Hurley Investments, LLC

1955 West grove Parkway, Suite 250, Pleasant Grove, Utah 84062

(888) 287-1030 FAX (801) 820-3180

A Registered Investment Adviser

HI Market View Commentary 06-22-2020

Beware of the BullS#%! That’s out there !!!!!

# step process to see if someone is full of it

- Open your account and lets see the trading history and results

- Fact check them – Broker check, Call the SEC for verified results, as for audited results, check online history about the individual/company, BBB check,

- Listen to them = Is it too far fetched to believe, is it logical, does it make sense for you

| Market Recap |

| WEEK OF JUN. 15 THROUGH JUN. 19, 2020 |

| The S&P 500 closed higher last week as Wall Street weighed a flurry of upbeat economic data against renewed COVID-19 concerns.

The benchmark index was up 1.9% for the week ending June 19 to 3,097.74 from last week’s close of 3,041.31. After last week’s rout, Wall Street dusted itself off and started the week on a positive note thanks to the Federal Reserve’s announcement it will buy corporate bonds on the open market. Early gains were fueled by an explosion in retail sales which surpassed even the most optimistic expectations. Researchers in the UK found what was termed a cheap and effective treatment for COVID, and President Donald Trump pledged as much as $1 trillion for infrastructure spending. Mounting COVID cases in Florida, Texas, and Beijing, however, torpedoed investor confidence mid-week and kept the S&P 500 from breaching the 78.6% retracement of the February-through-March downtrade. Though most of the S&P’s gains eroded once Apple (AAPL) said it would again close stores impacted by the COVID resurgence, the index still pulled off a higher close for the week thanks to sizable gains in technology, up 2.9% on the week, and healthcare stocks, up 3.2% over the last five days. Within these sectors, Lam Research (LRCX) was up 10.8% thanks to an upgrade by Morgan Stanley to overweight along with a 32% hike in its price target. The healthcare sector continued to capitalize on the race for a COVID vaccine. Eli Lilly (LLY) launched a late-stage study of its COVID candidate, bolstering the stock 11.4% this week. And the reopening of the dentist offices helped prop up orthodontics appliance-maker Align Technologies (ALGN) by 3.8%. Consumer stocks closed higher thanks to the surprising surge in May retail sales and the potential for a V-shaped recovery. Within the consumer discretionary sector, big-ticket items were the leaders, while food stocks came out ahead among consumer staple stocks. For the week, consumer discretionary gained 1.6% while consumer staples added 2.6%. Despite upbeat housing market data this week (housing market index, starts, and permits) the real estate sector drifted lower by 0.5% from last Friday, while energy shares ignored a 0.8% move higher in WTI, losing a collective 0.6% from the prior week’s close. This week’s data was mostly supportive of the outlook for a significant recovery in the second half of this year, even as the labor market continues to face oppressive unemployment. Retail sales in May were more than twice what the street expected. And both the Empire State and Philadelphia Fed indices surprised to the upside with the Philly Fed index hurled to a positive 27.5 in June from a negative 43.1 in May. Looking ahead to next week, Wall Street will get another look at how COVID-19 impacted the economy with Q1 GDP Thursday. More housing data is scheduled with existing home sales, new home sales, and home prices, along with the preliminary June manufacturing and services purchasing manager’s indices. |

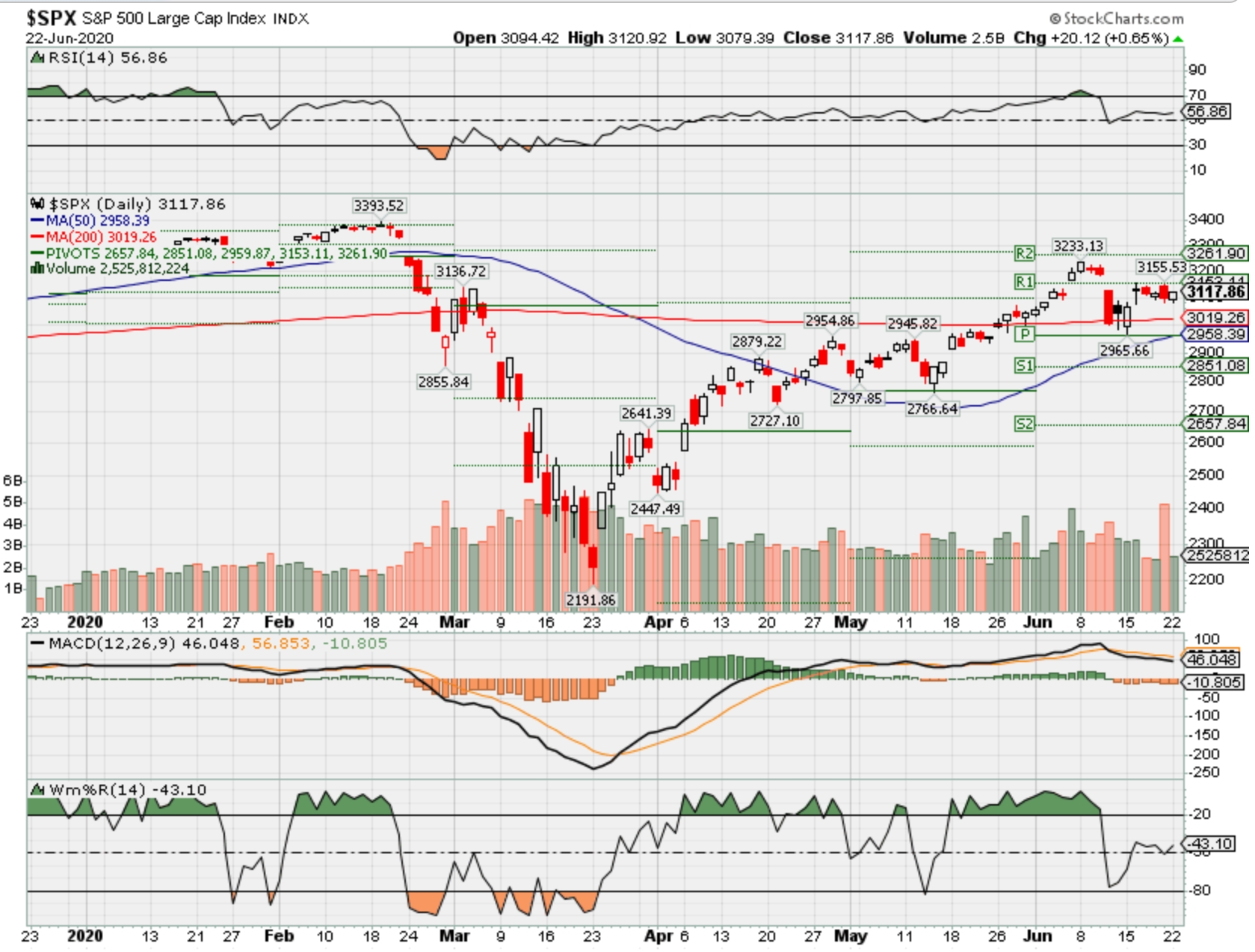

Where will our markets end this week?

Mixed

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end June 2020?

06-22-2020 +0,0%

06-15-2020 +0.0%

06-08-2020 +2.5%

06-01-2020 +2.5%

05-26-2020 +0.0%

Earnings:

Mon:

Tues:

Wed: WGO, BB, FUL, KBH

Thur: DRI, MKC, RAD, NKE

Fri:

Econ Reports:

Mon: Existing Home Sales

Tues: New Home Sales,

Wed: MBA, FHFA Housing Price Index

Thur: Initial Claims, Continuing claims, Durable Goods, Durable ex-trans, GDP, GDP Deflator

Fri: PCE Prices, PCE Core, Michigan Sentiment, Personal Income, Personal Spending

Int’l:

Mon –

Tues –

Wed –

Thursday – ECB: Monetary Policy Meeting

Friday-

Sunday –

How am I looking to trade?

Letting some things run, Taking Profits on leaps and adjusting farther out in time

We are trying to enjoy the run up until July Earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://seekingalpha.com/article/4354425-baidu-cheap-all-around

Baidu: Cheap All Around

Jun. 18, 2020 2:10 AM ET

Summary

Baidu is set to benefit from a buyout of its iQiyi position or reduced cost pressures in the sector.

The company already has an $11 billion net cash position, so the ultimate goal is an improved investment in the video streaming market.

Both the stocks of Baidu and iQiyi are cheap, with Baidu having a core EV of down to only $15 billion on a premium cash deal for iQiyi.

This idea was discussed in more depth with members of my private investing community, DIY Value Investing. Get started today »

Baidu (BIDU) spiked to recent highs on headline-grabbing news that Tencent (OTCPK:TCEHY) was interested in supplying the Chinese Internet search giant with some cash to part with an asset. Like a lot of Chinese stocks, Baidu has been under extreme pressure this year due to the coronavirus outbreak and fears of U.S. legislation restricting Chinese companies from listing on U.S. stock exchanges without reform. My investment thesis remains locked in on owning Baidu, as the company has several ways to reward shareholders.

Making A Deal

Baidu is heavily invested a large variety of businesses, usually to the detriment of the stock. The large Chinese company spends heavily on developing businesses that hurt profits, while the core Internet search business has struggled the last few years.

Baidu has traded down the last two years, while most industry stocks such as Alibaba (BABA), Tencent and Pinduoduo (PDD) are trading near the multi-year highs. Baidu got some interest on Tuesday after Tencent was reported as interested in acquiring the 56.2% position Baidu holds in iQiyi (IQ).

Considering Baidu is only worth $42.1 billion, the surge in iQiyi to a market value of $18.1 billion places its position value at $10.2 billion. The news reports provided absolutely no details on what price Tencent was willing to pay in order to acquire part or all of iQiyi.

The acquisition has an apparent goal of reducing competition in the sector for Tencent Video and the associated costs for acquiring subscribers and paying for content. Along with Alibaba’s Youku, the three companies control the long-form video segment, with somewhere around 100 million paying members for each service.

When a video streaming company like Netflix (NFLX) in the U.S. has a market valuation approaching $200 billion, any move to sell iQiyi appears short-sighted. My view agrees with that of Tim Culpan, a Bloomberg Opinion columnist covering technology. Any consolidation in the industry would just lead to additional entrants to compete in the less crowded space. Baidu needs to exit the sector, or the company needs to be careful to not sell a small stake and be left holding a less valuable asset in a suddenly more crowded space in the future.

In addition, Baidu has long had a large net cash balance, so selling iQiyi for cash isn’t necessarily appealing to shareholders. The company has over $20 billion in total cash and ~$11 billion in net cash. A deal with Tencent for $12-15 billion based on an additional premium for iQiyi would push the net cash position towards $23-26 billion prior to any tax implications for a sales transaction.

Data by YCharts

iQiyi ended the last quarter with 118.9 million paying subscribers, up 23% YoY. The market appears large enough for a few top competitors, so Baidu shouldn’t feel any pressure to exit the sector.

The company had Q1 revenues of $1.08 billion. The quarterly revenues were only up 9% YoY, but the key membership revenues surged 35%.

iQiyi Upside

Even with the Tencent-related boost in iQiyi from $19 to nearly $25, the stock still trades at half the forward P/S ratio of Netflix. Netflix has seen an advantage during the virus outbreak from not relying on online advertising revenues, but the market shouldn’t overly focus on short-term hiccups in what are otherwise sustainable business models.

The market has rewarded Netflix with double the P/S ratio of iQiyi. This is another reason that Tencent is likely looking at buying up its shares.

Data by YCharts

The desire for Tencent Video to focus on restraining costs could help Baidu either way. Its core business has 30% net profit margins, while the whole business is down at only 14%, due in a large part to the excessive costs and losses at iQiyi. Less-aggressive competition in the sector would help improve the overall margins at Baidu.

Ultimately, Baidu shouldn’t look at dumping iQiyi for such a low valuation when the company doesn’t lack for cash. It can clearly look to invest more in AI, Cloud and AV technology, but the company doesn’t need over $20 billion in cash to make these investments.

Remember, the stock is constantly compared to Alphabet (GOOGL) with its Internet search leadership position in the U.S. Google regularly invests in video via YouTube, Cloud and AV technology as well.

Takeaway

The key investor takeaway is that an easy argument can be made that both Baidu and iQiyi are cheap. Baidu doesn’t need a deal, but a premium deal for iQiyi would highlight how cheap the Chinese search leader’s stock is trading for an EV in only the $15 billion range. Either way, Tencent digging around should spark further interest in the Chinese stock nearly left behind in the recent market rally.

Disclosure: I am/we are long BIDU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

5 realities of this recession

Darrell Spence

Economist

April 30, 2020

Recessions can be hard to predict, but that’s not the case this time. The COVID-19 pandemic sweeping the globe has pushed the U.S. economy into recession, with U.S. GDP falling 4.8% in the first quarter. While the drop was sizable, an even more pronounced decline is in store for the second quarter, as broad swaths of the country remain shuttered. With the U.S. feeling the sting of a sharp reduction in consumer spending and industrial production, there are five realities to keep in mind.

1) We’ve been here before (sort of)

The largest post-1950 quarterly GDP decline was 10% in the first quarter of 1958.

This sharp drop in growth came amid the 1957–1958 recession, which resulted from a confluence of factors, including a flu pandemic. While the makeup of the present-day economy is much different, the U.S. is not unfamiliar with pandemic-related economic turmoil. The U.S. economy bounced back strongly in the late 1950s, with growth surpassing 5%.

As parts of the U.S. look to ease restrictions, I believe that a bounce back in activity could begin as early as June in some sectors and more broadly in the third quarter.

2) Recessions have tended to be short; the subsequent expansions have been powerful

The good news is that recessions generally haven’t lasted very long. While this time may be different, our analysis of 10 cycles since 1950 shows that recessions have ranged from eight to 18 months, with the average lasting about 11 months. For those directly affected by job loss or business closures, that can feel like an eternity. While there’s no way to minimize that feeling, investors with a long-term investment horizon should try to look at the big picture. The average expansion increased economic output by 25%, whereas the average recession reduced GDP by less than 2%.

3) It’s about the consumer

The U.S. consumer accounts for approximately two-thirds of the economy. With unemployment claims skyrocketing — although many may be temporary — and consumers staying in their homes, a weakening economy is no surprise. The $2 trillion stimulus package will help support some levels of consumer activity, but employment uncertainty is likely to keep many consumers in a frugal mindset.

4) Lower oil prices may be a tailwind for the economy

A precipitous decline in crude oil prices has put pressure on the energy sector. May oil contracts turned negative in April as producers scrambled to find storage for bloated supply stores, exacerbated by consumers’ sharp reduction in vehicle usage and gasoline consumption. While the negative impact of lower oil prices is likely to be felt in U.S. oil fields, lower energy prices can provide a tailwind for consumers and transportation-heavy industries.

5) Timing may not be everything

Waiting for the all-clear may leave investors missing out on market gains. Since World War II, in recessions with a corresponding equity correction, the S&P 500 has bottomed, on average, three months before the end of each recessionary period. It’s little solace to investors who have endured market volatility, but even as the economy weakens, there are opportunities to invest in great companies at a discount.

While the adage that the stock market is not the economy is true, market volatility tends to be captured, with a lag, in economic data. So even as financial markets are on a path to recovery, it may take time for the economy to catch up. Focusing on long-term investing can help investors navigate short-term volatility.

Darrell Spence is an economist and research director with 27 years of investment experience, all with Capital. He earned a bachelor’s degree in economics from Occidental College and is a CFA charterholder.

https://www.bloomberg.com/graphics/2020-swift-covid-19-lockdowns-more-effective/

Why Acting Fast Is the Key to Beating a Second Wave of Covid-19

By Chloe Whiteaker, Adrian Leung and Jeremy Scott Diamond

June 16, 2020

Many nations are emerging from lockdowns even as experts are predicting a second wave of Covid-19 infections. Based on the first wave, they can avoid the worst if they move deftly.

Governments that hesitated to mount a broad containment response when the virus first emerged ended up with eight times as many deaths per 100,000 citizens, on average, compared to those that sprung into action soon after—or even before—confirming their first case. That’s according to a Bloomberg News analysis of the Stringency Index—which measures the strictness of “lockdown style” policies tracked by Oxford University’s Blavatnik School of Government—and data on Covid-19 infections compiled by Johns Hopkins University.

“If you’re slow, you have a much larger base number of infections and that’s much more difficult to control,” according to Mark Dybul, a professor of global health at Georgetown University Medical Center and former head of the Global Fund to Fight AIDS, Tuberculosis and Malaria. “Even when you put really severe restrictions in place, you’ve already got spread happening at a level that’s very difficult to contain.”

Every Day Counts

Countries that reacted slower had higher death tolls, on average, regardless of how tough their restrictions were

Avg. deaths per million people

3

Slow

& Weak

2

Slow &

Strong

Fast

& Weak

1

Fast &

Strong

0

0

25

50

75

100

125

150

Days since first case

Note: Data as of June 14. Deaths are shown as a seven-day rolling average.

Sources: Johns Hopkins University Center for Systems Science and Engineering, Oxford COVID-19 Government Response Tracker, Blavatnik School of Government, analysis by Bloomberg

Fast responses were those where the full suite of containment measures went into effect within 35 days of reporting a first case—the average length of time for all countries analyzed. Slow responses entailed waiting to react—including the U.K.’s initial “herd immunity” strategy—or increasing restrictions gradually as infections rose.

Strong responses included a broad array of measures related to everything from the size of gatherings to domestic travel, and restrictions were often mandated for the entire country. Weak responses utilized fewer measures, with only regional mandates or mere recommendations. That includes Japan, where the federal government recommended staying inside, working from home and canceling events, but didn’t place limits on gatherings nor on its infamously crowded metro lines, and let prefectures determine school closures.

Almost all countries placed some limits on schools and international arrivals, but those with the strongest responses went far beyond that. Argentina earned the highest score on Oxford’s Stringency Index after bringing all semblance of normal daily life to a halt. Every school and non-essential business in the country was closed; all intercity buses, trains and domestic flights were suspended; international borders were sealed even for citizens; and checkpoints were set up on roads to catch those breaking quarantine—an offense punishable by up to two years in prison.

Neighboring Brazil took the opposite approach: a delayed response led by states and opposed by President Jair Bolsonaro, who encouraged people to get back to work. Brazil’s death toll is more than 11 times higher than Argentina’s, per 100,000 people, and is still rising rapidly.

Most countries started ramping up safety measures around the time the World Health Organization declared Covid-19 a pandemic in mid-March. By that time, dozens of countries had more than 100 cases.

Reactions to the Outbreak

- Fast & Strong

- Fast & Weak

- Slow & Strong

- Slow & Weak

Type 2 or more characters for results.

1

100

1,000

10,000

100,000

1,000,000 cases

0 (weakest)

⭠ Stringency Index ⭢

(strongest) 100

Covid-19 cases

⭢

Italy quarantined several towns in the north where clusters had formed.

Taiwan relied on aggressive testing, tracing and quarantining measures, as well as travel restrictions and mask-wearing.

New Zealand’s extreme lockdown came four days after surpassing 100 cases.

Italy had more than 150,000 cases by the time its strictest measures went into place.

U.S. restrictions consistently lagged other countries. It’s the only one with more than a million cases.

U.S. 11.1

U.S. 72.7

Italy 69.9

Italy 91.7

Taiwan 25

New Zealand 54.6

New Zealand 96.3

Note: Stringency scores are shown for the day a country first exceeded a benchmark number of cases. Response color categories are shown for maximum stringency scores.

Taiwanese government health officials were among the first to learn of a new SARS-like illness spreading through parts of China by spotting warnings from medical professionals posted on Chinese social media. The government acted quickly to block flights from the original epicenter of Wuhan, setting up temperature checks at airports and employing an impressive system for widespread testing, comprehensive contact tracing and enforced quarantines.

Taiwan began building an emergency-response network for containing infectious diseases after its experience with Severe Acute Respiratory Syndrome in 2003, when hundreds became ill and at least 73 died. Maintaining that system and remaining vigilant over the years allowed the government to effectively contain the virus from the outset, requiring few disruptions to daily life. Five months in, Taiwan has reported fewer than 500 cases and seven deaths. Its government is already preparing for the next pandemic.

“We treated the virus as a serious epidemic from day one,” Philip Lo, deputy director-general of Taiwan’s Centers for Disease Control, told Bloomberg News in an interview in April. “We didn’t wait till it broke out to take action.”

Taiwan

Sierra Leone

Hong Kong

25

35

50

New cases

0

0

0

Stringency Index

100

94.44

100

100

30.56

66.67

Jan. 22

Mar. 31

Jan. 23

Time between first case and maximum stringency

New Zealand mounted one of the strictest lockdowns in the world over the span of 27 days—more than a week faster than countries took to impose more relaxed measures, on average. The government blocked travel from China before reporting a single infection and expanded to include Iran after confirming its first case was a person who recently returned from the country. By the time it found 28 infections, Prime Minister Jacinda Ardern sealed the border to anyone who wasn’t a citizen or permanent resident—including foreign students and temporary workers. Over the next week, she ordered the closure of all schools, non-essential workplaces and public transport; banned all gatherings and domestic travel; and ordered people to stay home.

Ardern ended the seven-week lockdown on May 14 and lifted all social distancing measures on June 8, after two weeks with no new cases. New Zealand’s borders remain closed to outsiders, but two citizens returning from the U.K. were confirmed to be infected on June 16.

New Zealand

Denmark

Turkey

80

350

New cases

5,000

0

0

0

Stringency Index

100

100

100

72.22

96.3

80.56

Feb. 28

Feb. 27

Mar. 11

Time between first case and maximum stringency

Just as countries followed each other into lockdowns, now they’re filing out of them—whether or not they actually contained their outbreaks. The ones that succeeded in stifling infections will have to figure out how to protect themselves from the ones that didn’t.

“We are going to have quite a patchwork globally of countries doing different things,” said Stephen Morrison, Director of the Global Health Policy Center at the Center for Strategic and International Studies in Washington. “And the recovery process is going to be quite varied and a lot of countries will go through a roller coaster where infections will go up and down.”

U.K.

Russia

Brazil

12,000

30,000

New cases

6,000

0

0

0

Stringency Index

100

100

100

87.04

75.93

81.02

Jan. 31

Jan. 31

Feb. 26

Time between first case and maximum stringency

Governments are starting to form agreements with each other to allow their citizens to travel back and forth, but the ones still reporting high numbers of infections are being left out. Norway has opened its borders to all its Nordic neighbors, except Sweden, where the government imposed some social distancing curbs but steered clear of a full lockdown. Hard-hit Italy opened its borders to all European Union members, but a handful of countries have yet to return the favor. And with the most infections and deaths in the world, the U.S. could face an uphill battle convincing other countries to let Americans visit.

“It’s possible that Europe will open up to everyone else, except the United States,” said Dybul.

Sweden

Italy

U.S.

1,125

6,000

New cases

35,000

0

0

0

Stringency Index

100

100

100

93.52

46.3

72.69

Jan. 31

Jan. 31

Jan. 22

Time between first case and maximum stringency

The U.S. response to the virus was both slower and weaker than most other countries. With the exception of a ban on travelers arriving from China, and eventually Europe, containment was handled almost entirely by state and local governments that didn’t agree on how serious a threat the virus posed, or whether a lockdown was worth the economic hit. Despite confirming its first case in January, most states didn’t begin to cancel large gatherings or close schools until mid-March. Even then many people continued to travel across state lines.

“In a country that has the mobility of the United States, you just can’t leave it up to the states,” Dybul said. “So we are not going to be ready for a second wave unless there’s a federal response. And we can’t reopen safely, or well.”

Some countries, including Germany and South Korea, did manage to stem their outbreaks with a more localized approach, thanks to readily available testing and contact tracing. South Korea won global praise for being among the first countries to offer drive-through testing to entire communities. The U.S., on the other hand, has struggled to accurately gauge the scale of its infections. Testing rates have varied widely by state, and where drive-through testing exists, hospital workers have faced shortages of personal protective equipment, including surgical masks, gloves and gowns.

South Korea

Germany

700

New cases

6,000

0

0

Stringency Index

100

100

82.41

73.15

Jan. 22

Jan. 27

Time between first case and maximum stringency

Countries that are reopening in spite of rising cases, including the U.S., are likely to face resurgences sooner than they otherwise would have, making it all the more urgent for them to prepare to act as soon as warning signs emerge. Unfortunately, that’s not always happening. New cases are ticking up in more than 20 states, according to a Johns Hopkins virus tracker measuring the three-day moving average in each state, though the trend is particularly pronounced in fewer than 10 states. In Turkey, President Recep Tayyip Erdogan scrapped a plan to reimpose a lockdown after cases jumped by 1,000 in a single day—instead urging people to be careful and maintain social distancing at all times.

“We’ll have more infections spreading throughout the next 3 or 4 months than we need to have,” said Dybul. “That doesn’t augur well for a large second wave. It means we’re not ready for one, and it means the second wave will be larger than it needs to be.”

Sources: Oxford COVID-19 Government Response Tracker, Blavatnik School of Government, Johns Hopkins University Center for Systems Science and Engineering, data compiled by Bloomberg

Note: Strong responses were those which had a maximum stringency score that was higher than or equal to the average of all countries’ maximum scores. Weak responses were any below that average. Fast responses were those in which the number of days that elapsed between reporting a first case and reaching maximum stringency was less than or equal to the average number of days for all countries. Slow responses were any with more days than that average. All data are as of June 14. Small-multiple country charts show cases as a seven-day rolling average.

With assistance from: K. Oanh Ha, Cindy Wang, Hayley Warren and Andre Tartar

Editor: Alex Tribou

Boeing Stock Plummets on Bad News About the 737 MAX Jet

By

Updated June 11, 2020 11:49 am ET / Original June 11, 2020 8:16 am ET

The on-again, off-again Boeing 737 MAX drama continues. A key supplier was asked to halt work related to the grounded plane, potentially putting the existing timeline for its reintroduction to service, as well as total deliveries expected in 2020 and 2021, at risk.

The revelation is hitting both stocks. Boeing (ticker: BA) shares are down almost 10% in Thursday trading. Stock in Spirit AeroSystems (SPR)—the key supplier—is down more than 13%.

Spirit said on Wednesday evening that it received a letter from Boeing on June 4 directing the company to “pause additional work on four 737 MAX shipsets and avoid starting production on 16 737 MAX shipsets to be delivered in 2020.”

Spirit makes a lot of the fuselage of a 737 MAX jet, and the plane is its largest aircraft program. A shipset refers to all the work done on one MAX jet by the supplier.

The MAX—Boeing’s newest single-aisle airplane—has been grounded world-wide since mid-March 2019 following two deadly crashes inside of five months. Boeing has been working with global aviation regulators on fixes and hopes to start delivering the plane again to customers by the end of the summer.

The Spirit news might put that timeline at risk. Boeing only recently started producing MAX jets again after a long pause, having halted output after its inventory of finished MAX jets rose to about 450.

“Based on the information in the letter, subsequent correspondence from Boeing dated June 9, 2020, and Spirit’s discussions with Boeing regarding 2020 737 MAX production, Spirit believes there will be a reduction to Spirit’s previously disclosed 2020 737 MAX production plan of 125 shipsets,” adds the news release.

Less production in 2020 could signal a few things to investors. For starters, it could mean the MAX timeline is slipping again, despite recent reports that the Federal Aviation Administration was about ready to fly the MAX jets. FAA certification flights are a key step in the MAX approval process, but other things have to happen as well. Investors don’t know the order in which the FAA and other global aviation authorities will proceed.

The production pause could also mean Boeing will deliver MAX jets at a slower rate than previously expected. That would be bad news for cash flow at Boeing, and its suppliers, over the next couple of years.

Boeing referred Barron’s to earlier comments. The jet maker has said it plans to ramp MAX production back up slowly.

Before the second MAX crash involving an Ethiopian Airlines flight, Boeing was making 52 MAX jets a month and had plans to increase production to 57 a month in 2019. Now the company hopes to ramp back up into the range of 30 jets a month over time. That reflects the damage Covid-19 has done to the global aerospace industry.

Boeing stock is down about 38% year to date, worse than comparable returns of the Dow Jones Industrial Average and S&P 500 over the same span. Spirit shares are down about 57%.

Spirit generates a majority of its sales from Boeing, making the company uniquely sensitive to Boeing news. Other aerospace supplier stocks Barron’s tracks are down about 30% year to date.

The entire aerospace value chain is down Thursday. Aerospace suppliers’ stocks are off about 8%. Airline shares are down more than 9% on average.

Downbeat news about the spread of the coronavirus news and a negative reaction to Fed Chairman Powell’s comments Wednesday sent the broader market lower.

Write to Al Root at allen.root@dowjones.com

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com