HI Market View Commentary 05-18-2020

CYCLES BABY – 4 phases

Peak or TOP – that nobody can predict but signals a new resistance level, old high

Drop, Crash, Pullback, = Panic as index prices fall to previous support/resistance level, falls to some level of justification that prices are now cheap and will change direction to rise again

Through = the Bottom and also nobody can predict and usually comes by surprise

Recovery or Growth period = Stock rise to new highs

SO…. Was today a dead cat bounce?

My guess is NO we are in a recovery –

- Don’t fight the fed that said we are going to print money and worry about the ramifications later.

- Vaccine minute possibility by end of the year –

- Lower highs and lower lows on contagion

- People are willing, wanting and heading back out

- Companies are doing better than expected

Let’s Break some RULES !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

It’s NOT pertinent to always be protected IF you believe in trends, technical analysis or if you want trade in the 99.5% of normal market movement.

It’s OK to let something go – Following the trend

Its STUPID to use stop losses EVER

Once you stock price has fallen it is DUMB to cap the upside or rebound IF you believe in cycles

I don’t always roll long put to ATM for earnings during recoveries

It’s OK to let stocks range as they find levels of support and resistance

I’m taking the most relevant, recent and best educated/experienced guess on what the market may do next

And Today I’M RIGHT

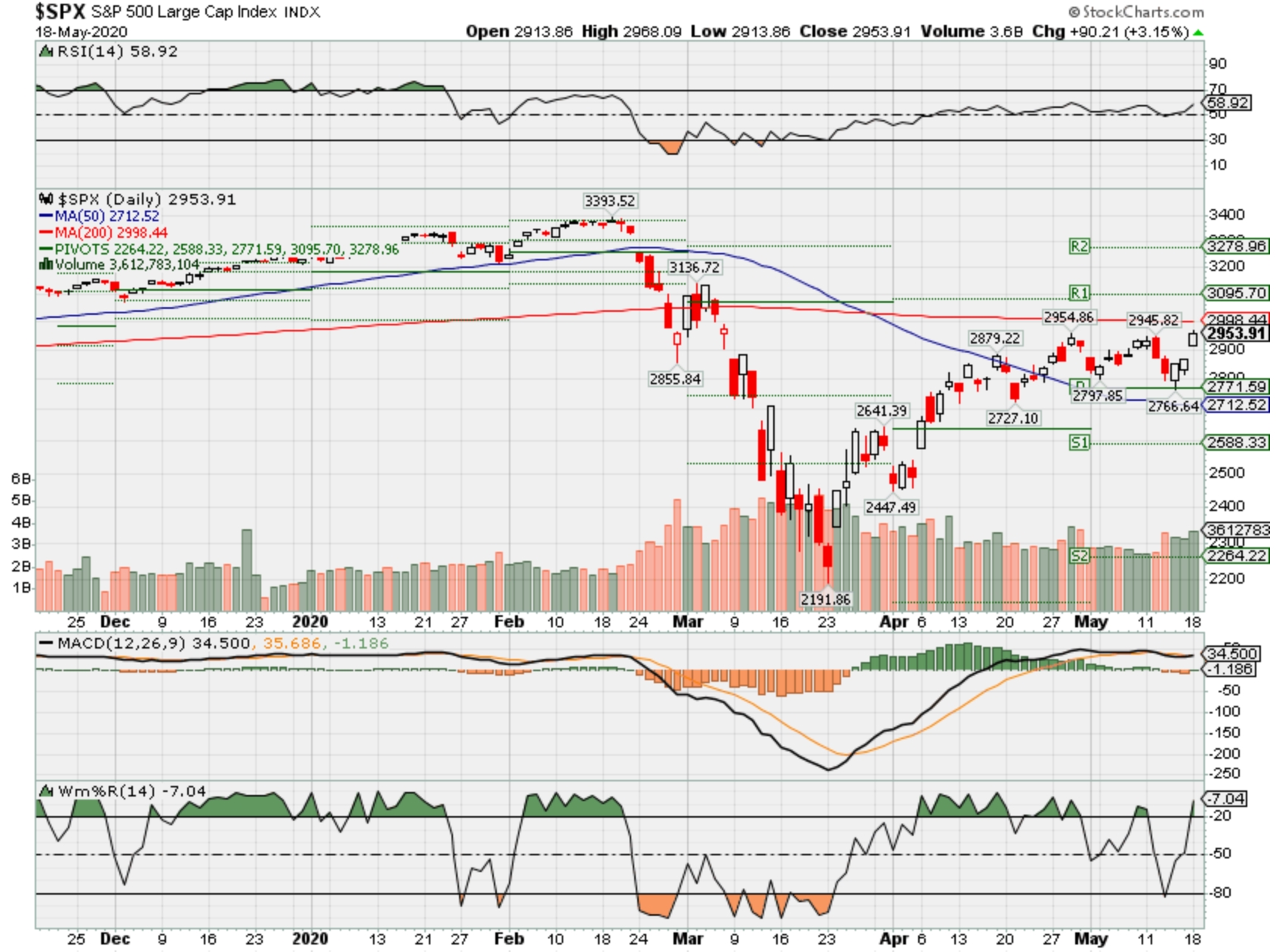

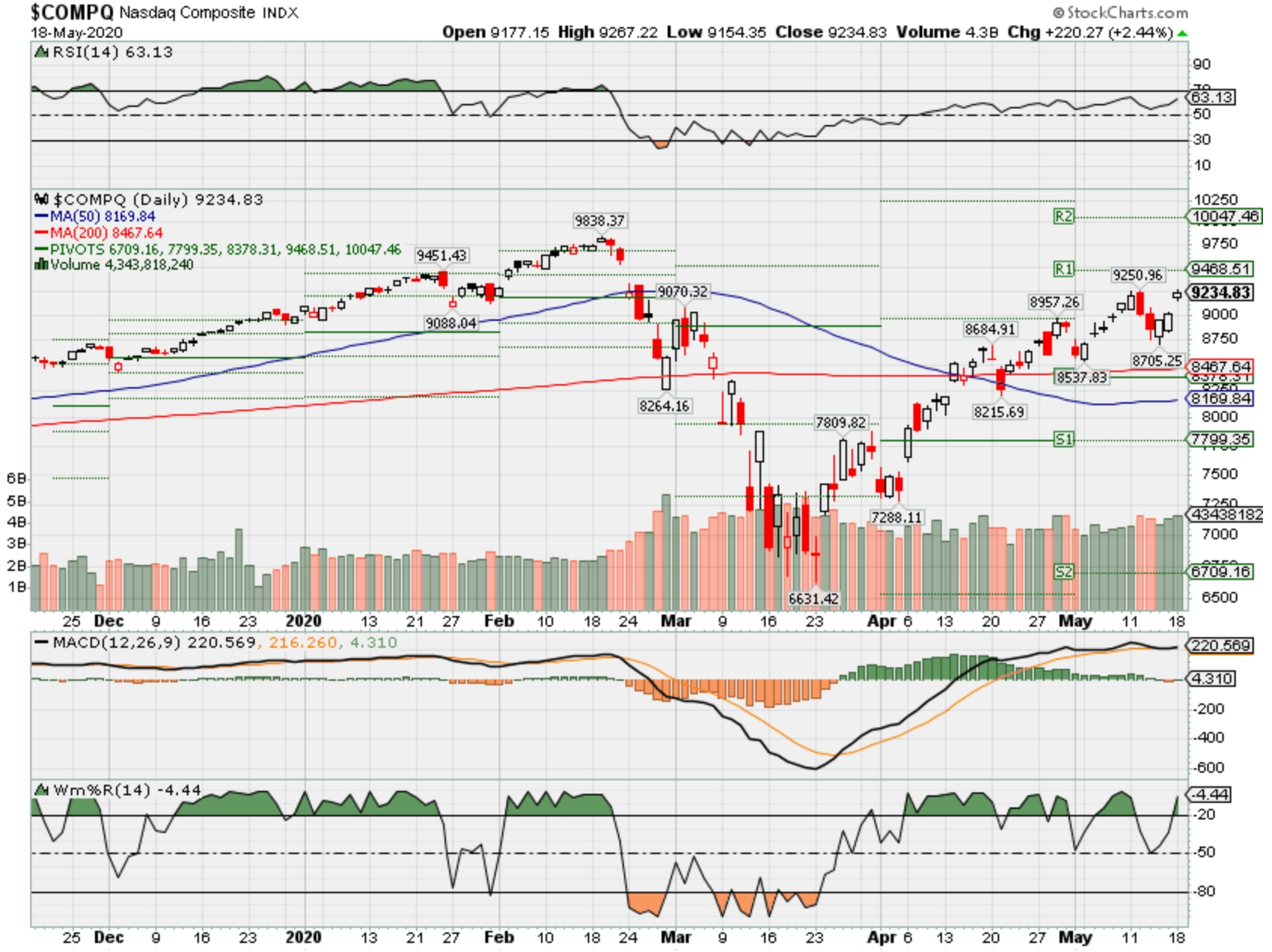

Where will our markets end this week?

Higher

SPX – Bullish

COMP – Bullish

Where Will the SPX end May 2020?

05-18-2020 +2.0%

05-11-2020 +2.0%

05-03-2020 +2.0%

04-27-2020 +2.0%

Earnings:

Mon: IQ, BIDU

Tues: AAP, HD, KSS, WMT, NTES, URBN

Wed: LOW, MCK, LB, TCOM, TGT

Thur: BBY, BJ, HRL, MDT, TJX, A, DPE, ITNU, NVDA, PANW, ROST

Fri: BABA, BKE, CPB, DE, FL, AMC

Econ Reports:

Mon: NAHB Housing Market Index

Tues: Building Permits, Housing Starts

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Phil Fed, Existing Home Sales, Leading Indicators

Fri:

Int’l:

Mon –

Tues – Powell Testimony

Wed – FOMC Minutes

Thursday –

Friday-

Sunday –

How am I looking to trade?

Letting some things run

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://seekingalpha.com/article/4347846-under-armour-recovery-time

Under Armour: Recovery Time

May 15, 2020 1:03 AM ET

Summary

Under Armour reported weak Q1 results as expected.

The current quarter should be the trough with key wholesale partners reopening stores.

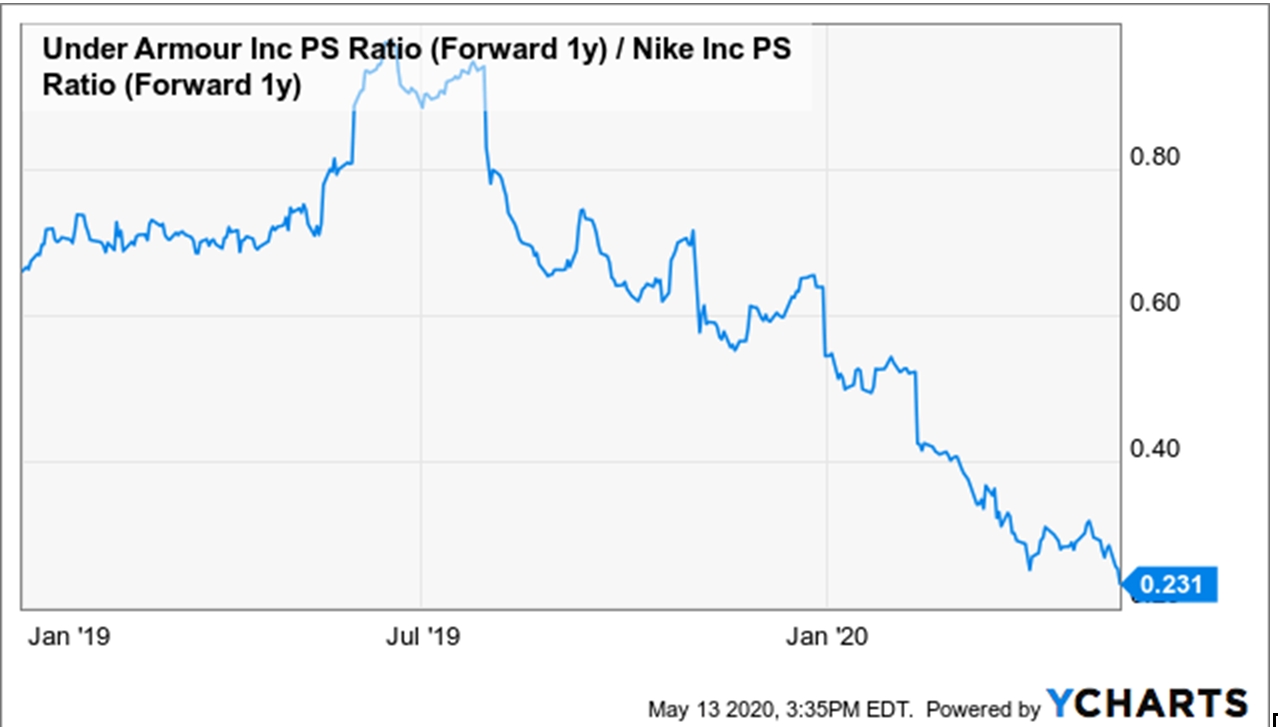

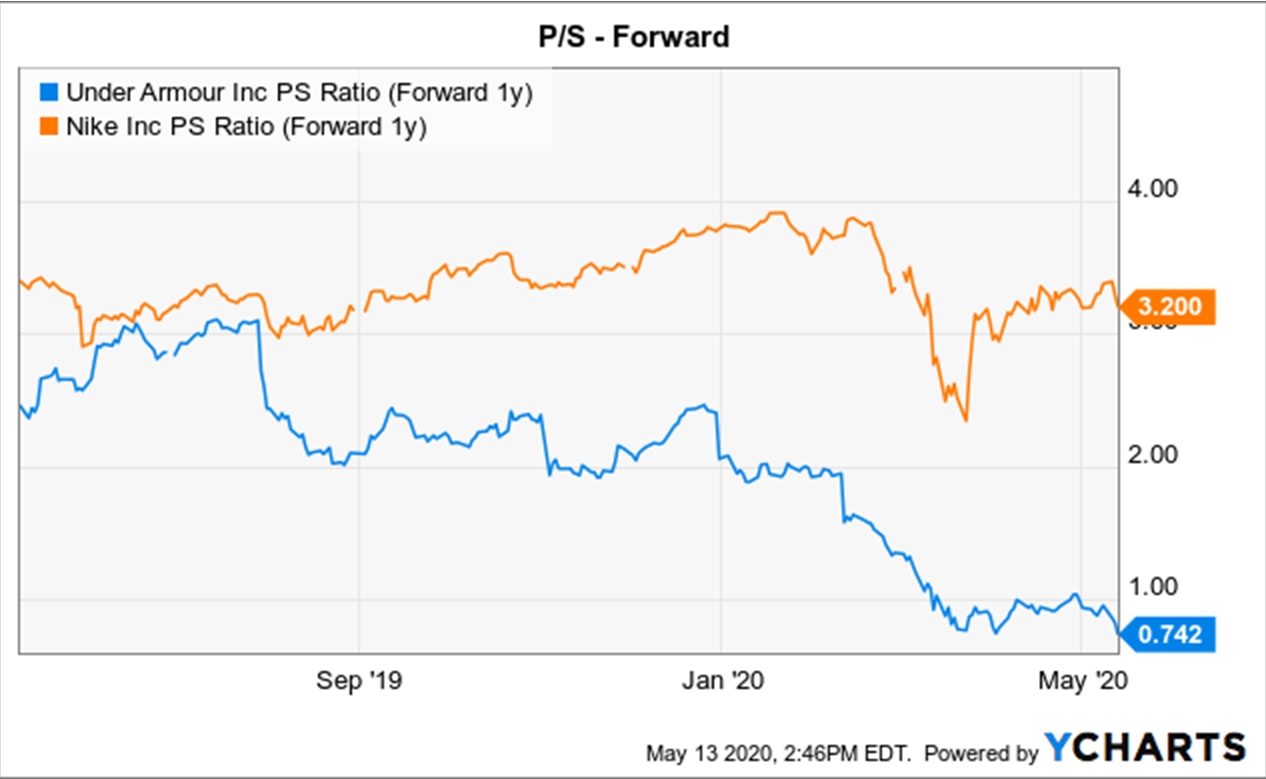

The P/S gap with Nike is the largest in the history of Under Armour.

The stock is a buy on an economic recovery in 2020.

This idea was discussed in more depth with members of my private investing community, DIY Value Investing. Get started today »

As state by state and sport by sport get back to normal, Under Armour (UA, UAA) is trading near decade lows. Sure, the Q1 results weren’t impressive, but the suggestion that the stock should be worth less than 50% from February levels doesn’t do justice to the retail brand. My investment thesis remains highly bullish on Under Armour with a market cap below $4 billion, as the stock market isn’t pricing in an obvious economic recovery with this company.

Recovery Time

Under Armour saw Q1 revenues collapse 23% to $930 million, due primarily to store closures in Asia and North America. The company is still highly reliant on wholesale revenue and has limited owned eCommerce sales at only a low-double digit percentage. This equation isn’t great in a stay-at-home scenario.

DTC revenues were only down 14% in the quarter to $284 million, but the amount is just 31% of total revenues even during a weak wholesale environment. In Q4, DTC revenues only grew by 2% as Under Armour still struggles to move beyond wholesale partners.

Some wholesale partners such as Dick’s Sporting Goods (DKS) have an extensive list of stores either now open or offering curbside pick-up. The sector is getting back to normal, but a lot of athletes remain sidelined, and Under Armour lacks the athleisure sales of competitor Nike (NKE).

Dick’s will report FQ1 results on June 2nd. Investors should get more indication if North America sales are rebounding as stores reopen in the majority of the domestic states.

The athletic apparel company is far more reliant on a rebound in sports and open retail stores for wholesale partners. Until business rebounds, Under Armour ended March with nearly $1.0 billion in cash on the balance sheet with $1.2 billion worth of debt. The retailer pulled down another $100 million from its credit line for additional liquidity.

Clearly, the athletic apparel company has the balance sheet to survive the downturn with the economy already rebounding here in May. Under Armour had an adjusted operating loss of $122 million in Q1, and the numbers should get worse in Q2. As the company cuts expenses by $325 million in the year, one should expect a Q3 with similar losses, leading to better numbers afterwards. The average analyst estimate is for a small profit in both Q3 and Q4.

Deep Value

Once making a case for Under Armour having limited financial impact going into the 2H, the long-term value equation returns. In addition, one has to make the case for Nike being even more valuable after the coronavirus crisis to stick with the larger name here. After all, Nike is only down $20 from the $105 highs.

The forward P/S gap has reached the largest level ever here. Nike still trades at 3.2x forward sales estimates, while Under Armour is down to only 0.7x lowered sales estimates. As the second chart below highlights, the P/S ratio of the stocks is now down to only 0.23 after trading near 1.0 back a year ago.

The market appears to be extrapolating far too much from the quarterly results of Under Armour in comparison to Nike, as the latter has a better DTC program and athleisure products. In addition, Nike is predicted to see FQ4 sales ending May collapse 21% in a sign that Under Armour isn’t such an outlier.

Under Armour will have a weak Q2 ongoing, but the results should be far better than analysts forecast as a key partner like Dick’s and other domestic retailers reopen stores.

Takeaway

The key investor takeaway is that the stock shouldn’t be near decade-long lows for a short-term virus hit to the business. Investors have to expect a second wave of the coronavirus to shut down sports and the economy to sell the stock here at $7. Under Armour is a Strong Buy, with the stock trading below a $4 billion valuation and the expectation for normalized revenues back above $5 billion.

The economic rebound stocks such as retailers haven’t bounced due to headwinds from some states delaying openings, but Under Armour should already see sales in recovery mode. The stock will follow the sales rebound.

Looking for a portfolio of ideas like this one? Members of DIY Value Investing get exclusive access to our model portfolios plus so much more. Signup today to see the stocks bought by my Out Fox model during this market crash.

Disclosure: I am/we are long UA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Powell says GDP could shrink more than 30%, but he doesn’t see another Depression

PUBLISHED SUN, MAY 17 20207:59 PM EDTUPDATED SUN, MAY 17 20209:27 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Fed Chairman Jerome Powell told “60 Minutes” that U.S. GDP shrinkage could be in the “20s or 30s.”

- He does not see the economy entering another Depression.

- Powell said the country will get to “an even better place” than it was before the coronavirus hit, and that it “won’t take that long.”

The U.S. economy could shrink by upwards of 30% in the second quarter but will avoid a Depression-like economic plunge over the longer term, Federal Reserve Chairman Jerome Powell told “60 Minutes” in an interview aired Sunday.

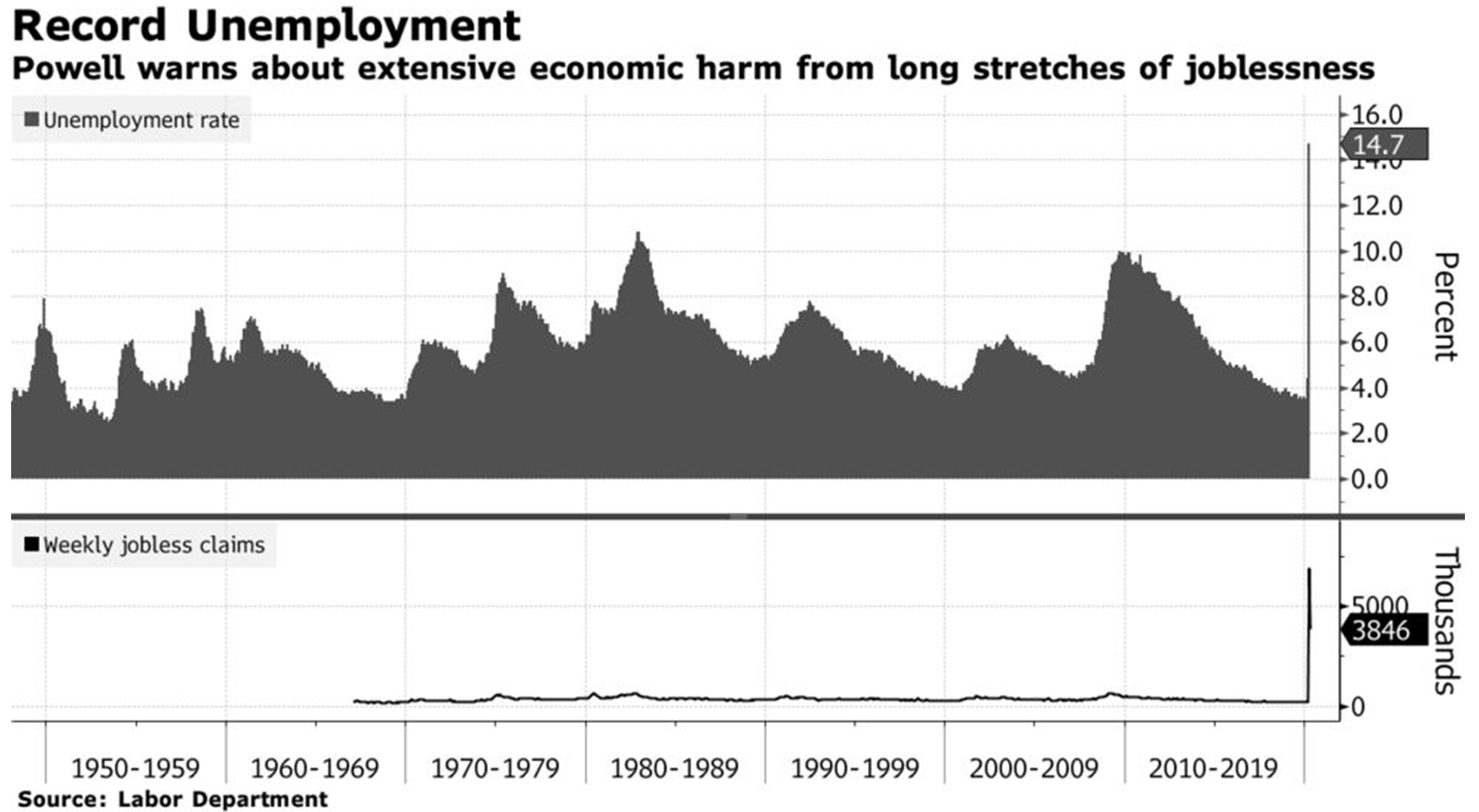

The central bank chief also conceded that jobless numbers will look a lot like they did during the 1930s, when the rate peaked out at close to 25%,

However, he said the nature of the current distress coupled with the dynamism of the U.S. and the strength of its financial system should pave the way for a significant rebound.

Asked by host Scott Pelley whether unemployment would be 20% or 25%, Powell said, “I think there’re a range of perspectives. But those numbers sound about right for what the peak may be.” Pressed on whether the U.S. is headed for a “second depression,” he replied, “I don’t think that’s a likely outcome at all. There’re some very fundamental differences.”

In a part of the interview that did not air, Powell said shrinkage of U.S. economic growth “could easily be in the 20s or 30s,” according to a CBS transcript.

He said that growth could return in the third quarter.

“I think there’s a good chance that there’ll be positive growth in the third quarter. And I think it’s a reasonable expectation that there’ll be growth in the second half of the year,” Powell said. “I would say though we’re not going to get back to where we were quickly. We won’t get back to where we were by the end of the year. That’s unlikely to happen.”

Among the factors that he said are different from the Depression era are an activist Fed and a Congress that already has passed close to $3 trillion in rescue funds and is contemplating another round. Also, the cause of this downturn is not an asset bubble or another associated more fundamental reason but rather a self-induced economic freeze brought on by efforts to combat the coronavirus.

Those efforts have led to 36.5 million Americans filing unemployment claims over the past two months and an unemployment rate currently at 14.7% and headed higher.

“In this case, you have governments around the world and central banks around the world responding with great force and very quickly. And staying at it,” Powell said. “So I think all of those things point to what will be — it’s going to be a very sharp downturn. It should be a much shorter downturn than you would associate with the 1930s.”

The Atlanta Fed estimated Friday that the data so far in the second quarter suggest a drop in GDP of 42%. That would be far and away the worst the U.S. has seen.

Powell did not speculate on what shape the recovery would take, but estimated that the U.S. ultimately will get to where it was before the virus hit — in the midst of the longest expansion in U.S. history. He cautioned, though, that a full recovery may not happen until a vaccine is found for the coronavirus.

“So in the long run, I would say the U.S. economy will recover,” he said. “We’ll get back to the place we were in February; we’ll get to an even better place than that. I’m highly confident of that. And it won’t take that long to get there.“

Correction: A previous version of this story incorrectly quoted Chairman Powell’s projection for unemployment.

Top money manager cuts exposure, warns stocks are too expensive

PUBLISHED SUN, MAY 17 20205:00 PM EDT

Stephanie Landsman@STEPHLANDSMAN

Stocks may be coming off their worst week in about two months, but Bryn Mawr Trust’s Jeffrey Mills warns there are few bargains.

He believes Wall Street isn’t accurately pricing in pain of the economic shutdowns.

“We don’t love the risk-reward right now in the stock market,” the firm’s chief investment officer told CNBCs “Trading Nation” on Friday. “We did use the rally above 2,800 [on the S&P 500] to lighten up a little bit on equities.”

It’s a strategy he outlined on the show in late March. By mid-April, he was cutting his exposure, and it’s a move he doesn’t regret.

“The market is trading right now at about 20x forward earnings. I think that multiple is just a little bit high considering all the uncertainty out there,” said Mills, who’s also a CNBC contributor.

He’s particularly concerned about the potential for massive bankruptcies associated with the coronavirus fallout — as well as the quality of the S&P 500′s massive comeback off the March 23 low.

“Only 15%… in the S&P 500 is trading above its 200-day moving average. So, you’ve had a lot of investors crowd into a specific perceived area of safety in the market — large cap growth stocks,” noted Mills. “Look at cyclicals. Look at small caps, banks, transports. All the areas that might indicate a more durable recovery in the economy. They’re all stuck below 2018 lows.”

Plus, Mills suggests it’s hard to firmly rely on Street estimates. According to Mills, earnings and economic estimates could be all over the map because the unprecedented shutdowns are putting forecasters in uncharted territory.

“To predict exactly where the data is going to come in relative to expectations, it’s just really, really difficult,” he said. “We are inventing new charts to even capture some of the data we’re seeing.”

He doesn’t expect to put new money to work in stocks until the markets stabilize.

“When people ask me, ‘How should I be invested? I need this money in one or even two years’ time.′ I tell them they probably shouldn’t even be in the stock market at all,” said Mills, who added the advice applies more than ever.

For now, he’s partial to having more cash than usual on the sidelines. He’s also looking to the bond market.

“There’s still opportunity in areas like investment grade credit. Credit spreads are still pretty wide,” Mills said. “They’re at levels that we saw in 2015-2016, when there were issues with oil.”

Worst-performing S&P 500 sector this month is no-touch right now, traders agree

PUBLISHED FRI, MAY 15 20201:25 PM EDT

The S&P 500 has come under pressure this month, and it’s been even worse for one of its sectors.

The real estate investment trusts sector, or REITS, has fallen more than 10%. That makes it the worst performer in May with losses more than three times the broader S&P 500. The group has been hit hard by dire forecasts for commercial real estate as companies reassess their need for office space during and after the coronavirus pandemic.

It could get worse for the beaten-down group, said Michael Bapis, managing director of Vios Advisors at Rockefeller Capital Management.

“We’re very cautious on the space. I mean, I think earnings are going to be reset in general across all companies. And in this particular space, there are so many uncertain and unpredictable variables such as rent collection, such as financing debt, leverage and across so many sectors,” Bapis said Thursday on CNBC’s “Trading Nation.”

Even one potential reason for owning REITS – a healthy dividend yield – does not hold appeal for Bapis.

“Short term, we’re advising our clients to turn elsewhere for yield – pharma, tech, telecom, banking, other sectors you can get yield. Most people have bought REITS in the past for their attractive dividend yields,” said Bapis.

The REITS sector yields 3.8%, higher than the 2% for the S&P 500.

Todd Gordon, managing director at Ascent Wealth Partners, is also tapping the brakes on REITS.

“We have been reducing our exposure to REITS at Ascent and we are cautious on the sector going forward,” Gordon said in the same segment. “In the event that this does get worse and there’s a black swan event, a highly levered asset like this is the richest part of the equity piece of the capital stack so last to collect.”

The charts also suggest that this is a sector to avoid, said Gordon.

“Just over March, you can see the lower part of this chart, you’re seeing the ratio — real estate into the S&P 500 — dropping so real estate was underperforming on that last part of the sell-off as well as the recovery back so we continue to remain cautious,” said Gordon.

The XLRE REITS ETF is down 21% this year. The S&P 500, by comparison, has fallen 12%.

Powell Says Recovery Could Drag Through 2021, Fed Has More Ammo

By Alister Bull

May 17, 2020, 9:31 AM MDT Updated on May 17, 2020, 5:37 PM MDT

Sign up here for our daily coronavirus newsletter on what you need to know, and subscribe to our Covid-19 podcast for the latest news and analysis.

The U.S. economy will recover from the coronavirus pandemic, but the process could stretch through until the end of next year and depend on the delivery of a vaccine, said Federal Reserve Chairman Jerome Powell.

“Assuming there’s not a second wave of the coronavirus, I think you’ll see the economy recover steadily through the second half of this year,” the U.S. central bank chief said in a television interview conducted Wednesday, parts of which were aired on CBS’s “Face the Nation” and “60 Minutes” shows on Sunday.

“For the economy to fully recover people will have to be fully confident, and that may have to await the arrival of a vaccine,” said Powell, seated in the Fed’s stately boardroom at the long table used to deliberate monetary policy. His interviewer was seated at a socially safe distance at the end of the table.

More than 36 million Americans have lost their jobs since February as the economy shuttered to limit virus spread. Countless companies, especially small businesses, are hurtling toward bankruptcy, while states and cities are confronting gaping budget shortfalls that could provoke a massive second wave of layoffs from the public sector.

To limit the harm, Powell and his colleagues have slashed interest rates to zero, flooded financial markets with trillions of dollars in liquidity, and unveiled nine emergency lending facilities to keep credit flowing in the economy.

Negative Rates

Some investors have bet the Fed may be pushed to follow other central banks in adopting negative interest rates, which President Donald Trump has repeatedly called for in the U.S.

Fed officials including Powell have consistently batted this idea away, and he did so again on Sunday. “I continue to think, and my colleagues on the Federal Open Market Committee continue to think, that negative interest rates is probably not an appropriate or useful policy for us here in the United States,” he said, according to a transcript of the full interview. “There’s no clear finding that it actually does support economic activity on net. And it introduces distortions into the financial system, which I think offset that.”

‘Take a While’

The Fed chief said people should never “bet” against the American economy and firmly played down suggestions that if faced a second Great Depression. But he took care not to promise a swift, so-called V-shaped rebound.

“This economy will recover. It may take a while,” he said. “It could stretch through the end of next year. We really don’t know.”

Powell also stressed that the central bank hadn’t exhausted its options for aiding the economy.

“There’s a lot more we can do. We’ve done what we can as we go. But I will say that we’re not out of ammunition by a long shot,” he said. Powell noted the Fed can increase its emergency lending programs and make monetary policy more supportive through forward guidance and by adjusting the Fed’s asset-purchase strategy.

That could be a veiled reference to yield curve control, where the Fed undertakes to hold yields out to a certain maturity at a certain level, as the Bank of Japan already does. Some analysts expect the Fed to move in that direction later this year.

Read More: Powell Steps Gently Onto Congress’s Turf With Spend-More Message

Fiscal Policy

Powell’s remarks follow his grave warning Wednesday that the U.S. economy faces lasting harm from the pandemic if the government doesn’t step up. The comments add support to calls for more congressional spending as Democrats push for a fresh $3 trillion in virus aid on top of a record $2.2 trillion package agreed in March. On Friday, the House passed the measure, though it has no future in the Republican-led Senate.

Powell can expect questions on the scale and timing of additional fiscal relief when he appears before the Senate Banking Committee on Tuesday.

Pressed on the question during the CBS interview, Powell said providing more congressional support to state and local governments was “something that deserves a careful look,” and also cited the need for policies to limit business insolvencies and keep workers in their jobs and homes.

He also declined to be drawn into the debate on when the U.S. economy should reopen, beyond saying it should happen carefully to minimize the risk of sparking more infections.

But he opened up when it came to the next time he’d feel safe sitting in a crowd to watch his hometown’s Stanley Cup-winning hockey team, the Washington Capitals.

“Certainly no sooner than next season,” he said. “Public sporting events, public concerts and things like that — those will be among the last things that can be resumed.” The National Hockey League’s 2020-2021 season is scheduled to start in October, 2020.

Bill Miller doesn’t see market as ‘dramatically overvalued,’ says Amazon could double in 3 years

PUBLISHED WED, MAY 13 20203:33 PM EDTUPDATED WED, MAY 13 20203:50 PM EDT

KEY POINTS

- “If you look at the overall market … we’re trading around 17 times the consensus on bottom-up earnings for 2021, which is about the average for the last five years,” Miller told CNBC’s “Closing Bell.”

- “It might be a little extended given we’ve got a chasm of bad news to go over here, but I don’t find is as dramatically overvalued” as others.

Bill Miller, founder of Miller Value Partners, disagreed Wednesday with the assessment made by other major investors about the market’s valuation being too high.

“If you look at the overall market … we’re trading around 17 times the consensus on bottom-up earnings for 2021, which is about the average for the last five years,” Miller told CNBC’s “Closing Bell.” “It might be a little extended given we’ve got a chasm of bad news to go over here, but I don’t find is as dramatically overvalued” as others.

Miller made his remarks after David Tepper, founder of Appaloosa Management, said earlier in the day that this market is the most overvalued he has seen since 1999. Stanley Druckenmiller, chairman and CEO of the Duquesne Family Office, said Tuesday that the “risk-reward for equity is maybe as bad as I’ve seen it in my career.”

The major averages fell sharply on Wednesday, with the Dow Jones Industrial Average, S&P 500 and Nasdaq Composite all losing around 2%. However, they are still up sharply from the March 23 lows, in part because of strong gains from major tech-related stocks such as Amazon.

Amazon is also Miller Value Partners’ largest holding, according to FactSet data. Miller noted Wednesday the stock could double in three years given the company’s efforts to “immunize” itself from future pandemic and strong position in cloud.

HI Financial Services Mid-Week 06-24-2014