HI Market View Commentary 04-26-2021

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF APR. 19 THROUGH APR. 23, 2021 |

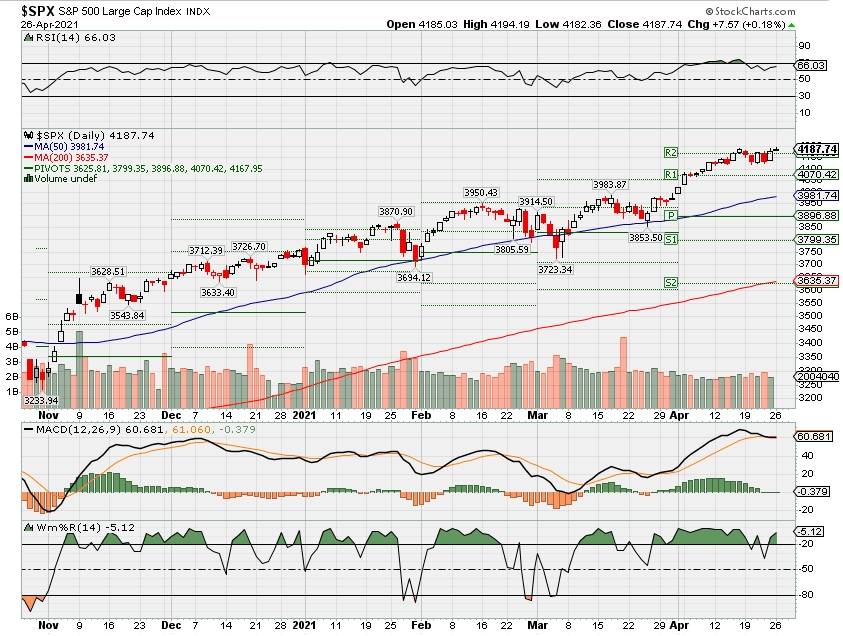

| The S&P 500 index slipped 0.1% last week, its first weekly decline in a month, amid surging global cases of COVID-19 and reports of a planned increase in the US capital gains tax rate, although better-than-expected corporate earnings and economic data helped minimize the drop. The market benchmark ended the week at 4,180.17, down from last week’s close of 4,185.47, which was a record closing high. The index has yet to reach a new closing high since then, but hit a new intraday high Friday at 4,197.14. This marks the S&P 500’s first weekly drop since the week ended March 19. It is still up 5.2% for April to date and up 11% for the year to date. The weekly decline came despite falling US cases of COVID-19, as the number of afflicted elsewhere climbed. India hit a global record for daily new infections. Amid the concerns about global cases, the US State Department added more than 100 countries to its “do not travel” advisory list, which now covers about 80% of countries worldwide. Investors also fretted over reports that US President Joe Biden is planning to propose nearly doubling the capital gains tax rate for wealthy individuals. Still, many US companies have reported Q1 earnings above expectations, and economic data have also been showing positive signs of a recovery. Among the encouraging releases that helped limit this week’s stock market decline, IHS Markit posted the fastest expansion in service-sector activity since it began collecting the data in 2009, and the Commerce Department reported new home sales rose nearly 21% in March to a 14-year high. By sector, energy had the largest percentage drop of the week, down 1.8%, followed by a 1.2% decline in consumer discretionary. The other sectors in the red were utilities, communication services, technology, consumer staples and financials. On the upside, real estate had the largest percentage gain of the week, up 2%, followed by a 1.8% increase in health care. Other gainers included industrials and materials. The drop in energy came as crude oil futures also fell amid the worries about global COVID-19 cases. The decliners included Halliburton (HAL), whose shares dropped 7.9% on the week. Halliburton reported year-over-year declines in Q1 adjusted earnings per share and revenue this week, although both figures surpassed Street expectations and the company said it expects international activity growth to accelerate in 2021 while it is seeing early positive momentum in North America. The decliners in consumer discretionary included Las Vegas Sands (LVS), which reported a wider Q1 adjusted loss from continuing operations than in the year-earlier period. The loss matched the Street consensus view, disappointing investors who were hoping for a beat. Revenue, meanwhile, fell by more than expected. The company’s shares posted a 2% weekly drop. The real estate sector’s gainers included Crown Castle International (CCI), which reported Q1 adjusted funds from operations up from the year-earlier period and above analysts’ mean estimate. The company also raised its outlook for 2021. Shares climbed 4.2%. Next week’s earnings slate includes Tesla (TSLA) on Monday; Alphabet (GOOGL) and Microsoft (MSFT) on Tuesday; Boeing (BA), Facebook (FB) and Apple (AAPL) on Wednesday; Merck (MRK), McDonald’s (MCD) and Kraft Heinz (KHC) on Thursday; and Clorox (CLX), Exxon Mobil (XOM) and Chevron (CVX) on Friday. The data calendar features March durable goods and core capital goods orders on Monday; April consumer confidence on Tuesday; March pending home sales on Thursday; and March consumer spending and core inflation, among other reports, on Friday. There will also be a Federal Open Market Committee meeting next week, concluding with an announcement Wednesday afternoon. Provided by MT Newswires |

Core Holdings,

AAPL – 4/28 AMC

BA – 4/28 BMO

BIDU – 5/17 est

COST – 5/27 AMC

DIS – 5/13 AMC

F – 4/28 AMC

FB – 4/28 AMC

GE – 4/27 BMO

GM – 5/5 BMO

UAA – 5/10 est

V – 4/27 AMC

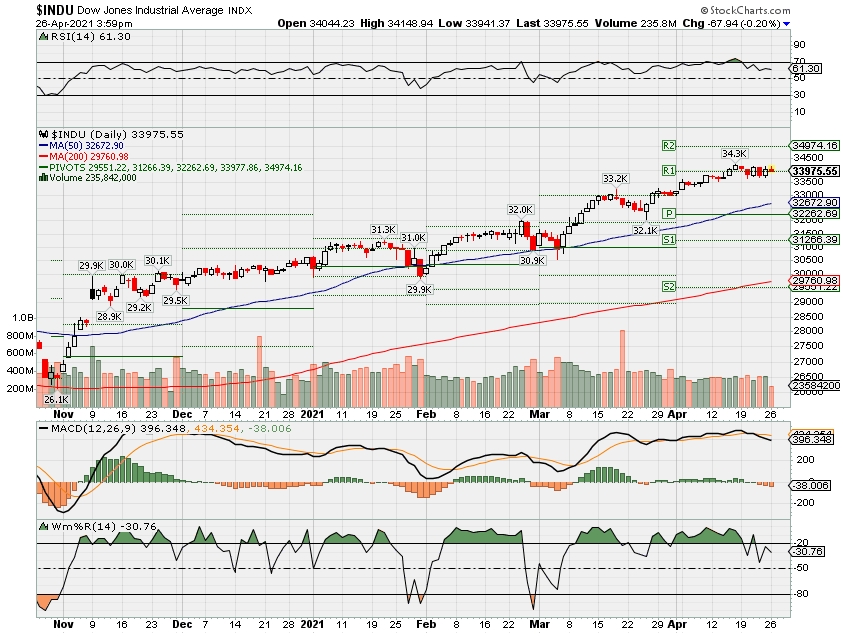

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end May 2021?

04-26-2021 4.5%

04-19-2021 2.0%

Earnings:

Mon: PHG, AMP, UHS, TSLA

Tues: MMM, UPS, BP, GLW, CROX, HAS, JBLU, PHM, WM, AMGN, COF, FEYE, LLY, GE, GOOG, MSFT, SBUX, V,

Wed: QCOM, AUY, BSX, HUM, SHOP, SIRI, YUM, CREE, EBAY, GRUB, LC, MGM, BA, CCL, AAPL, FB, F, WH

Thur: MO, BMY, CAT, SMCSA, DPZ, IP, KDP, KHC, TREE, MCD, MRK, TAP, BZH, FSLR, GNW, SKYW, X, WDC, MA, NEM, RCL, AMZN

Fri: CVX, CLX, CL, XOM, JELD, JCI, PSX, ABBV

Econ Reports:

Mon: Durable Goods, Durable ex-trans,

Tues: FHFA Housing, S&P Case Shiller, Consumer Confidence

Wed: MBA, FOMC Rate Decision

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator, Pending Home Sales,

Fri: Personal Income, Personal Spending, PCE Prices, Chicago PMI, Michigan Sentiment

Int’l:

Mon –

Tues – JP: BOJ Interest Rate Decision

Wed –

Thursday –

Friday- CN: Services PMI Manu, CN: NBS Manu Index, EUR: GDP

Sunday –

How am I looking to trade?

Earnings and adding protection where needed

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

1 in 4 workers is considering quitting their job after the pandemic—here’s why

In 2019, workers were quitting their jobs at record rates, with labor experts saying workers did so in order to secure the pay raises and promotions they weren’t getting from within.

Then, beginning in March 2020, the labor market shed 20.5 million jobs in the first few weeks of the coronavirus pandemic. Now, a year later, there are still nearly 7.9 million fewer Americans counted as employed than in February 2020, while the labor force is down 3.9 million.

But with signs pointing toward recovery in many economic sectors, workers are feeling the itch to job-hop yet again. By some estimates, 1 in 4 workers is planning to look for opportunities with a new employer once the threat of the pandemic has subsided, according to Prudential Financial’s Pulse of the American Worker survey. The data, collected by Morning Consult on behalf of Prudential in March 2021, includes a sample of 2,000 employed adults, including a statistically significant sample of workers that are or have been working remotely during the pandemic.

Here’s a look at who’s planning to leave, and what employers should be thinking about as they retain — or recruit — in a post-pandemic environment.

Who’s leaving, and why

Of the 26% of workers planning to leave their employers after the pandemic, 80% are doing so because they’re concerned about their career advancement; meanwhile, 72% say the pandemic caused them to rethink their skill sets. More than half of potential job-hoppers have sought out new trainings and skills during the pandemic, possibly to prepare to change jobs in the next few months.

Workers who want to quit overwhelmingly say they’re looking for a new job with more flexibility. Indeed, even among those who aren’t considering changing jobs, half of people currently working remotely say if their current company doesn’t continue to offer remote-work options long-term, they’ll look for a job at a company that does.

The share of people thinking of quitting, and their reasonings, doesn’t surprise Derek Avery, a researcher and University of Houston professor in industrial/organizational psychology. With that said, as workplaces figure out how to extend their flexible arrangements post-pandemic, he worries workplaces could widen the divide between the “haves,” or the upwardly mobile who can best leverage job-hopping, and the “have-nots,” or workers less likely to be able to move employers to gain new skills, money, status or flexibility.

“The notion of jumping ship to get other offers and increase your market value tends to work better for members of dominant groups” including white men, but less so for women and minorities, Avery tells CNBC Make It.

Already, people who can work remotely tend to be white, college-educated and higher-income workers. If a post-pandemic workplace accelerates this trend, it could worsen existing income inequality, Avery says.

What employers should be thinking about

Even one person considering quitting their job is cause for concern to Prudential Financial vice chair Rob Falzon and “any leader” of an organization, he says. For fellow employers, Falzon points to three areas of concern that leadership should be thinking about in their retention strategies.

First, Falzon says organizations should be rethinking how they maintain their company culture and help employees feel connected in a remote environment. A growing dissociation from their employer, especially over the last year, can “make people more open to changing jobs and taking that head hunter’s phone call,” he says.

But he cautions against resorting to bringing everyone back to the office full-time. Prudential’s survey adds to the chorus of research indicating workers want to continue their flexible arrangements long after the risks of the pandemic subside.

Most want a hybrid model of working, where they split their time between an office and a remote location. 68% of workers believe this balance is the “ideal” workplace model. Falzon agrees and says Prudential will be working with this model in the months ahead.

Second, he says the pandemic has increased workers’ anxiety that they’re not learning new skills or seeing room to advance unless they leave the company, something that’s long plagued workers but especially so in the last year.

“One result of the pandemic has been an accelerated rate of technological adoption to remain competitive, and therefore a need for learning skills,” Falzon says. But in the past year, many organizations have focused less on skills training and more on shifting their business operations, as well as providing workers with emergency resources for concerns like mental health and child care.

As companies consider the future of their benefits offerings, he says paths to upskill, reskill and get promoted should be considered, which could also help address the third area of concern for workers: financial resiliency.

With workers better able to take a job from anywhere, they’ll seek ones that pay well, have opportunities to learn and advance, and provide benefits that center work-life balance.

As Falzon cautions: “If you’re an employer and you’re not being accommodating, you’ll lose talent.”

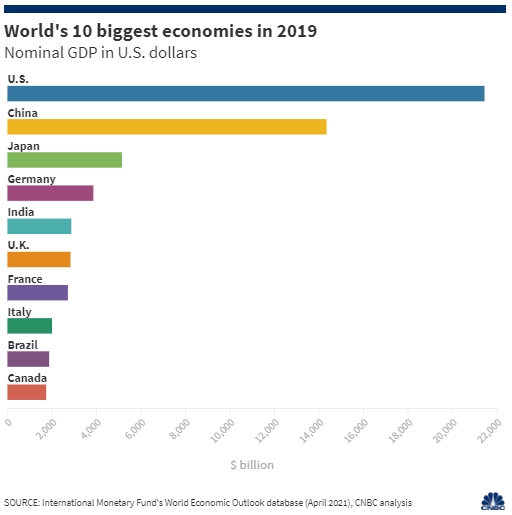

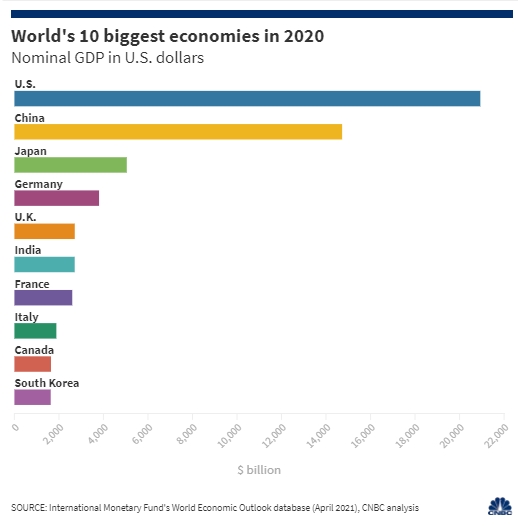

Here are the 10 biggest economies in the world — before the pandemic vs. now

KEY POINTS

- The United States, China, Japan and Germany still take the top four spots as the world’s largest economies.

- Some rankings have shifted as a result of the pandemic while one country fell off the top 10 list, according to CNBC analysis of the International Monetary Fund’s economic forecasts.

SINGAPORE — The Covid-19 pandemic has shaken up the ranking of the world’s largest economies after sending many countries into their worst economic recessions in recent history.

The United States, China, Japan and Germany still take the top four spots as the world’s largest economies — but some rankings have shifted as a result of the pandemic while one country fell off the top 10 list, according to CNBC analysis of the International Monetary Fund’s economic forecasts.

CNBC compared nominal gross domestic product in U.S. dollars across countries provided in the IMF’s World Economic Outlook database.

Nominal GDP estimates the market value of all finished goods and services produced in an economy but doesn’t strip out changes in price levels, or inflation — and can therefore overstate or understate the real economic value.

Still, nominal GDP values denominated in a common currency are a way of measuring and comparing economic sizes of different countries, and provide a glimpse of how developments — such as the pandemic — affect economies differently.

Here are the major changes in the ranking of the world’s 10 largest economies before and after the Covid outbreak.

https://flo.uri.sh/story/833057/embed

India falls behind the U.K.

India, which became the world’s fifth largest economy in 2019, slipped to sixth place behind the U.K. last year.

The South Asian country would not regain fifth place in the global economic ranking until 2023, according to CNBC analysis of IMF data.

India was hit by strict lockdowns last year as the country struggled to contain the coronavirus. Its economy was projected by the IMF to contract 8% in the fiscal year that ended in March 2021.

While the fund expects India to grow 12.5% in the current fiscal year which ends March 2022, some economists have warned that the latest surge in Covid cases could dampen the country’s prospects. India last week overtook Brazil to become the second worst-infected country globally, behind only the U.S.

“We grow even more concerned that rising Covid 19 cases pose a risk to our still shallow recovery,” Bank of America economists wrote in a Monday report.

The economists estimated that one month of nationwide lockdown — if imposed again — would shave 100-200 basis points off India’s annual GDP.

Brazil drops out of top 10

Brazil went from the ninth largest economy in 2019 to the 12th largest last year, becoming the only country that fell out of the top 10 ranking.

The South American country would stay out of the world’s 10 largest economies until at least 2026 — the furthest IMF projection available, CNBC analysis showed.

Brazil has reported the third highest Covid caseload and second largest death toll globally. But President Jair Bolsonaro — who has downplayed the virus threat — has repeatedly refused to impose a national lockdown to contain the coronavirus.

Sao Paulo’s health secretary reportedly wrote to the federal government warning of an “imminent” collapse in the state’s health-care system; while economists said the Brazilian economy would struggle to recover.

The economy contracted 4.1% last year and is forecast to grow 3.7% in 2021, according to the IMF.

South Korea enters top 10

With Brazil dropping out of the 10 largest economies in the world, South Korea moved up to 10th place and is expected to remain there until at least 2026, CNBC analysis showed. IMF’s data projection was only available until 2026.

South Korea was one of the earliest countries outside China to report cases of Covid-19 in early 2020. The country had some success in containing the virus last year that — along with strong semiconductor exports — helped its economy to contract by a modest 1% in 2020.

Consumption has also become increasingly resilient to virus outbreaks, thanks in part to a rise in online shopping. However, hospitality and recreation remain very weak.

The number of new daily infections rose this month, forcing authorities to extend social-distancing measures that include restricting large gatherings until early May.

Despite the virus uncertainty, the country’s manufacturing and export sectors remain strong, economists from consultancy Capital Economics said in a report last week.

“Consumption has also become increasingly resilient to virus outbreaks, thanks in part to a rise in online shopping. However, hospitality and recreation remain very weak,” they added.

The IMF predicts the South Korean economy could grow 3.6% this year.

Apple’s AirTag relies on a feature no competitor can match: 1 billion iPhones

KEY POINTS

- Users can attach Apple’s newest gadget, AirTag, to valuables such as keys or a backpack, then, if the item gets lost, locate it on a live map inside Apple’s built-in Find My software.

- AirTag’s most important differentiating feature isn’t the technology inside the $29 coin-sized stainless steel gadget. It’s other people’s iPhones.

- The product represents a new frontier for Apple: using its install base of over 1 billion iPhones as infrastructure to build services that its competitors can’t.

On Tuesday, Apple announced a long-awaited gadget called AirTag. Users can attach the $29 coin-sized device to valuables such as keys or a backpack, then, if the item gets lost, locate it on a live map inside Apple’s built-in Find My software.

AirTag competes with a number of other products on the market, including from Tile, whose general counsel complained before Congress on Wednesday about Apple’s overall dominance.

But AirTag’s most important differentiating feature isn’t the technology inside the $29 coin-sized stainless steel gadget. It’s other people’s iPhones.

AirTag doesn’t have a GPS signal, which would rapidly drain its battery and raise privacy questions. Instead, when it’s attached to a lost object, it sends out scrambled Bluetooth signals. For those signals to reach the internet and inform the person who’s looking for their lost device, they’ll need to find an iPhone that’s listening for them.

″Using Bluetooth and the hundreds of millions of iOS, iPadOS, and macOS devices in active use around the world, the user can locate a missing device even if it can’t connect to a Wi-Fi or cellular network,” Apple explained in a security disclosure about the Find My service. “Any iOS, iPadOS, or macOS device with ‘offline finding’ enabled in Find My settings can act as a ‘finder device.’”

The product represents a new frontier for Apple: using its install base of over 1 billion iPhones as infrastructure to build services that its competitors can’t. Now iPhones are part of a physical network out in the world that’s looking out for stolen goods — even if their users have never purchased an AirTag.

“The bottom line is AirTag is an example of Apple leveraging its ecosystem to create a more compelling product than what is currently in the market,” Loup Ventures founder Gene Munster wrote in a newsletter on Tuesday. “Specifically, AirTag will have better navigation and discovery features, along with a billion-plus device network that can be utilized to help locate lost items.”

Enrolling in the Find My network does have benefits to iPhone users who don’t buy AirTags. Many users sign up because the same app can be used to find lost Apple products, and it’s easy to do when signing into an iCloud account on an iPhone.

The Find My network can be used to find an iPhone after it’s been shut off, as thieves often do after stealing a phone. (If the device is on, it can be contacted through Find My iPhone, a similar service that uses the device’s internet connection and predates the Find My network.)

Users can also opt out of the Find My network in Apple’s settings, although that means they don’t get the benefits of the network, such as finding devices that have been turned off or aren’t connected to cellular or Bluetooth. (To do so, go to Settings > Your Name > Find My > Find My iPhone > and then toggle “Find My network” on or off.)

A vast, global network

The number of devices participating in the network is crucial for a product such as AirTag.

Apple describes its Find My service as a “vast, global network” and allows third-party accessory makers to release products that use it, too.

If an AirTag is lost in the middle of a desert with no Apple devices in Bluetooth range, it can’t connect to the internet to send signals or update the user’s map. But in the middle of an American city, where an estimated 42% of people have iPhones — more in some areas — you’re much more likely to find a device that’s looking for your lost AirTag.

Apple CEO Tim Cook has previously described Apple’s product strategy as “only Apple,” suggesting that because the company builds hardware, develops software and runs its own online services, it can introduce features that rivals such as Microsoft, Google and Samsung can’t.

While Samsung and other major smartphone vendors have similar numbers of phones in people’s hands, they don’t control the underlying operating system, making features such as Find My much more difficult to implement widely at once.

For Apple, AirTag is probably an effort to add distinguishing features to its iPhone to discourage current users from switching to an Android device. It’s not likely to be a major revenue driver.

“While the Airtags are incremental to our model we do not believe even a very successful launch of that product will have much impact on our forecasts given the low $29 price point,” Goldman Sachs analyst Rod Hall wrote in a note Tuesday.

If Apple becomes more skilled at using its installed devices as privacy-sensitive infrastructure, it could represent a durable advantage for the company. Apple’s installed base of iPhones could become especially important as it invests heavily in augmented reality, a technology that merges the physical and digital worlds.

A network of location-aware iPhones could be used in augmented reality apps such as Pokemon Go, for example, to identify where other players are competing and start a group experience. It provides the sensors and internet connection needed for building digital experiences in the real world without building new equipment each time.

The privacy angle

AirTag also represents a major test for Apple’s privacy positioning.

Since 2015, Apple has advertised privacy and security as major differentiators for its iPhone. It has consistently built systems, such as Covid tracking exposure notifications, that are decentralized, which means they are designed in a way that data is processed and calculated on a device instead of on servers that Apple can access.

Apple is building on that reputation to assure customers that its Find My system won’t leak user location or data when acting as a finding device. Apple says the Find My network keeps location data private and anonymous and that it doesn’t store location data or history.

How Apple pulls it off is a matter of complicated software engineering. “Find My is built on a foundation of advanced public key cryptography,” Apple’s security disclosure says.

Now Apple’s users will need to decide whether they understand and trust the Find My network and Apple — both as users of them, and as iPhone users participating in them to make them work better.

Bitcoin slides below $50,000 with $260 billion wiped off the crypto market as Biden’s tax proposals crush risk appetite

- Bitcoin marked its seventh loss in the last eight days by sliding below $50,000 on Friday.

- Other digital currencies declined after Biden was said to be eyeing a hike in tax rates on the rich.

- That drop led to $260 billion being wiped off the cryptocurrency market cap.

Bitcoin slid below $50,000 on Friday, extending losses for a seventh day in a row, while simultaneous drops in other digital currencies erased $260 billion off the total value of the cryptocurrency market.

The world’s most widely traded digital asset fell 4% to around $49,130, ether fell 7% to around $2,220, Dogecoin fell 17% to $0.17, and XRP dropped 8%.

The crypto market has come under fresh pressure after reports that US President Joe Biden is looking to double the capital gains tax rate on wealthy investors.

Biden’s proposals are aimed at funding expanded childcare and education programs. Federal tax rates, including an existing surtax on investment income, could be as high as 43% for those earning more than $1 million, according to Bloomberg.

https://products.gobankingrates.com/r/d9360ea31bf06ea8b9d0ef49288e28fb?subid= The Internal Revenue Service has been executing tax collection on crypto gains. Crypto is taxed as property, not currency. The agency began requiring crypto investors to disclose transactions on their 2019 tax returns, asking whether they “received, sold, sent, exchanged or otherwise acquired any financial interest in any digital currency.”

“It is clear that bitcoin is more sensitive to capital gains tax threats than most ‘asset’ classes,” Jeffrey Halley, a senior market analyst at OANDA, said. “The threat of regulation, either directly in developed markets or indirectly via the taxman, has always been crypto’s Achilles’ heel. Yes, you could store those juicy capital gains offshore as a US citizen, but we know how the G-Man treats tax evaders. It is not pretty.”

JPMorgan warned this week there could be further downside for bitcoin if it fails to climb back above the $60,000-level. Guggenheim’s Scott Minerd also recently said bitcoin could pull back to $20,000 or $30,000 after rising much too fast in a short period of time.