HI Market View Commentary 05-17-2021

https://go.ycharts.com/weekly-pulse

| Market Recap WEEK OF MAY. 10 THROUGH MAY. 14, 2021 The S&P 500 index fell 1.4% last week, with the consumer discretionary and technology sectors leading the decline amid worries about increasing consumer and producer prices. The market benchmark ended the week at 4,173.85, down from last Friday’s closing level of 4,232.60, which was a record closing high. Despite this week’s drop, the index is up 11% for the year to date. The drop from last week’s record levels came as data showed both the US consumer price index and producer price index rose by more than expected in April. The reports raised concerns about inflation, which investors fear could dent companies’ margins and lead the Federal Reserve to end its easy monetary policies sooner. Fed officials have said inflation is transitory, but investors’ worries remain. Meanwhile, progress continued in the US on the COVID-19 front, with federal health officials saying fully vaccinated people no longer need to wear a mask or physically distance during outdoor or indoor activities, large or small. About 46% of American adults are fully vaccinated, according to the Centers for Disease Control & Prevention. The S&P 500’s weekly drop was broad, with all but three sectors in the red. The consumer discretionary sector had the largest percentage drop of the week, down 3.7%, followed by a 2.2% decline in technology. On the upside, consumer staples rose 0.4%, followed by a 0.3% increase in financials and a 0.1% lift in materials. Among the consumer discretionary sector’s decliners, Hanesbrands (HBI) shares fell 14%. The clothing company issued downbeat guidance for the second quarter and full year even after results for the just-ended period came in above Wall Street’s views. The technology sector’s decliners included Applied Materials (AMAT). Shares of the supplier of equipment, services and software for chip making shed 6.1% ahead of the company’s release next week of fiscal Q2 results. In consumer staples, shares of Tyson Foods (TSN) rose 1.9% as the food producer reported higher fiscal second-quarter earnings that beat Wall Street estimates and raised its 2021 outlook. Next week, the market will get a flurry of new readings on the housing market, with the National Association of Home Builders index for May due Monday, followed by reports on April building permits and housing starts on Tuesday, and April existing home sales on Friday. May readings on manufacturing and services purchasing managers’ indexes are also due Friday. Provided by MT Newswires |

Book Value per share:

- What a company is worth if they sold all their assets right now.

- A good reference book value is around 10% of the value of the stock price.

- A lower number implies that a stock is overvalued and a larger number implies a stock is undervalued.

- We get an idea the value of a stock based on how the book/share is in relation to the stock price. AND how the book/share relates to other companies in a similar industry/sector.

Why are we so excited about BIDU fundamentally?

- 44% of the stock price can be added as Book Value/Share

- What was a good percentage? 10%

Core Holdings:

BIDU – 5/18 AMC

COST – 5/27 AMC

Where will our markets end this week?

Lower

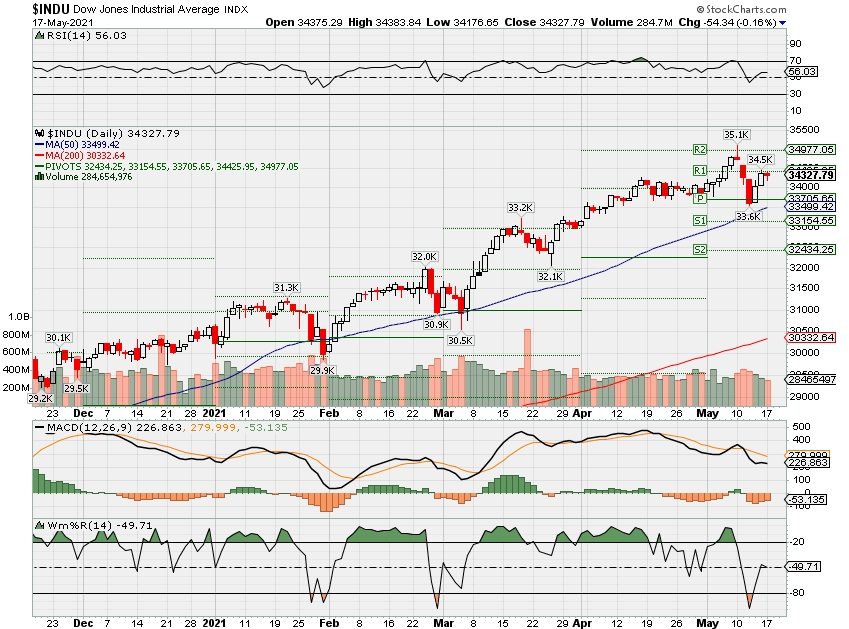

DJIA – Bullish

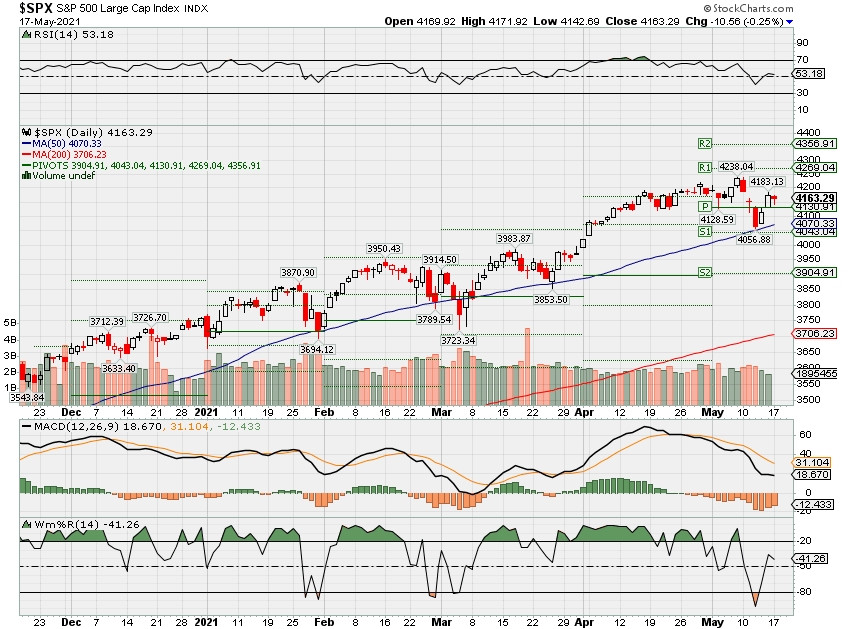

SPX – Bullish

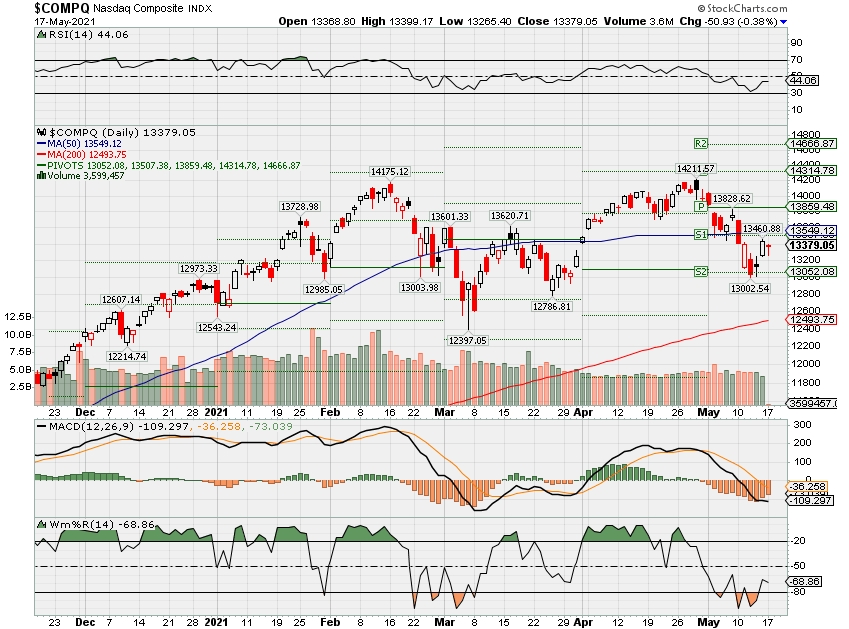

COMP – Bullish

Where Will the SPX end May 2021?

05-17-2021 4.0%

05-10-2021 4.0%

05-03-2021 4.0%

04-26-2021 4.5%

04-19-2021 2.0%

Earnings:

Mon: PRPL

Tues: HD, IQ, M, NTES, WMT, TCOM, BIDU

Wed: CCL, JD, LOW, TGT, TJX, CSCO, LB

Thur: HRL, KSS, RL, ROST

Fri: BKE, DE, FL, VFC

Econ Reports:

Mon: Empire Manufacturing, NAHB Housing Market Index, Net Long Term TIC Flows

Tues: Housing Starts, Building Permits

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Phil Fed, Leading Indicators

Fri: Existing Home Sales, OPTION EXPIRATION

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Earnings and adding protection where needed

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

J.P. Morgan Fires Back, Recruits $6.4-Mln Morgan Stanley Team

by Miriam Rozen

J.P. Morgan Advisors, the Wall Street bank’s traditional brokerage unit, nabbed a Morgan Stanley team generating $6.4 million in annual revenue with offices in Palm Beach Gardens, Florida and New York City, according to an announcement.

The four-person team who started on Friday at their new shop is a comeback for J.P. Morgan after Morgan Stanley one week ago hired a seven-person team with $8 million revenue.

The incoming J.P. Morgan team is led by 38-year broker Mark G. Donohue and oversaw $1.1 billion in client assets, according to the announcement. Donohue had ranked #12 on Forbes’ best-in-state wealth advisors list in Florida for 2021.

The group also includes 35-year industry veteran Gordon M. Sommer Jr., who is based in New York, as well as investment and client associates Butch Massaro and Steven Olson. They report to Rick Penafiel, regional director for J.P. Morgan who oversees offices in Boston, Palm Beach and Miami.

“We’re excited to welcome Mark and his award-winning team to the group of high caliber advisors at J.P. Morgan Wealth Management in Palm Beach,” Penafiel said in a written statement.

Donohue declined to comment for this story, as did a Morgan Stanley spokeswoman.

J.P. Morgan Advisors, formerly known as J.P. Morgan Securities, last month said it had replaced its chief executive, tapping former Merrill Lynch executive Phil Sieg to lead the group, which includes around 450 brokers and itself has been aiming to hire around 50 high-end teams per year.

The Advisors unit also last week said it hired a Merrill broker with $230 million in client assets.

Donohue moved to Morgan Stanley in 2011 after 26 years at RBC Wealth Management-U.S. and its Tucker Anthony Inc. predecessor, according to his BrokerCheck record. He started in the industry in 1982 at a municipal bond dealer and underwriter Gabriele Hueglin & Cashman, according to the database.

The lone disclosure on Donohue’s record, allegations based on a customer dispute, were denied.

Sommer, who started his career in 1981 at Laidlaw, Martin & Moysey, also moved to Morgan Stanley in 2011 from RBC, where he had spent two years, according to BrokerCheck. He prior to that worked for three years at J.P. Morgan Securities, and six other firms before that.

Sommer has two disclosures on his BrokerCheck record, including a 2013 judgement for $9,376 in favor of a landscaping company, and a customer dispute based on 2010 allegations of unauthorized and excessive trading that settled for $26,330 of $38,846 requested.

Elon Musk clarifies that ‘Tesla has not sold any Bitcoin’

PUBLISHED SUN, MAY 16 20214:15 PM EDTUPDATED MON, MAY 17 20215:48 AM EDT

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- In an early Monday morning tweet, Tesla CEO Elon Musk said the company “has not sold any Bitcoin.”

- In a Twitter exchange Sunday afternoon, Musk had implied that the electric vehicle maker sold or may sell the rest of its bitcoin holdings, sending the price of the cryptocurrency down.

- Musk has been a big supporter of cryptocurrencies, helping rally the prices of digital coins, including bitcoin, several times in the past year.

Tesla CEO Elon Musk clarified in a tweet early Monday that the electric vehicle maker “has not sold any Bitcoin.”

“To clarify speculation, Tesla has not sold any Bitcoin,” Musk said in a tweet.

The price of bitcoin saw a partial recovery, trading at $44,680 as of 2:35 a.m. ET Monday, according to data from Coin Metrics.

Earlier, bitcoin’s price had tumbled below $43,000 after Musk implied in a Twitter exchange Sunday afternoon that the electric vehicle maker sold or may sell the rest of its bitcoin holdings.

A Twitter user who goes by @CryptoWhale said, “Bitcoiners are going to slap themselves next quarter when they find out Tesla dumped the rest of their holdings. With the amount of hate @elonmusk is getting, I wouldn’t blame him…”

Musk replied, “Indeed.”

The exchange came just days after Musk said the company planned to hold rather than sell the bitcoin it already has and intended to use it for transactions as soon as mining transitions to more sustainable energy. Tesla did not immediately respond to a request for comment.

Musk has been a big supporter of cryptocurrencies, helping rally the prices of digital coins, including bitcoin, several times in the past year. In an SEC filing in February, Tesla revealed that it bought $1.5 billion worth of bitcoin. The company later said it registered a net gain of $101 million from sales of bitcoin during the quarter, helping to boost its net profits to a record high in the first quarter.

However, Musk seems to have reversed course in recent weeks in favor of dogecoin, the meme-inspired cryptocurrency. Tesla last week also “suspended vehicle purchases using bitcoin,” out of concern over “rapidly increasing use of fossil fuels for bitcoin mining.” The price of bitcoin dropped about 5% in the first minutes after Musk’s announcement.

Musk has since been hitting back on Twitter against users who are critical of his cryptocurrency stance. Influential venture investor Fred Wilson, a founding partner of Union Square Ventures, tweeted Friday: “He’s playing games. It is hard to take anyone who does that seriously. I’ve lost enormous respect for him over the last year because of it.”

Wilson added, “Deep respect for what he does with his talents. Less for what he does with his tweets.”

Musk is also pushing further into dogecoin. His aerospace venture, SpaceX, announced last week it would accept dogecoin as payment to launch “DOGE-1 mission to the Moon.” His endorsements have helped boost the price of the coin, pushing acceptance among some traders.

Crypto exchange platform Coinbase has said it would offer the digital coin in the next six-to-eight weeks. Other popular trading platforms among retail investors, Robinhood and Binance, already allow users to trade dogecoin.

Governments are deploying ‘wartime-like’ efforts to win the global semiconductor race

PUBLISHED MON, MAY 17 20211:25 AM EDTUPDATED MON, MAY 17 20214:53 AM EDT

KEY POINTS

- South Korea became the latest country to announce a colossal investment in the industry last week.

- The nation’s government said Thursday that 510 trillion South Korean won ($452 billion) will be invested in chips by 2030.

- The bulk of that will come from private companies in the country.

Tiny pieces of silicon with intricate circuits on them are the lifeblood of today’s economy.

These clever semiconductors make our internet-connected world go round. In addition to iPhones and PlayStations, they underpin key national infrastructure and sophisticated weaponry.

But recently there haven’t been enough of them to meet demand.

The reasons for the ongoing global chip shortage, which is set to last into 2022 and possibly 2023, are complex and multifaceted. However, nations are planning to pump billions of dollars into semiconductors over the coming years as part of an effort to sure up supply chains and become more self-reliant, with money going toward new chip plants, as well as research and development.

South Korea became the latest country to announce a colossal investment in the industry last week. The nation’s government said Thursday that 510 trillion South Korean won ($452 billion) will be invested in chips by 2030, with the bulk of that coming from private companies in the country.

Abishur Prakash, a geopolitical specialist at the Center for Innovating the Future, a Toronto-based consulting firm, told CNBC by email that it’s a “a wartime-like effort by South Korea to build future security and independence.”

“By building massive chip capabilities, South Korea will have the power to decide its own trajectory, instead of being forced in a specific direction,” added Prakash. “This is also about not depending on China or Taiwan. By investing hundreds of billions of dollars, South Korea is ensuring that it is not pegged to other nations for its critical technology needs.”

Through the so-called “K-Semiconductor Strategy,” the South Korean government said it will support the industry by offering tax breaks, finance, and infrastructure.

In a speech on May 10, South Korean President Moon Jae-in said: “Amid the global economy’s grand transformation, semiconductors are becoming a sort of key infrastructure in all industrial areas.”

He added: “While solidly keeping the status of our semiconductor industry as the world’s best, we will safeguard our national interests by using the current semiconductor boom as an opportunity for a new leap forward.”

But South Korea isn’t leading on all fronts. “In sheer manufacturing capacity, Taiwan is #1 and South Korea is #2, with the U.S. in third place and China gaining quickly,” Glenn O’Donnell, VP and research director at analyst firm Forrester, told CNBC.

South Korea has a commanding lead in memory chips with a 65% share, largely thanks to Samsung, he said. He added that Asia as a whole dominates in manufacturing, with 79% of all the world’s chips produced on the continent in 2019.

O’Donnell said it’s “difficult to say” whether the investment will help South Korea seize the global chipmaking crown in the way that it wants to. “This is a monumental investment, but the U.S., Taiwan’s TSMC, and the Chinese are also investing heavily,” he said.

Deep pockets

South Korea’s investment is being led by two of its biggest chip firms: Samsung Electronics and SK Hynix.

Samsung Electronics — the nation’s biggest chipmaker and a rival to Taiwan’s TSMC — is planning to invest 171 trillion won in non-memory chips through 2030, raising its previous investment target of 133 trillion won, which was announced in 2019.

Elsewhere, SK Hynix, a semiconductor supplier of dynamic random-access memory (DRAM) chips and flash memory chips, is planning to spend 230 trillion won in the next decade. A spokesperson for SK Hynix told CNBC that the company will spend 110 trillion won on its existing production sites in Icheon and Cheongju between now and 2030. It is also investing 120 trillion won into four new factories in Yongin, and separately plans to double the amount of chips it produces at its foundry business.

Prakash said the world should be shocked at the size of the South Korea’s overall war chest. “With almost half a trillion dollars, and the involvement of more than 150 companies, South Korea is moving mountains to secure its place in the future,” he said.

U.S., China and EU also investing

South Korea’s pledge comes after U.S President Joe Biden proposed a $50 billion plan for chipmaking and research, while China’s Xi Jinping has pledged to spend on high-tech industries, with a big emphasis on semiconductors. The EU said in March it wants 20% of the world’s semiconductors to be manufactured in Europe by 2030, up from just 10% in 2010.

“In the ongoing battle for dominance in the technology field, all nations are jockeying for that all-important designation as the key supplier to the world,” said Forrester’s O’Donnell. “South Korea, Japan, the U.S., Taiwan, the EU, and China all covet that gold medal in the Tech Olympics podium.”

O’Donnell noted that it takes about two years to build a chip manufacturing plant, or a fab. “Each fab will cost upwards of $10 billion, but all the money in the world won’t solve the chip shortage quickly nor will it guarantee that gold medal.”

He added: “Geopolitical tensions also play into the dynamics. South Korea always lives under the threat from North Korea that will destabilize its tech position if things heat up too much across the DMZ. Taiwan, arguably the biggest current semiconductor supplier faces a similar threat as tensions heat up with mainland China.”

Outside South Korea, all of the major chip manufacturers have announced big investments of their own.

TSMC has pledged to spend $100 billion over three years to grow its production capacity, while Intel is planning to build two new factories in Arizona with $20 billion. Both companies have also been in discussions about a new European factory, according to reports.

Elsewhere, Chinese chipmaker SMIC said Friday it is working rapidly to expand capacity with some plans moving ahead of schedule. Haijun Zhao, the CEO, said on an earnings call that semiconductor demand in every customer segment continues to exceed supply.

SMIC posted a 22% jump in first quarter sales to $1.1 billion and raised its sales outlook for the first half of the year.

Dow drops more than 100 points to start the week as tech shares lag

PUBLISHED SUN, MAY 16 20216:06 PM EDTUPDATED 10 MIN AGO

Persistent weakness in technology stocks kept the major indexes under pressure on Monday after last week’s hotter-than-expected inflation readings sparked a downturn in equity markets.

The Dow Jones Industrial Average fell 120 points, or 0.4%, as Home Depot and Boeing weighed on the blue-chip index. The S&P 500 lost 0.5% as the tech sector pulled back more than 1%. The Nasdaq Composite fell 0.9%.

Big Tech quickly came under pressure to start the week, with Apple and Facebook each down 0.8%, Netflix down 1% and Google-parent Alphabet shedding 0.6%. Traders have punished the technology sector in recent weeks amid a broader shift out of growth stocks and into cyclical, reopening trades in energy, financials and materials.

Communication services stocks Discovery and AT&T bucked that trend, both up on news of a merger agreement. AT&T announced Monday that it is in advanced talks to merge WarnerMedia, which includes HBO, with Discovery. The new entity will trade as its own public company.

Discovery’s Class C stock rose 17.3%, while AT&T added about 4%.

Wall Street came off one of the wildest weeks of 2021 that saw the S&P 500 fall 4% through midweek amid heightened inflation fears. The broad equity benchmark eventually rebounded and ended the week down just 1.4%.

The tech-heavy Nasdaq Composite, which got hit particularly hard by inflation fears, dropped 2.3% last week. The blue-chip Dow fell 1.1% in that period. All three benchmarks posted their worst week since February 26.

“Not only are [last] week’s events a warning sign of how uncomfortable inflation prints can become but also a warning sign of how overbought equity markets have become,” Nikolaos Panigirtzoglou, a managing director at JPMorgan, said in a note.

Data last week showed the Consumer Price Index jumped 4.2% from a year earlier in April, the fastest rate since 2008, which intensified fears that the Federal Reserve could be forced to start tapering its easy monetary policy if higher price pressures are sustained.

The Fed’s minutes from its last meeting, which will be released Wednesday, could offer some clues on policymakers’ thinking on inflation.

Bitcoin was taken for a wild ride overnight Sunday. Earlier, the price tumbled below $43,000 after Elon Musk implied in a Twitter exchange that Tesla may have dumped its bitcoin holdings. Last week, Tesla said it would no longer accept bitcoin for car purchases due to environmental concerns.

Bitcoin then rebounded some after Musk later clarified in a tweet that the electric vehicle maker “has not sold any Bitcoin.” The price was last at $45,505. Tesla stock lost 1.5%.

Elsewhere, the first-quarter earnings season is wrapping up with more than 90% of the S&P 500 companies having reported their results. So far, 86% of S&P 500 companies have reported a positive EPS surprise, which would mark the highest percentage of positive earnings surprises since 2008 when FactSet began tracking this metric.

Walmart, Home Depot and Macy’s will deliver earnings on Tuesday.

“Investor and equity analyst reactions to earnings results reveal skepticism that 1Q beats provide a reason for additional forward-looking optimism,” wrote David Kostin, Goldman Sachs’ chief U.S. equity strategist. “Firms that beat EPS estimates typically outperform the S&P 500 by 100 [basis points] the day after reporting. However, the typical stock that beat on EPS this quarter outperformed by just 51 [basis points], continuing the trend from 2020.”

https://www.advisorperspectives.com/dshort/updates/2021/05/12/components-of-the-cpi-april-2021

Components of the CPI: April 2021

by Jill Mislinski, 5/12/21

Note: The charts in this commentary have been updated to include today’s Consumer Price Index news release.

Back in 2010, the Fed justified its aggressive monetary policy “to promote a stronger pace of economic recovery and to help ensure that inflation, over time, is at levels consistent with its mandate” (full text). In effect, the Fed has been trying to increase inflation, operating at the macro level. More recently, in August of 2020, Fed Chairman Jerome Powell has introduced a policy that not only allows for a level above 2% but welcomes it. But what does inflation mean at the micro level — specifically to your household?

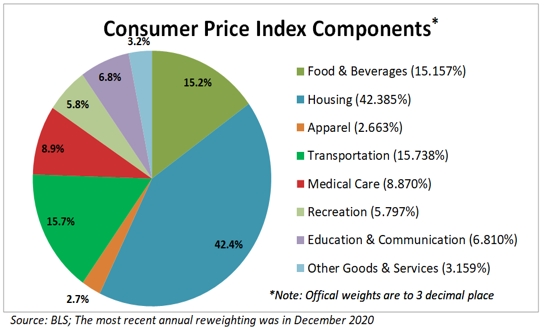

Let’s do some analysis of the Consumer Price Index, the best-known measure of inflation. The Bureau of Labor Statistics (BLS) divides all expenditures into eight categories and assigns a relative size to each. The pie chart below illustrates the components of the Consumer Price Index for Urban Consumers, the CPI-U, which we’ll refer to hereafter as the CPI.

The slices are listed in the order used by the BLS in their tables, not the relative size. The first three follow the traditional order of urgency: food, shelter, and clothing. Transportation comes before Medical Care, and Recreation precedes the lumped category of Education and Communication. Other Goods and Services refers to a bizarre grab-bag of odd fellows, including tobacco, cosmetics, financial services, and funeral expenses. For a complete breakdown and relative weights of all the subcategories of the eight categories, here is a useful link.

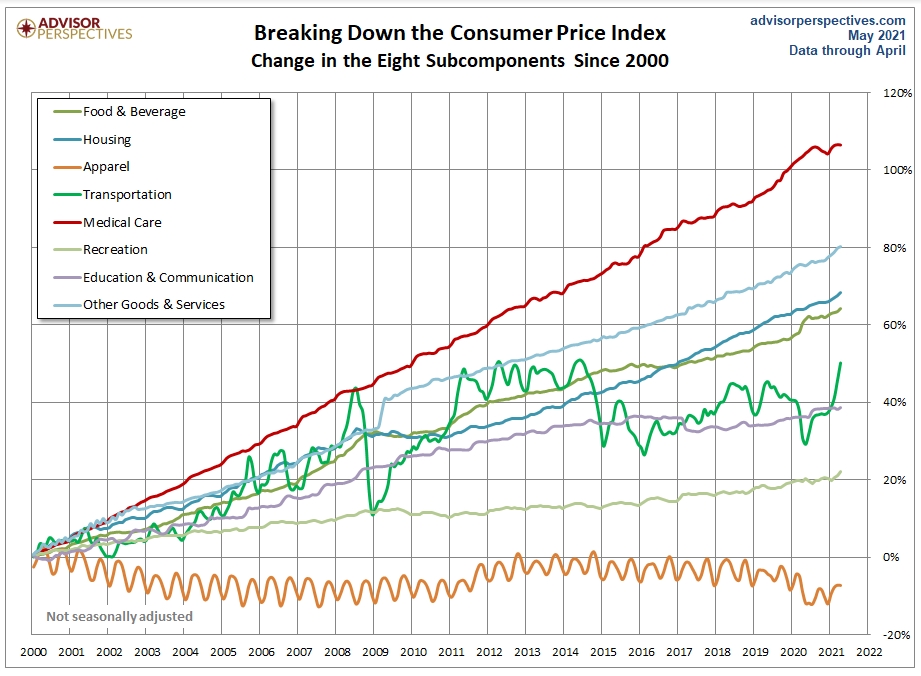

The chart below shows the cumulative percent change in price for each of the eight categories since 2000.

Not surprisingly, Medical Care has been the fastest-growing category. At the opposite end, Apparel deflated since 2000. Another unique feature of Apparel is the obvious seasonal volatility of the contour.

Transportation is the other category with high volatility — much more dramatic and irregular than the seasonality of Apparel. Transportation includes a wide range of subcategories. The volatility is largely driven by the Motor Fuel subcategory. For a closer look at gasoline, see this chart in our weekly gasoline update.

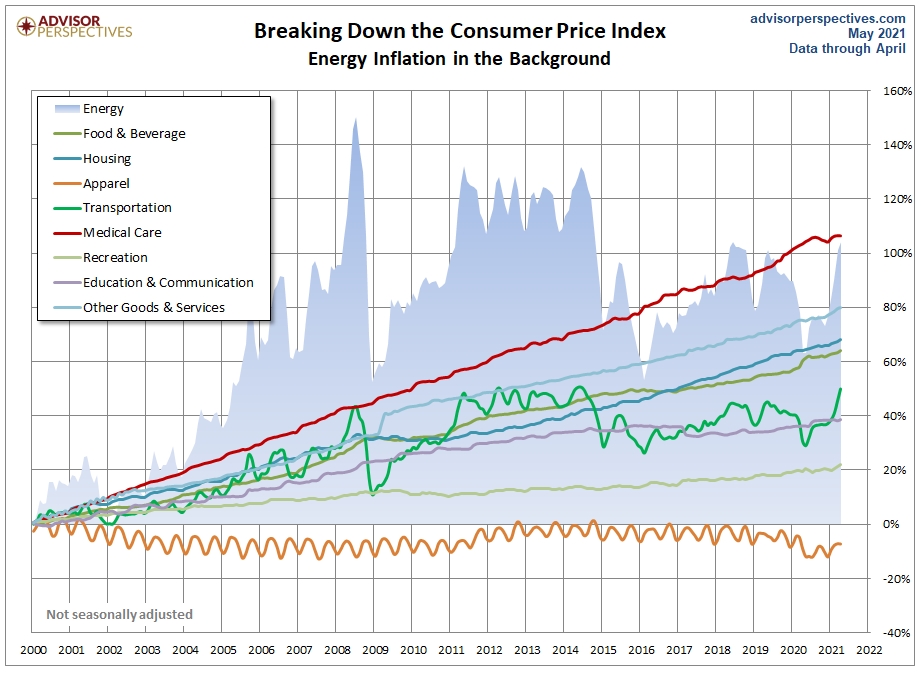

The Ominous Shadow Category of Energy

The BLS does not lump energy costs into an expenditure category. Instead, it includes energy subcategories in Housing in addition to the fuel subcategory in Transportation. Also, energy costs are indirectly reflected in expenditure changes for goods and services across the CPI.

The BLS does track Energy as a separate aggregate index, which in recent years has been assigned a relative importance of 6.155 out of 100. In other words, Uncle Sam calculates inflation on the assumption that energy in one form or another constitutes 6.2% of total expenditures, 2.8% goes to transportation fuels — mostly gasoline (this is included in the “Transportation” category). The next chart overlays the highly volatile Energy aggregate on top of the eight expenditure categories. We can immediately see the impact of energy costs on transportation.

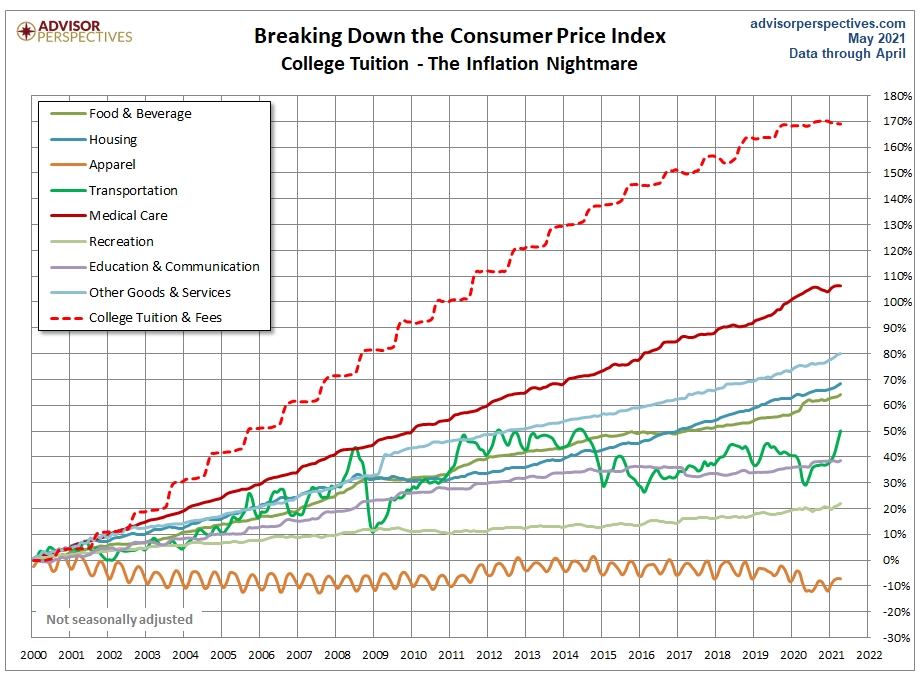

The next chart will come as no surprise to families footing the bill for college tuition. Here we’ve separately plotted the College Tuition and Fees subcategory of the Education and Communication expenditure category. Note that the steady staircase in this cost matches the annual cost increases in late summer for each academic year.

The tuition series in the chart above, however, is overly dramatic. The BLS calculates tuition based on the sticker price, which is higher than many, if not most, households pay. A New York Times piece, How the Government Exaggerates the Cost of College, explains that the government data ignores financial-aid grants which substantially lowers the real cost to consumers. For a more accurate view on college tuition, see the statistics at the College Board website.

Core Inflation

Economists and policymakers (e.g., the Federal Reserve) pay close attention to Core Inflation, which is the overall inflation rate excluding Food and Energy. Now this is a somewhat peculiar metric in that one of the exclusions, Energy, is an aggregate that combines specific pieces of two consumption categories: 1) Transportation fuels and 2) Housing fuels, gas, and electricity. The other, Food, is a major part of the Food and Beverage category. Note that “beverage” for the BLS means alcoholic beverages. So coffee and Coca-Colas are excluded from Core Inflation, but Budweiser and Jack Daniels aren’t.

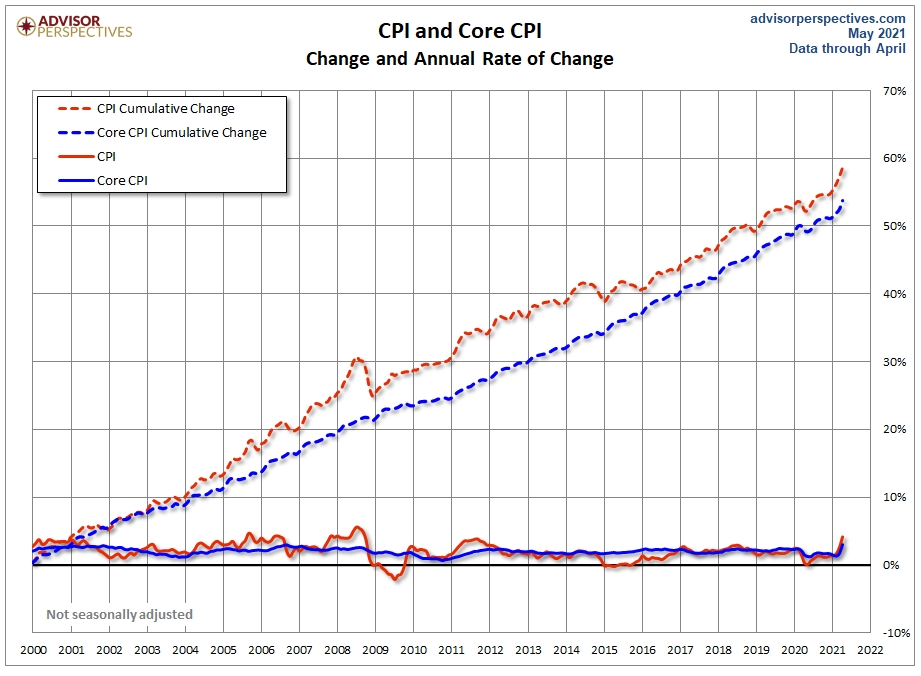

The next chart shows us the annualized rate of change (solid lines) and the cumulative change (dotted lines) in CPI and Core CPI since 2000.

Consumers, especially those who’ve managed expenses over several years, are most closely attuned to the top line.

Inflation and Your Household

The universal response is to moan over price increases and take delight when prices are cheaper. But in reality, households vary dramatically in the impact that inflation has upon them. When gasoline prices skyrocket, a two-earner suburban family with long car commutes suffers far more than the metro family with short subway commutes or retirees with no commute. And the pain is even more extreme for low-income households whose grocery money shrinks when gas prices rise. And remember, Uncle Sam excludes energy costs from Core Inflation.

Households with high medical costs are significantly more vulnerable than comparable households with low expenses in this category.

The BLS weights College Tuition and Fees at 1.569% of the total expenditures. But for households with college-bound children, the relentless growth of tuition and fees can cripple budgets. Often those costs get bundled into loans that saddle degree recipients with exorbitant debt burdens. Of course, the Federal Reserve would point out that the right dose of Core Inflation (extended of course to wages) would enable debt-burdened college grads to pay down their loans with inflated dollars.

Which brings us back to the Fed’s efforts to manage the level of Core Inflation. At the macro level, the Fed can doubtless make a theoretical case for manipulating inflation. But have their efforts — ZIRP and Quantitative Easing — achieved the desired goal?

As of April, headline and core CPI are now both well above the 2% benchmark.

One thing we can be certain about is this: Inflation volatility has a painful effect on lower income households, those on fixed incomes, those with higher ratios of tuition, transportation, or medical costs … and all households whose discretionary spending is more dream than reality.