HI Market View Commentary 04-15-2019

What I want to talk about today?

When does earnings season start?= Usually it’s been when AA, BUT you might have some bigger banks that report the week before.

When should you have started your earnings list for stock you trade? I started my list last Sunday 04/07/19 and was just a tad bit late

AAPL 04/30 AMC

AMD 04/24

AOBC 06/19

ATVI 05/02 AMC

BA 04/24 BMO

BAC 04/16 BMO

BIDU 04/25

CVS 05/01 BMO

DEA 05/07

DIS 05/08 AMC

F 04/25 AMC

FB 04/24 AMC

FCX 04/25 BMO

IBKR 04/16 AMC

INTC 04/25 AMC

ISRG 04/18 AMC

LULU 05/30

MO 04/25 BMO

MRO 05/01 AMC

MU 06/19

NFLX 04/16 AMC

NVDA 05/16 AMC

RHT 06/20

SLB 04/18 BMO

TGT 05/22 BMO

UAA 05/02

V 04/24 AMC

ZION 04/22 AMC

If you are going to protect your stocks most of us should have protection on tomorrow, Wednesday and no later than Thursday

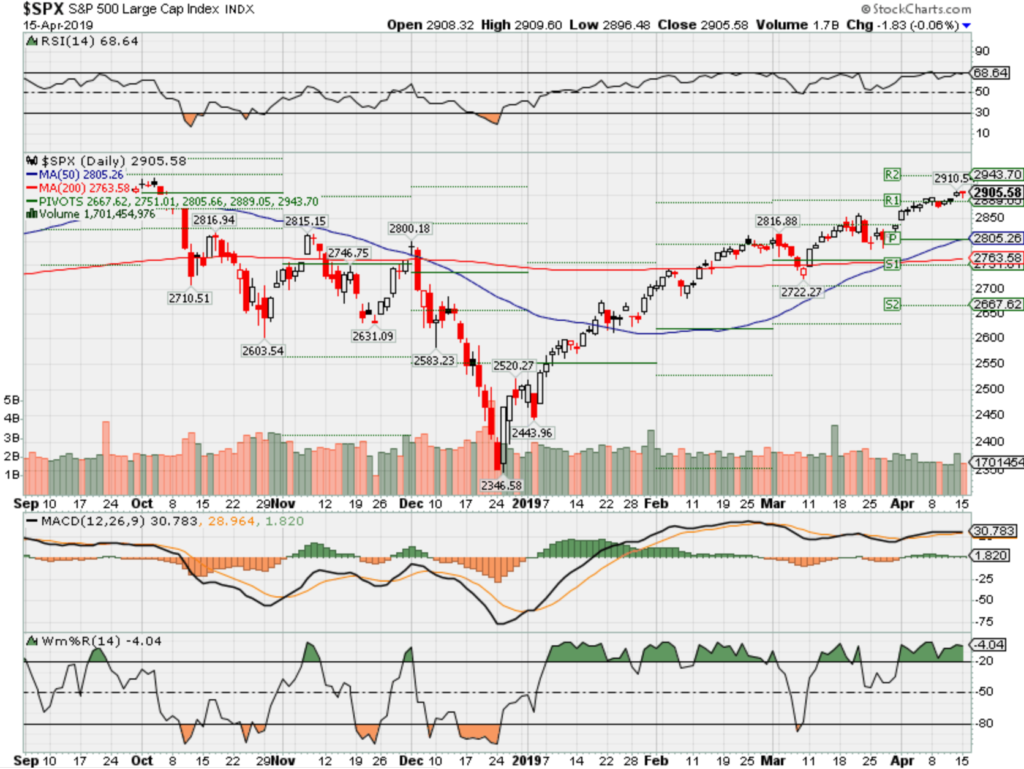

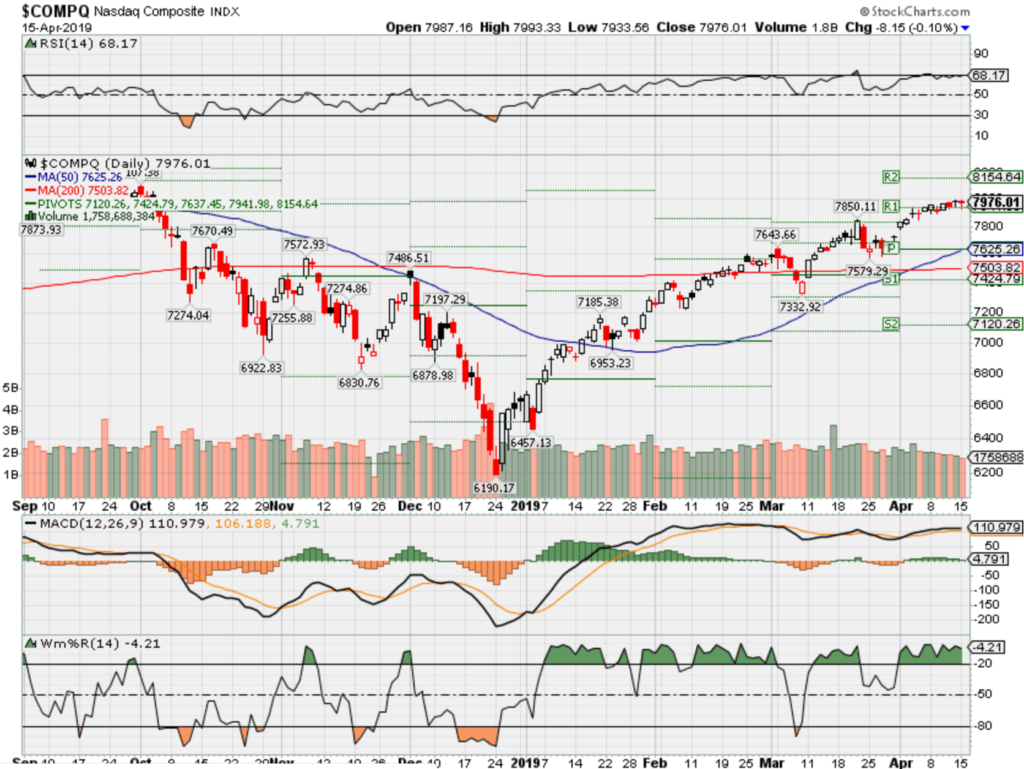

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end April 2019?

04-15-2019 2.5%

04-08-2019 2.5%

04-01-2019 2.5%

03-25-2019 0.0%

Earnings:

Mon: C, GS, SCHW

Tues: BAC, BLK, FHN, JNJ, UNH, IBM, CSX, NFLX,

Wed: ABT, MS, PEP, USB, AA, KMI, LVS,

Thur: AXP, HON, KEY, PM, UNP, SLB, ISRG,

Fri:

Econ Reports:

Mon: Empire, NET Long Term TIC Flows

Tues: Capital Utilization, Industrial Production,

Wed: MBA, Fed Beige Book, Trade Balance

Thur: Initial, Continuing, Retail Sales, Retail Ex-auto, Phil Fed, Business Inventories, Leading Indicators,

Fri: STOCK MARKET CLOSED for Good Friday

Int’l:

Mon –

Tues – CN: GDP Q1 est

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Going long for a China Deal and next Earnings which I expect to be better than expected Earnings

Starting tomorrow, Wednesday and Thursday long puts are going on stock positions

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Apple Stock Is Poised to Have Its Longest Winning Streak Since 2010

By

Tomi Kilgore, MarketWatch

April 9, 2019 11:33 a.m. ET

Shares of Apple Inc. AAPL, +0.18% rose 0.4% in morning trade Tuesday, putting them on track extend its win streak to 10 sessions. That would be the longest such streak since the 10-day stretch of gains ended Oct. 18, 2010. There have been five 9-session win streaks since then, in August and April of 2018, July 2017, August 2014 and October 2013. Apple’s stock was one of just two of 30 Dow Jones Industrial Average DJIA, -0.10% components gaining ground, the other being Walt Disney Co.’s stock DIS, +1.52% which rose 0.6%. Apple’s stock gain comes after Wedbush raised its price target to $225 from $215, and Disney’s advance comes after a Cowen upgrade to outperform from market perform.

11539

Blog/Economics

Posted Apr 10, 2019 by Martin Armstrong

QUESTION: Dear Mr. Armstrong,

I have a question that might interest not just me but also other blog Readers:

In your blog Posts you write that you expect that we will have a hard landing

going into 2020.

My question is: What does that mean for the Dow? Do you expect the dow to

correct into 2020 more that 20%.

Thank you for your work and best Regards,

A

ANSWER: The hard landing is economic and will have its greatest impact outside the USA. While central banks have sold US Treasuries in an attempt to keep the dollar down, the private sector has been pouring assets into the USA and particularly the Dow. Our capital flows have tracked a significant shift in global capital flows into the USA especially from Europe. That should come as no surprise given the chaos in BREXIT as well as the May elections.

We still do not see a major correction in the Dow. We have been undergoing a shift from public to private assets on a global scale. Therefore, the hard landing will be more economically based and central banks will try to do something, as in lowering rates, but they have run out of bullets. The Fed has tried to back off on rates after buying into the problem of a hard landing outside the USA. The ECB has been on its hands and knees, pleading with the Fed not to raise rates when they will have to continue their QE programs or face sovereign debt defaults.

QUESTION: Hi Martin,

What are your thoughts

on preferred shares? Especially the ones with good quality DBRS ratings. Will

the survive the downturn or will they fail?

Thx

FS

ANSWER: Ordinary and preference shares are a claim on corporate earnings and assets. Dividends for ordinary shares may be irregular and indefinite, whereas preference shareholders will receive a fixed dividend which will accrue usually if the payments are not made in one term. Ordinary shareholders are in a riskier position than preference shareholders since they are the last to receive their share in the event of liquidation. That may not be a concern in a blue chip company. Nevertheless, they also are open to the possibility of a higher dividend during times when the firm is doing well in contrast to preferred shared with fixed income.

Preferred shares can be looked upon as a hybrid debt where you have a claim on the assets, but like a loan, it has a fixed rate. Ownership of preference shares offers advantages and disadvantages. On one hand, it provides a higher claim on earnings, assets, and fixed dividends. On the other, it limits voting rights and the possibility for growth in dividends in times when the company is financially sound.

The good companies will generally survive. This is a collapse in government – not the private sector.

https://seekingalpha.com/news/3450883-ts-warnermedia-exits-hulu-1_43b

AT&T’s WarnerMedia exits Hulu for $1.43B

Apr. 15, 2019 5:27 PM ET|About: Comcast Corporation (CMCSA)|By: Jason Aycock, SA News Editor

WarnerMedia (NYSE:T) has an agreement where it sold its minority stake in Hulu back to the joint venture, further cementing Disney’s (NYSE:DIS) control of the streaming service.

After Disney’s $71B deal for Fox (FOX, FOXA) media assets, it took a 60% stake in Hulu, with some 30% being owned by Comcast (NASDAQ:CMCSA) and about 9.5% owned by WarnerMedia, a vestige of Time Warner’s investment in the service.

Now with AT&T’s stake valued at $1.43B, Hulu overall is valued at $15B.

The deal effectively leaves ownership of Hulu at two-thirds Disney, one-third Comcast.

AT&T will use proceeds to reduce debt it incurred closing its deal for Time Warner.

After hours: T +0.1%; CMCSA +0.2%.

https://seekingalpha.com/news/3450185-disney-confirms-branded-streaming-will-ad-free-updated-price

Disney confirms branded streaming will be ad-free (updated with price)

Apr. 11, 2019 5:38 PM ET|About: Comcast Corporation (CMCSA)|By: Jason Aycock, SA News Editor

At the Disney (NYSE:DIS) investor day, Direct-to-Consumer and International chief Kevin Mayer set the framework for its major streaming services going forward: Disney Plus, ESPN Plus and Hulu — services the company will “likely bundle at a discounted price.”

Painting a broad picture of revenue models, Mayer said that Disney Plus will be an ad-free subscription product. ESPN Plus has a limited-ad subscription model — live sports breaks naturally lend themselves to ads — and Hulu still has a choice of limited-ad subscriptions or slightly more expensive ad-free subs, along with its live-TV offering.

After a U.S. debut, Disney Plus will be launched in global markets over time. ESPN Plus is looking at Latin American expansion, and Hulu will expand overseas as well.

Disney’s steering the ship at Hulu now with a 60% share, but the service is also co-owned by Comcast (NASDAQ:CMCSA), with a 30% stake, and WarnerMedia (NYSE:T), with 10%.

Updated 7:59 p.m.: And there it is: Disney Plus will launch Nov. 12, 2019, at $6.99/month, with an annual option of $69.99.