HI Market View Commentary 04-04-2022

OK let’s talk about ARK Innovations Fund and the fall and the most recent rise

DOWN 70% and now up 30%

Average is 40% down SO your thought process is every $100 is now worth $60

BUTT let’s do the math IF $100 loses 70% then it is only worth $30 AND if the $30 gains 30% = $39

When down 70% right 233% gets you back to break even

Kevin What do you mean when you said you are twice as bad as the market right now on the way down but three times a good on the way up?

Lets do a quarter review on our core holdings:

Last Week I went over how to use valuations to determine a stock price !!!!

Stock Ticker Symbol Forward PE Range Next Yr EPS Expected Stock Price within 1 Yr

AAPL $172.17 32 – 34 $6.18 $197.76 – $210.12

BA $215.50 54 – 58 $4.87 $262.98 – $282.46 ALL $ 410

BAC $49.18 18 – 22 $3.18 $57.12 – $69.96

BIDU $153.33 8 – 12 $56.94 ($38) $304 – $456

COST $536.18 40 – 44 $13.97 $558.80 – $614.68

CVS $104.19 14 – 16 $8.26 $115.64 – $132.16

DG $238.27 22 – 23 $11.25 $247.50 – $253

DIS $157.83 34 – 36 – 44 $5.61 $190.74 – $213.18 – $246.84

F $24.44 13 – 14 – 15 $1.99 $25.87 – $27.86 – $29.85

JPM $167.16 16 – 18 $11.96 $191.36 – $215.28

SQ $141.54 125 – 135 $1.83 $228.75 – $247.05

UAA $19.85 28 – 32 $0.79 $22.12 – $25.28 – 27.50=34.4PE

V $216.96 32 – 36 $8.41 $269.12 – $302.76

FB $331.79 25 – 28 – 32 $14.23 $355.75 – $398.44 – $455.36

Earnings coming up:

AAPL 4/28 AMC

BA 4/27 est

BAC 4/18 BMO

BIDU 5/18 est

DIS 5/10 est

F 4/27 AMC

FB 4/27 est

JPM 4/13 BMO

KO 4/28 BMO

LMT 4/19 BMO

MU 6/30 est

SQ 5/05 AMC

TGT 5/18 BMO

UAA 5/03 est

USB 4/14 BMO

V 4/26 est

VZ 4/22 BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 25-Mar-22 14:02 ET

Let the front-loading begin

On March 16 the Federal Open Market Committee (FOMC) raised the target range for the fed funds rate for the first time since December 2018. It was a tidy 25 basis points, which took the target range from 0.00-0.25% to 0.25-0.50%.

There wasn’t unanimous consent for that decision. St. Louis Fed President Bullard wanted the FOMC to raise rates by 50 basis points.

Mr. Bullard didn’t get his wish in March, but it’s sounding increasingly as if he will in May and perhaps even at some additional meetings after that.

Still Chasing the Rabbit

The Summary of Economic Projections conveyed an otherwise hawkish bent. The median estimate for the fed funds rate in 2022 increased to 1.9% from 0.9% in December. Furthermore, the median estimate for the fed funds rate in 2023 jumped to 2.8% from 1.6%, leaving it above the longer-run rate of 2.4%.

The projection for 2022 implied an expectation for seven rate hikes in 2022, including the one that was announced in March. The projection for 2023, meanwhile, suggested the Fed expects to be operating with a restrictive stance in 2023 since the median estimate is above the longer-run rate. Of course, the restrictive rate is only as good as the forecast for inflation and the longer-run rate.

The Fed’s inflation estimates since the pandemic began have been woefully conservative, although the most recent estimate has sprinkled a little more reality into the situation.

Still, with the PCE inflation rate at 6.1% in January and the Core PCE inflation Rate at 5.2% (before the Russia-Ukraine situation worsened the inflation picture), the latest estimate still looks more like a case of the dog chasing the rabbit.

| Fed Economic Projections (median estimate for 2022) | ||

| PCE Inflation | Core PCE Inflation | |

| June 2020 | 1.7% | 1.7% |

| September 2020 | 1.8% | 1.8% |

| December 2020 | 1.9% | 1.9% |

| March 2021 | 2.0% | 2.0% |

| June 2021 | 2.1% | 2.1% |

| September 2021 | 2.2% | 2.3% |

| December 2021 | 2.6% | 2.7% |

| March 2022 | 4.3% | 4.1% |

Source: Federal Reserve Summary of Economic Projections

Remarkably, the stock market rallied in the wake of the FOMC announcement with Fed Chair Powell winning plaudits for his presentation style during the press conference. He indicated at the press conference that the Fed would use its tools to ensure that higher inflation does not become entrenched.

Stock investors reportedly liked the implication that the Fed is going to get tough and get inflation in check, seemingly forgetting that the process for doing that will entail a series of rate hikes and reducing the size of the Fed’s balance sheet — actions that should slow economic and earnings growth, if not drive them into a contraction.

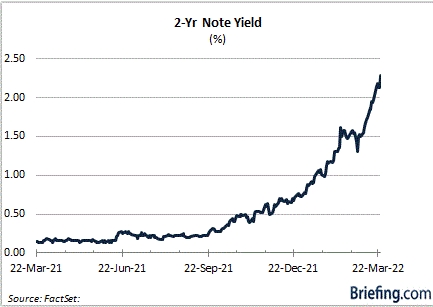

Treasuries, however, quickly woke up to the reality that policy rates are headed higher. The 2-yr note yield, which settled at 1.85% the day before the FOMC announcement, now sits at 2.31%.

Getting Personal

Strikingly, several Fed officials issued some personal opinions in the days following the FOMC meeting about how they think the Fed might have to think about removing policy accommodation.

- Mr. Bullard (arguably the biggest hawk at the Fed) said he thinks the fed funds rate should be above 3.0% this year.

- Fed Governor Waller said he favors the Fed front-loading its rate hikes, which could entail raising rates by 50 basis points at one or more meetings in the near future.

- Minneapolis Fed President Kashkari (arguably the biggest dove at the Fed) acknowledged that he moved his SEP submission for the fed funds rate for year-end 2022 from 0.50-0.75% in December to 1.75-2.00% in the most recent SEP and said the Fed may need to get modestly above neutral while inflation dynamics unwind or even move to a contractionary stance if the economy persists in a high-pressure, high-inflation equilibrium.

- Fed Chair Powell, in a speech for the NABE Conference, reiterated that the Fed will be more aggressive if necessary to ensure a return to price stability, including raising the fed funds rate by more than 25 basis points at a meeting or meetings and tightening beyond common measures of neutral and into a more restrictive stance if needed.

- Cleveland Fed President Mester thinks a fed funds rate of 2.5% by year end looks appropriate.

- Chicago Fed President Evans expects the federal funds rate at 2.75-3.00% by the end of 2023 and 2024.

What was peculiar about all these remarks is that they were made despite an awareness that peace talks between Russia and Ukraine are getting bogged down. Recall that the Fed took a more conservative step with the first rate hike, predominately because of the uncertainty surrounding the Russia-Ukraine situation which is still highly uncertain.

Only days after doing so, “front-loading” has become the new buzzword when it comes to discussing future policy moves.

What It All Means

Fed officials are talking tough about needing to rein in inflation. That’s good to hear because inflation is out of hand and it promises to get worse still before getting better. Then again, Fed officials know they have to talk tough given that there hasn’t been any noticeable downshift in inflation expectations following the first rate hike and their median estimate that another six rate hikes are likely to follow this year.

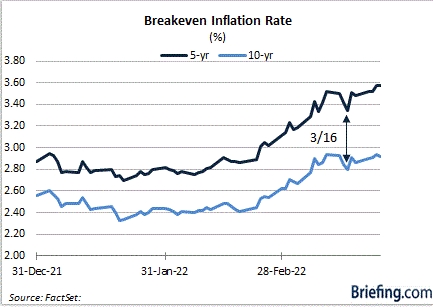

The 5-year breakeven inflation rate stood at 3.42% on March 15. Today it sits at 3.57%. The 10-yr breakeven inflation rate stood at 2.84% on March 15. Today it sits at 2.92%.

Inflation expectations are inflated, sitting at 20-year highs. The bump in inflation expectations after the first rate hike is not what the Fed wants to see. Not surprisingly, then, the jawboning about front-loading rate hikes has gone up an octave or two.

By the same token, the fed funds futures market looks to be taking the more vocal Fed officials at their word. According to the CME’s FedWatch Tool, the December fed funds futures show an 86.6% probability of the fed funds rate being at 2.25-2.50% and a 51.5% probability that it will be at 2.50-2.75%.

That jibes with Ms. Mester’s view, but it’s still short of Mr. Bullard’s thinking.

In any case, it points to an awareness that the Fed has a lot of catching up to do if it wants not only to tame inflation but also inflation expectations.

Let the front-loading begin.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: The next installment of The Big Picture will be published the week of April 4)

| https://go.ycharts.com/weekly-pulse |

| Market Recap |

| WEEK OF MAR. 28 THROUGH APR. 1, 2022 |

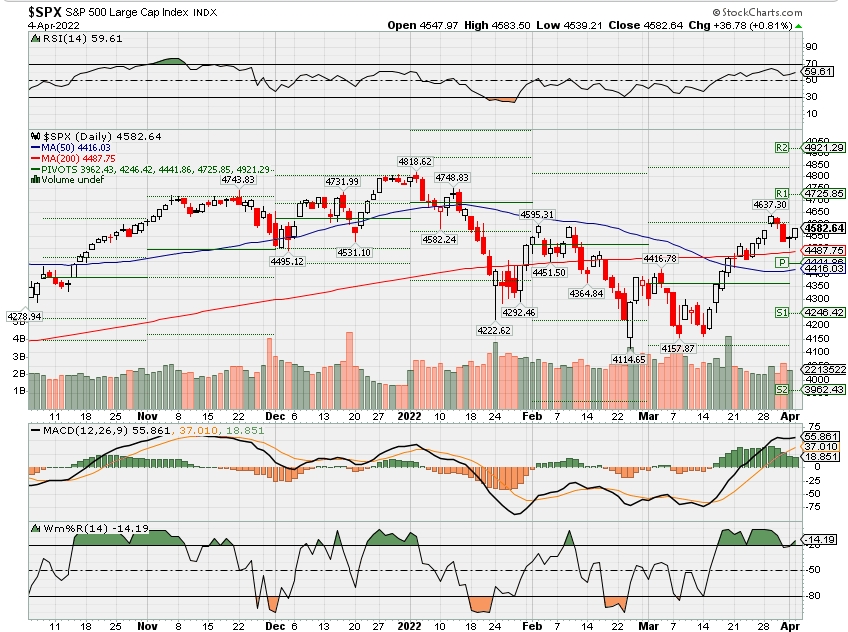

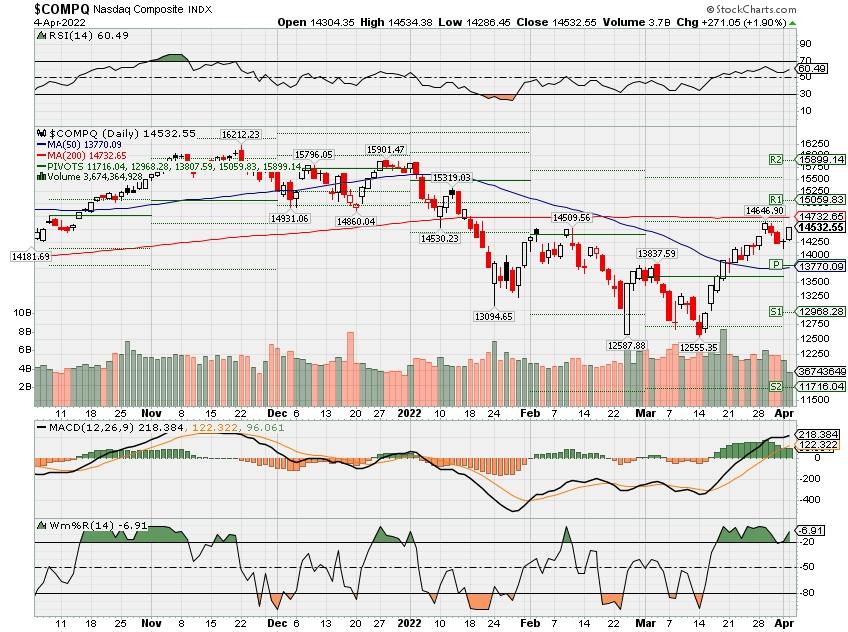

| The S&P 500 closed fractionally higher for the week, extending its winning streak to a third week, as a last gasp to the upside made up for early losses that were tied to lingering concerns about a global recession and the ongoing conflict in Eastern Europe. The benchmark index closed 0.06% higher at 4,545.86 versus last week’s close of 4,543.06. For the month, the S&P gained 5.2% in March with the utility sector outperforming with an 11% gain from the month prior. But for the first quarter, the S&P 500 was down 5.6%, making this the worst quarter for the index since 2020. An impressive 34% gain in the energy sector and 5% gain in utilities were overshadowed by losses in the other nine sectors. Stocks were cautiously higher at the start of the week as Russia’s war again Ukraine and the siege of the port town of Mariupol continued to hold global financial markets captive. For US investors, the risk that a recession will result from overly aggressive monetary policy was amplified by last week’s economic data that suggested the post-pandemic economic surge is fading, causing consumer discretionary stocks like Best Buy (BBY) and Tapestry (TPR) to close with sizeable losses last week. But thanks to impressive gains in the cruise industry after the Centers for Disease Control eased cruise restrictions, the consumer discretionary sector eked out a 0.89% gain. Real estate was the top-performing sector within the S&P with a 4.43% gain for the week. While traditional real estate stocks closed the week with modest gains, the top names were in data storage and cell phone towers. Equinix (EQIX), Iron Mountain (IRM), and SBA Communications (SBAC) all gained more than 6% last week, while REITs were under increasing pressure from rising rates. Utility stocks gained a collective 3.7% with Constellation Energy (CEG) closing the week 7.8% higher and adding to last week’s gain after creditors approved its debt restructuring plans. The semiconductor sector gave back last week’s gains as investors rotated out of growth stocks and into value stocks amid concerns about a recession and COVID-related shutdowns that spread to China’s largest city, Shanghai. Shares of Qualcomm (QCOM), Applied Materials (AMAT), and Advanced Micro Devices (AMD) were the worst-performing stocks in the technology sector with losses of 7%, 7%, and 9.5%, respectively. Thanks to outsized gains in payroll processing firms Paychex (PAYX) and Automatic Data Processing (ADP), the technology sector ended the week with a modest 0.12% gain. Financials, which comprised the worst-performing sector of the week, were down 3.28% as a flattening yield curve undermines banks’ interest margins. Last week saw the yield between the 2-yr note and 10-yr note invert and end the week at a negative 8 basis point spread. This inversion was primarily responsible for stocks like Zions Bancorp (ZION) and M&T Bank (MTB) losing as much as 10% last week. Airline stocks got a boost by relaxed COVID travel restrictions, and a 23% rally in Nielson Holdings (NLSN) on a go-private offer helped blunt losses in freight stocks. But the industrial sector erased last week’s gain and ended the week 1.5% lower, while energy shares lost a collective 2.4% to make it the second worst-performing sector. Last week’s second-tier economic data was eclipsed by the March labor market report which showed the economy added 431,000 jobs. The jobless rate declined to 3.6% while at the same time, wages rose for the twelfth consecutive month. This fueled expectations that the Federal Reserve will hike interest rates 50 basis points in May even as regional data showed signs of a slowing manufacturing sector. Next week’s calendar includes data on factory orders (Monday), trade balance (Tuesday), the S&P and ISM services sector PMIs (Tuesday) and the minutes from the March FOMC meeting at which the Fed raised rates by 25 basis points. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bullish 5,20 day

SPX – Bullish

COMP – Bullish

Where Will the SPX end April 2022?

04-04-2022 +2.0%

03-28-2022 +2.0%

Earnings:

Mon:

Tues:

Wed: LEVI

Thur: CAG, STZ, WDFC

Fri:

Econ Reports:

Mon: Factory Orders,

Tues: Trade Balance, ISM Services

Wed: MBA, FOMC Minutes

Thur: Initial Claims, Continuing Claims, Consumer Credit,

Fri: Wholesale Inventories

How am I looking to trade?

Currently letting a lot of things just run without protection

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

From Barron’s:

The Bond Market Is Flashing a Recession Warning—but Stocks Have Thrived After Inversion

Everybody’s talking about the yield curve inversion.

At one point yesterday the yield on the 2-year Treasury briefly traded above that of the 10-year. Historically, such an inversion has been an accurate predictor of a recession, typically within two years.

It’s a strong indicator, but just that.

Philadelphia Federal Reserve President Patrick Harker said on Tuesday the yield curve inversion clearly correlates with recessions but causation was “not very clear.”

Maybe he has a point. The last time it happened was in August 2019. Sure, a recession came along the following year but only because of the Covid-19 pandemic—something the bond market, nor anyone else, could see coming.

Inversion isn’t a recession guarantee, but a “questioning of Fed confidence on how high rates can go,” Standard Chartered analysts said earlier this week.

Either way, it isn’t a good sign—longer-term yields trading below short-term yields point to a more pessimistic outlook on the economy.

That being said, history suggests it could be far from bad news for U.S. stocks, at least soon.

The 2-year and 10-year yield curve has inverted seven times since 1977, according to Dow Jones Market Data. A year later after an inversion the S&P 500 has been an average 11.8% higher—falling on just one occasion following the February 2000 inversion.

Fed Chair Jerome Powell sounded pretty adamant earlier this month in his view that the U.S. economy was strong enough to withstand rate hikes without falling into recession. But with surging inflation and a bona fide recession warning sign now flashing, he has a difficult job on his hands.

—Callum Keown

Metaverse Could Become a $13 Trillion Market by 2030

The metaverse economy, encompassing virtual worlds such as gaming and virtual reality as well as smart manufacturing, online events, and digital currency, could become an $8 trillion to $13 trillion total market by 2030, Citi said in a research report. That would make it 1% of the $128 trillion global economy.

- Even though investments tied to the metaverse have been underperforming, Citi said the metaverse could see five billion unique internet visitors by the end of the decade, driving trillions of dollars in revenue.

- Metaverse gaming companies include Fortnite maker Epic Games, Roblox, Ubisoft Entertainment, and Microsoft, which owns Minecraft.

- Citi is the latest banking giant to call the metaverse and web 3.0 a multi-trillion-dollar opportunity. Goldman Sachs in December valued the metaverse at $12.5 trillion, an outlook that assumes one-third of the digital economy becomes virtual and then expands another 25%.

- Chip maker Nvidia’s vision for the “omniverse,” including industrial applications and artificial-intelligence innovations, remains a key part of analysts’ optimism for its stock, which jumped 103% over the past year. Shares of Roblox, a platform for building and experiencing virtual worlds, have plummeted 31% over the past year.

What’s Next: MKM Partners analysts note Roblox’s more-than-50 million daily active users, largely in the 5-to-24 age group. They think the platform’s long-term total addressable market is one billion people, though their medium-term estimate is 180 million people.

—Jack Denton and Janet H. Cho

These Tech Stocks Just Had Their Worst Quarter Ever

Investors punished tech stocks during the first three months of 2022, resulting in the worst quarter in history for a dozen S&P 500 stocks. The S&P 500 fell 4.9% over the past three months, snapping a seven-quarter winning streak. The Nasdaq is down 9.1%.

- Half the stocks that had their worst quarterly percentage declines as tracked by Dow Jones Market Data Group are tech companies: Etsy, PayPal, Facebook parent company Meta Platforms, Keysight Technologies, Match Group, and Charter Communications.

- The 12 stocks combined to lose $494.19 billion in market value. The bulk of that came from Facebook, which dropped more than $300 billion in valuation as investors chopped off roughly a third of its stock price, MarketWatch reported.

- A change to Apple’s mobile operating system slammed Facebook advertisers. Other social-media stocks also took a hit for the quarter, with Twitter dropping 10%, Snap falling more than 20% and Pinterest falling 30%.

- Other tech stocks had bad quarters but not record-setting ones. Netflix fell 37.8%, its worst quarterly performance since the second quarter of 2012, while Adobe fell 19.7%, its worst since the third quarter of 2011.

What’s Next: Charter benefited when people had to stay home during the pandemic, but now it’s seeing a slowdown in broadband subscriber growth and is looking to the wireless business for its next big opportunity.

—Liz Moyer

Ford’s first-quarter sales fell 17% as the automaker battled a chip shortage

KEY POINTS

- Ford’s U.S. sales of new vehicles declined 17% during the first quarter, including a 26% slide last month, as the automaker continues to battle a global shortage of semiconductor chips.

- The automaker on Monday reported first-quarter sales of 432,132 vehicles, including 159,328 units in March. Those sales were in line with analyst expectations.

DETROIT – Ford Motor’s U.S. sales of new vehicles declined 17% during the first quarter, including a 26% slide last month, as it battles a global shortage of semiconductor chips.

The automaker on Monday reported first-quarter sales of 432,132 vehicles, including 159,328 units in March. Those figures were in line with analyst expectations.

Andrew Frick, Ford’s vice president of sales, distribution and trucks, said the company experienced some positive signs heading into the spring selling season.

“While the global semiconductor chip shortage continues to create challenges, we saw improvement in March sales, as in-transit inventory improved 74% over February. F-Series had a record 50,000 new retail orders in March, while a record 41% of our overall retail sales came from previously placed retail orders,” he said in a statement.

Sales of Ford’s trucks were off 23% during the first quarter. Car sales were down 49%, while SUV sales were off just 5.1%.

Sales of Ford’s highly profitable F-Series pickups, including the F-150 and its larger siblings, were down 31% during the first quarter, including a 47% decline in March. On improved inventory, Ford said its SUV sales increased 39% compared with February.

Automakers such as Ford have been managing a global shortage of semiconductor chips for more than a year. The parts scarcity has caused sporadic shutdowns of plants and depleted new vehicle inventories.

Ford is among the last of the major automakers to report its March and first-quarter sales. U.S. new-vehicle sales overall for January through March likely came in below 3.3 million, down 14% from the first quarter of 2021, industry analysts say.

Ford touted demand for its newest vehicles, such as the Bronco and Bronco Sport SUVs and the Maverick small pickup truck. March Maverick sales increased 115% from February, with the average vehicle selling off a dealer lot just four days after arrival.

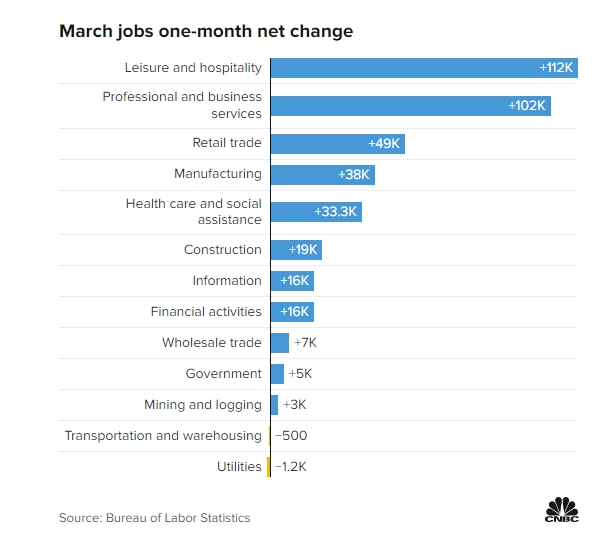

Here’s where the jobs are — in one chart

KEY POINTS

- As Covid restrictions eased, rebounds in the leisure and hospitality and business sectors continued last month and helped to drive a strong March jobs report.

- The March 2022 jobs report showed that the leisure and hospitality industry, which includes hotels, restaurants and amusement parks, added a net 112,000 jobs.

- The broad health and social services sector added more than 30,000 in March 2022 thanks to hiring for social services workers, which include child-care staff.

https://datawrapper.dwcdn.net/levHp/1/ As Covid restrictions eased, rebounds in the leisure and hospitality and business sectors helped to drive a strong March jobs report.

The U.S. economy added more than 400,000 jobs in the final month of the first quarter, the Labor Department said Friday.

Leisure and hospitality, which includes hotels, restaurants and amusement parks, added a net 112,000 jobs in the third month of 2022. Within the industry, restaurants and bars added 61,000 jobs, hotels and other lodging businesses tacked on 25,000 and amusement, gambling and other recreation climbed 16,400.

The industry, one of the hardest-hit during the worst of Covid-19 and government business shutdowns, has posted 15 straight months of net job gains of at least 100,000. Still, employment in leisure and hospitality has fallen by 1.5 million, or 8.7%, since February 2020.

The wide-ranging professional and business services sector also posted a robust March with a net addition of 102,000 positions. Accountants and other bookkeeping staff had a particularly strong month, with a climb of 18,000.

Computer system designers and management consultants, both of which fall under business services, added 12,300 and 15,100 jobs, respectively. Building services employees, including pest control and landscaping workers, added 22,100.

A top economic advisor to the White House welcomed the March report and said that the print underscores the “incredible resilience” of the labor market as it recovers from the pandemic.

“We’re seeing about 560,000 jobs a month over the last quarter, and that’s been consistent over the last year,” Brian Deese, the director of President Joe Biden’s National Economic Council, told “Squawk on the Street” following the report.

“Importantly, we’re seeing that in broad breadth. And, of course, we’re seeing the unemployment rate now down to 3.6%,” he added. “There’s only been three months in the last 50 years that the United States has had an unemployment rate lower than 3.6%.”

Retail had a decent month with a gain of 49,000, thanks to healthy hiring at grocery stores (+17,800) and warehouse clubs and supercenters (+21,400). Gas station employment rose by nearly 3,000, and motor vehicle and parts dealers added 5,100 to payrolls.

Stores that sell furniture, electronics and building materials all saw minimal losses.

Transportation and warehousing, an industry scrutinized for potential supply chain relief, saw little change over the month, with a loss of 500 jobs. Within the sector, couriers and messengers that deliver mail and packages added 6,700 jobs while truck transportation shed almost 5,000 workers.

The broad health and social services sector added more than 30,000 to payrolls, thanks in large part to unusual hiring for social services workers, which include child-care workers, community food and housing staff and vocational rehabilitation employees.

Social assistance alone added 25,000 jobs last month on top of February’s gain of 30,400. February’s addition was the subsector’s best one-month gain since September 2020.

— CNBC’s Crystal Mercedes contributed reporting.

Asia is seeing a wave of buybacks. Goldman and Morgan Stanley say these companies could be next

KEY POINTS

- Chinese tech giant Alibaba said last week it will increase its share buyback program from $15 billion to $25 billion. Phone maker Xiaomi also announced a buyback of up to 10 billion Hong Kong dollars ($1.28 billion) this week.

- “We have seen an accelerating trend of Chinese companies announcing buyback plans,” Morgan Stanley said.

- Nomura said in a note that a combination of generally modest stock valuations and “reasonably strong” balance sheets will drive up share buybacks.

- Morgan Stanley and Goldman Sachs picked out Asia stocks that are best placed or likely to carry out buybacks.

Asia has seen a wave of stock buybacks, and bank analysts say it’s not stopping anytime soon.

Chinese tech giant Alibaba said last week it will increase its share buyback program from $15 billion to $25 billion. Phone maker Xiaomi announced Tuesday a buyback of up to 10 billion Hong Kong dollars ($1.28 billion), while JD Health, JD’s online healthcare arm, said it would buy back shares of up to 3 billion Hong Kong dollars.

The news sent stocks of those firms soaring.

“Chinese companies are behaving similarly to their American counterparts by announcing large stock buyback programs on weakness in an effort to shore up investor confidence as their business growth slows,” said Ben Silverman, director of research at investment consulting firm Verity.

Here’s how share buybacks work: when a company repurchases its own stock, the move reduces the number of shares that are publicly traded.

The buyback can push the price of each share higher because some common metrics used to evaluate a stock price are spread across fewer shares. As a result, the stock can look more attractive.

The trend isn’t just confined to Chinese tech giants. British bank HSBC, insurance giant AIA and Japanese automaker Toyota have also announced stock buybacks in the past few weeks.

‘Accelerating trend’ in stock buybacks

China’s tech stocks have fallen since last year on the back of regulatory crackdowns in China as well as U.S.-China tensions, among other factors.

“We have seen an accelerating trend of Chinese companies announcing buyback plans [year-to-date] against the backdrop of broad-based Chinese equities valuation derating,” Morgan Stanley said in a March 24 note.

“We believe this trend will continue for longer as it is reinforced by the [China Securities Regulatory Commission] statement last week explicitly encouraging listed companies to conduct share buybacks,” analysts from the investment bank said.

There was speculation that Tencent could be next, although markets were disappointed when the Chinese gaming giant did not announce a buyback recently.

“The market definitely expected Tencent to announce a buyback. I think this was mainly because Alibaba had and the positive price reaction to it,” said Neil Campling, head of technology, media and telecom research at Mirabaud Equity Research.

″[Tencent] did note their own stock price has dropped significantly too – which may be a sign that they would consider a buyback, so I don’t think that possibility should be ruled out in its entirety,” he added.

Nomura said a combination of generally modest stock valuations and “reasonably strong” balance sheets will drive up share buybacks. The trend suggests scope for higher shareholder returns, the Japanese investment bank said.

“We think this theme is likely to be the focus in the weeks ahead, especially after a rally in the shares of [U.S.-listed Alibaba] after it boosted its share buyback program by USD10bn,” said the March 24 note.

In the short term, markets will react favorably to buyback announcements especially for U.S.-listed Chinese stocks, according to Morgan Stanley’s analysis of data from 2014 to 2021 of such stocks as well as A-shares, or mainland-listed stocks.

“US-listed Chinese equities reacted the most positively compared with Hong Kong listings and A-shares,” the investment bank’s analysts said.

Stocks best positioned to carry out buybacks

Morgan Stanley picked out stocks that are best placed to carry out buybacks based on a list of criteria: balance sheet strength to support buybacks, “heavily discounted” company valuation, sizable market cap, and strong fundamentals.

Here are the top 20 stocks of Morgan Stanley’s selection, sorted by market capitalization:

Kweichow Moutai

Alibaba

China Mobile

Wuliangye Yibin

JD.com

NetEase

HikVision

Pinduoduo

CNOOC

Mindray Bio-Medical

China Tourism Group Duty Free

Shanxi Xinghuacun Fen Wine Factory

Jiangsu Hengrui

Xiaomi

Anta Sports Products

Budweiser

Cosco Shipping

Foxconn Industrial Internet

Gree Electric Appliances

Nari Technology

Goldman Sachs also screened stocks likely to carry out stock buybacks. In a March 25 note, the bank said it focused on companies with track records of share buyback announcements.

“While cash-rich and high-profit growth stocks appear particularly well-placed to repurchase shares, we note that companies with no track record of buybacks often do not announce repurchases, even when cash rich,” Goldman said, explaining why it focused on companies with a history of such moves.

Here are the top 10 Japanese stocks from Goldman Sachs, sorted by market capitalization. The companies have announced buybacks in the five of the past six fiscal years – but have yet to announce any in fiscal year 2021:

KDDI

Fujitsu

Dai-ichi Life

Shionogi

Daiwa Securities Group

Tokyo Gas

Toho

Sekisui Chemical

Tis

Hirose Electric

— CNBC’s Michael Bloom contributed to this report.

Social Security’s retirement age is moving to 67. Some experts say that could go even higher

KEY POINTS

- While many people hope to retire at 62, Social Security doesn’t pay full benefits until as late as age 67.

- That normal retirement age could get pushed even higher based on how lawmakers choose to address the program’s solvency issues.

- Here’s what those changes could mean for people in retirement or planning for it.

Many Americans eagerly look forward to a time when they can stop working and officially set their status to “retired.”

But when asked what age they anticipate that could be, there isn’t a consensus.

The average age when people say they hope to retire is 62, according to one survey.

That is also the age at which people can first claim Social Security retirement benefits, so long as they are eligible based on their work records.

However, people receive reduced benefits for claiming early. If they wait until full retirement age to claim — generally 66 or 67, depending on when they were born — they receive the full benefits which they have earned. If they wait until age 70, they stand to get an 8% per year benefit increase over their full retirement age.

Meanwhile, the House of Representatives last week approved a retirement bill that would push out the age for required minimum distributions on certain savings accounts to 75, up from the current age of 72. That change, if it passes the Senate, would be gradually phased in by 2032.

The proposal reflects a reality that many people today are generally healthier than generations past and therefore are living and working longer, said Mark J. Warshawsky, a senior fellow at the American Enterprise Institute and former deputy commissioner for retirement and disability policy at the Social Security Administration.

“It should cascade to other official ages throughout the tax code and the government’s programs, Social Security included,” Warshawsky said.

To be sure, no imminent changes to the Social Security program are in the works.

“It has and will continue to be the third rail of politics because of the public sensitivity around the issue,” said Shai Akabas, director of economic policy at the Bipartisan Policy Center.

That does not mean there is no urgency around the issue, however.

The trust funds that the Social Security Administration relies on to pay benefits are projected to become depleted in 2034. At that time, 78% of promised benefits will be payable, the government agency said last year.

To shore up the program, lawmakers have a choice of increasing taxes on benefits, raising payroll taxes or increasing the retirement age. Any enacted changes could include a combination of all three.

Of note, Social Security advocates are staunchly against tweaking the Social Security retirement ages.

“An increase in the full retirement age is just a benefit cut,” said Joe Elsasser, founder and president of Covisum, a provider of Social Security claiming software.

How the retirement age could change

Retirement ages were last altered in 1983 under then-President Ronald Reagan.

Those changes, which raised the full retirement age to 67 from 65, are still being phased in today.

Even just the bump up to age 66 from 65 represented a 5% benefit cut, Elsasser noted.

Many experts expect that any future changes could push up the Social Security retirement age. Notably, the Social Security 2100 Act: A Sacred Trust, introduced by Rep. John Larson, D-Conn., last year, would leave those thresholds unchanged and, in some respects, make benefits more generous. But the legislation has a five-year timeframe.

Separately, the Social Security Administration has scored the financial effects other proposals to change the age thresholds could have on the program.

Just in 20 years, we’ve seen a substantial increase in the retirement age.

Mark J. Warshawsky

SENIOR FELLOW AT THE AMERICAN ENTERPRISE INSTITUTE

“I expect that at some point in the not too distant future, Congress will agree on a Social Security package that includes some type of adjustment to the retirement age,” Akabas said. “Whether that’s in two years or 10 years, it’s very difficult to predict.”

Experts say it’s possible the full retirement age could get pushed up by a year or two, which could be gradually phased in.

Additionally, lawmakers could also raise the initial age for eligibility for retirement benefits from 62, as well as the highest age for delaying benefits and earning benefit increases from 70.

Adjustments could make it so the most vulnerable — those who are forced to retire at the earliest possible age — don’t see the same type of benefit reduction, Akabas noted.

In 2000, the average age at which people retired was roughly 61 or 62. Two decades later, it’s around 66, according to government data, Warshawsky said.

“Just in 20 years, we’ve seen a substantial increase in the retirement age,” Warshawsky said. “People really, really are working longer.”

Anecdotally, Elsasser said he sees more people retiring earlier than they had anticipated as their work prospects change.

That highlights the importance of planning ahead, so you anticipate whatever your retirement years bring. Admittedly, that can be tricky, given that Social Security could be susceptible to change.

If you’re 60 and up, there is less reason to worry any prospective changes would affect your benefits, Elsasser said.

But if you’re 45 to 60 years old, it’s reasonable to plan for benefit reductions of about 5%, he said. For those who are even younger, a 10% to 15% cut is possible.

Moreover, people of all ages should also plan for worst-case scenarios in which the program does reach a point where it can only pay a portion of benefits, which may prompt as much as a 24% benefit cut for retirees.

“The real importance of planning is just making sure you have all your bases covered,” Elsasser said.