HI Market View Commentary 06-17-2019

We decided the market looks “toppy”

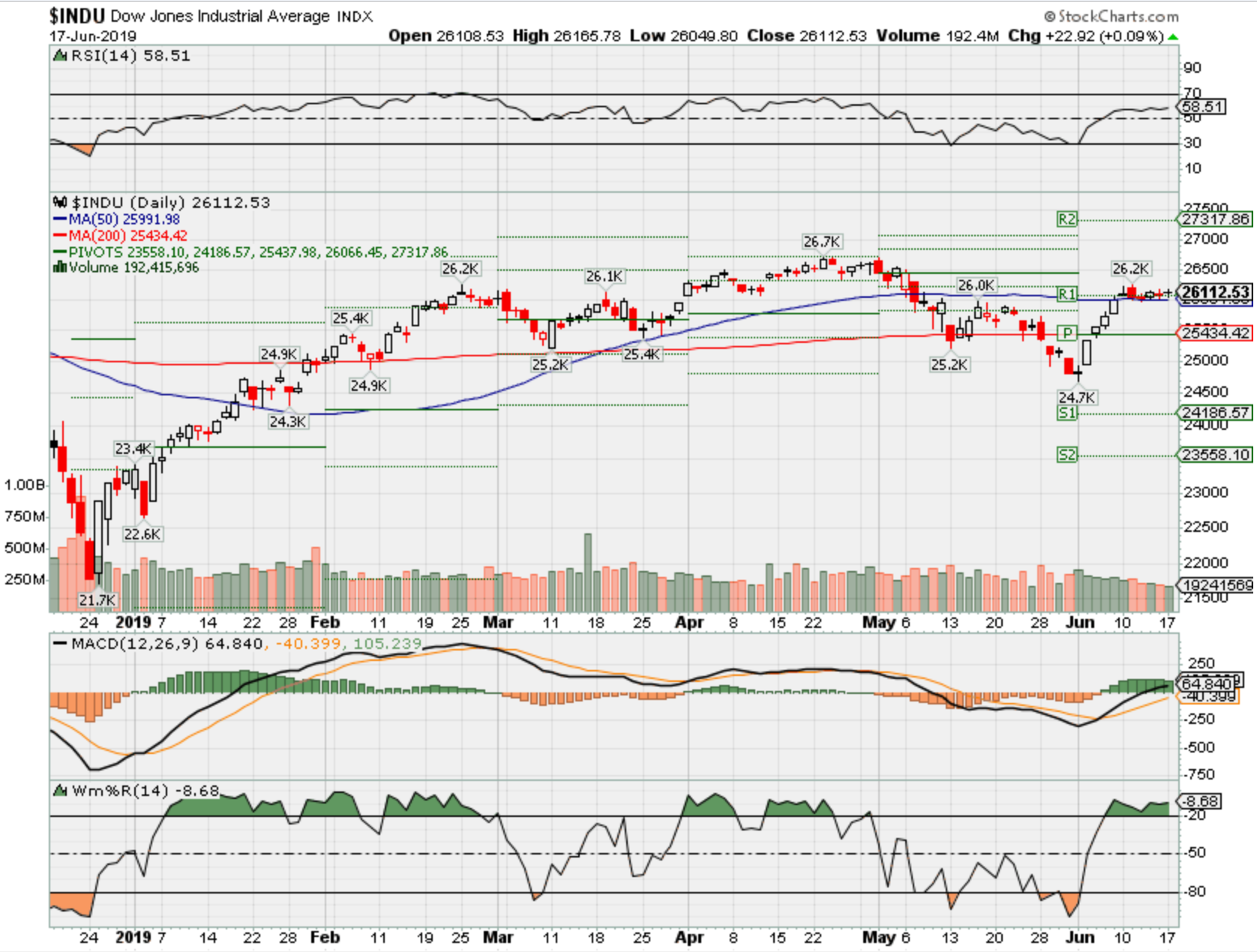

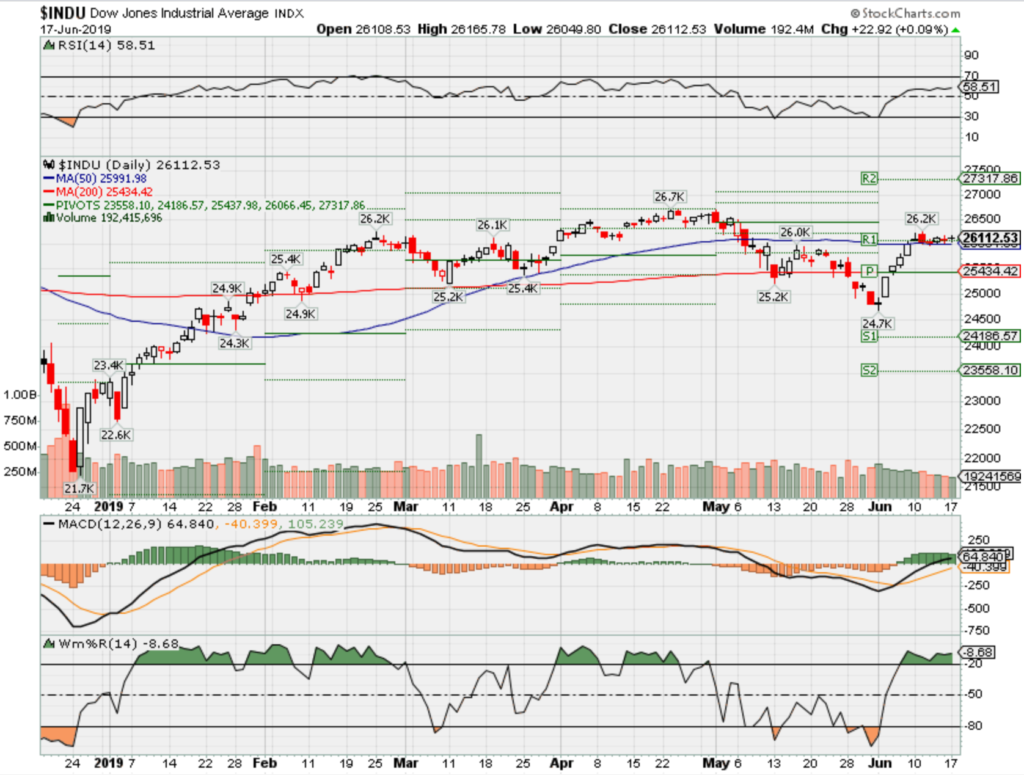

Today has anything changed? Technically we are now in a bullish market/ SIDEWAYS

Thoughts on our market thru summer

Still worried about the FOMC meeting on Wed because Powell hasn’t caved to Trump at all

G-20 end of June and President Trump and Chi need to meet otherwise another round of rate hikes

Summer Doldrums usually require longer term short calls on positions to make something through the summer, YET I can’t find the catalyst to pull the trigger because the risk seems to be to the upside

We collar trade over sometimes extended periods of time until fundamentally sound companies come back

That means sometimes we overprotect, sometimes we wait longer than we thought we would and eventually we then make a killing as the stock recovers

The best part of collar trading? Sleeping at night, protection, picking up more shares with the long put profits, dollar cost averaging without being asked to put more money into your account, making a killing when it comes back = PATIENCE

Covered call on Bidu

BTO Shares at 114.33

STO a CC Aug 120 for $4.90

Net cost basis = risk = $109.43

Max Profit = 120-109.43 = 10.57 = 9.65% ROR

BUT if you take the 4.90 /114.33 = 4.2% risk covered and still have 95.8% of you total invested capital at risk

Where if you added a protective put or collar trade

BTO 114.33 Stock

BTO Aug 115 Long pUt for $7.25

New cost basis = $121.58

New Risk in the trade = 121.58 – 115 = 6.58 or 5.4% of your totasl invested capital is at risk meaning you’ve protected 94.6% of you total capital in the stock market !!!

Where will our markets end this week?

Down

DJIA – Bullish Market

SPX – Bullish

COMP – Bullish

Where Will the SPX end June 2019?

06-17-2019 +3.0%

06-10-2019 -1.0%

06-03-2019 -1.0%

05-27-2019 -1.0%

Earnings:

Mon:

Tues: ADBE

Wed: AOBC, ORCL, WGO

Thur: KR, RHT

Fri: KMX

Econ Reports:

Mon: Empire, NAHB Housing Market Index Net Long Term TIC flows

Tues: Building Permits, Housing Starts

Wed: MBA, FOMC Rate Decision

Thur: Initial, Continuing, Current Account Balance, Phil Fed, Leading Indicators

Fri: Existing Home Sales, MONTHLY OPTIONS EXPIRATION

Int’l:

Mon – EA: ECB Draghi Speech (2 days)

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Headline risk and adding protection as needed

Keeping it on longer than needed for the unexpected

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

A Morgan Stanley economic indicator just suffered a record collapse

PUBLISHED THU, JUN 13 2019 2:01 PM EDTUPDATED FRI, JUN 14 2019 7:13 AM EDT

Maggie Fitzgerald@MKMFITZGERALD

KEY POINTS

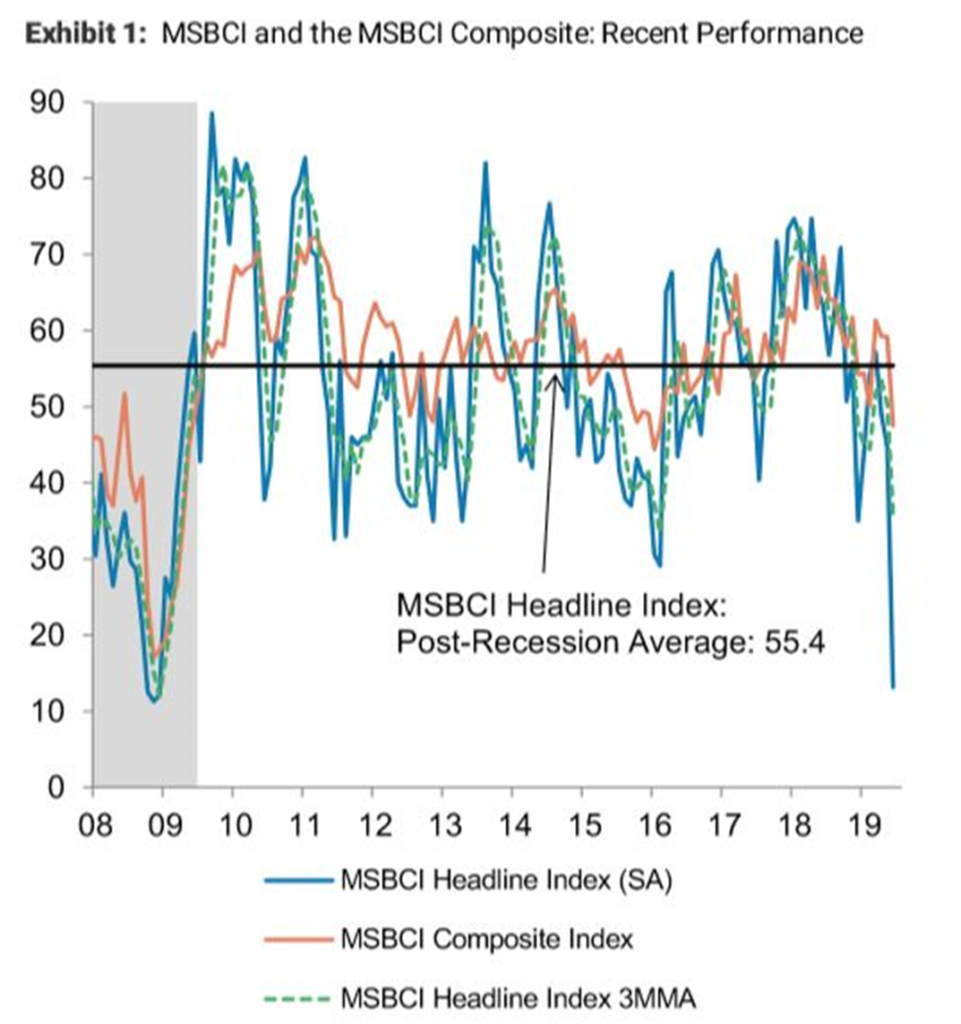

- The Morgan Stanley Business Conditions Index fell by 32 points in June, to a level of 13 from a level of 45 in May. This drop is the largest one-month decline on record.

- “The decline shows a sharp deterioration in sentiment this month that was broad-based across sectors,” economist Ellen Zentner said in a note to clients on Thursday.

- Every subindex of the Business Conditions Composite fell in June, except for the credit condition category, which “is consistent with the recent easing in broad financial conditions,” Zentner said. A reading of the economy from Morgan Stanley is signaling “June gloom.”

Morgan Stanley’s Business Conditions Index, which captures turning points in the economy, fell by 32 points in June, to a level of 13 from a level of 45 in May. This drop is the largest one-month decline on record and the lowest level since December 2008 during the financial crisis, according to the firm.

“The decline shows a sharp deterioration in sentiment this month that was broad-based across sectors,′ economist Ellen Zentner said in a note to clients. “Fundamental indicators point to a broad softening of activity, but analysts did not widely attribute the weakening to trade policy.”

Fears of a possible economic slowdown were raised last week after a much worse than expected jobs report. The economy added just 75,000 jobs in May, according to the Labor Department last Friday. A report Thursday showed a spike in jobless claims last week. Manufacturing activity last month grew at the slowest pace in two years.

Worries about a trade deal getting passed between the U.S. and China weighed on stock markets in May. Perversely, that weak sentiment actually boosted equities this month because traders are hoping the Federal Reserve will cut interest rates. But some investors are starting to worry that the economy could fall into an outright recession.

June’s conditions index reading showed notable declines in hiring, hiring plans, capex plans and business conditions exceptions, Morgan Stanley said.

The manufacturing subindex business conditions fell sharply to zero, “a decline that was likely exaggerated by the recent turn lower in oil prices, while marking the lowest level for the subindex on record,” Zentner said.

The services subindex also fell to 18 from 35.

https://seekingalpha.com/article/4269973-visa-strong-growth-attractive-valuation

Visa: Strong Growth And Attractive Valuation

Jun. 12, 2019 7:46 PM ET

Summary

Visa continues to lead among its competitors in the credit card market.

Growth in the Payment Processing Solutions Market is expected to double by 2024.

While a larger proportion of Visa’s transactions are credit-card based, the company has seen significant growth in the debit card market.

I take a bullish view on this company.

Investment Thesis: A strong exposure to the credit card market, growth in debit card transactions, and a relatively attractive valuation on a price-earnings basis is why I take a bullish view on this stock.

As an upfront disclaimer, I recently went long Visa’s (V) direct competitor – MasterCard (MA) – for reasons I outlined in a previous article.

That said, my hypothesis is that both companies have great exposure to a fast-growing global payments market, and wish to assess whether Visa would also be suitable for a long position at this time.

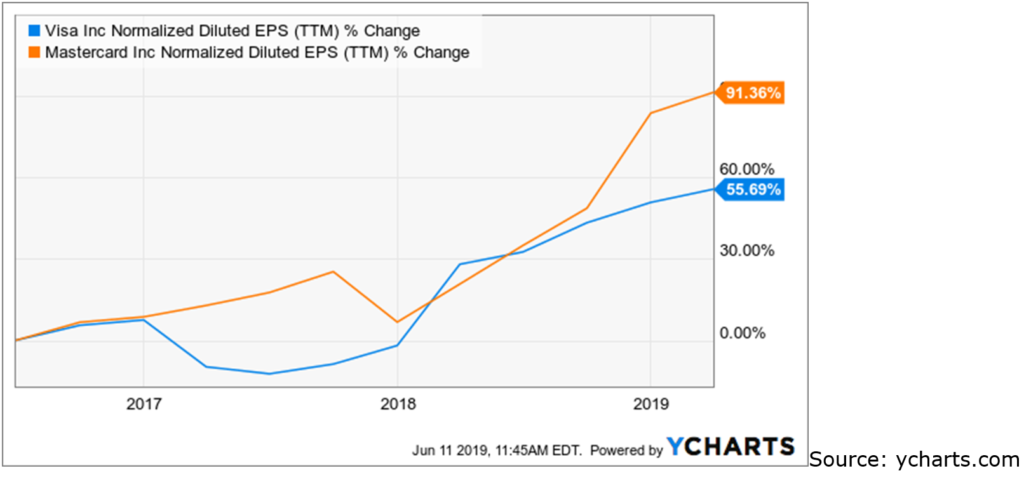

From a return standpoint, we can see that MasterCard has slightly outperformed Visa on a return basis during this time:

Source: investing.com

Moreover, we can see that while Mastercard’s earnings per share has grown at a faster pace than that of Visa over the past three years, the stock is also more expensive than Visa on a P/E ratio basis:

Earnings

Source: ycharts.com

P/E Ratio

Source: ycharts.com

However, looking at earnings alone may not tell the whole story. Earnings – broadly speaking – could be rising for reasons such as lower operating costs, lower taxes, etc. On its own, this metric does not necessarily reflect how a business is performing over the long-term.

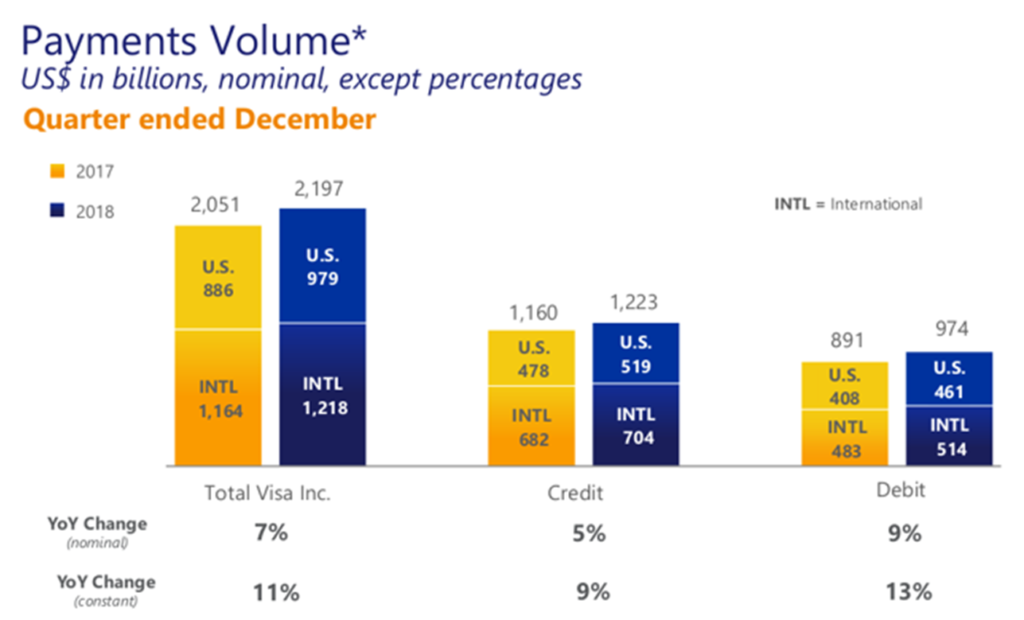

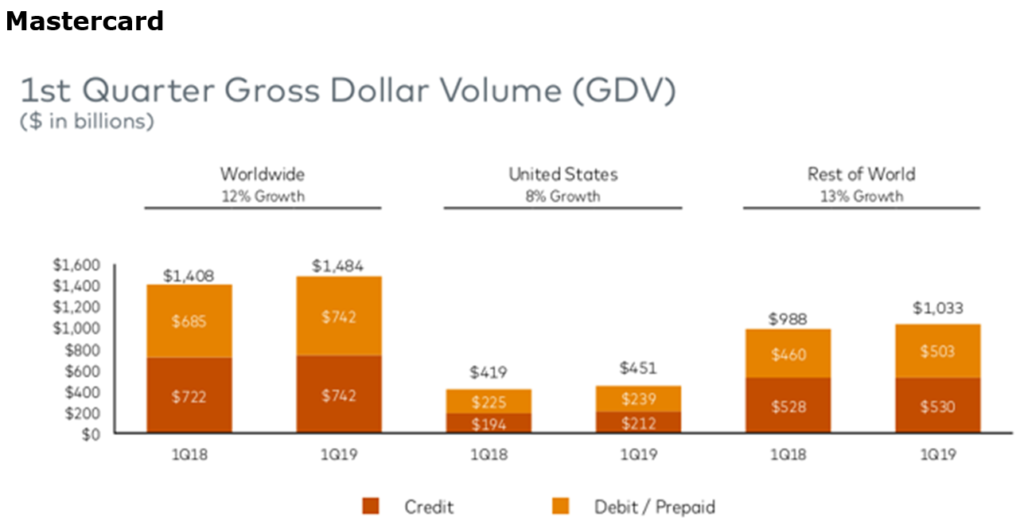

Let’s compare Total Payments Volume (or Gross Dollar Volume) for Visa and Mastercard – both in terms of growth relative to last year and relative to one another.

We can see that for the most recently reported quarter – Mastercard’s GDV grew by just over 5%, whereas Visa reported slightly higher growth of 7%.

Visa

Source: Visa Q2 2019 Financial Results

Mastercard

Source: Mastercard Q1 2019 Earnings Presentation

Moreover, we also see that growth for the United States stood at 7% for Mastercard, and over 10% for Visa.

Therefore, while Mastercard has reported higher earnings, the growth in actual payment volume has been higher for Visa, particularly in the United States.

In terms of transactions, Mastercard saw equal gross dollar volume across credit and debit cards, while Visa has seen significantly more volume across credit card offerings – accounting for just over 55% of the total.

So, given the strong similarity in performance between both of these companies, are there any advantages of holding Visa relative to Mastercard? Conversely, are there any risks inherent to Visa that are not inherent to Mastercard?

When comparing both debit and credit card usage, the majority of contactless payments (85 per cent) is conducted through debit cards according to the Financial Times. Moreover, while credit card usage has been increasing, these have been more for the purpose of day-to-day spending instead of borrowing, given that the rate of growth in outstanding balances have been slowing. In this regard, given that Visa currently sees slightly more credit transactions rather than debit, this does mean that the company needs to grow debit transactions over the longer-term, as it is estimated that 36 percent of all payments will be made by contactless cards by 2027.

That said, growth in Visa’s debit transactions (13%) has outpaced that of credit transactions (9%) on a constant basis in the past year. Moreover, Visa’s market share for credit cards far surpasses Mastercard at almost 53%, with a share of 22% for the latter. Therefore, it is hardly surprising that Visa would see a higher credit card payment volume. However, the fact that debit transactions are growing is reassuring and shows that the company is not overly reliant on credit transactions to sustain its business.

Moreover, when one considers the future of credit card transactions, the Payment Processing Solutions Market is expected to see high growth through to 2024, up to USD 69.5 billion from USD 39.3 billion this year. This marks a CAGR of 10.4 percent per year. While debit cards have been increasing in popularity, credit cards are still preferred for higher-value purchases, and as a result is expected to have the biggest impact on the Payment Processing Solutions Market given the increasing demand for digital payments. Even though Amazon (AMZN) is seeking to enter the credit card market by catering to those customers with either bad or no credit history, the very fact that such credit cards are being aimed at lower-income customers will limit the overall transaction volume generated by these cards, and as such I do not particularly see a threat to Visa’s dominance in this regard.

To conclude, Visa appears to show strong performance in both the credit and debit card markets, and has shown solid growth in total payment volumes. While I am personally long Mastercard, I see Visa as a strong competitor, and see further upside for the stock from here – given the company’s growth record and relatively cheaper valuation on a P/E basis.

Disclosure: I am/we are long MA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article is written on an “as is” basis and without warranty. The content represents my opinion only and in no way constitutes professional investment advice. It is the responsibility of the reader to conduct their due diligence and seek investment advice from a licensed professional before making any investment decisions.

https://finance.yahoo.com/news/15-mistakes-even-smart-people-100002969.html

15 Mistakes Even Smart People Make in Retirement

Cameron Huddleston

GOBankingRatesJune 13, 201915 Mistakes Even Smart People Make in Retirement

More Americans make plenty of mistakes when it comes to planning for retirement, the biggest of which is not saving enough. In fact, a recent GOBankingRates survey found more than half of Americans will retire broke. Even if you have made saving a priority, however, you still can make missteps once you leave the 9-to-5 that will put a comfortable retirement at risk.

Click through to learn how you can avoid these common mistakes people make in retirement.

1. Claiming Social Security Too Early

More than a third of baby boomers take advantage of the option to claim Social Security benefits early at age 62, according to the Center for Retirement Research. But taking benefits before full retirement age results in a permanent reduction of as much as 25 percent of your benefit, said Patricia Cathey, an investment advisor with financial services firm Smart Retirement in Denver.

Full retirement age is 66 for those born between 1943 and 1954 and gradually increases until it reaches 67 for people born after 1959. “Waiting to claim Social Security is one of the best things you can do to boost your income in retirement,” Cathey said. “And there’s a big bonus for delaying your claim beyond your full retirement age: Your benefit will grow by as much as 8 percent a year from your full retirement age up until age 70.”

See how your retirement age impacts your Social Security benefits and maximize your money.

2. Continuing to Work After Claiming Social Security Early

If you start receiving benefits at 62 and continue to work, you will lose $1 in benefits for every $2 earned above the annual limit of $17,040. The year in which you reach full retirement age, you will lose $1 in benefits for every $3 earned above the annual limit of $45,360. That continues until the month you actually reach full retirement age — at which point the limit disappears.

Stay Active: Senior-Friendly Jobs That Are Perfect for Retirement

3. Carrying Debt Into Retirement

Having debt in retirement when you are on a fixed income makes you vulnerable to financial hardships because it leaves you with less money to cover unexpected expenses, Cathey said.

She recommends you pay off all debt before you retire. But if that’s not possible, have a plan to pay it off by a certain date in retirement.

In particular, you should focus on paying off your mortgage, because it is the biggest monthly expense for most people, said Robert Steen, enterprise advice director for retirement and complex financial planning for USAA, which offers financial services for members of the military.

4. Being Too Conservative With Investments

Many retirees shy away from holding stocks in their retirement account portfolios because they fear losing money in a market downturn. By avoiding stocks, though, they are trading off one risk for another — not having enough growth potential in their portfolio to outpace inflation, Steen said.

Although they are often volatile over short periods, stocks tend to outperform bonds and other conservative investments over long periods, said David Walters, a certified financial planner and portfolio manager with Palisades Hudson Financial Group’s Portland, Ore., office.

“Retirees need to understand that the period of their retirement can be upwards of 30 years, and they need their portfolio to support them throughout this entire period,” he said. “So, while it is important to keep the risk of the portfolio in check, some allocation to stocks is warranted.”

5. Being Too Aggressive With Investments

Some retirees become too aggressive with their portfolios to achieve better returns, said Corey Sunstrom, a Charlotte, N.C.-based certified financial planner with Hobart Financial Group. “The truth is, aggressive investors aren’t being rewarded either, and their portfolios have a greater propensity for loss,” he said.

Rather than reach for returns, Sunstrom recommends working with an advisor to ensure you are properly diversified with investments that will help you reach goals.

The Inside Scoop: 15 Stocks for Beginners to Try in 2018

6. Overexposure to One Stock or Asset Class

Some people have a significant portion of their portfolio invested in their former employer’s stock, Walters said. This creates risk, though, because a large amount of your retirement income could be riding on the fate of a single stock. If it tanks, so will your portfolio.“Where possible, allocations to any single company should be minimized in favor of a well-diversified portfolio with exposure to many companies and asset classes,” Walters said.

7. Not Knowing How Much to Withdraw

More than three-quarters of Americans over the age of 40 don’t know how much of their retirement savings they can safely spend each year without outliving their assets, according to a survey conducted by Ipsos Public Affairs for New York Life.

About a third of those surveyed believe they can spend 10 percent a year. But if past investment returns are any guide, they would likely run out of money in 11 years or less at that rate.

The rule of thumb is that you can withdraw 4 percent a year from savings to minimize the odds of outliving your money, said Steen. Consider that a guideline only, though. Steen said your withdrawal rate should be based on expenses and the performance of your investments each year.

8. Failing to Take Required Minimum Distributions

Some retirees make the opposite mistake when it comes to withdrawing money from their retirement accounts. Instead of withdrawing too much, they do not take out enough.

If you have a qualified retirement plan such as a 401k or traditional IRA, you typically have to start taking withdrawals by age 70 1/2, said Jeff Jones, a Huntsville, Ala.-based certified financial planner with Longview Financial Advisors.

It can be confusing, however, because you can delay your first required minimum distribution (RMD) until April 1 of the following year after turning 70 1/2. If you fail to take an RMD, you will be hit with a 50 percent excise tax on the amount you were supposed to withdraw, Jones said.

Save Your Money From Uncle Sam: How to Use Your IRA as a Last-Minute Tax Deduction

9. Dismissing Annuities

Annuities get a bad rap because of the fees associated with them and the unscrupulous sales tactics used by some people who sell them. But a basic immediate annuity can be a good addition to a retirement portfolio because it can provide a guaranteed stream of income, Steen said.

To figure out how much to invest in an annuity — which you can do by taking a lump-sum from your retirement account — determine how much money you will need each year in retirement for fixed expenses, said Cathy McCabe, senior managing director at financial services provider TIAA. Then, calculate how much income you will get from Social Security and pensions.

If that income doesn’t cover your expenses, consider an annuity to bridge the gap, she said.

10. Not Updating Your Investment Strategy

Volatility in the stock market can affect your savings — as can your current expenses and future needs, said Jim Poolman, executive director of the Indexed Annuity Leadership Council. So, the investing strategy you created before retirement might need adjusting once you enter retirement.

“Once you start your retirement, it’s beneficial to review your strategy,” Poolman said. “Revisit your retirement plan every few years to make sure your savings reflect your needs, and adjust for market conditions.”

11. Overspending in Early Years of Retirement

One of the biggest errors is overspending in the early years on large expenses that should have been addressed during working years, said Pedro Silva, a wealth manager with Provo Financial Services in Shrewsbury, Mass.

“Large home repairs such as driveways, additions or new roofs and new vehicle purchases should be done before retirement,” he said. Making withdrawals from retirement savings to cover such expenses can make a permanent dent in your portfolio.

12. Not Considering Home Equity as a Source of Income

You do not have to think of your home’s equity as a last resort when looking for a source of income in retirement. Either a reverse mortgage — which lets you tap your home’s equity — or a home equity line of credit can be a useful tool in your retirement toolbox, Steen said.

Tapping home equity can be a good way to cover expenses in a year when the value of your retirement portfolio drops because of a market downturn. You can draw on your home’s equity rather than cashing in losing stocks. That will give your portfolio time to recover, Steen said.

13. Neglecting to Plan for Long-Term Care

The cost of long-term care can be one of the single largest threats to your nest egg, said Rodger Friedman, a Washington, D.C.-based chartered retirement planning counselor and founding partner of Steward Partners Global Advisory. The average annual cost of care in an assisted living facility is $43,500, and a nursing home is almost twice as expensive, according to the Genworth 2016 Cost of Care Survey.

At least 70 percent of adults over 65 will need some form of long-term care, according to Genworth. But Medicare and most health insurance plans don’t cover long-term care. Unless you have long-term-care insurance, you will have to cover these costs on your own — or rely on Medicaid if you have extremely limited resources.

14. Not Having Estate Planning Documents

More than 50 percent of Americans do not have a will, according to a 2016 Gallup poll. And only about a third have a living will that spells out healthcare wishes if they cannot make them on their own, according to a study by Health Affairs.

“These are essential documents that need to be in place before something happens,” said George Urist, a certified financial planner and president of Urist Financial and Retirement Planning in East Syracuse, N.Y. “Without them, most states have their own ideas on where your funds will go,” including getting tied up in probate court.

Creating an estate plan can help your loved ones overcome common legal issues that emerge if you die, or are unable to make decisions for yourself.

15. Underestimating How Long You Will Live

The average life expectancy for a man is 76 years, and for a woman it’s 81 years, Cathey said. But many people live well into their 90s or even past 100. “It would be much easier to plan if we all knew how long we were going to live, but it just doesn’t work that way,” she said.

To ensure your retirement savings will last, plan on living longer than you expect and withdraw from your savings at a rate that improves the odds you will have enough money for several decades. “You do not want to have to go back to work to support yourself in your 90s,” she said.

Making Smart Money Decisions

Having a successful retirement means making savvy money decisions while you’re still in your earning years. By being smart with your investments, and keeping spending in check, you can ensure that your retirement years truly are golden.

Germany should heed the call of its deeply worried business community

PUBLISHED SUN, JUN 16 2019 9:05 PM EDTUPDATED SUN, JUN 16 2019 10:43 PM EDT

Dr. Michael Ivanovitch@MSIGLOBAL9

KEY POINTS

- A quasi stagnant German economy is a serious problem for the stability of the European monetary union, and for economic activity in the rest of the world.

- German businesses have legitimate complaints about the economic policies of a government that has lost the people’s popular support.

- Sadly, the outlook for the German economy and political stability are more uncertain than ever.

Germany accounts for nearly 30% of a monetary union consisting of 19 European economies. That’s how dangerous it is to see the world’s fourth-largest economy stuck in a virtually stagnant quarterly pace during the 12 months to March.

And here’s more: Measured at annual rates, the German economy at the beginning of this year was moving along at less than half the capacity of its potential and non-inflationary growth rate — a monumental waste of the country’s human and physical capital.

The German business community is blaming the government for high corporate taxes (31% compared with a European average of 22%), high energy costs, inadequate digital infrastructure, lack of high-speed fiber optic connections in most of the country’s industrial parks, unclear economic and political orientations, and more.

Exports should not be the only way out

At their meeting earlier this month, the members of a powerful Federation of German Industries (Bundesverband der Deutschen Industrie – BDI) voiced their declining confidence in government policies at a time when they were facing increasing pressures from Chinese and American competitors. That’s what they told an uneasy audience of 1,500 people, headed by German Chancellor Angela Merkel and her economic and finance ministers.

German businesses wanted no “national champions” and bureaucratic meddling. They asked for effective economic and financial policies to support small- and medium-sized companies — the country’s celebrated Mittelstand — that represent 99% of German companies, generate about three-quarters of all jobs, and account for more than half of the nation’s GDP.

They probably knew they were asking far too much of a moribund governing coalition, trashed in recent European parliamentary elections and facing a certain demise if the wishes of 52% of German voters were met for new national elections.

That should be an urgent consultation because, according to the latest opinion polls, Germany has a minority government with the center-right parties — Merkel’s Christian Democratic Union (CDU) and its sister party, Christian Social Union (CSU) — polling 24%. The junior coalition partner, Social Democrats, polled 13%.

That was a gloomy business meeting in Berlin. But suddenly, and very curiously, people cheered up to give a standing ovation to the French Economy and Finance Minister, Bruno Le Maire.

Speaking in German, the French official apparently struck a chord by pleading for a European response to American and Chinese challenges. France and Germany, he said, should act together in the spirit of “complementarity” rather than “rivalry” to stay ahead in emerging new areas of top technologies.

The French were also pleased with a call for revival of a wobbly French-German partnership. After two years of constant prodding, Germany relented last Friday to approve the French project of a euro area budget. But instead of calling it a budget and agreeing to hundreds of billions of euros demanded by the French, Paris had to settle for the new “budgetary instrument for competitiveness and convergence” with only 17 billion euros ($19.08 billion) over a period of seven years.

A Pyrrhic victory of sorts, because that will get new votes for the eurosceptic Marine Le Pen’s National Rally (RN) to see Paris acting as Berlin’s junior partner subservient to German interests.

France will pay

Yes, President Emmanuel Macron and Le Maire have nothing to cheer about watching the German confusion and disarray that will end up exacting a large cost in terms of French jobs and incomes.

France and the rest of Europe — and, incidentally, the U.S., too — should have expected Germany to rev up its economy and buy more goods and services from its main trade partners. With a budget surplus of 1.7% of GDP, public debt of 60.9% of GDP, and a trade surplus on goods and services of 8% of GDP, Germany was supposed to lead the European (and global) economic recovery by stimulating its domestic spending and opening up its markets.

But that won’t happen. As always, France, the rest of Europe and the U.S. will foot the bill of German economic revival as German companies step up their sales on external markets to survive. That’s called Germany’s export offensive – big time.

Countries like France and the U.S., with a typically low political tolerance for weak economic growth, will suffer the most from the onslaught of German companies’ export sales. Washington can still do something to scare them off, but there is nothing that France can do in a perfectly functioning customs union with its neighbors across the Rhine river.

Here is an example of how that goes. In the last two quarters, the beleaguered French government boosted public spending and wage growth to calm an ongoing public unrest. As a result, the rate of French economic growth during that period was double that in Germany. Predictably, German exports to France picked up at an annual rate of 3% in the six months to April, after virtually no growth during 2018.

No wonder German business leaders gave a standing ovation to the French finance minister. That could have sounded like an encouragement to keep up the good work by spending the money he did not have, and messing up the French public finances in the process.

Germany will call him out on that later this year.

Berlin, and its Brussels sidekicks, are just too busy now setting up Italy for penalties and disciplinary procedures for its excessive public debt and an intolerably high budget deficit of 2.4% of GDP – unless U.S. President Donald Trump tweets to save the day for his Roman friends. Bravely looking at a budget deficit increase of 77% in the first four months of the current fiscal year, Trump could probably scare the Germans with a tweet to lay off the struggling Italians.

Investment thoughts

The European Central Bank President Mario Draghi should not worry about central and eastern Europeans being vulnerable to ongoing global trade disputes. Those people know all about hardship and sacrifice. Instead, Draghi should call out Germany’s destabilizing mercantilism.

Incidentally, Draghi could also say a thing or two about French fiscal policies. That would calm down France’s newfound ardor to lecture about the fictional European sovereignty and Rome’s public finances, even though Italy’s headline and primary budget balances look much better than those in France.

Germany is Europe’s big economic problem, but nobody, except Washington, dares say so.

The German DAX equity index is down 10.5% in dollar terms over the last 12 months. By comparison, the 4% gain on the Dow Jones Industrial Average looks like a stellar performance.

Maybe, at some point, somebody in Germany will care about that and heed the call for help from a deeply worried German business community.

Commentary by Michael Ivanovitch, an independent analyst focusing on world economy, geopolitics and investment strategy. He served as a senior economist at the OECD in Paris, international economist at the Federal Reserve Bank of New York, and taught economics at Columbia Business School.

Goldman Sachs is reportedly combining four private-investing units with $140 billion in total assets

PUBLISHED SUN, JUN 16 2019 5:19 PM EDT

Kevin Breuninger@KEVINWILLIAMB

KEY POINTS

- Goldman Sachs is merging four separate private-investment groups into one unit in an attempt to generate steadier income and make itself more attractive to investors, The Wall Street Journal reported Sunday.

- The new division, which combines units investing in private companies, real estate and “other hard-to-access deals,” is expected to command roughly $140 billion in assets, the Journal reported, citing people familiar with the matter.

- It will reportedly take shape over a period of several months.

Goldman Sachs is merging four separate private-investment groups into one unit in an attempt to generate steadier income and make itself more attractive to investors, The Wall Street Journal reported Sunday.

The new division, which combines units investing in private companies, real estate and “other hard-to-access deals,” is expected to command roughly $140 billion in assets, the Journal reported, citing people familiar with the matter.

It will reportedly take shape over a period of several months.

The newspaper wrote that Goldman’s executives are hoping CEO David Solomon’s changes to a firm that historically thrived in investment banking and trading will boost its stagnant stock price.

Goldman is also planning a fundraising blitz to raise money from outside investors, rather than putting up its own money as it had done in past private-equity ventures, people briefed on those plans told the Journal.

The plan to reshape Goldman’s private-investing strategy “will be a multiyear effort to evolve this business into more fee revenue and a more balanced business mix,” Goldman President John Waldron reportedly said at an industry conference last month.

Trump: If President Xi does not attend G-20, more China tariffs will go into effect immediately

PUBLISHED MON, JUN 10 2019 8:54 AM EDTUPDATED MON, JUN 10 2019 1:32 PM EDT

Michael Sheetz@THESHEETZTWEETZ

KEY POINTS

- President Trump threatened more tariffs on Chinese imports if President Xi Jinping is not at this month’s G-20 meeting.

- The president previously threatened to put levies on another $300 billion in Chinese goods if an agreement is not reached soon.

President Donald Trump confirmed on Monday that additional tariffs on Chinese goods will be levied if Chinese President Xi Jinping does not attend this month’s G-20 meeting.

When asked during a telephone interview if that means the new tariffs would go into effect immediately, Trump told CNBC’s Becky Quick, “Yes, it would.”

The president previously threatened to put levies on another $300 billion in Chinese goods if a trade agreement is not reached soon. The Trump administration increased tariffs last month on $200 billion worth of goods the U.S. imports from China.

Trump is supposed to meet with Xi at the G-20 summit, which is scheduled for June 28-29 in Osaka, Japan. The leaders of 19 nations and the European Union are expected to attend.

In the telephone interview on “Squawk Box, ” the president said he’d be surprised if Xi did not attend. Trump said he has “a great relationship” with Xi, adding that “he’s actually an incredible guy.”

As the trade war between the U.S. and China continues, Trump has said he will continue raising tariffs on Chinese goods. He said his administration is currently taxing “35% to 40%” of the Chinese goods the U.S. imports. If an agreement isn’t reached, there are “another 60% and that’ll be taxed,” Trump said.