China is certainly an important one with plenty of evidence to back it up. It has even partially contributed to counterproductive political ideas such as former President Trump’s trade war or President Biden’s insistence that the US must do more to emulate China’s state spending model.

There is no denying that China has certainly risen in power and poses a considerable threat to the interests of the United States as well as the future of human liberty. However, recent trends suggest that China has some serious roadblocks to overcome as the consequences of the CCP’s own behavior comes back to haunt them.

The Tighter You Clench, The More Sand Slips From Your Hand

Perhaps one of the greatest indicators of coming struggle is China’s increasing grip over its citizens both economically and politically, which is a reversal of previous trends of liberalization. Xi Jinping has recently called for greater private sector loyalty to the party line and has also called for more alignment of its political system with the party as well.

Furthermore, China’s security state has been drastically expanding after seeing decades of rollback, which UCSD Professor Tai Ming Cheung explains is due to a number of setbacks regarding internal disruptions and instability. The New York Times has reported that the CCP has recently begun a crackdown on “illegal non-profits” to which they write,

“The campaign against such dissent reflects concerns among China’s top leaders that the party must do more to strengthen public loyalty and fortify its control of society.

Mr. Xi has long warned that Communist rule could disintegrate if the party does not assert control across society, including the private sector, schools and the news media. Party organs at the national and local levels are hosting study sessions on party history for cadres. Chinese military officials say they are using the centenary to “forge absolute loyalty” to the party and Mr. Xi.”

When regimes tighten control over their populations, that typically means things are not going well, especially when it comes to China, which has heavily restricted its population from questioning the status quo. A reinvigorated crackdown on independent thought can only be in reaction to the subversive effects of outside influences and demands for further liberalization. That is because although China has gotten richer and more powerful through engagement with other countries, such engagement also brings in outside ideas, such as democracy, human rights, and economic freedom.

An emblematic example of this would be the brief disappearance of Chinese billionaire Jack Ma, who merely criticized the performance of China’s financial system. Such criticism was certainly warranted as he was heavily invested in an innovative fintech company known as Ant Group which promised to revolutionize finance. However, such sentiments are dangerous to the long-term credibility of the CCP, which led them to punish Ma and Ant Group.

Such behavior on China’s part is both understandable and counterproductive. On one hand, allowing such dissent and criticism on anything, even productive conversations such as improving the Chinese banking system can lead to greater dissent in the future. At the same time, they are killing the goose that laid the golden egg as liberalization and dynamic thought are what lead to progress in the first place.

It also goes without saying that much of China’s grand ambitions are starting to unravel before them as the consequences of their authoritarian behavior come back to haunt them. China’s once highly celebrated effort to rewire global trade with the Belt and Road Initiative is starting to sputter as countries refuse to accept the sovereignty infringements that come with it. China’s increasing aggression in the Indo-Pacific region has sparked new security partnerships or reinvigorated existing ones such as The Quad to contain China. The Quad is an informal alliance between the US, Australia, Japan, and India. However, it is worth noting that more countries like South Korea, Vietnam and the Philippines are all noting their displeasure with China’s behavior.

Europe has also toughened its stance on China, which has led to a number of notable exchanges such as a back and forth on slavery allegations in Xinjiang as well as a Czech delegation visiting Taiwan, a huge insulting gesture for the Chinese. Finally, among many other problems, China’s long-term economic growth is in jeopardy due to a variety of issues such as an aging population and an inflexible economy. It is also worth noting that China’s GDP numbers are highly inflated and manipulated, so their real success is likely well below the reported numbers.

A Rock and a Hard Place

Limited free market reforms in China brought about much success, lifting millions from poverty and turning it into the global player it is today. In its special economic zones such as Hong Kong (although not for long) and Macau, which enjoy economic freedom greater than most Western countries, the standards of living are greater by orders of magnitude. At the same time, such openness and dynamism also invite free thought, which is why the same policies were not implemented for the rest of the country. Free thought often leads one to look to the outside world and exposure to more attractive ideas, such as a free and open society. This is a serious problem for the long-term rule of the CCP.

In particular, Beijing’s implementation of the recent Hong Kong security law will dissolve many of the freedoms that made the city-state so prosperous in the first place. The move is emblematic of China’s ultimate conundrum: freedom allows it to grow and prosper, but it also spreads dissent.

On the one hand, they must pursue greater economic growth, which is sorely needed as many of its citizens still live well below the standards of the Western world (or even to its free neighbor Taiwan) and also to achieve its goals of global influence. On the other hand is the real danger of increased liberalization for the CCP, especially with the world now highly critical and vocal about China’s human rights abuses.

Furthermore, embracing greater liberalization would shatter the image of infallibility that the CCP has built for itself. Much like Jack Ma took issue with China’s fundamentally flawed state banking system, allowing greater economic competition and exchange of ideas would cause more questions to be asked.

Although Xi Jinping and the Chinese Communist Party certainly put on a great show for their 100th birthday, much like any authoritarian regime, it was a lot of smoke and mirrors. There is no denying that China has achieved many milestones in terms of its economic and political goals. At the same time, its authoritarian policies have consequences and it seems like the chickens are starting to come home to roost.

Those of us in the West should certainly take note, not just because these are important developments regarding our top geopolitical rival, but also so we do not make the mistake of emulating the Chinese. Rather, this should be another reason to double down on our confidence in the superiority of a free and open society, an objective that we can safely pursue to our own benefit, whereas the Chinese cannot.