HI Market View Commentary 05-11-2020

Welcome to the weirdest market EVER !!!

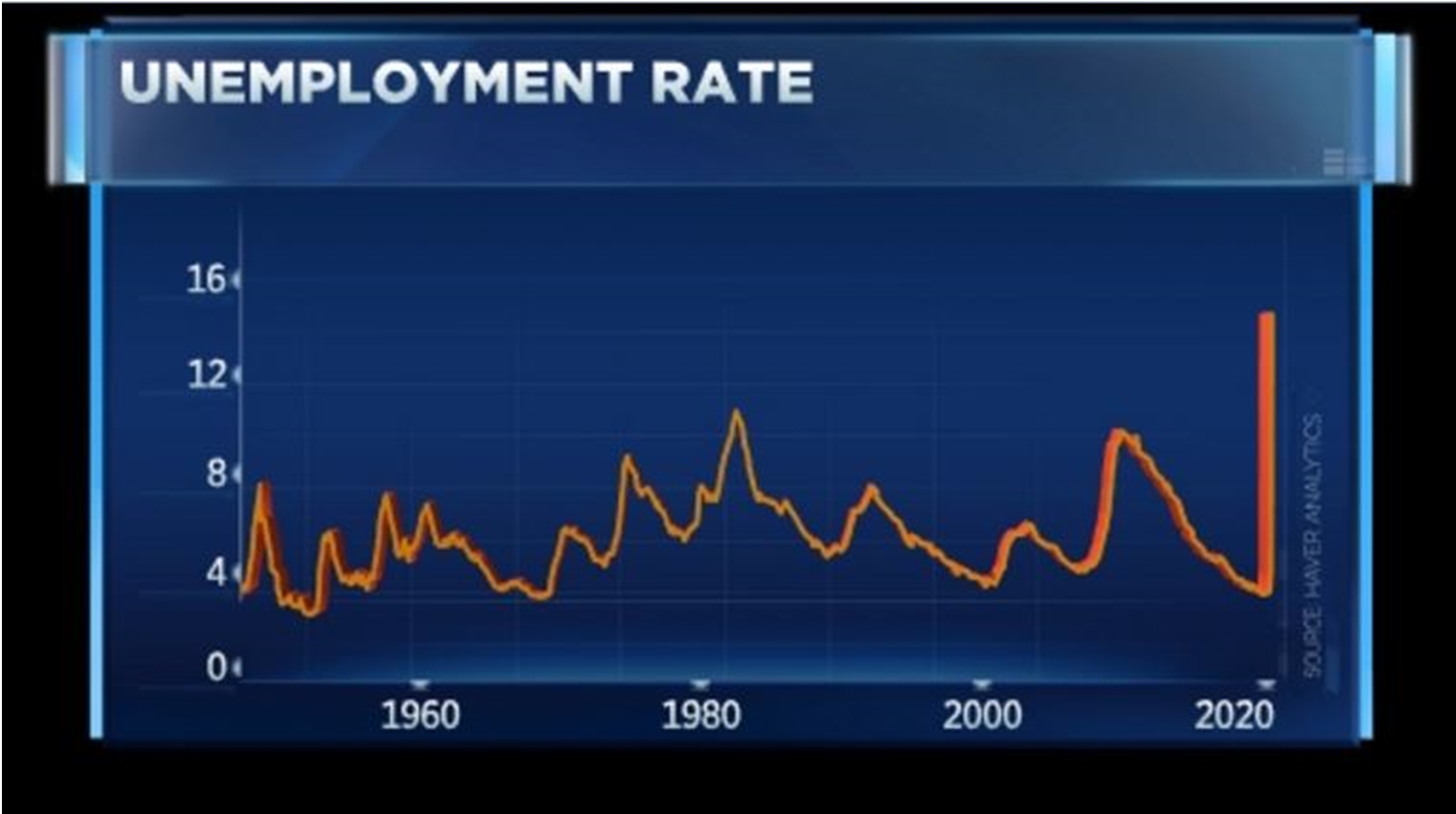

It starts with last Friday !!! 14.7% unemployment rate

The losses are much worse than reported

There is a disconnect to our markets right now. There is no reason that the markets should be moving higher.

Remember this is NO PREDICTIVE Model available for the outcome of this pandemic

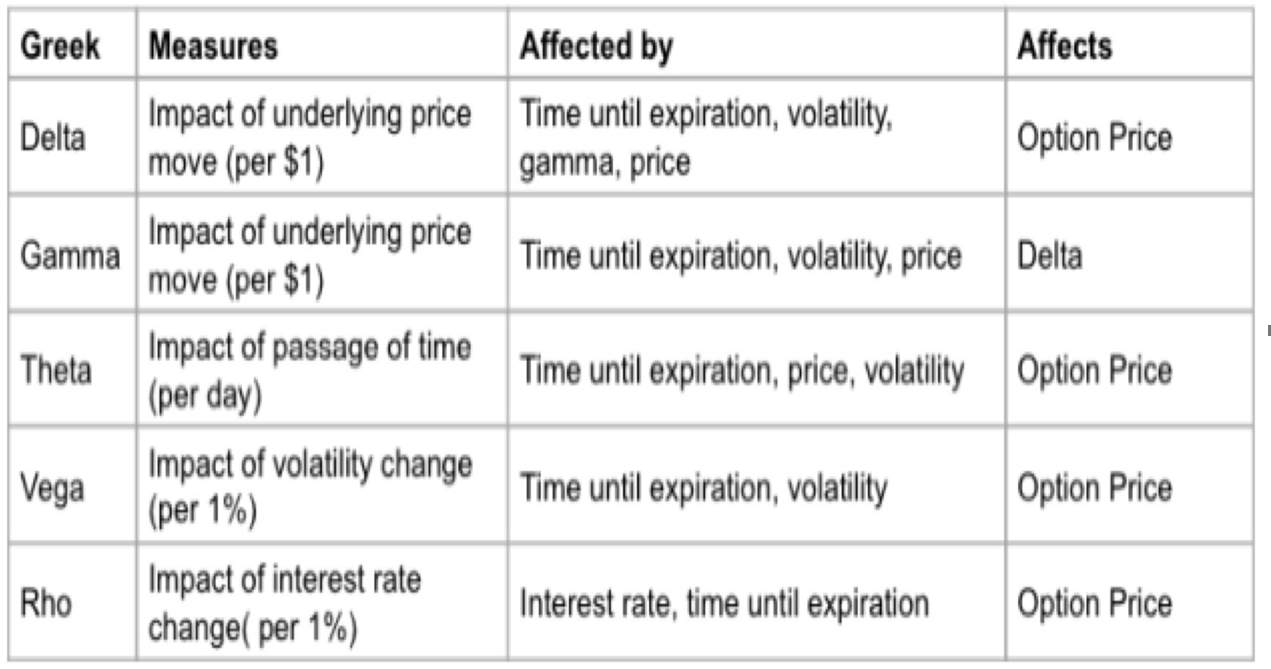

Options are not being priced correctly

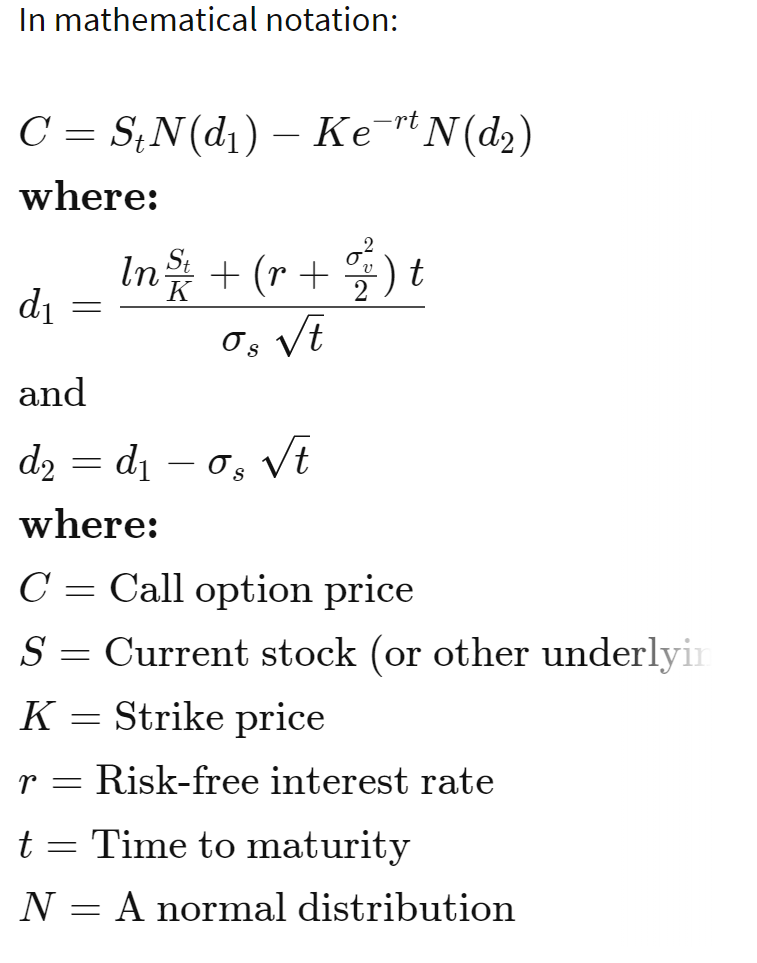

The Black-Scholes Formula

The Black Scholes model is perhaps the best-known options pricing method.

Remember the pricing of options is done through the use of theoretical data which means there are times you get screwed up theoretical pricing that will frustrate the crap out of you !!!

There pricing Model = Black Sholes Doesn’t work because pricing includes volume, open interest and one variable messes up the whole model

https://go.ycharts.com/weekly-pulse?utm_campaign=Pulse&utm_source=hs_email&utm_medium=email&utm_content=87710301&_hsenc=p2ANqtz-9jdE5XTH9iMDnA3w6p_3YXvX6i6msKR4u4V7POzrhOxJi0ktt6IATt6Mh9NQuoo4jLlLRdPqy_Sw5NP876ksNgS4VzpIAQFVihL3mFL3HR_sjUiUM&_hsmi=87710301

https://go.ycharts.com/weekly-pulse?utm_campaign=Pulse&utm_source=hs_email&utm_medium=email&utm_content=87710301&_hsenc=p2ANqtz-9jdE5XTH9iMDnA3w6p_3YXvX6i6msKR4u4V7POzrhOxJi0ktt6IATt6Mh9NQuoo4jLlLRdPqy_Sw5NP876ksNgS4VzpIAQFVihL3mFL3HR_sjUiUM&_hsmi=87710301

| Market Recap |

| WEEK OF MAY. 4 THROUGH MAY. 8, 2020 |

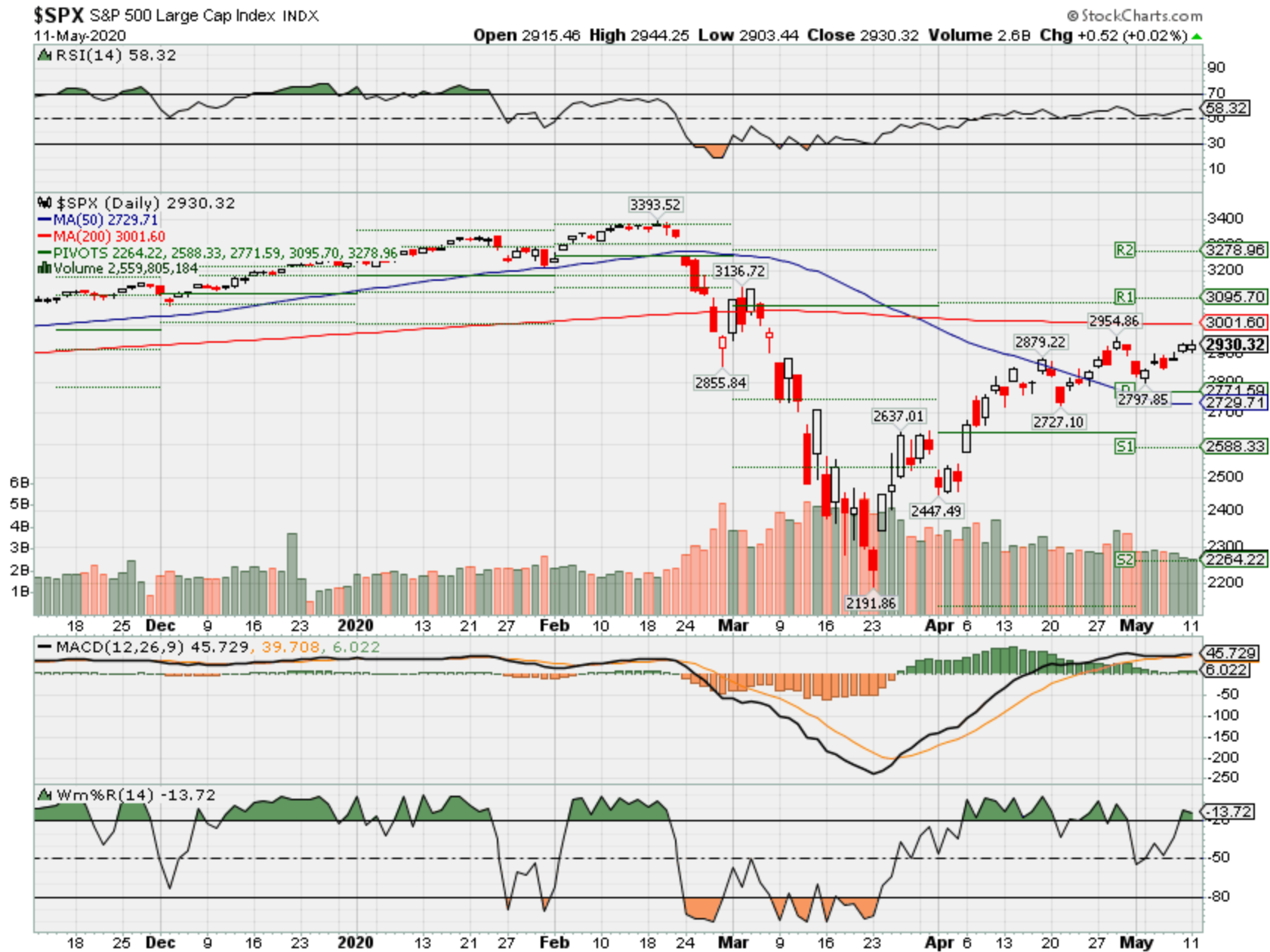

| The S&P 500 rose 3.5% last week even as Warren Buffett bailed out of airline stocks, a key services sector index fell to an 11-year low and the Labor Department unleashed its worst market report in history as Wall Street disconnected from the harsh economic realities of the COVID-19 pandemic.

The benchmark average closed at 2,929.80 versus last week’s close of 2,830.71. The gains were mostly broad-based throughout all sectors of the benchmark index although an aberrant drop in Treasury yields in the midst of a risk-on rally weighed on the utility sector, which increased by just 0.5%. Among the names in the sector, NiSource (NI) came in at the bottom as a result of the company’s disappointing earnings report on Wednesday. As oil futures continued to recoup April’s losses, the energy sector was again at the top of the S&P leader board with a gain of 8.2% from last Friday’s close. Of the major oil producers, Chevron (CVX) outperformed with a 6.7% increase in share price from last Friday. The tech sector, with a 6.6% gain from the week prior, was propped up by better-than-expected results from Fortinet (FTNT), a price target hike from BofA to ServiceNow (NOW), and a surge in online transactions that fueled a record high in shares of PayPal (PYPL) on Thursday. A relief rally early this week in financials helped keep the sector above water, higher by 1.0%, largely on advances in shares of Arthur J. Gallagher (AJG) and Willis Towers Watson (WLTW), both of which reported their best week in a month with an 11.5% and 7.6% gain, respectively. Weighed down by Warren Buffett’s decision to give up on airline stocks, the industrial sector struggled to stay positive this week. Falling to the bottom of the sector was the entire airline space with the biggest carriers taking the brunt of Buffett’s rebuff. Although shares of United (UAL), American (AAL), and Delta (DAL) regained some lost ground, the sector could only eke out a more modest by comparison gain of 1.4% gain. The S&P 500 gained despite the ISM non-manufacturing index registering a 41.80 print on Tuesday, the lowest level since March 2009. On Friday, the Bureau of Labor Statistics said nonfarm payrolls fell by 20.5 million in April, the worst month-to-month decline since record-keeping started in 1939, dropping employment to its lowest level since February 2011. |

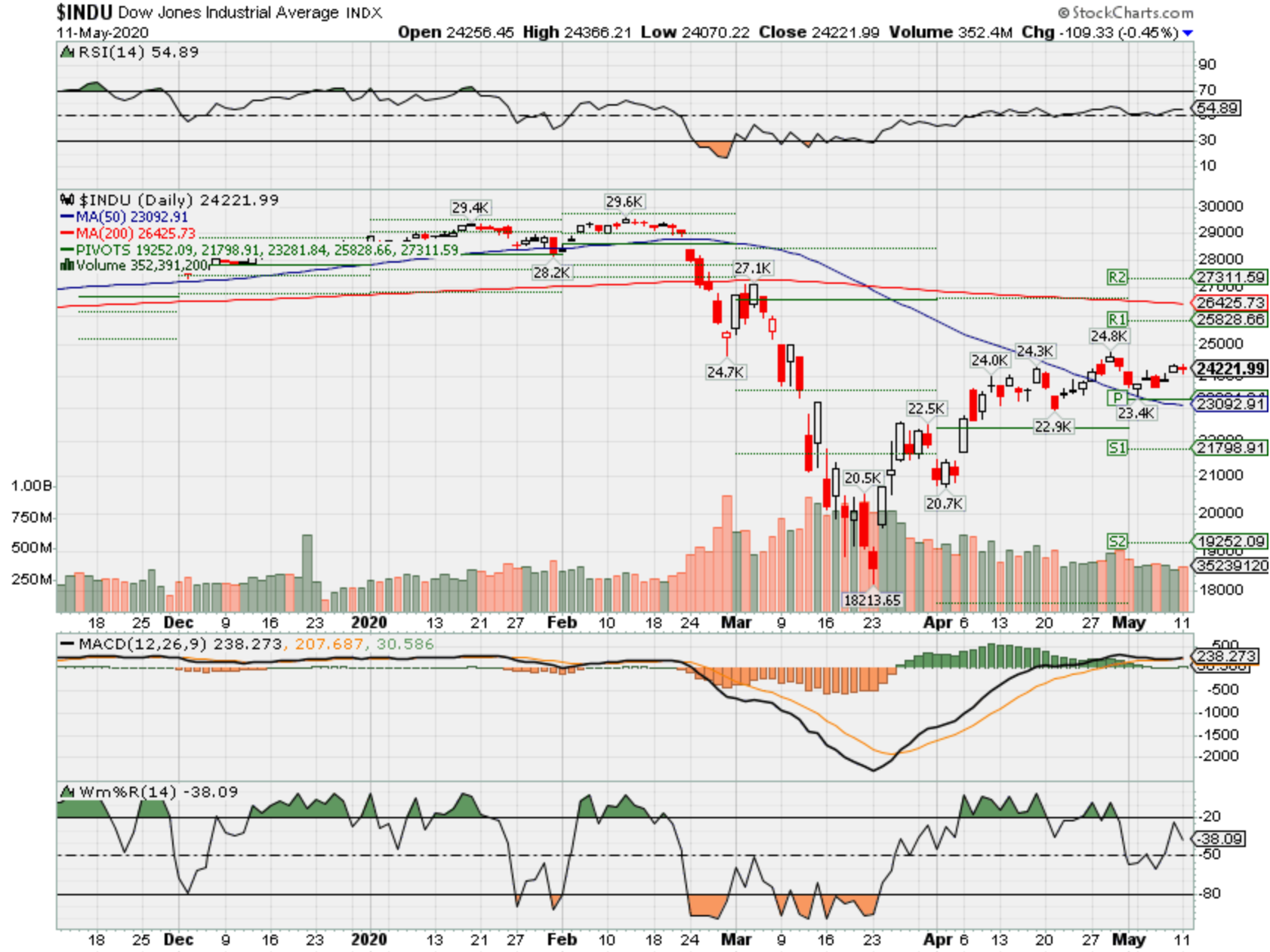

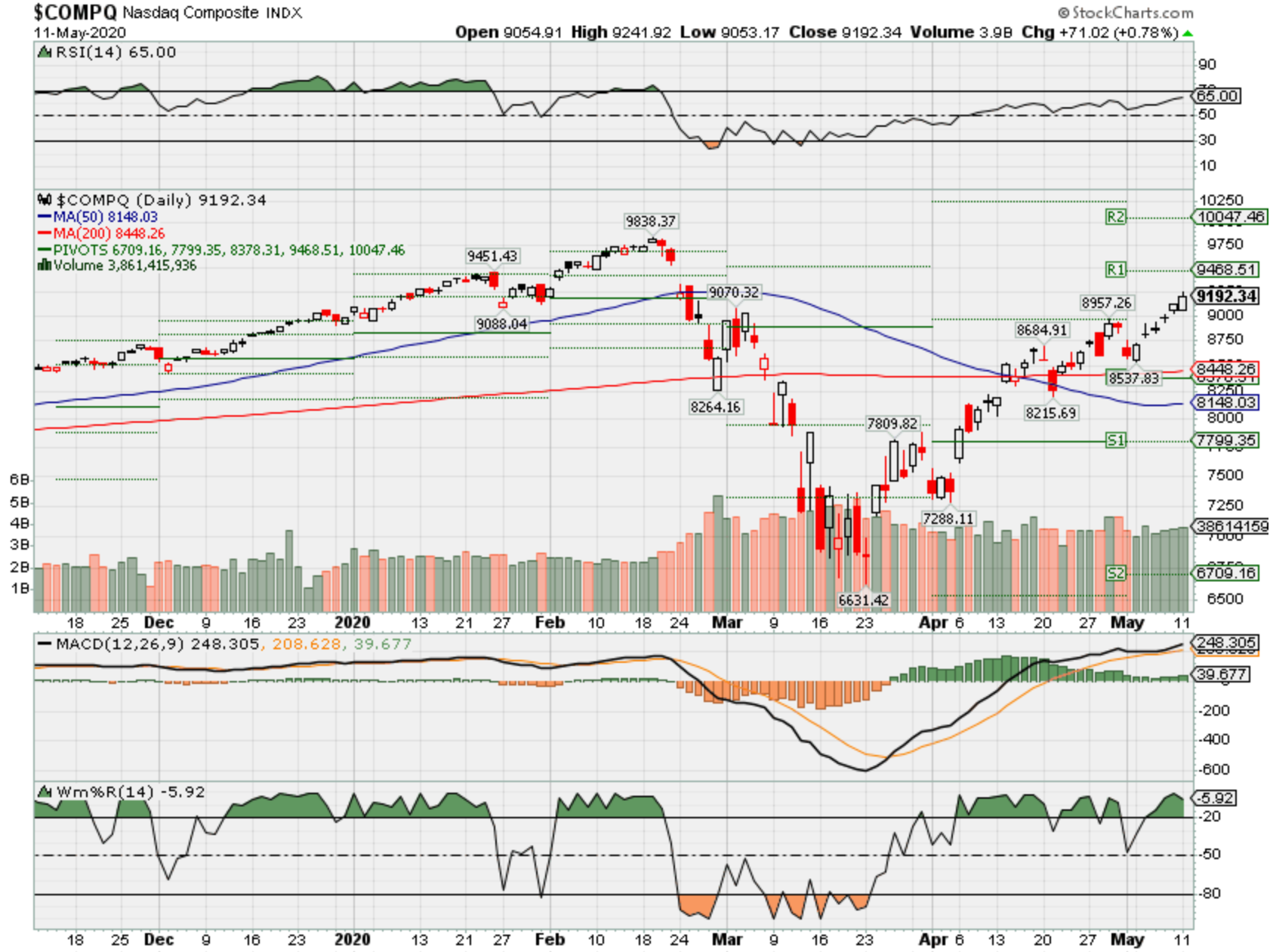

Where will our markets end this week?

Higher

SPX – Bullish

COMP – Bullish

Where Will the SPX end May 2020?

05-11-2020 +2.0%

05-03-2020 +2.0%

04-27-2020 +2.0%

Earnings:

Mon: CAH, MAR, UAA

Tues: DUK

Wed: DDS, JACK

Thur: BABA, FOSL, CCL, HTZ

Fri: JD, VFC

Econ Reports:

Mon:

Tues: CPI, Core CPI, Treasury Budget

Wed: MBA, PPI, Core PPI

Thur: Initial Claims, Continuing Claims, Import, Export,

Fri: Empire, Retail, Retail ex-auto, Capacity Utilization, Industrial Production, Business Inventory, Michigan Sentiment

Int’l:

Mon –

Tues – CN: CPI. PPI

Wed –

Thursday –

Friday- EUR: GDP

Sunday –

How am I looking to trade?

I’m protecting through earnings, rolling long puts up and out and I wouldn’t think of not having protection on during an earnings season that so far has no forgiveness.

I can and might be adding short calls after earnings for a little extra credit

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Ford Reports a Loss and Drops a Bombshell in Its Outlook. Here’s Why the Stock Isn’t Dropping.

By

Updated April 29, 2020 10:04 am ET / Original April 28, 2020 5:06 pm ET

Detroit auto maker and iconic American manufacturer Ford Motor’s first-quarter earnings missed Wall Street estimates. But that actually isn’t the bad news: Results in the second quarter are about to get far worse because of Covid-19.

Ford (ticker: F) reported a per-share loss of 23 cents and $34.3 billion in sales. Sales in the first quarter of 2019 tallied $40.3 billion. Wall Street had predicted a loss of 6 cents a share.

The miss isn’t the most surprising part. Ford earnings estimates, like those for most auto companies , have been coming down recently. Analyst estimates for Ford’s first-quarter earnings were 36 cents a share just three months ago.

The second-quarter guidance is what is most shocking: Ford expects to lose about $5 billion on an operating basis for the quarter ending in June.

Everyone knows things are tough for car companies as the coronavirus pandemic continues. No one is making cars, and few U.S. consumers are buying them. But the $5 billion loss is about twice as large as analysts expected only a few days ago.

Ford shares were down about 4.5% in premarket trading Wednesday, but moved into the green later in the morning, for a gain of about 1%. The stock is holding up because the shares have already been hammered. Year to date, Ford shares are down about 47% year to date, far worse than the double-digit drops of the S&P 500 and Dow Jones Industrial Average.

The entire automotive universe has been hammered by the Covid-19 outbreak. Traditional auto maker stocks, including Ford, are down about 45% on average. Parts suppliers are off about 40% on average. Dealers are down about an average 36% year to date. Auto-heavy lenders are down almost 50%, and after market-related stocks are off about 25%. Hundreds of billions of dollars of market value has been wiped out.

Ford, for now, is focused on its balance sheet and maintaining ample liquidity. During the quarter, Ford borrowed $15 billion from existing credit facilities and raised another $8 billion in bond sales. Management says Ford and Ford Credit have $35.1 billion and $28 billion in liquidity, respectively.

Don’t forget Ford, like other auto makers, has a large lending arm, making simple comparisons of net debt to operating earnings more difficult. Ford’s credit arm increased reserves for future loan losses, mirroring what large U.S. banks did when reporting first-quarter numbers.

“We’ve taken decisive actions to lower our costs and capital expenditures and been opportunistic in strengthening our balance sheet and optimizing our financial flexibility,” said Ford CFO Tim Stone in the company’s news release. “We believe the company’s cash is sufficient to take us through the end of the year, even with no additional vehicle wholesales or financing actions.”

Enough cash through year-end is a bit of good news for investors.

Looking ahead, U.S. auto makers have to think about bringing production back on line. Most global auto makers stopped making cars in mid-March to help flatten the Covid-19 new infection curve. Exactly how capacity will come back isn’t known. Work flows and plants layouts might be modified to limit the risk of a coronavirus outbreak in a car plant.

“Part of skillfully managing through this crisis is having a well thought-out protocol for back to work,” said CEO Jim Hackett on the company’s earnings conference call. “And we did this for China, and I’m pleased that earlier today, we announced we’ll restart our European manufacturing production with enhanced employee protection protocols in place.”

China is running at close to 90% of capacity, according to Hackett. Ford surveyed its supply base there to make sure it could support production and modified shift patterns in plants to minimize the change of widespread infection. Those are steps it plans to “export” to the U.S.

Ford stock closed up 4.1% in Tuesday trading, better than the 0.5% decline of the S&P.

Write to Al Root at allen.root@dowjones.com

US is risking a second coronavirus wave and a depression, economist Mark Zandi warns

PUBLISHED SUN, MAY 10 20205:00 PM EDT

Stephanie Landsman@STEPHLANDSMAN

It may be the economy’s make or break moment.

Mark Zandi of Moody’s Analytics is getting increasingly worried states are taking a large gamble by reopening businesses too quickly.

He warns a spark in new coronavirus infections would send the economy further into tailspin — especially since there’s no vaccine.

“If we get a second wave, it will be a depression,” the firm’s chief economist told CNBC’s “Trading Nation” on Friday. “We may not shut down again, but certainly it will scare people and spook people and weigh on the economy.”

Zandi defines a depression as 12 months or more of double digit unemployment.

On Friday, the Labor Department reported the April jobless rate soared to 14.7%, and non-farm payrolls tumbled by 20.5 million. Both sets of employment data are post-World War II records.

The market seemed to take the data in stride. The Dow, S&P 500 and tech-heavy Nasdaq closed almost 2% higher on Friday.

“The market is casting a pretty high probability of a V-shaped shaped recovery,” said Zandi. “The horizon may be a little short term: Next month, the month after, the month after that.”

Zandi predicts jobs will start to rebound by Memorial Day weekend as businesses reopen. If there’s no second wave, he estimates the gains will flow through the summer into early fall.

“After that, I think we’re going to be in quicksand because of the uncertainty around the virus and the impact that it’s going to have on consumers and businesses,” he added.

Zandi has been warning Wall Street about the coronavirus threat since winter. In late February, he told “Trading Nation” the Street was underestimating the damage from a pandemic. His forecast came before states imposed strict lockdowns to contain the spread of the virus.

For the economy to get back on track, he contends it’s necessary to get solid progress on a vaccine. A delay or failure to come up with a vaccine within the next year or so would also cause a 1930s-type downturn, according to Zandi.

“It’s critical. It’s a necessary condition for the economy to fully recover,” Zandi said. “We’re going to see the market reevaluate things at some point. ”

https://www.bbc.com/news/world-us-canada-52189349

How the coronavirus led to the highest-ever spike in US gun sales

By Max MatzaBBC News, Washington

6 April 2020

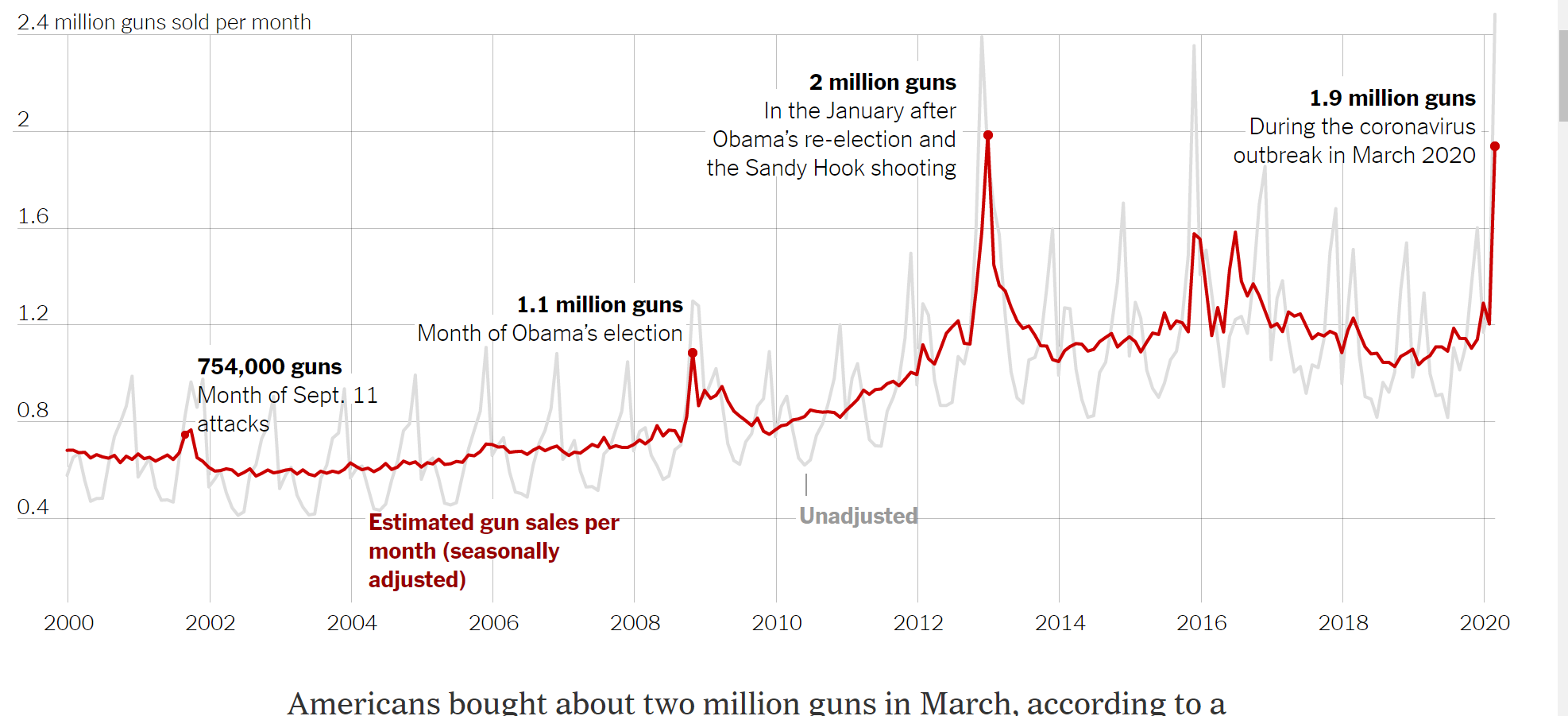

Americans grappling with the rapidly-spreading coronavirus purchased more guns last month than at any other point since the FBI began collecting data over 20 years ago. Why?

With the death toll climbing every day and most of the country under some form of lockdown, many Americans seem to be turning to guns as part of their response.

And it’s not just about fears over social disorder, say experts.

What do the figures show?

The FBI conducted 3.7m background checks in March 2020, the highest total since the instant background check programme began in 1998.

The figure represents an increase of 1.1m over March 2019.

On 21 March alone, 210,000 checks were done, the largest one-day record ever.

According to US media, the FBI data indicates that over two million guns were purchased in March alone.

Illinois led with nearly a half million sales, followed by Texas, Kentucky, Florida, and California.

Gun shops across the country report that they are unable to re-stock shelves quickly enough to cope with the rush.

The latest figure also tops the previous high of 3.3 million, which was set in December 2015 after the Obama administration raised the possibility of restricting assault rifles in the wake of a mass shooting in San Bernardino, California.

Why are sales skyrocketing?

According to Georgia State University law school professor Timothy Lytton, an expert on the US gun industry, most new gun sales are being motivated by two factors that have been spurred on by the coronavirus crisis.

The first is the concern that civil society – fire, police and health services – could be severely “eroded” someday, leading to a breakdown in law and order. In such a case, a gun can be viewed as a “self-help” survival tool, he says.

The second reason is concerns over so-called big government infringing on American freedoms such as gun ownership, which is enshrined in the US constitution.

“Many of the public health measures, such as shelter-in-place, restricting peoples’ movements, restricting what people can buy,” Mr Lytton says, “raises fears among many groups of the potential for government takeover and tyranny.”

In some ways these two reasons are in opposition to each other, he tells BBC News.

“Some people are worried about the fact that government’s falling apart and won’t protect them, and other people are worried that the government is getting too strong and is going to limit their freedom.”

Why I bought my first guns

One new gun owner told BBC News that he made the decision to buy his first two firearms on 12 March, one day after the NBA announced that they were suspending all games.

The man, who asked that his name not be used, says he views his decision as an extension of the guidance he had seen from emergency officials, who have told Americans to consider having a few days supply of food and water in case of any disruptions to the supply chain.

“I think it’s hard to discount the very minor chance of there being temporary civil unrest where I can’t rely on the police department.

“And a gun is cheap insurance against that,” says the man, who grew up in Berkeley, California and now lives in Chicago.

It’s all well and good to have a stockpile of food and supplies, but there is no use having all that without a means of defending it, he argues.

What’s the reaction been?

Some states have allowed gun stores to continue to operate as “essential” businesses despite mandatory lockdown orders affecting around 90% of the US.

New York, Massachusetts, and New Mexico have forced shops to close but have allowed them to continue selling online. Washington state ordered shops to close, but several continued to operate despite the ban.

Gun control advocacy groups have praised the closures.

“There is no constitutional right to immediately buy or sell guns. And there certainly is no right to spread coronavirus while buying or selling guns,” Kris Brown, president of the anti-gun violence Brady Campaign, told NBC News.

Shannon Watts, from the group Moms Demand Action, said her concern was for the families of new gun owners, who she says are adding danger to an already volatile situation.

Amy Hunter, a spokeswoman for the National Rifle Association (NRA), said in a statement to BBC News that “headlines about prisoner furloughs and law enforcement selectively responding to calls have made many realise the gravity of self-defense during these unprecedented times.

“In addition, efforts by some anti-gun politicians to shutter gun stores have deeply concerned law-abiding Americans. That is why the NRA makes no apology for our efforts to ensure gun stores stay open so law-abiding people can exercise their right to defend themselves and their families.”

What else can influence gun sales?

US domestic politics often influence gun sales, as Democratic candidates are viewed as more likely to crack down on gun rights than Republicans such as President Trump.

Gun sales spiked after President Obama’s two election victories, and rose in 2016 as Hillary Clinton rose in the presidential polls and was widely expected to defeat Mr Trump. Sales then dropped off after Mr Trump’s victory.

Mass shootings, which also trigger concerns among gun advocates of a crackdown on private ownership, also cause sales of guns and ammo to go up.

“It tends to go up and down depending on what people’s anxiety levels are,” says Mr Lytton.

Normally the concern is over access to weapons, he adds.

“Or in this case it’s anxiety about the deterioration of government – or the growth of government.”

https://www.nytimes.com/interactive/2020/04/01/business/coronavirus-gun-sales.html

About 2 Million Guns Were Sold in the U.S. as Virus Fears Spread

By Keith Collins and David Yaffe-BellanyApril 1, 2020

2.4 million guns sold per month

2 million guns

In the January after Obama’s re-election and the Sandy Hook shooting

1.9 million guns

During the coronavirus outbreak in March 2020

2

1.6

1.1 million guns

Month of Obama’s election

1.2

754,000 guns

Month of Sept. 11 attacks

Americans bought about two million guns in March, according to a New York Times analysis of federal data. It was the second-busiest month ever for gun sales, trailing only January 2013, just after President Barack Obama’s re-election and the mass shooting at Sandy Hook Elementary School.

With some people fearful that the pandemic could lead to civil unrest, gun sales have been skyrocketing. In the past, fear of gun-buying restrictions has been the main driver of spikes in gun sales, far surpassing the effects of mass shootings and terrorist attacks alone.

Sales rose sharply in December 2015 after Mr. Obama sought to make it harder to buy assault weapons after the terrorist attack in San Bernardino, Calif. And in January 2013, the heaviest sales came after a call for new restrictions in the wake of the Sandy Hook shooting.

But last month was different. As they prepare for an uncertain future, Americans have been crowding grocery stores to stock up on household essentials like canned beans and toilet paper. A similar worry appears to be driving gun sales.

“People are nervous that there’s a certain amount of civil disorder that might come if huge numbers of people are sick and a huge number of institutions are not operating normally,” said Timothy Lytton, a law professor at Georgia State University and an expert on the gun industry. “They may have an anxiety about protecting themselves if the organs of state are starting to erode.”

Several recent gun-related incidents have been linked to fears surrounding the pandemic. Last week, police in Alpharetta, Ga., arrested a man they accused of pointing a gun at two women wearing medical masks and gloves because he feared he might contract the virus. A man in New Mexico was charged with the accidental shooting death of his 13-year-old cousin with a gun he told police he was carrying “for protection” amid the outbreak. And in Maine, a man with a felony conviction who claimed he needed guns to protect himself during the outbreak was charged with illegally possessing a firearm.

The monthly sales figures are estimates based on the number of background checks reported by the F.B.I., which has been publishing the data since 1998. Many sales, especially in states where background checks are not required or at gun shows where buyers may not be subject to background checks, could have gone uncounted.

In recent weeks, lines have been snaking out of gun stores throughout the country. In many states, estimated sales doubled in March compared with February. In Utah, they nearly tripled. And in Michigan, which has become a hot spot for virus cases, sales more than tripled.

The run on firearms has raised public health concerns and prompted local officials to debate whether gun stores should be temporarily closed. Advocates for stricter safety measures argue that the surge in purchases could pose a safety threat if buyers aren’t trained properly, new guns aren’t stored safely and background checks aren’t completed.

But after lobbying from the firearm industry, the Trump administration said this week that the stores qualified as essential businesses and should stay open during the lockdown alongside pharmacies, gas stations and grocery stores.

Mnuchin says jobless numbers will ‘get worse before they get better’ — unemployment may have hit 25%

PUBLISHED SUN, MAY 10 202012:53 PM EDTUPDATED SUN, MAY 10 20202:09 PM EDT

KEY POINTS

- The real unemployment rate, which includes people who are not looking for work or are underemployed, already stands at 22.8%.

- Mnuchin acknowledged that the jobless rate may be even higher and stand at 25%.

- “The reported numbers are probably going to get worse before they get better,” he said.

WASHINGTON — Treasury Secretary Steven Mnuchin acknowledged Sunday that the U.S. unemployment rate may have already reached 25% as the administration works to reopen the economy amid the coronavirus pandemic.

“This is no fault of American business, this is no fault of American workers, this is a result of a virus,” Mnuchin told Chris Wallace during an interview on “Fox News Sunday.” “The reported numbers are probably going to get worse before they get better,” he said, adding that “next year is going to be a great year.”

The real unemployment rate, which includes people who are not looking for work or are underemployed, already stands at 22.8%, according to the Bureau of Labor Statistics. Mnuchin acknowledged that the jobless rate may be even higher and stand at 25%, comparable to the Great Depression, when pressed on the issue by Wallace who pointed out that April’s unemployment report stopped in the middle of the month.

In just over a month, the coronavirus has erased all job gains since the Great Recession, bringing the nation’s decade-long economic growth streak to a grinding halt.

The U.S. economy lost an unprecedented 20.5 million jobs in April as the unemployment rate jumped to 14.7%, up from 4.4% in March, according to the monthly employment report, released Friday by the Department of Labor.

“These numbers impact real people. My numbers aren’t rosy, what I said is you’re going to have a very, very bad second quarter,” Mnuchin said, adding that the United States could see “permanent economic damage” if the country does not reopen.

Earlier on Sunday, White House advisor Kevin Hassett told CNN’s Jake Tapper that the U.S. unemployment rate could reach up to 20%.

“This is the biggest negative shock to an economy that we have ever seen in our lifetimes. It hit an economy that in January was about the strongest economy we’d ever seen,” explained Hassett on “State of the Union.”

“The fact though is, with all of the aggressive bipartisan action to toss maybe as much as $9 trillion at this sort of bridge to the other side, we see things like the jobs report on Friday, almost everybody who declared themselves unemployed said they expect to go back to work in six months,” he added.

China under pressure to write off loans as countries struggle to repay debt during coronavirus crisis

PUBLISHED SUN, MAY 10 20209:32 PM EDTUPDATED MON, MAY 11 20207:10 AM EDT

KEY POINTS

- “Many countries under the (Belt and Road) initiative have borrowed heavily from China to invest in new projects, but the pandemic is disrupting economies and will complicate repayment plans,” said Kaho Yu, senior Asia analyst at Verisk Maplecroft.

- Yu told CNBC that currently, low-income countries under the BRI are already asking China for debt relief.

- China has had a track record of taking over assets when countries indebted to it go under.

- It will be “under pressure” to extend those loans or even write them off, analysts say.

China could find itself having to write off massive loans as countries that owe Beijing money under its massive infrastructure project struggle with mounting debts in the coronavirus fallout, analysts say.

China’s mammoth infrastructure investment plan — also known as the Belt and Road Initiative (BRI) — is highly controversial and widely criticized for saddling many countries with debt.

It is an ambitious project that aims to build a complex network of rail, road and sea routes stretching from China to Central Asia, Africa and Europe. It is also aimed at boosting trade. Chinese financial institutions have provided hundreds of billions in funding to countries involved in the BRI projects.

“Many countries under the BRI initiative have borrowed heavily from China to invest in new projects, but the pandemic is disrupting economies and will complicate repayment plans,” Kaho Yu, senior Asia analyst at Verisk Maplecroft, told CNBC.

The coronavirus pandemic has spread to more than 180 territories and countries in the world, and has infected more than 4.1 million people so far, according to data from Johns Hopkins University. At least 282,694 deaths related to Covid-19 have been reported since it first emerged late last year in China.

Several major BRI projects — such as those in Indonesia, Malaysia, Cambodia, Sri Lanka and Pakistan — have been stalled by lockdowns, according to Simon Leung, a banking and finance partner at law firm Baker McKenzie.

The outbreak has also led to disruptions in BRI projects which often depend heavily on labor and supplies — but both were prevented from reaching the sites as a result of the lockdowns, Leung pointed out.

“The drop in export revenues, coupled with increasing domestic spending as a result of the outbreak, have led to significant depreciation of local currency and in turn adversely affected the ability of borrowers to meet forex-denominated debts owing to Chinese banks,” said Leung, referring to increased spending in terms of stimulus packages. Less demand for a country’s goods typically also means less demand for its currency, causing it to weaken.

All that has affected the ability of debtor countries to repay their dollar-denominated loans from China.

More than 130 countries are under the BRI initiative, according to Beijing-based research firm Green Belt and Road Initiative Center. Many of those countries are in Europe, Africa, and Central Asia.

According to Yu, low-income countries under Belt and Road are already asking China for debt relief. That could come in the form of interest waivers, extension of payment periods or to suspend payments altogether in the medium term.

Pakistan and Sri Lanka could be among the worst-off, and may not be able to service their overall debt obligations this year as a result of the pandemic, analysts said.

Barter trade

Countries have also signed so-called “barter deals” with China, and they are “in an even more difficult position,” Yu said.

Some Chinese loans are reportedly denominated in barrels of oil — a practice the World Bank has flagged as opaque, because they mask the true payment amounts.

“Since the pandemic hit the oil prices, they will have to produce more oil to repay the loans. However, the pandemic has also disrupted all kinds of industrial activities, making it impossible for these countries to meet the required production level,” Yu said. “As a result, Chinese companies will likely be handed control over joint ventures or be repaid by assets.”

There is, however, a growing likelihood that Chinese lenders will be forced into broader debt forgiveness, owing to force-majeure clauses or other arrangements.

The Economic Intelligence Unit

China has had a track record of taking over assets when countries cannot repay their loans. One high-profile example is Sri Lanka, which had to hand over a strategic port to Beijing in 2017, after it couldn’t pay off its debt to Chinese companies.

China’s loans to countries have been shrouded in secrecy, according to reports, with Beijing often demanding public-sector assets as collateral. Between 2000 and 2017, other countries’ debt owed to China soared ten-fold, according to a study last year.

‘Pressure’ to write off loans

China will be “under pressure” to extend those loans or even write them off, according to research firm Economist Intelligence Unit. It has already “indicated some willingness” to offer debt-relief programs to certain low-income countries, said EIU.

“There is, however, a growing likelihood that Chinese lenders will be forced into broader debt forgiveness, owing to force-majeure clauses or other arrangements,” the EIU said. A force majeure event occurs when unforeseeable circumstances — such as natural catastrophes or in this case, a pandemic — prevent one party from fulfilling its contractual duties, absolving them from penalties.

“Widespread debt write-offs could generate a negative feedback cycle that would discourage future Chinese lending activity over the remainder of 2020 (and into 2021),” the research firm said.

Much of the lending is done through two policy banks — the China Development Bank and Export-Import Bank of China, both of which are “closely linked” to the Chinese government, said Baker McKenzie’s Leung.

“Those banks enjoy government backing and support and therefore the debt renegotiations may involve political dialogue,” he said.

More importantly, Beijing could be motivated to write off debts due to the BRI’s significance to China. “We suspect that China will eventually come around to rescheduling and forgiving some of the debts to BRI countries, especially for projects that are strategically important,” said Homin Lee, Asia macro strategist at Swiss private bank, Lombard Odier.

“Debt problems will be highly idiosyncratic, especially since China has strategic stakes in many of the transnational projects and also economic interest in ensuring the long-term success of the program,” he told CNBC in an email.

Back home, Chinese banks are already preparing for a growing pile of bad loans, as consumers and companies alike suffer the brunt of the pandemic. Earlier this year, China’s central bank said state lenders will have to tolerate higher levels of bad loans to support firms affected by the coronavirus.

It pays to stay unemployed. That might be a good thing

PUBLISHED SAT, MAY 9 202010:36 AM EDTUPDATED SUN, MAY 10 20202:07 PM EDT

KEY POINTS

- Roughly 40% of workers stand to make more money while unemployed than from their former jobs, according to one analysis of expanded benefits.

- This is especially true for lower-wage earners, who are concentrated in certain industries like retail, accommodation and food services.

- There are factors beyond a straight dollar-for-dollar comparison, however, that may dissuade Americans from trying to remain unemployed.

Americans have lost jobs by the millions as the coronavirus pandemic continues to bludgeon the U.S. economy.

However, many jobless workers stand to reap a financial benefit from their layoffs.

Some could more than double their prior salaries.

The distortion results from the $2.2 trillion economic relief bill enacted in March, which boosted jobless benefits to a level unseen since the unemployment insurance program was created in the 1930s.

Around 40% of all workers could theoretically earn more while unemployed than going back to work, according to an analysis by Noah Williams, director of the Center for Research on the Wisconsin Economy at the University of Wisconsin-Madison.

Critics say the policy serves as a disincentive to return to work as states start re-opening their economies — in turn limiting the country’s economic rebound, according to critics.

Labor economists generally agree the situation isn’t ideal. However, it’s necessary given the extraordinary health and economic crises at hand, they said.

“This is definitely a second- or third-best solution to a very serious problem,” said Stephen Wandner, senior fellow at the National Academy of Social Insurance. “But I’m not sure they had a much better way of dealing with this.”

The relief law, known as the CARES Act, enhanced unemployment benefits in several ways. It boosted weekly benefits, increased their duration and extended jobless pay to previously ineligible groups like the self-employed.

The law offered an extra $600 per week, funded by the federal government, to unemployment recipients.

That infusion supplements the unemployment benefits typically doled out by a worker’s state. While unemployment insurance is a joint federal-state program, states control key aspects like benefit levels and vary significantly in generosity.

The average worker in more than half of states stands to collect more from unemployment than from their prior job, according to an analysis conducted by Ernie Tedeschi, an economist at Evercore ISI.

These dynamics are largely a function of a state’s wages and unemployment generosity.

Generally, the lower the wages and the greater the unemployment benefits in a state, the more it pays to be unemployed. (This, of course, doesn’t account for the negative effects of long-term unemployment such as suppressed wages or benefits like health insurance that an employer may offer.)

States cap their maximum weekly unemployment pay, meaning the financial benefits of unemployment dissipate after a certain point for those making higher salaries.

Take the accommodation and food services industry, for example.

This industry category includes restaurant and hotel workers — among the worst-hit sectors of the U.S. economy as state lockdown orders led to mass layoffs in the hospitality sector.

The average worker in this industry, which employs 14 million people, makes $13.45 an hour — the lowest compared with other industries.

These workers would benefit most under the unemployment system when compared to others — collecting 182% of their previous wages, according to a CNBC analysis of Bureau of Labor Statistics and Labor Department data.

The dynamic could be especially lucrative for the typical fast-food worker, who would collect 219% of prior pay from unemployment, among the occupations that stands to benefit most.

That wage replacement rate means the average worker would earn more than twice as much as from their regular job, which pays just $11 an hour.

In normal times, state unemployment benefits replace less than half of prior wages for out-of-work Americans. That’s meant to incentivize individuals to find a new job and provide financial support until they do.

The $600-a-week infusion aimed to boost that ratio to 100% — or, full wage replacement — for the average American.

That makes sense when U.S. and state officials are urging people to stay home, forcing businesses to close and preventing huge swaths of people from looking for work, economists said.

Workers in New Mexico, for example, would replace 129% of their prior salaries on average from unemployment — the largest “wage replacement rate” among any state.

In Kansas and Montana, more than half their respective state workforces could make more on unemployment than by working – the largest shares of any other states, according to Williams.

“I think it’s a good compromise with the situation we’re in,” Jesse Rothstein, director of the Institute for Research on Labor and Employment at the University of California, Berkeley, and former chief economist of the U.S. Department of Labor, said of the $600 payments.

“We needed to support families, and dramatically scale up the amount of benefits,” he added. “It would have been much, much worse without something like this.”

Absent a significant infusion, the economy would have suffered from even greater spending pullbacks as more people curtailed purchases and delayed rent payments to make ends meet, economists said.

“Giving extra income payments to people who make less than $20 an hour is pretty much getting money in the hands of people who need it to pay utility bills, buy groceries, and help [the economy] right now,” said Betsey Stevenson, a professor of economics and public policy at the University of Michigan.

That was the case for one Amazon warehouse worker in Kentucky.

The worker, who wished to remain anonymous for fear of company reprisal, has been collecting unemployment benefits in the state since the end of April after the warehouse temporarily closed.

The individual makes nearly double his typical pay from a 40-hour work week pre-pandemic — $1,150 a week from unemployment benefits compared with $600 a week from a $15-an-hour wage. (The company recently instituted a $2-per-hour temporary raise and increased overtime pay from 1.5 times to 2 times hourly pay, the worker said.)

This is definitely a second- or third-best solution to a very serious problem. But I’m not sure they had a much better way of dealing with this.

Stephen Wandner

SENIOR FELLOW AT THE NATIONAL ACADEMY OF SOCIAL INSURANCE

The worker’s warehouse has since re-opened, but the individual plans to take unpaid time off and collect unemployment benefits through July due to a risk of contracting the Covid-19 by returning to work — an especially fraught idea given that the worker is caring for high-risk family members due to health conditions.

The $600-a-week additional payments are a “relief,” the person said.

“It eased financial strains in an already strained situation,” the worker said. “The [state benefit] would’ve kept the four walls up and everything else on. But it would be tight.”

Absent the $600-a-week payments, the worker would still opt to collect unemployment due to health concerns.

The beefed-up unemployment benefits was also an issue of expediency. State unemployment systems are clunky and outdated even in the best of times, economists said. Instating a more-complicated formula would have delayed benefits for months – a potentially devastating outcome for families in dire straits, they said.

However, some critics believe taking additional time to ensure workers couldn’t make more from the unemployment system than their previous job would have been worthwhile, even if it resulted in delays.

“I understand it could have added a little time,” said Rachel Greszler, a research fellow at the Heritage Foundation, a conservative think tank. “But I don’t think it’s a good argument for incentivizing unemployment.”

The Heritage Foundation believes the CARES Act enhanced benefits could increase unemployment by nearly 14 million people and reduce U.S. gross domestic product by up to $1.49 trillion.

The $600 weekly payments are ending after July 31, however, after which point Congress would have to extend them. Economists don’t believe that’s likely.

But there are mechanisms that will blunt any adverse impacts of people choosing not to return to work, economists said.

For one, if workers refuse a work offer — say, from a prior boss who’d furloughed them or laid them off — they generally won’t be able to continue collecting unemployment.

Because more than 33 million Americans have filed for unemployment over the past seven weeks, state unemployment funds are being drained quickly, giving states an incentive not to be lenient in their interpretations of who can continue to collect benefits, Stevenson said.

States may also try to claw back some unemployment pay in certain circumstances like fraud.

Plus, just because a worker is unemployed doesn’t mean they will be necessarily be deemed eligible by a state. And workers in most states have had significant challenges filing applications for unemployment benefits and getting them processed amid record volume surges.

Some have waited roughly two months without seeing one payment.

The temporary nature of the extra $600 payment may dissuade others from being lax about their employment situation.

“Turning [employment] down in an environment where there aren’t many jobs isn’t likely to make sense for very many people,” Rothstein said.

With reporting from CNBC’s Nate Rattner.

Under Armour sales plummet 23% as coronavirus stalls turnaround plans

PUBLISHED MON, MAY 11 20207:04 AM EDTUPDATED MON, MAY 11 202010:19 AM EDT

KEY POINTS

- Under Armour reported an adjusted loss of 34 cents per share in the first quarter on revenue of $930.2 million.

- Apparel sales also dropped 23%, to $598 million, while footwear revenue was down 28% to $210 million and accessories revenue declined 17% to $68 million, the company said.

Under Armour on Monday reported a sales decline of 23% during its first quarter as its business took a blow from the coronavirus pandemic and its stores were forced shut, freezing its turnaround plans.

The athletic apparel company said it plans to cut about $325 million in operating costs in 2020 to help it weather the crisis, including by temporarily laying off some retail employees.

During a conference call with analysts, it said it expects revenue could be down as much as 50% to 60% during the second quarter, as demand for its merchandise remains constrained. The company said it predicts the second quarter to be the most challenging to work through, and the rest of the year will be highly promotional.

Its shares were down more than 9% following the release.

Here’s how Under Armour did during its fiscal first quarter ended March 31:

- Earnings per share: A loss of 34 cents, adjusted

- Revenue: $930.2 million

“Since mid-March, as the pandemic accelerated dramatically in North America … and retail store closures ensued, we’ve experienced a significant decline in revenue across all markets,” CEO Patrik Frisk said in a statement.

Under Armour reported a net loss of $589.7 million, or $1.30 per share, compared with a profit of $22.5 million, or 5 cents per share, a year earlier.

Excluding one-time charges, the company lost 34 cents per share.

Under Armour said it expects to report $475 million to $525 million in pretax restructuring costs this year as it looks to revive its business. During the first quarter, it recorded $436 million in restructuring and impairment charges.

Net revenue fell 23% during the first quarter, to $930.2 million from $1.20 billion. Under Armour said roughly 15 percentage points of the decline stemmed from the Covid-19 crisis.

Apparel sales also dropped 23%, to $598 million, while footwear revenue was down 28% to $210 million and accessories revenue declined 17% to $68 million, it said.

Analysts had been calling for the company to report an adjusted net loss of 19 cents per share, on revenue of $949 million, according to a poll by Refinitiv. However, it is difficult to compare reported earnings to analyst estimates for Under Armour’s first quarter, as the coronavirus pandemic continues to hit global economies and makes earnings impact difficult to assess.

The company said it ended the first quarter with cash and cash equivalents of $959 million. Inventories were up 7%. It also said it expects to spend about $100 million on capital expenditures this year compared with prior expectations of $160 million.

Under Armour has been struggling to gain momentum on its home turf in the U.S., competing with the likes of Nike, Adidas and Lululemon.

“With Under Armour having slower sales momentum than its competitors, we expect sales to be under greater pressure near-term and for its sales trend to take longer to recover,” Telsey Advisory Group analyst Cristina Fernandez said in a post-earnings note to clients.

The Baltimore-based company, known for its sweat-wicking workout gear, relies heavily on its wholesale partners, including some department store chains, which have also been hit hard by the coronavirus and forced to close their doors temporarily.

Under Armour’s wholesale revenue fell 28% to $592 million during the first quarter.

In North America, which marks its largest business region and accounts for roughly 65% of total sales, revenue fell 28% to $609 million. International sales dropped 12% to $287 million.

As some retailers such as Macy’s and Gap are slowly beginning to get some of their locations back up and running, Under Armour said Monday, “the pace and timing of store openings, and traffic patterns when the stores re-open, remain highly uncertain.”

As of Friday’s market close, Under Armour shares were down almost 54% this year. The company has a market cap of $4.5 billion.

Find the full earnings report from Under Armour here.