HI Market View Commentary 03-29-2021

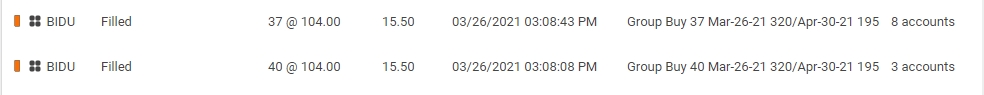

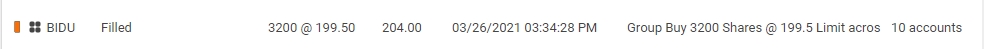

So let’s start with BIDU and what we’ve learned and did over a week

So last week BIDU created a dual listing on the US and the Hong Kong exchange to help their price of the stock go up, trading during different time frames and more liquidity to put into the stock.

Worries Delisting US, China has more overreach to “made the companies use GAAP accounting principles”

HI basically said that we didn’t see any delisting or any regulations coming down the pipe for BIDU

Booking over 800K

Dollar cost average with the profits and keep long puts in place

Some sold out but looking for leap bull call spreads to continue the run higher

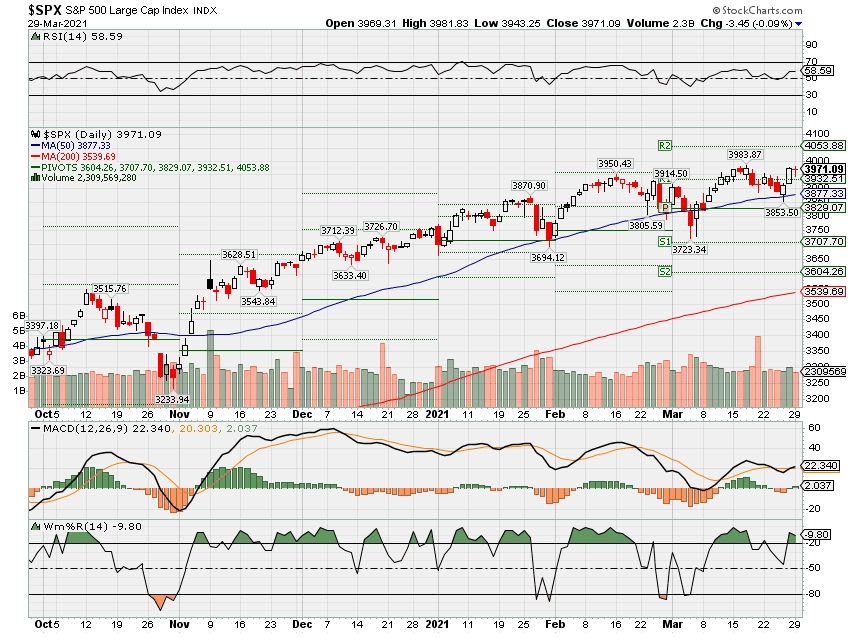

Where will our markets end this week?

Flat

DJIA – Bullish

SPX – Bullish

COMP – Bearish

Where Will the SPX end March 2021?

03-29-2021 0.0%

03-22-2021 0.0%

03-08-2021 0.0%

03-01-2021 0.0%

Earnings:

Mon:

Tues: MKC, BB, LULU, PVH

Wed: WBA, GES, MU

Thur: KMX

Fri:

Econ Reports:

Mon:

Tues: Case-Shiller, FHFA Housing Price Index, Consumer Confidence

Wed: MBA, ADP Employment, Chicago PMI, Pending Home Sales,

Thur: Initial Claims, Continuing Claims, ISM Manufacturing Index, Construction Spending

Fri: US Stock Market CLOSED

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Some protection and even that’s is making some mistakes

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Morgan Stanley Tightens The Noose, Fires Billion Dollar Advisor In NJ

March 29, 2021/in Article: News /by BrokerChalk Editor

At times we’ve discussed the nature of regulatory action in the wealth industry as being increasingly proactive. The Tom Buck saga is ‘Exhibit A’ for regulatory overreach and eventual incarceration. Did something similar just go down at Morgan Stanley in New Jersey?

Here is what happened:

David S. Weinerman was fired Tuesday for what Morgan Stanley called “firm policy violations” that did not relate to customer accounts. Given that the allegations aren’t related to customer accounts makes this case different than Tom Buck. Still, the size of Mr. Weinerman’s business is of real interest.

Weinerman had been managing more than $1 billion in assets and turning it over to the tune of $4 million in annual revenue. Another marker in the ‘we don’t care how big you are’ regulatory movement.

Mr. Weinerman was #6 on Forbes’ list of top New Jersey advisors this year. Of real interest, he has no customer complaints or regulatory disclosures.

So Morgan Stanley seems to have fired a previously perfect advisor with a billion in client assets for reasons having ZERO to do with customer accounts.

This doesn’t pass the proverbial smell test. What it does do is serve as another reminder to retain your own PERSONAL counsel and institute policies on and around your own team that go beyond company policies. Don’t use email, have your admin team do it on your behalf. Tread lightly, be more politically correct, stay away from younger staffers (or don’t hire them at all), and hire an internal ‘compliance liaison’ on your team so you don’t miss anything.

Nobody is safe in an active corporate and regulatory environment. Nobody. Just ask David Weinerman.

Here’s what happened in that wild trading in China internet stocks

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- A trader who participated in some of the wild trading in Chinese internet stocks on Friday confirmed that the primary cause of the selling in Chinese stocks was that a fund, Archegos Capital Management, was forced out of its positions.

- The catalyst was ViacomCBS, which did a $3 billion stock offering through Morgan Stanley and J.P. Morgan earlier in the week that fell apart. It resulted in massive selling.

- The dramatic drop in ViacomCBS’s price resulted in margin calls. Archegos was also long many China internet names that traded in the U.S.

Chinese stocks listed in the U.S. fell sharply last week, after several weeks in correction mode.

A trader who participated in some of the wild trading in Chinese internet stocks on Friday confirmed that the primary cause of the selling in Chinese stocks was that a fund, Archegos Capital Management, was forced out of its positions.

Here is the sequence of events, according to the trader, who spoke on condition of anonymity because trade details are usually private.

1. The catalyst was ViacomCBS, which did a $3 billion stock offering through Morgan Stanley and JPMorgan earlier in the week that fell apart. It resulted in massive selling. This fund was long a lot of ViacomCBS using a lot of leverage.

2. The dramatic drop in ViacomCBS’s price resulted in margin calls. Archegos was also long many China internet names that traded in the U.S.

3. Goldman Sachs, Morgan Stanley, Credit Suisse, and Deutsche Bank all forced Archegos to liquidate many of the China internet names through unregistered trades, according to the trader. Late in the day Friday, Goldman took many of the names held by Archegos onto its balance sheet then liquidated by distributing to clients.

4. Much of this trading was difficult to see because many of the big trades were done over the counter and not printed.

5. Reports earlier in the week that the Securities and Exchange Commission was beginning steps to enforce potential sanctions against U.S.-listed Chinese stocks that did not cooperate with U.S. regulatory authorities was a factor in the Chinese internets tanking midweek — but the primary source of the chaos on Friday was the forced liquidation of a good part of Archegos, said the trader.

https://www.reuters.com/article/us-usa-markets-blocktrades-idUSKBN2BK0OR

Global banks face losses, regulatory scrutiny after Archegos share dump

By Makiko Yamazaki, John Revill, Matt Scuffham

7 MIN READ

TOKYO/ZURICH/NEW YORK (Reuters) – Nomura and Credit Suisse are facing billions of dollars in losses and regulatory scrutiny after a U.S. investment firm, named by sources as Archegos Capital, defaulted on equity derivative bets, putting investors on edge about who else might be exposed.FILE PHOTO: People are seen on Wall St. outside the New York Stock Exchange (NYSE) in New York City, U.S., March 19, 2021. REUTERS/Brendan McDermid Losses at Archegos Capital Management, run by former Tiger Asia manager Bill Hwang, triggered a fire sale of stocks on Friday, a source familiar with the matter said.

A phone message left for Archegos at its New York offices on Monday morning was not immediately returned.

Warnings by Credit Suisse and Nomura that they expect to incur big losses as a result of lending to Archegos triggered a sell-off in banking stocks around the globe on Monday. Morgan Stanley shares fell nearly 3% and Goldman Sachs Group dropped 1.5%. Nomura shares closed down 16.3%, a record one-day drop, while Credit Suisse shares tumbled 14%, their biggest fall in a year.

The financial impact on Goldman Sachs was immaterial, a separate source said on Monday. Morgan Stanley, which sold $4 billion related to Archegos on Friday, did not incur significant losses, CNBC reported on Monday.

Moreover, the broader market impact appeared limited, with the U.S. S&P 500 benchmark flat in afternoon trading while financial stocks were down 1%.

“You continue to see strength in the overall market. There is not fear of selling stocks all together, there’s just fear in pockets of the market,” said Dennis Dick, head of market structure at Bright Trading LLC in Las Vegas.

Nomura, Japan’s largest investment bank, warned on Monday it faced a possible $2 billion loss due to transactions with a U.S. client, while Credit Suisse said a default on margin calls by a U.S.-based fund could be “highly significant and material” to its first-quarter results.

The Swiss bank said that a fund had “defaulted on margin calls” to it and other banks, and the institutions were liquidating those positions.

Two sources said Credit Suisse’s losses were likely to be at least $1 billion. One of those sources said the losses could go as high as $4 billion, a figure also reported by the Financial Times. Credit Suisse declined to comment on any estimate.

Switzerland’s financial regulator said on Monday it was in touch with Credit Suisse regarding the incident.

In Japan, Chief Cabinet Secretary Katsunobu Kato said the government would carefully monitor the situation at Nomura and the Financial Services Agency would share information with the Bank of Japan.

Other banks’ shares were affected, with Deutsche Bank down 5%, while UBS was 3.8% lower. UBS had no immediate comment on its stock price or exposure to Archegos.

Deutsche Bank said in a statement that it had significantly de-risked its Archegos exposure without incurring any losses and was managing down its “immaterial remaining client positions,” on which it did not expect to incur a loss.

In the United States, the Securities and Exchange Commission has been “monitoring the situation and communicating with market participants since last week,” a spokesperson said.

MARGIN CALLS

A margin call is when a bank asks a client to put up more collateral if a position partly funded with borrowed money has fallen sharply in value. If the client cannot afford to do that, the lender will sell the securities to try to recoup what it is owed.

Margin calls on Archegos Capital prompted a massive unwinding of leveraged equity bets.

Shares in ViacomCBS and Discovery each tumbled around 27% on Friday, while U.S.-listed shares of China-based Baidu and Tencent Music plunged during the week, dropping as much as 33.5% and 48.5%, respectively, from Tuesday’s closing levels.

Archegos bet on the stocks using derivatives including “total return swaps” which allow investors to receive profits on their positions without actually owning the stocks, according to one source familiar with the trades. The fund posts collateral against the securities rather than buying them outright with cash.

The underlying shares were held by Archegos’ prime brokers, which lent the firm money and processed its trades. They included Goldman Sachs, Morgan Stanley, Deutsche Bank, Credit Suisse and Nomura.Archegos’ positions were highly leveraged. The firm had assets totalling around $10 billion but held positions worth in excess of $50 billion, the source said.

With such high leverage, investors were nervous on Monday about whether the full impact of Archegos’ problem had been realized or whether more selling would follow.

Hwang did not respond to a LinkedIn message seeking comment.

Hwang, who ran Tiger Asia from 2001 to 2012, renamed the hedge fund Archegos Capital and converted it to a family office, according to a page capture of the fund’s website. Family offices act as private wealth managers and have lower disclosure requirements than other investment companies. Tiger Asia was a Hong Kong-based fund trading in Asia securities.

Hwang and his firm in 2012 paid $44 million to settle SEC insider trading charges.

Hwang is known to use outsized leverage to magnify his bets.

“Bill Hwang … runs a very concentrated, highly leveraged book,” said Thomas Hayes, chairman at Great Hill Capital LLC in New York.

Other hedge fund managers said they were puzzled as to why Hwang, whom several described as a “smart guy,” had made such big bets on ViacomCBS and Discovery, given many investors were betting against the companies. The pair are not seen as high-growth plays, in contrast to other media stocks that have outperformed during the COVID-19 pandemic, the sources said.

Short interest in ViacomCBS and Discovery was 18.4% and 30.45% respectively, according to Monday data from S3 Partners.

REGULATORY FALLOUT

Alex Brazier, head of financial stability strategy and risk at the Bank of England, said in a Reuters Newsmaker interview on Monday that the BoE was monitoring events “very closely and the supervisors of the relevant firms are closely engaged”.

Other stocks involved in Archegos-related liquidations included Baidu Inc, Tencent Music Entertainment Group, Vipshop Holdings Ltd, Farfetch Ltd, iQIYI Inc and GSX Techedu Inc.

Reporting by Megan Davies, Ira Iosebashvili and Kenneth Li in New York, additional reporting by Juby Babu and Sagarika Jaisinghani in Bengaluru, Rachel Armstrong and Julien Ponthus in London, Tom Sims in Frankfurt, Svea Herbst-Bayliss in Boston and Matt Scuffham, Herbert Lash and Elizabeth Dilts in New York; Writing by Jane Merriman and David Randall Editing by Carmel Crimmins, Susan Fenton and Cynthia Osterman

Our Standards: The Thomson Reuters Trust Principles.

Build America Bonds may be key to financing Biden’s infrastructure plans

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- The country’s overall infrastructure needs over the next 10 years total nearly $6 trillion, and lawmakers are split on how to pay for it.

- Citigroup’s head of Citi’s municipal bonds strategy, thinks he has the answer: a resurrection of Build America Bonds.

- The bonds allow states and counties, which manage the majority of U.S. infrastructure, to float debt with interest costs subsidized by the federal government.

Republicans and Democrats agree that the U.S. is in dire need of a major infrastructure overhaul, and at the very least, that Congress should authorize significant repairs to roads and bridges.

The fierce disagreement between the two parties begins over which provisions are worthy of running the federal deficit higher, as well as over how to finance such a massive undertaking.

And while Wall Street worries about potential increases to corporate and individual income tax rates, Democrats may soon turn to an Obama-era tool to finance their infrastructure plans: Build America Bonds.

BABs are special municipal bonds that allow states and counties to float debt with interest costs subsidized by the federal government. That underwriting not only served to ease jittery investors in the aftermath of the financial crisis, but also made municipal debt even more attractive with rates sometimes north of 7%.

This approach could be especially helpful in President Joe Biden’s infrastructure push, especially after the hefty price tag of his $1.9 trillion Covid-19 relief package. Even by the most modest estimates, the cost to repair the nation’s infrastructure reaches into the trillions of dollars.

The country’s overall infrastructure needs over the next 10 years total nearly $6 trillion, according to a report published earlier in March by the American Society of Civil Engineers. It says there’s a $125 billion backlog on bridge repairs, a $435 billion backlog for roads and a $176 billion backlog for transit systems.

Those sums, merely for repairs already deemed necessary, come before the expansive and innovative technologies Democrats hope to include in Biden’s forthcoming bill. The White House is expected to pitch a bill worth at least $3 trillion and include a litany of infrastructure and social assistance programs.

Biden for BABs?

Vikram Rai, head of Citi’s municipal bonds strategy, thinks Build America Bonds are the answer.

Build America Bonds entered U.S. markets more than a decade ago as the Obama administration sought ways to finance capital projects across the country and jumpstart the economy in the aftermath of the Great Recession.

The beauty of subsidizing the interest associated with muni bonds, Rai argues, is that every dollar spent by the federal government works to reinforce the integrity of larger spending projects that, legally, only states and localities have the power to pursue.

The federal government owns less than 10% of the nation’s infrastructure, while the rest is operated by states, cities and the private sector.

“This price tag of $2 trillion, $3 trillion — that’s not really accurate because the price tag is only that big if the federal government is going to give state and local governments grants,” Rai said in a phone interview earlier in March.

Instead, when the federal government underwrites BABs, it allows states and cities to issue far more debt than investors would otherwise accept without astronomical interest costs and doubts over whether they would be able to repay.

“What a lot of people don’t realize is that just some tax raises — like increasing the corporate tax rate or implementing a carbon fuel tax — even those very marginal tax increases will be more than enough to fund the initial outlay of infrastructure projects,” Rai said.

“These projects are, ultimately, self-sustaining,” he added. “There’s a magnifier effect, a stimulative effect: It generates employment, it generates tax revenues. So, it’s a no-brainer.”

Rai added at the time that it’s almost certain the White House is considering BABs among a variety of financing options.

Transportation Secretary Pete Buttigieg confirmed later Friday, after this story was initially published, that the administration is considering the bonds amid other financing options.

“I’m hearing a lot of appetite to make sure that there are sustainable funding streams,” Buttigieg said. Build America Bonds show “a lot of promise in terms of the way that we leverage that kind of financing. There have been ideas around things like a national infrastructure bank, too.”

A critical feature of BABs is that unlike 83% of the market for municipal bonds, they are taxed by the federal government.

Most bonds issued by state and local governments under “normal” conditions are attractive to investors because the interest is generally exempt from federal income taxes. As a result, U.S. investors are willing to accept a lower interest rate than they would otherwise demand.

For foreign investors, however, the interest on U.S. municipal bonds is still taxable by their home country, so they are generally apathetic low-yielding debt issued in the U.S.

But by making BABs subject to federal taxes, state and local governments are forced to offer higher interest rates on their bonds to guarantee investors the same effective rate of return.

Given that foreign investors, with their multitrillion-dollar demand base, have expressed an unwavering interest in investing in U.S. infrastructure, they would be keenly interested in a taxable structure. This is because from their perspective, BABs are indistinguishable from a conventional taxable bond, according to Rai.

Political perils

The drawback of BABs, though perhaps more impactful than grants written for the equivalent amount, is that the federal government is still on the hook for billions of dollars’ worth in interest costs until the BABs mature.

The Obama-era program, which had no annual caps and subsidized interest costs at 35%, expired at the end of 2010 after states and municipalities sold more than $180 billion of the bonds, far more than the federal government initially expected.

Some lawmakers, such as Sen. Ron Wyden, D-Ore., remain supportive of the program and open to the possibility that they could play a role again in future infrastructure initiatives.

“Build America Bonds were an overwhelming success in the Recovery Act,” Wyden, chairman of the Senate Finance Committee, told CNBC on Wednesday. “I’m incredibly proud of that program, and a similar financing structure will be part of the conversation as we move forward.”

Leading Republicans, on the other hand, had grown sick of the costs associated with BABs by 2011. GOP lawmakers said the federal government’s commitment to subsidize 35% of the interest payments on local bonds was too high.

Former Sen. Orrin Hatch, then the ranking Republican on the Senate Banking Committee, said in February 2011 that the bonds were “simply a disguised state bailout” that disproportionately helped New York and California.

“These bonds rightly expired at the end of 2010 and it is my hope the Obama administration does not try to resurrect such a nonsensical provision in their upcoming budget,” he said at the time.

Sen. Pat Toomey, R-Penn., a member of the Senate Finance Committee, is a “no” on resurrecting the bonds.

“State and local governments have never been more flush with cash. In addition to record tax collections last year, Congress sent them $500 billion. Despite all that, two weeks ago, Congress sent them an additional $350 billion they didn’t need,” he told CNBC on Friday. “So no, I do not support misallocating billions of dollars more to incentivize potentially unworthy projects and to encourage insolvent or irresponsible state and local governments to take on even more debt.”

Rai conceded that appetite for BABs could vary based on each state’s creditworthiness, with states like New York with stronger balance sheets perhaps a more appealing bet than Illinois.

He countered, however, that even cities in Illinois could see significant revenue generation via BABs if the state works to backstop local municipal bonds. The federal government’s commitment to subsidize interest costs could be lowered from 35% to 30% or even 28%, as Democrats proposed in 2011, Rai said.

But with the nation’s infrastructure in dire straits, some Republicans may view BABs as a compelling option to fund infrastructure projects that, in time, eventually pay for themselves through job creation and tax revenues.

Mississippi Sen. Roger Wicker, the GOP’s ranking member on the Commerce Committee, co-sponsored a bill with Sen. Michael Bennet, D-Colo., in 2020 that called for a revival of BABs with certain improvements.

Like BABs, their so-called American Infrastructure Bonds program would create a class of “direct-pay” taxable municipal bonds to help struggling governments finance critical public projects.

Wicker and Bennet’s bonds would be exempt from sequestration, the process by which Congress has gradually eroded the size of its payments toward financing the original class of BABs.

“Empowering our local leaders to start important infrastructure projects is a proven, cost-effective way to help our communities emerge from severe financial hardship with assets that provide value to the area for years to come,” Wicker said in a July press release.

Signs of Inflation so Far

https://player.spokenlayer.net/american-institute-for-economic-research?story=3f411fa78a22b210f113d54683e41377 The Federal Reserve has announced that it intends to raise inflation in the United States to two percent per year on average. Inflation generally has been less than two percent in recent years. Is the Federal Reserve likely to be successful at hitting this new target or even exceeding it? Recent dramatic increases in the money supply make higher inflation more than likely. It is not so clear that it will average only two percent.

Figure 1