HI Market View Commentary 03-22-2021

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF MAR. 15 THROUGH MAR. 19, 2021 |

| The S&P 500 index fell 0.8% last week as rising bond yields again worried investors, especially after the Federal Reserve increased its median projection for inflation, while a Fed decision to end big banks’ emergency capital relief weighed on the financial sector. The market benchmark ended the week at 3,913.10, down from last Friday’s closing level of 3,943.34. However, it is up 4.2% for the year to date. The weekly decline came despite the S&P 500 reaching new intraday and closing highs this week at 3,983.87 and 3,974.12, respectively. The new highs were hit Wednesday as investors initially cheered a Fed statement that day that the central bank would keep overnight interest rates near zero. However, by Thursday, the market was parsing the Fed’s statement further and grew concerned by an increase in its projections for economic growth and inflation. Friday, the Fed announced a decision to end its temporary easing of capital requirements for big banks. The move was a big disappointment to firms that had been pushing for the yearlong relief to be extended. The energy sector had the largest percentage drop of the week, down 7.7%, followed by a 1.7% decline in financials and a 1.4% drop in technology. Three sectors still rose on the week: communication services gained 0.5%, health care edged up 0.4% and consumer staples inched up 0.2%. The energy sector’s tumble came as crude oil futures and natural gas futures also fell. The International Energy Agency said global oil demand may not reach pre-pandemic levels before 2023 while the Paris-based agency warned demand for gasoline is unlikely to return to 2019 levels “as efficiency gains and the shift to electric vehicles eclipse robust mobility growth in the developing world.” Among the energy sector’s decliners, shares of Marathon Oil (MRO) dropped 9.7% this week while Occidental Petroleum (OXY) fell 8.3%. The financial sector’s decliners included JPMorgan Chase (JPM), down 0.65%, and Wells Fargo (WFC), down 0.85%, amid the Fed decision to end the relaxation of big banks’ capital requirements. On the upside, the gainers in communication services included ViacomCBS (VIAC) as it and the National Football League said they struck a new 11-year multiplatform rights agreement extending the company’s relationship with the NFL through the 2033 season. The deal, which begins with the 2023 season, grants NFL rights across ViacomCBS networks and platforms. Class B shares of ViacomCBS climbed 2.5% on the week. Next week, earnings reports are expected Tuesday from Adobe (ADBE) and GameStop (GME), followed by Wednesday reports from General Mills (GIS) and KB Home (KBH). Darden Restaurants (DRI) is expected to release its quarterly results Thursday. Economic data due next week include February existing home sales on Monday and new home sales Tuesday. February durable goods orders are expected Wednesday in addition to Markit’s preliminary March readings on the manufacturing and services sectors. Weekly jobless claims are due Thursday, followed by Friday reports on February personal income, consumer spending and core inflation, as well as March consumer sentiment. Provided by MT Newswires |

So our markets are just acting weird. Are we going to go down or are we going to head higher?

The real answer nobody knows = we just did something that has never been done before = 1.9 TRILLION DOLLAR STIMULUS

I would rather protect earlier than later for earnings/tax sell off because of the seasonal event= Tax selling

Next week is good Friday and the markets are closed

The problem is this huge amount for stimulus is 3x what it was before for inside the US and its twice as big based on international boost to economies

Problem with ETRADE and the feed of information to the account

Problem #2 – Powell speaks all week long

Problem #3 – No historical feedback, trends to follow during the end of a pandemic and start of huge stimulus

When you are uncertainty it seems like it would be time to protect

Visa –

BIDU – Index streaming quotes problem (hangover) from Friday

Where will our markets end this week?

Up

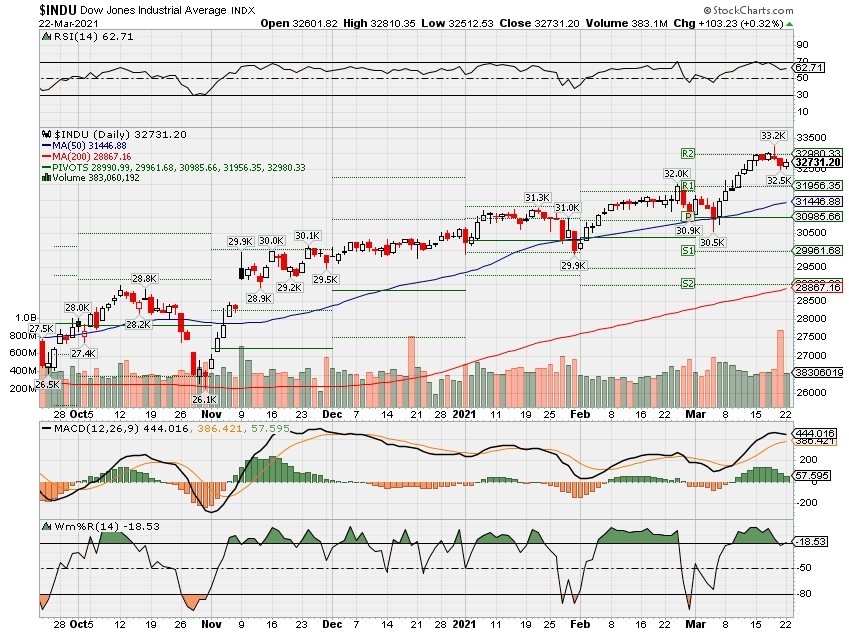

DJIA – Bullish

SPX – Bullish

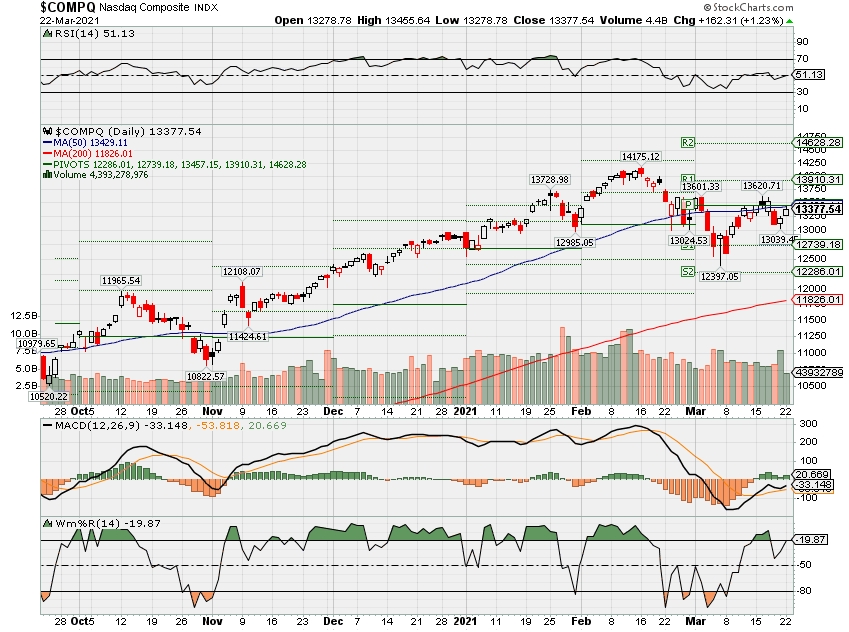

COMP – Bearish

Where Will the SPX end March 2021?

03-22-2021 0.0%

03-08-2021 0.0%

03-01-2021 0.0%

Earnings:

Mon:

Tues:

Wed:

Thur:

Fri:

Econ Reports:

Mon: Existing Home Sales

Tues:

Wed: MBA,

Thur: Initial Claims, Continuing Claims,

Fri:

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Some protection and even that’s is making some mistakes

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

U.S. Justice Department probing Visa over debit practices

By Reuters Staff

3 MIN READ

(Reuters) – The Justice Department is looking at Visa Inc’s debit practices, the company said on Friday, after reports the United States was investigating whether the credit card company uses anticompetitive practices in the debit-card market.

“The U.S. Department of Justice has informed Visa of its plans to open an investigation into Visa’s U.S. debit practices,” the company said in a securities filing. “We have received a notice to preserve relevant documents related to the investigation.”

The Justice Department is probing whether Visa uses anticompetitive practices in the debit-card market, a source familiar with the matter said on Friday. The Wall Street Journal, which first reported the news, said the Justice Department’s antitrust division was looking in to whether Visa limited merchants’ ability to route debit-card transactions over card networks that are often less expensive.

“We believe Visa’s U.S. debit practices are in compliance with applicable laws,” the company said. “Visa is cooperating with the Department of Justice.”

Visa shares fell sharply on Friday, sinking 6.2% to close at $206.90.

The Justice Department declined comment on Friday.

Merchants have long complained about the high cost of network fees, or interchange fees, which can be 2% or more of each transaction and go to the financial institutions behind the transactions.

Industry group the Merchants Payments Coalition, which fights so-called swipe fees, called the probe good news. “The MPC has been concerned about these practices to limit debit routing for years and it’s great to see the Department of Justice looking in to it,” said spokesman Craig Shearman.

While such investigations are not unusual, this one comes amid a greater interest in the digital marketplace.

Earlier this year, Visa and fintech startup Plaid called off a $5.3 billion merger after the government sued to stop the deal and called Visa a “monopolist in online debit transactions.”

The Justice Department has previously investigated the credit card payments industry but settled with Visa and Mastercard Inc in 2010 when they agreed to allow merchants to offer consumers incentives to use a low-cost credit card.

American Express refused to settle. It took its battle with the Justice Department all the way to the Supreme Court, which ruled in 2018 that it was legal for American Express to forbid merchants from trying to steer consumers to cheaper cards.

Reporting by Niket Nishant in Bengaluru; Additional reporting by Diane Bartz in Washington; Editing by Anil D’Silva and Matthew Lewis

Our Standards: The Thomson Reuters Trust Principles.

CalPERS Rejects Reinvesting in Tobacco Again

Pension plan’s investment committee votes down a second attempt from member Jason Perez to reverse its 20-year-old ban.

Saying he wanted to boost portfolio returns, California Public Employees’ Retirement System (CalPERS) investment committee member Jason Perez made a second try at reversing the pension plan’s ban on tobacco stocks. But Perez’s proposal was overwhelmingly rejected Monday night.

At a meeting of the CalPERS investment committee, Perez’s new attempt—his first was in March 2019—attracted only one other vote on the 13-member panel, from Margaret Brown. The ban has been in place since 2001.

The $440 billion pension system would have earned an additional $3.6 billion in investment gains if it kept tobacco stocks in its portfolio between Jan. 1, 2001, and June 30, 2020, according to an analysis by Wilshire Associates, a CalPERS general investment consultant.

But more recently, the pension system has done better by having a tobacco-free equity portfolio. Wilshire concluded that CalPERS gained $856 million by holding no tobacco stocks between Jan. 1, 2017, and June 30 last year, because these shares lagged behind the market during that period.

CalPERS, the largest US pension plan by assets, was one of the first institutional investors in the world to remove tobacco companies from its holdings.

When its investment committee debated the issue in the 2000, the panel concluded that lawsuits by ex-smokers and their relatives would send stock prices collapsing and even bankrupt some tobacco companies.

What the committee didn’t anticipate is that the industry would settle the lawsuits and remake itself to gain huge profits, as it added foreign markets and hooked a new generation of consumers on the products.

CalPERS initially revisited the divestment decision in 2016, when Wilshire first presented a cost analysis showing the pension plan was suffering a multibillion-dollar loss by not investing in tobacco.

Many investment committee members at the time said they favored reinvesting in tobacco. The reinvestment issue surfaced as investment staffers and investment committee members were looking for ways to help boost financial returns for the pension plan.

CalPERS has been chronically unfunded since the 2008-2009 financial crisis, when it lost tens of billions of dollars (its current funding is 70%). In the latest fiscal year ending last June 30, CalPERS made 4.7%, which is below its annual expected 7% rate of return.

The 2016 reinvestment issue quickly stirred major controversy. Anti-smoking and health groups criticized the investment committee. They derided the irony of the pension plan reinvesting in tobacco stocks, given that tobacco was making some of its members sick, adding to health costs the retirement system must shoulder.

CalPERS purchases health care for many of its members. In fact, the program is the second-largest purchaser of medical care for government workers in the United States, behind the federal government.

Perez, a police sergeant from Corona, Calif., a suburban community 48 miles from Los Angeles, won election to the CalPERS investment committee and board in late 2018. His platform called for the pension system to invest in any asset possible that made money—as long as it was legal.

“This is a retirement fund, not a political fund, and that’s what I want the goal to be,” Perez told his fellow investment committee members Monday night.

Brown, the other supporter of reinvestment on the panel, backed him up with a similar argument. “The investment staff should decide what to buy or sell, when to buy or sell, how much to buy or sell,” she said.

Their comments didn’t sway the rest of the investment committee, whose members include the California state treasurer and the state controller.

This time around, Perez could only count on Brown’s vote. Back in March 2019, when he first presented a similar reinvestment plan, he received two other investment committee votes.

Perez worded his resolution Monday to lift the prohibition, but also to allow for the pension system’s investment staff to decide if reinvestment in tobacco should be made.

The investment committee also knocked down another plan Perez presented to allow the pension system to reinvest in firearms manufacturers that make weapons that are illegal in California.

But firearms manufacturers made up only about $8.5 million in the CalPERS portfolio before the investment committee divested its gun stock holdings in 2013, while tobacco companies made up more than $1.2 billion before divestment.

After rejecting Perez’s plan, the investment committee then reaffirmed its ban on tobacco and firearms manufacturer stocks. It also upheld bans mandated by the California legislature on CalPERS investing in thermal coal companies and companies that do business in Iran and Sudan.

Perez was the only investment committee member who dissented on the thermal coal and Iran and Sudan investments. Even Brown went along with the rest of the board.

Overall, the thermal coal, firearms, Iran, and Sudan investments combined made up a little more than $200 million in CalPERS’ equity portfolio. Reinvesting in tobacco stocks would mean that CalPERS would invest at least several billion dollars in the companies.

Wilshire’s analysis of CalPERS reinvesting in tobacco stocks also showed the pension could see transaction costs between $3.97 million and $15.24 million.

Perez’s case to reinvest in tobacco was not helped by Dan Bienvenue, CalPERS’ interim chief investment officer. He told the investment committee Monday that it was unclear how tobacco stocks would perform investment-wise in the future. He offered no advice to the investment committee on which way to proceed.

“I do think a reasonable investor can come to either place, especially when considering some of the costs associated with investing” in tobacco, he said.

Investment committee member David Miller said he did not see a reason to reinvest in tobacco stocks, a belief endorsed by most other investment committee members who did not speak during the more than two-hour discussion.

He said health and litigation issues continued to surround tobacco, along with uneven investment returns. “We are better off without tobacco,” he said.

Apple reportedly preparing high-end iPads that could launch as soon as April

PUBLISHED WED, MAR 17 20216:25 PM EDT

KEY POINTS

- Apple could release new iPads as soon as April, according to a report in Bloomberg.

- The new iPads will be part of Apple’s high-end iPad Pro line and could feature improved cameras and a faster processor.

- Apple has not announced a spring launch event this year.

Apple could release new iPads as soon as April, according to a report in Bloomberg.

The new iPads will be part of Apple’s high-end iPad Pro line and could feature improved cameras, a faster processor, and a new type of Mini-LED display on the largest iPad with improved brightness and contrast.

Otherwise, they will look similar to the current 11-inch and 12.9-inch iPad Pros, according to the report. Apple’s current 11-inch iPad Pro costs $799 and the larger model starts at $999.

The report comes as Apple’s iPad business has been boosted by people looking for computers to work and play from home during the Covid-19 pandemic. During the most recent holiday quarter, Apple reported $8.4 billion in iPad sales, an increase of more than 42% increase from the previous year.

Apple typically releases most of its new products, including iPhones, in the fall, but sometimes delivers less significant product updates during a launch event in the spring. The Cupertino-based giant has not announced a spring launch event this year.

In recent years, Apple has been positioning its iPad Pro models as laptop replacements, including introducing mouse support and keyboard accessories like the $299 Magic Keyboard.

Ford’s Share Price Has Risen Too Far, Too Fast

Mar. 16, 2021 2:39 AM ET

Summary

- Ford’s share price is up 52% for the year-to-date.

- The price is 6% above the Wall Street consensus 12-month target.

- The option-implied outlook is bearish.

- The current stock price has too much expected good news baked in.

COVID-19 has been a massive disruption to the U.S. auto industry. Ford (F) saw U.S. sales decline by 14.1% in February as compared to last year. Intriguingly, this announcement comes as Ford’s share price has shot above its pre-COVID 2020 high price of $9.42 on January 2nd of 2020. At the most recent close of $13.37, the company is almost 42% more valuable than it was just before COVID shut down a huge swath of the U.S. and global economies. It is hard to see how this makes sense. The prevailing narrative is that Ford is going to be a major player in electric vehicles, along with launches of several impressive new/updated vehicles.

Price history and basic statistics for F (Source: Seeking Alpha)

Ford has been in a long-term slide since it was trading above $17.50 in September of 2014. The stock lost 46% of its value between September of 2014 and its 2020 pre-COVID high. The new Ford Bronco, the Mustang Mach-E, and the latest iterations of the F-150 should all be strong performers, but the current share price reflects a large amount of optimism.

Wall Street Analyst Outlook

The consensus of eleven ranked Wall Street analysts compiled by eTrade is a 12-month price target of $12.40, 6.06% below the most recent close. The consensus rating is bullish. The consensus rating compiled by eTrade has toggled between neutral and bullish over the last twelve months. One striking feature of the analyst price targets is that the highest of these is $14, only 6.06% above the most recent close. In other words, even the most bullish analyst sees little additional upside in the stock price over the next 12 months.

Wall Street analyst consensus rating and 12-month price target for F (Source: eTrade)

The consensus EPS outlook for F shows, as expected, a huge recovery in the EPS in 2021 as compared to 2020, along with an additional 37% jump in EPS from 2021 to 2022. The EPS consensus for 2024, however, is below that for 2021.

Earnings per share (EPS) for 2020 and consensus estimated EPS for 2021-2023 (Source: eTrade)

The Wall Street analyst consensus compiled by Seeking Alpha from a group of nineteen analysts has a rating of neutral and a price target of $12.13, slightly lower than the consensus price target calculated by eTrade. Of the nineteen analysts, thirteen assign a neutral rating to Ford stock.

Wall Street analyst consensus rating and price target for F (Source: Seeking Alpha)

Outlook From the Options Market

I like to compare the analyst consensus outlook to the market-implied outlook derived from analysing the options market. For an explanation of the method, please see this blog post.

I have analyzed options expiring on June 18, 2021, and January 21, 2022, to generate an option-implied price return outlook from now until both of these dates.

Option-implied price return probabilities for F from now until June 18, 2021 (Source: author’s calculations using options quotes from eTrade)

Ford Is Here To Win

Ford’s Focus On Strengths, EVs To Drive Growth

Digital Transformation Comes To Energy, Autos, And Currency – Jon Markman And Greg King Join Alpha Trader (Podcast Transcript)

The option-implied outlook from now until June 18, 2021, (3.15 months) is bearish, with the single most-probable price return of -11.9% (the highest probability point on the chart above) and consistently higher probability of negative returns vs. positive returns of the same magnitude for a wide range of the most likely outcomes (the red dashed line is above the solid blue line). There is a 56% chance of a price return less than or equal to zero between now and June 18th. The annualized volatility derived from this distribution is 56%.

Option-implied price return probabilities for F from now until January 21, 2022 (Source: author’s calculations using options quotes from eTrade)

The option-implied outlook from now until January 21, 2022, is an amplification of the bearish outlook using the June 18, 2021, options. The single most-probable price return from now until January 21, 2022, is -27%. The annualized volatility of this distribution is 52% and the probability of a price return less than or equal to zero from now until January 21, 2022, is 59%.

Especially in the January 21, 2022 outlook, there is a pronounced positive tail (the probability of extreme positive returns is greater than for equal-magnitude negative returns).

Summary

It stands to reason that Ford should enjoy a surge in earnings in 2021, both relative to the terrible 2020 and because of potential pent-up demand. The current share price reflects this optimistic view. The question is whether all of the realistic upside is already priced in. The share price is already 7% or more above the Wall Street analyst consensus price target. Even the highest analyst price target is less than 5% above the current share price.

The option-implied outlook for Ford is bearish, with elevated probabilities of negative returns between now and January 21, 2022. The single most-probable price return between now and that date is estimated to be -27%. My conclusion is that Ford’s share price has gotten ahead of where it should be with the 48% gain in the last three months, such that there is a higher probability of decline than of additional gains. As such, my outlook for the share price is bearish, even as I am optimistic about the company’s future.

This article was written by

Disneyland to reopen on April 30, CEO says

Mar. 17, 2021 11:36 AM ETThe Walt Disney Company (DIS)By: Josh Fineman, SA News Editor31 Comments

- Disneyland in Anaheim, California will reopen April 30, Disney CEO Bob Chapek said in interview on CNBC.

- Disney will reopen the park with limited capacity, Chapek said. on CNBC.

- Disney hopes to be operating its cruise lines by the fall and expects to get positive news from the CDC in the upcoming months.

- “We are hopeful that by the fall we will be back in business on our cruise lines,” Chapek said.

- Disney gained 0.4%.

- Recall March 8, Disney rises to new record as California begins to ease park restrictions.

Netflix and Disney are trading places: Disney is the upstart, Netflix the old guard

PUBLISHED TUE, JAN 19 20216:30 PM ESTUPDATED TUE, JAN 19 20217:05 PM EST

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- Netflix said Tuesday it may start buying back shares for the first time since 2011.

- Activist investor Dan Loeb has pushed Disney to halt its dividend in order to use the capital for content.

- Netflix has become streaming’s incumbent while Disney is the upstart.

Disney and Netflix pride themselves on storytelling. Now they’ve switched places when it comes to the tales they’re telling Wall Street.

Netflix said on Tuesday that it would consider buying back shares for the first time since 2011. After nearly a decade of borrowing $15 billion to fund original content, Netflix said Tuesday it planned to be cash-flow positive after 2021 and would no longer need outside financing for its operations.

Disney, meanwhile, temporarily halted its dividend last year and has heard calls from activist investor Dan Loeb to permanently end its annual $3 billion payment to shareholders. Loeb wanted Disney to funnel that money into original content, using Netflix’s startling runup from an $11 billion company to a $220 billion media giant as a model.

While Disney hasn’t ended its dividend yet, the company is focusing its operations around streaming. Disney plans to roll out dozens of Star Wars, Marvel and Pixar movies and series in the coming years for its flagship streaming service, Disney+. The service has gained more than 86 million subscribers in a year, way ahead of Disney’s original expectations, and the company now expects between 230 million and 260 million subscribers by 2024.

“It’s super impressive what Disney has done,” Netflix co-CEO and co-founder Reed Hastings said during Netflix’s earnings conference call. “It’s incredible execution for an incumbent to pivot to take on the insurgent. It shows members are willing and interested to pay for more content because they’re hungry for great stories. And Disney does have great stories.”

But while Hastings still refers to Disney as the incumbent, investors see a different picture. There’s a reason Disney shares gained more than 2% after hours on Netflix’s news, which sent Netflix shares up more than 12%. Investors don’t see the battle as Disney versus Netflix. They see that Disney wants to be like Netflix, and there’s room for both.

Netflix was founded in 1997. Disney has been around for nearly 100 years.

But in the streaming video world, Netflix is the incumbent and Disney the upstart.

The student has become the teacher.